5 July 2022 Morning Session Analysis

USDCAD dipped over the rising inflation expectations.

The overall trend of USDCAD remained bearish over the backdrop of rising inflation expectation in Canada. According to Reuters, Bank of Canada (BoC) released a survey on Monday which showed that the consumers’ expectations of inflation have risen, along with concerns about food, petrol and rental prices. Besides, BoC found that companies are expected to face high inflation for longer, with firms eyeing record wage rises over the next 12 months, according to the separate survey of BoC. As the market participant expected the inflation is widespread, it increased the odds of aggressive rate hike from BoC in order to stabilize the soaring inflation. Past of few weeks, Canada annual inflation rate reached 7.7%, and the BoC vowed that the cental bank would take ‘more forcefully’ action if the inflation still remained on high-level. As of now, investors would continue to scrutinize on the latest updates with regards of rate hike decision from BoC in order to receive further trading signals. As of writing, USDCAD eased by 0.06% to 1.2851.

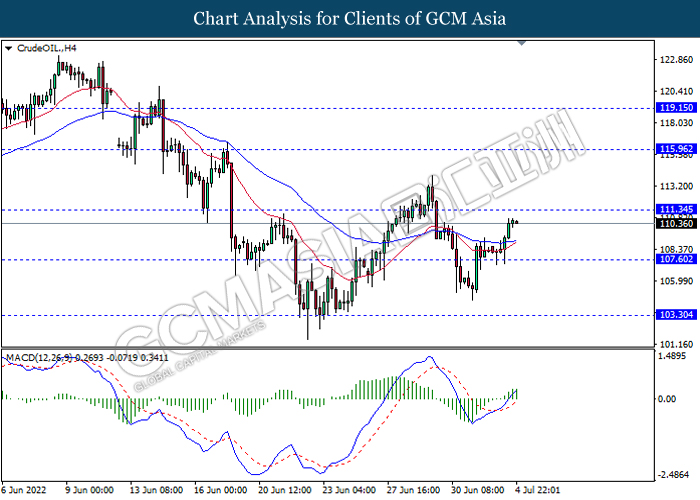

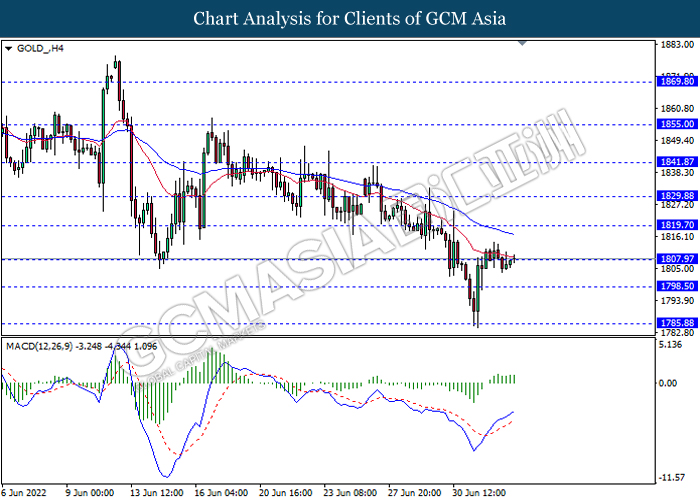

In the commodities market, crude oil price rose by 1.85% to $110.44 per barrel as of writing following the supply concern driven by political crisis in Libya. On the other hand, gold price appreciated by 0.45% to $1809.65 per troy ounce as of writing. Though, gold price still under pressure as prospects of higher interest rates dimmed appeal of the non-yielding asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

18:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Jul) | 0.85% | 1.35% | – |

