4 April 2017 Daily Analysis

Risk appetite subsides, major events in limelight.

Greenback was a tad lower against its major peers as investors awaits Australia’s central bank monetary decision. The dollar index shed 0.09% and was last quoted at 100.28. Investors’ risk appetite was subdued ahead of an upcoming meeting between US President Donald Trump and Chinese President Xi Jinping while Friday’s highly anticipated Nonfarm Payrolls report remains in play. Concurrently, Reserve Bank of Australia will review their monetary policy at noon and economists expect the benchmark rate to keep on hold at a record low of 1.50%. The central bank is deemed to have less urgency in easing their policy further given the concerns over affecting the household balance sheets while remained optimistic towards the global economy. Likewise, the Australian dollar was down 0.20% to $0.7591 against the US dollar.

Looking into the commodities, crude oil price was up slightly while latest figure on US inventories due tomorrow morning is expected to set the market tone. On the other hand, gold price was up 0.46% to $1,256.52, buoyed by metro explosion incident at St Petersburg, Russia.

Today’s Holiday Market Close

Time Market Event

All Day HKD Hong Kong – Ching Ming Festival

All Day CNY China – Tomb Sweeping Day

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

21:30 EUR ECB President Draghi Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 06:00 | NZD – NZIER Business Confidence (Q1) | 28% | – | 17% |

| 12:30 | AUD – RBA Interest Rate Decision (Apr) | 1.50% | 1.50% | – |

| 16:30 | GBP – Construction PMI (Mar) | 52.5 | 52.4 | – |

| 20:30 | USD – Trade Balance (Feb) | -48.50B | -44.80B | – |

| 20:30 | CAD – Trade Balance (Feb) | 0.81B | 0.50B | – |

| 04:30 | Crude Oil – API Weekly Crude Oil Stock | 1.900M | – | – |

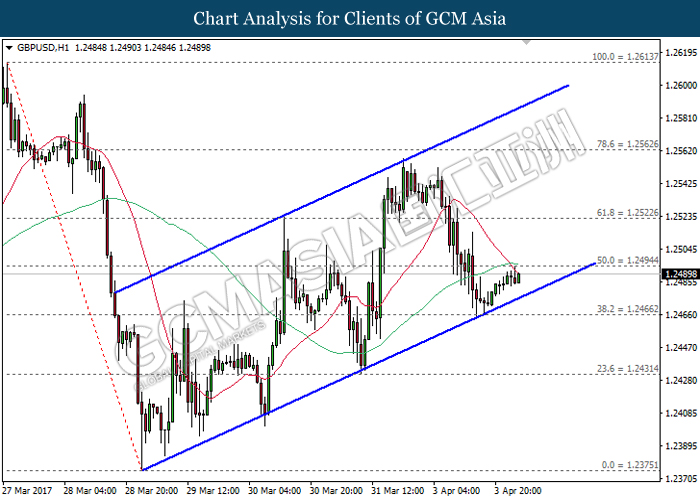

GBPUSD

GBPUSD, H1: GBPUSD remains traded within the upward channel while currently testing at the bottom level of the channel. A breakout from this level would signal a change in trend direction to move further downwards thereafter. Otherwise, a rebound from this level would suggest GBPUSD to be traded higher in the short-term.

Resistance level: 1.2495, 1.2520

Support level: 1.2465, 1.2430

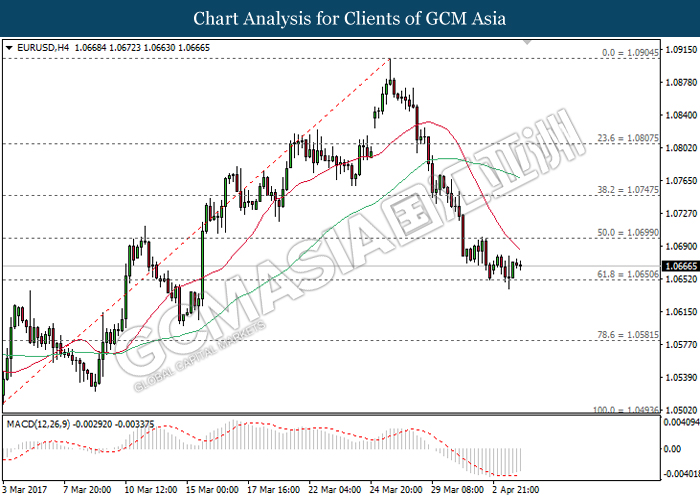

EURUSD

EURUSD, H4: EURUSD was traded higher following a rebound from the strong support level of 1.0650. With regards to the MACD indicator which begins to hover outside of downward momentum, EURUSD is expected to experience brief retracement period and may be traded higher in the short-term. Otherwise, long-term trend direction still suggests EURUSD to extend its downward momentum.

