04 September 2020 Afternoon Session Analysis

Aussie extend losses following lower revision of Retail Sales.

During late Asian session, the Australian dollar which traded against the dollar and other currency pairs remain depressed and fell following a downward revision of Australia’s Retail Sales for July. According to Australian Bureau of Statistics, the Australian consumer spending which represented as Retail Sales have fell to 3.2%, lower than market expectation of 3.3%. At the same time, heightening tension between U.S and China also continue to weigh heavily on the pair. Following latest development, US have added another issue in its rivalry where Senior US diplomat claims China “manipulating” water flows in the Mekong River poses immediate challenge to the Southeast Asia. Meanwhile, investors will now waiting for upcoming U.S Non-farm Payroll to obtain more signal for direction. At the time of writing, AUD/USD drop 0.01% to 0.7269.

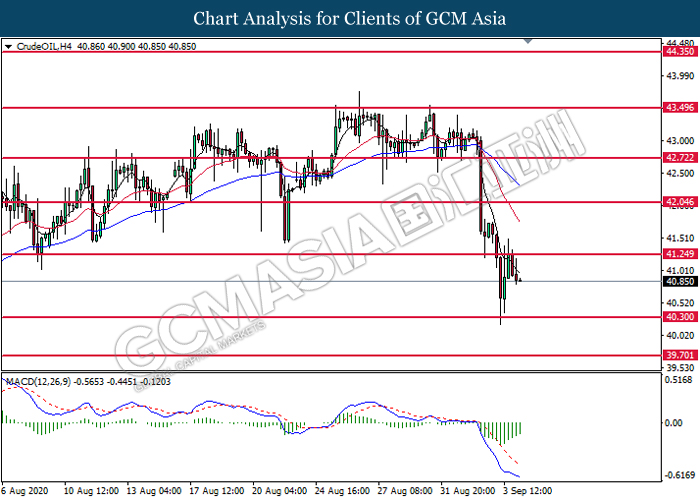

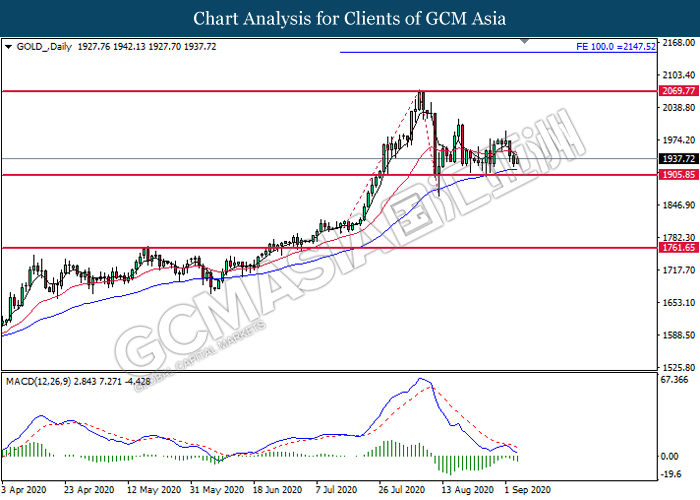

In the commodities market, crude oil price plummets 0.61% to $40.92 per barrel as of writing following speculation of weak demand. According to data on Refinitiv Eikon, the volume of crude arriving in China, the world’s largest crude importer, is set to slow in September. On the other hand, gold price edge higher 0.05% to $1936.41 a troy ounce at the time of writing following risk-off appetite due to U.S stock market tumble.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Aug) | 58.1 | 58.3 | – |

| 20:30 | USD – Nonfarm Payrolls (Aug) | 1,763K | 1,400K | – |

| 20:30 | USD – Unemployment Rate (Aug) | 10.2% | 9.8% | – |

| 20:30 | CAD – Employment Change (Aug) | 418.5K | 300.0K | – |

| 22:00 | CAD – Ivey PMI (Aug) | 68.5 | 57.5 | – |

Technical Analysis

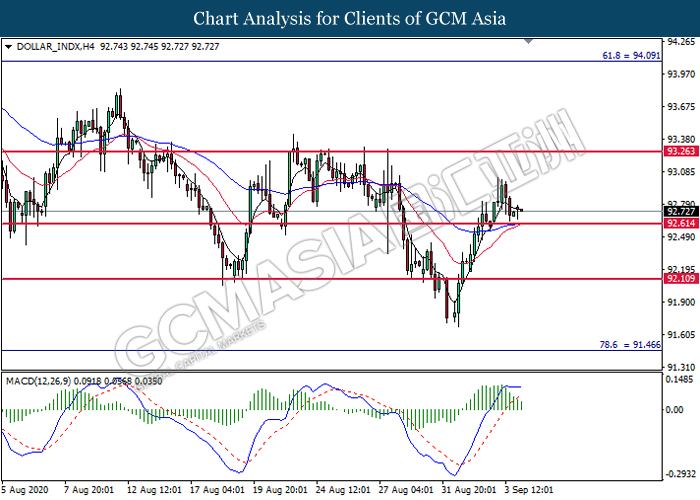

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward the support level at 92.60.

