03 June 2021 Afternoon Session Analysis

Pound remains resilient following plans of lockdown easing.

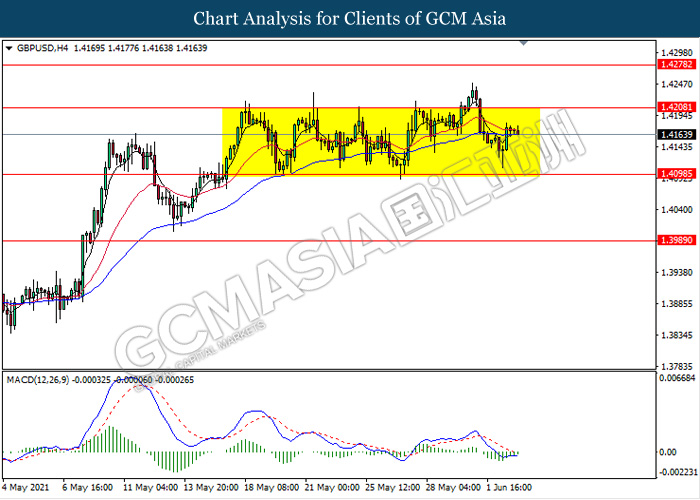

The pound sterling which traded against the greenback and other currency pairs have rose as improving situation on COVID-19 in the U.K have heightening expectation of Prime Minister Boris Johnson to ease restriction. According to the latest statistics, the U.K. recorded no new Covid-19 deaths for the first time since the global pandemic began. The milestone will reinforce business calls for the government to push ahead with plans for its fourth and final stage of unlocking the economy on June 21 including an end to all social distancing guidelines. Boris Johnson also remain upbeat and stated that he did not see anything in data that would delay the step four which is reopening on June 21. At the time of writing, GBP/USD rose 0.03% to 1.4166.

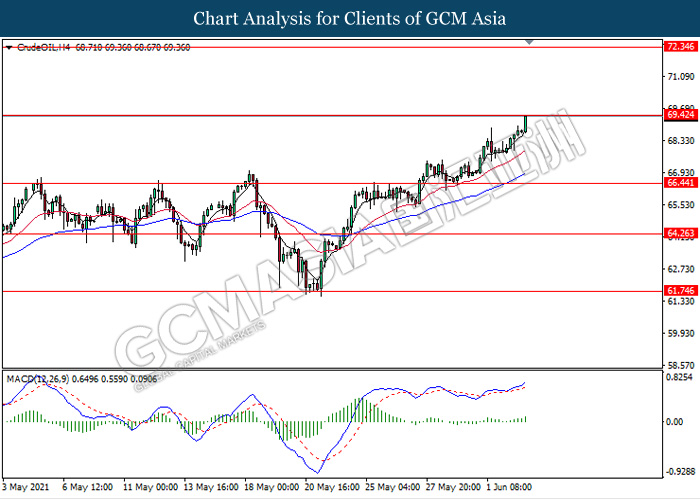

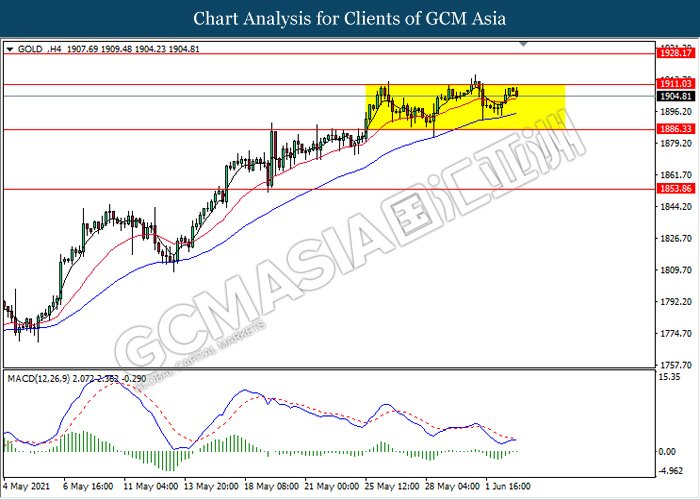

In the commodities market, crude oil price rose 0.87% to $69.31 per barrel at the time of writing following expectation of increase fuel demand. According to report, market forecasters including OPEC+ expected that the oil demand will exceed supply in the second half of 2021. OPEC+ data shows that by the end of the year oil demand will be 99.8 million barrels per day versus supply of 97.5 million bpd. On the other hand, gold price retreats 0.16% to $1905.17 a troy ounce as of writing following dollar strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Services PMI (May) | 61.8 | 61.8 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 742K | 650K | – |

| 20:30 | USD – Initial Jobless Claims | 406K | 395K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (May) | 62.7 | 63.0 | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -1.662M | – | – |

