04 August 2020 Morning Session Analysis

Pound slumped over the negative economic outlook.

Pound Sterling slumped over the concerns of a second wave of coronavirus infections, weak economy and growing tensions to strike a post-Brexit trade deal before a transition period ends in December. On the economic data front, the Markit/CIPS reported that the U.K. Manufacturing Purchasing Managers Index (PMI) came in at only 53.3, missing the economist forecast at 53.6, while fading the hopes upon the V-shape economic recovery from the UK region. Besides that, the UK Prime Minister Boris Johnson announced that some lockdown easing planned for the whole of UK region would need to be delayed following the coronavirus death toll spiked up to the record high, which further sapping the demand of the Pound Sterling. Nonetheless, investors are now eyeing on the further post-Brexit talks between UK and Europe as well as the Bank of England monetary meeting on Thursday to gauge the likelihood movement for the pair. As of writing, the GBP/USD depreciated by 0.02% to 1.3075.

In the commodities market, the crude oil price appreciated by 0.01% to $40.68 per barrel as of writing. The oil market inched higher following the U.S. Manufacturing surveys showed that the economic recovery from the U.S region continues despite the resurgence of the coronavirus, which providing positive prospect for the market demand of this black-commodity in the future. On the other hand, the gold price slumped 0.19% to $1973.15 per troy ounces over the backdrop of the positive U.S. economic data, which spurring risk-on sentiment in the market while diminishing market demand on the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA State Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | Retail Sales (MoM) (Jun) | 16.9% | 2.4% | – |

| 12:30 | RBA Interest Rate Decision (Aug) | 0.25% | 0.25% | – |

Technical Analysis

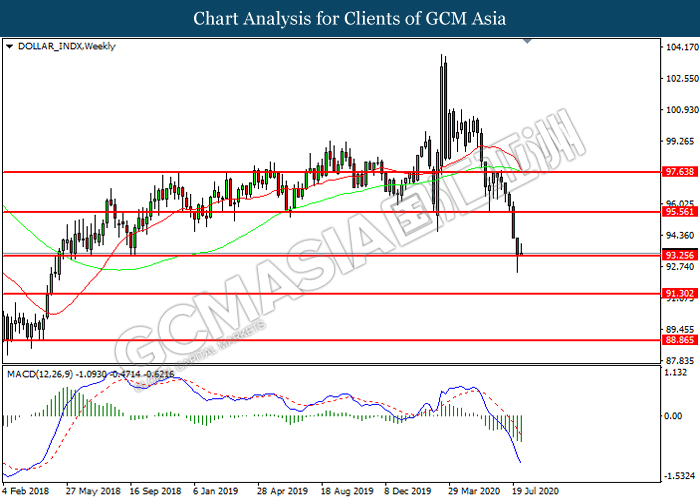

DOLLAR_INDX, Weekly: Dollar index was traded lower while currently testing the support level at 93.25. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 95.55, 97.65

Support level: 93.25, 91.30

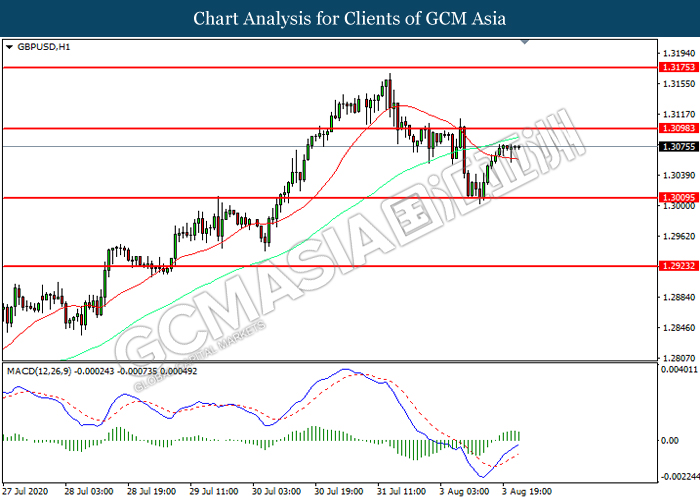

GBPUSD, H1: GBPUSD was traded higher following prior rebound from the support level at 1.3010. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3100, 1.3175

