3 September 2020 Afternoon Session Analysis

Euro slumps as doves signs.

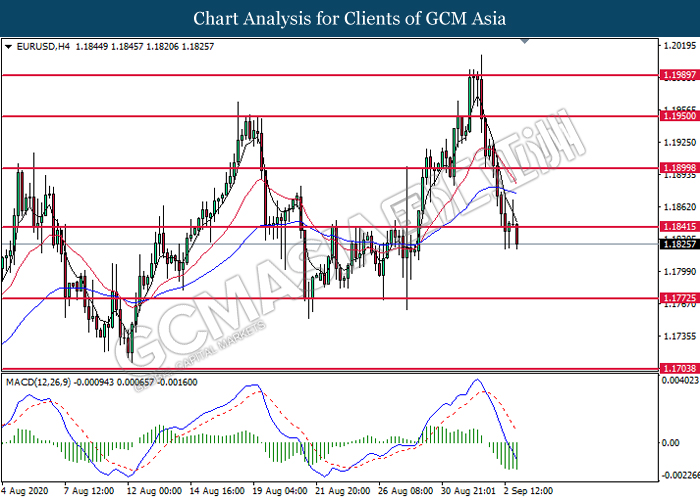

Euro extended its losses during mid-Asian trading session following dovish signal given by member of European Central Bank (ECB). According to ECB Chief Economist Philip Lane, he said that the exchange rate in between euro and US dollar does play a significant role towards their monetary policy. The comment suggests that the central bank is paying attention upon recent appreciation in euro as it may dampen the prospect to achieve their inflation target of 2%. Higher exchange rate tends to put pressure upon exports which may led to slower economic recovery in the EU zone. As such, investors fear that ECB may initiate open market operations to control the appreciation in euro, thus short-selling the currency subsequent to Lane’s dovish remark. In addition, euro receives extensive bearish pressure following bearish economic data from Germany (euro largest economy). For the month of July, German Retail Sales shrank by -0.9%, significantly lower than forecast of 0.5%. For the time being, investors will place their attention upon future economic release from EU in order to gauge euro’s near-term trend direction. As of writing, pair of EUR/USD fell 0.19% to 1.1830.

In the commodities market, crude oil price rebounds by 0.43% to $41.69 per barrel. Oil prices continues to trade within a tight range as investors continues to monitor global demand for crude oil. On the other hand, gold price rose 0.31% to $1,948.83 a troy ounce due to weaker US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22.00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16.30 | GBP – Composite PMI (Aug) | 57.0 | 60.3 | – |

| 16.30 | GBP – Services PMI (Aug) | 56.5 | 60.1 | – |

| 20.30 | USD – Initial Jobless Claims | 1006K | 950K | – |

| 22.00 | USD – ISM Non-Manufacturing PMI (Aug) | 58.1 | 57.0 |

Technical Analysis

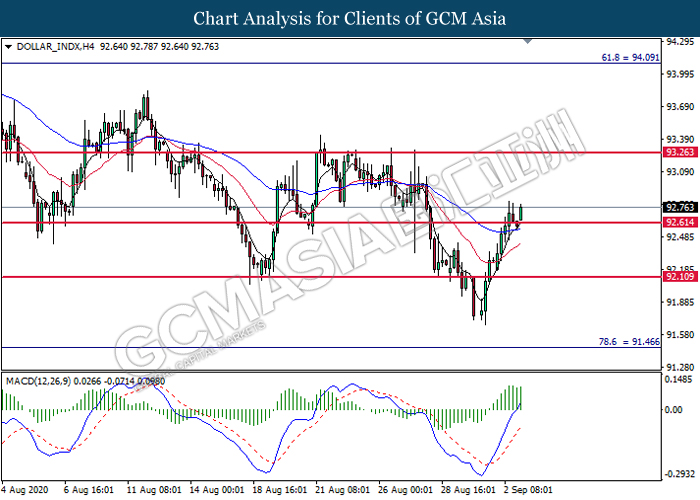

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 92.60. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 93.25.

Resistance level: 93.25, 94.10

Support level: 92.60, 92.10

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3470. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3255.

Resistance level: 1.3470, 1.3590

Support level: 1.3255, 1.3045

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1840. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1775.

