3 August 2023 Afternoon Session Analysis

Eurozone’s PMI fell for 6th consecutive month in July, EUR plunged.

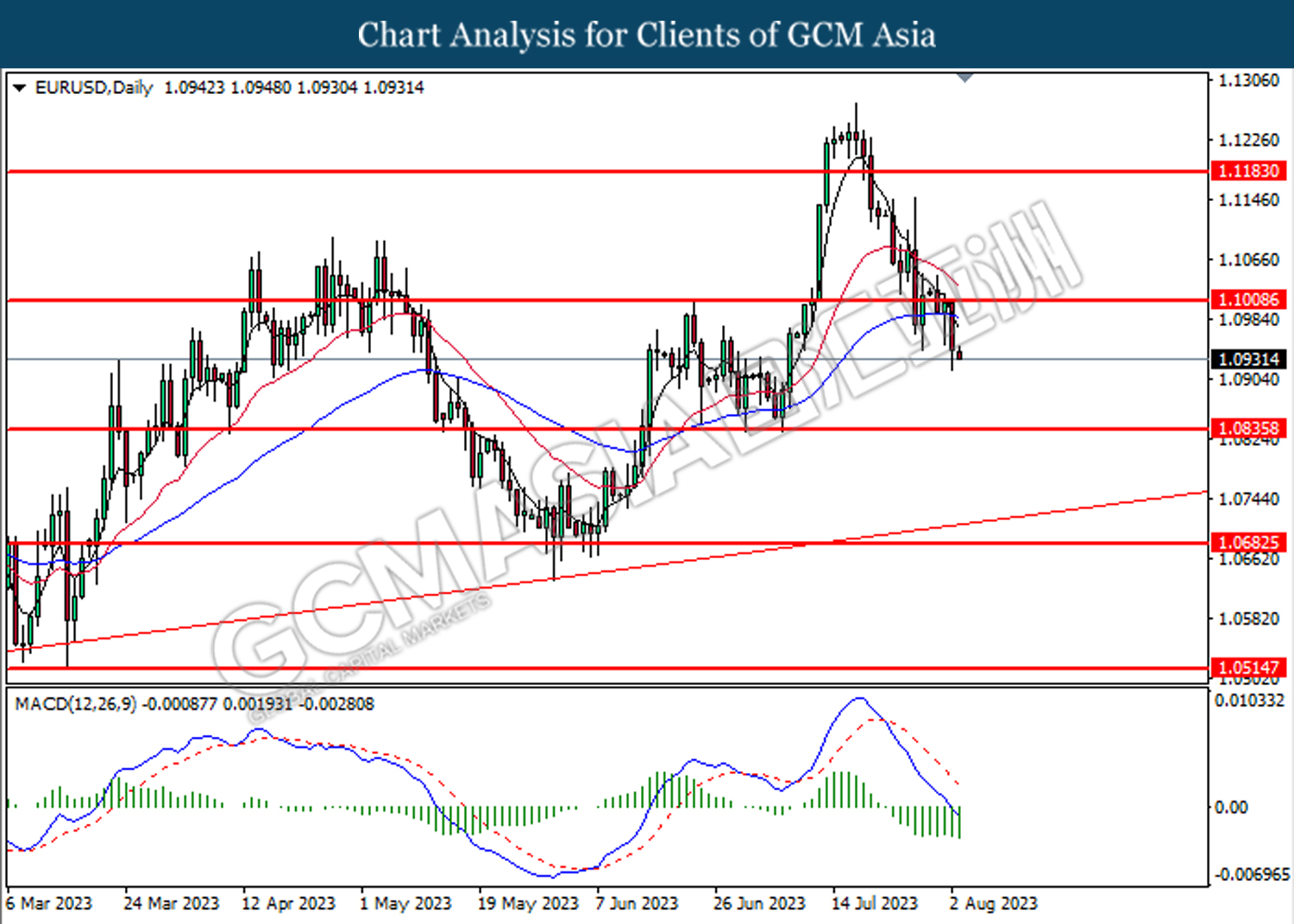

Euro (EUR), which was widely traded by global investors, dropped after the Eurozone manufacturing PMI data was released. Eurozone’s manufacturing PMI has been fell for six consecutive month in July, decreased from 43.4 to 42.7, matched with the market forecast. This is the thirteenth month in a row that PMI data remained below 50, which represented there were around 1 year that the Eurozone manufacturing sector has stopped expanding. Besides that, according to Eurostat, the unemployment rate remained the same at 6.4%, below the market forecast of 6.5%. Although the unemployment rate were decreasing, but the labor market pressure eased. On the other hand, Germany, as the Eurozone’s largest economic country, released disappointing HCOB PMI, where it decreased from 40.6 to 38.8, matched with the market forecast. The German’s manufacturing sector weakened further amid the deterioration of demand, quantity of new order declined sharply. As the European Central Bank (ECB) stated that they will be open-minded to decide the upcoming interest decision, all these underperformed economic data may lead ECB member to shift its stance from hawkish to dovish. As of writing, EUR/USD dropped -0.03% to 1.0930.

