3 October 2022 Afternoon Session Analysis

US Dollar surged following PCE data.

The Dollar Index which traded against a basket of six major currencies rebounded from its support level following the Personal Consumption Expenditures (PCE) Price Index jumped 0.6% after being unchanged in July, which exceeding the market expectation at 0.5%. The economic data from the United States on Friday indicated that the underlying inflation pressures remained high, providing cover for the Federal Reserve to maintain their aggressive contractionary monetary policy path. Though, the long-term prospect for the US Dollar still remained negative as slowing in wage growth combined with stiff interest rate hikes from the Fed, has increased the vulnerability to recession in United States region next year. On the other hand, the Euro extend its gains yesterday following the released of upbeat inflation data, rising odds for the European Central Bank (ECB) to unleash hawkish tone. According to Eurostat, Eurozone Consumer Price index (CPI) came in at 10.0%, exceeding the market forecast at 9.7%. As of writing, the Dollar Index appreciated by 0.02% to 112.05 while EUR/USD surged by 0.14% to 0.9815.

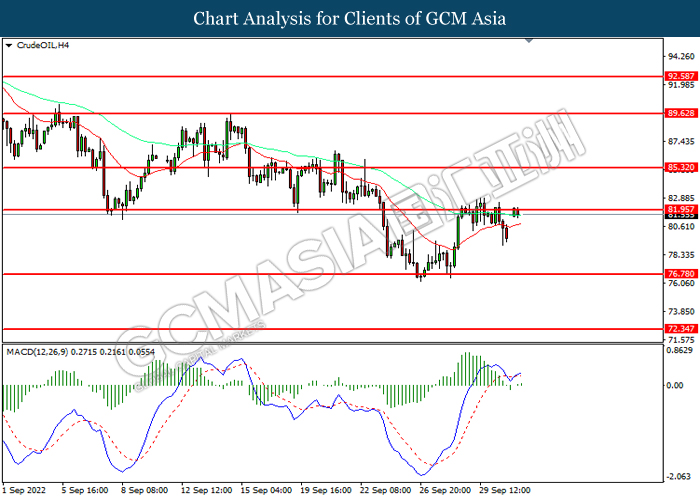

In the commodities market, the crude oil price appreciated by 2.42% to $81.85 per barrel as of writing amid speculation over the production cut from OPEC+ by more than 1 million barrels a day continue to spark bullish momentum on this black-commodity. On the other hand, the gold price depreciated by 0.20% to $1664.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Sep) | 48.3 | 48.3 | – |

| 16:30 | GBP – Manufacturing PMI (Sep) | 48.5 | 48.5 | – |

| 22:00 | USD – ISM Manufacturing PMI (Sep) | 52.5 | 51.9 | – |

Technical Analysis

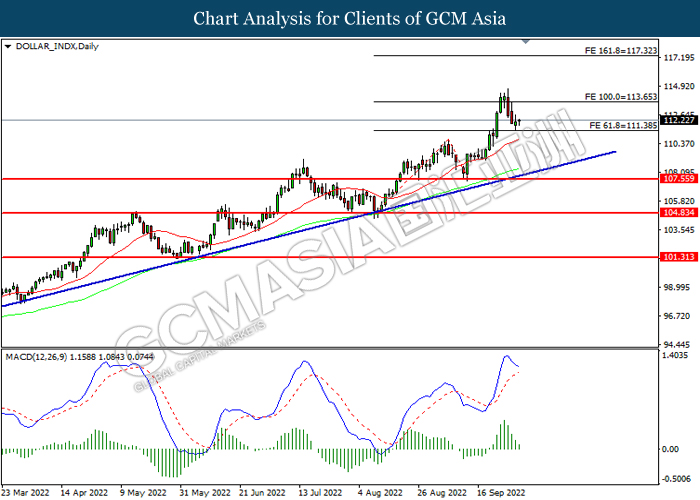

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses after breakout.

