3 August 2023 Morning Session Analysis

Unstoppable bull in US dollar market amid strong economic data.

The dollar index, which was traded against a basket of six major currencies, extended its rallies yesterday amid the announcement of upbeat labor data. On Wednesday, the dollar experienced an upward surge as investors seemed unfazed by Fitch’s decision to downgrade the U.S. credit rating. According to the agency, there is a possibility that the fiscal situation may deteriorate in the next three years, while the ongoing negotiations regarding the debt ceiling, taking place at the last minute, pose a threat to the government’s capacity to honor its debt obligations. Although Fitch’s downgrade from AAA to AA+ on Tuesday sparked anger from the White House and surprised investors, it had only a minor impact on the world’s most-traded currency, the dollar. This suggests that the market is currently more focused on the encouraging employment data and less affected by the credit rating change. The greenback received a boost from encouraging data, indicating a larger-than-expected increase of 324,000 jobs in the private sector in July, according to the ADP National Employment report. Economists had previously forecasted a more modest increase of 189,000 jobs. This positive employment report serves as further evidence of the resilience of the U.S. labor market, despite the Federal Reserve’s efforts to slow the economy and tackle inflation. The strong job growth may act as a safeguard for the nation’s economy, potentially shielding it from a possible recession. As of writing, the dollar index rose 0.29% to 102.60.