In the commodities market, crude oil prices rose 0.33% to 79.70 per barrel amid by the EIA crude oil inventories has decreased to -17 million, below the market forecast. Besides, gold prices rose 0.12% to 1936.90 per troy amid the investors gained confident for US dollar following the release of outstanding economic data, therefore investors chose to leave the “safe heaven” asset and invest into dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

19:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 19:00 | GBP – BoE Interest Rate Decision (Aug) | 5.00% | 5.25% | – |

| 20:30 | USD – Initial Jobless Claims | 221K | 227K | – |

| 21:45 | USD – S&P Global US Services PMI (Jul) | 52.4 | 52.4 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 53.9 | 53.0 | – |

Technical Analysis

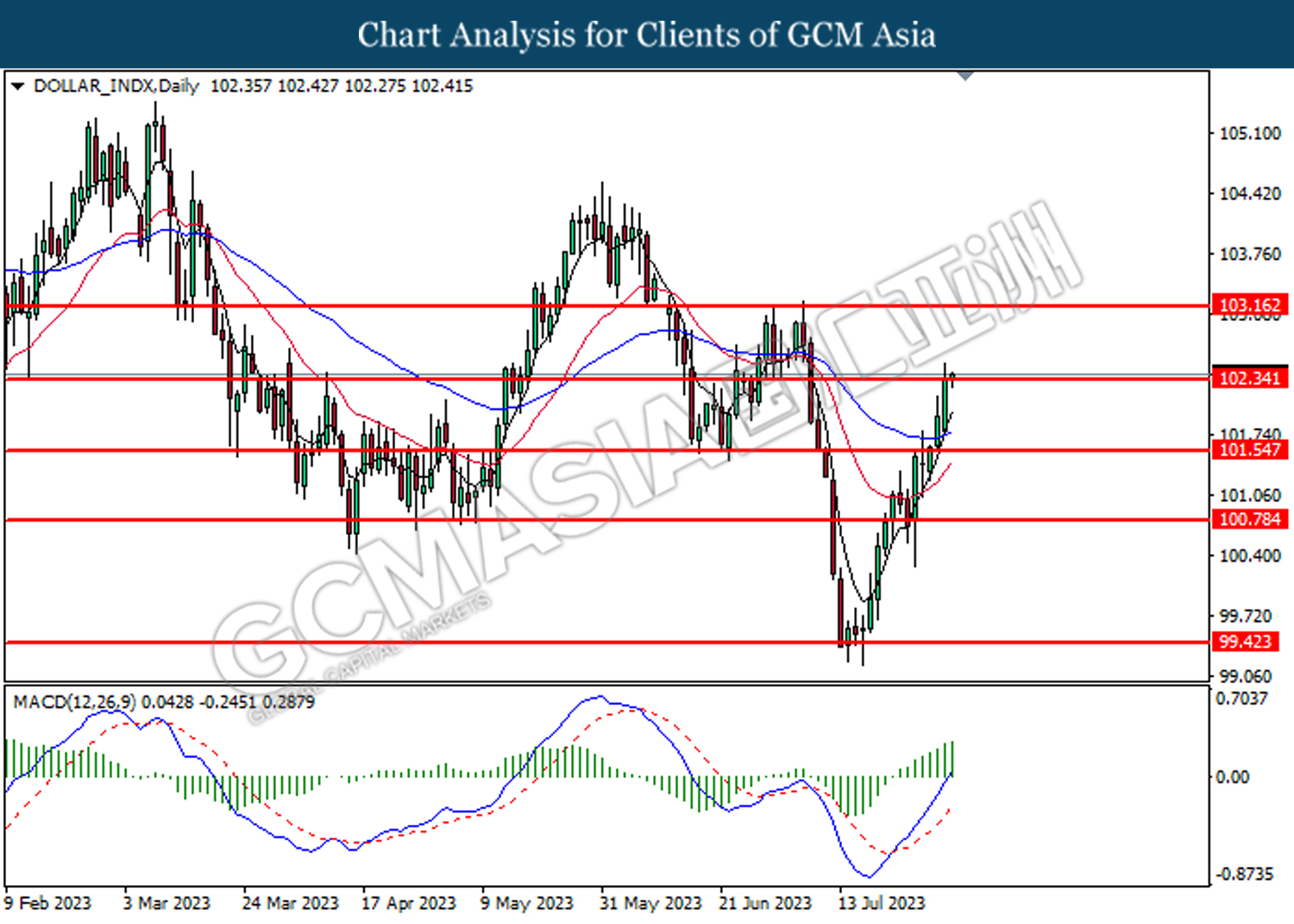

DOLLAR_INDX, Daily: Dollar index was traded higher while testing the resistance level at 102.35. MACD which illustrated increasing bullish momentum suggests the index to extend its gains after it breakout the resistance level.

