04 June 2021 Morning Session Analysis

US Dollar surged amid upbeat economic data.

The Dollar Index which traded against a basket of six major currency pairs surged significantly on yesterday over the backdrop of string of the upbeat crucial economic data, which dialed up the market optimism toward the economic progression in United States. According to Automatic Data Processing (ADP), the ADP Nonfarm Employment Change notched up significantly from the previous reading of 654K to 978K, exceeding the market forecast at 650K. Besides, U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI) and U.S. Initial Jobless Claims came in at 64.0 and 385K, which both fared better than market expectation at 63.0 and 390K respectively. Such bullish economic data had increased the expectation that the U.S. central Bank would start to unwind some of its asset purchases while tapering its quantitative easing program. Nonetheless, investors would continue to scrutinize the latest updates with regards of crucial Nonfarm Payroll data tonight to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index surged 0.65% to 90.50.

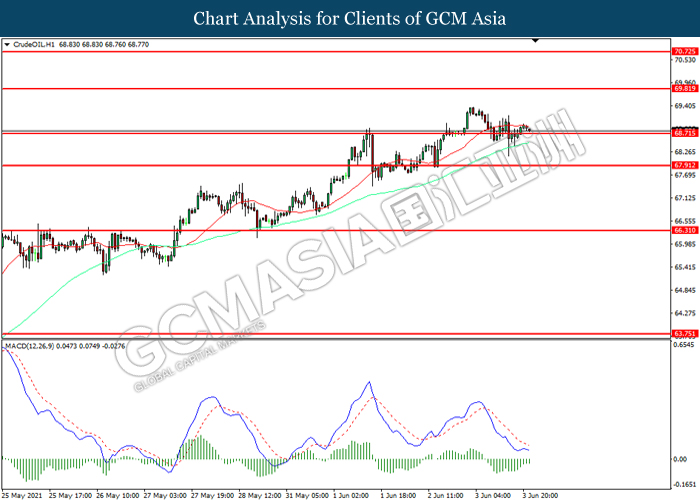

In the commodities market, the crude oil price surged 0.12% to $69.00 per barrel as of writing following the Energy Information Administration (EIA) reported that the U.S. Crude Oil Inventories had notched down significantly from the preliminary reading of -1.662M to -5.080M, better than the market forecast at -2.443M. On the other hand, the gold price slumped 0.05% to $1872.00 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:00 NZD RBNZ Gov Orr Speaks

19:00 USD Fed Chair Powell Speaks

19:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (May) | 61.6 | 62.0 | – |

| 20:30 | USD – Nonfarm Payrolls (May) | 266K | 650K | – |

| 20:30 | USD – Unemployment Rate (May) | 6.1% | 5.9% | – |

| 20:30 | CAD – Employment Change (May) | -207.1K | -22.5K | – |

| 22:00 | CAD – Ivey PMI (May) | 60.6 | – | – |

Technical Analysis

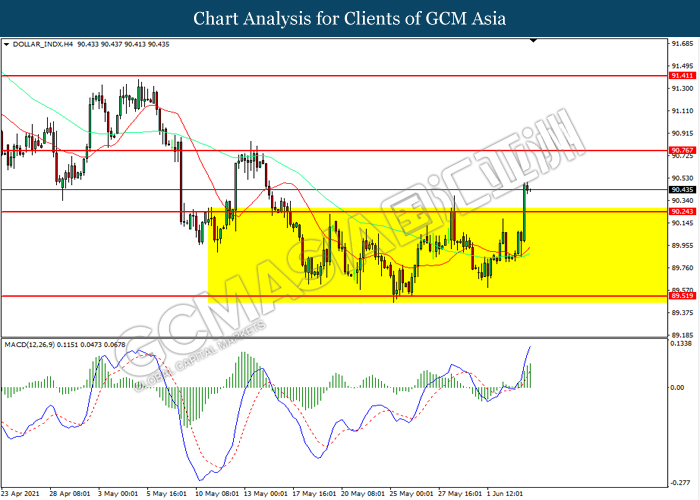

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 90.25. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 90.75.