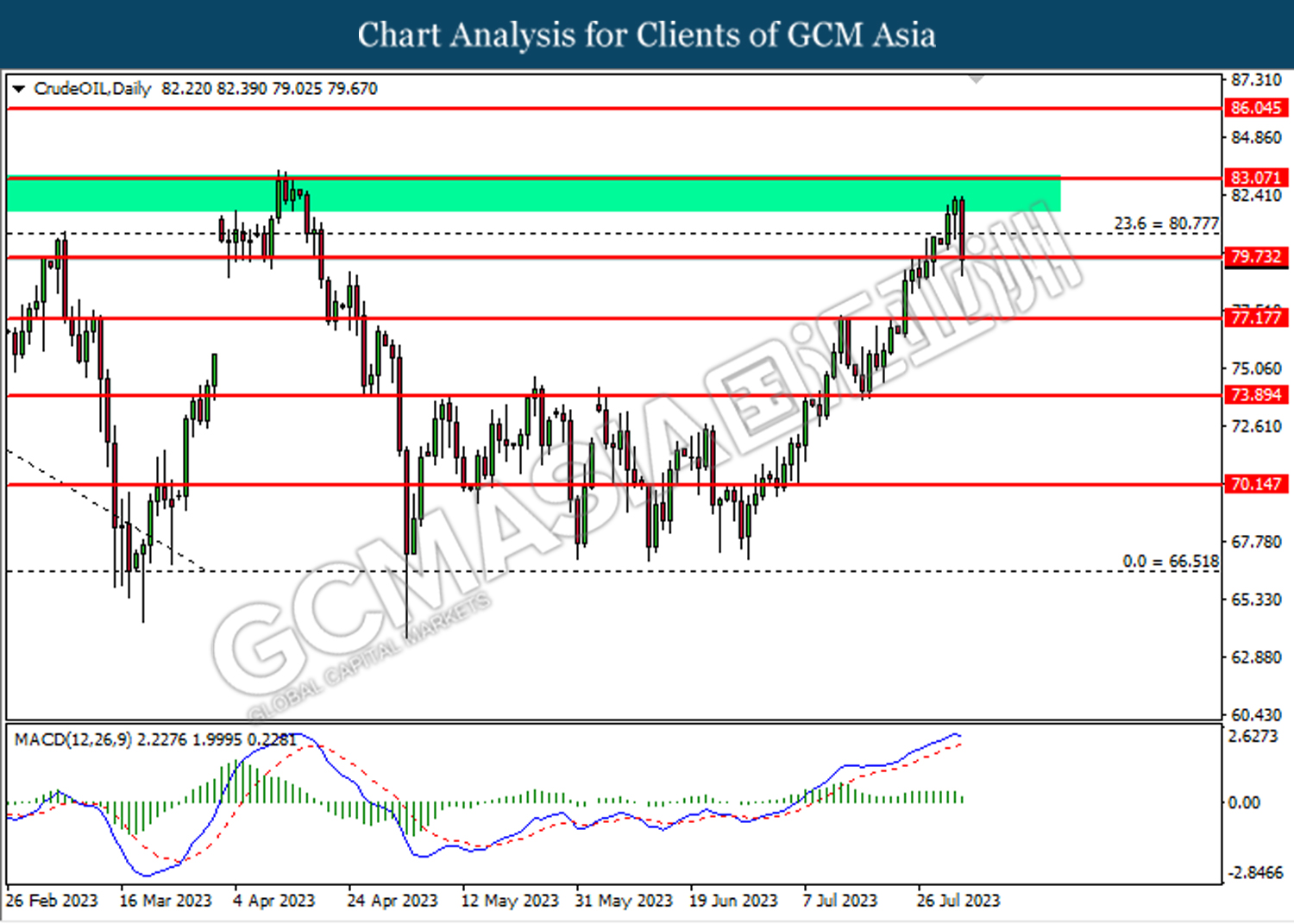

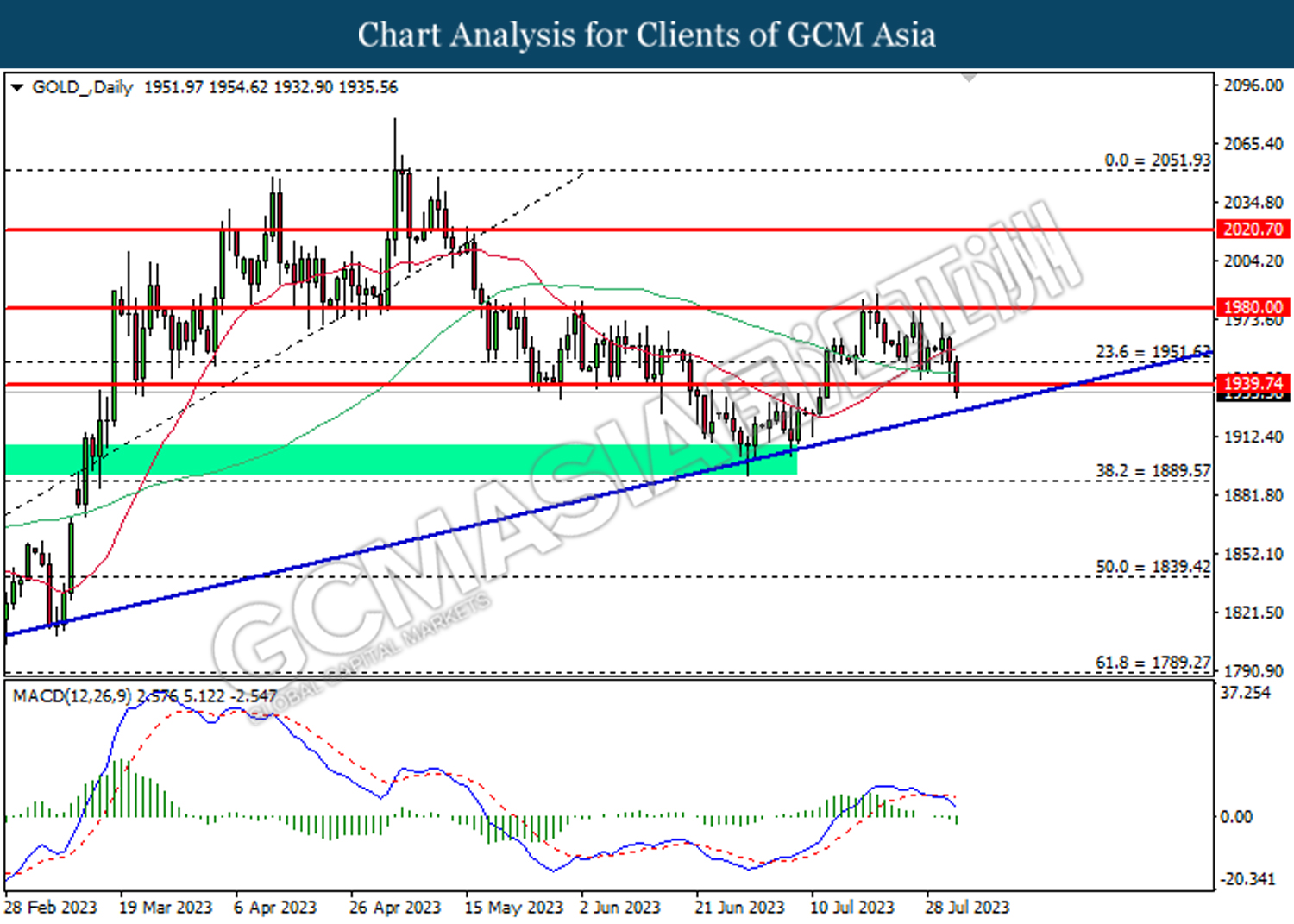

In the commodities market, crude oil prices were down by -3.15% to $79.65 per barrel following the profit-taking activities in the market despite a huge draw in US crude stocks. Besides, the gold prices rebounded 0.09% to $1936.65 per troy ounce following a sharp drop amid the release of strong ADP data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE MPC Meeting Minutes

19:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:00 | GBP – BoE Interest Rate Decision (Aug) | 5.00% | 5.25% | – |

| 20:30 | USD – Initial Jobless Claims | 221K | 227K | – |

| 21:45 | USD – S&P Global US Services PMI (Jul) | 52.4 | 52.4 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 53.9 | 53.0 | – |

