03 August 2020 Afternoon Session Analysis

Japanese Yen slips following the release of Q1 GDP.

The Japanese Yen have fell against the dollar and other currency pairs during late Asian session after the recent release of Japan GDP in the first quarter. According to Japan’s Cabinet Office, Japan’s first quarter GDP remain shrinking at 0.6% and 2.2% for annual which both readings are unchanged compared to the previous results. The data also showed that Japan was already in a recession before the pandemic took its heaviest toll. Following a rare finance ministry move to update its capital spending data last week due to previous low response rate which deemed insufficient, the revision was much lesser than expected. At the same time, Prime Minister Shinzo Abe already facing spiralling budget deficits after pledging about $2 trillion in stimulus and weak recovery could force his administration to increase more, according to reports. He also stated that it now see completely no chance of balancing the budgeting before the year ending March 2030. At the time of writing, USD/JPY rose 0.08% to 105.90.

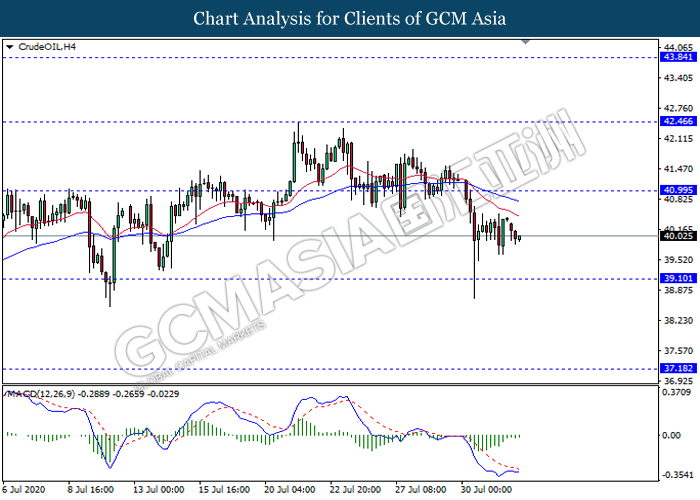

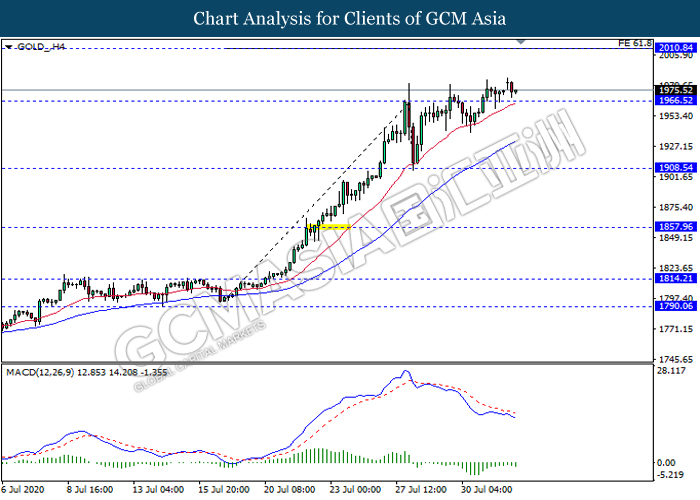

In the commodities market, crude oil price extend losses and fell 0.10% to $39.90 per barrel at the time of writing following OPEC boost production. The production increase that will start this month will see about 1.5 million barrels added to global supply per day. However, fuel demand has yet to recover due to the COVID-19 pandemic, thus continue to affect the price of the commodity. On the other hand, gold price remains steady and edge higher 0.11% to $1972.94 a troy ounce at the time of writing as risk of COVID-19 and uncertainties of U.S congress to pass new COVID stimulus bill continue to boost demand for the commodity.

Today’s Holiday Market Close

Time Market Event

All Day CAD Civic Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Jul) | 45.2 | 50.0 | – |

| 16:30 | GBP – Manfucturing PMI (Jul) | 50.1 | 53.6 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 52.6 | 53.6 | – |

Technical Analysis

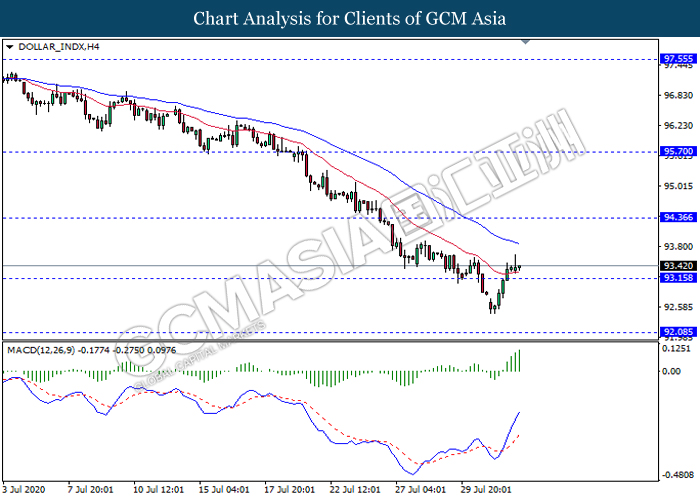

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level 93.15. MACD which illustrate ongoing bullish momentum suggest the dollar to extend its gains towards the resistance level 94.35.

