3 December 2021 Afternoon Session Analysis

Aussie extend losses amid dismal China data.

The Australian dollar which traded against the dollar and other currency pairs have fell following the release of downbeat data from China. According to a private survey from Reuters, activity in China’s services sector have expanded at a slower pace in November due to rising inflation and COVID-19 outbreaks. China Caixin Services PMI came in at 52.1, weaker than previous reading of 53.8. At the same time, the Composite PMI which include both services and manufacturing activity from the previous reading from 51.5 to 51.2. Besides that, adding further to the pressure was the renewed U.S-China tension where Didi Global Inc prepares to delist from the U.S stock exchange and China ambassador called U.S for the abolition of tariffs on Chinese goods. On the other hand, rising cases of Omicron in the world also dampened market sentiment which further weigh on the Aussie. At the time of writing, AUD/USD fell 0.27% to $0.7075.

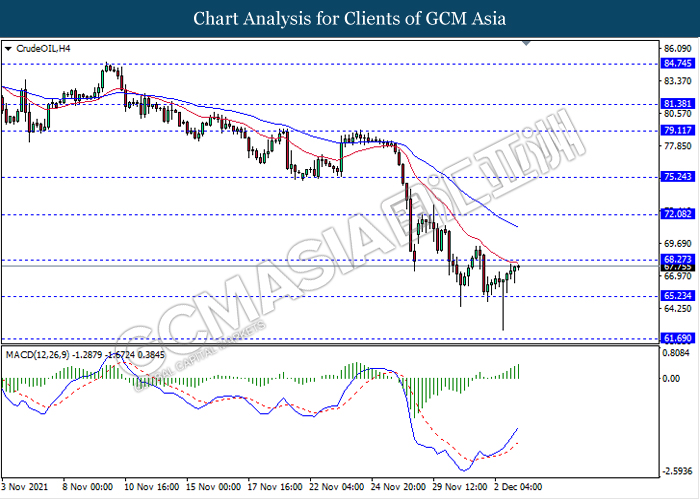

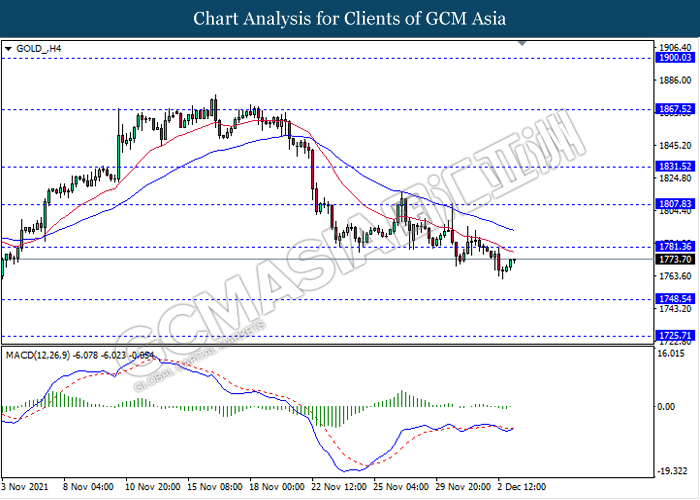

In the commodities market, crude oil price rebounds 0.44% to $67.67 per barrel as of writing following OPEC planning to meet if Omicron affect fuel demand. According to reports, OPEC and its allies stated that they would meet again and review supply additions ahead of its next scheduled meeting if the Omicron variant hit fuel demand. On the other hand, gold price rebound 0.24% to $1773.19 a troy ounce at the time of writing following dollar retracement.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Nov) | 57.7 | 57.6 | – |

| 17:30 | GBP – Services PMI (Nov) | 58.6 | 58.6 | – |

| 21:30 | USD – Nonfarm Payrolls (Nov) | 531K | 550K | – |

| 21:30 | USD – Unemployment Rate (Nov) | 4.60% | 4.50% | – |

| 21:30 | CAD – Employment Change (Nov) | 31.2K | 40.0K | – |

Technical Analysis

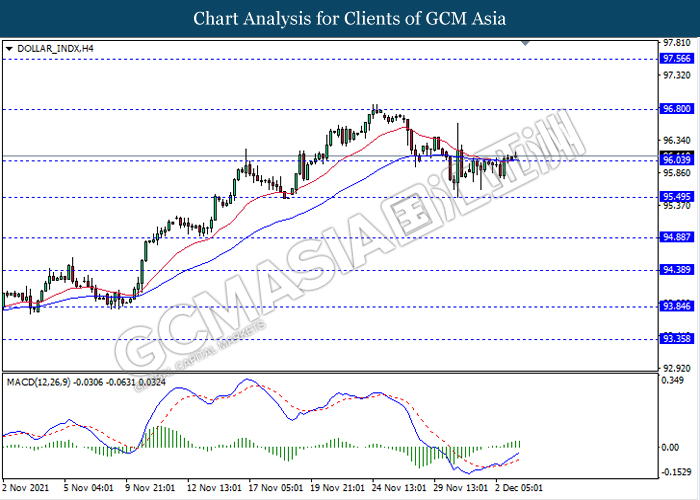

DOLLAR_INDX, H4: Dollar index was traded flat after it breaks above the previous resistance level 96.05. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the dollar to be traded higher in short term towards the resistance level 96.80.

