4 August 2023 Morning Session Analysis

The dollar’s bull hit a wall amid disappointing economic data.

The dollar index, which was traded against a basket of six major currencies, lingered near the recent high level as a series of downbeat data hold back the index from further gains. Last week, the number of Americans filing new claims for unemployment benefits increased slightly. The Department of Labor reported that the unemployment claims rose by 6,000 to 227,000, aligning with market estimates while the previous week’s level remained unchanged at 221,000. Besides, the Institute for Supply Management (ISM) reported that the non-manufacturing Purchasing Managers’ Index (PMI) fell to 52.7 last month, down from 53.9 in June. Despite a 525 basis point increase in interest rates by the Federal Reserve since March 2022, the current level of non-manufacturing PMI indicates that the economy continues to progress. Services are seeing sustained demand due to a shift in consumer spending away from goods. The US activity data has demonstrated remarkable resilience compared to other parts of the world, which is why the dollar index managed to remain steady despite the disappointing data. On Friday, the government is set to release its highly anticipated employment report for July. According to economists polled by Reuters, an increase of 200,000 jobs is expected for the month following a rise of 209,000 in June. The unemployment rate is forecasted to remain unchanged at 3.6%. As of now, the dollar index dropped -0.12% to 102.45.

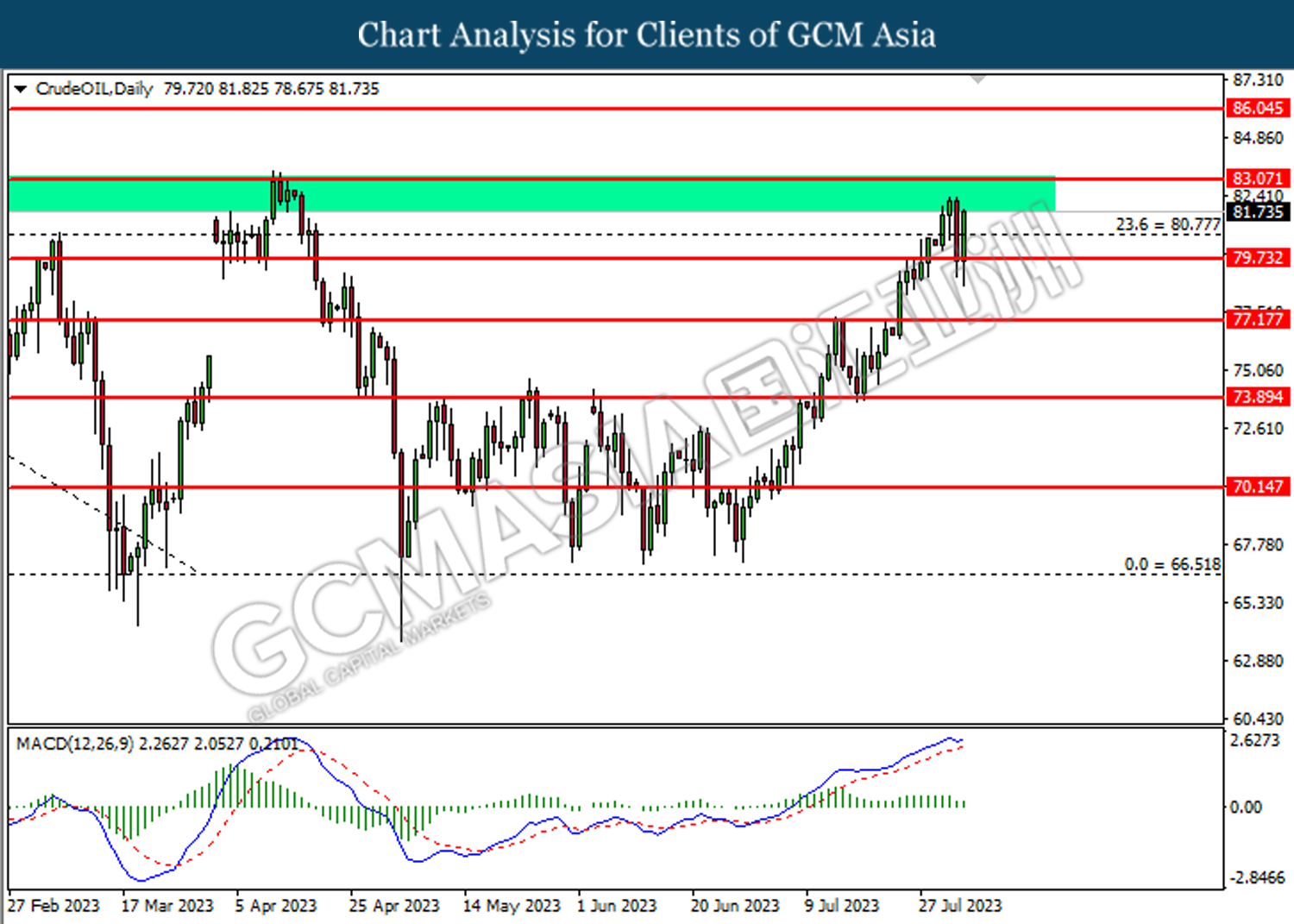

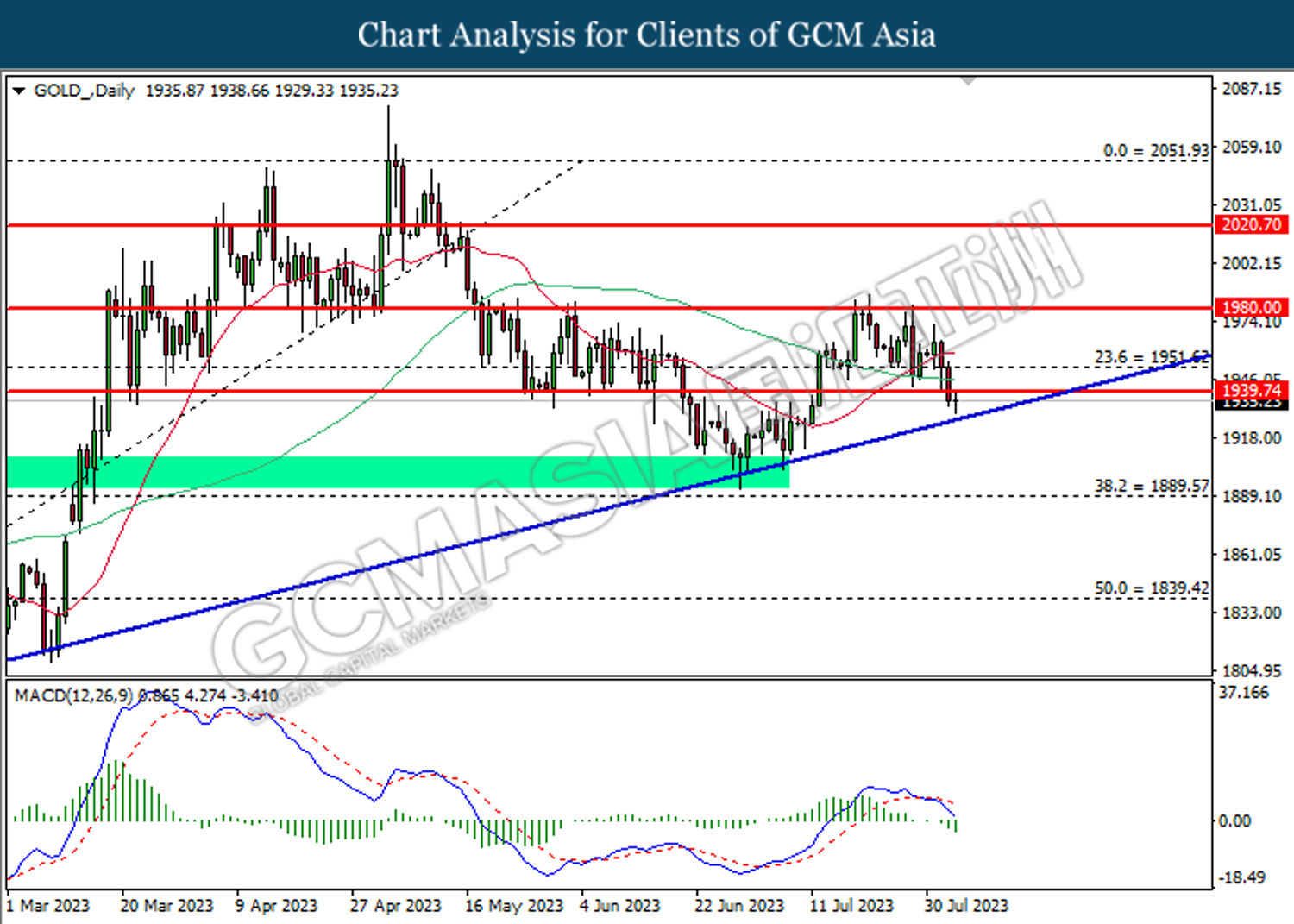

In the commodities market, crude oil prices were up by 0.07% to $81.80 per barrel as Saudi Arabia announced a further extension of 1 million barrels voluntary oil cut for another month. Besides, the gold prices rebounded 0.05% to $1935.05 per troy ounce amid the weakness of US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (Jul) | 0.4% | 0.3% | – |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 209K | 200K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 3.6% | 3.5% | – |

