2 December 2022 Afternoon Session Analysis

Dollar plunged ahead of NonFarm Payroll.

The dollar index, which was traded against the six major currencies in the basket, plummeted more than 1% in the previous trading session as the inflation figure of the US came in at a lower-than-expected reading. The cooling down of high inflationary pressures in the nation has uplifted the probability that the Fed would scale back from its aggressive rate hike plan. While the chairman of the Federal Reserve warned the world that a single inflation figure does not precisely reflect the real situation of inflation, the Core PCE data likely further confirm the drop in inflation. According to the CME FedWatch Tool, the chances of a rate hike with only 50 basis points increased from the previous week’s 75.8% to 79.4%, while the probability of 75 basis points slumped to 20.6% from the prior week’s 24.2%. Going forward, investors are eyeing the long-awaited NonFarm Payroll data to gauge the further direction of the dollar index. As of writing, the dollar index rebounded 0.12% to 104.85.

In the commodities market, the crude oil price was down by -0.23% to $81.75 per barrel, while the market participants remain cautious ahead of the OPEC+ meeting. Besides, the gold prices edged down by -0.30% to $1797.80 per troy ounce following the rebound of the Greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Nonfarm Payrolls (Nov) | 261K | 200K | – |

| 21:30 | CAD – Employment Change (Nov) | 108.3K | 5.0K | – |

| 22:56 | USD – Unemployment Rate (Nov) | 3.7% | 3.7% | – |

Technical Analysis

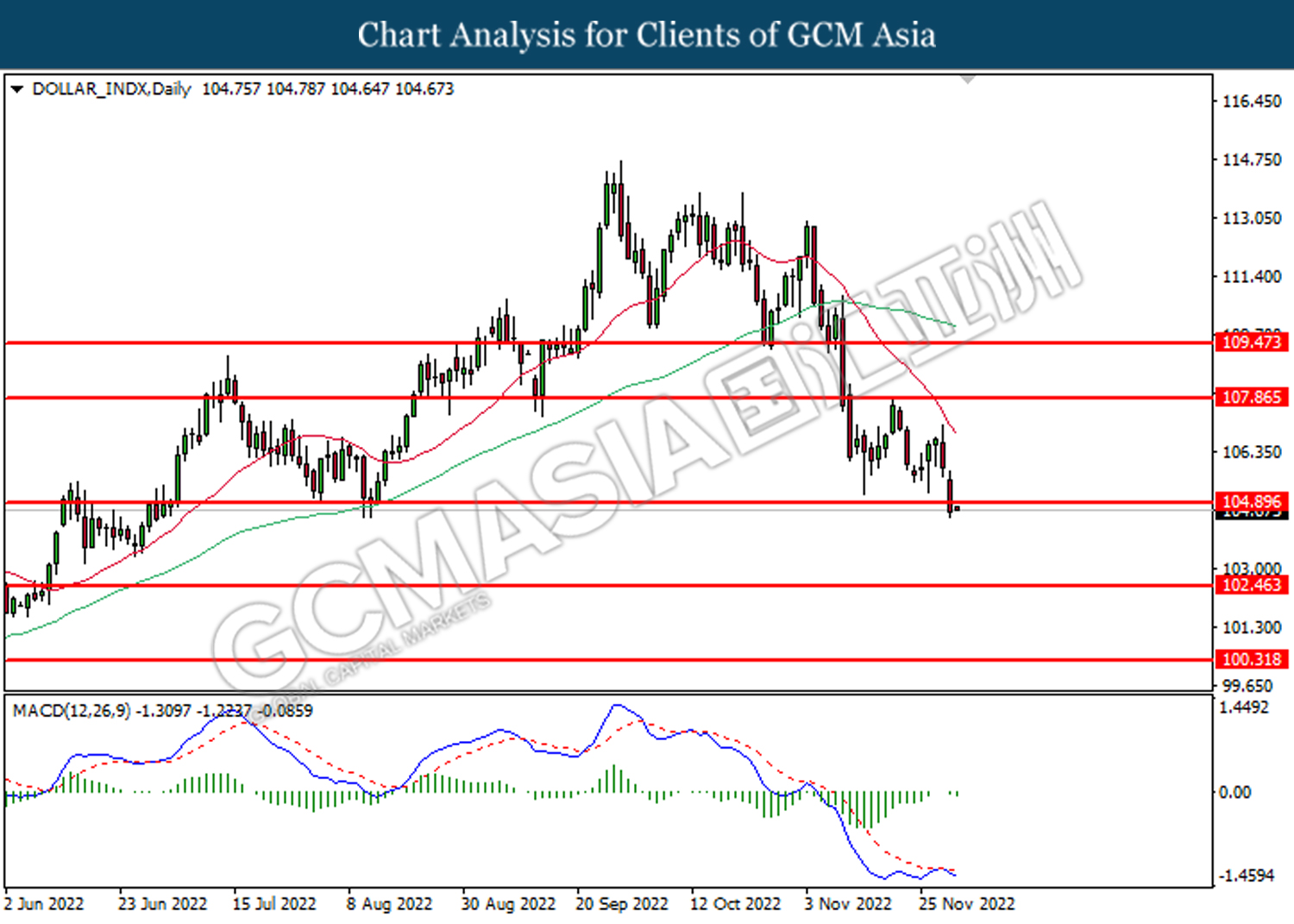

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 104.90. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 102.45.