Resistance level: 102.35, 103.15

Support level: 101.55, 100.80

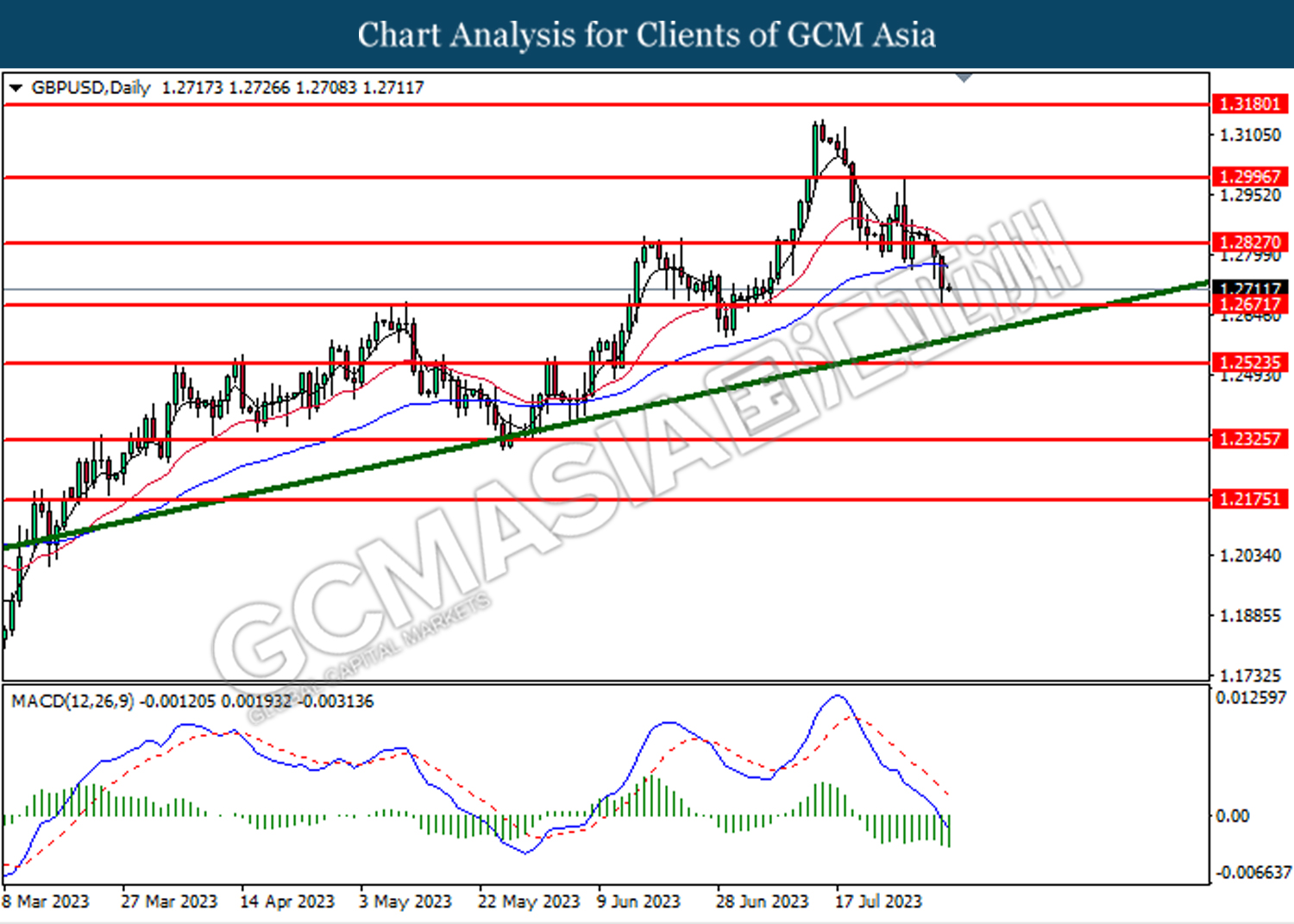

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2830. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.2670.

Resistance level: 1.2830, 1.3000

Support level: 1.2670, 1.2525

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.0835.

