4 August 2023 Afternoon Session Analysis

GBP rose as BoE hike interest rate to 5.25%.

Pound Sterling (GBP), which was widely traded by global investors, rose after the Bank of England (BoE) decided to hike 25 basis points (bps) of interest rate. Yesterday, BoE has decided to raise the interest rate by 25 bps decision from 5.0% to 5.25%, matched with market forecast. Since the inflation is dropping faster than expected, therefore the interest rate decision only raised by 25 bps instead of 50 bps. BoE expects that the inflation in October will fall to around 5%. After that, the BoE Governor Andrew Bailey has mentioned the upcoming interest rate decision will have no presumed path, which means that the upcoming interest rate decision will still depend on economic data. Besides that, in the labor market, Andrew Bailey stated that other parts of the labor market were softening, but wage inflation was persistent. Although the unemployment rate remained very low at 4.0%, the wage paid remained high since May, and the pay growth is notably stronger than standard models would have suggest. BoE remained their inflation target at 2% and they expect recession will not happened. As of writing, GBP/USD rose 0.22% to 1.2740.

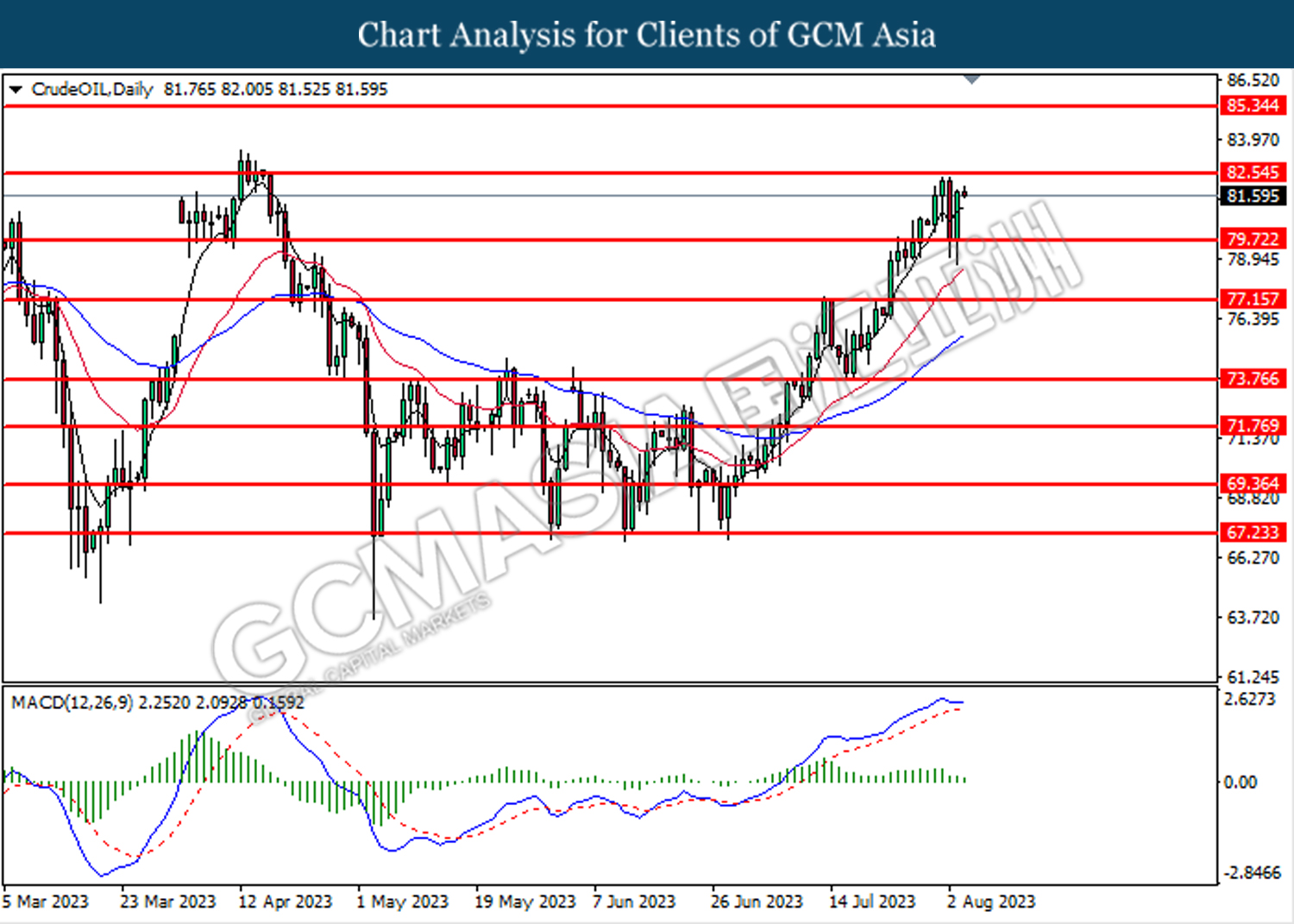

In the commodities market, crude oil prices rose 0.21% to 81.70 per barrel amid Russia also followed Saudi Arabia to continue the oil production cut plan to September of 300,000 barrels per day. Besides, gold prices rose 0.08% to 1936.00 per troy amid investors’ disappointment with the recent US economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Event | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (Jul) | 0.4% | 0.3% | – |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 209K | 200K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 3.6% | 3.5% | – |