Technical Analysis

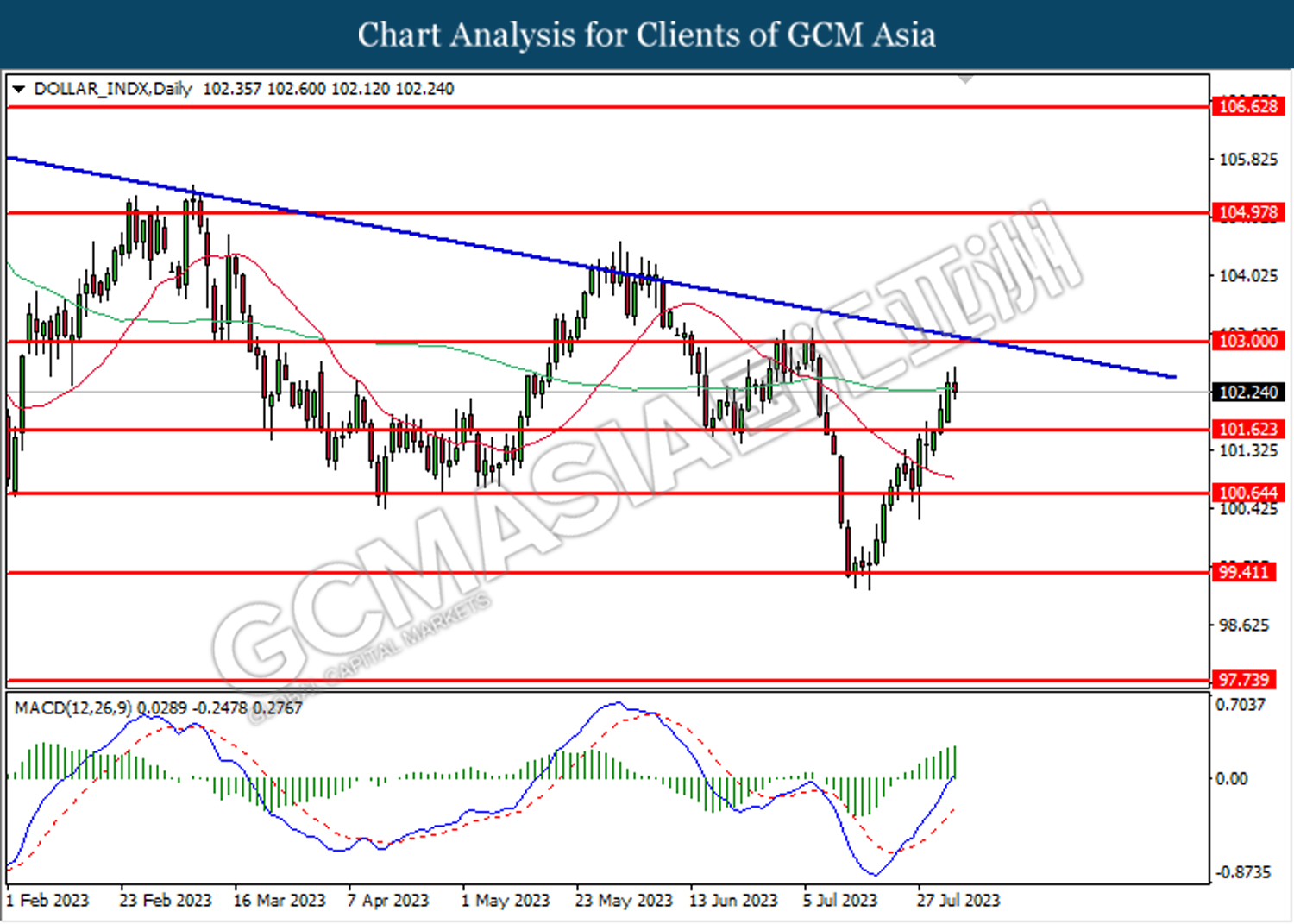

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.00.

Resistance level: 103.00, 105.00

Support level: 101.65, 100.65

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2765. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2605.

Resistance level: 1.2765, 1.2875

Support level: 1.2605, 1.2415

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0960. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0850.