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

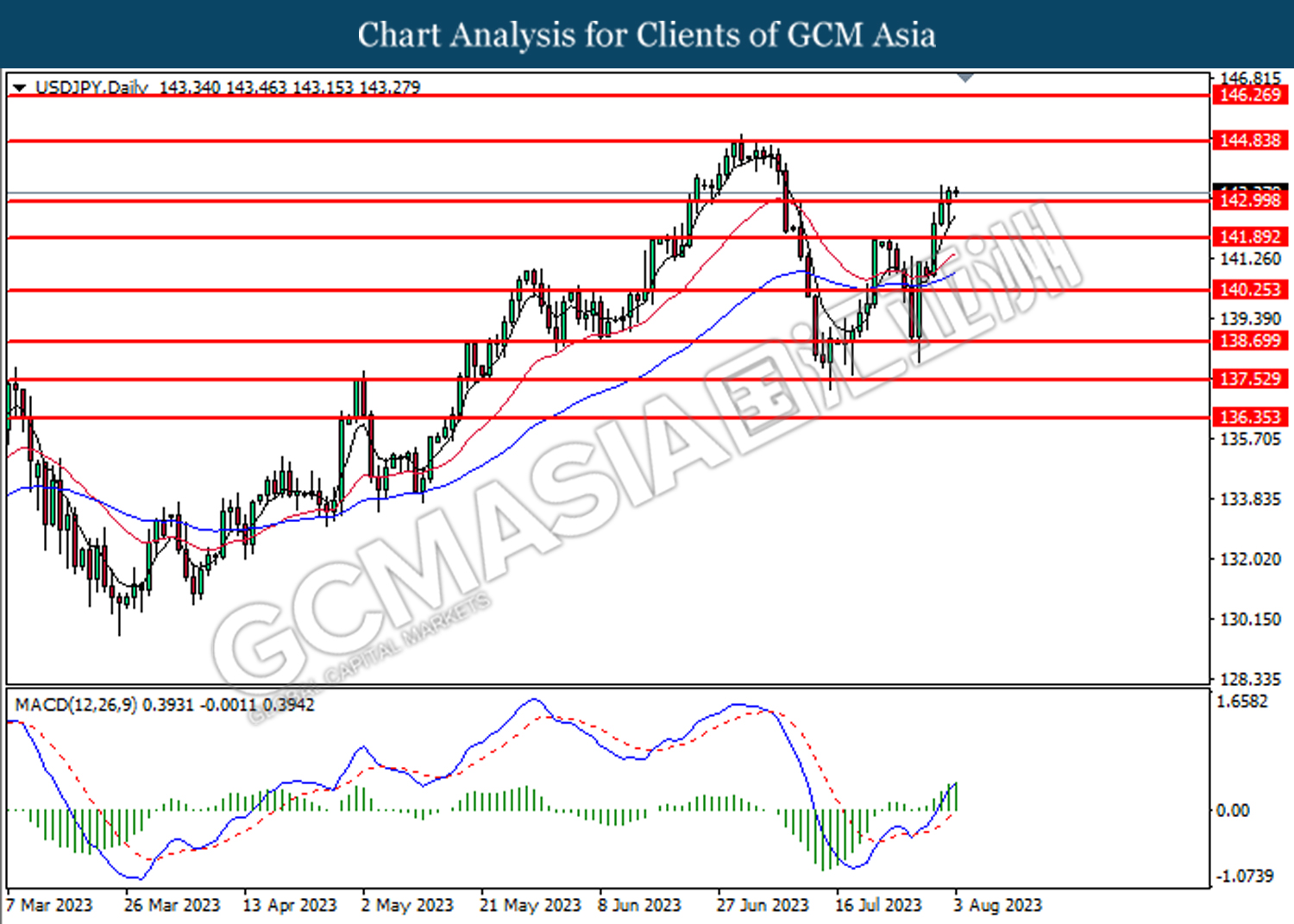

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 143.00. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 144.85

Resistance level: 144.85, 146.25

Support level: 143.00, 141.90

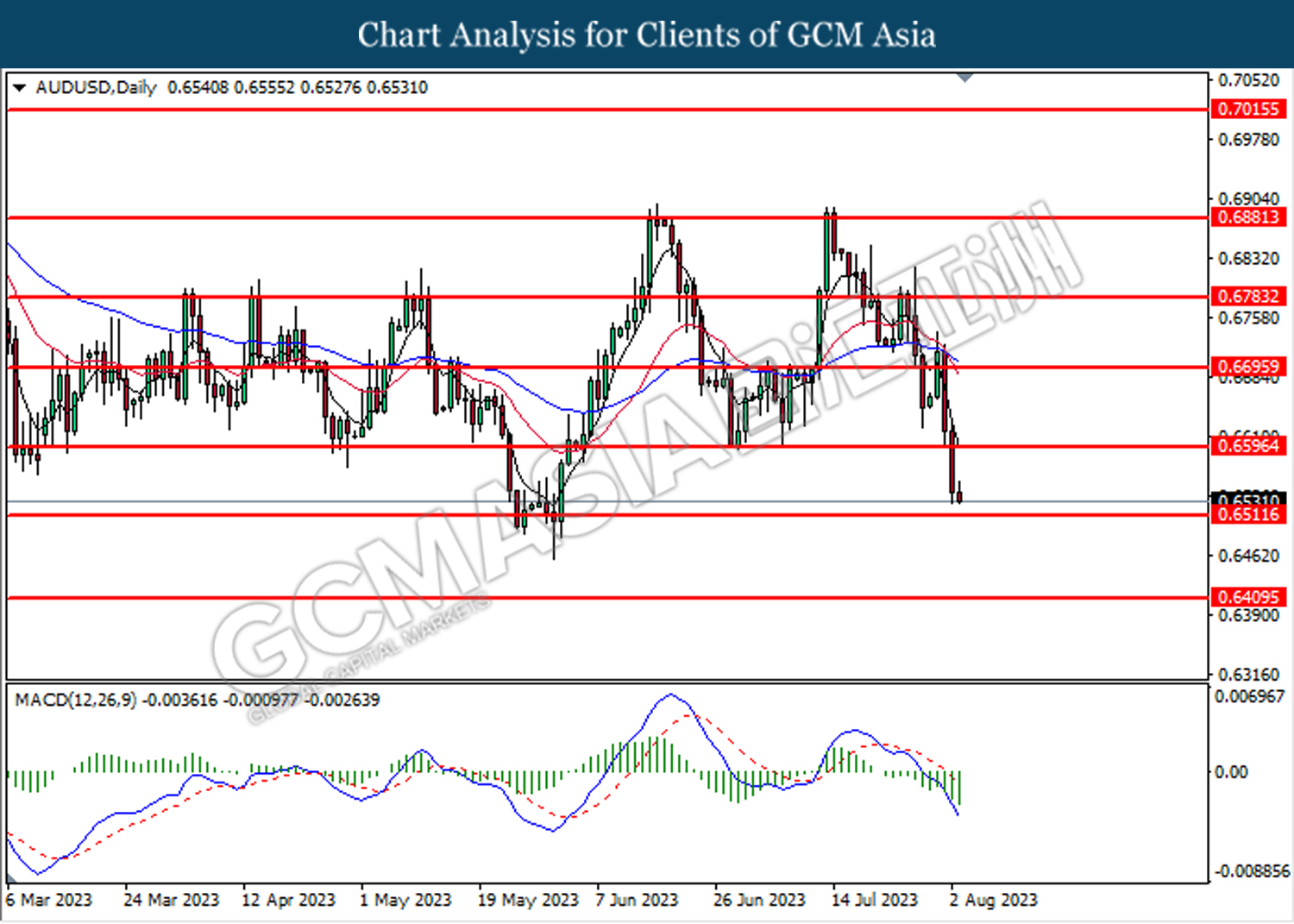

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6595. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6510.