Technical Analysis

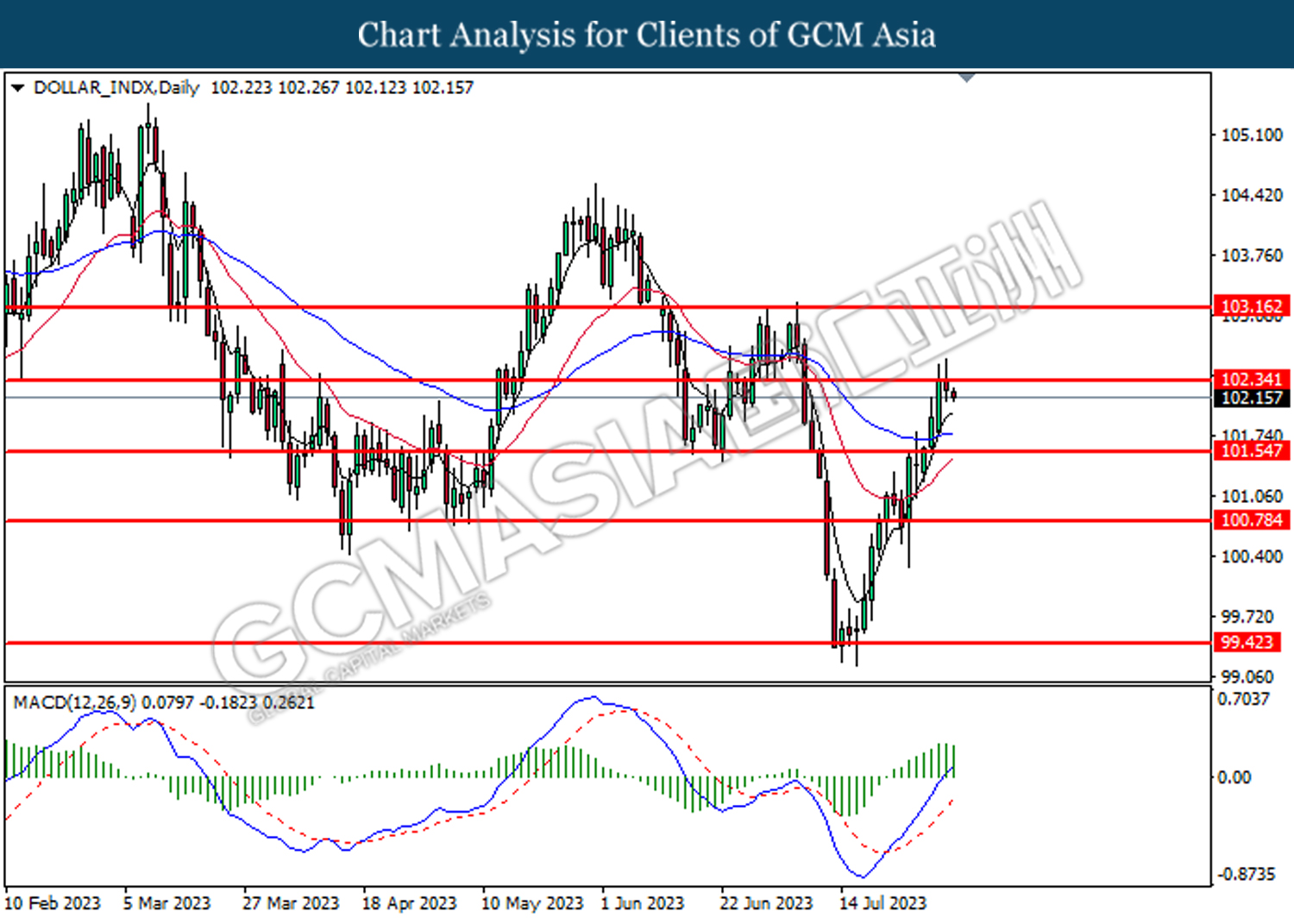

DOLLAR_INDX, Daily: Dollar index was traded lower while following the prior retracement from the resistance level at 102.35. MACD which illustrated decreasing bullish momentum suggests the index to extend its losses toward the support level at 101.55.