Resistance level: 94.35, 95.70

Support level: 93.15, 92.10

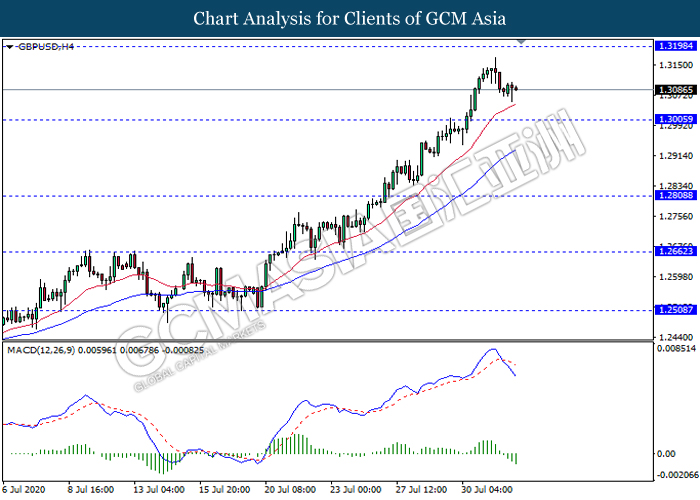

GBPUSD, H4: GBPUSD was traded lower following prior retracement from its high level. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its retracement towards the support level 1.3005.

Resistance level: 1.3200, 1.3320

Support level: 1.3005, 1.2810

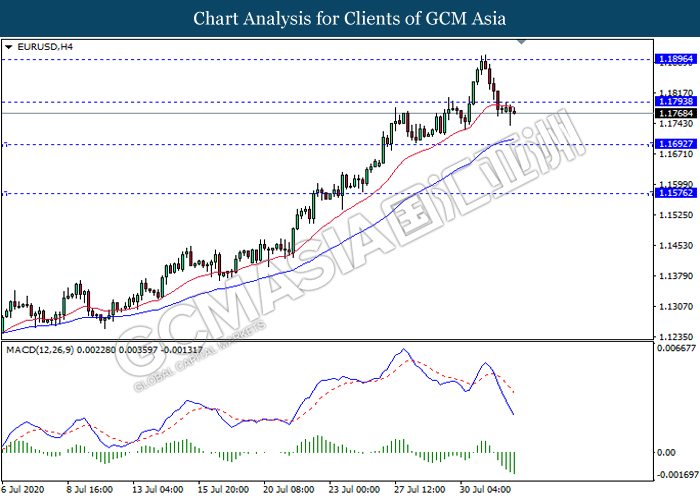

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level 1.1795. MACD which illustrate persistent bearish momentum signal suggest the pair to extend its losses towards the support level 1.1690.

Resistance level: 1.1795, 1.1895

Support level: 1.1690, 1.1575

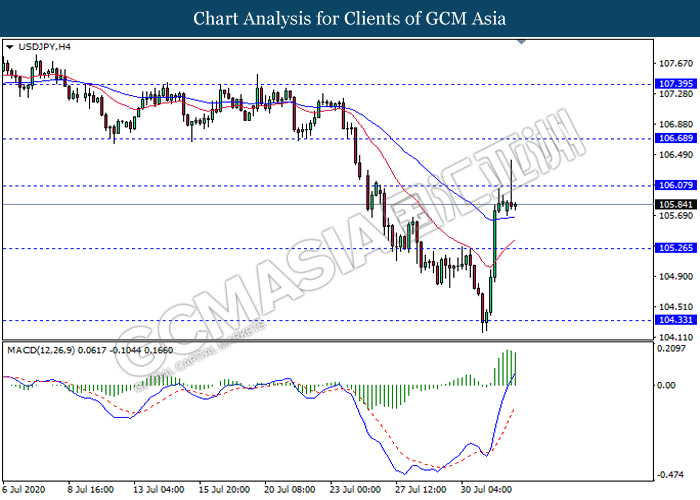

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level 106.05. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction in short term towards the support level 105.25.

Resistance level: 106.05, 106.70

Support level: 105.25, 104.35

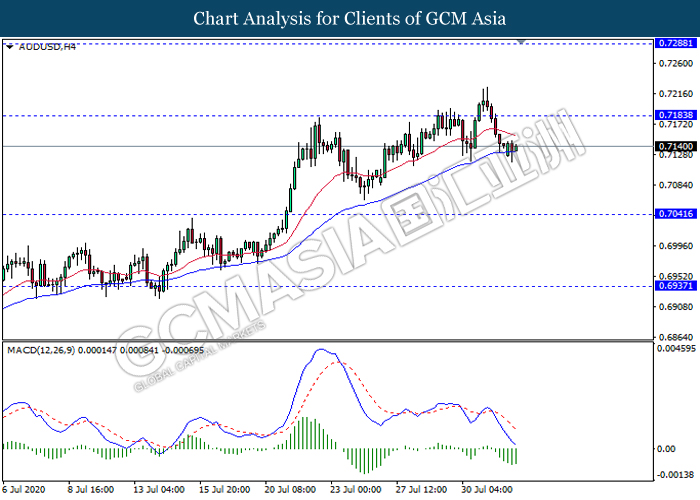

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7185. MACD which illustrate bearish bias signal suggest the pair to extend its losses towards support level 0.7040.

