03 August 2020 Morning Session Analysis

Brexit deadlock remains pressured on pound.

Pound sterling which acts as one of the major currency dipped in early trading session today as Post-Brexit negotiation remains stalled as there are gaps in Brexit talks between UK and EU. Since UK voted to exit from EU bloc, both parties had undergone uncountable times of talk on all aspects of their future ties. Yet, there is no any official trade deal been achieved by UK and EU as the fishing conflict is remains as the major issue that need to be solved in the current condition. In details, UK and EU are now struggling on the talks with regards to the future fish industry as UK insists to block EU fishermen from its water. Prior to now, Britain reacted furiously and criticized Brussels as they demanded UK to allow their accesses of boat to UK water after transition period ended, which is simply unacceptable by UK government. Nevertheless, investors are now eyeing on the further trade talk between these two parties, which have been scheduled to be held all the way from time to time until the beginning of October. During Asian early trading session, the pair of GBP/USD inched up 0.07% to 1.3095.

In the commodities market, crude oil price depreciated by 0.47% to $40.00 per barrel as of writing amid heightening of market worries over prospect of oil demand. According to a poll from Reuters, potential second wave of Covid-19 still remains as the major threat that could limit the pace of recovery of this black commodity market. Besides, gold price up 0.35% to $1982.95 a troy ounce as increasing in virus’s cases spurred up the market’s risk avoidance behaviour.

Today’s Holiday Market Close

Time Market Event

All Day CAD Civic Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Jul) | 45.2 | 50.0 | – |

| 16:30 | GBP – Manfucturing PMI (Jul) | 50.1 | 53.6 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 52.6 | 53.6 | – |

Technical Analysis

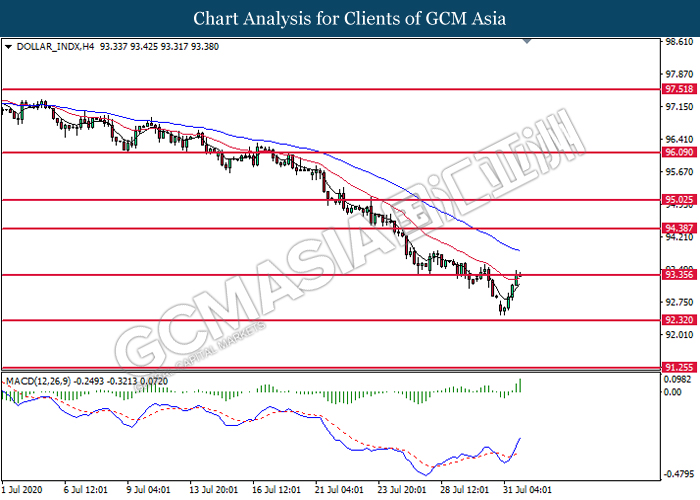

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 93.35. MACD which illustrate bullish bias momentum signal suggest the dollar to extend its gains after it successfully breakout above the resistance level at 93.35.

Resistance level: 93.35, 94.40

Support level: 92.30, 91.25

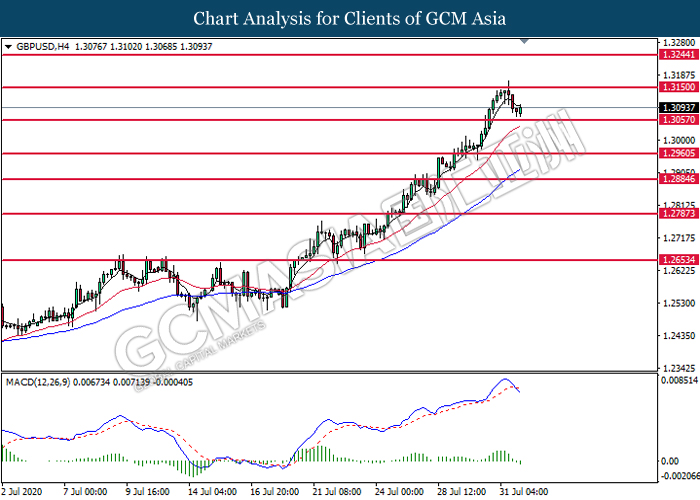

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3150. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses toward the support level at 1.3055.

Resistance level: 1.3150, 1.3245

Support level: 1.3055, 1.2960

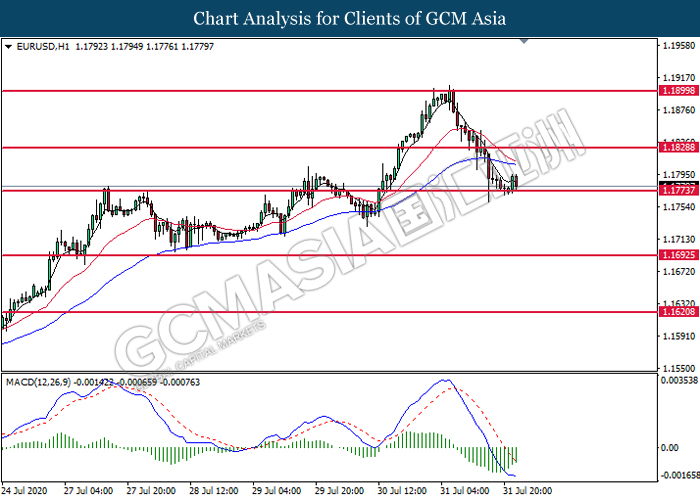

EURUSD, H1: EURUSD was traded higher following prior rebound from the support level at 1.1775. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound toward the resistance level at 1.1830.