Resistance level: 102.35, 103.15

Support level: 101.55, 100.80

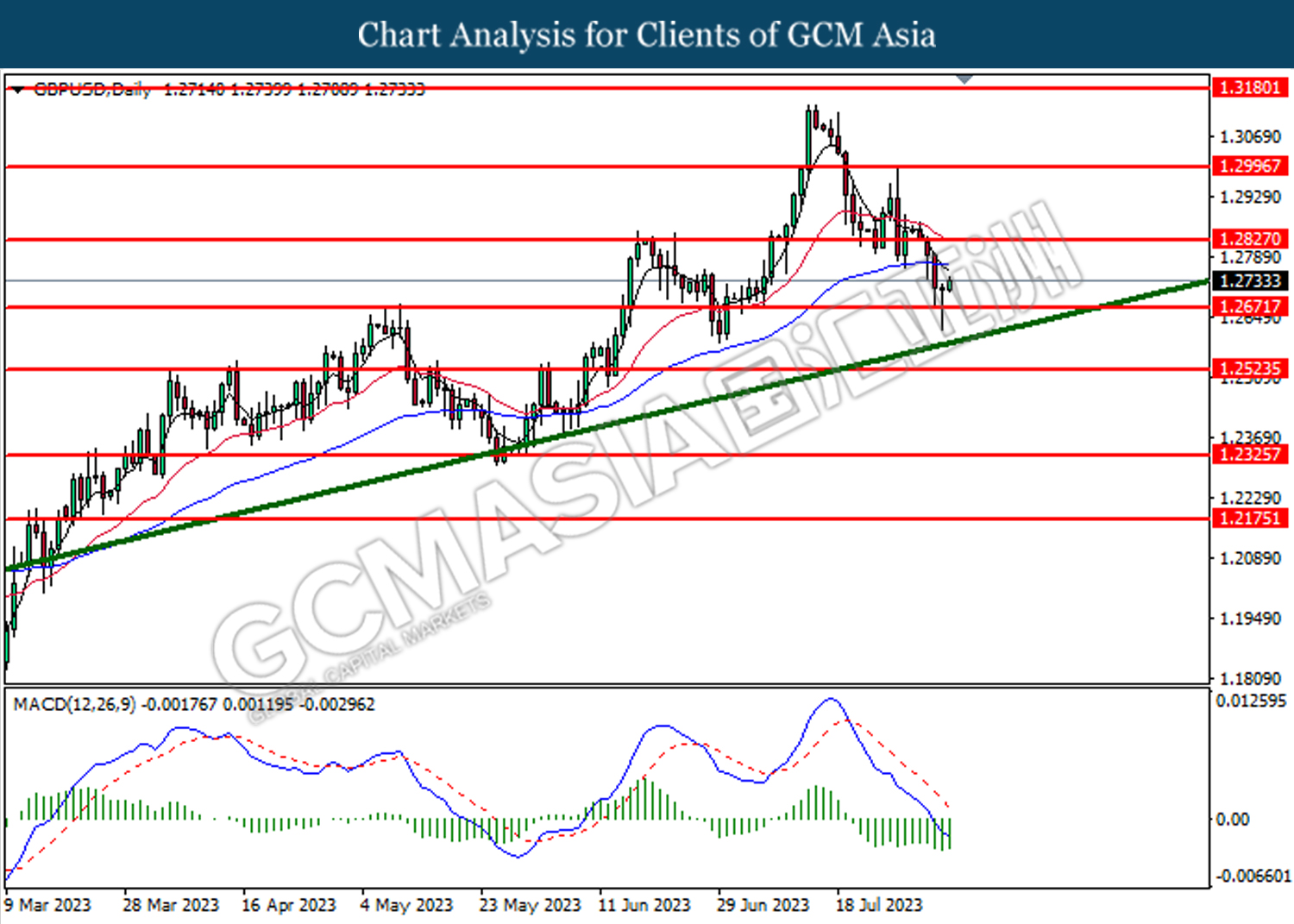

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from lower level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2830.

