5 April 2017 Daily Analysis

Yen appreciates amid North Korea missile launch.

US dollars was a tad lower during Asian trading hours as a round of risk aversion rippled through the market while Japanese Yen remained as the star player as it gained further when compared to other major peers. The recent launch of ballistic missile by North Korea fueled higher demand for safe haven Yen, ahead of a summit between US and Chinese leaders tomorrow. Ongoing concerns over the upcoming summit has capped the dollar’s upside due to ongoing speculation that US President Donald Trump may face challenges in implementing his policies in wake of his administration’s failure to pass healthcare reform bill. The dollar index was down 0.04% and last quoted at 100.31. Meanwhile, pound sterling seesawed while last seen around $1.2441 against the greenback, pressured by a slowdown in UK construction growth which has catalyzed more pessimism on top of ongoing Brexit conundrum.

Taking a look in the commodities market, crude oil price rose in Asia while extending overnight gains after industrial estimates reported a larger-than-expected draw in US crude inventories. On the other hand, gold price dipped slightly as investors seize the opportunity to cash in their profit after its price touches one-week high yesterday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Meeting Minutes

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Services PMI (Mar) | 53.3 | 53.5 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 298K | 187K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Mar) | 57.6 | 57.0 | – |

| 22:30 | Crude Oil – Crude Oil Inventories | 0.867M | -0.435M | – |

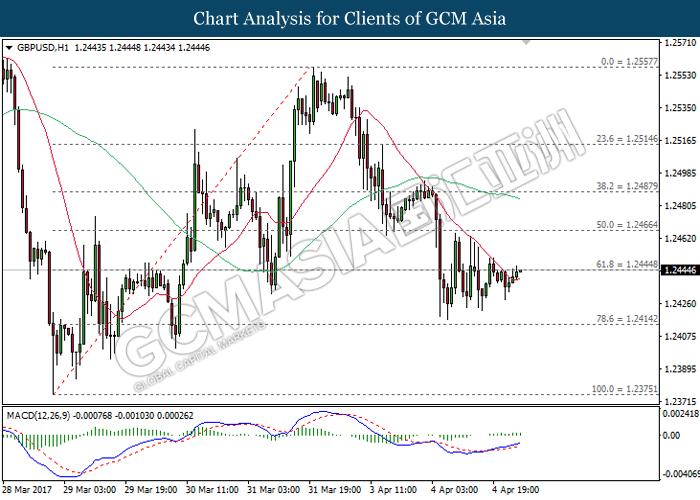

GBPUSD

GBPUSD, H1: GBPUSD was traded higher following previous rebound and closure above the 20-moving average line (red). With regards to the MACD histogram which illustrates upward signal and momentum, a closure above the resistance level of 1.2445 would suggest GBPUSD to advance further upwards.

Resistance level: 1.2445, 1.2465

Support level: 1.2415, 1.2375

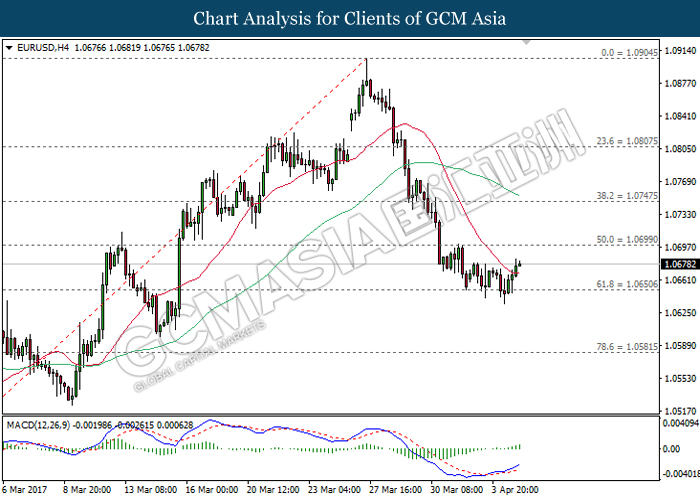

EURUSD

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level of 1.0650 while closing above the 20-moving average line (red). Referring to the MACD histogram which illustrates an upward signal and momentum, EURUSD is expected to advance further up towards the target of resistance level at 1.0700.