Resistance level: 1.0960, 1.1065

Support level: 1.0850, 1.0775

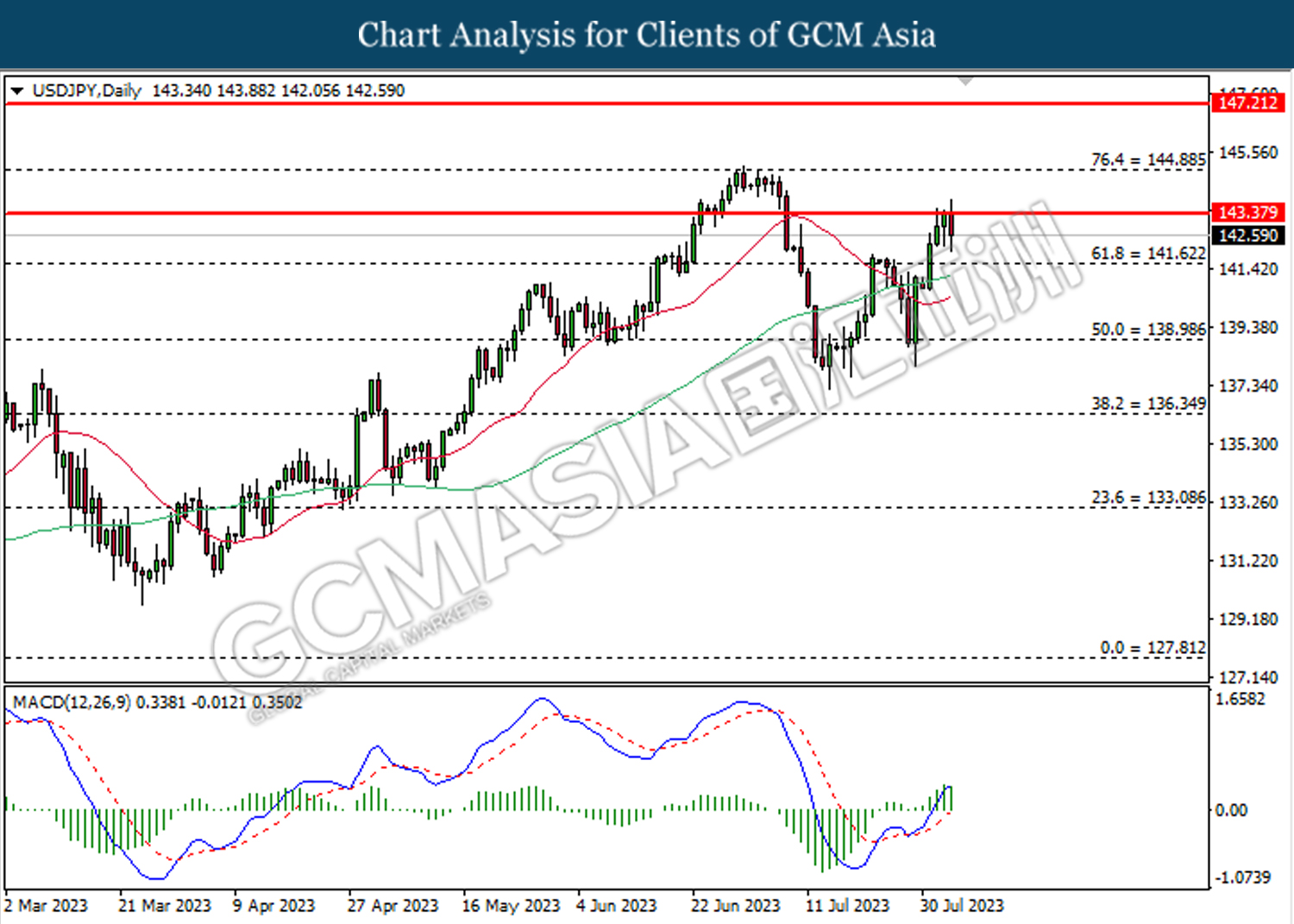

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 143.40。 MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 143.40, 144.90