Technical Analysis

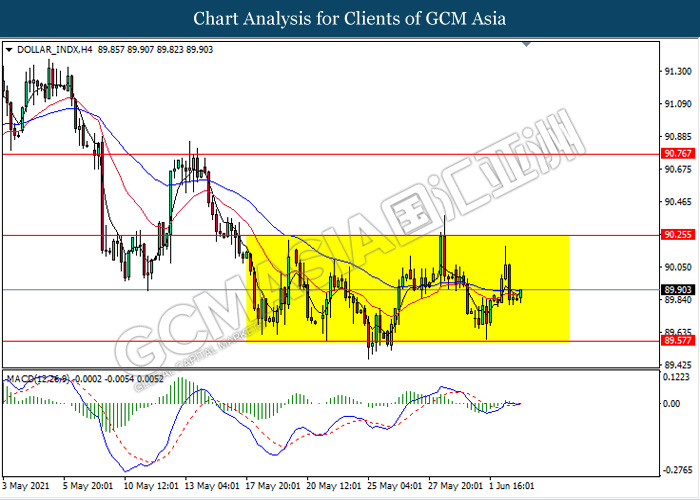

DOLLAR_INDX, H4: Dollar remain traded in a sideway channel. Due to lack of clear direction and momentum from MACD, it is suggested to wait until further signal appear before entering the market.

Resistance level: 90.25, 90.75

Support level: 89.55, 89.10

GBPUSD, H4: GBPUSD remain traded in a sideway channel. However, MACD which illustrate bearish momentum signal suggest the pair to be traded lower towards the support level 1.4100.

Resistance level: 1.4210, 1.4280

Support level: 1.4100, 1.3990

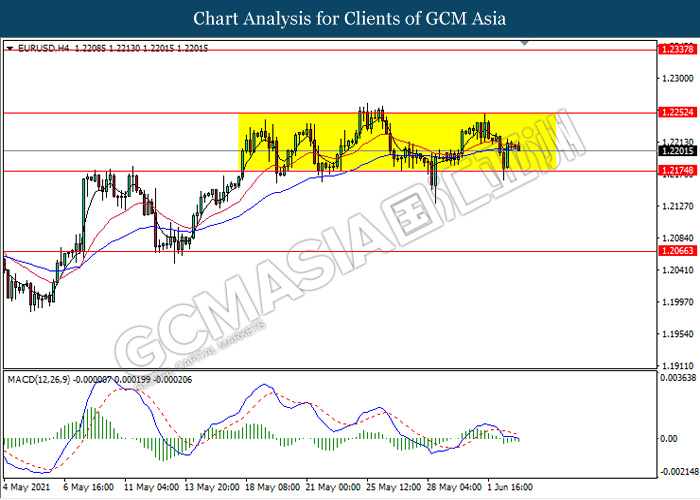

EURUSD, H4: EURUSD remain traded in a sideway channel. However, MACD which illustrate bearish momentum signal suggest the pair to be traded lower in short term towards the support level 1.2175.

Resistance level: 1.2250, 1.2335

Support level: 1.2175, 1.2065

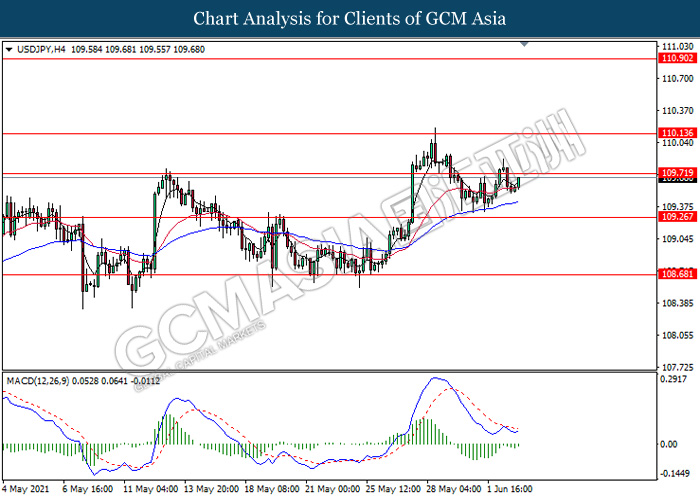

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level 109.70., MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 109.70, 110.15

Support level: 109.25, 108.70

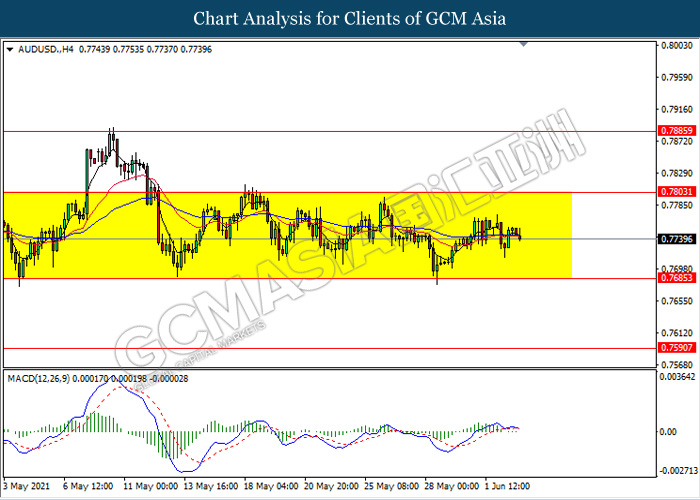

AUDUSD, H4: AUDUSD remain traded in a sideway channel. However, MACD which illustrate bearish momentum signal suggest the pair to extend its losses in short term towards the support level 0.7685.