Resistance level: 96.80, 97.55

Support level: 95.50, 94.90

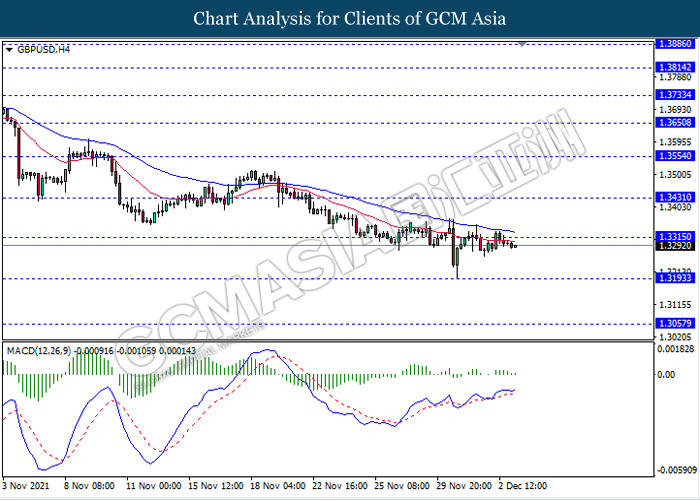

GBPUSD, H4: GBPUSD was traded flat near the resistance level 1.3315. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower in short term towards the support level 1.3195.

Resistance level: 1.3315, 1.3430

Support level: 1.3195, 1.3055

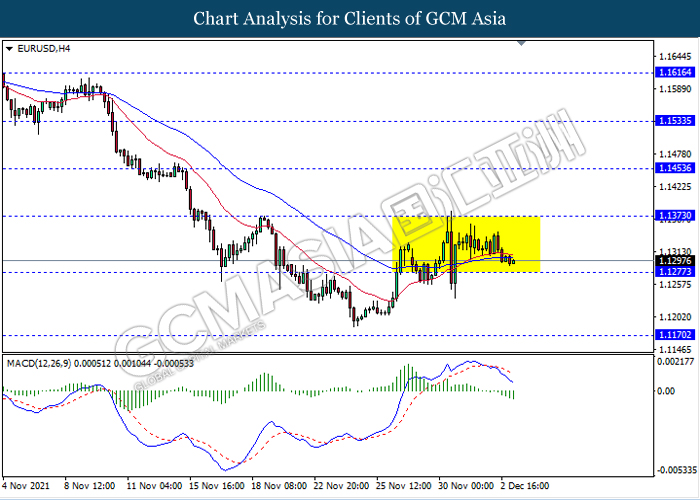

EURUSD, H4: EURUSD remain traded in sideway channel while currently testing near the support level 1.1275. However, MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1375, 1.1455

Support level: 1.1275, 1.1170

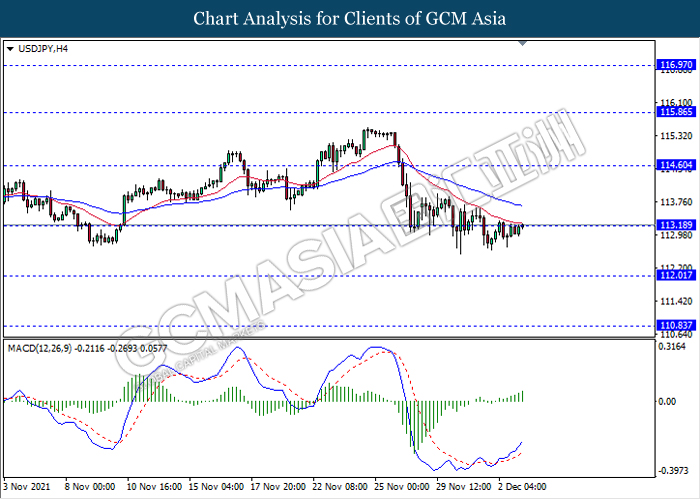

USDJPY, H4: USDJPY was traded flat while currently testing the resistance level 113.20. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to be traded higher after it breaks above the resistance level.

Resistance level: 113.20, 114.60

Support level: 112.00, 110.85

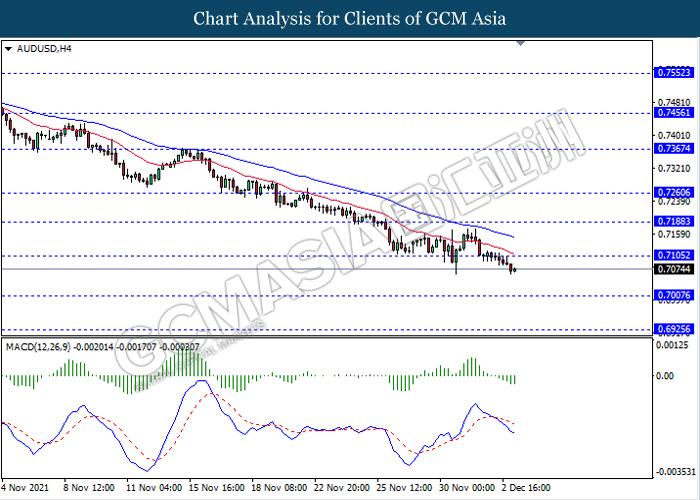

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level 0.7105. MACD which illustrate beaish bias signal suggest the pair to extend its losses towards the support level 0.7005.