Resistance level: 113.65, 117.30

Support level: 111.40, 107.55

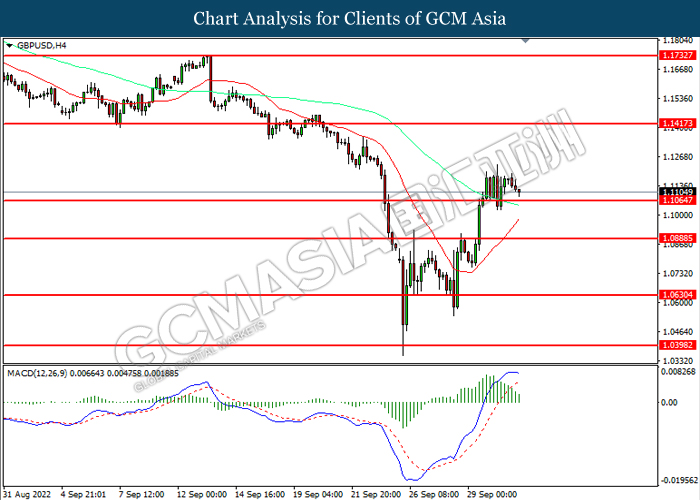

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout below the support level.

Resistance level: 1.1415, 1.1730

Support level: 1.1065, 1.0890

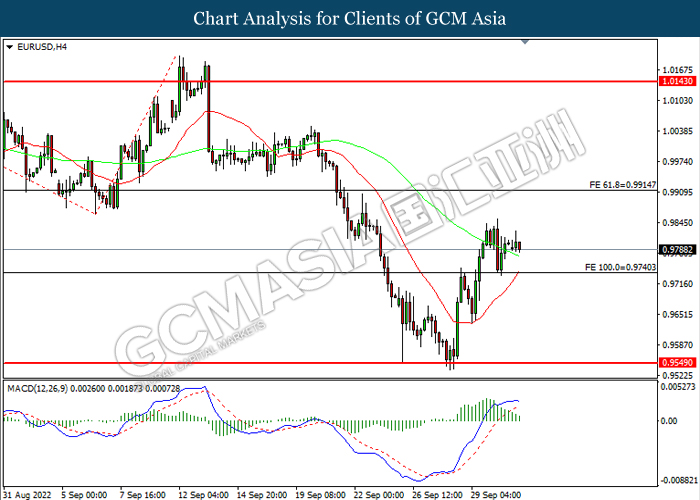

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9915, 1.0145

Support level: 0.9740, 0.9550

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

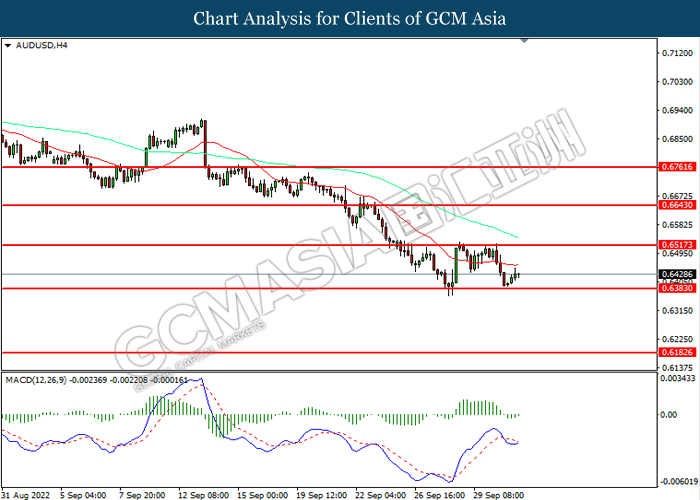

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

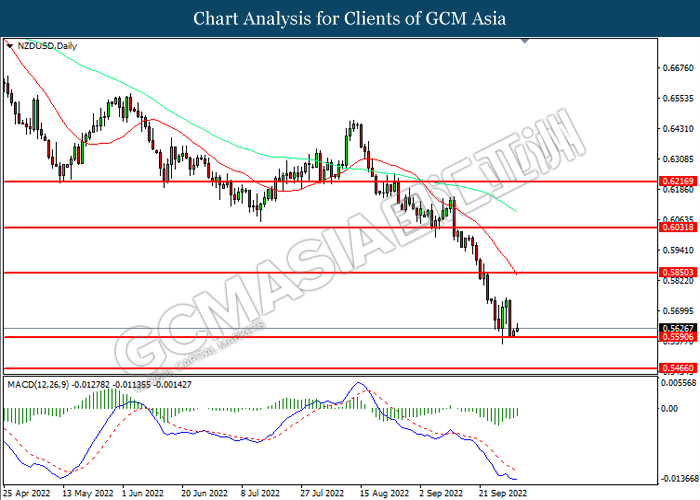