Resistance level: 104.90, 107.85

Support level: 102.45, 100.30

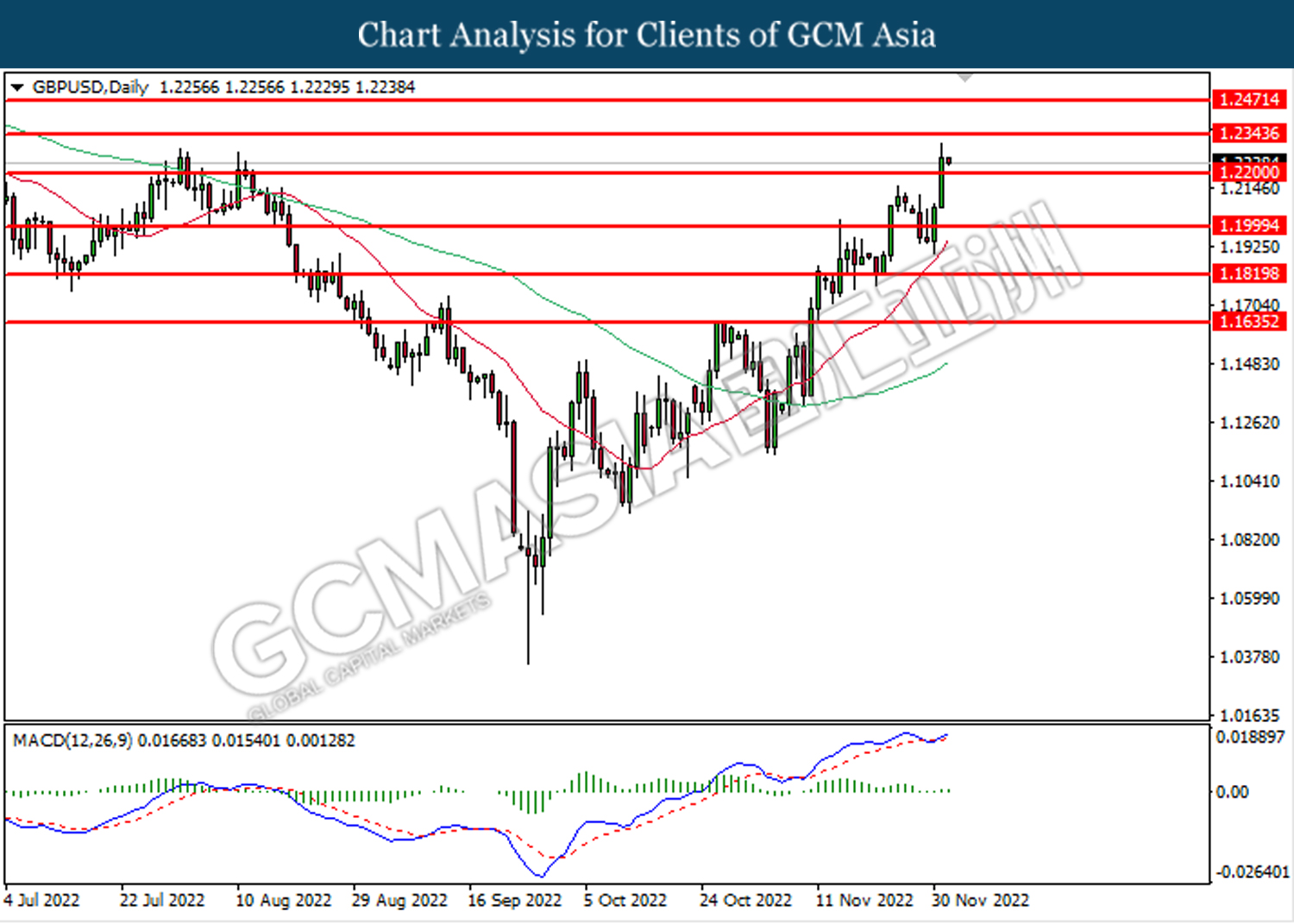

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

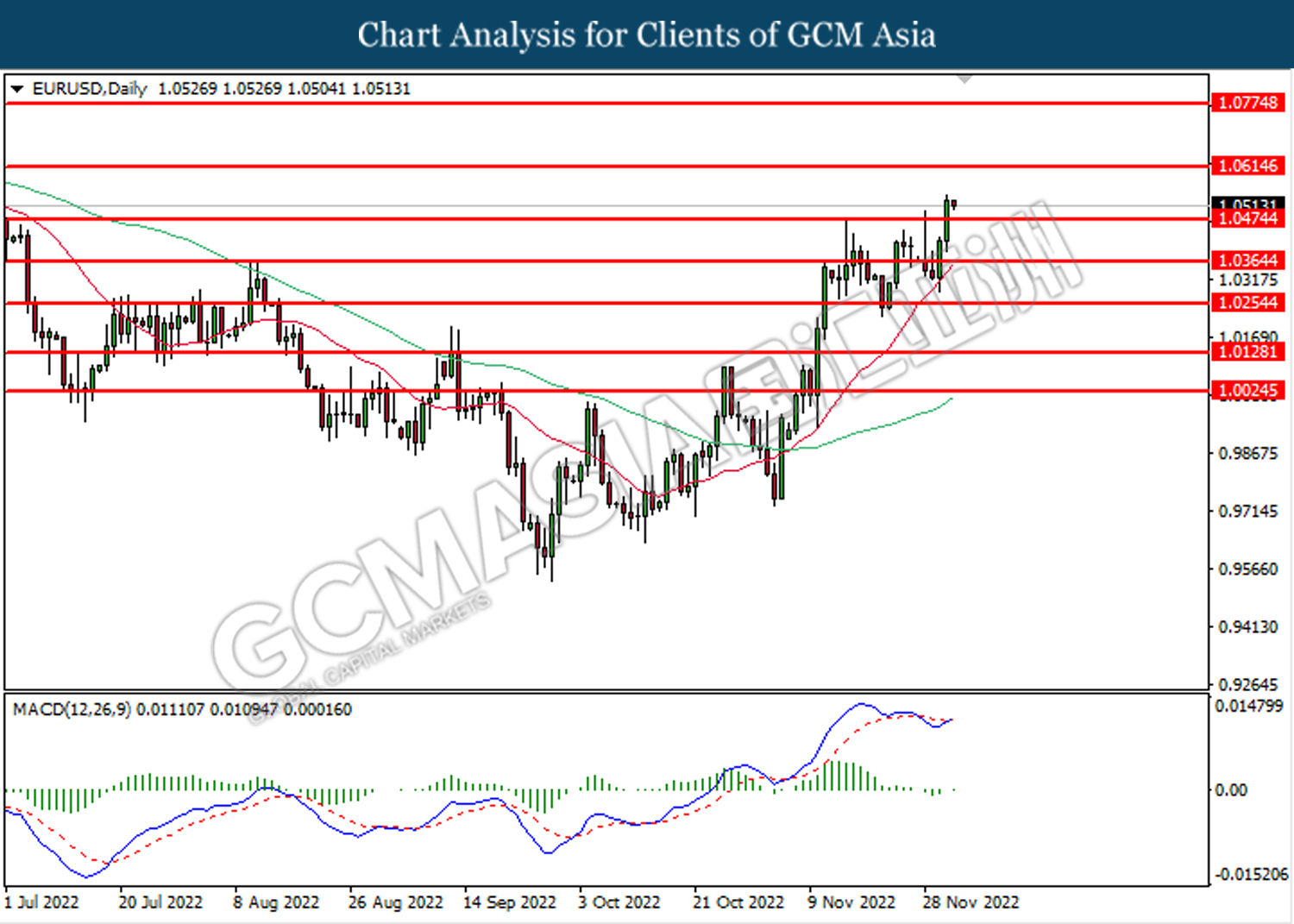