| 16:30 | GBP – Composite PMI (Jun) | 53.1 | 53.1 | – |

| 16:30 | GBP – Services PMI (Jun) | 53.4 | 53.4 | – |

Technical Analysis

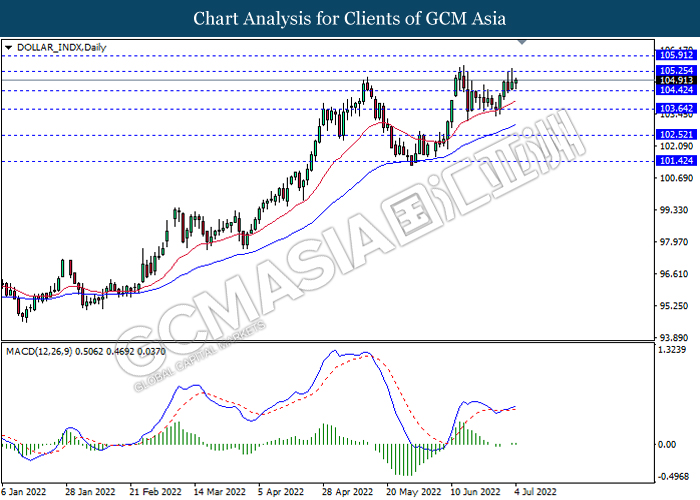

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 105.25, 105.90

Support level: 104.40, 103.65

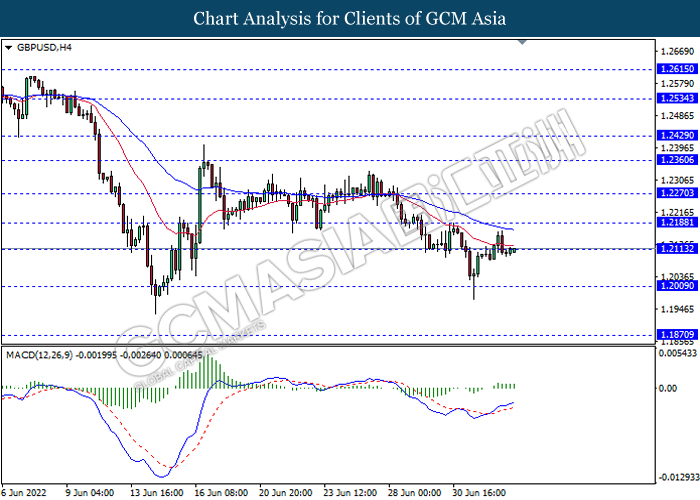

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2115, 1.2190

Support level: 1.2010, 1.1870

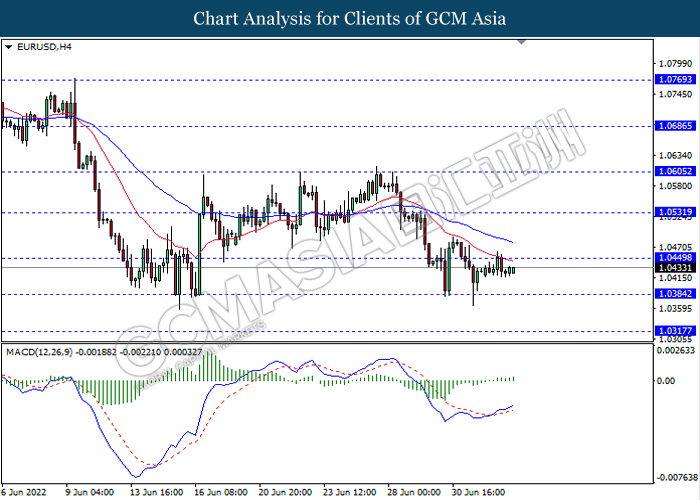

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0450, 1.0530

Support level: 1.0385, 1.0315

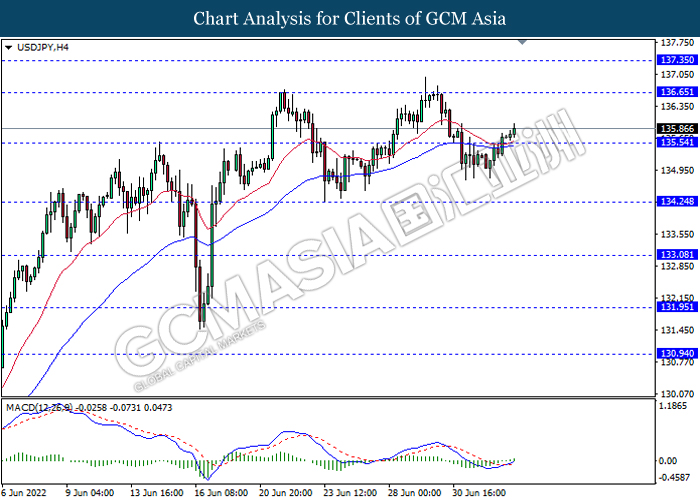

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