Technical Analysis

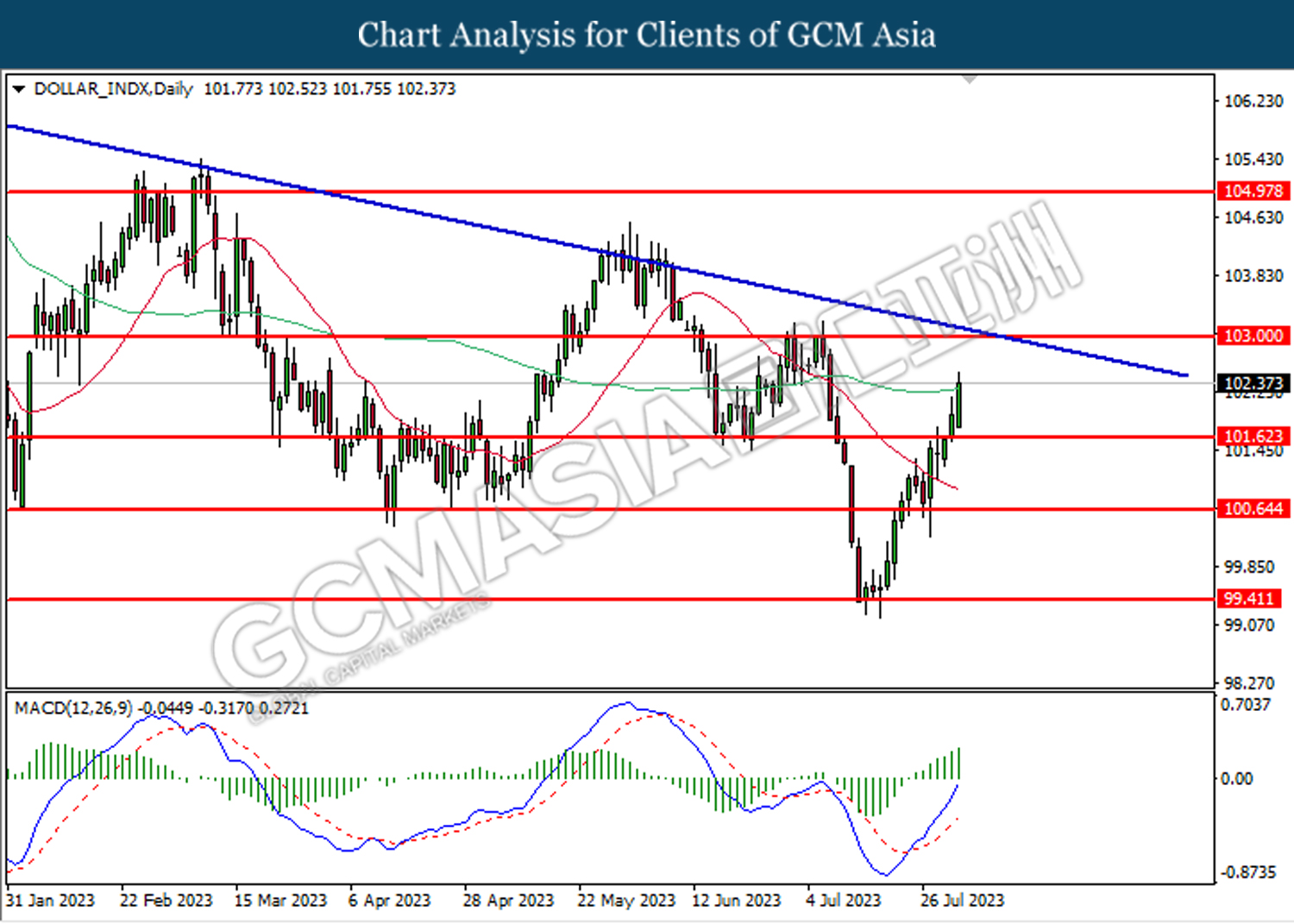

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 105.00

Support level: 101.65, 100.65

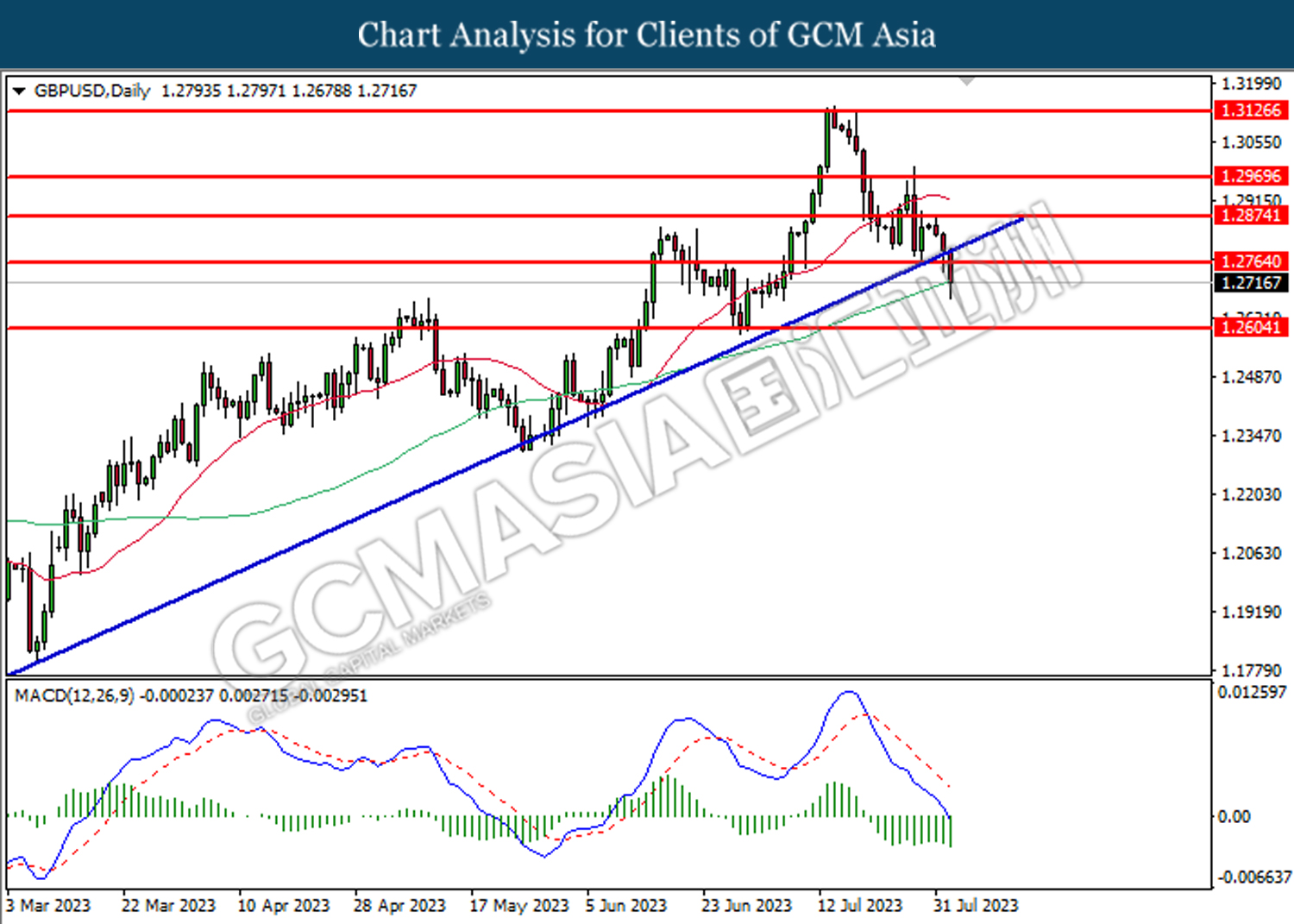