Resistance level: 0.7185, 0.7290

Support level: 0.7040, 0.6935

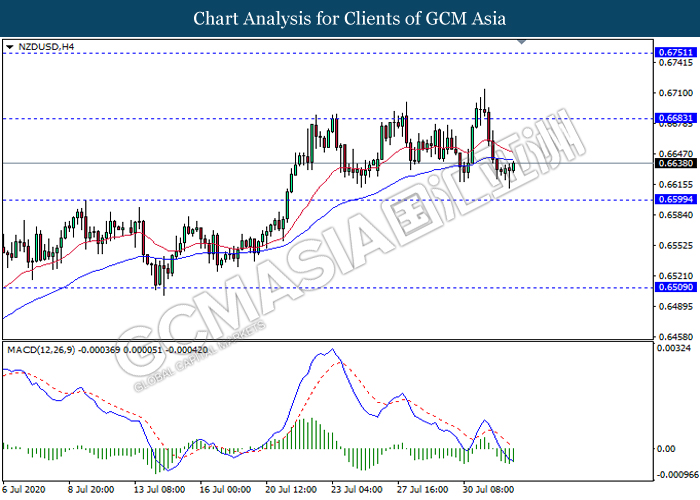

NZDUSD, H4: NZDUSD was traded lower while currently testing near the support level 0.6600. However, MACD which illustrate diminishing bearish momentum suggest the pair to experience a short term technical correction towards the resistance level 0.6685.

Resistance level: 0.6685, 0.6750

Support level: 0.6600, 0.6510

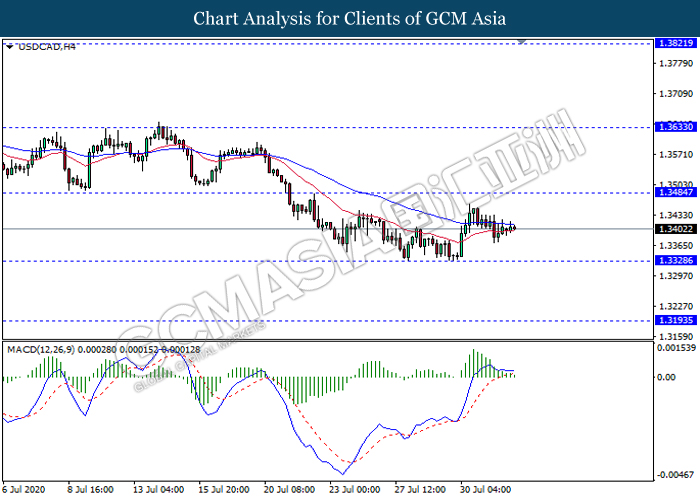

USDCAD, H4: USDCAD was traded flat near the MA lines. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower in short term towards the support level 1.3330.

Resistance level: 1.3485, 1.3635

Support level: 1.3330, 1.3195

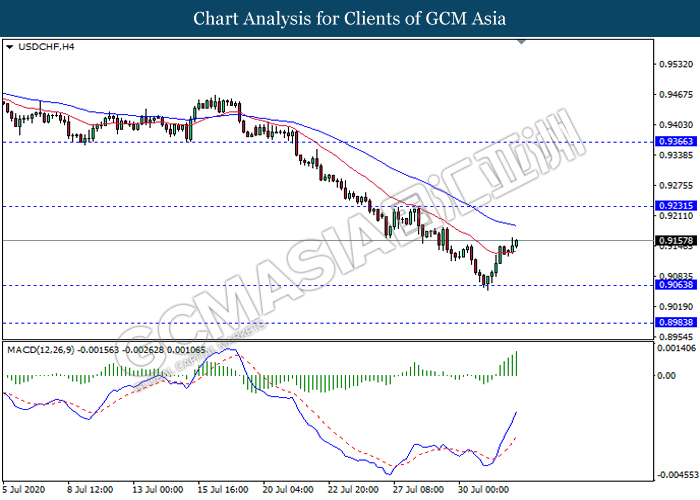

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level 0.9065. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 0.9230.

Resistance level: 0.9230, 0.9365

Support level: 0.9065, 0.8985

CrudeOIL, H4: Crude oil price was traded flat after recent breakout below the previous support level 41.00. MACD which illustrate diminishing bearish momentum signal suggest the commodity to be traded higher in short term towards the resistance level 41.00.

Resistance level: 41.00, 42.45

Support level: 39.10, 37.20

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1966.50. However, MACD which illustrate bearish momentum signal suggest the pair to experience a technical correction in short term back to 1966.50.

Resistance level: 2010.85, 2075.15

Support level: 1966.50, 1908.55