03 June 2021 Morning Session Analysis

US Dollar traded flat amid investors wait for data.

The Dollar Index which traded against a basket of six major currency pairs hovers near two-year low on yesterday amid market participants currently waited for employment data later in the week to speculate the economic outlook for the United States. Last month, the previous jobs report came in at much weaker than market expectation, spurring significant selloff for the US Dollar. On the trade war front, the U.S. and China’s top negotiators have held talks on yesterday, their first since President Joe Biden become the U.S. President. Nonetheless, despite the opening of trade discussion with China, analysts suggest that the Biden administration is unlikely to ease the pressure on the trade relationship this year. Market participants would have to continue to scrutinize the progress of the US-China trade talks in order to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index appreciated by 0.08% to 89.90.

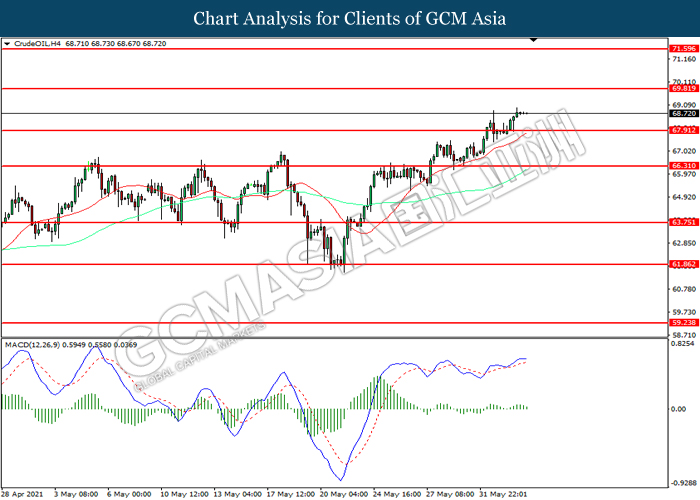

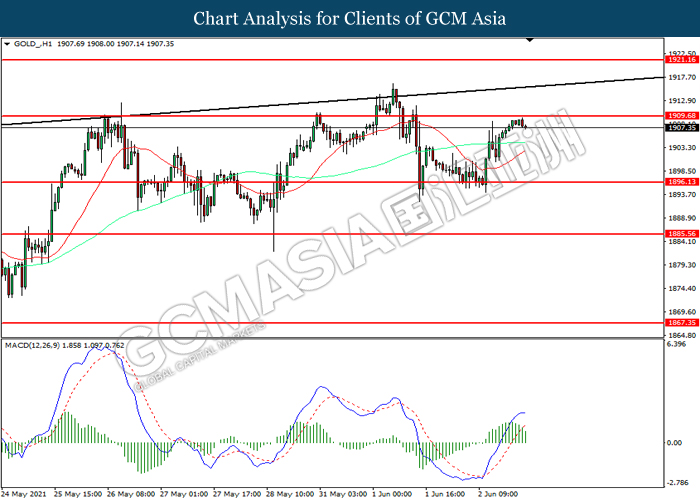

In the commodities market, the crude oil price appreciated by 0.06% to $68.70 per barrel as of writing. The oil market edged higher over the backdrop of bullish inventory data. According to American Petroleum Institute, U.S. API Weekly Crude Oil Stock notched down significantly from the previous reading of -0.439m to -5.360M, better than the market forecast at -2.114M. On the other hand, the gold price surged 0.01% to $1908.10 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Services PMI (May) | 61.8 | 61.8 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 742K | 650K | – |

| 20:30 | USD – Initial Jobless Claims | 406K | 395K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (May) | 62.7 | 63.0 | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -1.662M | – | – |

Technical Analysis

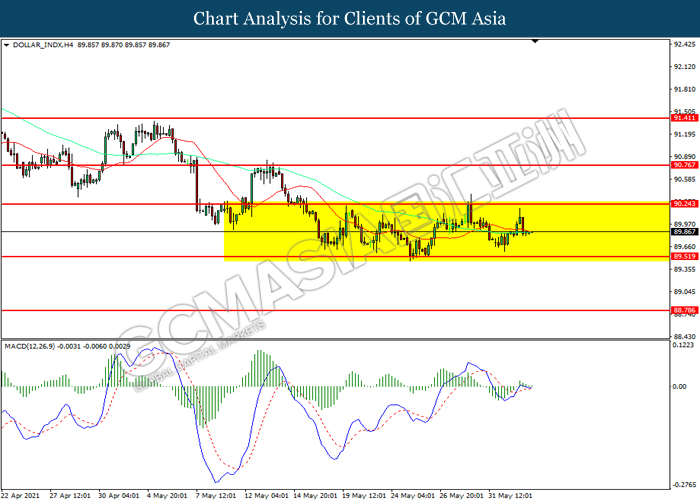

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level at 90.25. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level at 89.50.