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2605

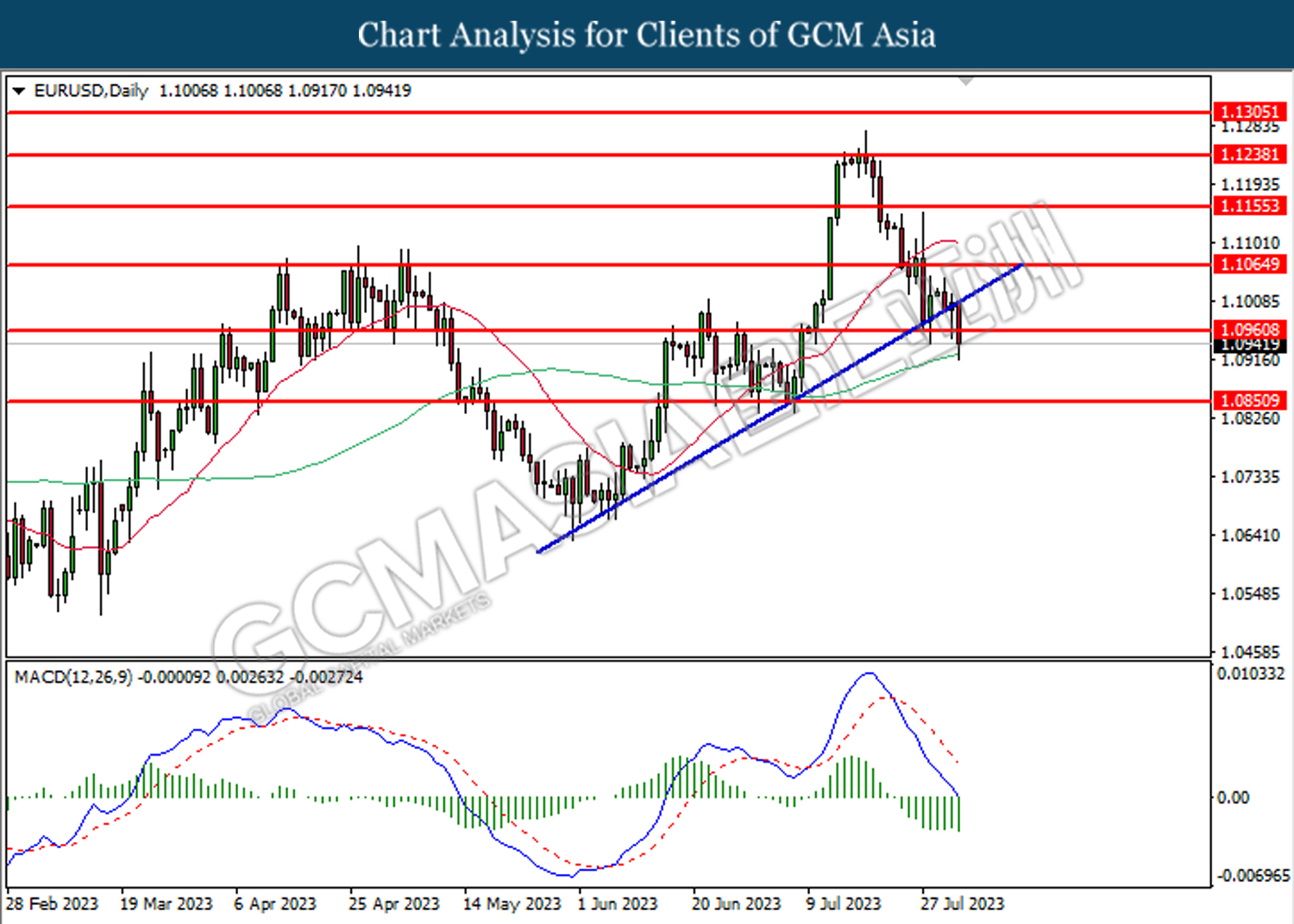

EURUSD, Daily: EURUSD was traded lower while currently retesting the support level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1065, 1.1155