Resistance level: 1.2830, 1.3000

Support level: 1.2670, 1.2525

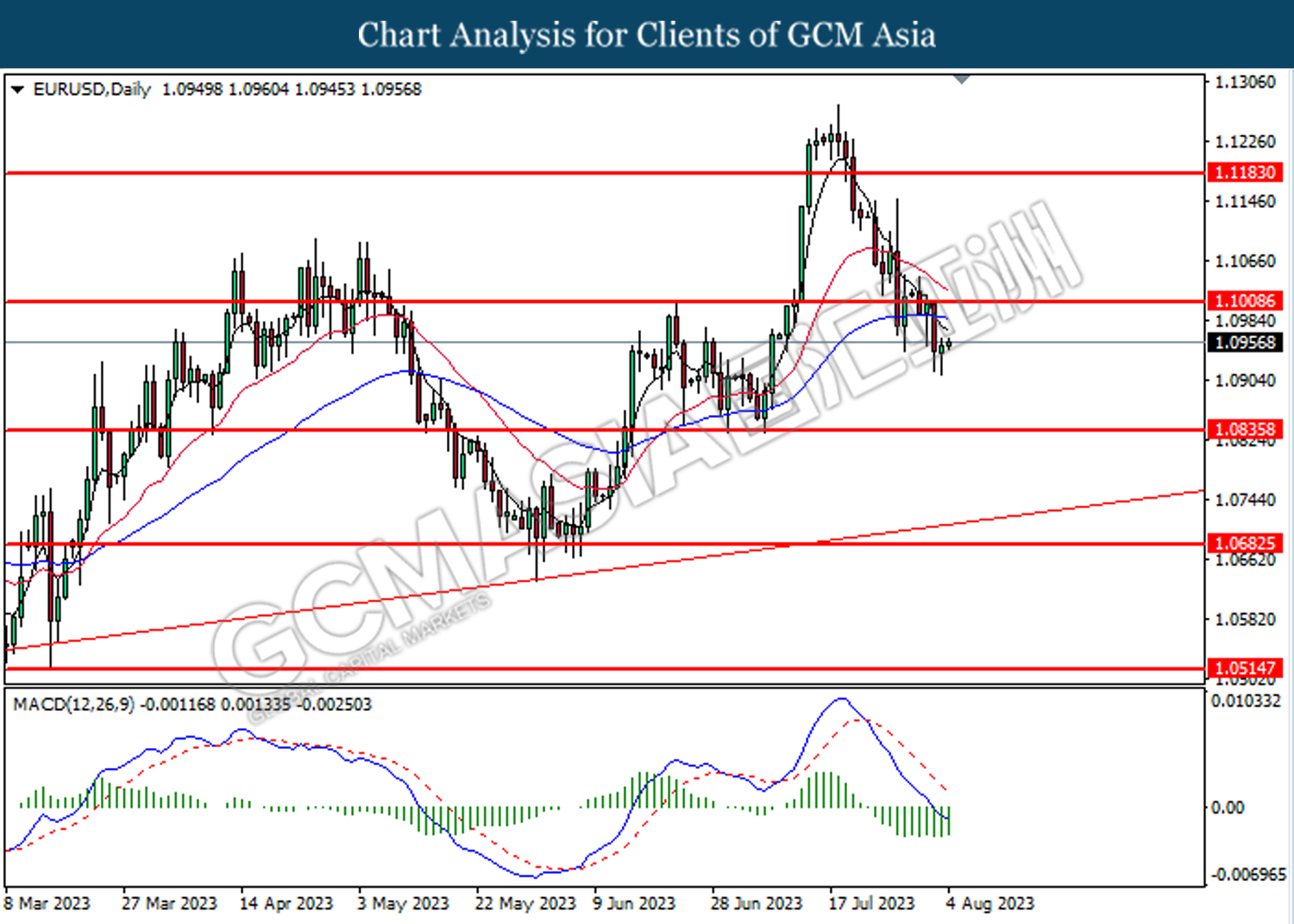

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.0835.