Resistance level: 0.6595, 0.6695

Support level: 0.6510, 0.6410

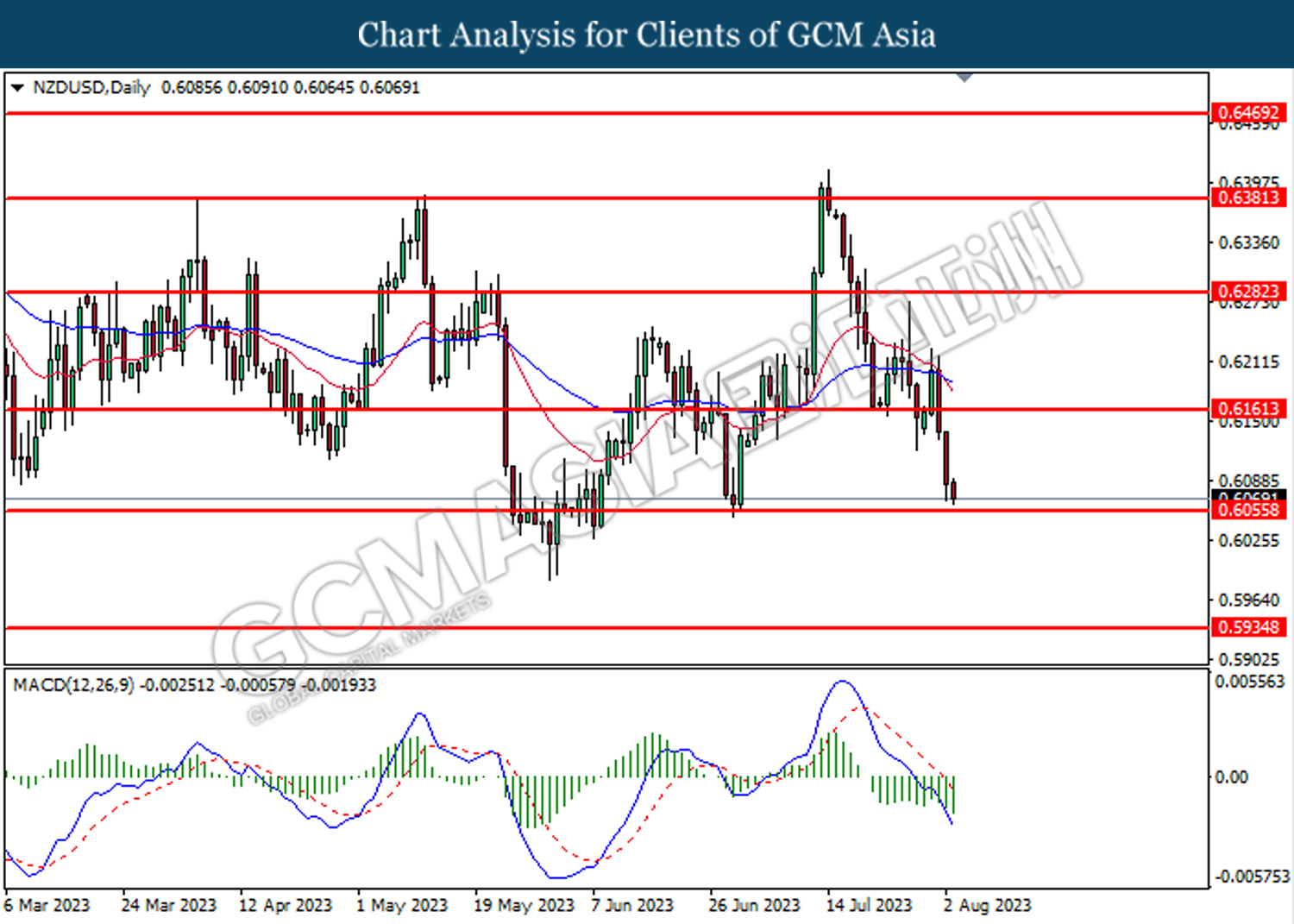

NZDUSD, Daily: NZDUSD was traded lower while testing the support level at 0.6055. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses after breakout the support level.

