4 August 2022 Afternoon Session Analysis

Pound on pressure as economic data weakened.

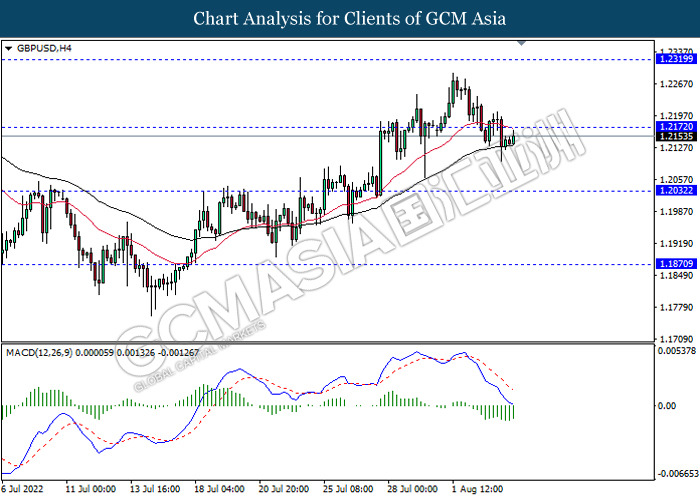

The GBP/USD which well known by majority of investors dropped on yesterday amid the bearish economic data has been unleashed. According to Markit Economics, the UK Composite Purchasing Managers’ Index (PMI) for July notched down from the previous reading of 53.7 to 52.1, missing the market forecast of 52.8. Besides that, the UK Services Purchasing Managers Index (PMI) had also given a pessimistic reading, which came in at the reading of 52.6 while lower than the consensus expectation of 53.3. The lower-than-expected reading indicated that the UK economy is at the risk of recession, which dragged down the appeal of Pound Sterling. At this juncture, investors would continue to scrutinize the interest rate decision from BoE which scheduled at 7pm tonight in order to gauge the likelihood movement of GBP/USD. Market participants are predicting that BoE would likely to implement 50 basis point rate hike, the most since 1995 to suppress the spiking inflation. As of writing, GBP/USD edged up by 0.06% to 1.2152.

In the commodities market, the crude oil price appreciated by 0.47% to $91.15 per barrel as of writing. Nonetheless, the overall trend of oil price remained bearish after OPEC+ claimed that it would increase its oil output. On the other hand, the gold price rallied by 0.45% to $1767.86 per troy ounce as of writing after it slumped throughout the overnight trading session over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Jul) | 52.6 | 52.0 | – |

