4 August 2022 Morning Session Analysis

Dollar recovered further on the back of upbeat data.

The dollar index, which traded against a basket of six major currencies, continued to enjoy a revival yesterday as upbeat economic data restrained the index from falling further. According to the Institute for Supply Management (ISM), US ISM Non-Manufacturing PMI rose from the prior month reading of 55.3 to 56.7 in July. To take note, a reading above 50 indicates an expansion in the services sector, while a reading below 50 signals a recession in the particular sector. The increase has put the prior 3 straight monthly declines into an end, while showing that the US services industry picked up amid solid new orders. Undoubtedly, the upbeat services PMI data has also erased the views that US economy is currently in a recession stage. On the other side, the hawkish statement to rein in the high inflation from the Fed officials continue to spur the value of the US dollar. In the statement, the Fed officials signaled that they are committed to cool down the overheating economy, whereby the long-term inflation target will still be around 2%. As of writing, the dollar index rose by 0.13% to 106.40.

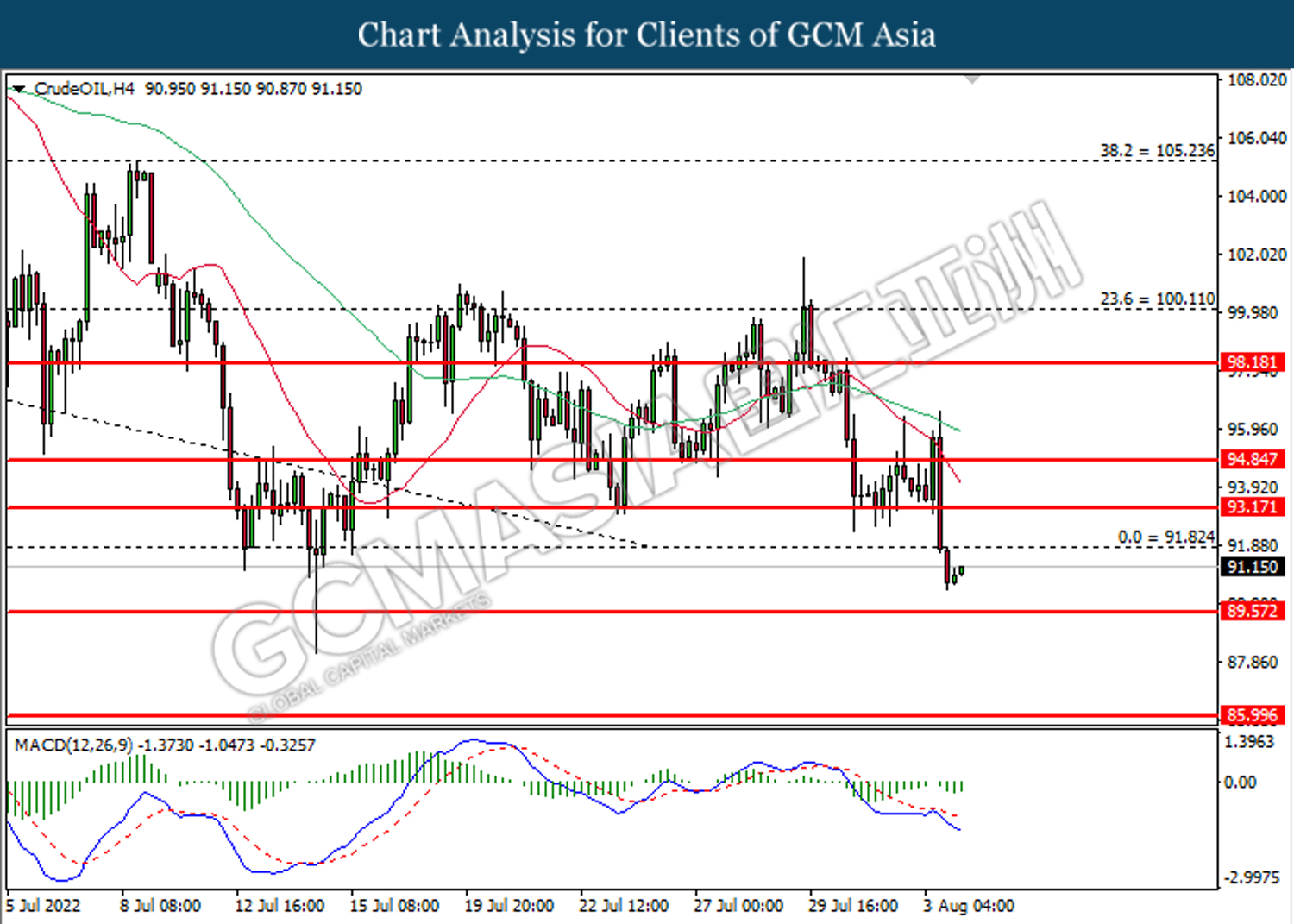

In the commodities market, the crude oil price dropped 0.10% to $91.05 a barrel after the US Crude Oil Inventories showed a huge stockpile, dragging the appeal of this black commodity. According to the EIA, the US crude oil inventories level rose by 4.467M, while the consensus forecast was expecting to see a -0.629M of inventories drawdown. Besides, the gold prices rose 0.01% to $1764.25 per troy ounce on the back of US dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Jul) | 52.6 | 52.0 | – |

