04 January 2021 Morning Session Analysis

Dollar slumped on budget deficit gap.

The overall trend for the US Dollar remained bearish amid the explosion in budget and trade deficits had dialled down the market optimism toward the economic progression in the United States, which prompting investor to selloff significantly the US Dollar for the year of 2020. Massive budget and trade deficits mean that more dollars could be printed in order to support the repayment amount. Likewise, the current account deficit widened to a 12-year high in the third quarter of 2020. In fact, the President-elect Joe Biden is promising that more U.S. economic stimulus plan would be implemented next year, which also further dragged down the appeal of the US Dollar. Nonetheless, the losses experienced by the US dollar was limited over the backdrop of string of upbeat job data from the United States on last week. According to Department of Labor, U.S. Initial Jobless Claims unexpectedly notched down significantly from the preliminary reading of 806K to 785K, much better than the market expectation at 833K. As of writing, the Dollar Index depreciated by 0.01% to 89.83.

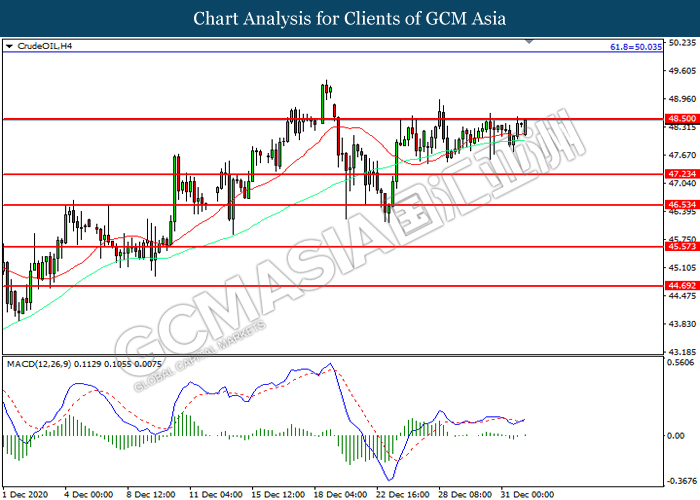

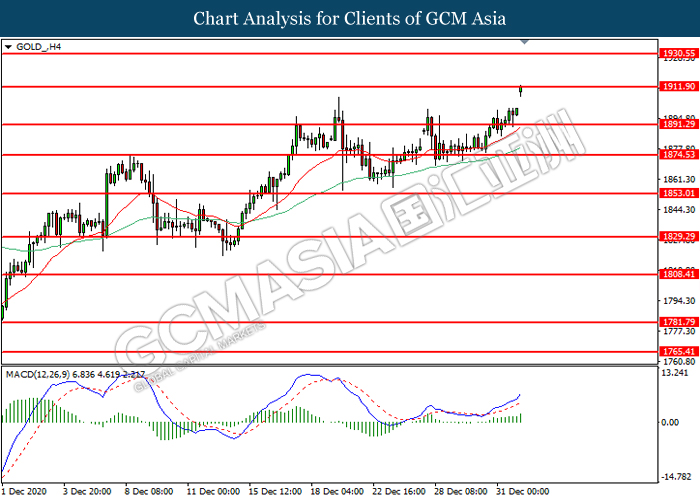

In the commodities market, the crude oil price surged 0.05% to $48.35 per barrel as of writing amid the positive Covid-19 vaccine development. As for now, The Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia would be holding a virtual meeting on Monday. Hence, investors would continue to scrutinize the latest updates with regards of such meeting as well as the Covid-19 progress in order to receive further trading signal. On the other hand, the gold price appreciated by 0.93% to $1911.50 per troy ounces amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Dec) | 58.6 | 58.6 | – |

| 17:30 | GBP – Manufacturing PMI | 57.3 | 57.3 |

Technical Analysis

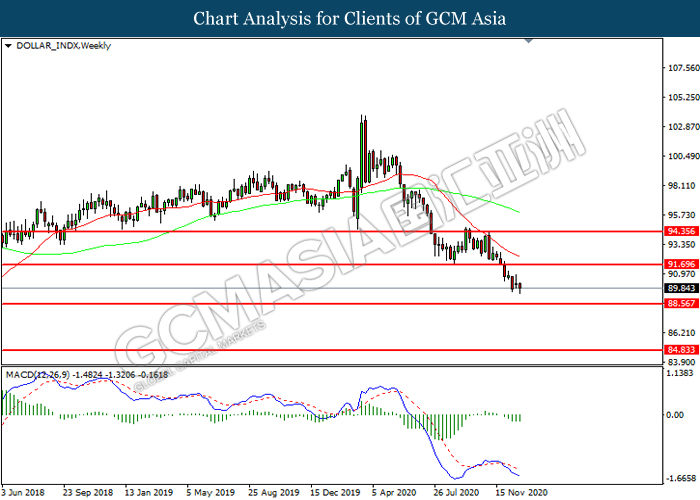

DOLLAR_INDX, Weekly: Dollar index was traded lower following prior breakout below the previous support level at 91.70. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 88.55.