Support level: 141.60, 139.00

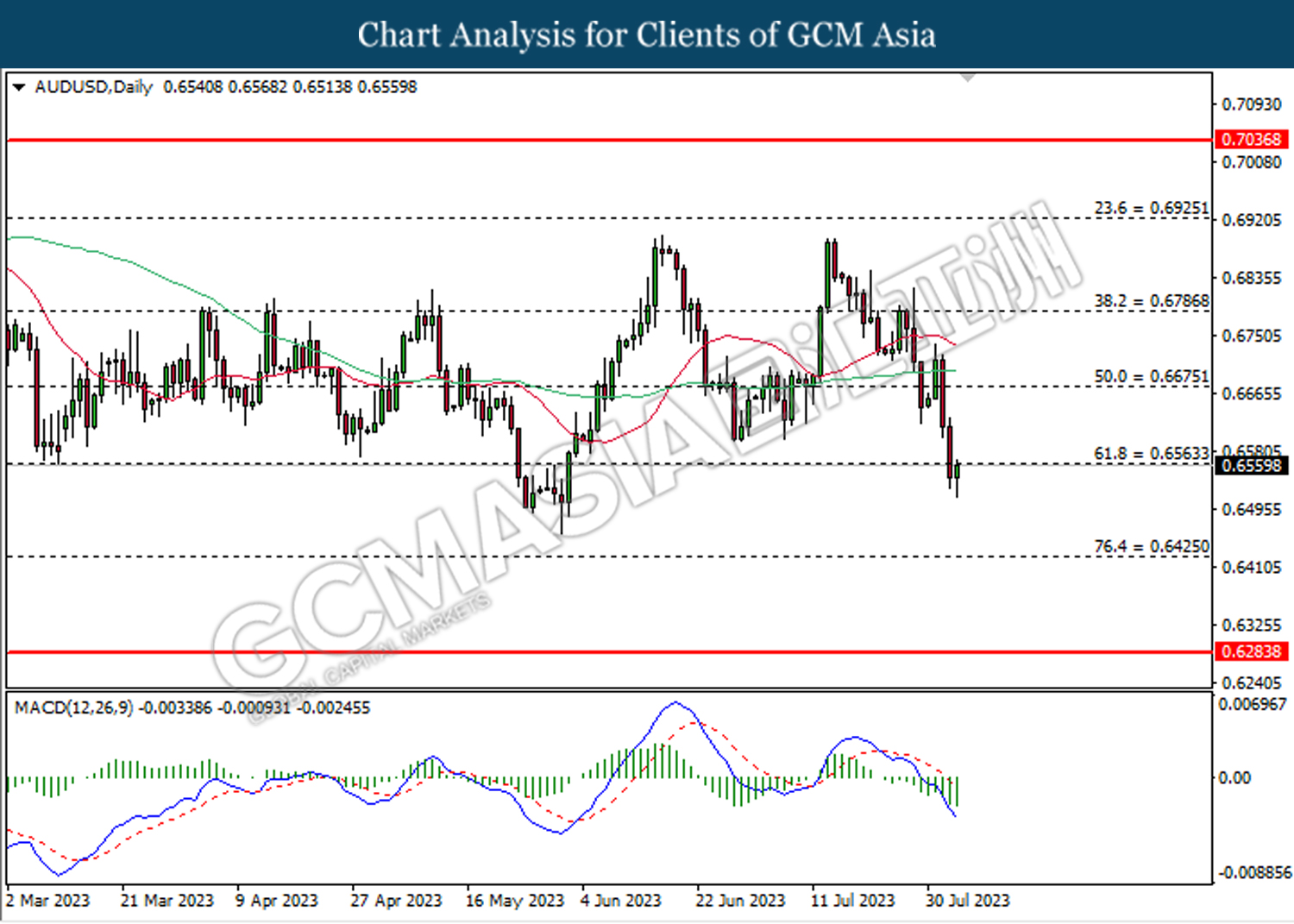

AUDUSD, Daily: AUDUSD was traded higher while currently retesting the resistance level at 0.6565. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6565, 0.6675