Resistance level: 90.25, 90.75

Support level: 89.50, 88.80

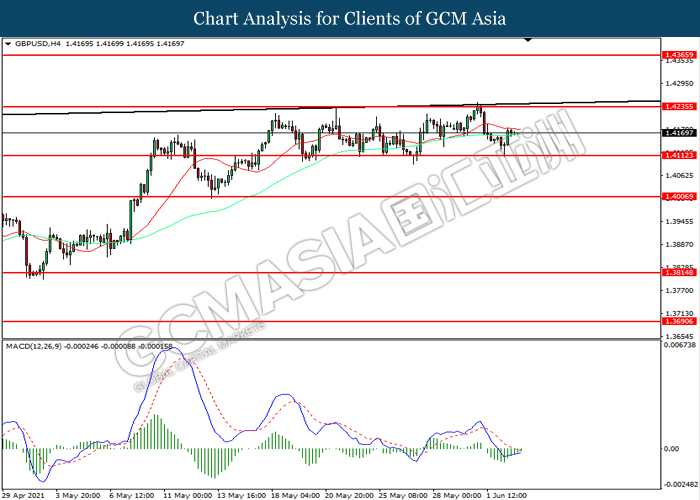

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.4110. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.4235.

Resistance level: 1.4235, 1.4365

Support level: 1.4110, 1.4005

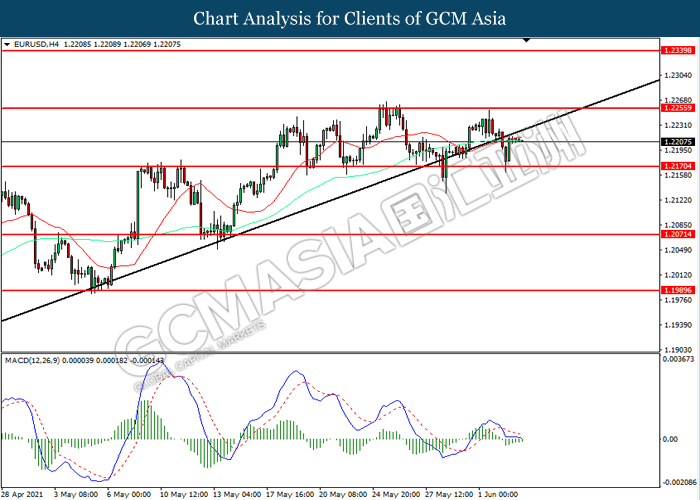

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.2170. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.2255.

Resistance level: 1.2255, 1.2340

Support level: 1.2170, 1.2070

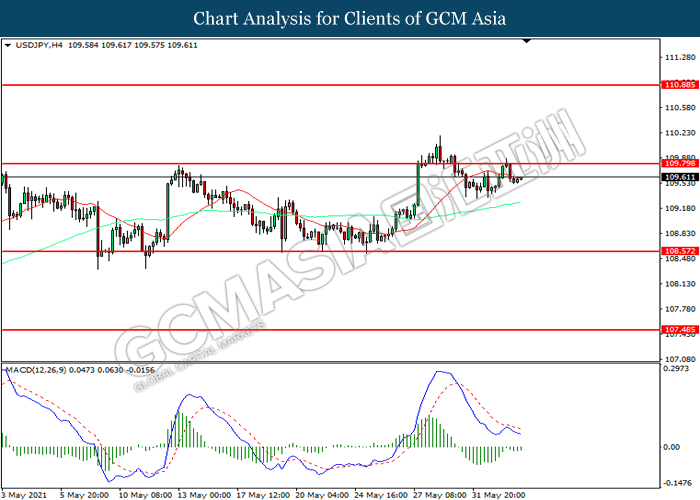

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 109.80. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.80, 110.90

