05 July 2022 Afternoon Session Analysis

Aussie surged amid easing Chinese tariff expectation from US.

The global risk appetite accelerated as market participants speculated that the White House would likely to announce an easing of some Chinese tariffs later this week in an attempt to stabilize the inflation rate, risky currencies as well as Chinese-proxy currency such as Australia Dollar received significant bullish momentum. Currently, the inflation has soared to 8.6%, the White House is currently debating whether lifting some tariffs would provide some relief to US Consumers. In addition, the Aussie extend its gains ahead of crucial monetary policy decision from Reserve Bank of Australia. Economists are tipping a 50-basis point of rate hike when the Reserve Bank meet on Tuesday, lifting the official cash rate from 0.85% to 1.35%, with further rises expected throughout 2022 to combat the inflation rate. Though, investors would continue to scrutinize the latest updates from Reserve Bank of Australia to receive further trading signal. As of writing, AUD/USD appreciated by 0.20% to 0.6880.

In the commodities market, the crude oil price appreciated by 0.36% to $111.05 per barrel as of writing amid Norwegian offshore workers began a strike that will reduce oil and gas output. According to Reuters, the oil output from Wednesday would likely to cut by 130,000 barrel per day, corresponding to around 6.5% of Norway production. On the other hand, the gold price extends its gains by 0.08% to $1809.20 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

18:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Jul) | 0.85% | 1.35% | – |