Support level: 0.6425, 0.6285

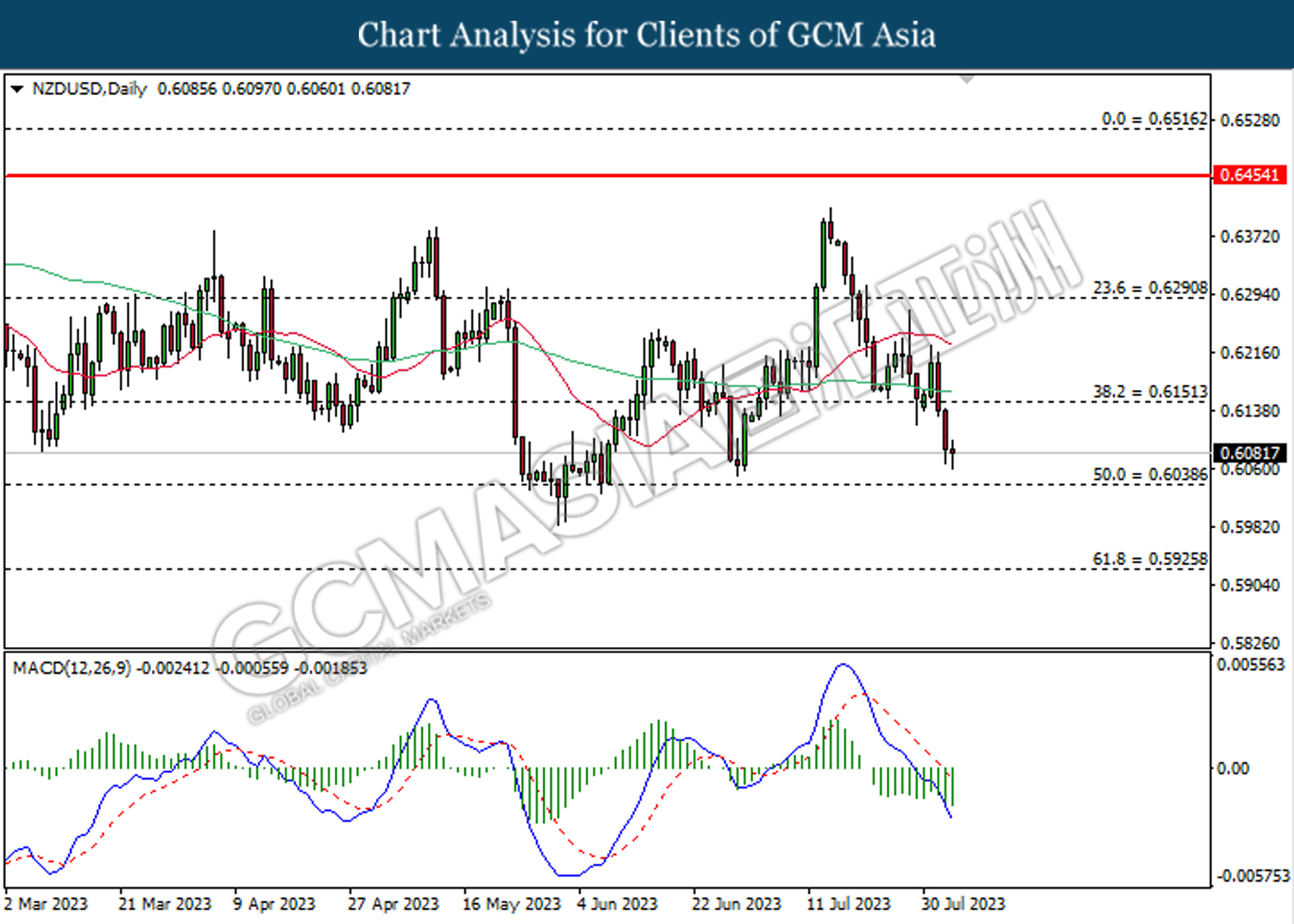

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

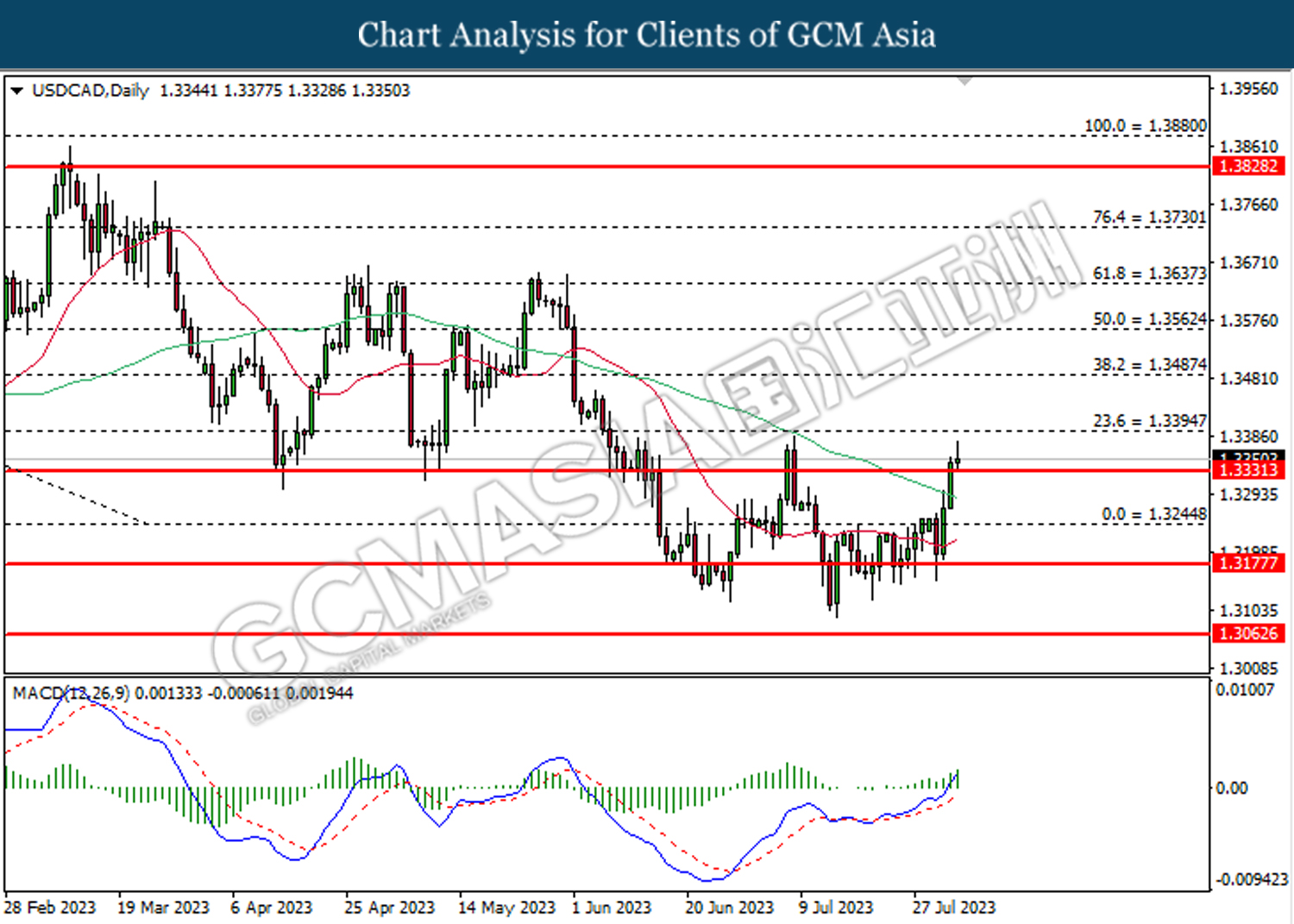

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3330. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3395.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