Resistance level: 90.75. 91.40

Support level: 90.25, 89.50

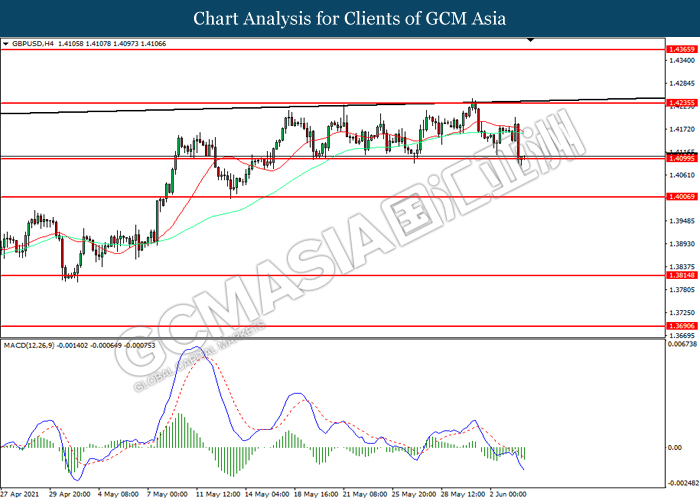

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.4100. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.4235, 1.4365

Support level: 1.4100, 1.4005

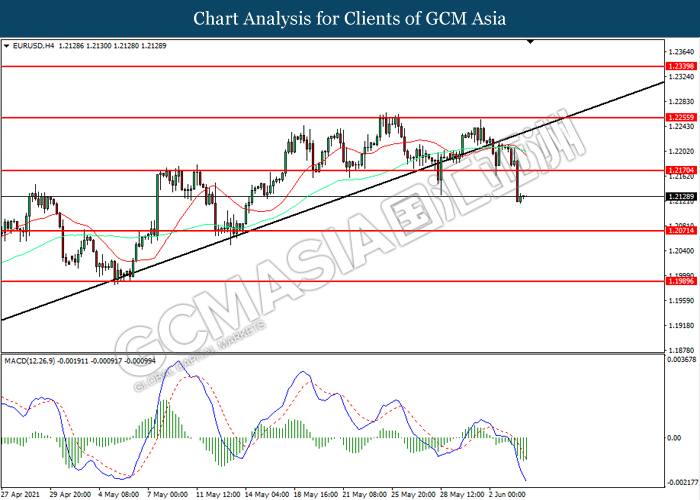

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.2170. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.2070.

Resistance level: 1.2170, 1.2255

Support level: 1.2070, 1.1990

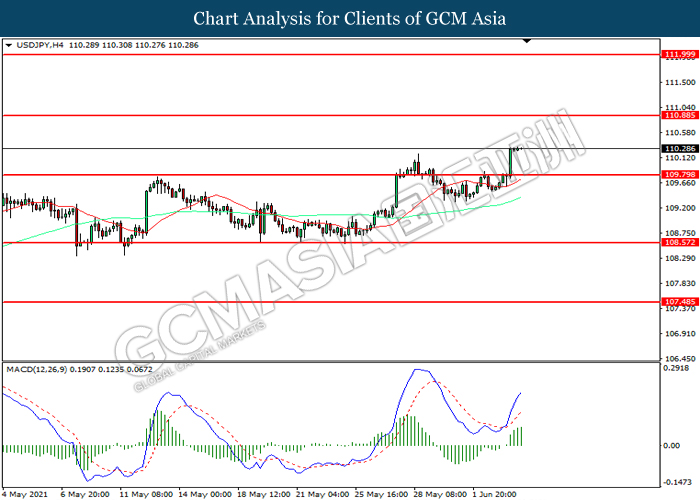

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 109.80. MACD which illustrated increasing bullish momentum suggest the pair to extend its gain toward resistance level at 110.90.

Resistance level: 110.90, 112.00

Support level: 109.80, 108.55

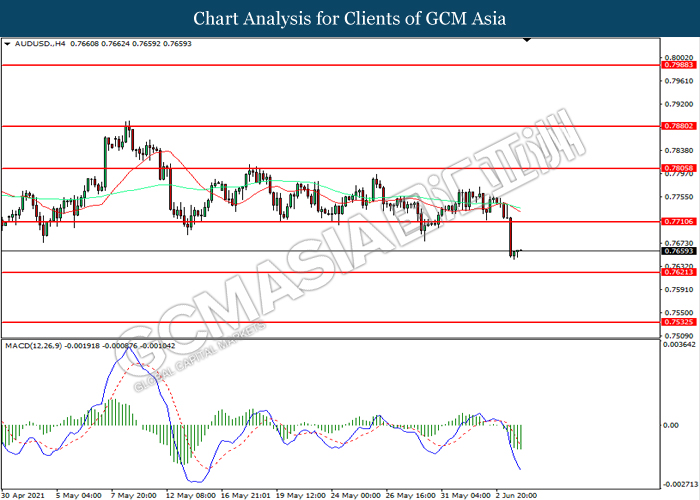

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7620. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7710, 0.7805