| 19:00 | GBP – BoE Interest Rate Decision (Aug) | 1.25% | 1.75% | – |

| 20:30 | USD – Initial Jobless Claims | 256K | 259K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 106.10. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the next resistance level at 107.15.

Resistance level: 107.15, 107.60

Support level: 106.10, 105.15

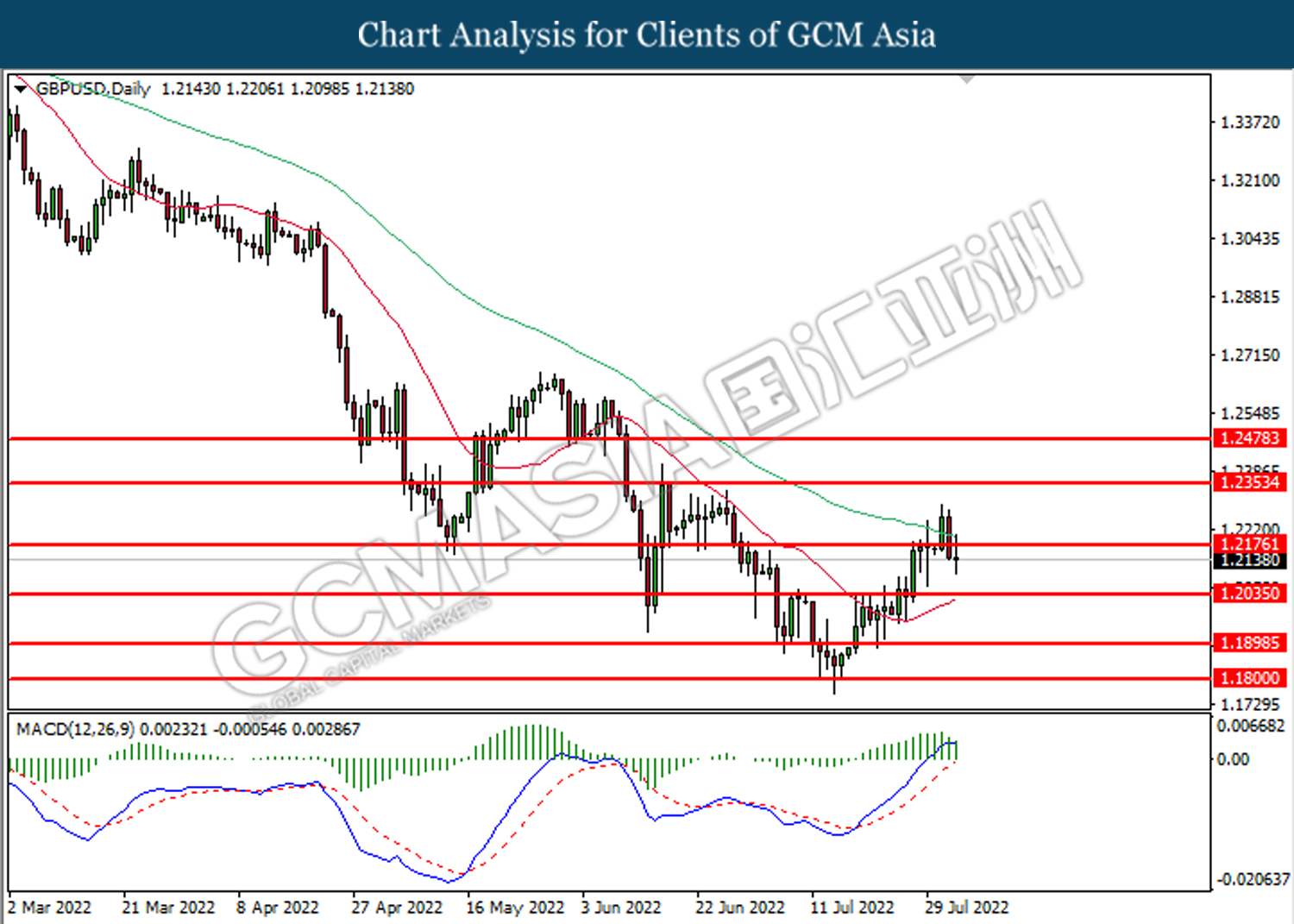

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2175. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2035.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

