4 September 2020 Morning Session Analysis

Japanese Yen surged as risk-off sentiment.

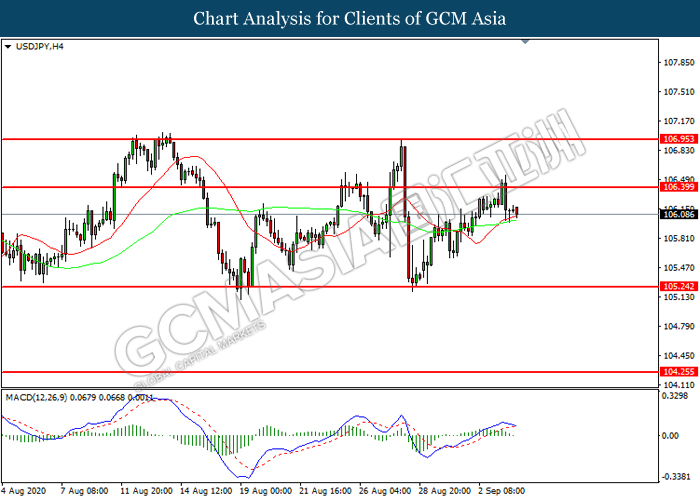

The safe-haven currency such as Japanese Yen surged amid a significant selloff in the U.S. stock market on yesterday, which spurring the risk-off sentiment while prompting investors to shift their portfolio toward safe-haven currency. Big falls in Apple Inc, Alphabet, Amazon.com, Microsoft had pushed the Wall Street’s main indexes to be lower on Thursday, on track for their biggest one-day slumped since June. Analysts expected that the move was broadly driven by weak economic data which highlighting worries about a long and difficult recovery from the U.S. region. On the U.S. economic data front, the U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI) notched down from the preliminary reading of 58.1 to 56.9, worse than the market forecast at 57.0. However, the U.S. Initial Jobless Claims came in at 881K, fared better than the market expectation at 950K while limiting the risk-off sentiment in the FX market. Nonetheless, investors would continue to scrutinize the latest updates with regards of the crucial U.S. jobs data tonight in order to gauge the likelihood movement for the currency. As of writing, USD/JPY depreciated by 0.08% to 106.05.

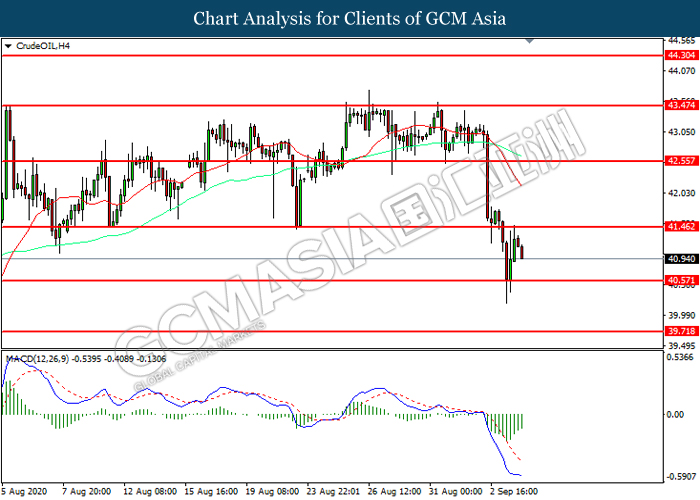

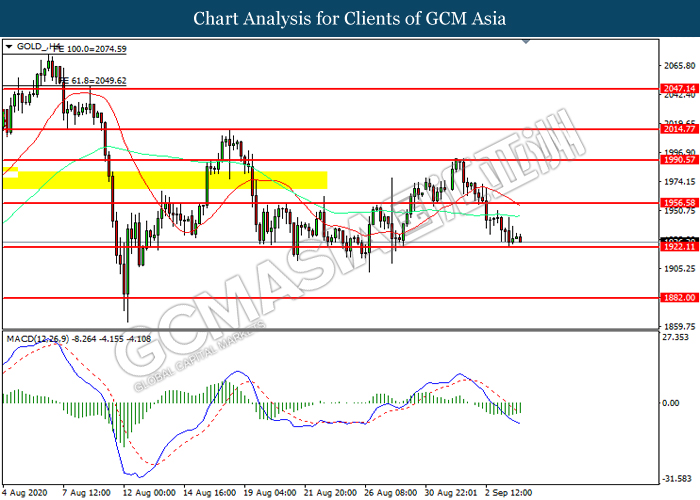

In the commodities market, the crude oil price slumped 0.38% to $41.05 per barrel as of writing. The oil market extends its losses amid the spiking number of the coronavirus continue to weigh the market demand on this black-commodity. On the other hand, the gold price slumped 0.05% to $1930.85 per troy ounces as of writing amid investors start to selloff the gold commodity while turning it into cash in order to prevent margin call from the bank.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:30 | AUD – Retail Sales (MoM) (Jul) | 2.7% | 3.3% | – |