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0475. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0615.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

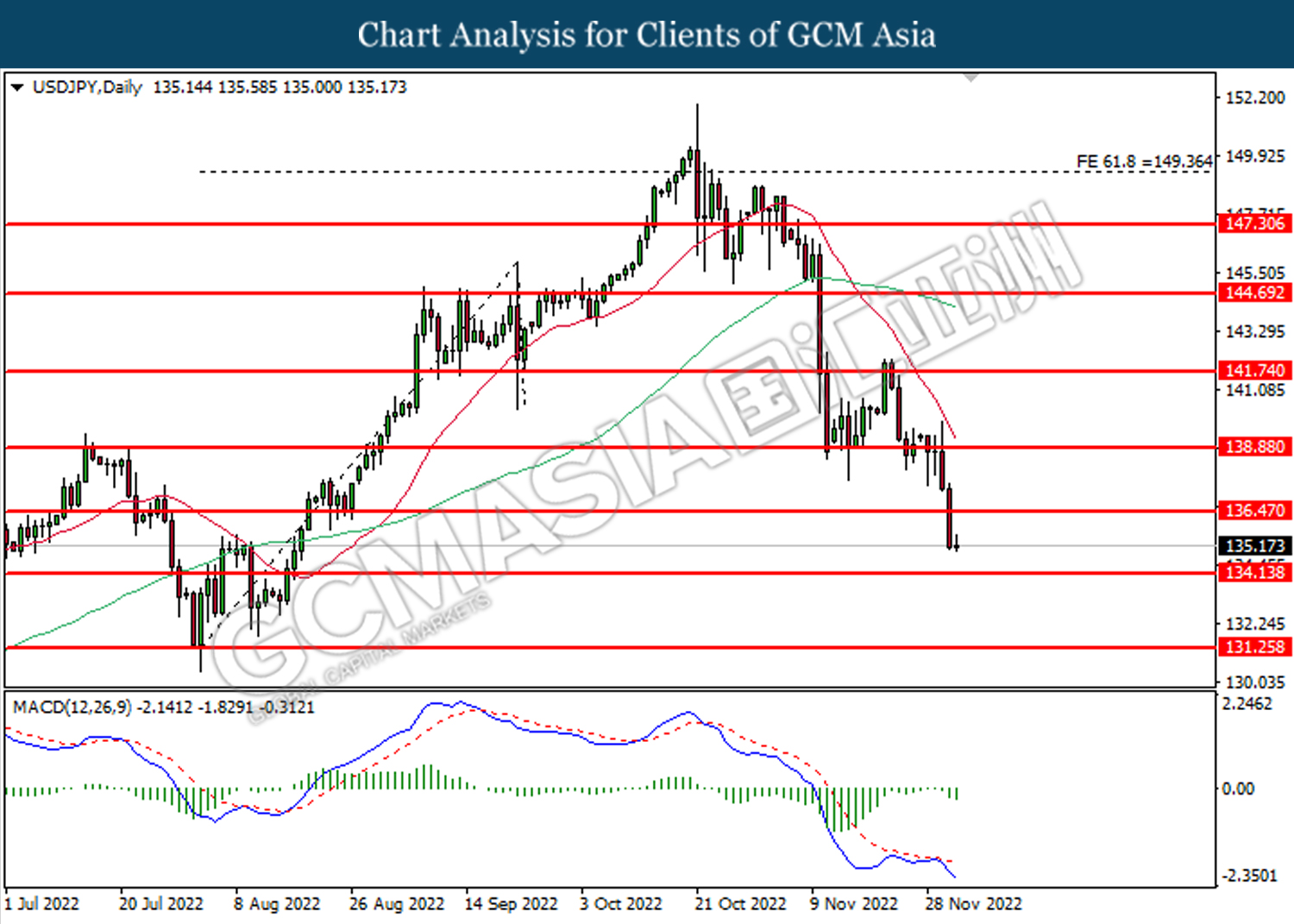

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 136.45. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 134.15.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend it gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