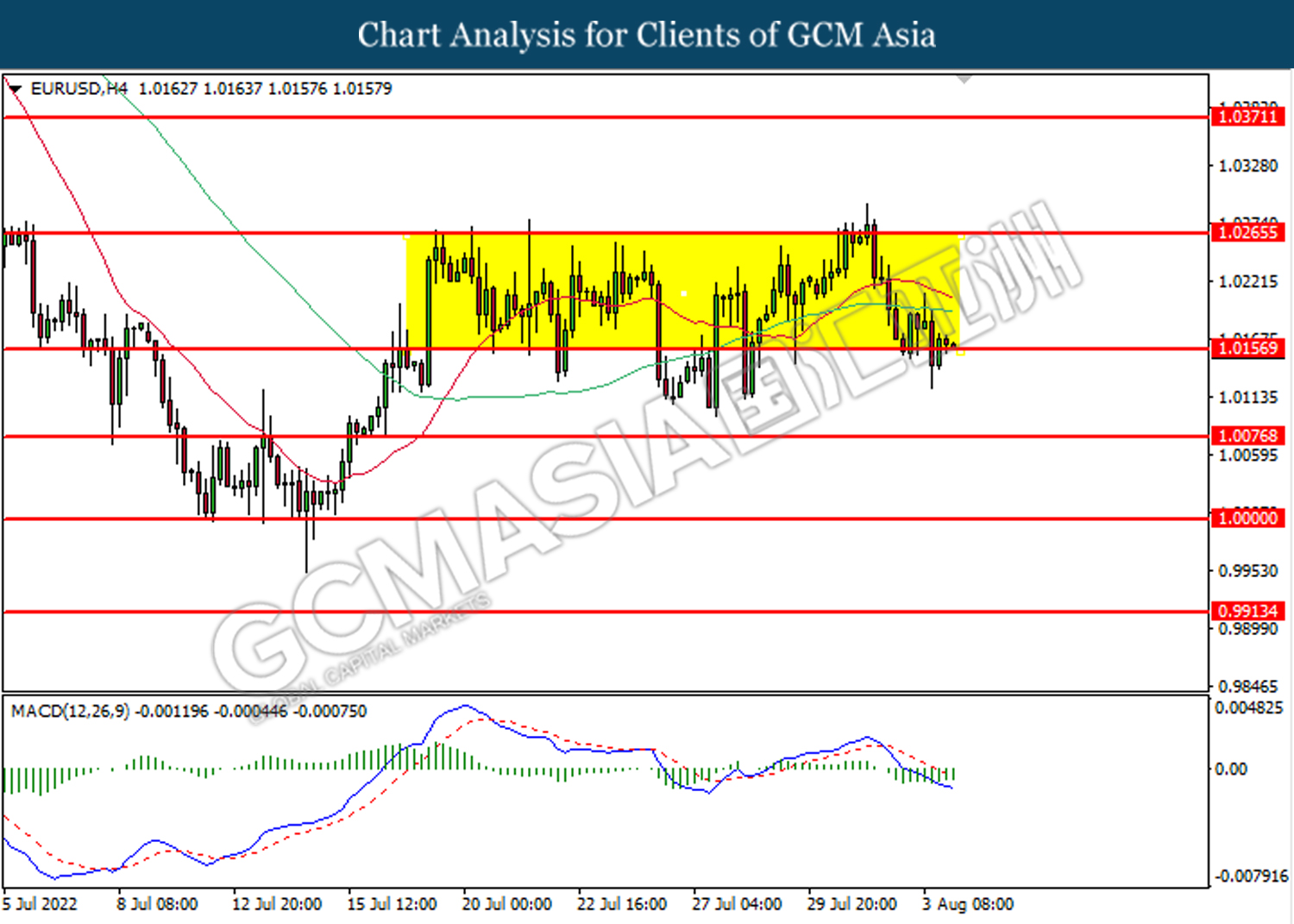

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0155. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