Resistance level: 91.70, 94.35

Support level: 88.55, 84.85

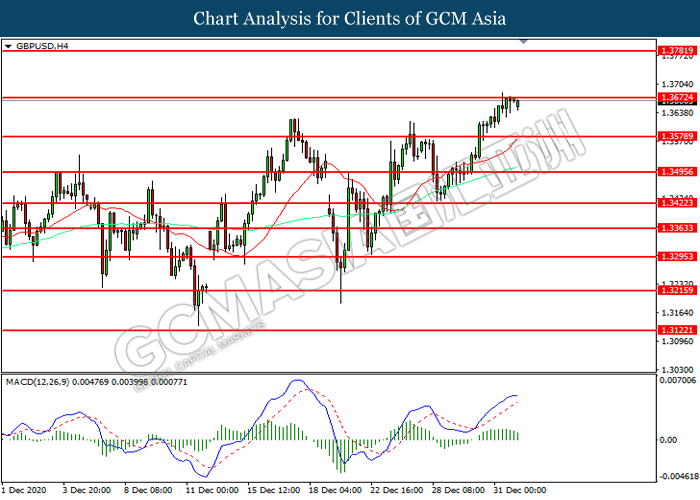

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3580. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3670, 1.3780

Support level: 1.3580, 1.3495

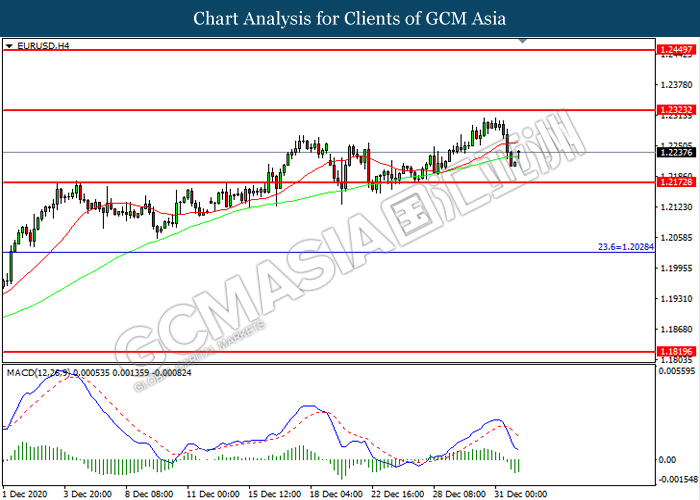

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.2325. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2325, 1.2450

Support level: 1.2175, 1.2030

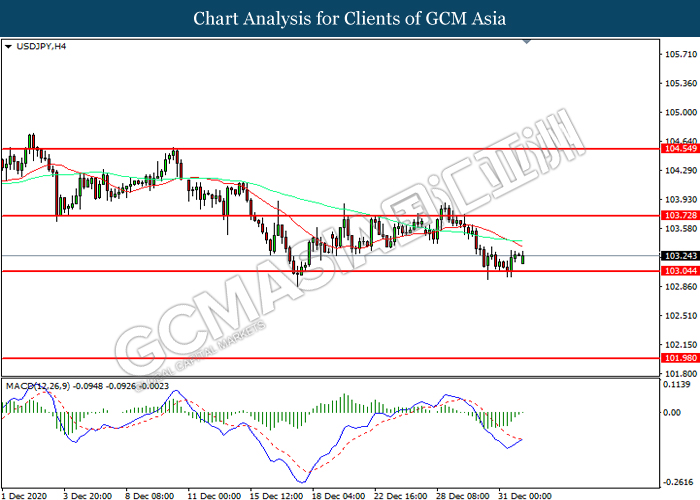

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 103.05. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 103.70, 104.55

Support level: 103.05, 102.00

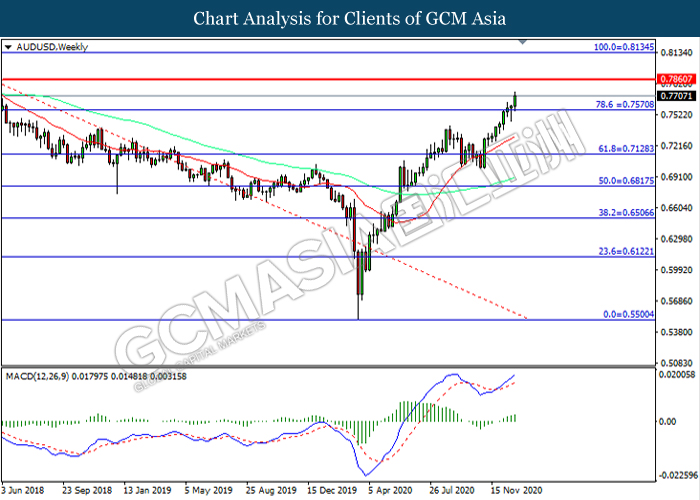

AUDUSD, Weekly: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7570. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7860.