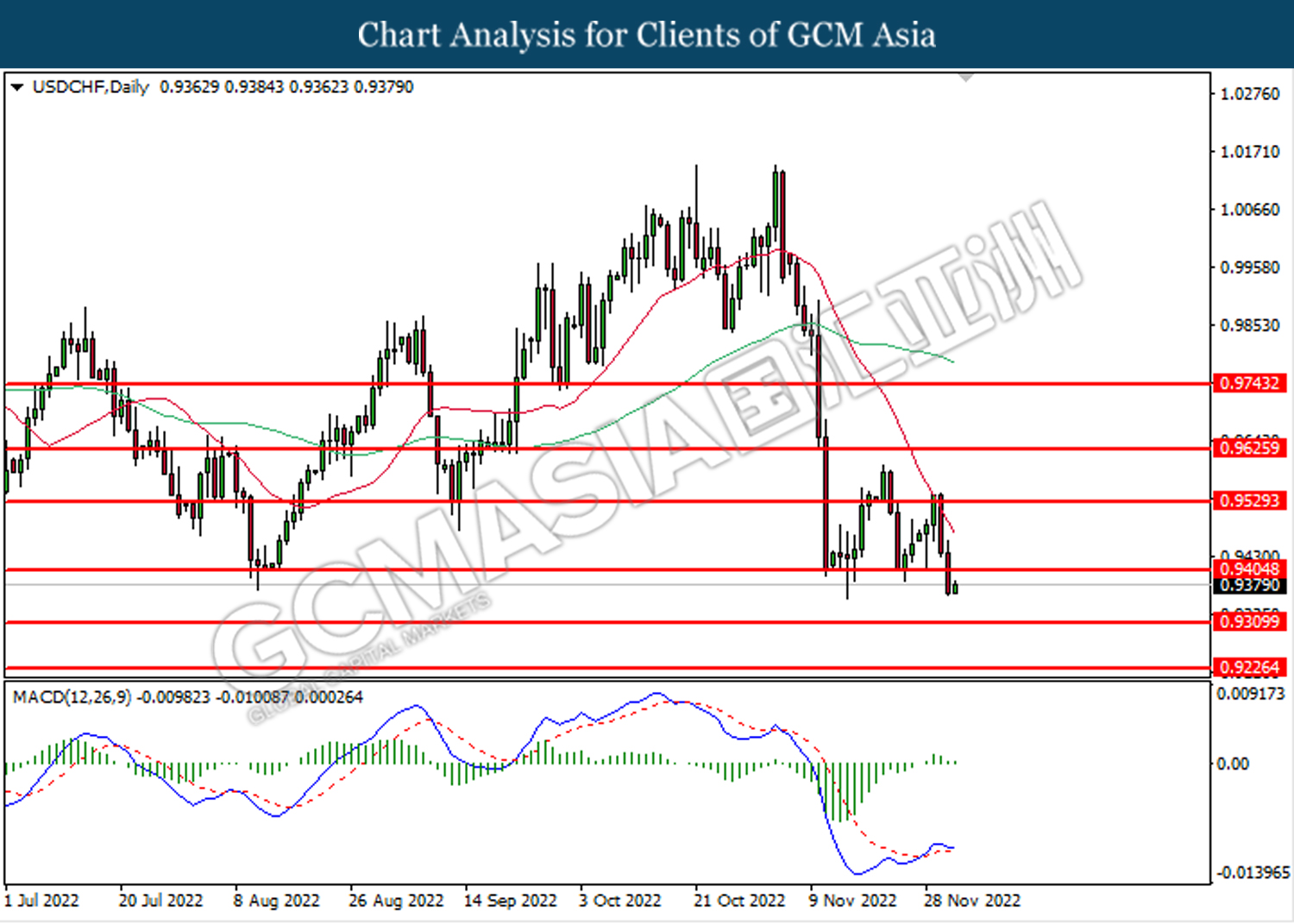

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9310.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