Support level: 108.55, 107.50

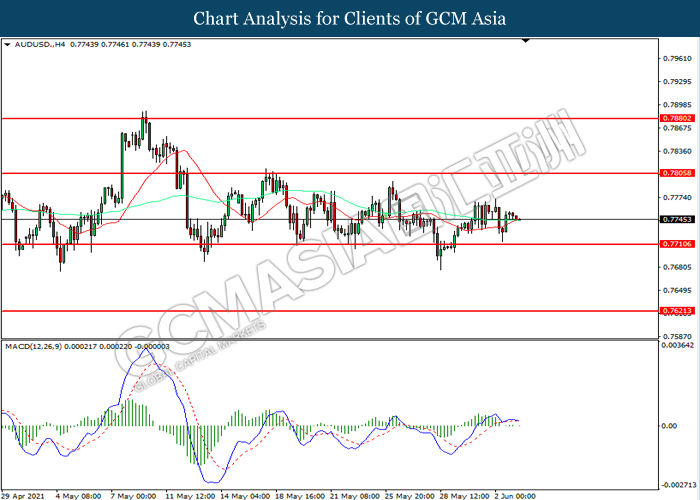

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level at 0.7710. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7805, 0.7880

Support level: 0.7710, 0.7620

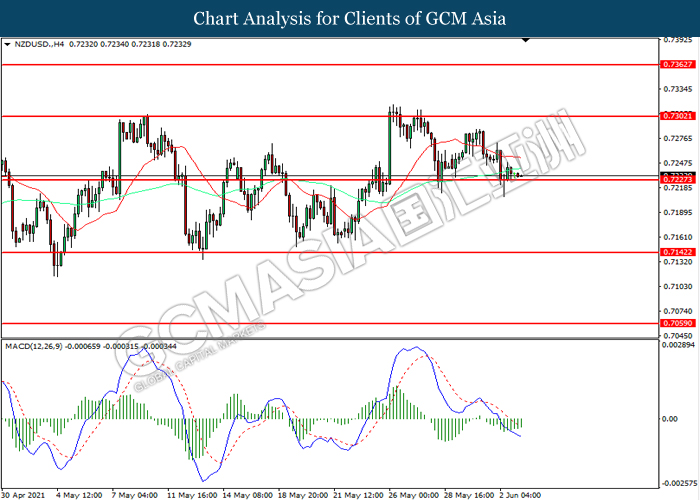

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.7230. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.7300, 0.7360

Support level: 0.7230, 0.7140

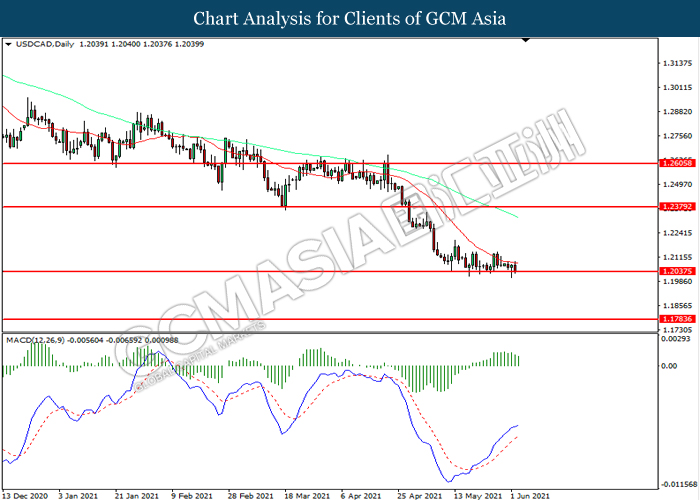

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2040. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2380, 1.2605

Support level: 1.2040, 1.1785

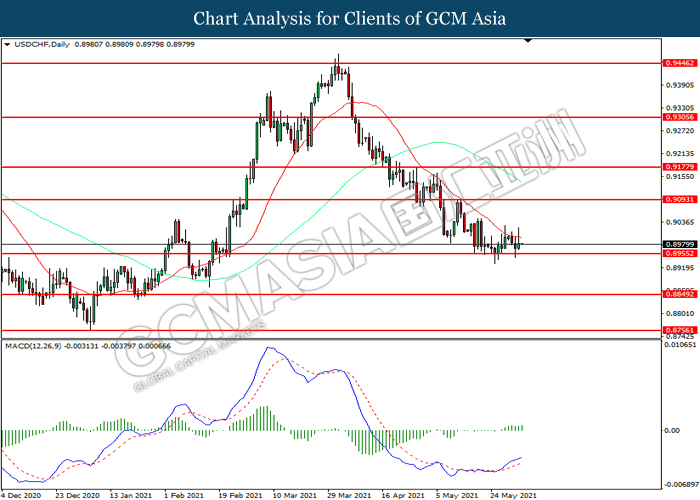

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8955. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9095, 0.9175

Support level: 0.8955, 0.8850

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 67.90. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 69.80, 71.60

Support level: 67.90, 66.30

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 1909.70. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1909.70, 1921.15

Support level: 1896.15, 1885.55