Resistance level: 1.1010, 1.1185

Support level: 1.0835, 1.0680

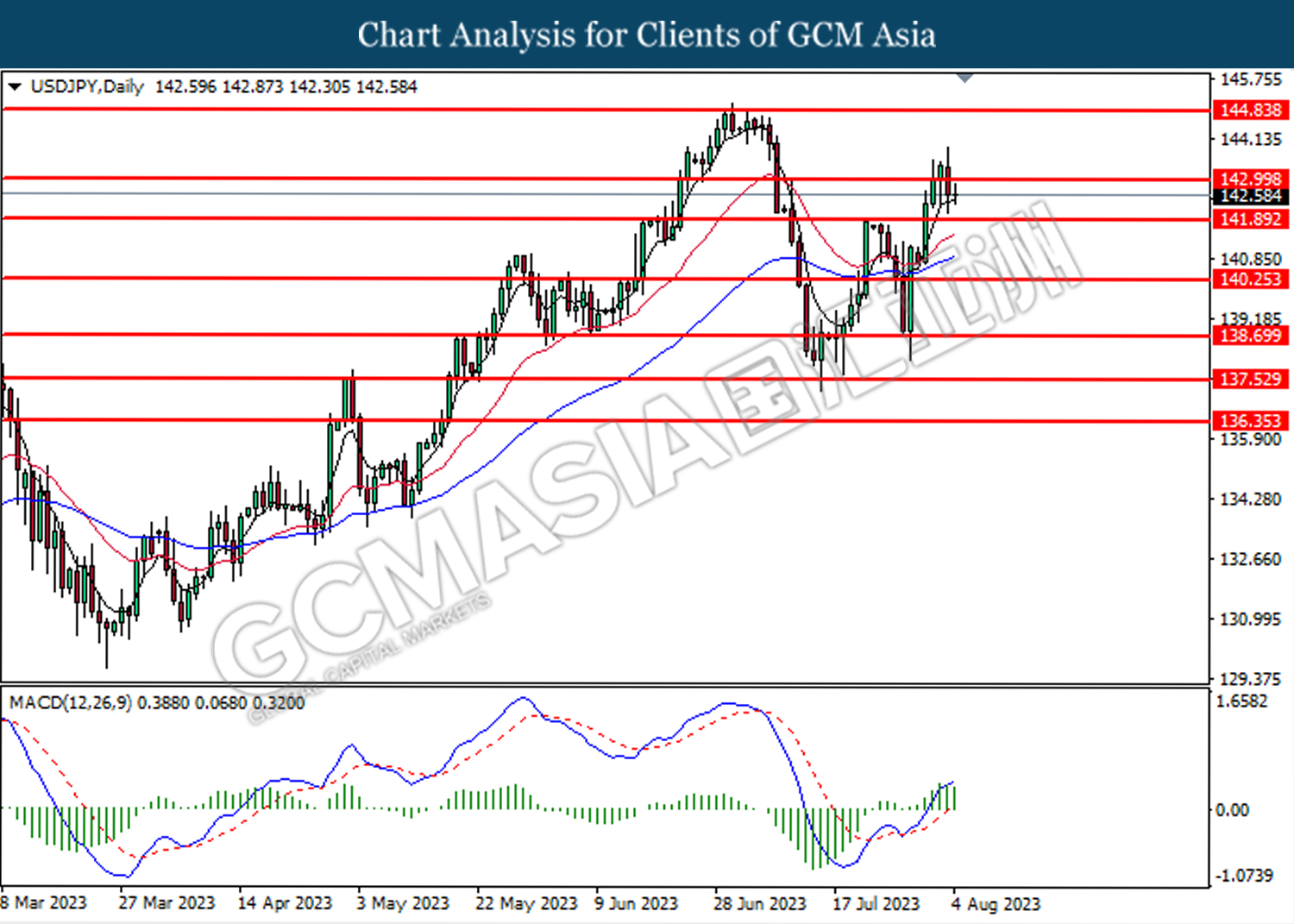

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 143.00. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses toward the support level at 141.90.

Resistance level: 143.00, 144.85

Support level: 141.90, 140.25

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6510. However, MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6595, 0.6695