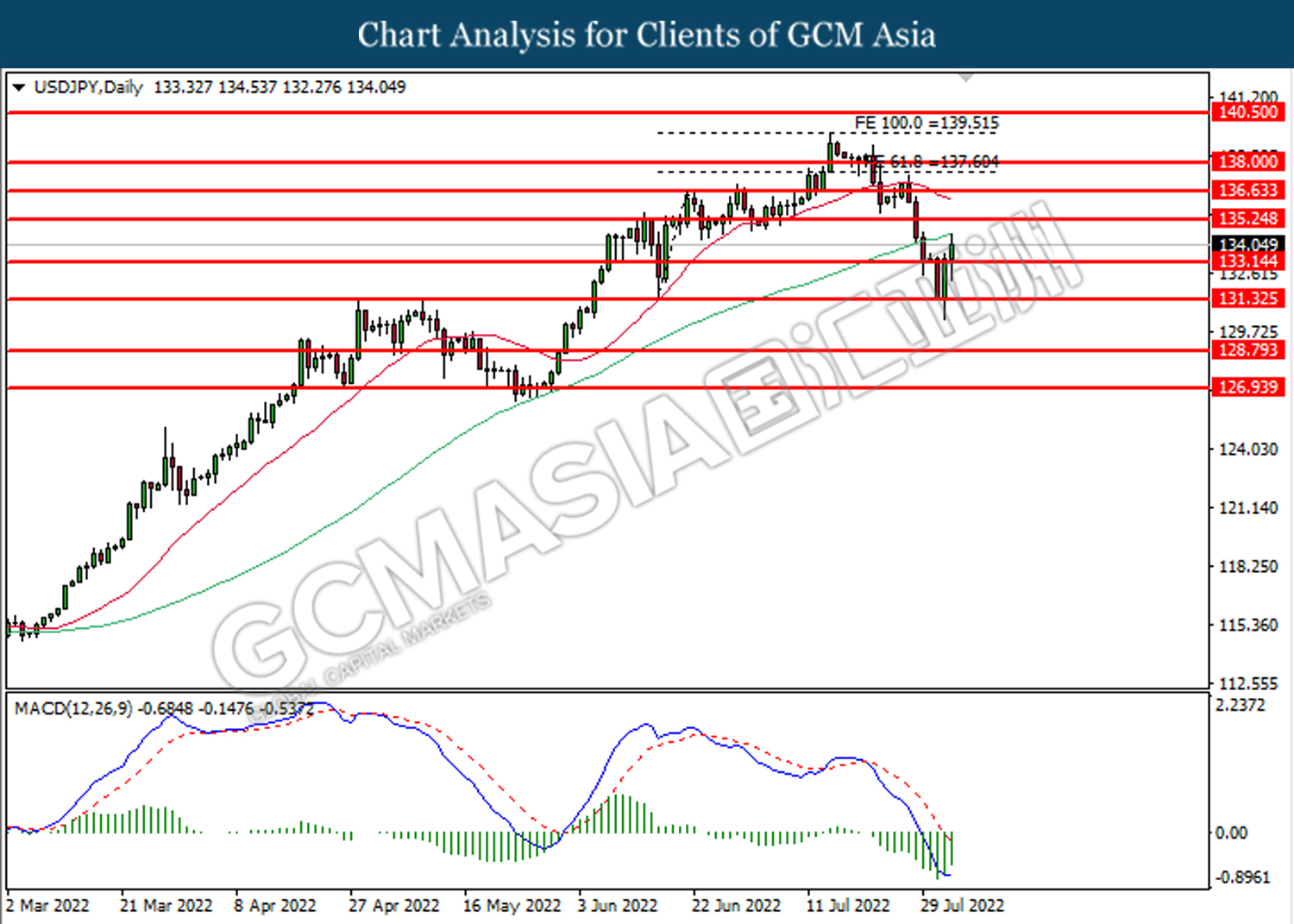

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 133.15. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after its candle successfully close above the resistance level.

