04 July 2022 Afternoon Session Analysis

US Dollar slumped amid downbeat economic outlook.

The Dollar Index which traded against a basket of six major currencies retreated from its higher level amid the fear upon the recession in United States continue to spark further selloff on the US Dollar. According to Institute for Supply Management, US ISM Manufacturing Purchasing Managers Index (PMI) notched down significantly from the previous reading of 56.1 to 53.0, missing the market forecast at 54.9. Such negative economic data had indicated that currently the economy was cooling and slowing down following the aggressive contractionary monetary policy by the Federal Reserve. In addition, the recession fears were amplified by a separate report from the Commerce Department on Friday, indicating that the construction spending unexpectedly fell in May. Meanwhile, the Atlanta Federal Reserve has diminished its second-quarter GDP outlook to show contraction. As of writing, the Dollar Index depreciated by 0.06% to 104.83.

In the commodities market, the crude oil price slumped 0.53% to $108.00 per barrel as of writing. The oil market edged lower amid the fears upon the global recession over the backdrop of a string of bearish economic data continue to weigh down the market demand on this black-commodity. On the other hand, the gold market appreciated by 0.03% to $1810.85 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Independence Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

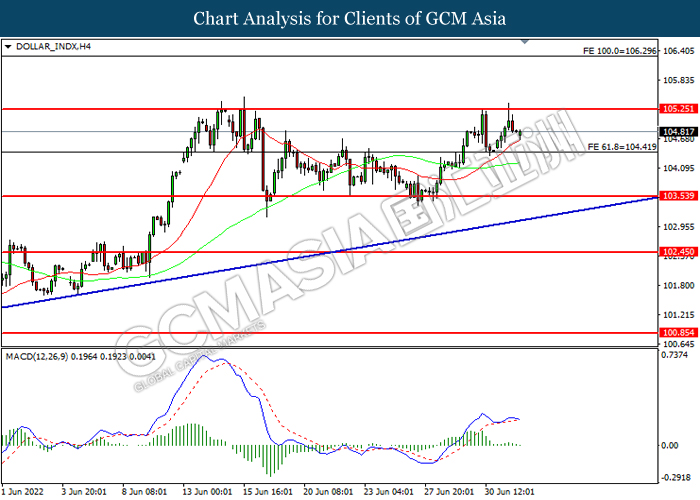

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward support level.