Resistance level: 1.1830, 1.1900

Support level: 1.1775, 1.1695

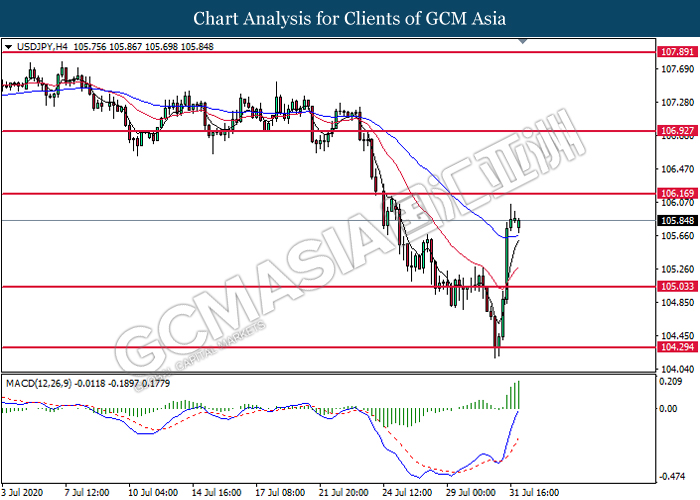

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 105.00. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 106.15.

Resistance level: 106.15, 106.95

Support level: 105.05, 104.30

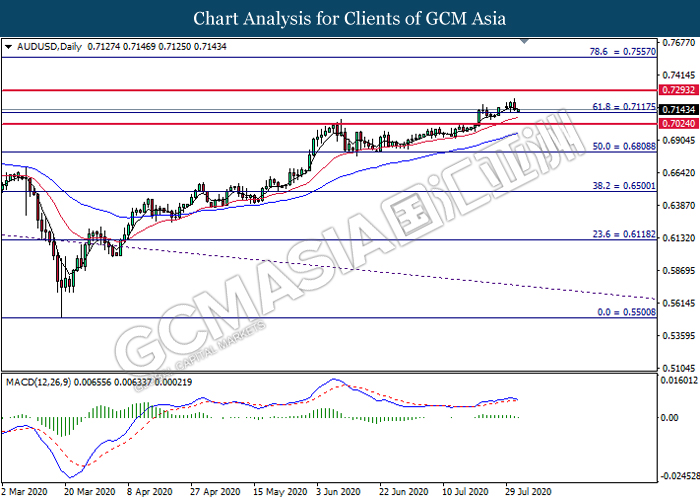

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7115. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to undergo technical correction in short term.

Resistance level: 0.7295, 0.7555

Support level: 0.7115, 0.7025

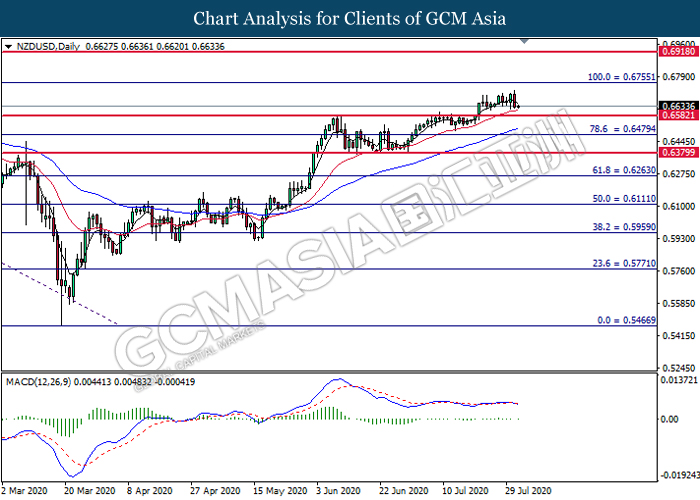

NZDUSD, Daily: NZDUSD was traded lower following prior retracement near the resistance level at 0.6755. MACD which illustrated bearish momentum suggest the pair to extend its losses toward the support level at 0.6580.