Resistance level: 93.25, 94.10

Support level: 92.60, 92.10

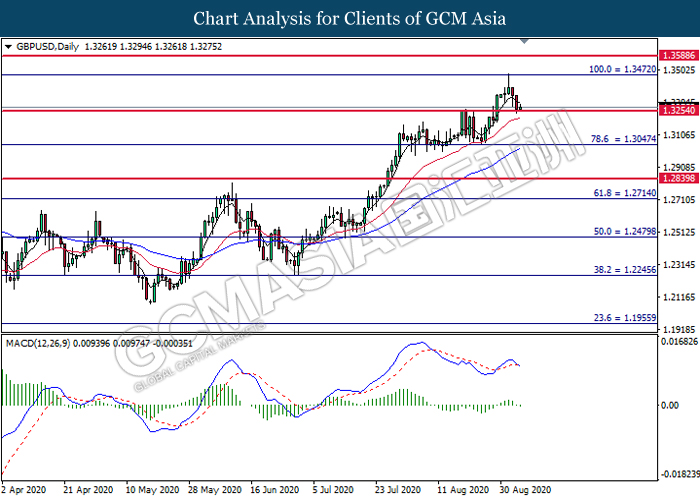

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.3255. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.3255.

Resistance level: 1.3470, 1.3590

Support level: 1.3255, 1.3045

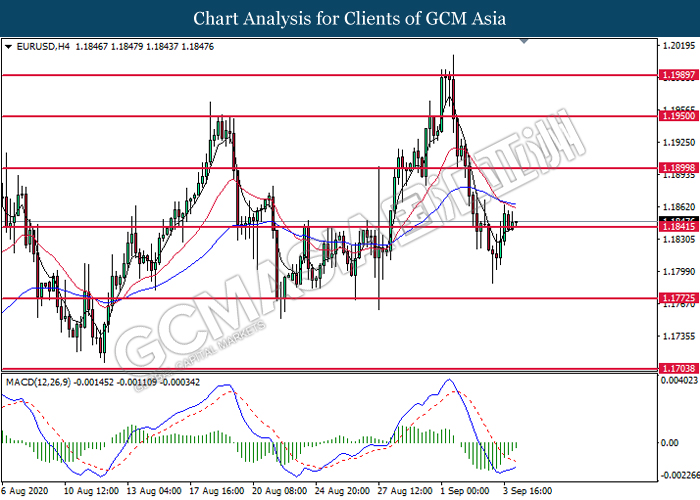

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1840. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1900.

Resistance level: 1.1900, 1.1920

Support level: 1.1840, 1.1775

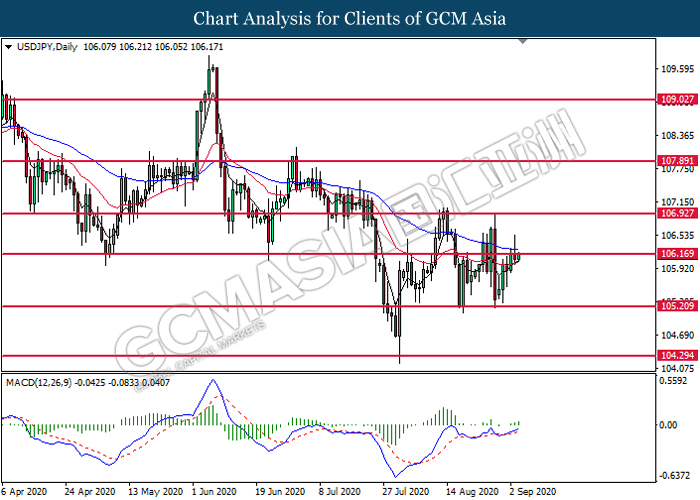

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 106.15. MACD which illustrates bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 106.15, 106.95

Support level: 105.20, 104.30

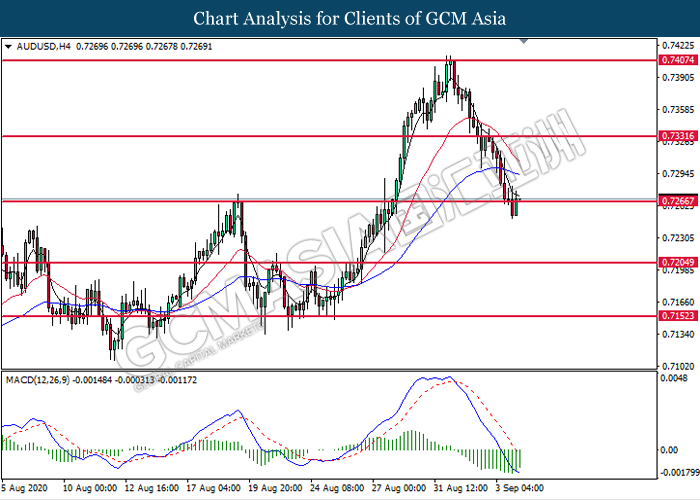

AUDUSD, H4: AUDUSD was traded higher while currently testing resistance level at 0.7265. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.7265.