Resistance level: 1.1840, 1.1900

Support level: 1.1775, 1.1705

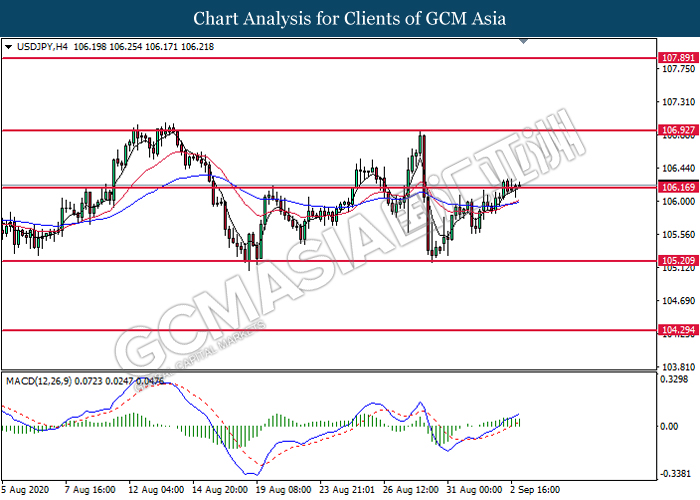

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 106.15. MACD which illustrates bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 106.15, 106.95

Support level: 105.20, 104.30

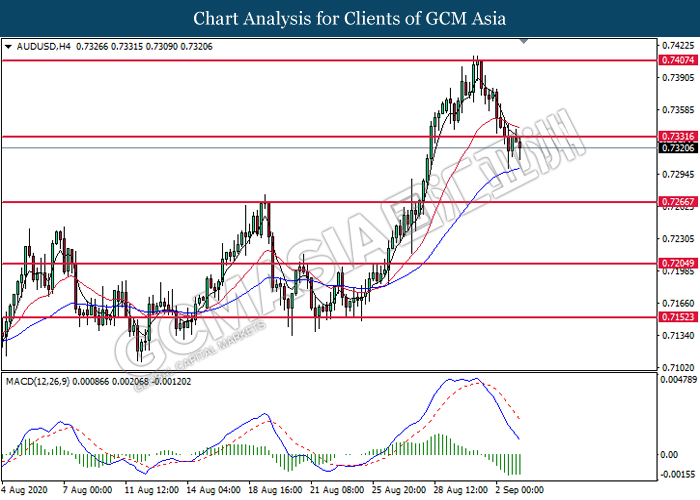

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7330. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.7265.

Resistance level: 0.7330, 0.7405

Support level: 0.7265, 0.7205

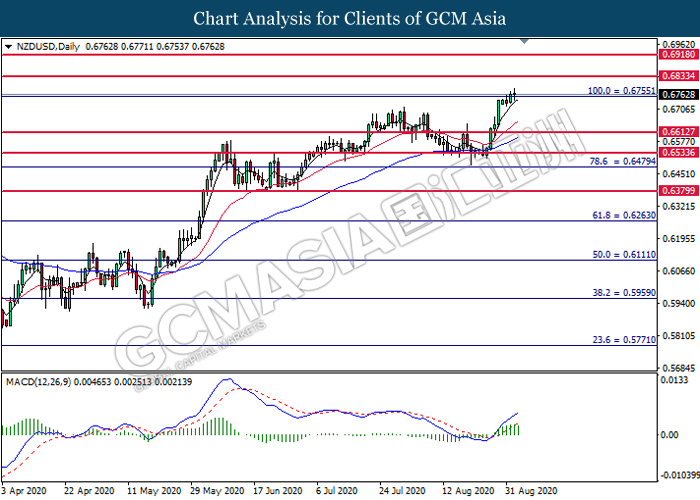

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6755. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above resistance level at 0.6755.

Resistance level: 0.6755, 0.6920

Support level: 0.6615, 0.6535

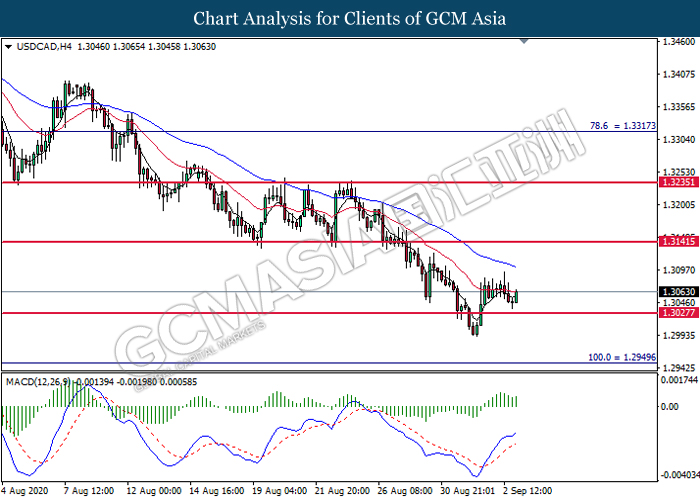

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3030. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.3140.