Resistance level: 1.0700, 1.0780

Support level: 1.0650, 1.0580

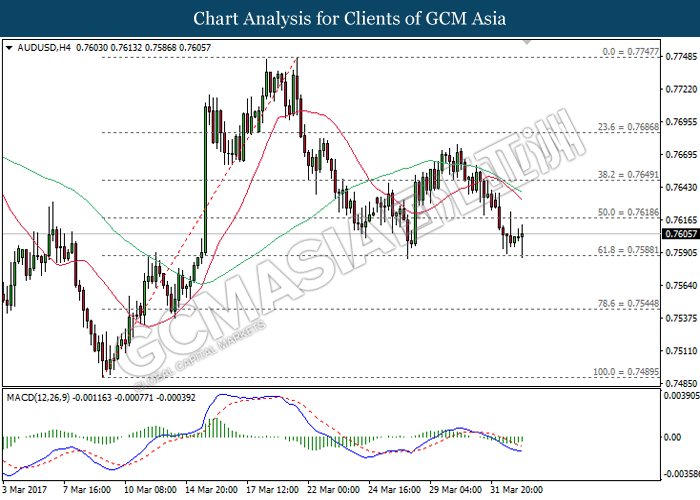

AUDUSD

AUDUSD, H4: AUDUSD was traded higher following a rebound from the strong support level of 0.7590. Referring to the downward signal line from MACD histogram which begins to narrow sideways, AUDUSD may be traded higher in the short-term as technical correction. Otherwise, the downward expansion of both MA lines suggests AUDUSD to extend its downward momentum.

Resistance level: 0.7620, 0.7650

Support level: 0.7590, 0.7545

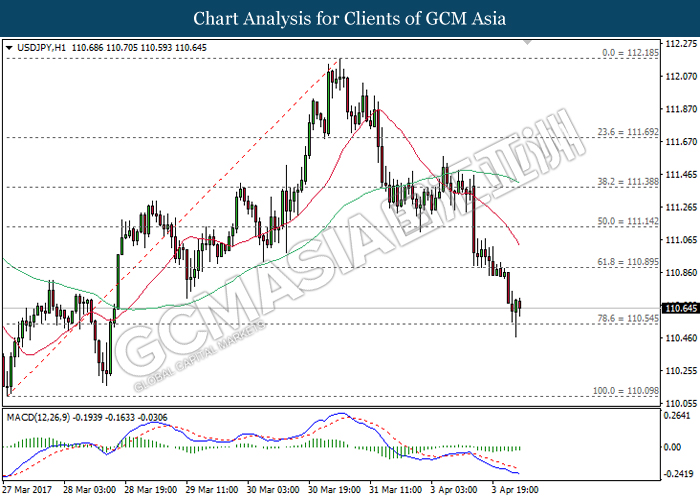

USDJPY

USDJPY, H1: USDJPY was traded lower following the downward expansion of both MA lines after the formation of death cross. As the MACD histogram continues to illustrate moderate downward signal and momentum, a successful closure below the support level of 110.55 would suggest USDJPY to extend its current downtrend.

Resistance level: 110.90, 111.15

Support level: 110.55, 110.10

CrudeOIL

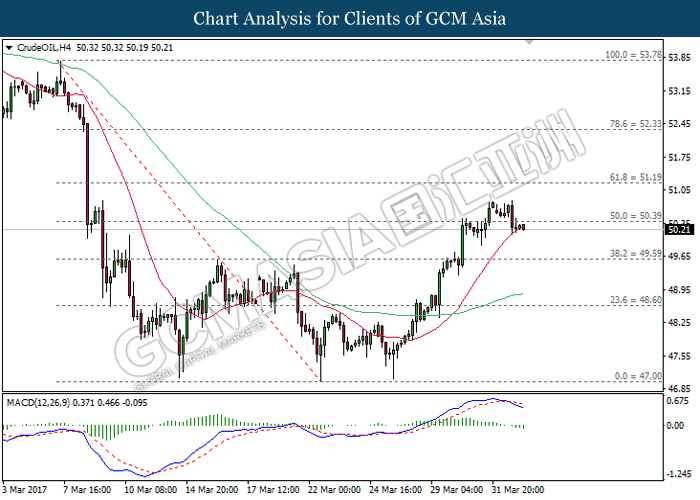

CrudeOIL, H4: Crude oil price was traded lower following a retracement while currently testing near the 20-moving average line (red). Referring to the MACD histogram which begins to illustrate downward signal and momentum, a closure below this line would suggest crude oil price to advance towards the target of support level at 49.60.

Resistance level: 50.40, 51.20

Support level: 49.60, 48.60

GOLD

GOLD_, H1: Previously, gold price broke out from the top level of downward channel, signifying a change in trend direction to move further upwards. However, recent retracement from previous high of 1256.30 suggests gold price to experience brief technical correction and may be traded lower in the short-term. Otherwise, the upward expansion of both MA line after the formation of golden cross suggests gold price to extend its uptrend.

Resistance level: 1256.30, 1259.00

Support level: 1252.70, 1250.20