Resistance level: 105.25, 106.30

Support level: 104.40, 103.55

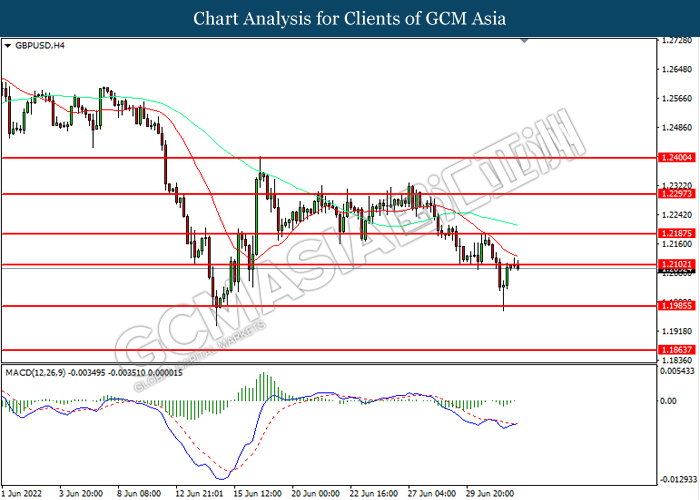

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2100, 1.2185

Support level: 1.1985, 1.1865

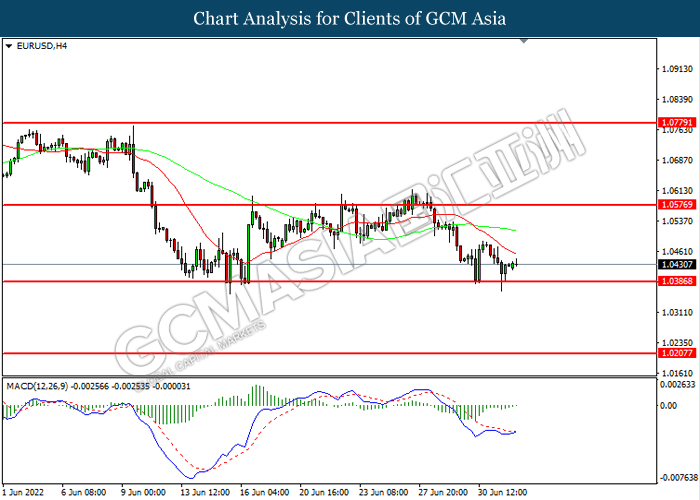

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0575, 1.0780

Support level: 1.0385, 1.0205

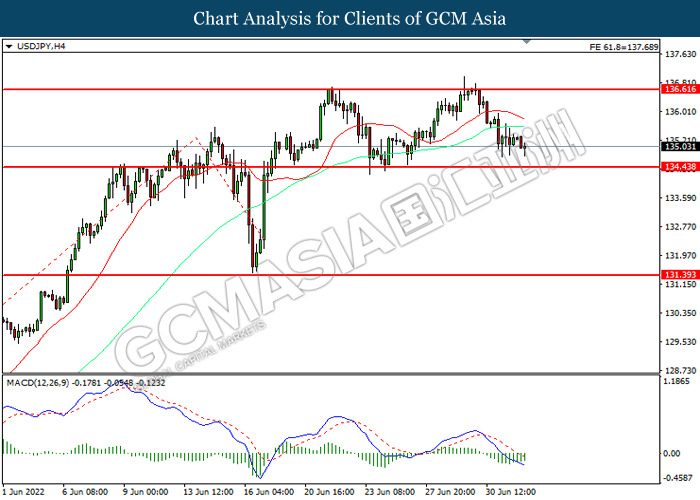

USDJPY, H4: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 136.60, 137.70

Support level: 134.45, 131.40

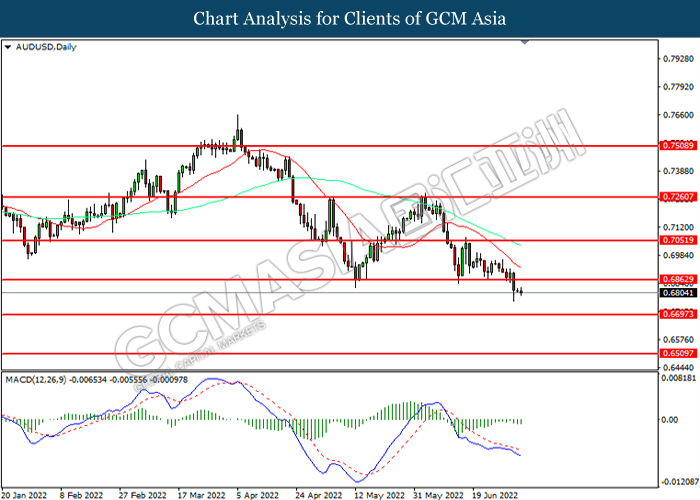

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6865, 0.7050

Support level: 0.6695, 0.6510

