5 May 2017 Daily Analysis

Greenback quivers as NFP approaches.

Euro held onto its overnight gains during early Friday trading while investors anticipates for tonight’s US Nonfarm Payrolls report which will dictates overall market tone. Pairing of EUR/USD eased 0.09% to $1.0974. The single common currency received higher buying volume after viewer’s poll declared that Emmanuel Macron won a TV presidential debate against Marine Le Pen on yesterday. Such optimism has further increased the likelihood of Macron in reigning his victory at the runoff vote which will be held on Sunday. Otherwise, greenback regained some grounds after sliding off against other major peers during North American trading hours. The US dollar was derailed from its prior rally following a mélange of US economic data performance whereby initial jobless claims fell more than expected while factory orders were rather subdued during March. The dollar index was last quoted at 98.64 as of writing.

As for commodities, crude oil price rose 0.15% to $45.59 while having limited upside as market participants remains concerned over the ongoing oversupply glut and a rebound in US shale production. Likewise, gold price inched up 0.1% to $1,228.31 while on track for its biggest weekly losses due to receding political risk in France and higher expectation for a US rate hike as early as June.

Today’s Holiday Market Close

Time Market Event

All Day JPY Japan – Children’s Day

Today’s Highlight Event

Time Market Event

09:30 AUD RBA Monetary Policy Statement

01:30 USD Fed Chair Yellen Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 98K | 185K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 4.5% | 4.6% | – |

| 20:30 | CAD – Employment Change | 19.4K | 10.0K | – |

| 22:00 | CAD – Ivey PMI | 61.1 | 62.3 | – |

| 01:00 | Crude Oil – US Baker Hughes Oil Rig Count | 697 | – | – |

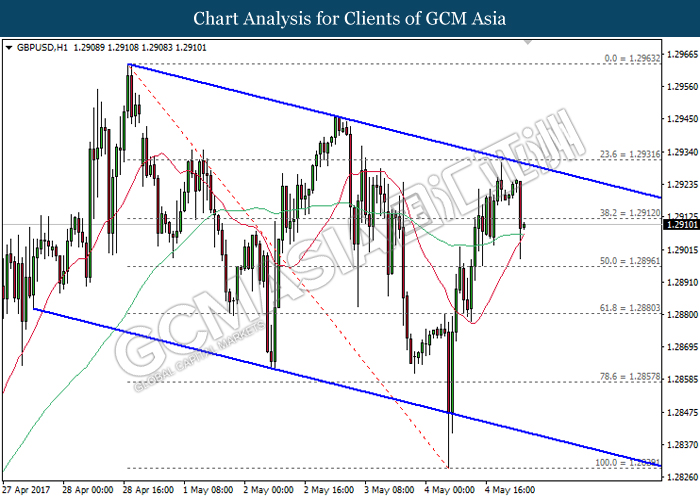

GBPUSD

GBPUSD, H1: GBPUSD remains traded within a downward channel after retracing from the top level of the channel. A closure below the 20-moving average line (red) would suggest GBPUSD to advance further down, towards the target of support level at 1.2895.

Resistance level: 1.2910, 1.2930

Support level: 1.2895, 1.2880

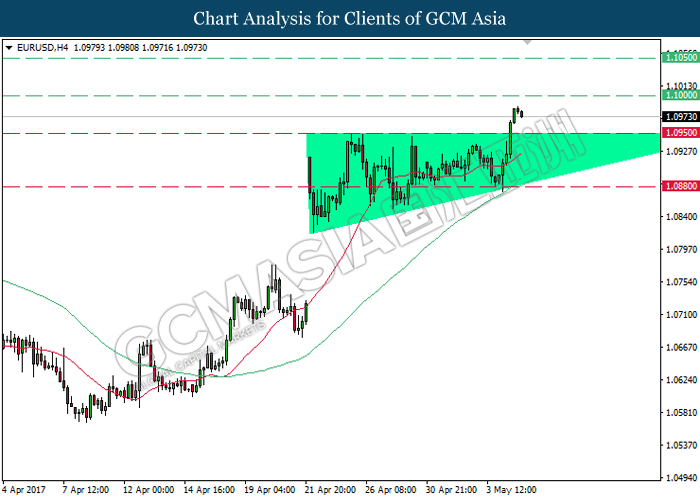

EURUSD

EURUSD, H4: EURUSD has recently slipped from the top level of ascending triangle, signaling a change in trend direction to move further upwards. It is expected to extend its upward momentum after breaking the psychological level at 1.1000.