| 16:30 | GBP – Composite PMI (Jun) | 53.1 | 53.1 | – |

| 16:30 | GBP – Services PMI (Jun) | 53.4 | 53.4 | – |

Technical Analysis

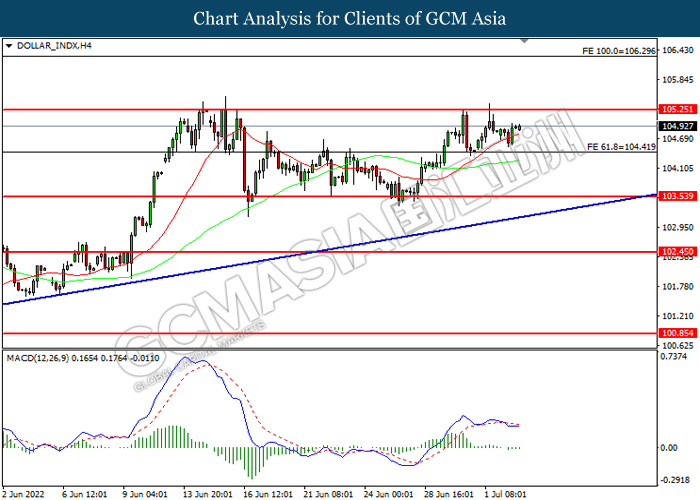

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 105.25, 106.30

Support level: 104.40, 103.55

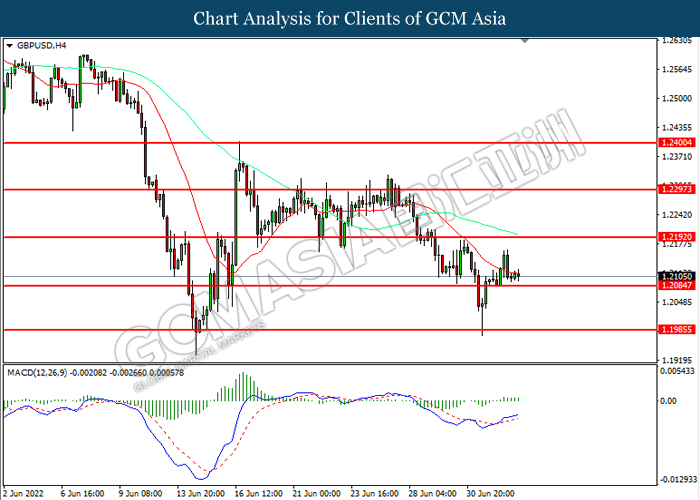

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2190, 1.2295

Support level: 1.2085, 1.1985

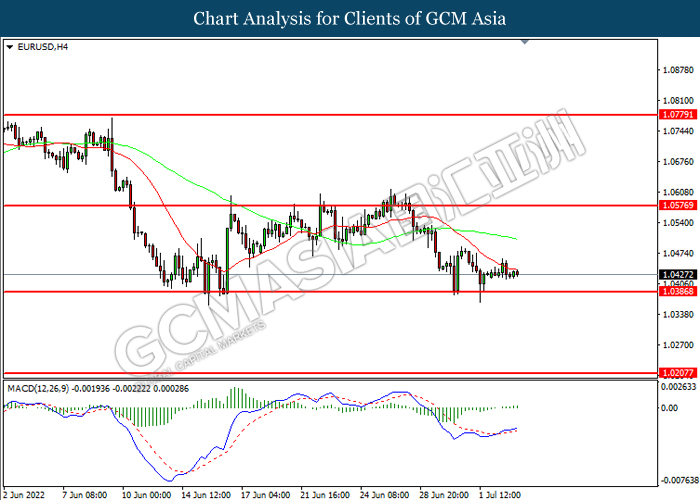

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0575, 1.0780

Support level: 1.0385, 1.0205

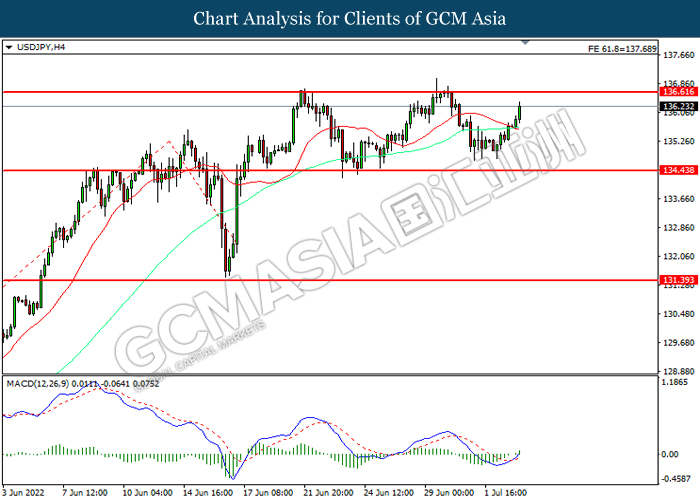

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 136.60, 137.70

Support level: 134.45, 131.40

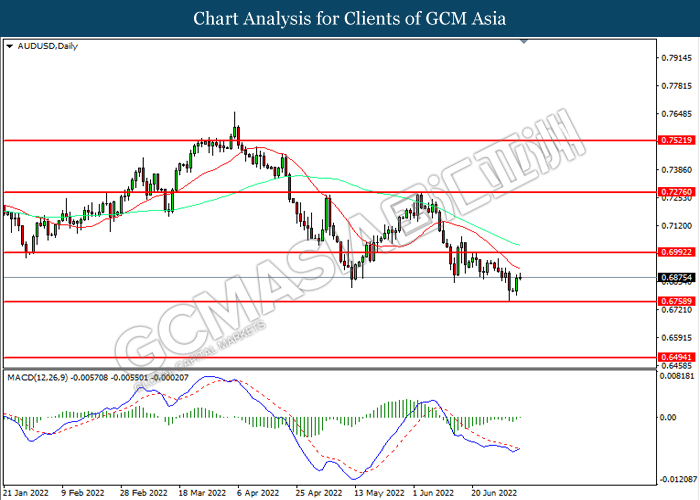

AUDUSD, Daily: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6990, 0.7275