Support level: 0.7620, 0.7535

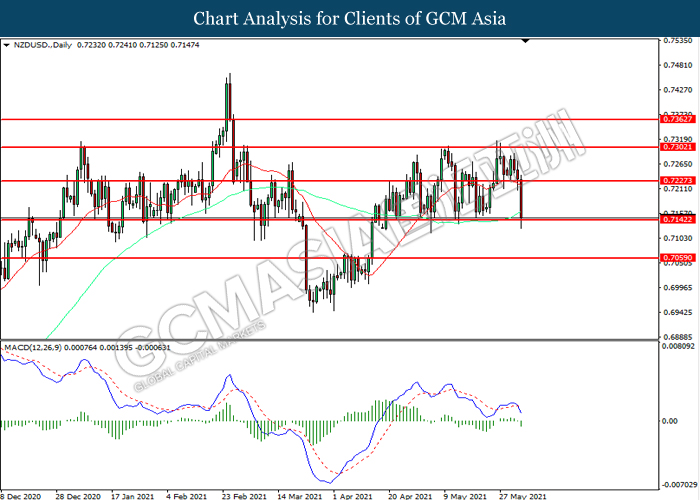

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.7140. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7225, 0.7300

Support level: 0.7140, 0.7060

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2040. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.2380, 1.2605

Support level: 1.2040, 1.1785

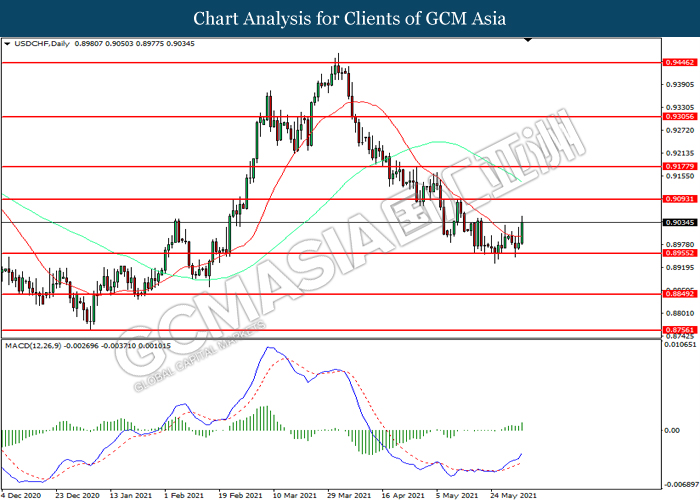

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.8955. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9095.

Resistance level: 0.9095, 0.9175

Support level: 0.8955, 0.8850

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level at 68.70. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 69.80, 70.75

Support level: 68.70, 67.90

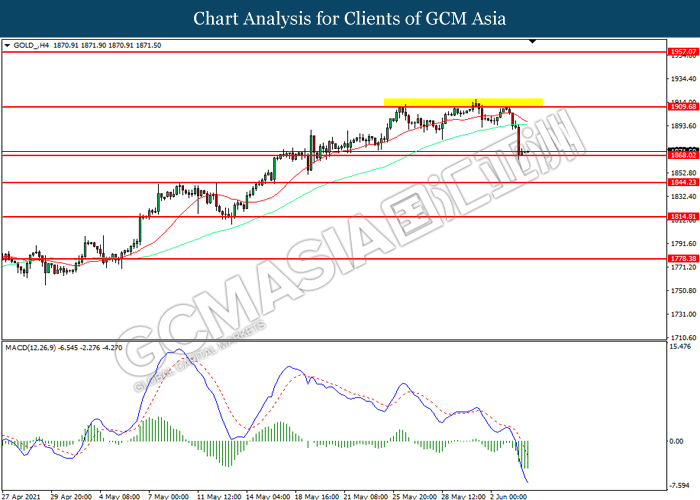

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1868.00. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1909.70, 1957.05

Support level: 1868.00, 1844.25