Support level: 1.3010, 1.2925

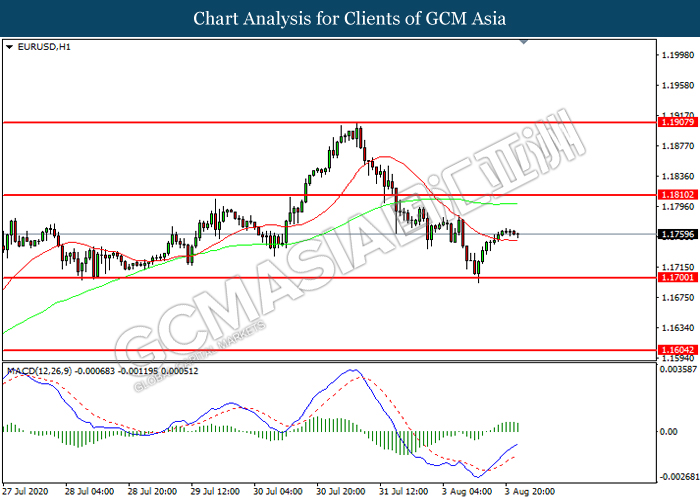

EURUSD, H1: EURUSD was traded higher following prior rebound from the support level at 1.1700. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1810, 1.1910

Support level: 1.1700, 1.1605

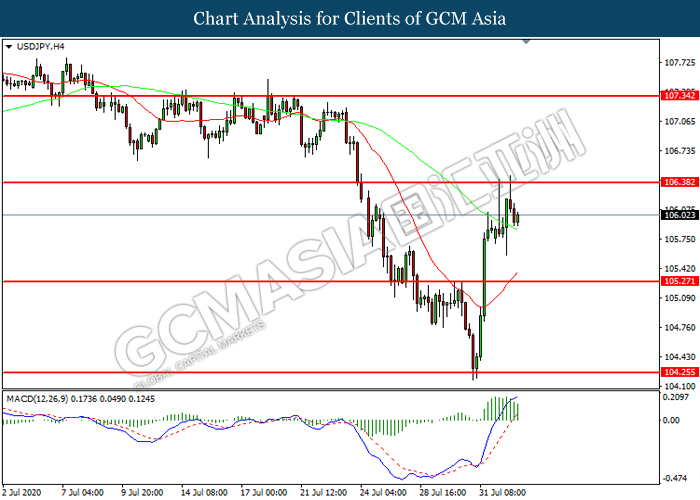

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 106.40. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 105.25.

Resistance level: 106.40, 107.35

Support level: 105.25, 104.25

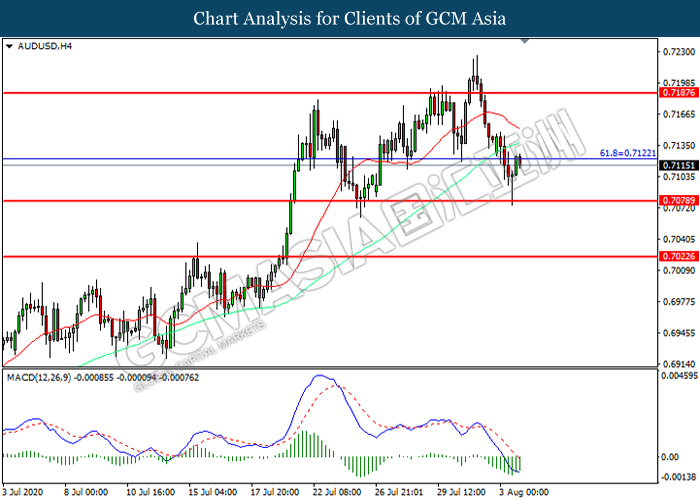

AUDUSD, H4: AUDUSD was higher while currently testing the resistance level at 0.7120. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7120, 0.7185

Support level: 0.7080, 0.7025

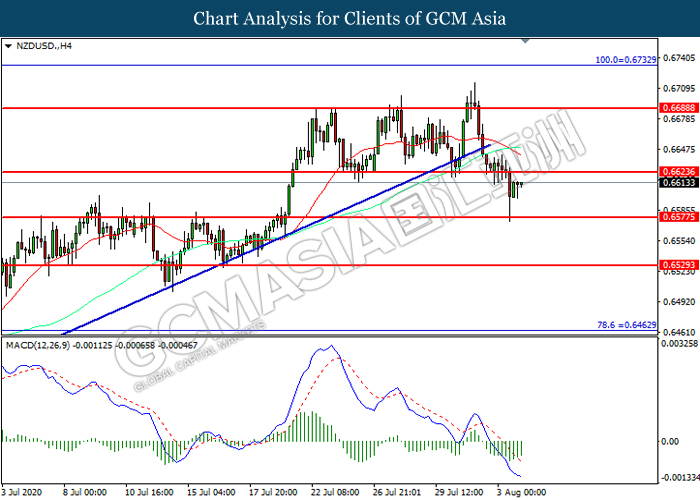

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6625. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6625, 0.6690