Resistance level: 133.15, 135.25

Support level: 131.35, 128.80

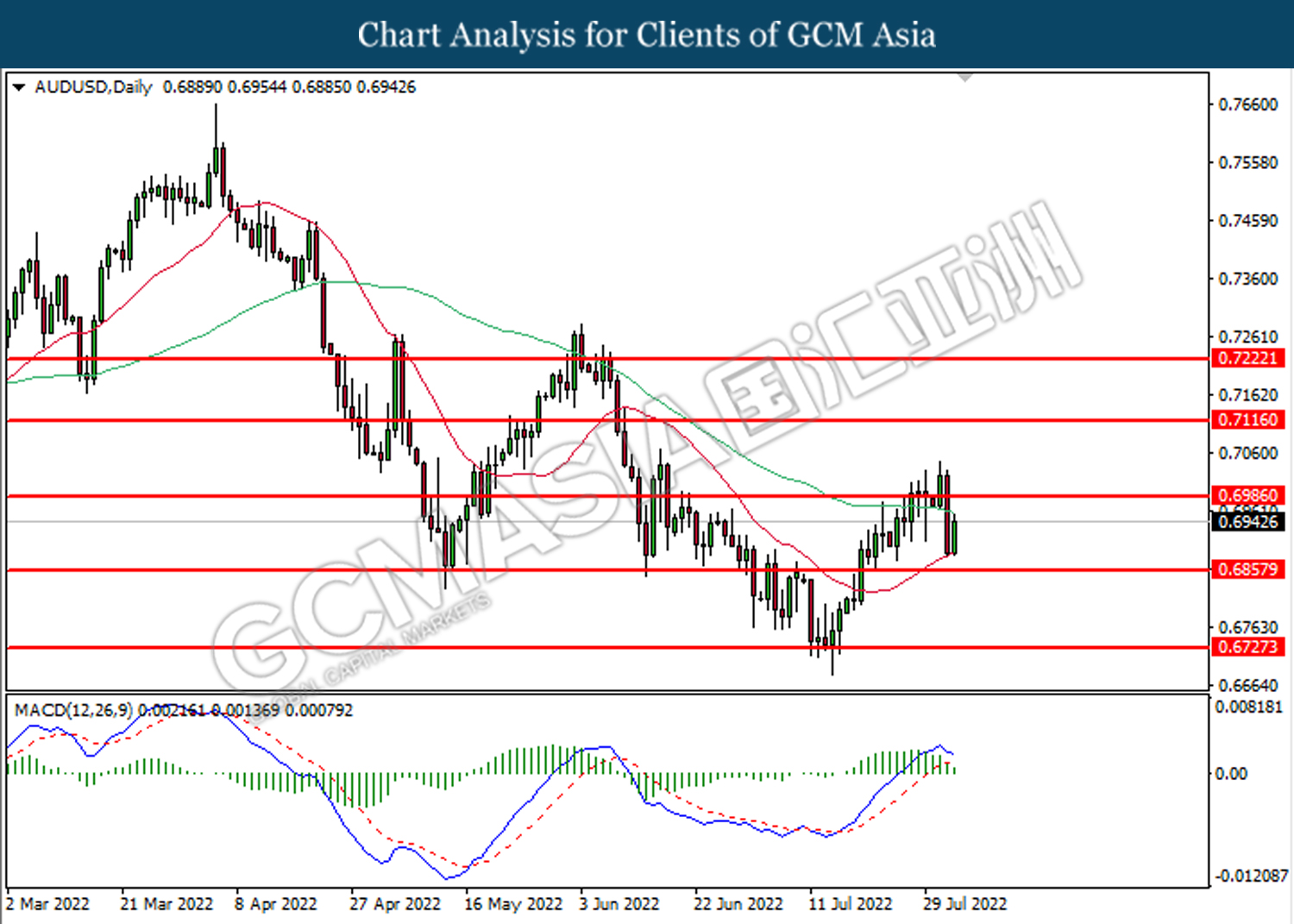

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6985. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6855.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