Resistance level: 0.7265, 0.7330

Support level: 0.7205, 0.7150

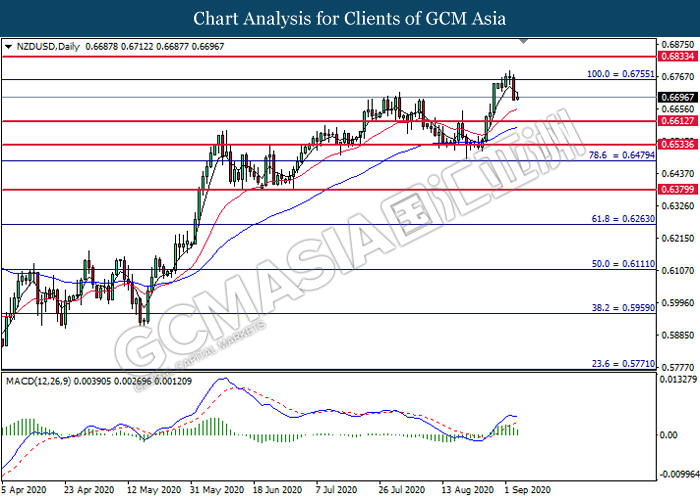

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6755. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6615.

Resistance level: 0.6755, 0.6835

Support level: 0.6615, 0.6535

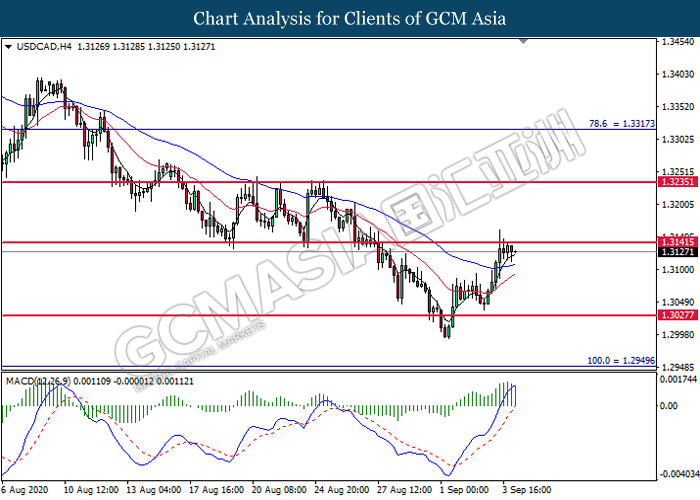

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3140. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical retracement toward the support level at 1.3030.

Resistance level: 1.3140, 1.3235

Support level: 1.3030, 1.2950

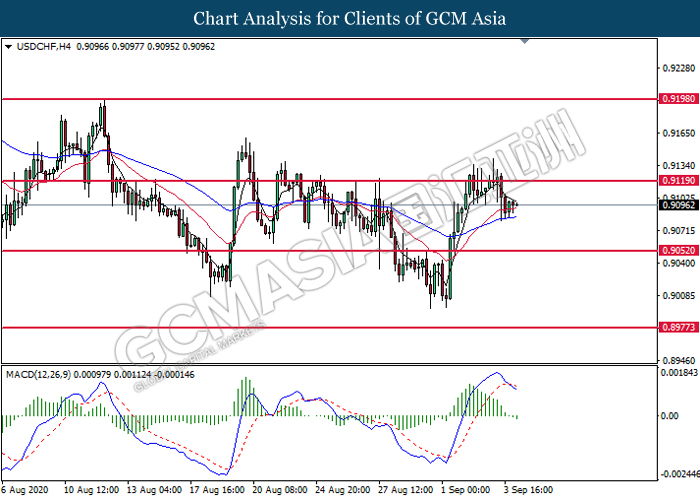

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9120. MACD which illustrates bearish momentum suggest the pair to extend its losses toward the support level at 0.9050.

Resistance level: 0.9120, 0.9200

Support level: 0.9050, 0.8975

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 41.25. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 41.25, 42.05

Support level: 40.30, 39.70

GOLD_, Daily: Gold price was traded lower following prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1905.85.

Resistance level: 2067.75, 2147.50

Support level: 1905.85, 1761.65