Support level: 1.0960, 1.0850

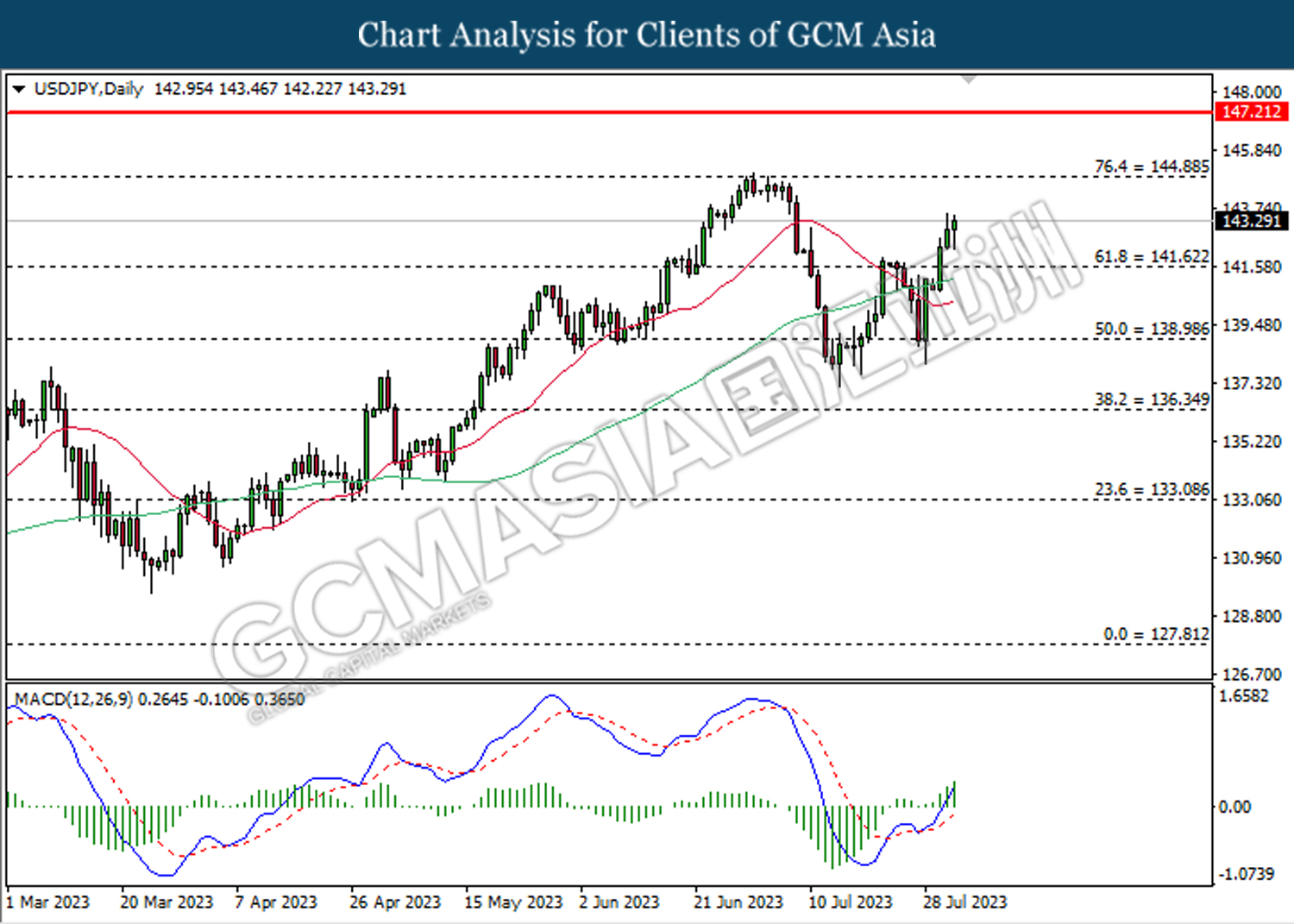

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 144.90.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