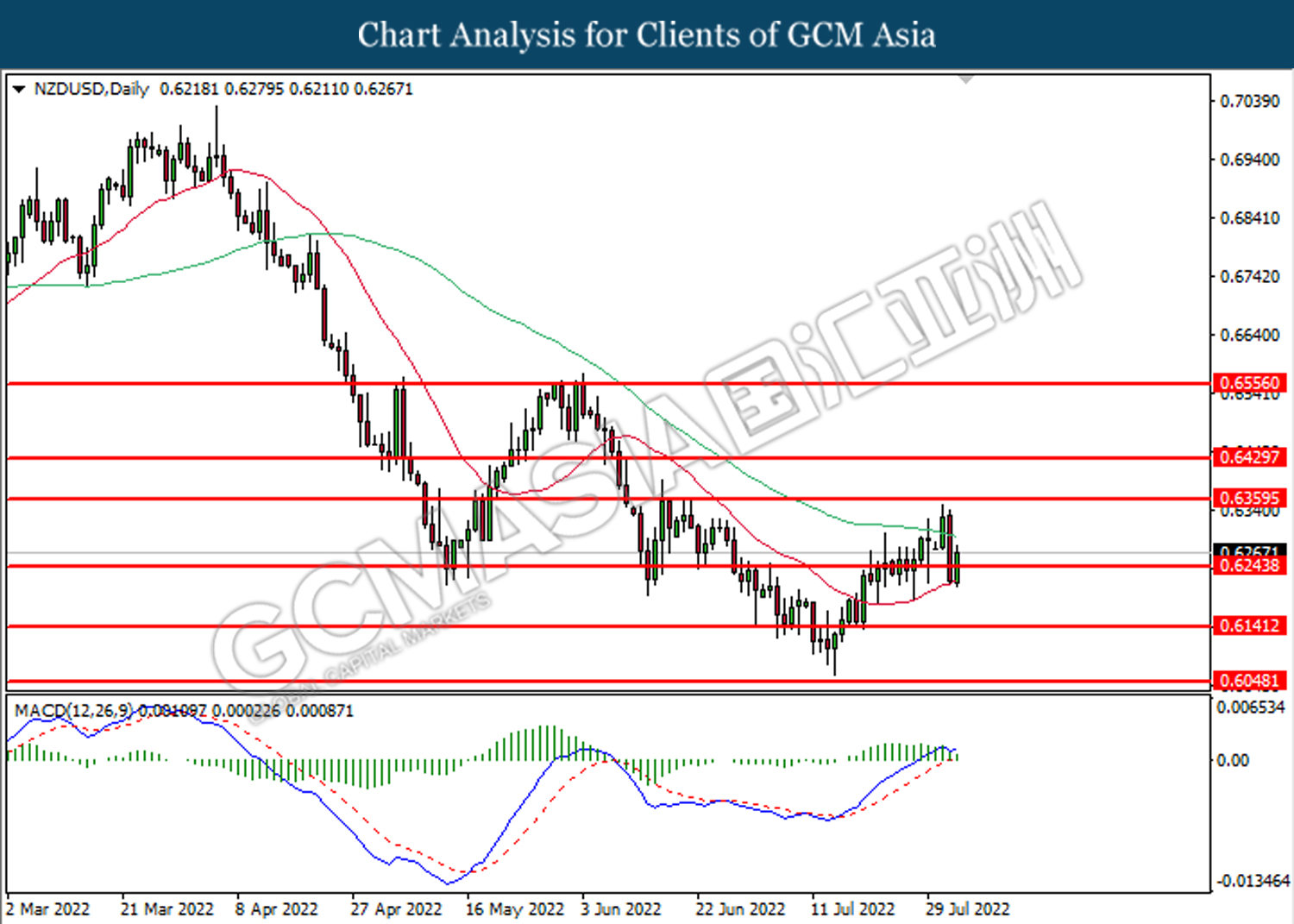

NZDUSD, Daily: NZDUSD was traded higher while retesting the resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after its candle successfully close above the resistance level.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

