2 December 2022 Morning Session Analysis

US Dollar beaten down amid the easing inflationary risk.

The Dollar Index which traded against a basket of six major currencies remained its bearish trend following the easing of inflationary risk in the US. According to Bureau of Economic Analysis, the US Core PCE Price Index MoM that excluding the food and energy consumption notched down from the previous reading of 0.5% to 0.2%, missing the consensus forecast of 0.3%. Besides that, the US ISM Manufacturing Purchasing Managers Index (PMI) had given a downbeat reading, which post at the figures at 49.0 as well as lower than market expectation of 49.8. The lower-than-expected PCE figures add to signs that US inflation is falling, while the weakened manufacturing sector has dialed down the market optimism toward economic progression in the US. With such background, investors were anticipating that the lower rate hike would likely to be implemented in the December meeting, says 50 basis point. As of now, the announcement of NFP data tonight still highly attract the eye of investors, as it could provide a clearer view of interest rate decision. As of writing, the Dollar Index depreciated by 1.17% to 104.66.

In the commodities market, the crude oil price dropped by 0.11% to $81.33 per barrel as of writing following the various other officials of the oil producing alliance have privately told media that OPEC+ will likely stand pat on production at Sunday’s meeting. In addition, the gold price eased by 0.03% to $1802.30 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

10:40 EUR ECB President Lagarde Speaks

12:30 NZD RBNZ Gov Orr Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Nonfarm Payrolls (Nov) | 261K | 200K | – |

| 21:30 | CAD – Employment Change (Nov) | 108.3K | 5.0K | – |

| 22:56 | USD – Unemployment Rate (Nov) | 3.7% | 3.7% | – |

Technical Analysis

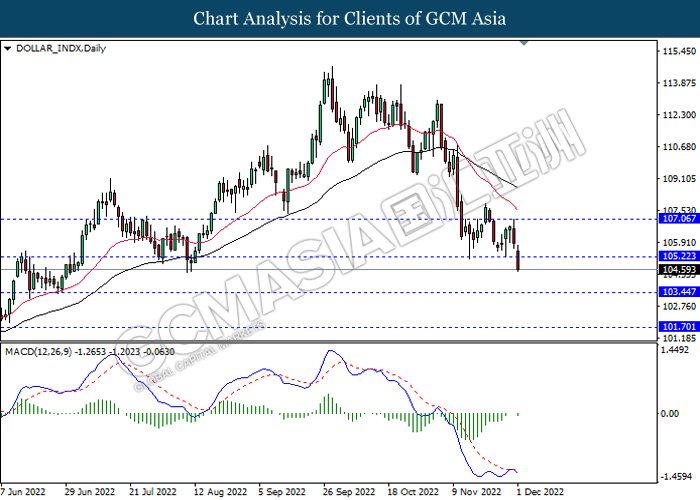

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

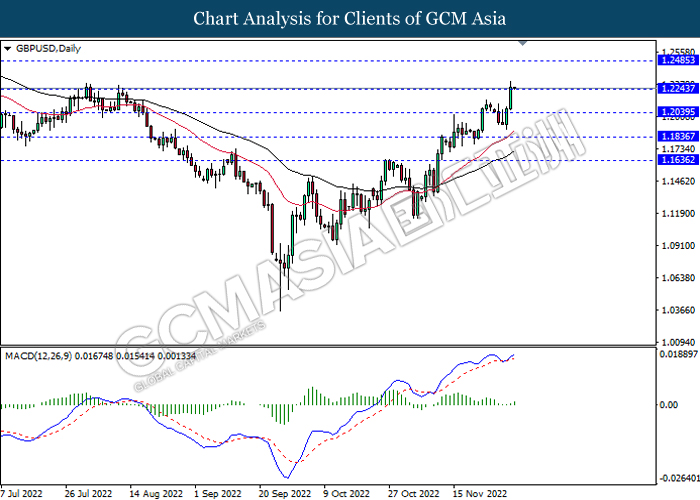

GBPUSD, Daily: GBPUSD was traded while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2245, 1.2485