Resistance level: 0.7805, 0.7885

Support level: 0.7685, 0.7590

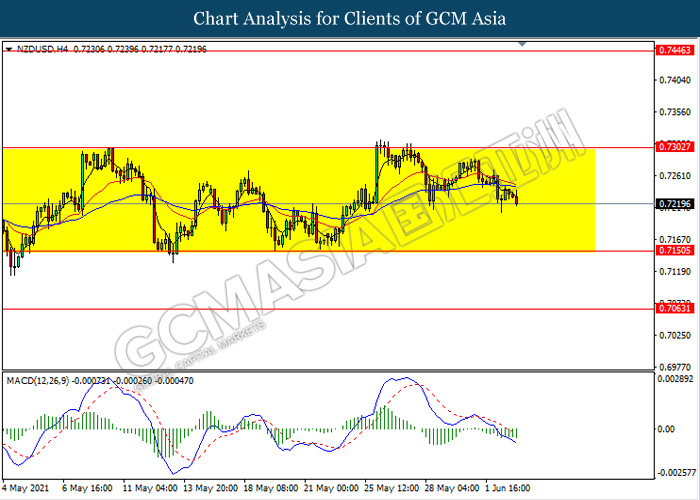

NZDUSD, H4: NZDUSD remain traded in a sideway channel following prior retracement from its high level. However, MACD which illustrate bearish momentum signal suggest the pair to extend its retracement towards the support level 0.7150.

Resistance level: 0.7300, 0.7445

Support level: 0.7150, 0.7065

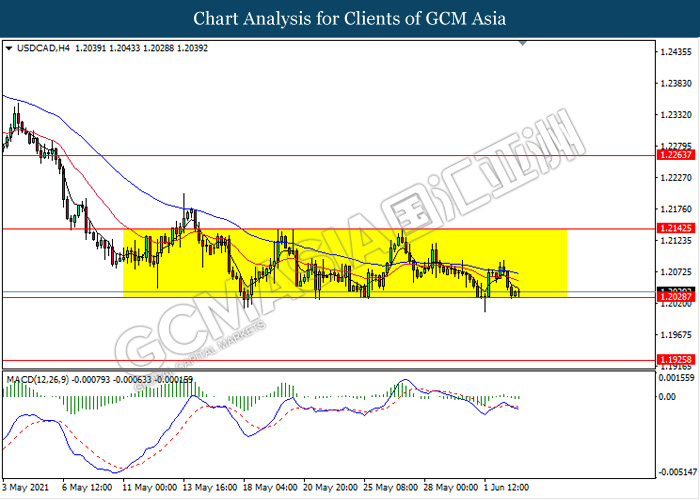

USDCAD, H4: USDCAD remain traded in a sideway channel while currently testing the support level 1.2030. However, MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.2140, 1.2265

Support level: 1.2030, 1.1925

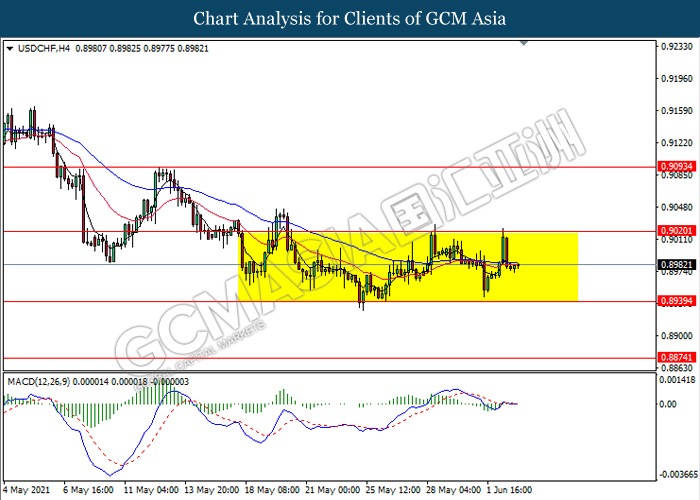

USDCHF, H4: USDCHF remain traded in a sideway channel. Due to lack of momentum and clear direction from MACD, it is suggested to wait until further signal appear before entering market.

Resistance level: 0.9020, 0.9095

Support level: 0.8940, 0.8875

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 69.40. MACD which illustrate persistent bullish momentum signal suggest the commodity to extend its gains after it breaks above the resistance level.

Resistance level: 69.40, 72.35

Support level: 66.45, 64.25

GOLD_, H4: Gold price remain traded flat in a sideway channel while currently testing near the resistance level 1911.05. However, MACD which illustrate bearish momentum signal suggest the pair to be traded lower in short term towards the support level 1886.35.

Resistance level: 1911.05, 1928.15

Support level: 1886.35, 1853.85