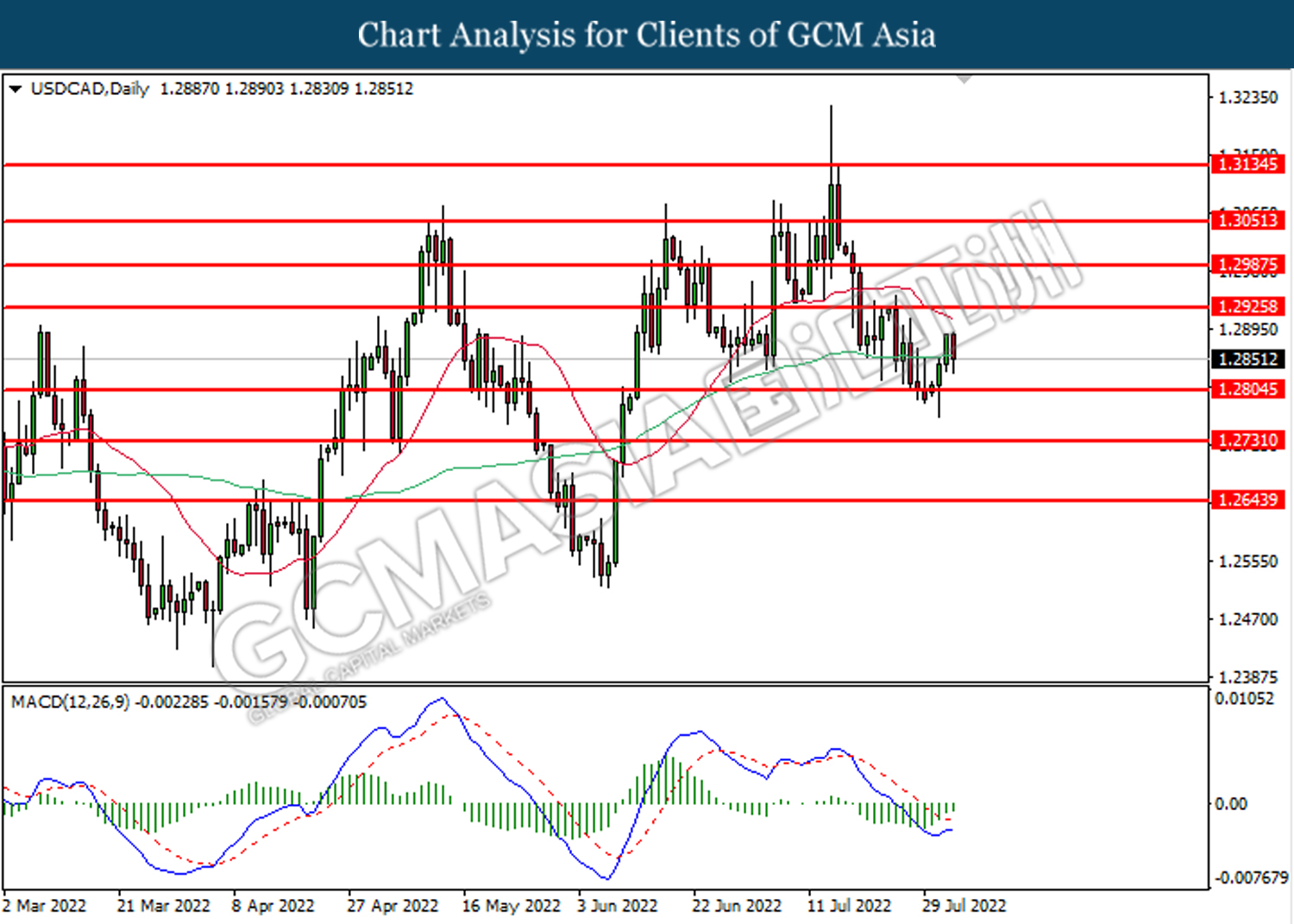

USDCAD, Daily: USDCAD was traded higher following prior rebound near the support level at 1.2805. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2925.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

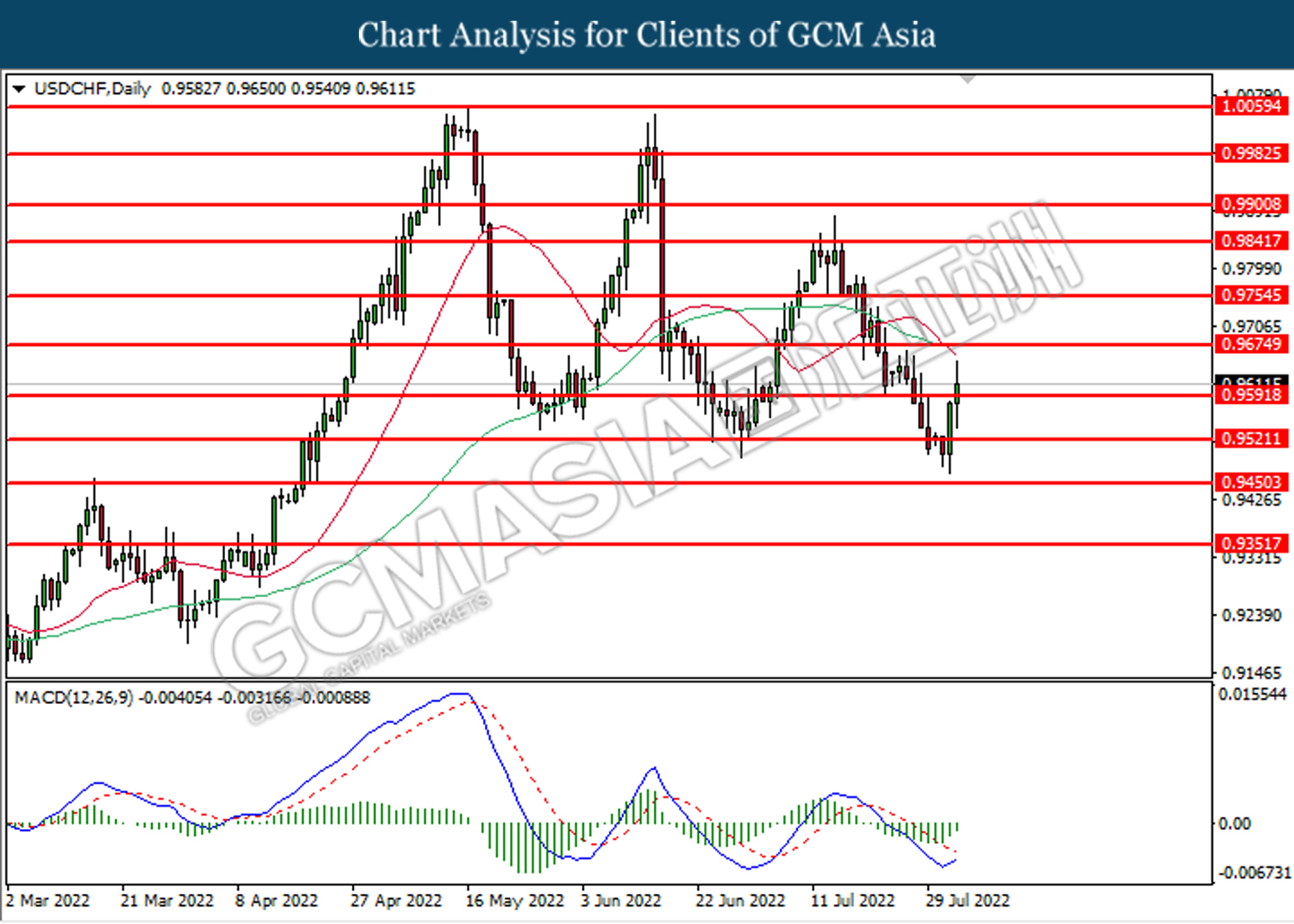

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 91.80. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 89.55.