Resistance level: 0.6160, 0.6280

Support level: 0.6055, 0.5935

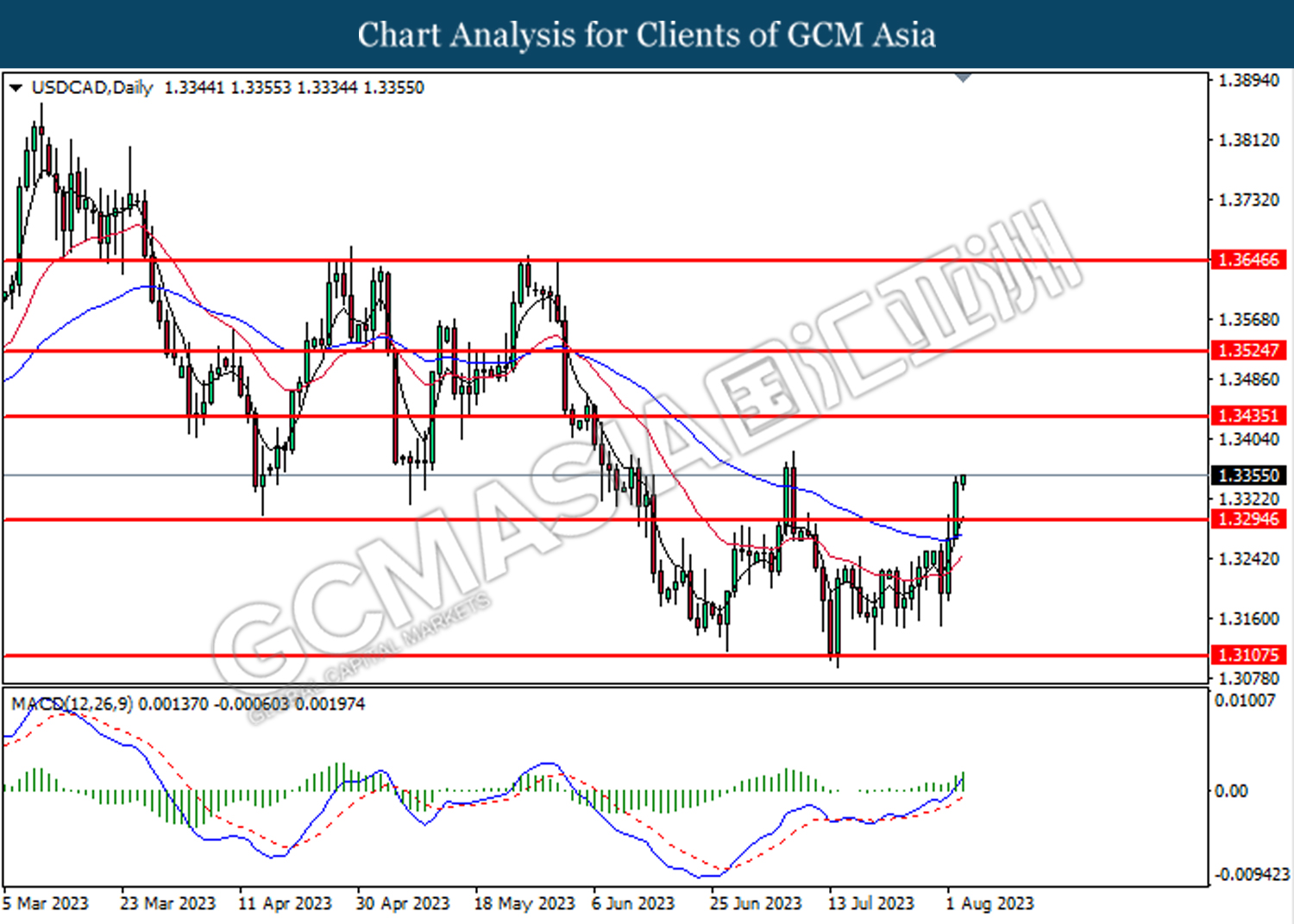

USDCAD, Daily: USDCAD was traded higher following the prior after breakout above the previous resistance level at 1.3295. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3425.