Resistance level: 0.7860, 0.8135

Support level: 0.7570, 0.7130

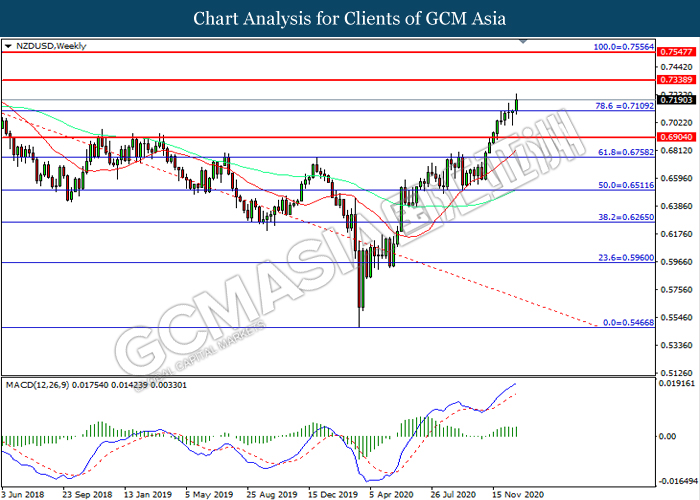

NZDUSD, Weekly: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.7110. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7340.

Resistance level: 0.7340, 0.7550

Support level: 0.7110, 0.6905

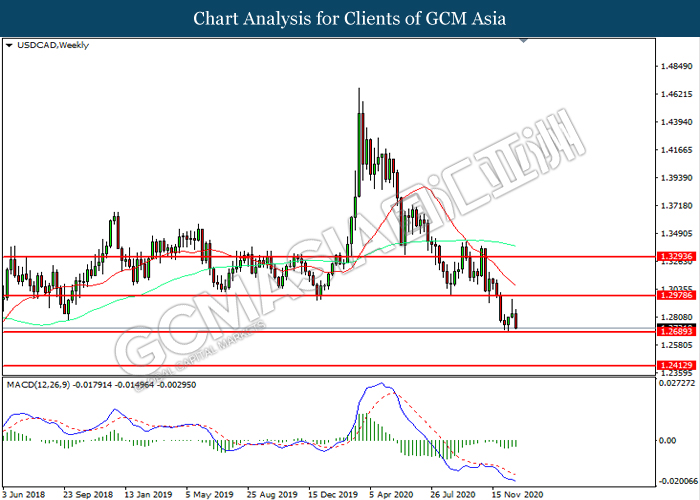

USDCAD, Weekly: USDCAD was traded lower while currently testing the support level at 1.2690. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2980, 1.3295

Support level: 1.2690, 1.2415

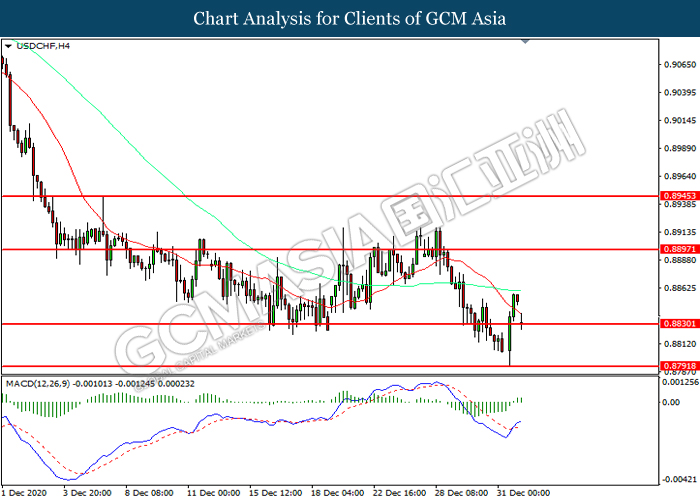

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.8830. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.8895, 0.8945

Support level: 0.8830, 0.8790

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 48.50. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 48.50, 50.00

Support level: 47.25, 46.55

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1911.90. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1911.90, 1930.55

Support level: 1891.30, 1874.55