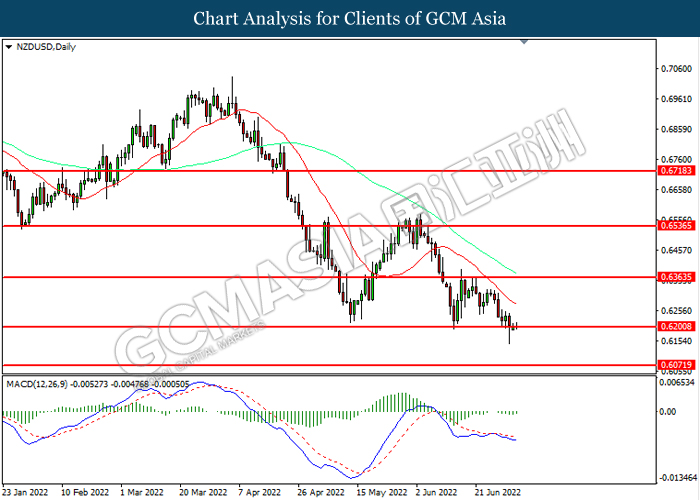

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6365, 0.6535

Support level: 0.6200, 0.6070

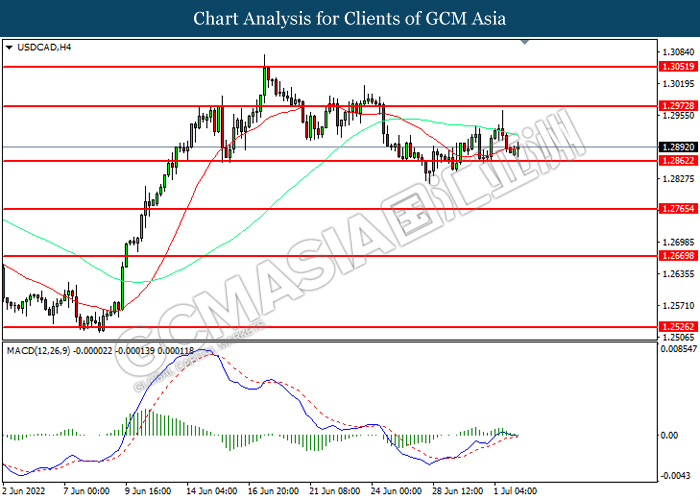

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

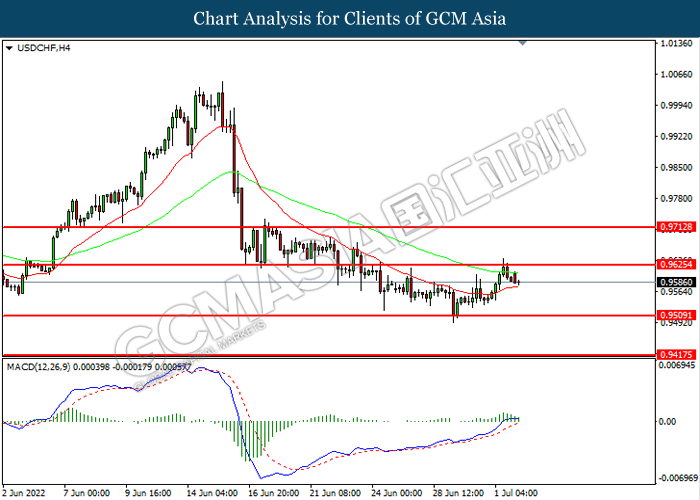

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9625, 0.9715

Support level: 0.9510, 0.9415

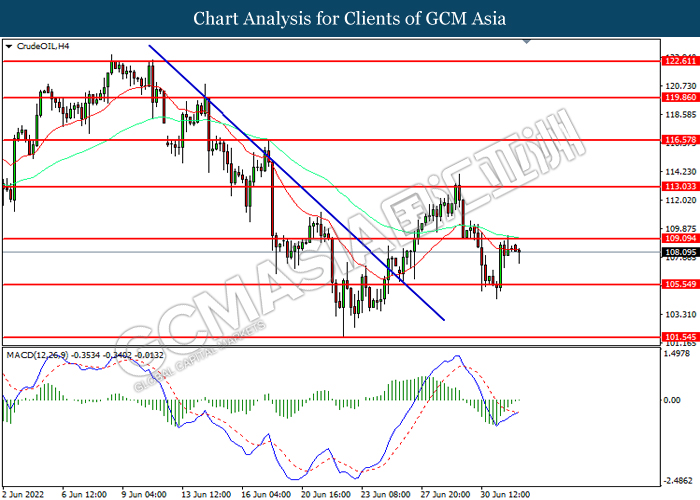

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 109.10, 113.05

Support level: 105.55, 101.55

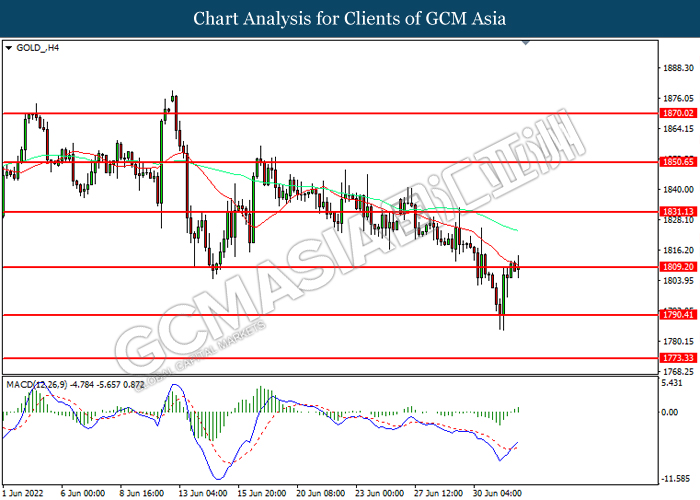

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1809.20, 1831.15

Support level: 1790.40, 1773.35