Support level: 0.6575, 0.6530

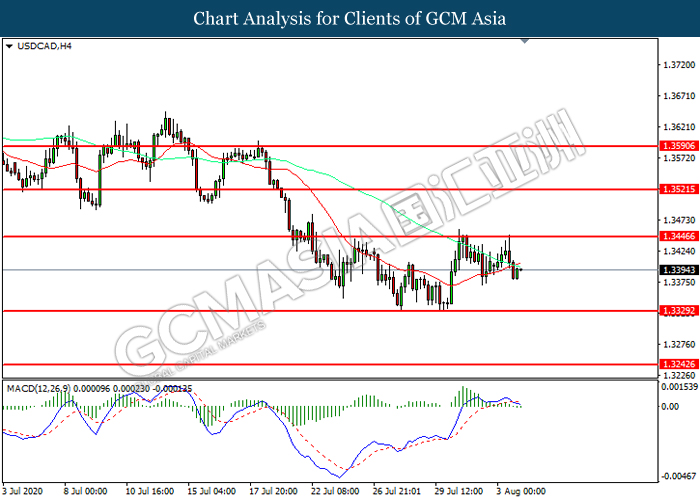

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level ta 1.3445. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.3330.

Resistance level: 1.3445, 1.3520

Support level: 1.3330, 1.3245

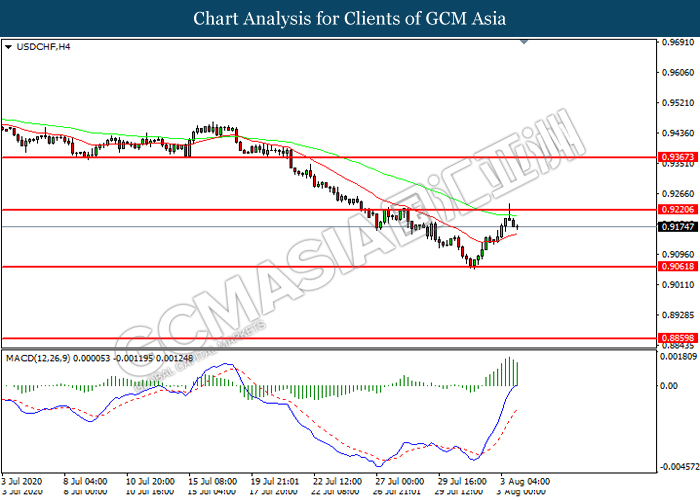

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9220. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9220, 0.9365

Support level: 0.9060, 0.8860

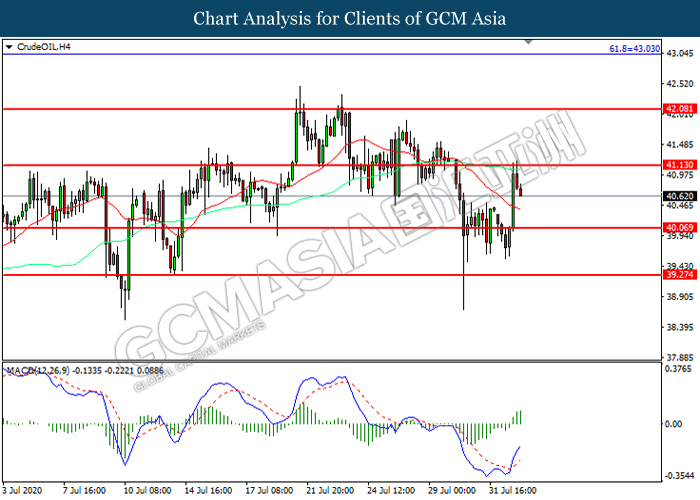

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 41.15. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 41.15, 42.10

Support level: 40.05, 39.25

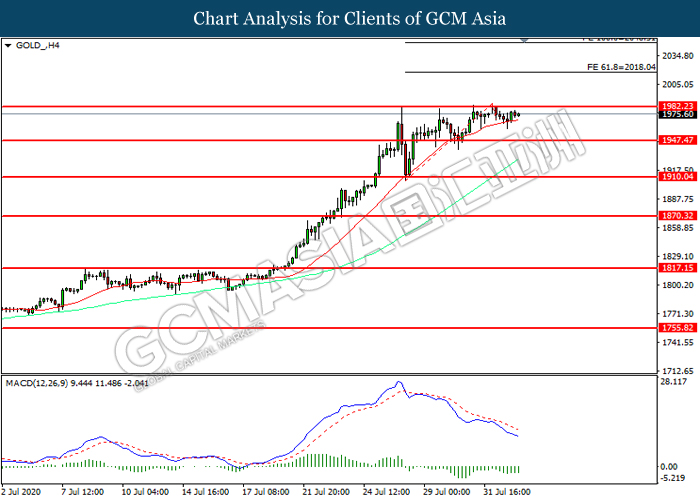

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1982.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1982.25, 2018.05

Support level: 1947.45, 1910.05