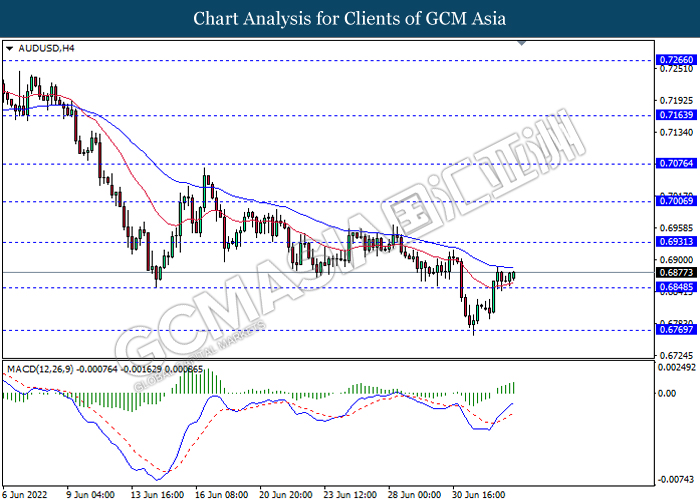

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend it gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

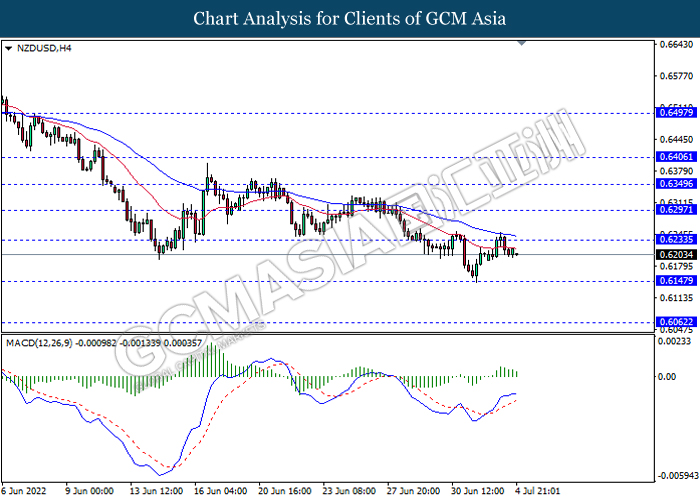

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

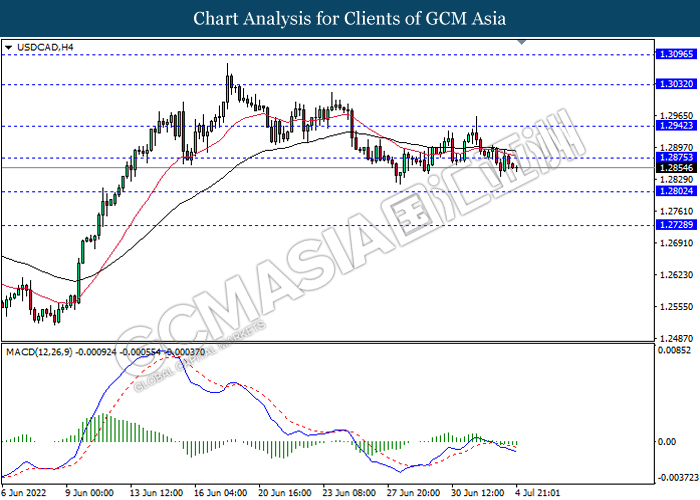

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2940

Support level: 1.2800, 1.2730

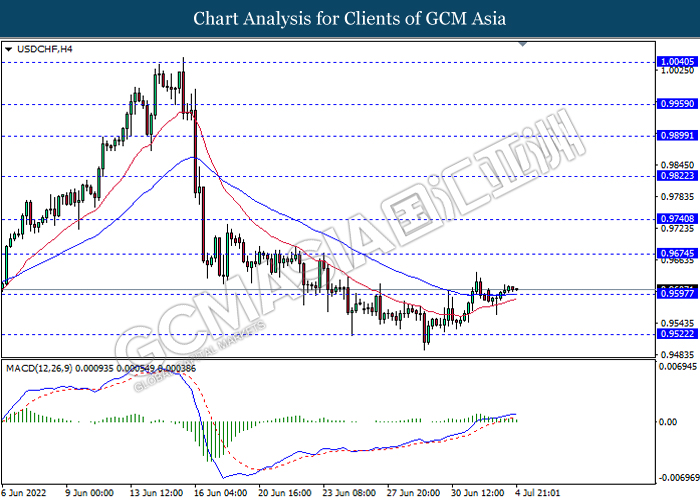

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 111.35, 115.95

Support level: 107.60, 103.30

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1807.95, 1819.70

Support level: 1798.50, 1785.90