Resistance level: 0.7105, 0.7190

Support level: 0.7005, 0.6925

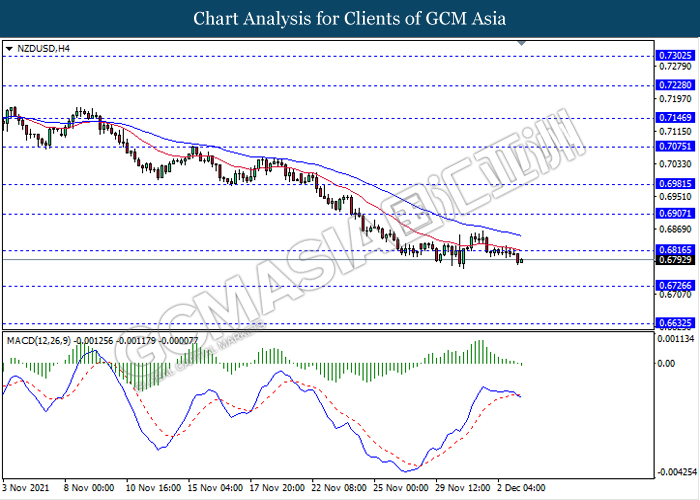

NZDUSD, H4: NZDUSD was traded flat near the resistance level 0.6815. However, MACD which illustrate diminishing bullish momentum signal with the formation of death cross suggest the pair to extend its losses toward the support level 0.6725.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6630

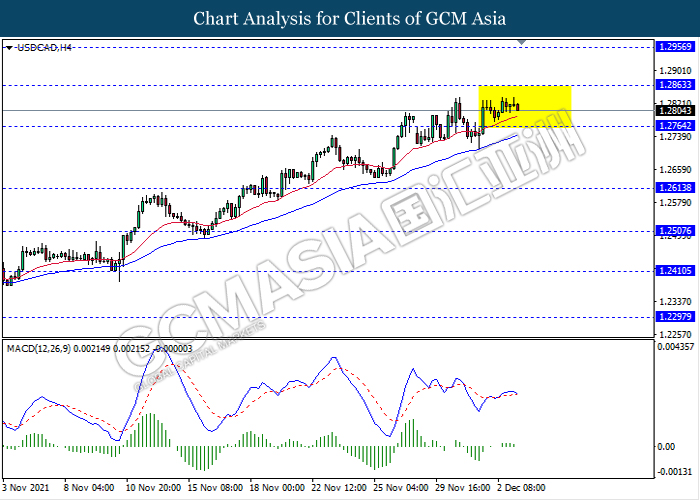

USDCAD, H4: USDCAD was traded flat in a sideway channel. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be traded lower in short term towards the support level 1.2765.

Resistance level: 1.2835, 1.2955

Support level: 1.2765, 1.2615

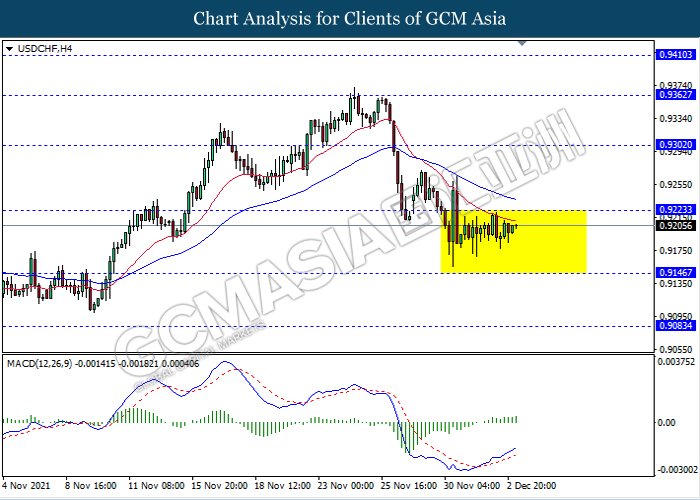

USDCHF, H4: USDCHF remain traded flat in a sideway channel while currently testing near the resistance level 0.9225. However, MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to be traded higher after it breaks above the resistance level 0.9225.

Resistance level: 0.9225, 0.9300

Support level: 0.9145, 0.9085

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level 68.25. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level 68.25.

Resistance level: 68.25, 72.10

Support level: 65.25, 61.70

GOLD_, H4: Gold price was traded higher following prior rebound from its low level and currently testing near the resistance level 1781.35. However, MACD which illustrate diminishing bearish momentum signal with the formation of golden cross suggest commodity to extend its rebound after it breaks above the resistance level.

Resistance level: 1781.35, 1807.85

Support level: 1748.55, 1725.70