02 December 2021 Morning Session Analysis

Dollar surged amid bullish data.

The Dollar Index which traded against a basket of six major currency pairs surged over the backdrop bullish economic data from the US region yesterday. According to Automatic Data Processing (ADP), U.S. ADP Nonfarm Employment Change came in at 534K, exceeding the market forecast at 525K. Such upbeat data was released just days ahead of the monthly nonfarm payrolls due Friday, heightening the expectations for the Federal Reserve to step up the pace of bond tapering program. Nonetheless, the gains experienced by the US Dollar was limited following the U.S. confirmed its first case of the new Omicron Covid-19 strain, triggering a fresh wave of uncertainty across the US economy. According to Reuters, U.S. health officials confirmed Wednesday that the first case of Omicron variant was identified in California. As for now, investors would continue to scrutinize the latest updates with regards of the latest variant development as well as the economic data in order to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index appreciated by 0.05% to 96.05.

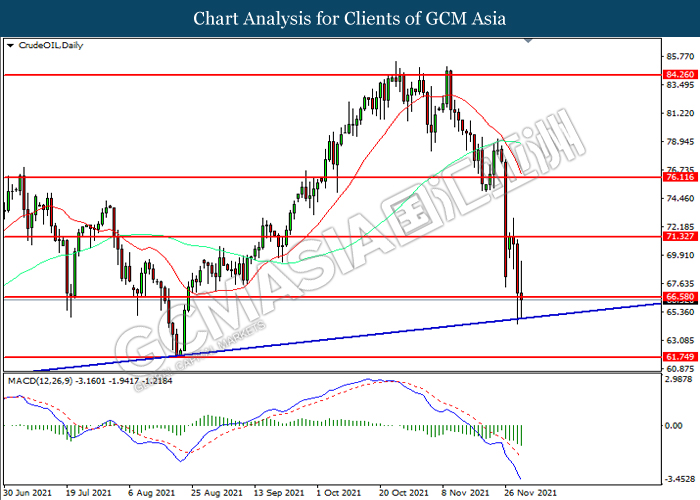

In the commodities market, the crude oil price slumped 0.05% to $66.65 per barrel as of writing. The oil market continues to edge lower amid uncertainty with regards of the Covid-19 variant had continued to spur negative prospect for this black-commodity in future. On the other hand, the gold price slumped 0.04% to $1781.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 199K | 250K | – |

Technical Analysis

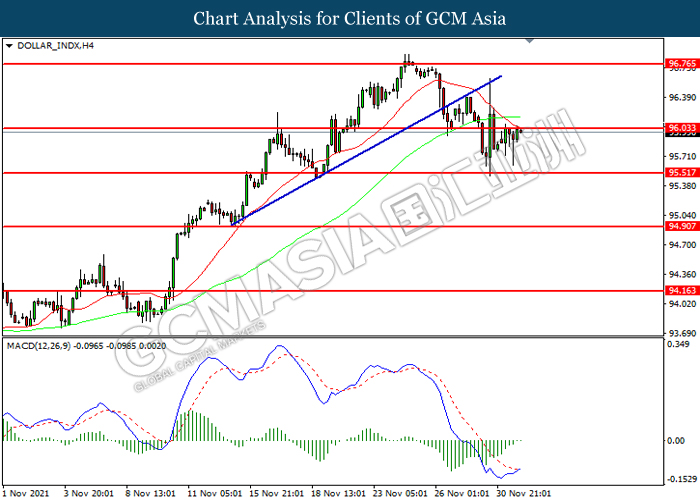

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 96.05. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 96.05, 96.75

Support level: 95.50, 94.90

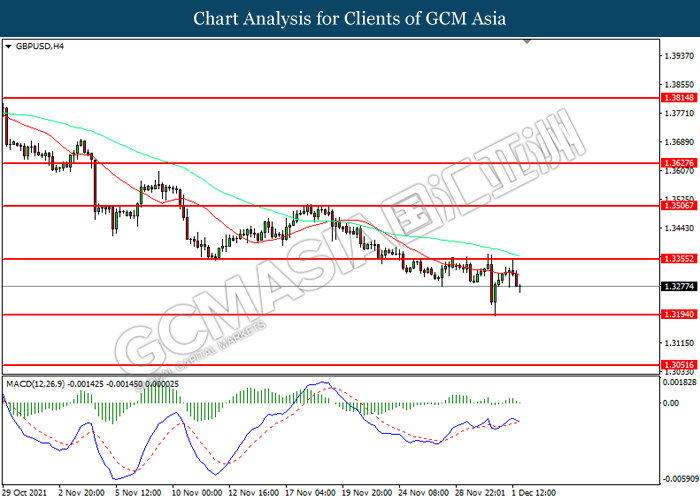

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3355. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.3195.