Support level: 0.6510, 0.6410

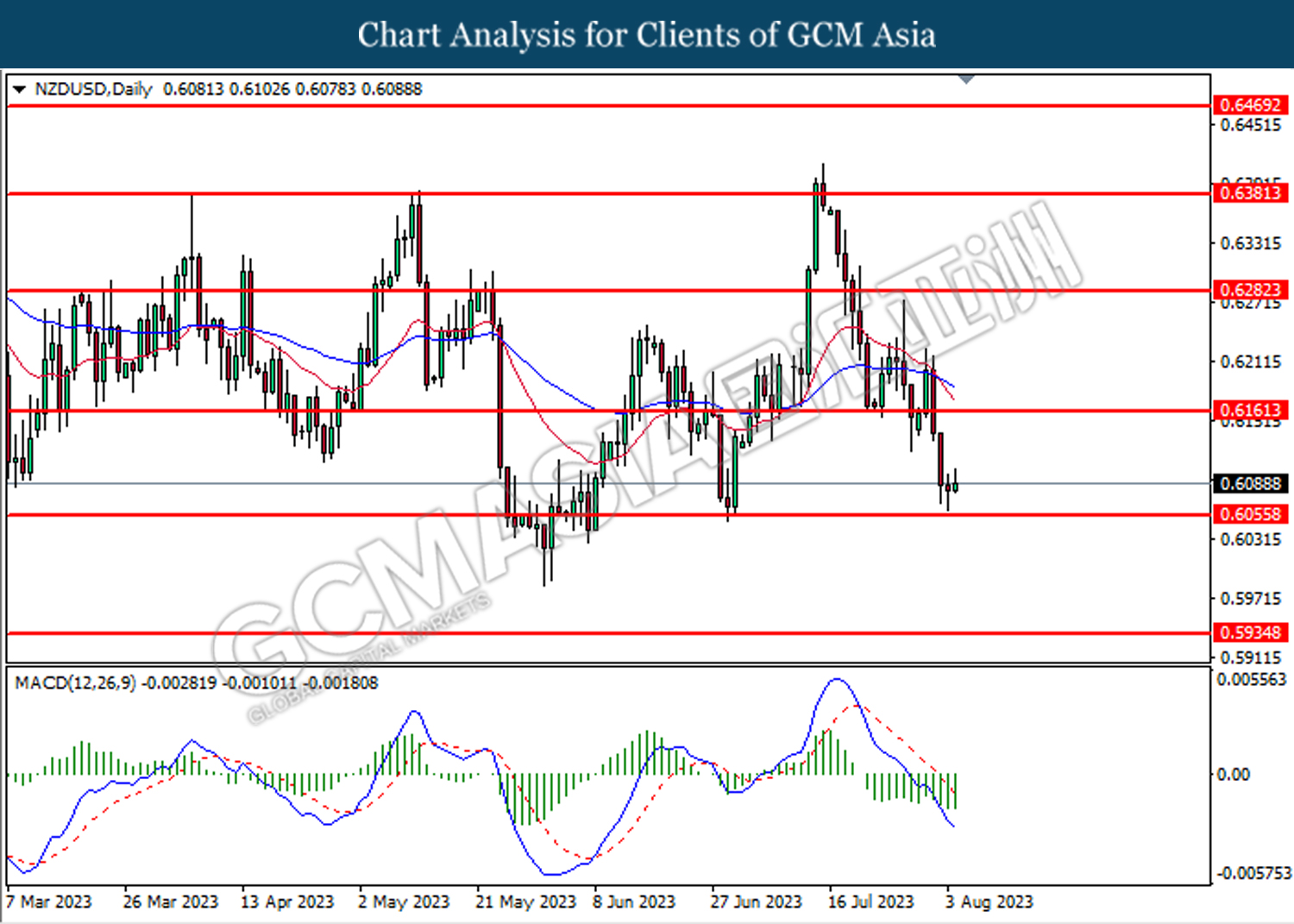

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6055. However, MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6160, 0.6280