Resistance level: 91.80, 93.15

Support level: 89.55, 86.00

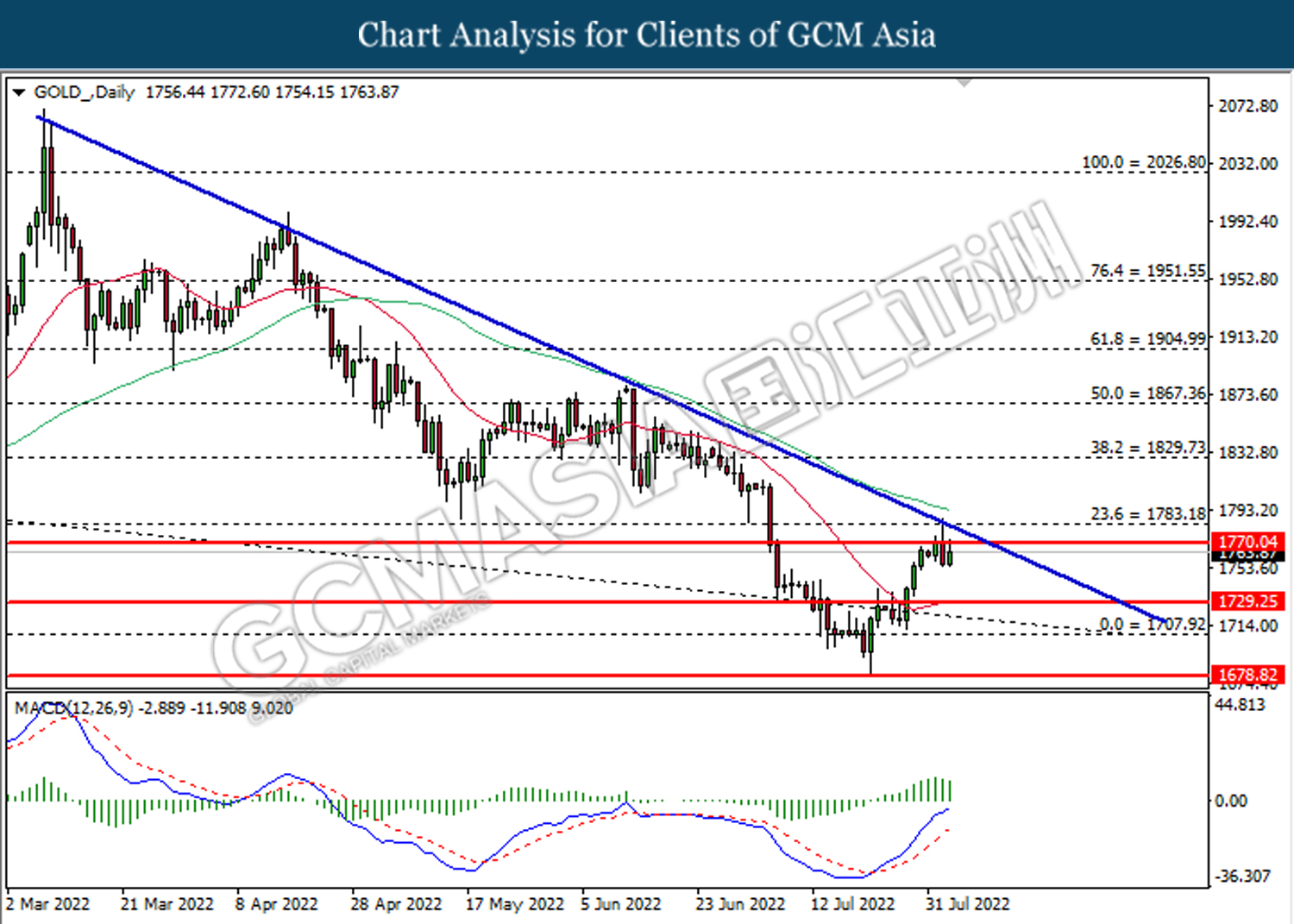

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1770.05. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1729.25.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90