Resistance level: 0.6755, 0.6920

Support level: 0.6580, 0.6480

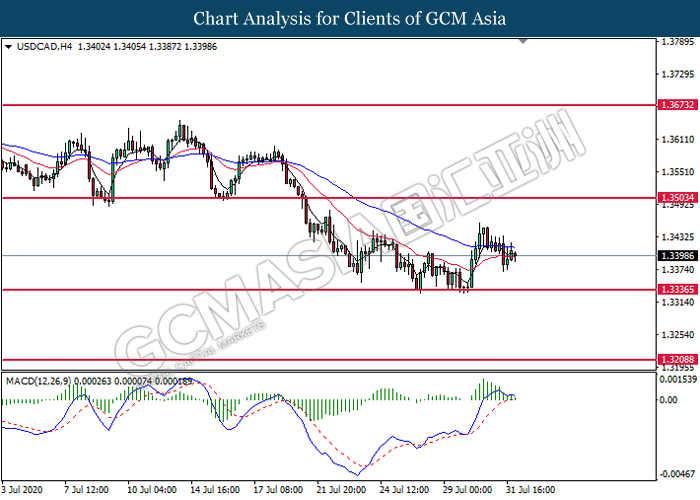

USDCAD, H4: USDCAD was traded lower following prior retracement from the higher level. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.3335.

Resistance level: 1.3505, 1.3675

Support level: 1.3335, 1.3210

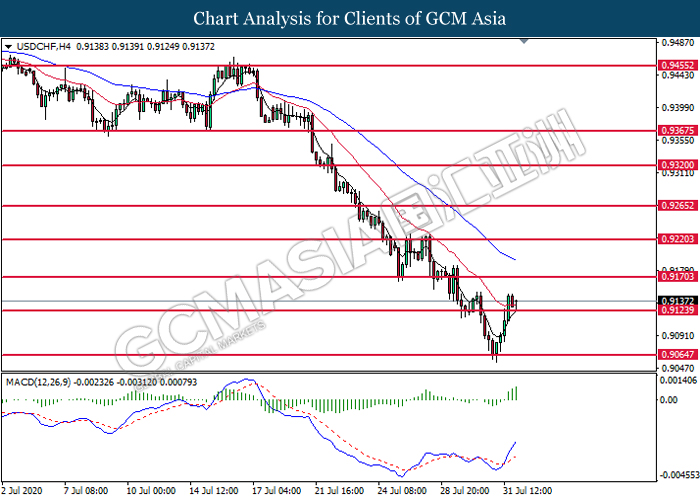

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9125. MACD which illustrate bullish bias momentum signal suggest the pair to extend its gains toward the resistance level at 0.9170.

Resistance level: 0.9170, 0.9220

Support level: 0.9125, 0.9065

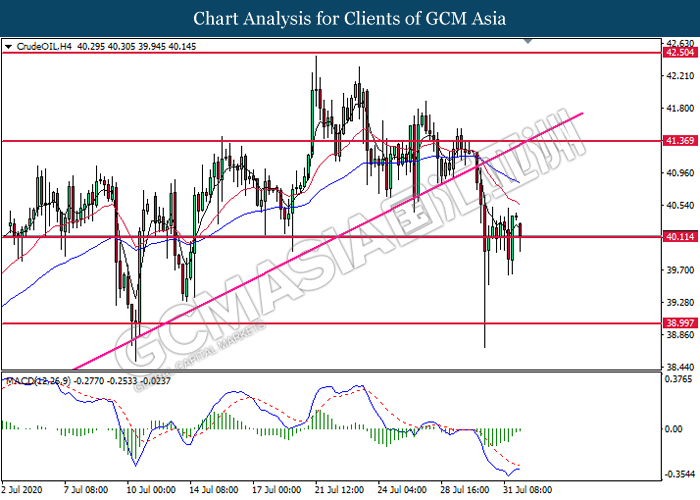

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 40.10. However, MACD which illustrate diminishing bearish momentum signal suggest the commodity to undergo technical correction in short term toward the higher level.

Resistance level: 41.35, 42.50

Support level: 40.10, 39.00

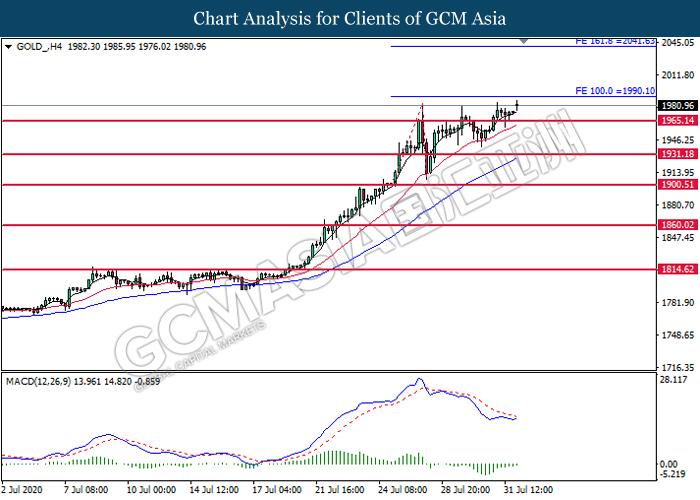

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 1965.15. MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains toward the resistance level at 1990.10.

Resistance level: 1990.10, 2041.65

Support level: 1965.15, 1931.20