Support level: 0.6055, 0.5935

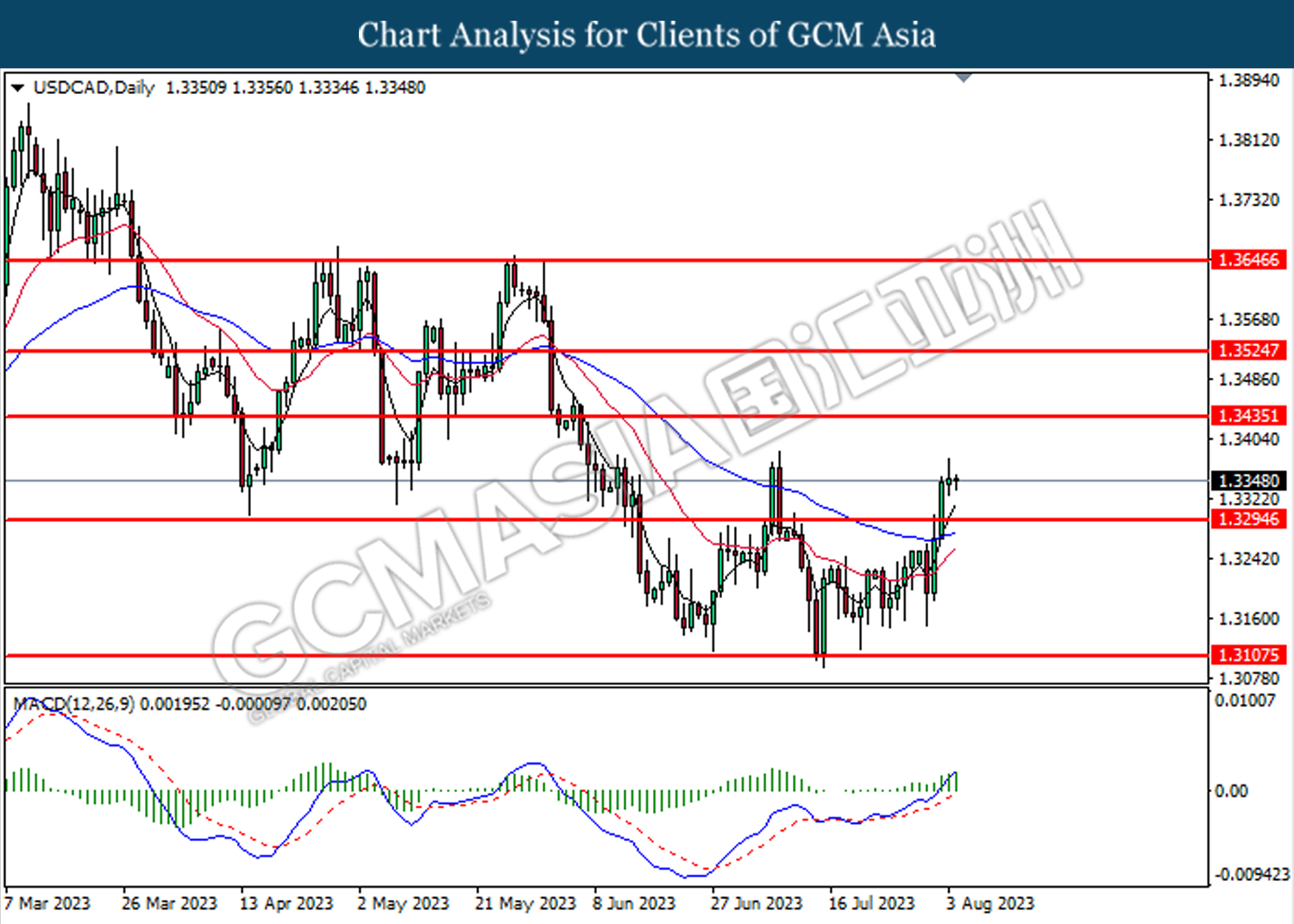

USDCAD, Daily: USDCAD was traded higher following the prior after breakout above the previous resistance level at 1.3295. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3425.

Resistance level: 1.3435, 1.3525

Support level: 1.3295, 1.3110

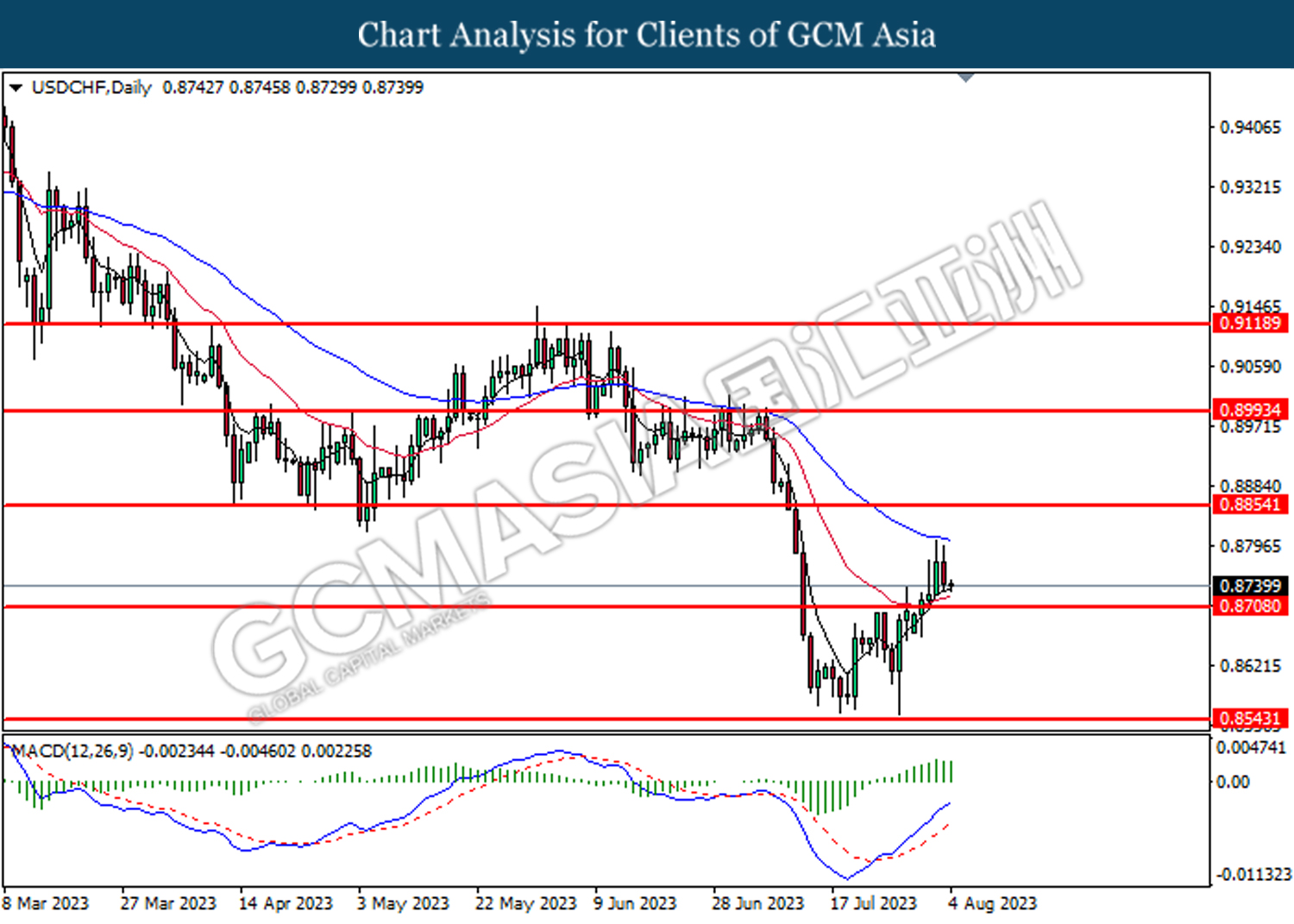

USDCHF, Daily: USDCHF was traded lower following the prior retracement from higher level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 0.8710.