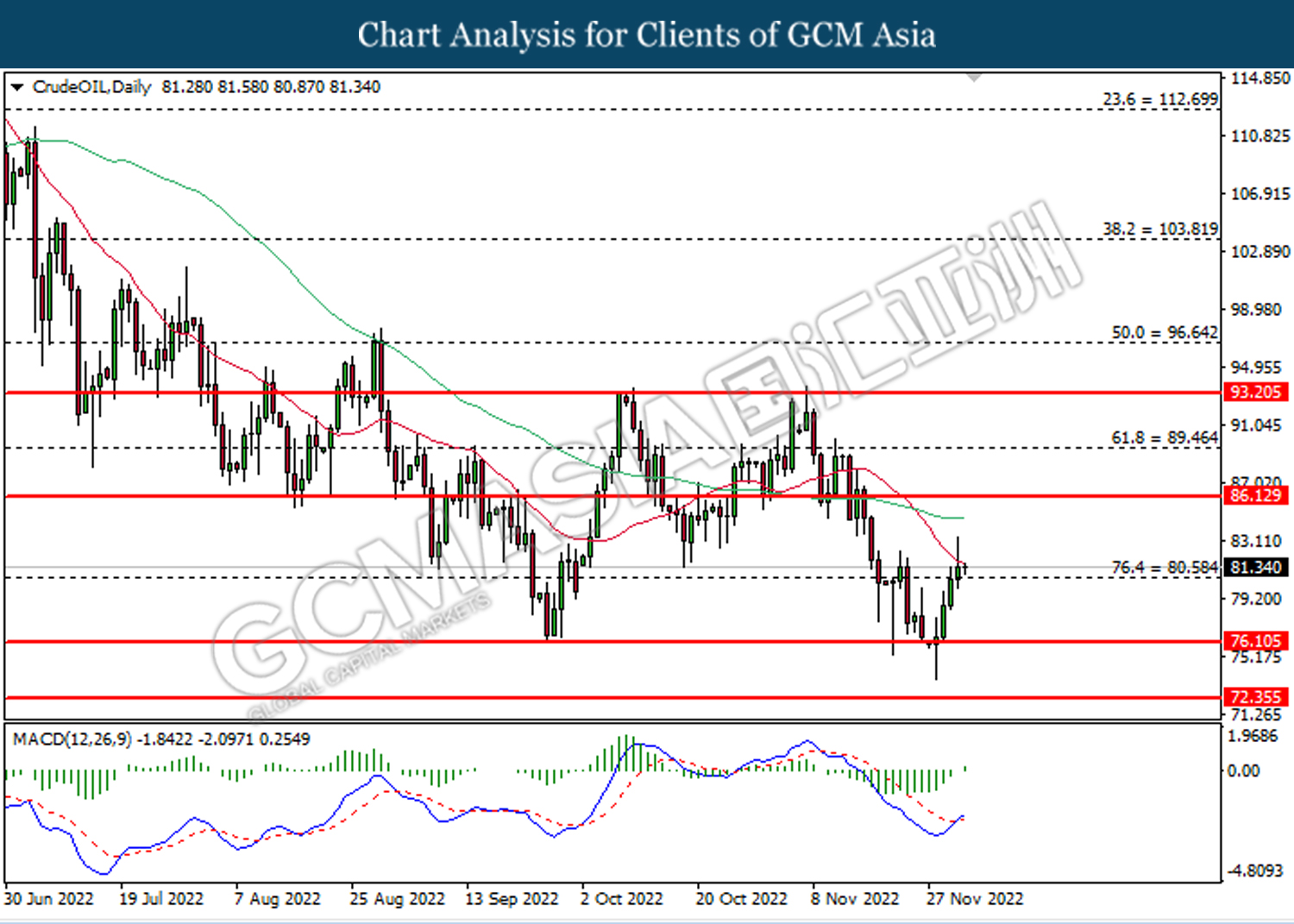

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 80.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 86.15.

Resistance level: 86.15, 89.45

Support level: 80.60, 76.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1805.90. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15