Support level: 0.6760, 0.6495

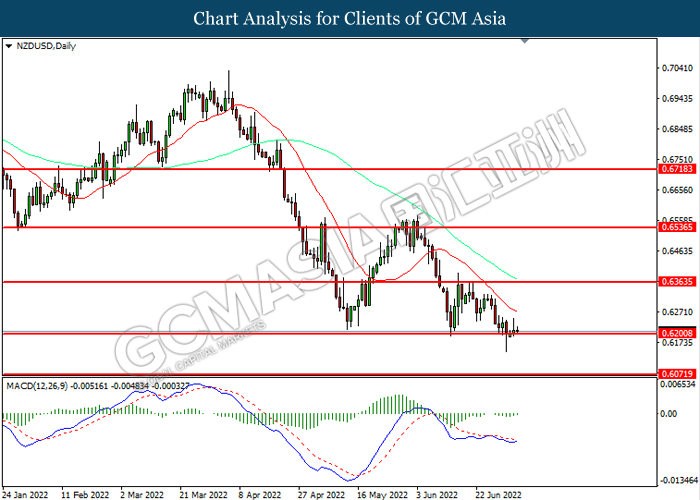

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6365, 0.6535

Support level: 0.6200, 0.6070

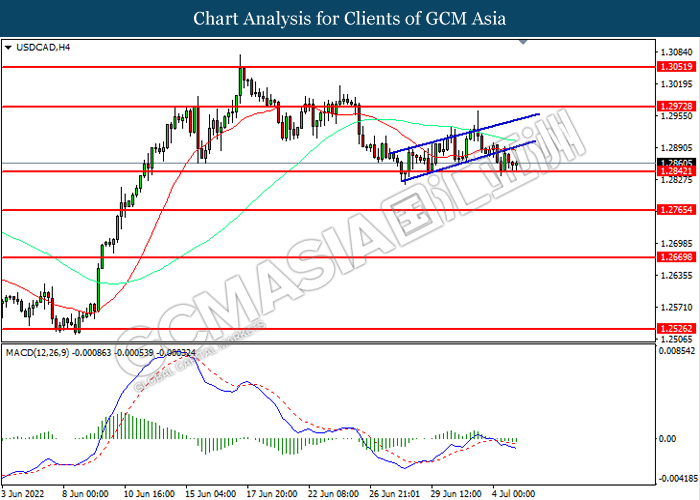

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish suggest the pair to extend its losses after breakout.

Resistance level: 1.2975, 1.3050

Support level: 1.2840, 1.2765

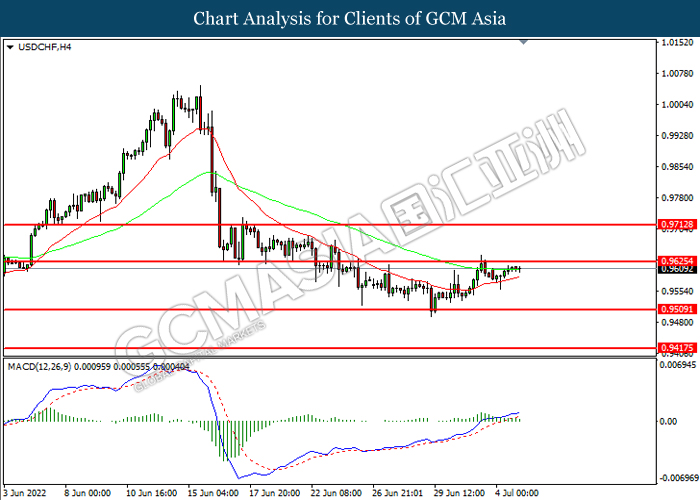

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9625, 0.9715

Support level: 0.9510, 0.9415

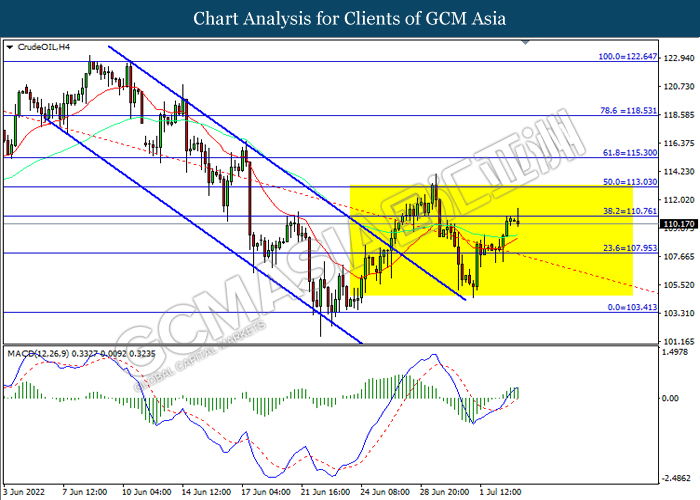

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 110.75, 113.05

Support level: 107.95, 103.40

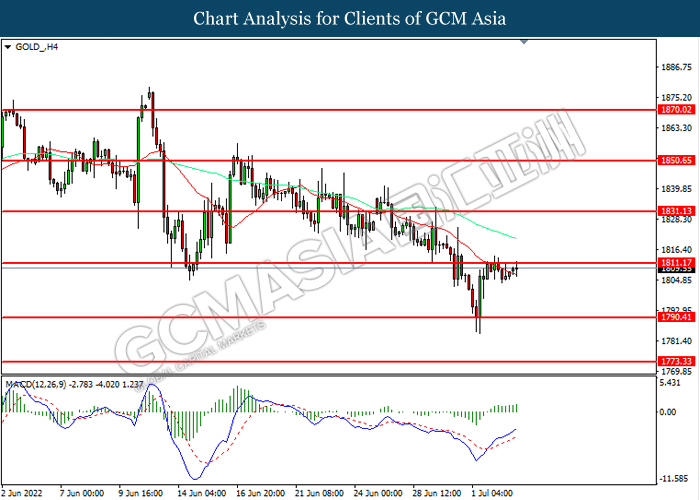

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1811., 1831.15

Support level: 1790.40, 1773.35