05 Jul 2023 Afternoon Session Analysis

The Australian dollar fell and rebounded after the monetary policy decision.

The Australian Dollar (AUSSIE) Which Traded Against The Dollar Index Fell and Rebounded After the Monetary Policy DeCision by the Reserve Bank of Australia (RBA) The rba kept the cash rate unchanged at 11 Years High of 4.10% after the Central Bank Lifted the rates by 400 basis points since May 2022. AUD/USD slips after central bank pause rate hikes Governor Philip Lowe’s comments in the statement mention that The central bank decided to keep interest rates stable at the current position and explained that the effect of previous rate hikes will take some time to assess the impact on the economy. Besides, growth in the Australian economy has slowed and the labor market has eased from its peak, which could be a reason to prompt the RBA a pause its rates. In addition, inflation in Australia had passed its peak and the recent month’s CPI indicator showed a further decline after the central bank aggressively tightened its monetary policy. However, Lowe reiterated that further tightening of monetary policy would be required if the inflation stays above the central bank target. A further tightening move is required to ensure the inflation returns to the central bank’s 2% target. As of writing, the AUDUSD slipped by -0.07% to 0.6685.

In the commodities market, crude oil prices increase by 1.46% to $70.81 per barrel as the market continues to weigh on supply cuts by Saudi Arabia with Russia and weaker China’s economic growth. Elsewhere, the gold price slightly decreases by -0.08% to 1924.44 ahead of the Fed minutes release.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Meeting Minutes

(6th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:50 | EUR – French Services PMI (Jun) | 52.5 | 48.0 | – |