Support level: 1.2040, 1.1835

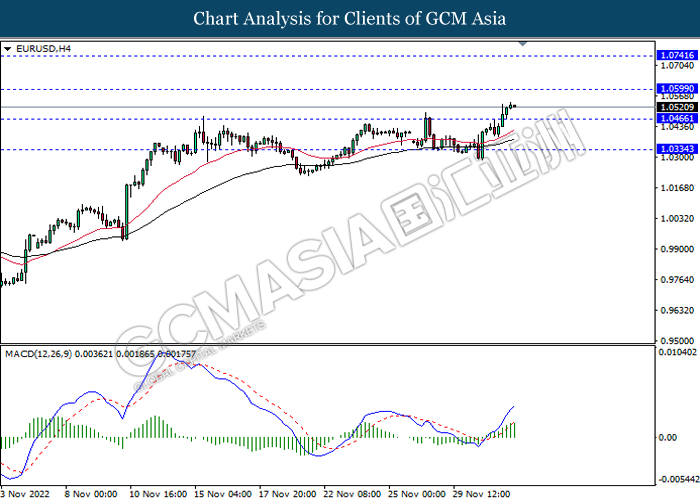

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

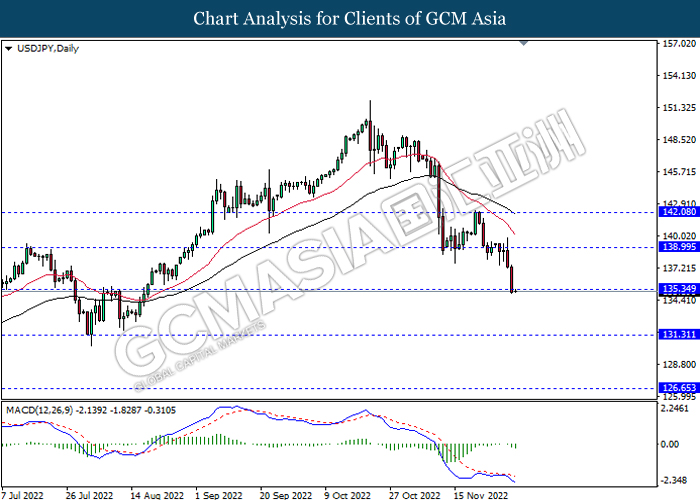

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.35, 139.00

Support level: 131.30, 126.65

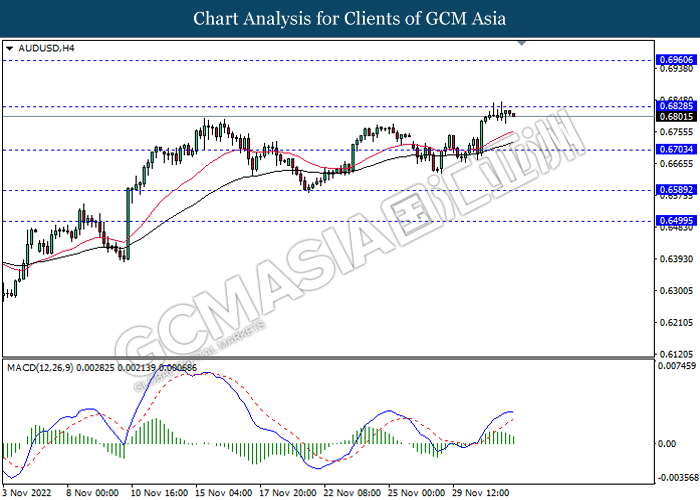

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

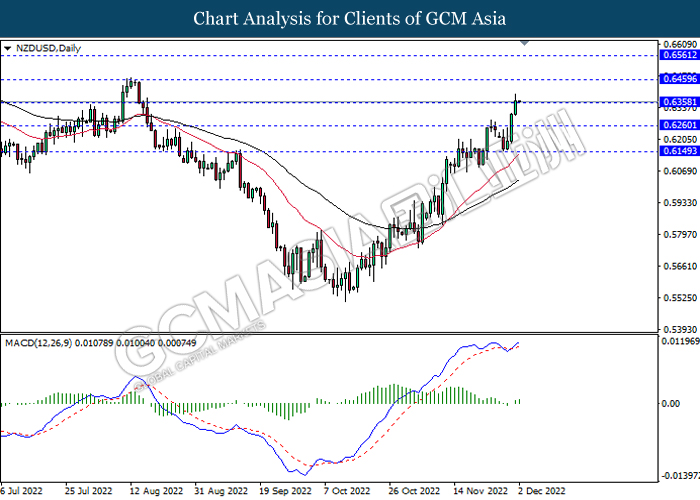

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