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

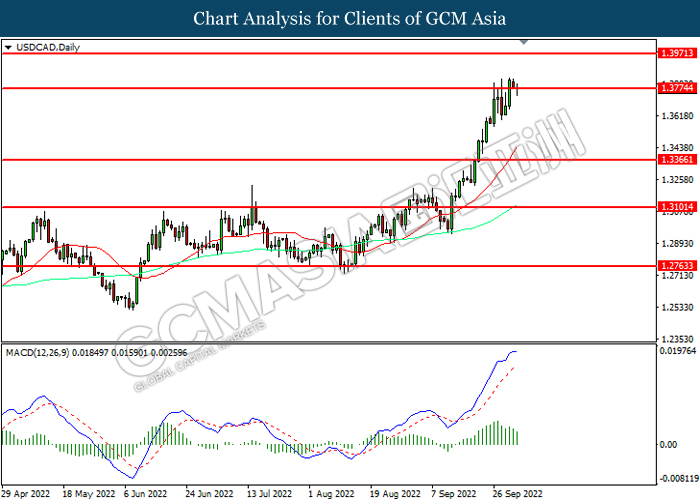

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

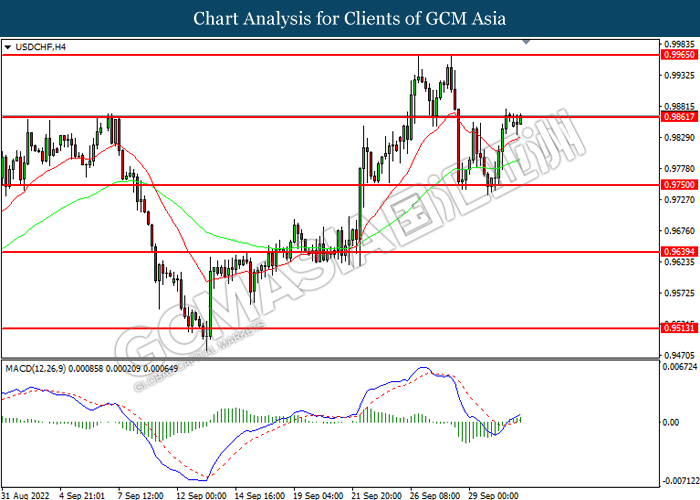

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout the resistance level.

Resistance level: 0.9860, 0.9965

Support level: 0.9750, 0.9640

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 81.95, 85.30

Support level: 76.80, 72.35

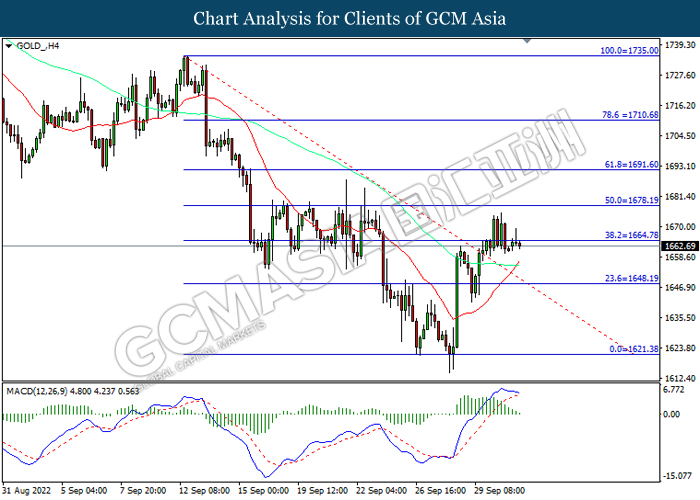

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1664.80, 1678.20

Support level: 1648.20, 1621.40