Resistance level: 1.3355, 1.3505

Support level: 1.3195, 1.3050

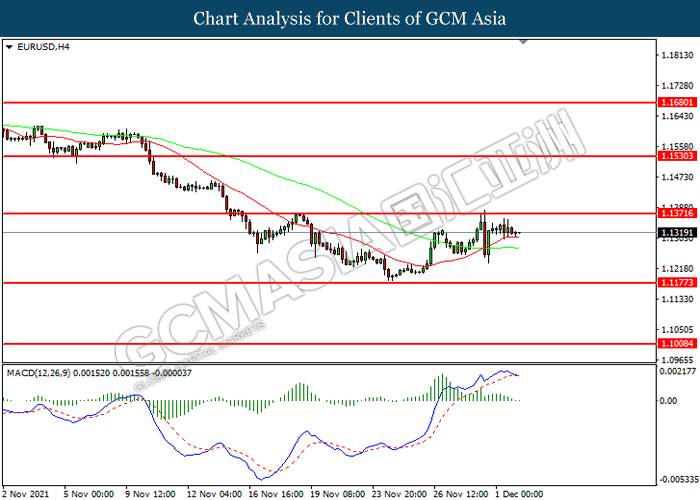

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1370. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1370, 1.1530

Support level: 1.1175, 1.1010

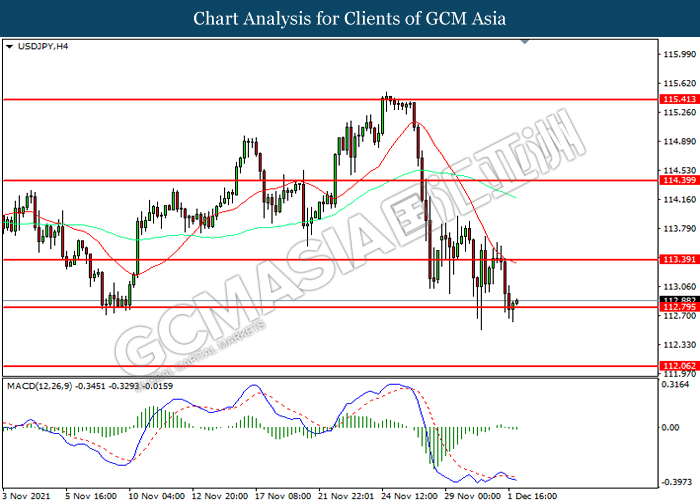

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 112.80. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 114.40, 115.40

Support level: 112.80, 112.05

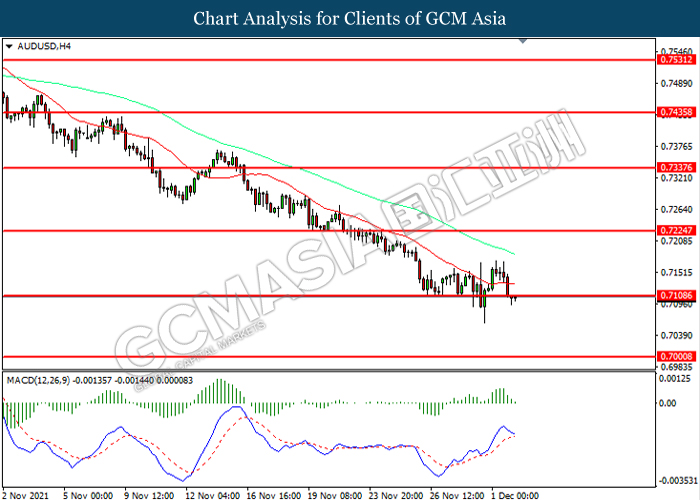

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7110. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7225, 0.7335