| 16:30 | GBP – Construction PMI (Aug) | 58.1 | 58.3 | – |

| 20:30 | USD – Nonfarm Payrolls (Aug) | 1,763K | 1,400K | – |

| 20:30 | USD – Unemployment Rate (Aug) | 10.2% | 9.8% | – |

| 20:30 | CAD – Employment Change (Aug) | 418.5K | 300.0K | – |

| 22:00 | CAD – Ivey PMI (Aug) | 68.5 | 57.5 | – |

Technical Analysis

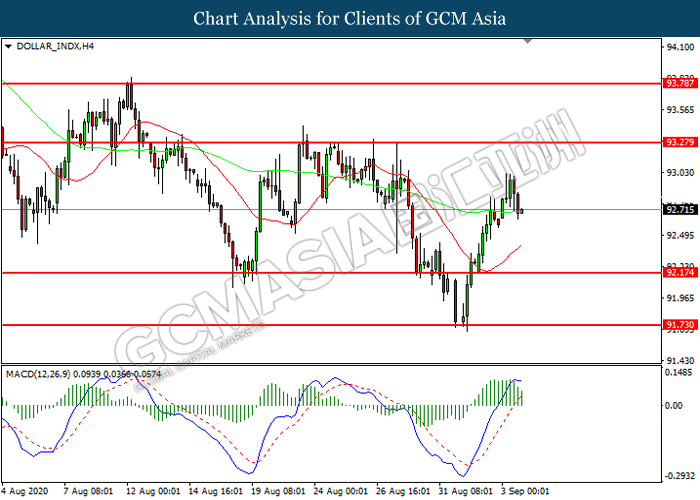

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 93.25. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 93.25, 93.80

Support level: 91.75, 92.15

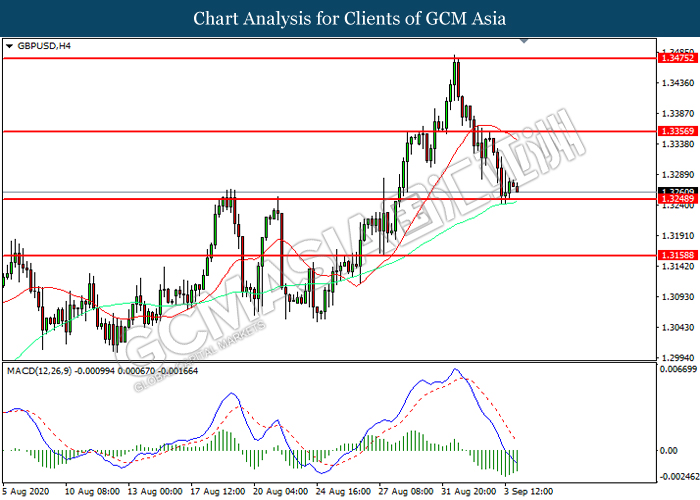

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3250. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3355, 1.3475

Support level: 1.3250, 1.3160

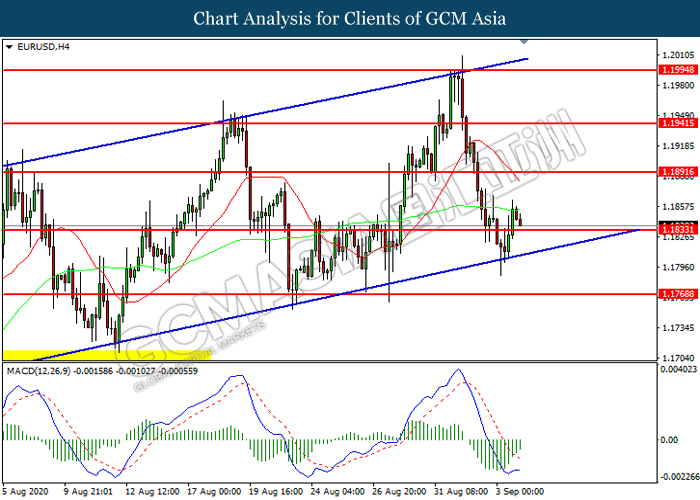

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1835. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1890, 1.1940

Support level: 1.1835, 1.1770

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 106.40. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 105.25.