| 19:00 | GBP – BoE Interest Rate Decision (Aug) | 1.25% | 1.75% | – |

| 20:30 | USD – Initial Jobless Claims | 256K | 259K | – |

Technical Analysis

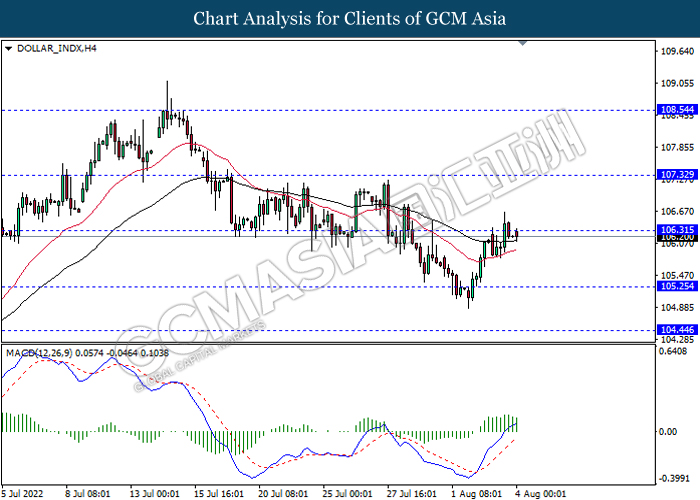

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

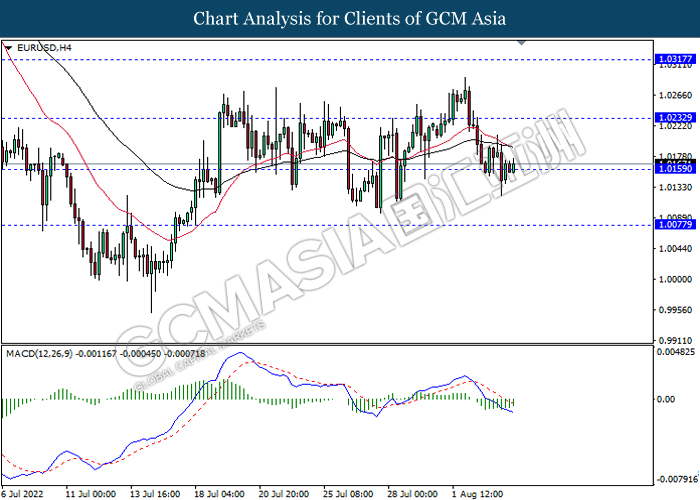

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

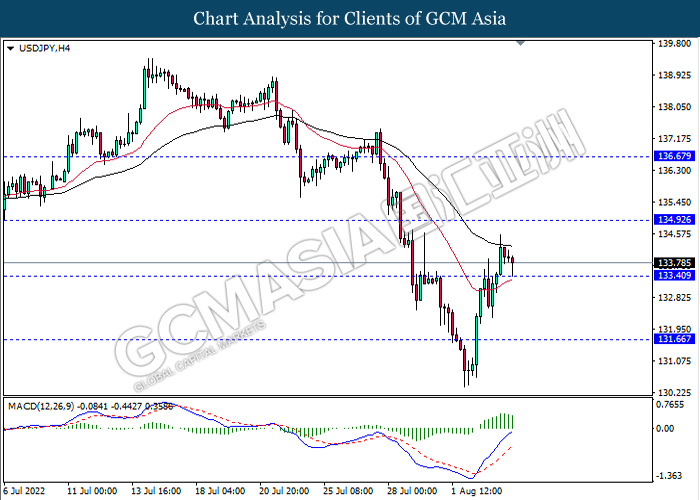

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 134.90, 136.65

Support level: 133.40, 131.65

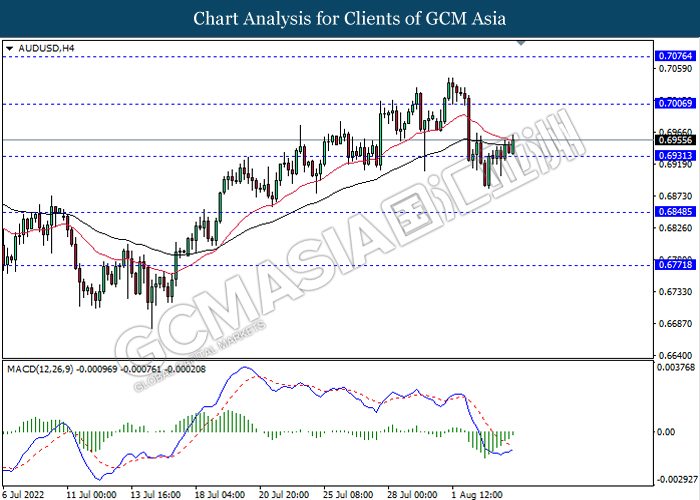

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