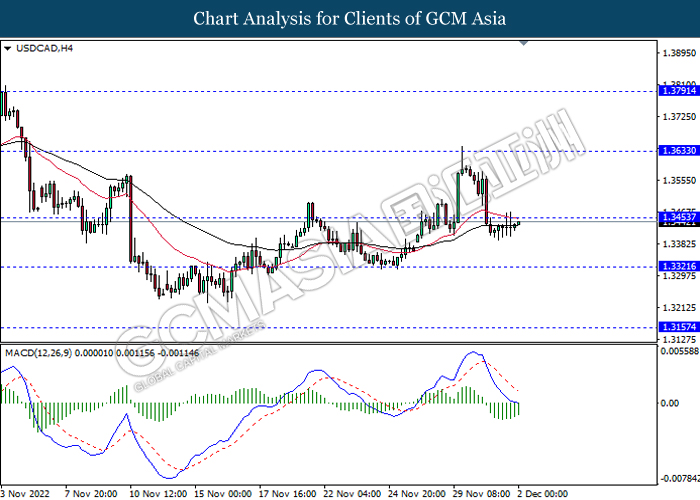

USDCAD, H4: USDCAD was traded higher while currently testing the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

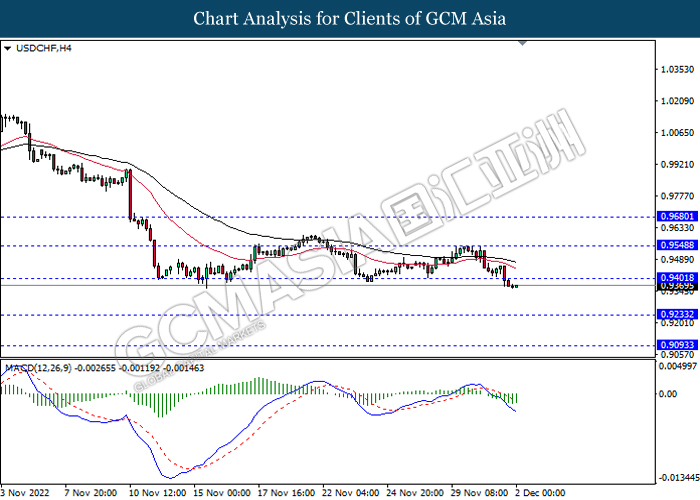

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

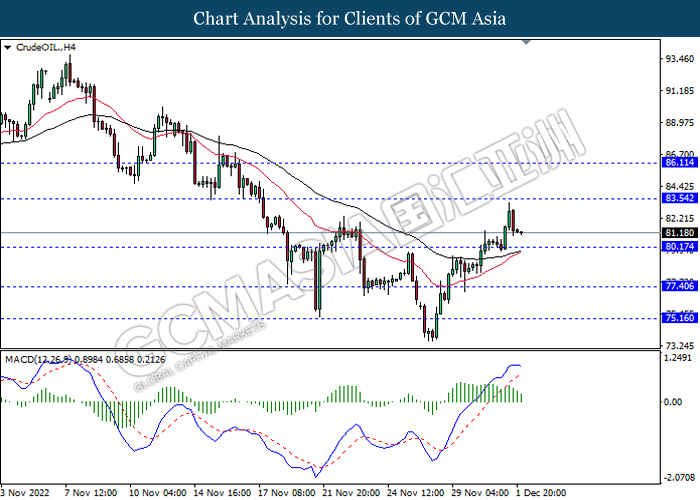

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 83.55, 86.10

Support level: 80.15, 77.40

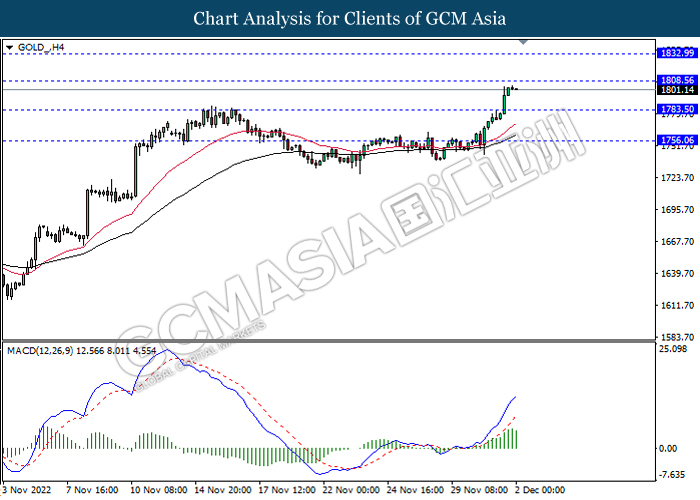

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05