03 September 2020 Morning Session Analysis

Dollar rebound slowed amid disappointing jobs data.

The dollar index which traded against a basket of six major currency pairs was slowed down and retreat following downbeat employment data. According to Automatic Data Processing Inc (ADP), the ADP Employment Change data which reflect changes in business payrolls have only increased by 428k, lesser than market expectation of 950k. The data have suggested that the recovery in U.S labor remains gradual with the employment is well below pre-pandemic level. At the same time, the Paycheck Protection Program which help support employment in recent months have expired and U.S lawmakers are still facing difficulty in passing another comprehensive stimulus package. Following the disappointing results, investors are now also worries that the upcoming Non-Farm Payroll report will also provide the same results, thus weighing heavily on the greenback currently. At the time of writing, dollar index slips 0.12% to 92.59.

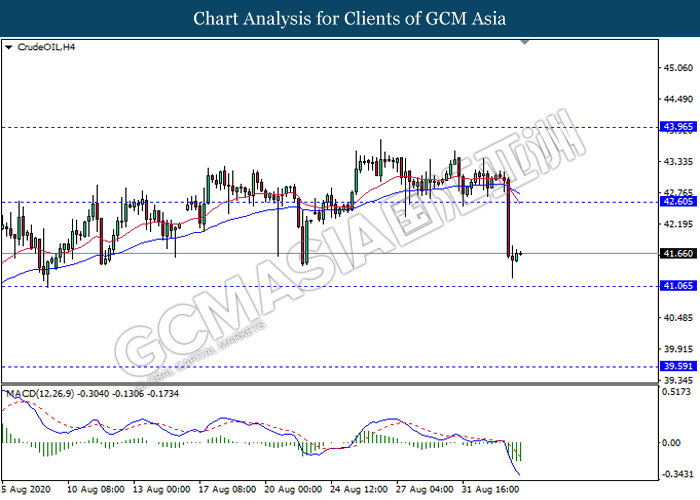

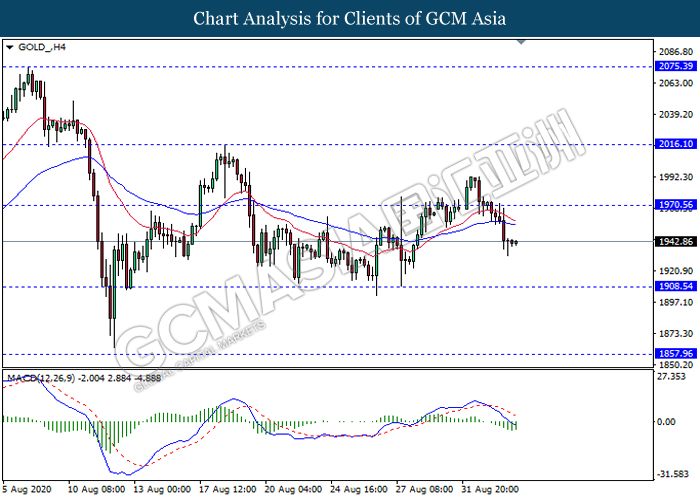

In the commodities market, crude oil price plummets 0.19% to $41.68 per barrel as of writing despite with a favourable inventory report. According to EIA, crude oil inventories fell by 9.362 million barrels, surpassing market expectation with a drop of only 1.887 million barrel. However, the data still unable to excite investors due to upcoming refiner maintenance season. The maintenance work is coincide in the summertime fuel consumption, thus giving a warning that the demand for oil may further weaken. On the other hand, gold price edge higher 0.09% to $1943.24 a troy ounce at the time of writing amid slowed dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22.00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16.30 | GBP – Composite PMI (Aug) | 57.0 | 60.3 | – |