Resistance level: 1.0700, 1.0750

Support level: 1.0650, 1.0580

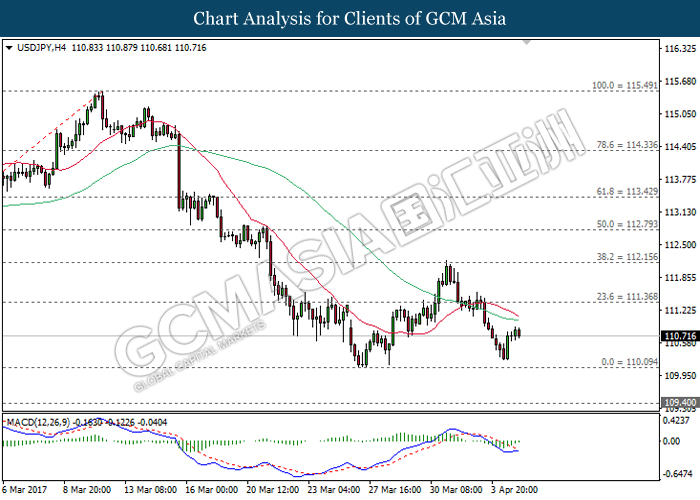

USDJPY

USDJPY, H4: USDJPY was traded higher following prior rebound before the support level of 110.10. With regards to the downward signal from MACD histogram which continues to narrow upwards, USDJPY may experience brief technical correction and suggested to be traded higher in short-term. Otherwise, long-term trend direction suggests USDJPY to move further downwards as both MA lines continue to narrow down.

Resistance level: 111.35, 112.15

Support level: 110.10, 109.40

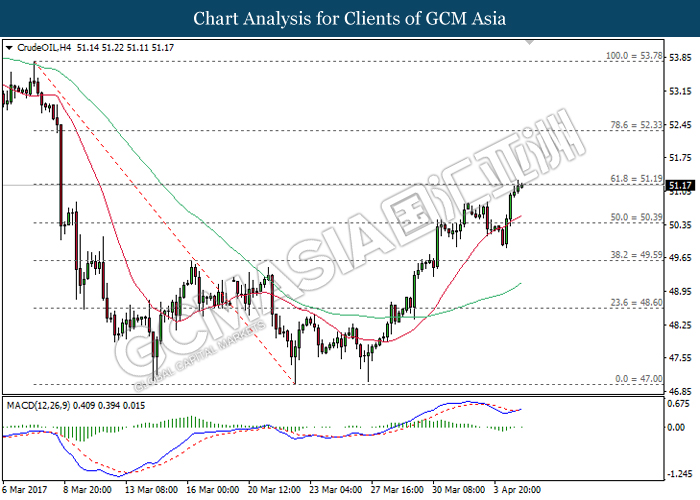

CrudeOIL

CrudeOIL, H4: Crude oil price was traded higher following prior rebound while closing above the 20-moving average line (red). Referring to the MACD histogram which begins to illustrate upward signal, a closure above the resistance level of 51.20 would suggest crude oil price to extend its upward momentum.

Resistance level: 51.20, 52.35

Support level: 50.40, 49.60

GOLD

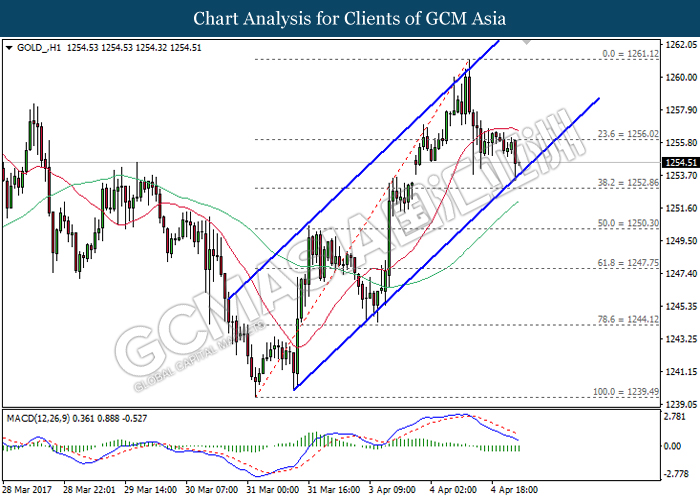

GOLD_, H1: Gold price remains traded within an upward channel while currently testing near the bottom level of the channel. A breakout from this level would signal gold price to experience a change in trend direction to move further downwards. Otherwise, a rebound would suggest gold price to be traded higher in short-term within the upward channel.

Resistance level: 1256.00, 1261.10

Support level: 1252.85, 1250.30