Resistance level: 1.3435, 1.3525

Support level: 1.3295, 1.3110

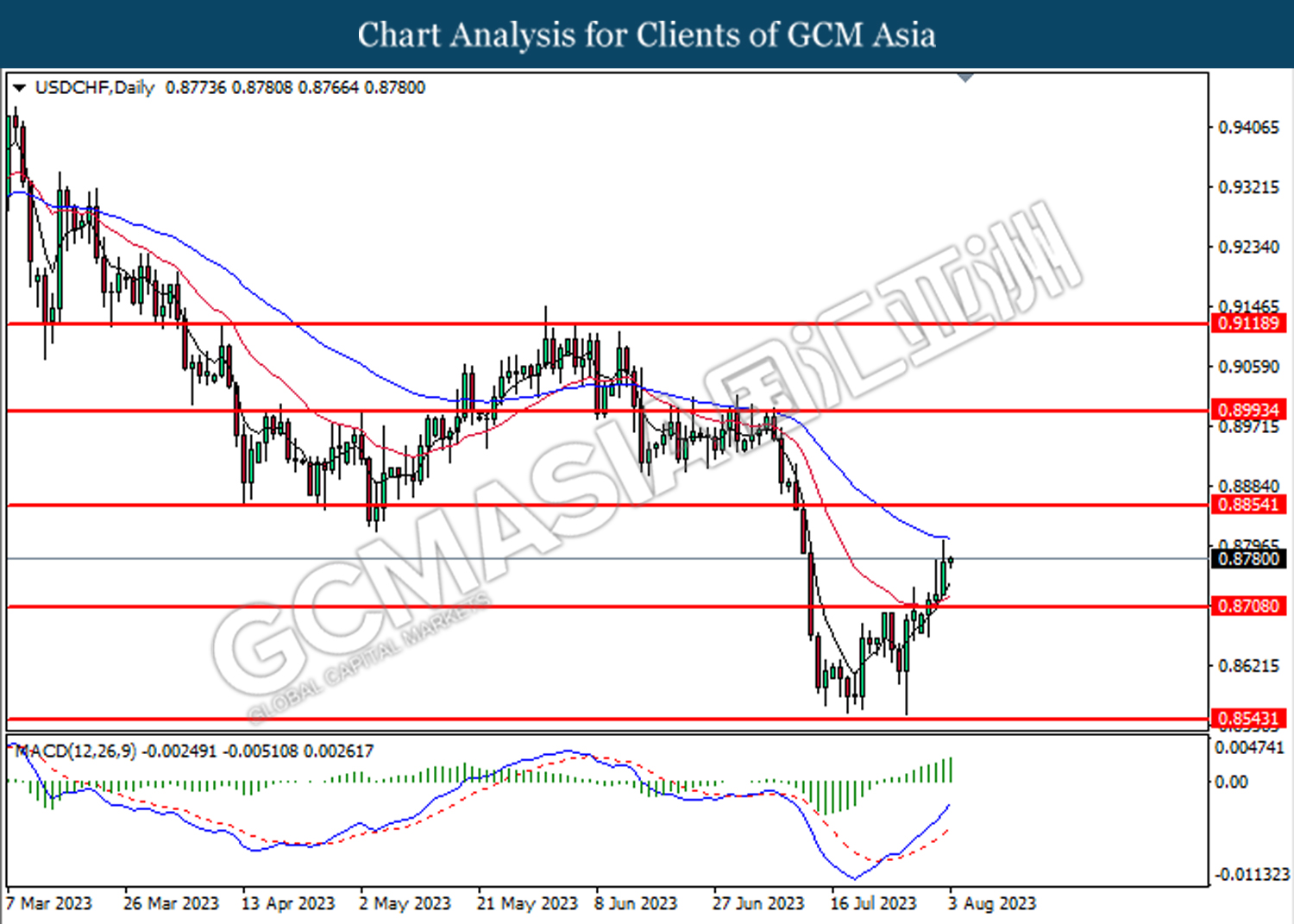

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8710. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.8855