| 16.30 | GBP – Services PMI (Aug) | 56.5 | 60.1 | – |

| 20.30 | USD – Initial Jobless Claims | 1006K | 950K | – |

| 22.00 | USD – ISM Non-Manufacturing PMI (Aug) | 58.1 | 57.0 |

Technical Analysis

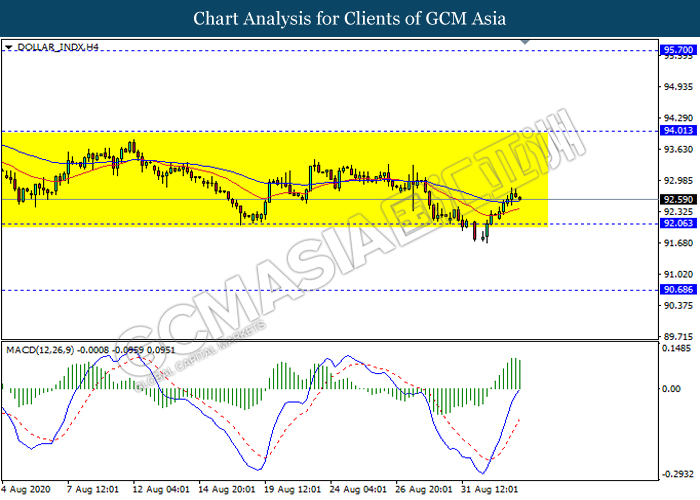

DOLLAR_INDX, H4: Dollar index remain traded in a sideway channel. However, MACD which illustrate diminishing bullish momentum suggest the dollar to be traded lower in short term towards the support level 92.05.

Resistance level: 94.00, 95.70

Support level: 92.05, 90.70

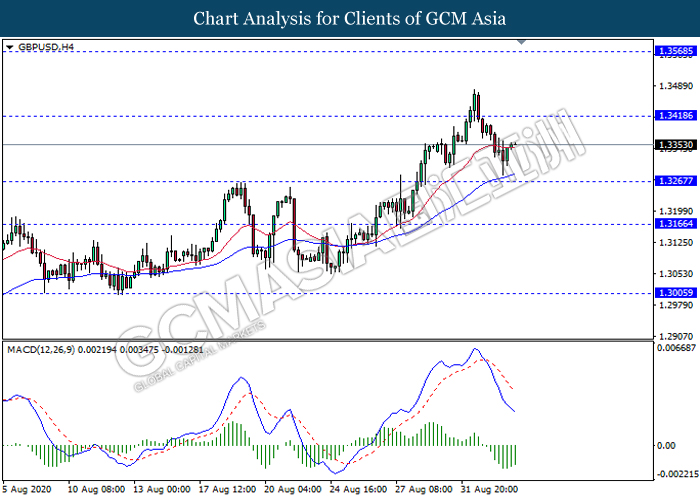

GBPUSD, H4: GBPUSD was traded higher following prior rebound from its low level. MACD which display diminishing bearish momentum suggest the pair to extend its rebound in short term towards the resistance level 1.3420.

Resistance level: 1.3420, 1.3570

Support level: 1.3265, 1.3165

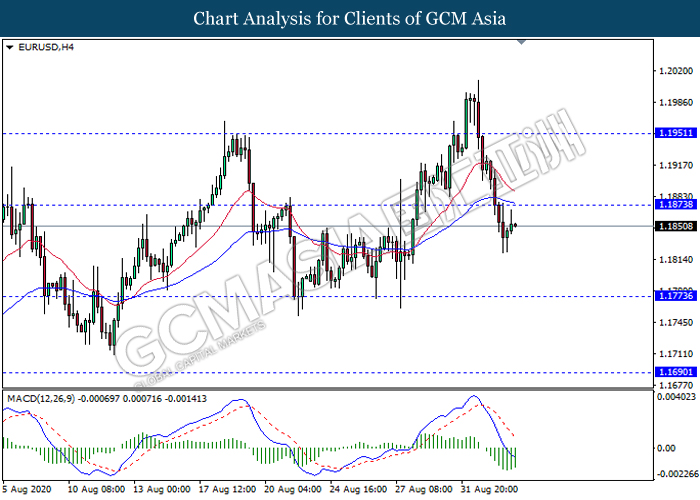

EURUSD, H4: EURUSD was traded lower following recent breakout below the previous support level 1.1875. However, MACD which illustrate diminishing bearish momentum suggested the pair to experience a short term technical correction towards the current resistance level 1.1875.