Support level: 0.7110, 0.7000

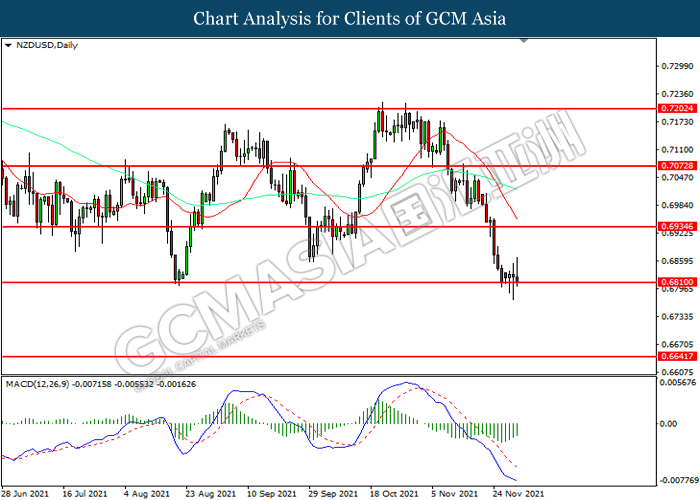

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6810. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6935, 0.7075

Support level: 0.6810, 0.6640

USDCAD, H1: USDCAD was traded higher while currently testing the resistance level at 1.2815. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2815, 1.2895

Support level: 1.2745, 1.2645

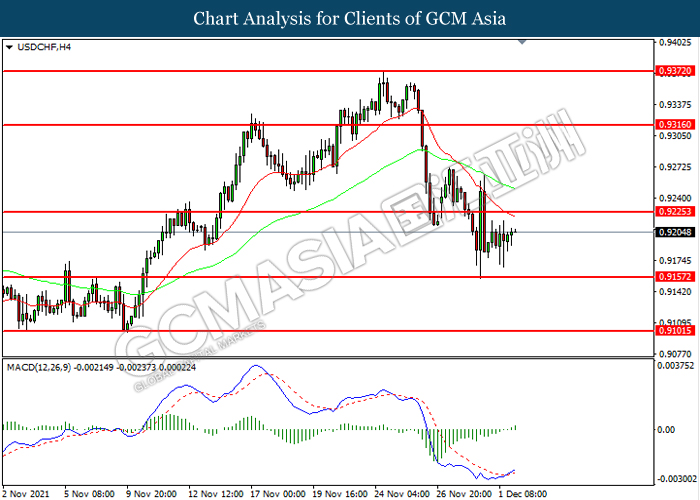

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9315

Support level: 0.9155, 0.9100

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.35, 76.10

Support level: 66.60, 61.75

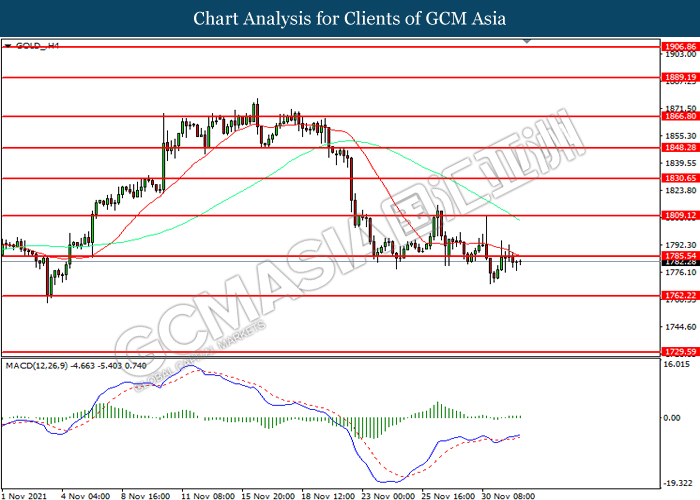

GOLD_, H1: Gold price was traded lower following prior breakout below the previous support level at 1783.80. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 1762.20.

Resistance level: 1783.80, 1809.10

Support level: 1762.20, 1729.60

Risk Statement:

Forex, Gold, Crude Oil, Commodities, CFD and all other margin trading investment products involve high level of risk and may not be suitable for all investors. Your previous investment success in stock, futures or any other investment achieved does not mean that all your future investment will obtain the same results. You should carefully consider your investment objectives; risk associated and seek professional advice before deciding to trade or if you have any doubts.