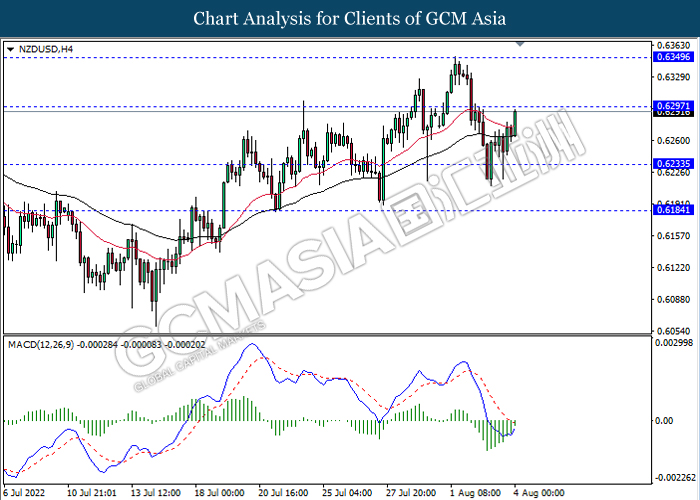

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

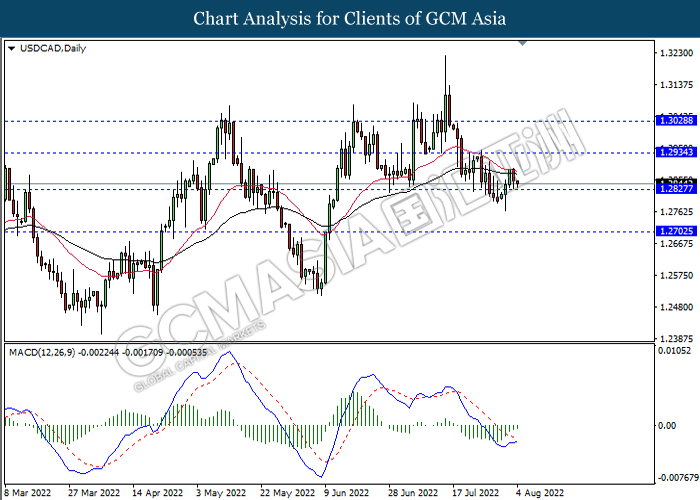

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

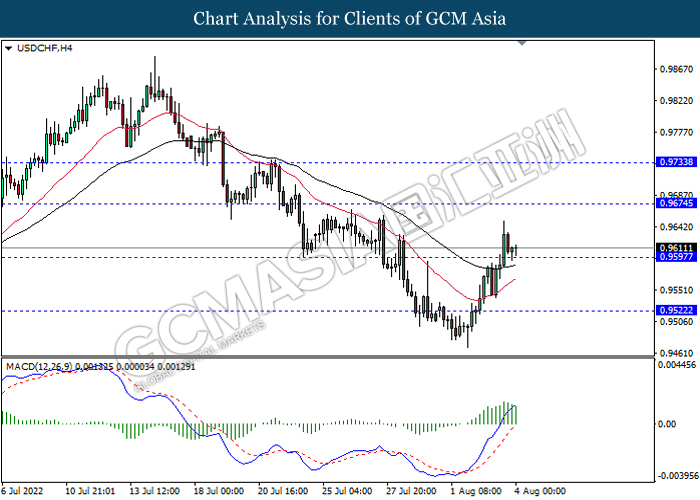

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9675, 0.9735

Support level: 0.9595, 0.9520

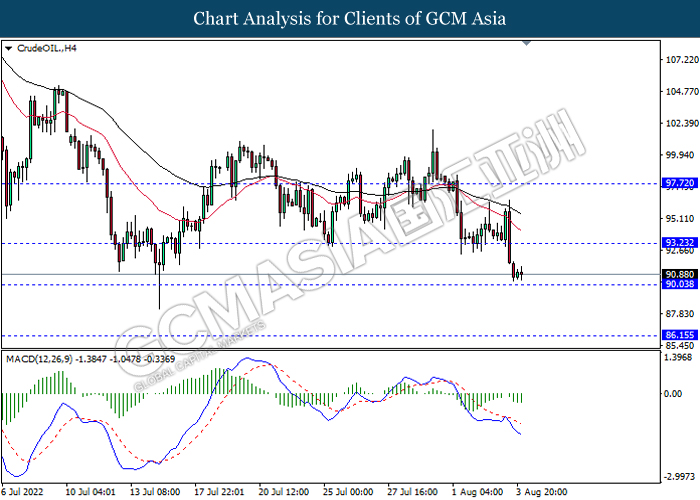

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 93.25, 97.70

Support level: 90.05, 86.15

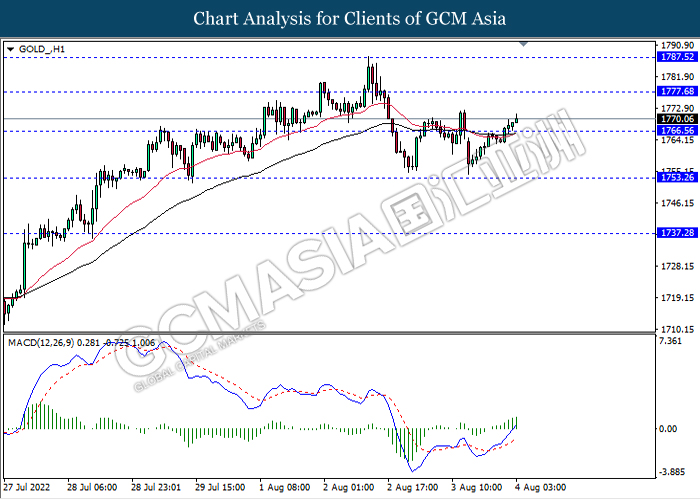

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1777.70, 1787.50

Support level: 1766.55, 1753.25