Resistance level: 1.1875, 1.1950

Support level: 1.1775, 1.1690

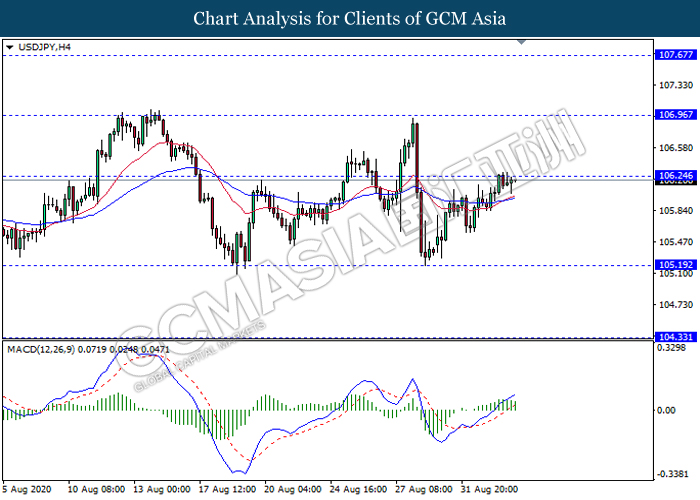

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level 106.25. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower as a technical correction towards the support level 105.20.

Resistance level: 106.25, 106.95

Support level: 105.20, 104.35

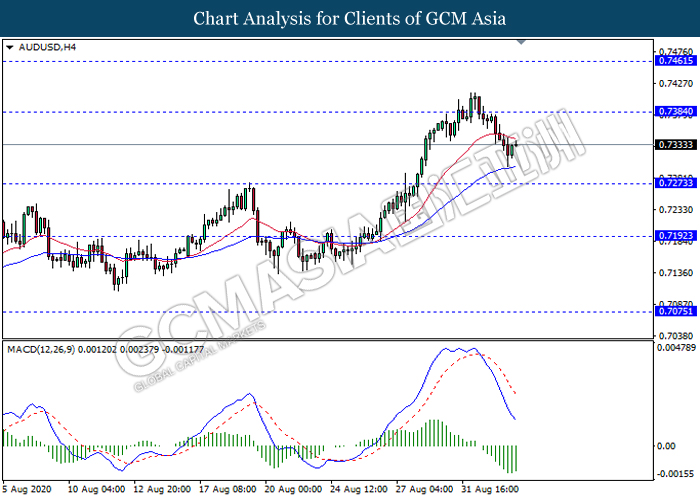

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7385. However, MACD which display diminishing bearish momentum signal suggest the pair to be traded higher as a short term technical correction towards back the resistance level 0.7385.

Resistance level: 0.7385, 0.7460

Support level: 0.7275, 0.7190

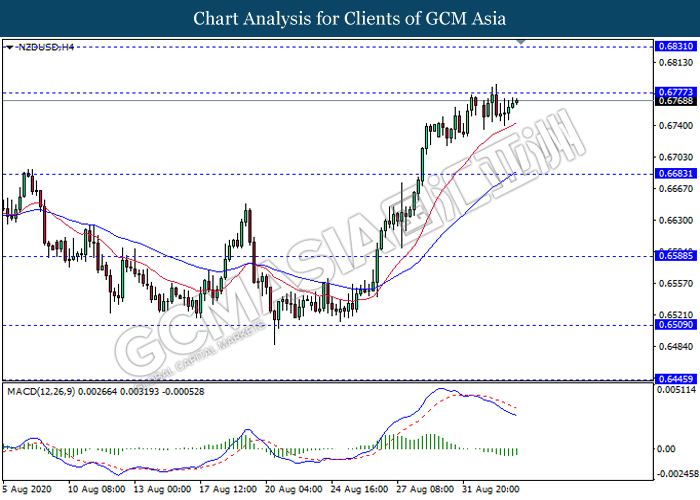

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6775. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.6775, 0.6830