Resistance level: 1.1000, 1.1050

Support level: 1.0950, 1.0880

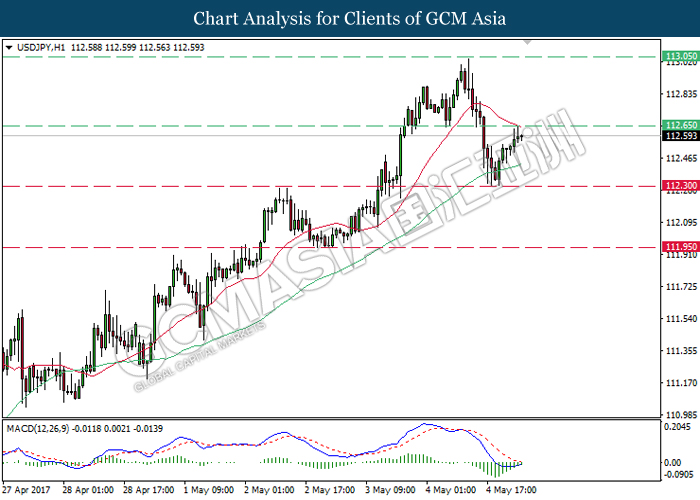

USDJPY

USDJPY, H1: USDJPY were traded higher following prior rebound from the strong support level of 112.30. As the downward signal line from MACD histogram continues to narrow upwards, a closure above the resistance level of 112.65 would suggest USDJPY to extend its upward momentum.

Resistance level: 112.65, 113.05

Support level: 112.30, 111.95

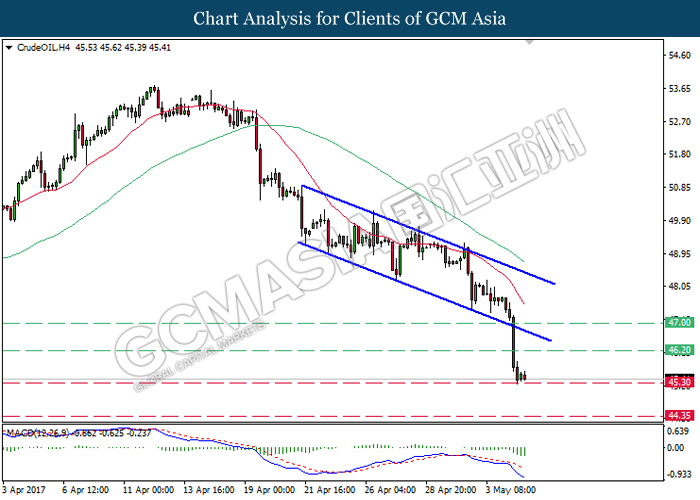

CrudeOIL

CrudeOIL, H4: Crude oil price has recently slipped out from the bottom level of downward channel, signifying the change in trend direction to move further downwards. As MACD histogram continues to illustrate prominent downward signal and momentum, a closure below the support level of 45.30 would suggest crude oil price to extend its losses.

Resistance level: 46.20, 47.00

Support level: 45.30, 44.35

GOLD

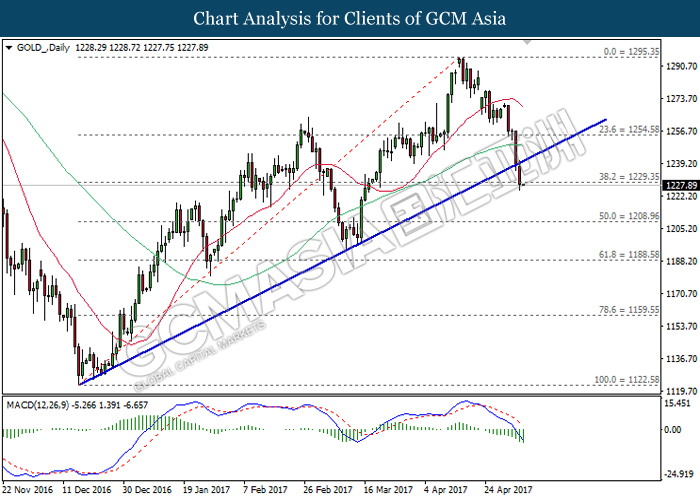

GOLD_, Daily: Gold price has recently closed below the upward trend line, signaling a change in trend direction to move further downwards. As the downward signal from MACD histogram continues to expand downwards, gold price is expected to advance further down towards the target of support level at 1208.95.

Resistance level: 1229.35, 1254.60

Support level: 1208.95, 1188.60