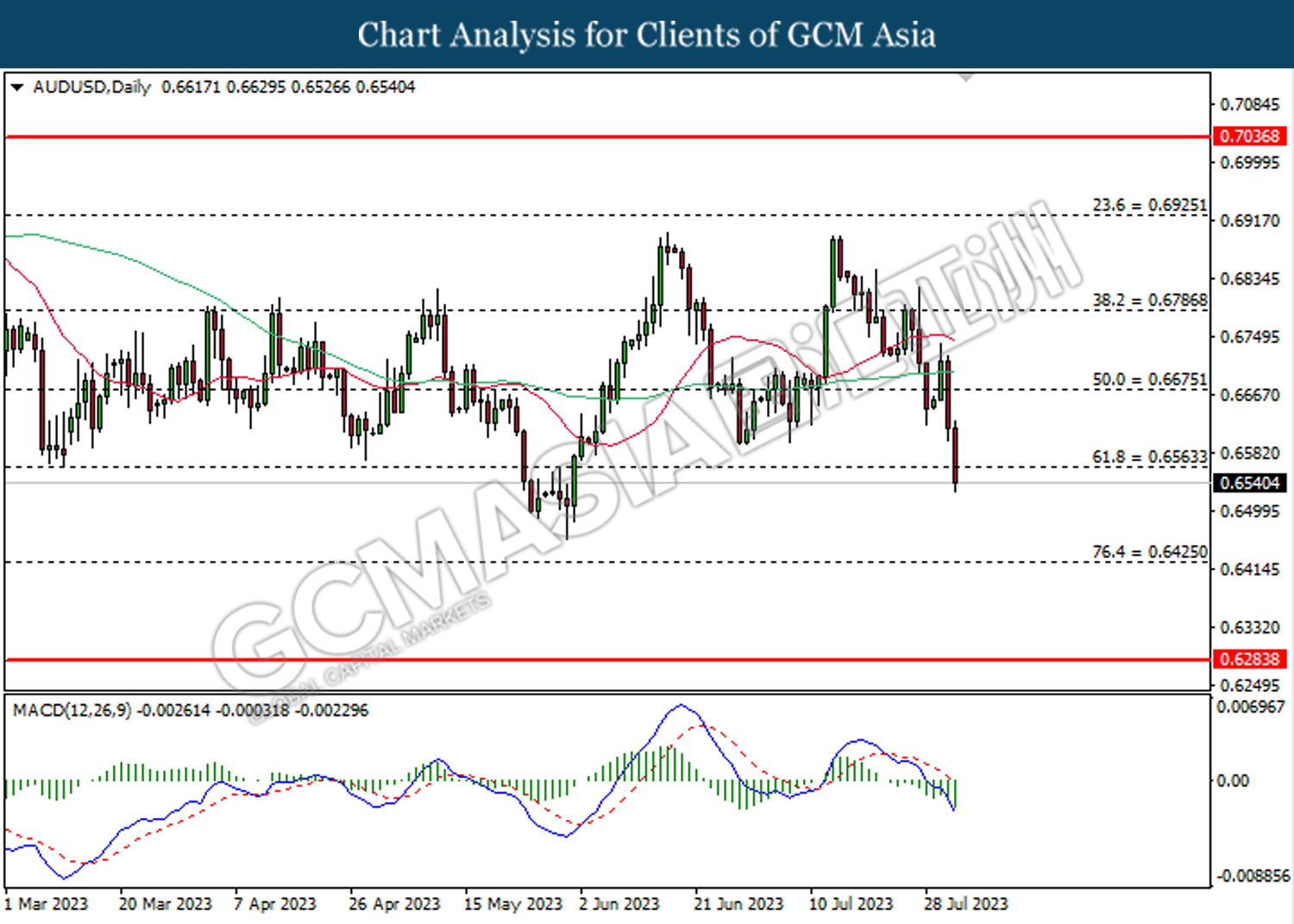

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

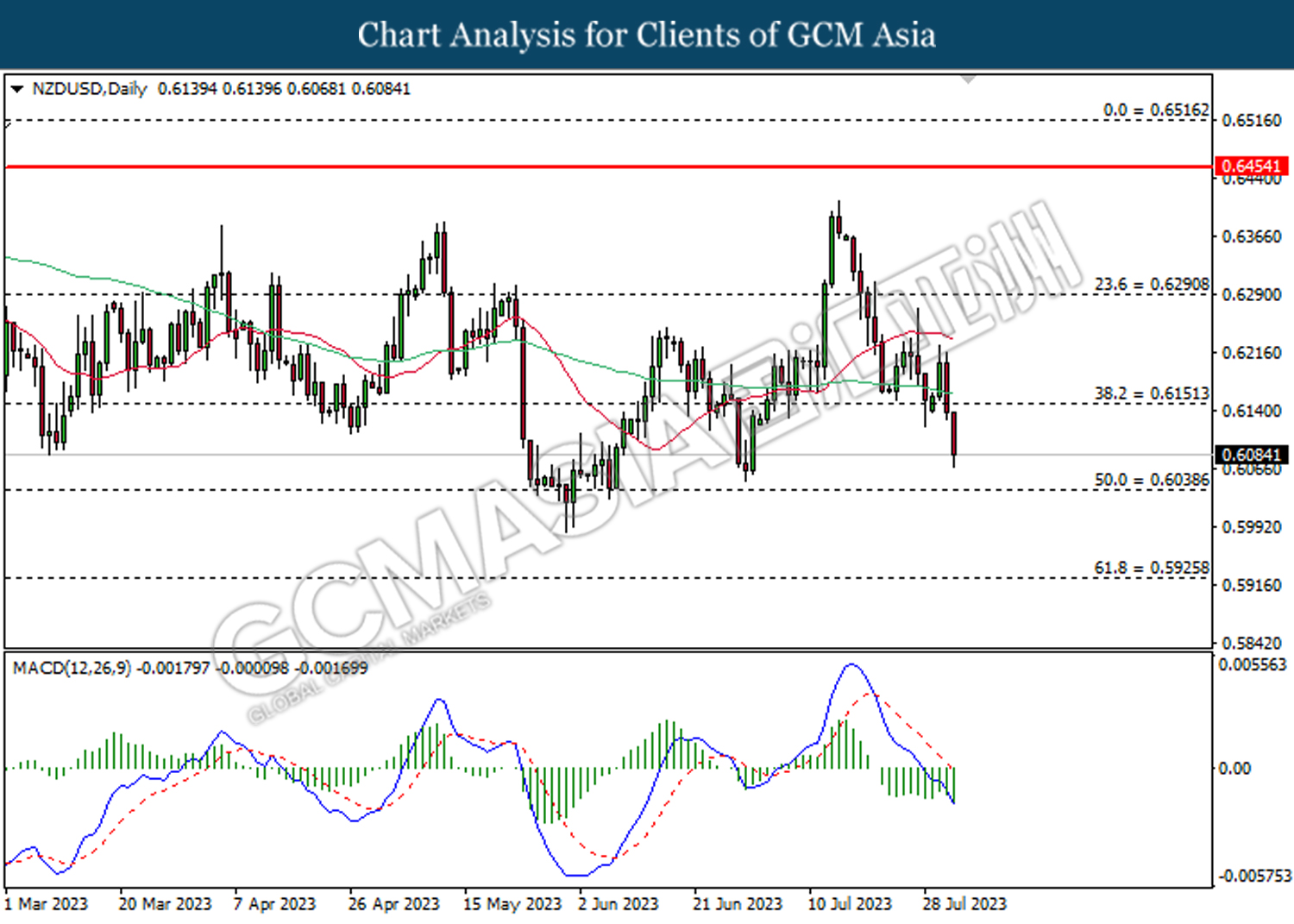

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

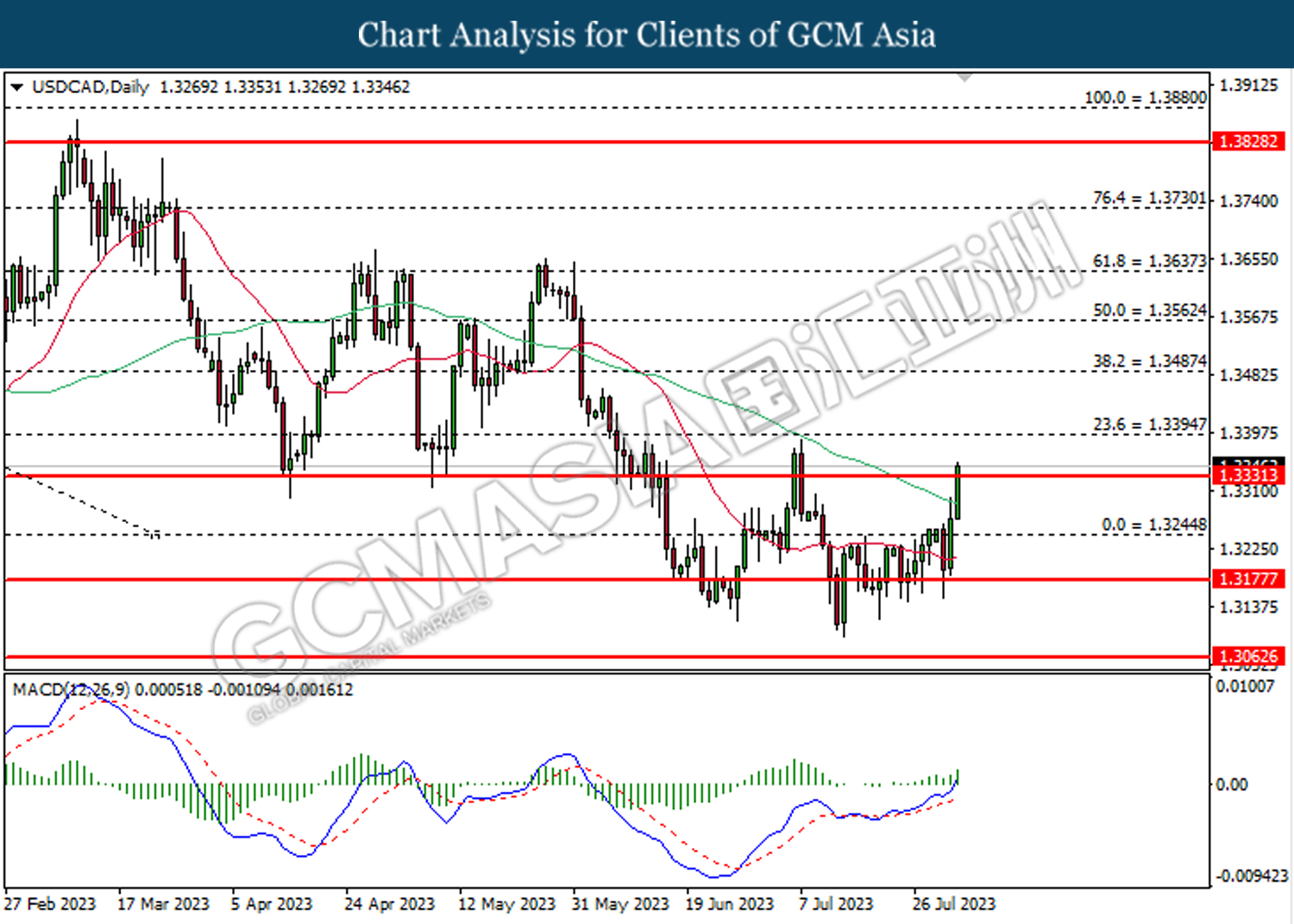