Resistance level: 1.3140, 1.3235

Support level: 1.3030, 1.2950

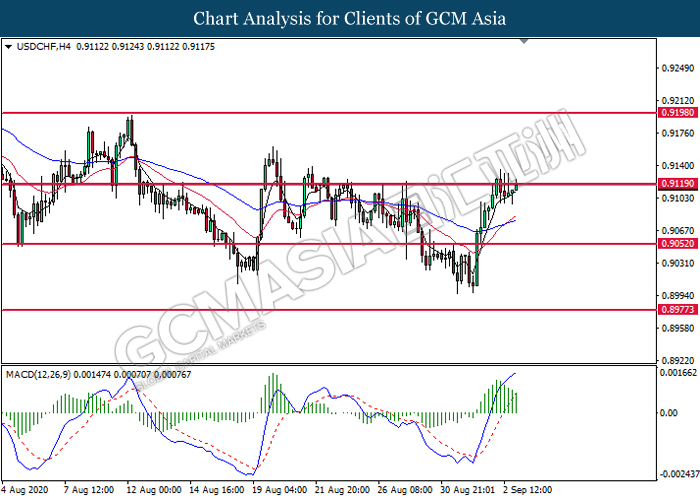

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9120. However, MACD which illustrates diminishing bullish momentum suggest the pair to undergo technical correction in short term toward the lower level.

Resistance level: 0.9120, 0.9200

Support level: 0.9050, 0.8975

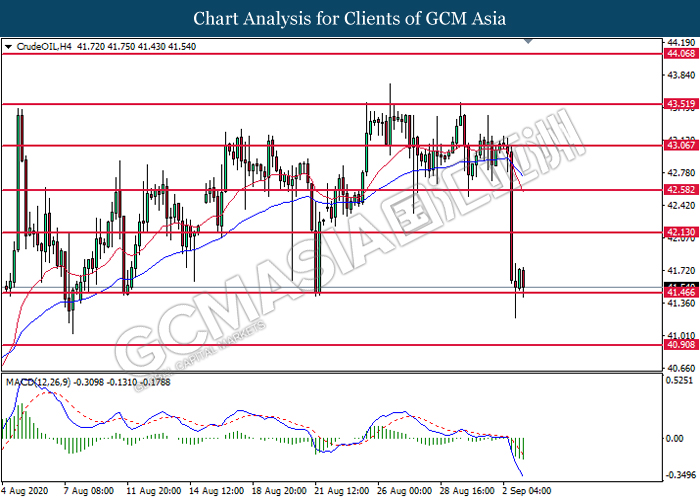

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 41.45. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 42.15, 42.60

Support level: 41.45, 40.90

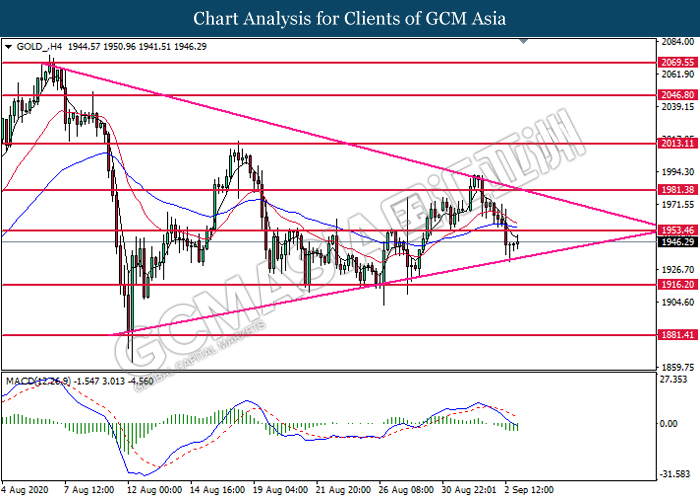

GOLD_, H4: Gold price was traded higher following prior rebound from bottom level of triangle. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1953.45.

Resistance level: 1953.45, 1981.40

Support level: 1916.20, 1881.40