Support level: 0.6685, 0.6590

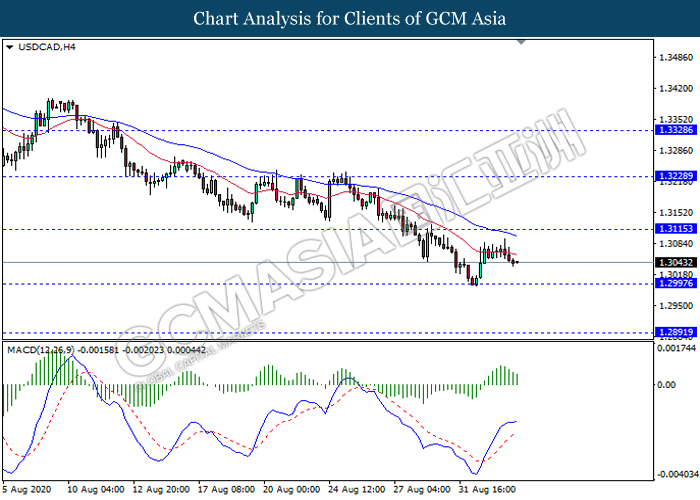

USDCAD, H4: USDCAD was traded lower following prior retracement from the MA lines. MACD which illustrate diminishing bullish bias signal suggest the pair to extend its retracement in short term towards the support level 1.2995.

Resistance level: 1.3115, 1.3230

Support level: 1.2995, 1.2890

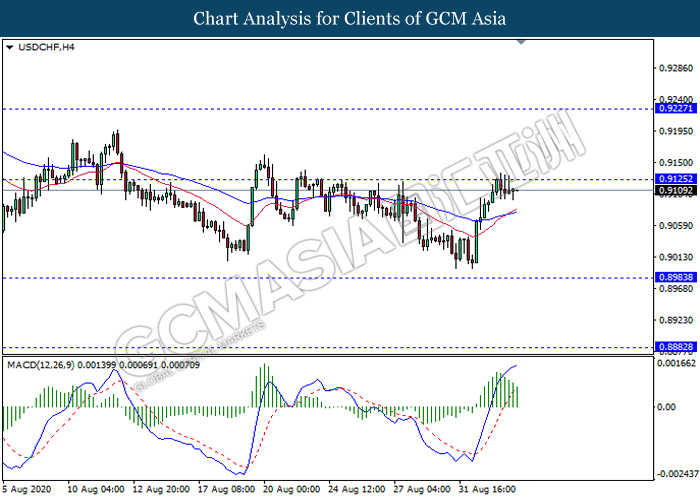

USDCHF, H4: USDCHF was traded higher while currently testing near the resistance level 0.9125. However, MACD which illustrate diminishing bullish momentum suggest the pair to experience a technical correction towards the support level 0.8985.

Resistance level: 0.9125, 0.9225

Support level: 0.8985, 0.8880

CrudeOIL, H4: Crude oil price was traded lower following recent breakout below the previous support level 42.60. MACD which illustrate bearish bias signal suggest the commodity to extend its losses towards the support level 41.05.

Resistance level: 42.60, 43.95

Support level: 41.05, 39.60

GOLD_, H4: Gold price was traded lower following recent retracement from the resistance level 1970.55. MACD which illustrate bearish bias signal suggest the commodity to extend its retracement towards the support level 1908.55.

Resistance level: 1970.55, 2016.10

Support level: 1908.55, 1857.95