Resistance level: 0.8855, 0.8995

Support level: 0.8710, 0.8545

CrudeOIL, Daily: Crude oil price was traded following the prior rebound form the support level at 79.70. However, MACD which illustrated decreasing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 82.55, 85.35

Support level: 79.70, 73.80

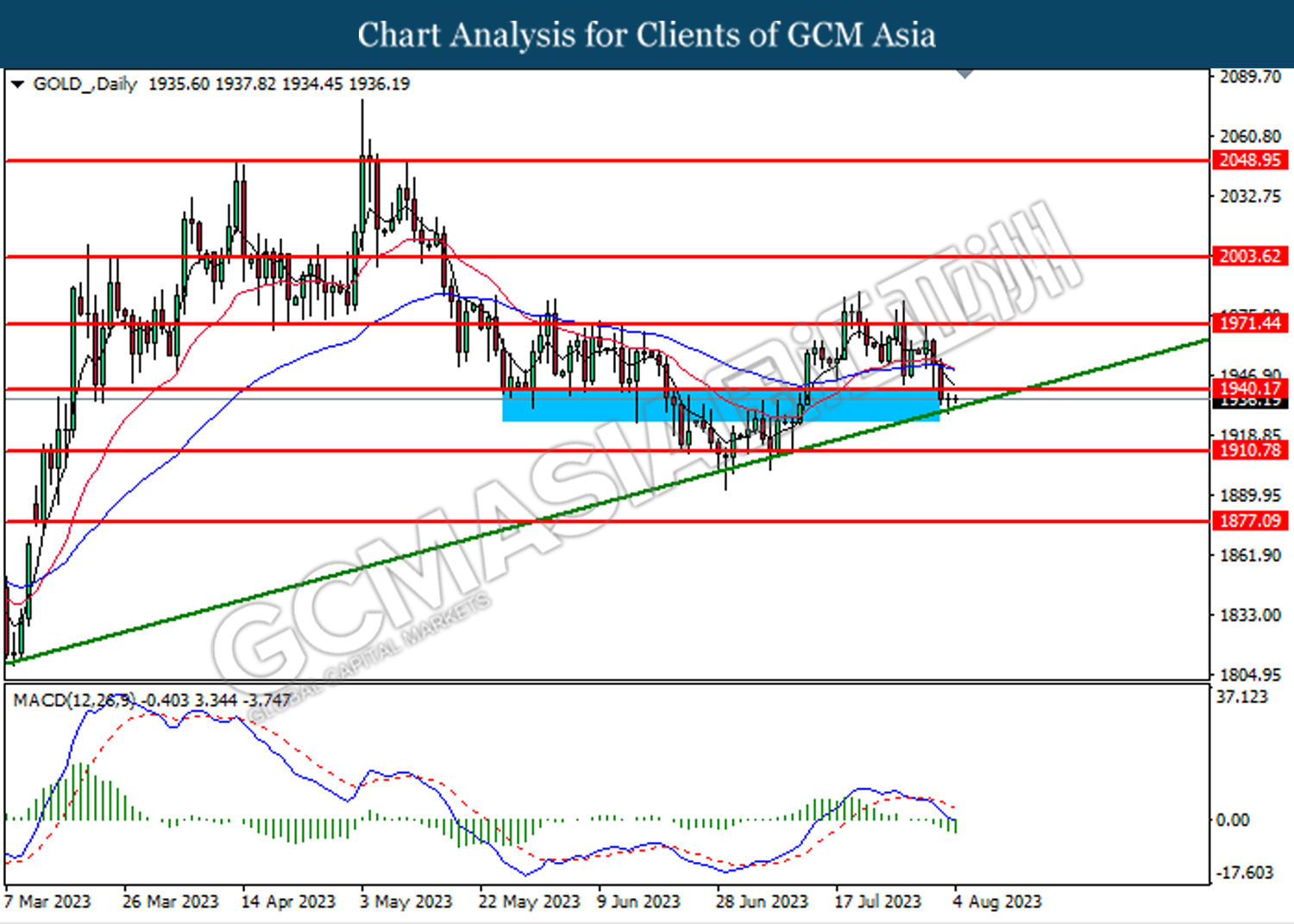

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1940.20. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level at 1910.80.

Resistance level: 1940.20, 1971.45

Support level: 1910.80, 1877.10