Resistance level: 0.8855, 0.8995

Support level: 0.8710, 0.8545

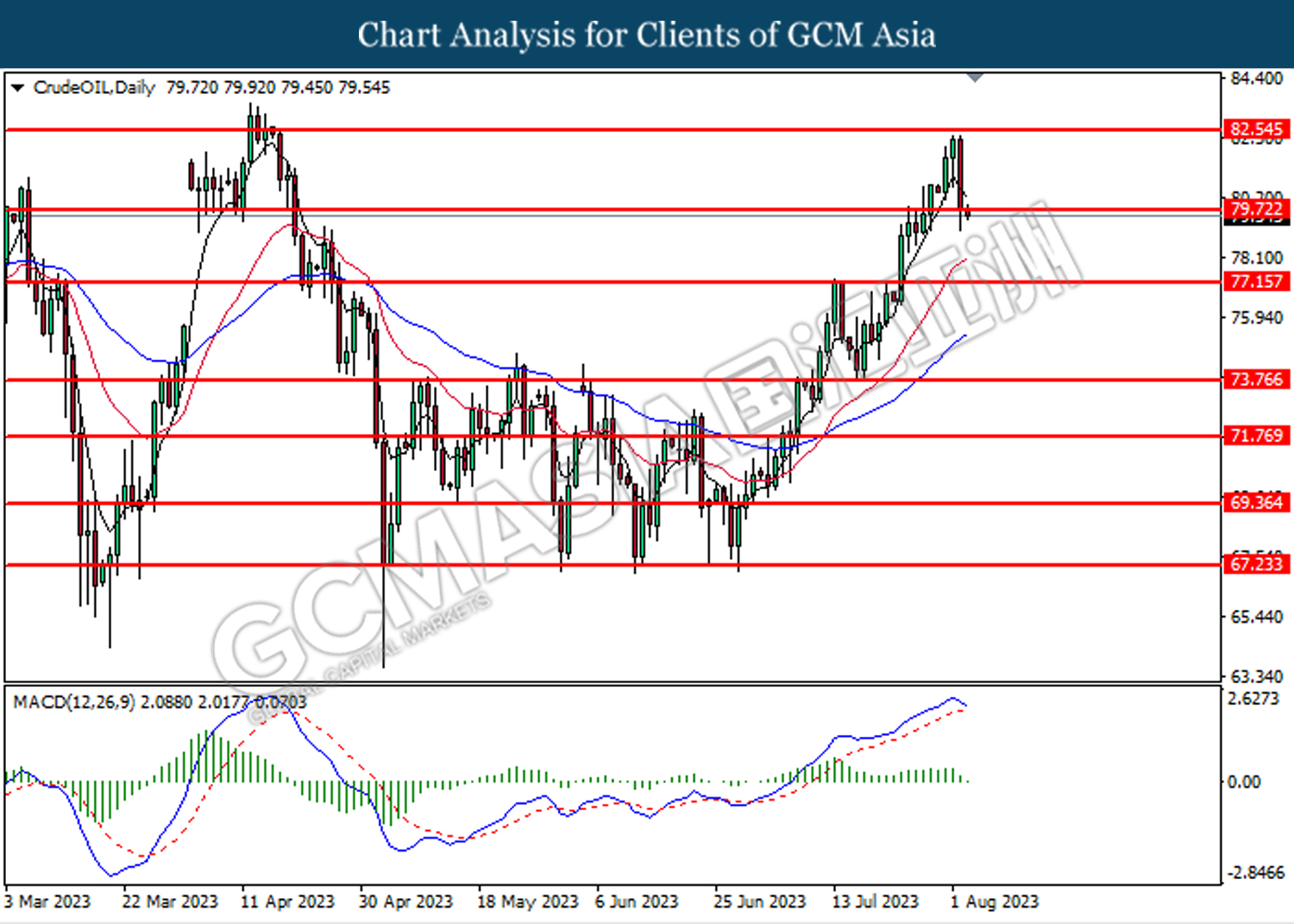

CrudeOIL, Daily: Crude oil price was traded lower while testing the support level at 79.70. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses after breakout the support level.

Resistance level: 79.70, 82.55

Support level: 77.15, 73.80

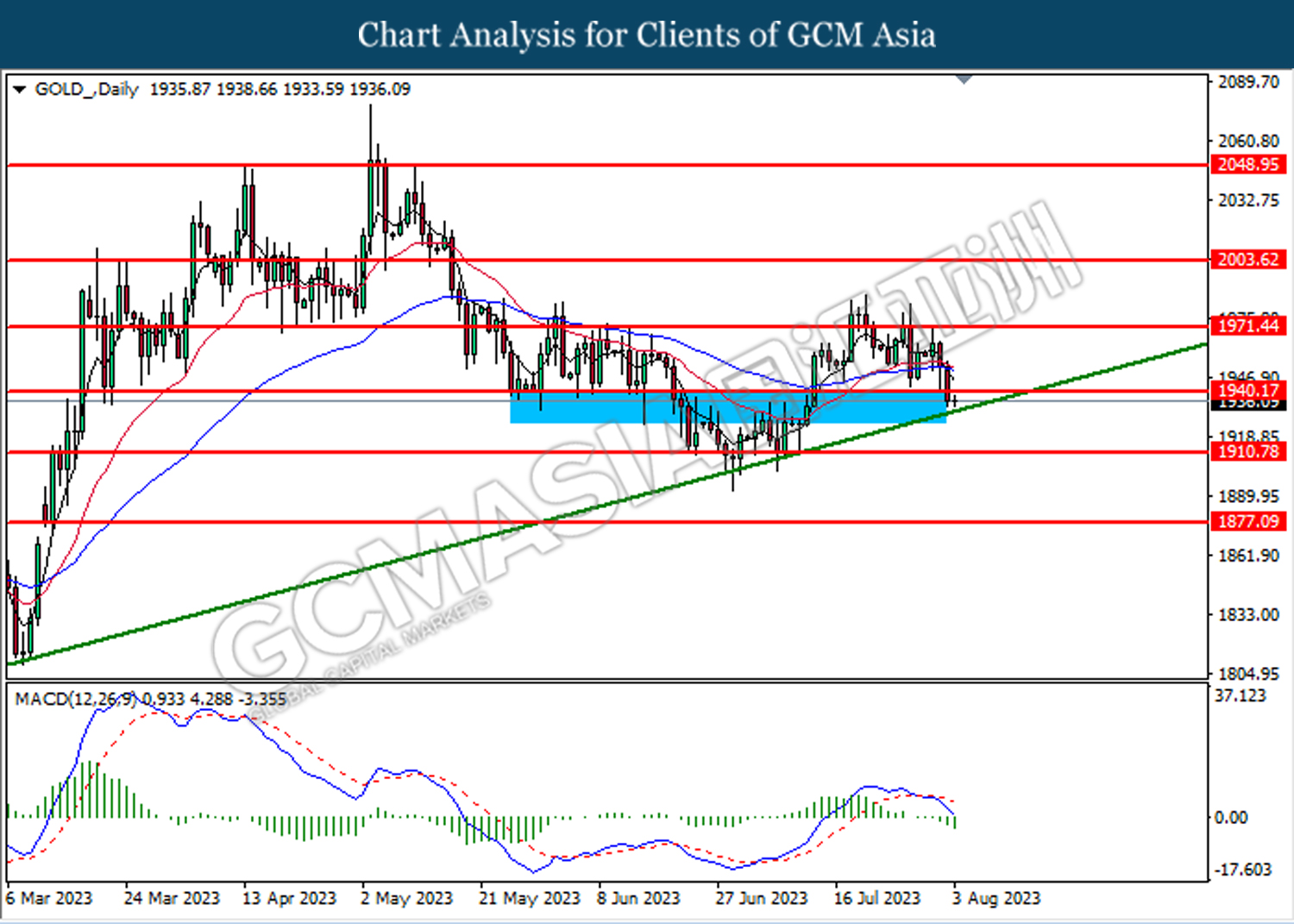

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1940.20. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1910.80.

Resistance level: 1940.20, 1971.45

Support level: 1910.80, 1877.10