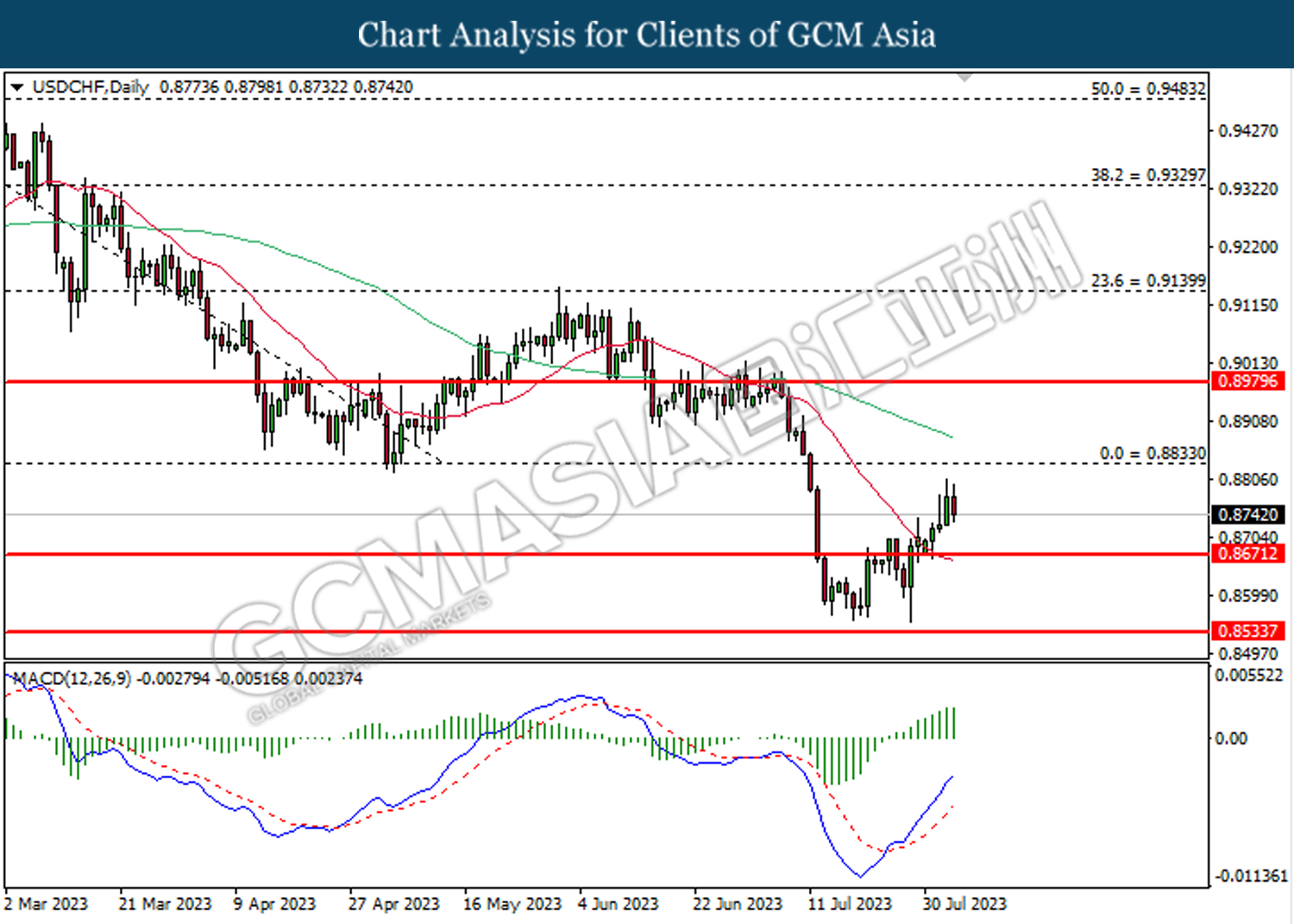

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8670. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.8835.

Resistance level: 0.8835, 0.8980

Support level: 0.8670, 0.8535

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.75. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.75, 83.05

Support level: 79.75, 77.15

GOLD_, Daily: Gold price was traded lower while currently testing near the upward trend line. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40