Resistance level: 106.40, 106.95

Support level: 105.25, 104.25

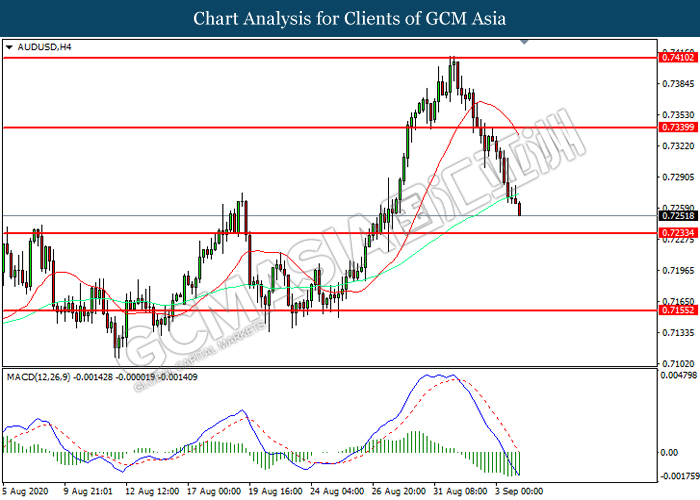

AUDUSD, H4: AUDUSD was traded lower while currently near the support level at 0.7235. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7340, 0.7410

Support level: 0.7235, 0.7155

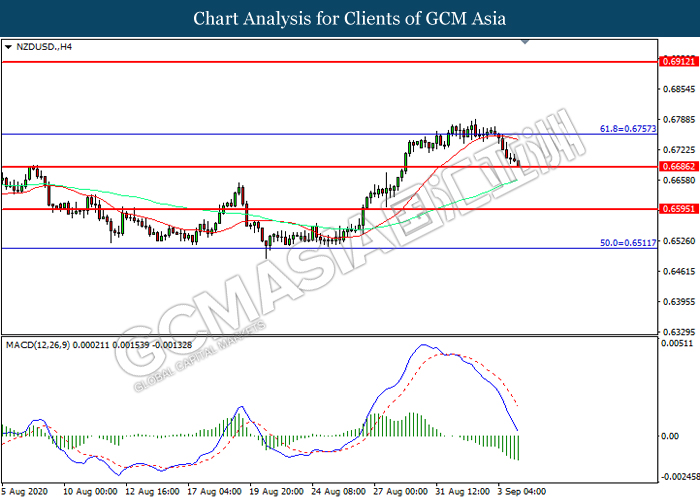

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6685. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6755, 0.6910

Support level: 0.6685, 0.6595

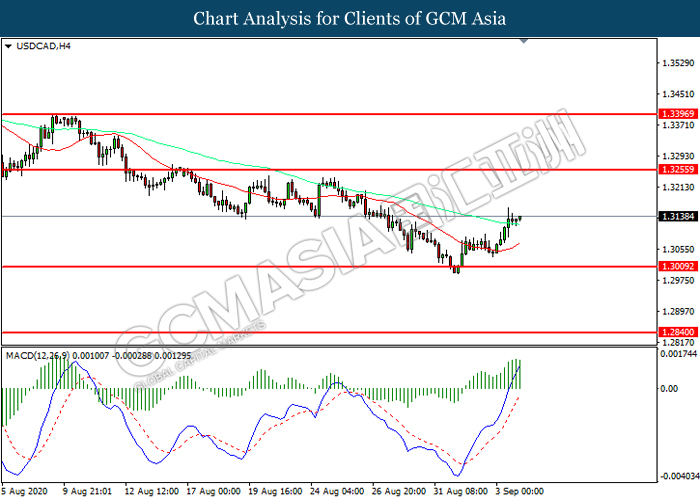

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.3010. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3255, 1.3395

Support level: 1.3010, 1.2840

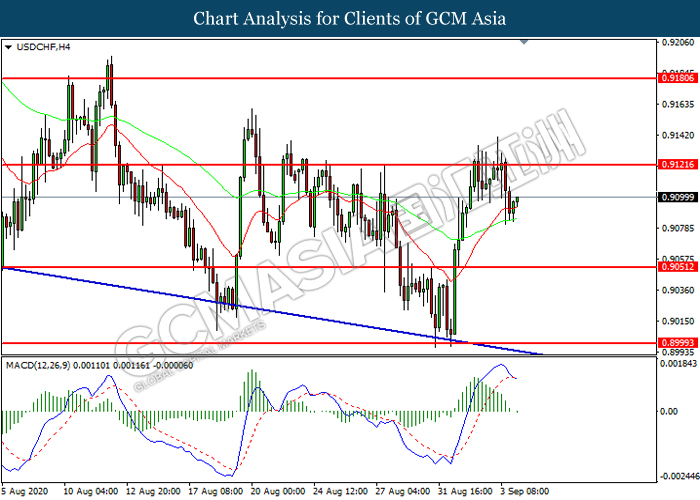

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9120. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.9050.

Resistance level: 0.9120, 0.9180

Support level: 0.9050, 0.9000

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 41.45. However, MACD which illustrated diminishing bearish momentums suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 42.15, 42.60

Support level: 41.45, 40.90

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1922.10. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher in short-term as technical correction.

Resistance level: 1956.60, 1990.55

Support level: 1922.10, 1882.00