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3330. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3175

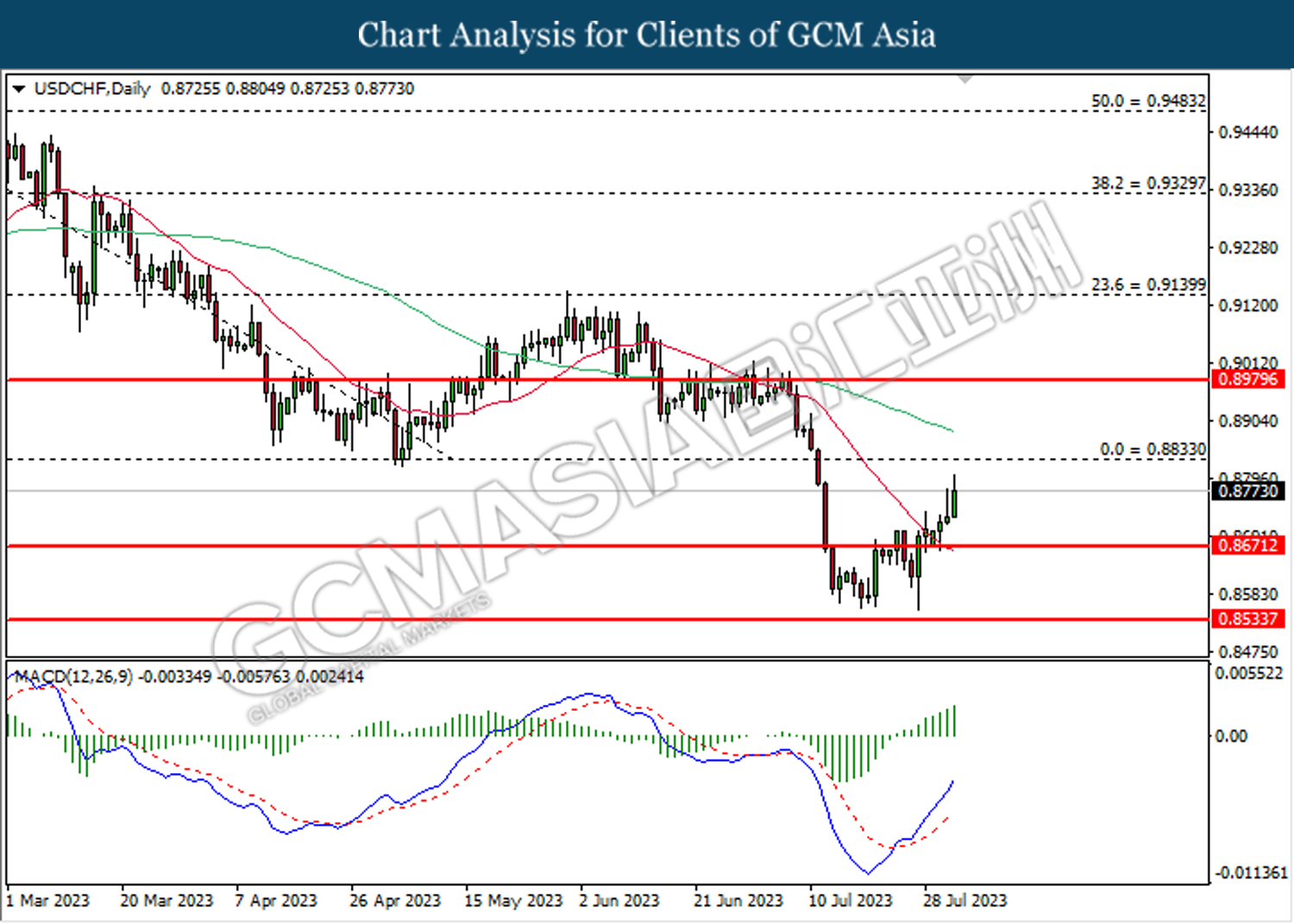

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 79.75. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 80.75, 83.05

Support level: 79.75, 77.15

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1939.75 MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55