| 15:55 | EUR – German Services PMI (Jun) | 57.2 | 54.1 | – |

| 16:00 | EUR – S&P Global Composite PMI (Jun) | 52.8 | 50.3 | – |

| 16:00 | EUR – Services PMI (Jun) | 55.1 | 52.4 | – |

| 16:30 | GBP – Composite PMI (Jun) | 54.0 | 52.8 | – |

| 16:30 | GBP – Services PMI (Jun) | 55.2 | 53.7 | – |

Technical Analysis

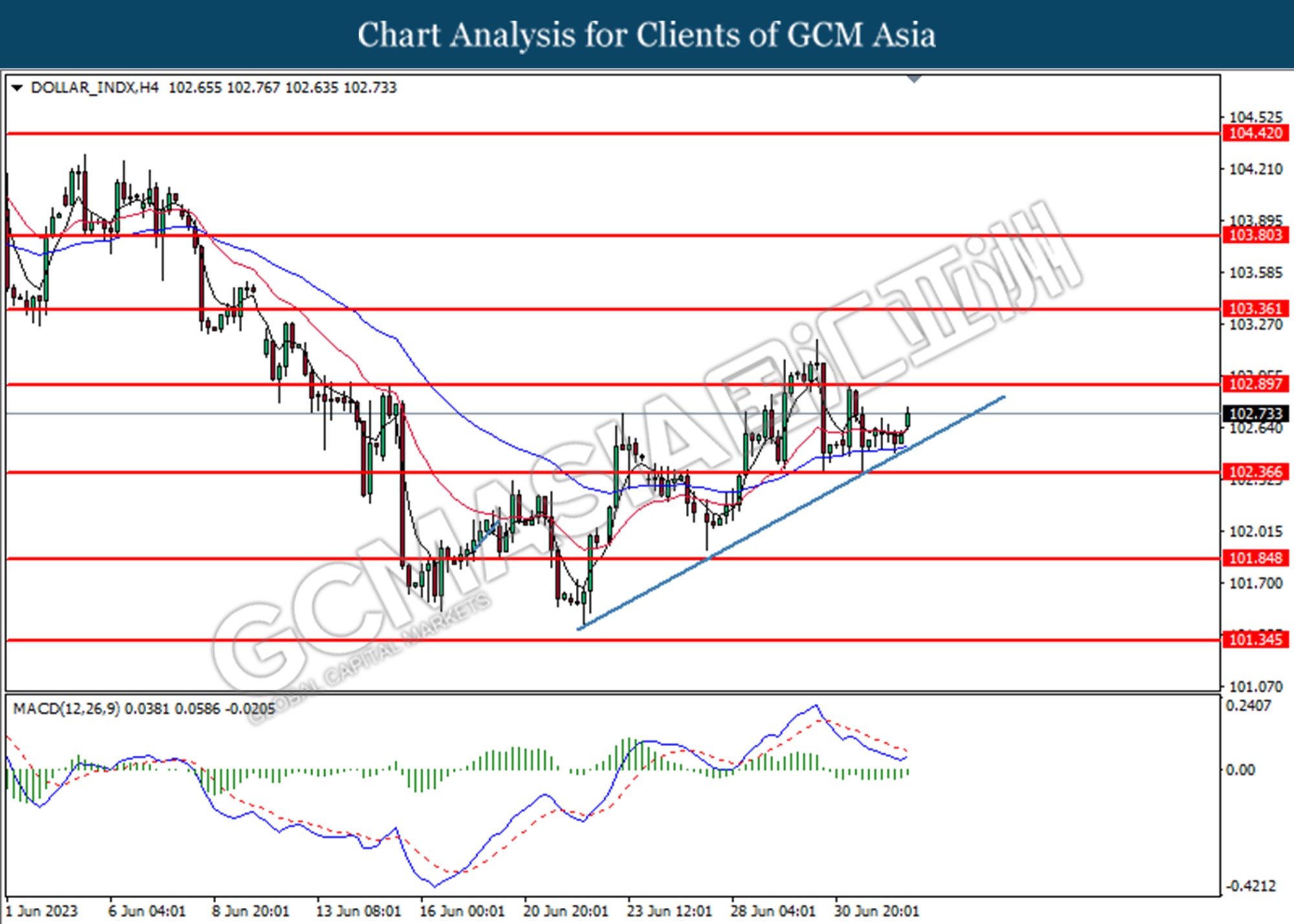

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 102.90.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

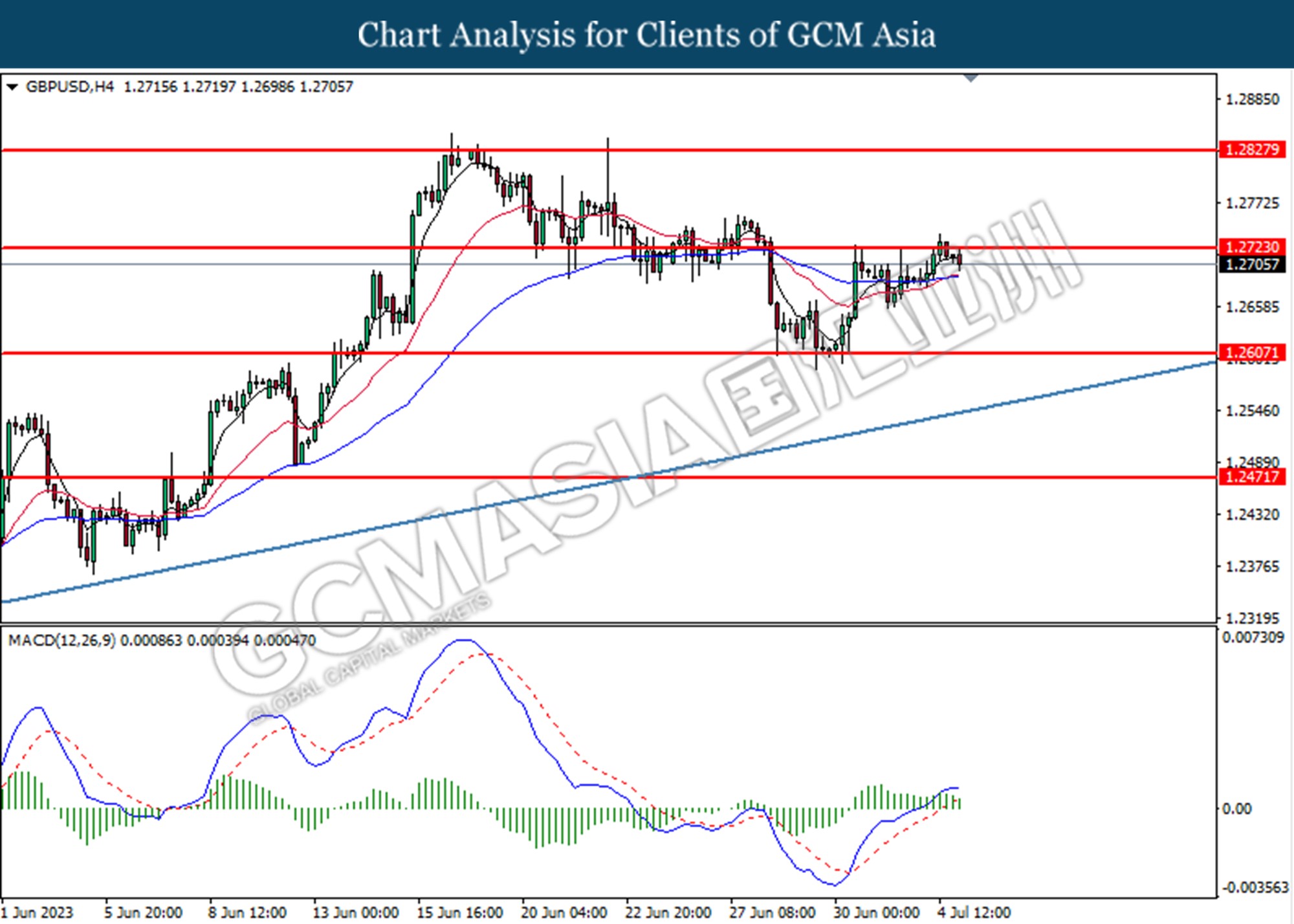

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2730. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2730, 1.2830

Support level: 1.2610, 1.2470

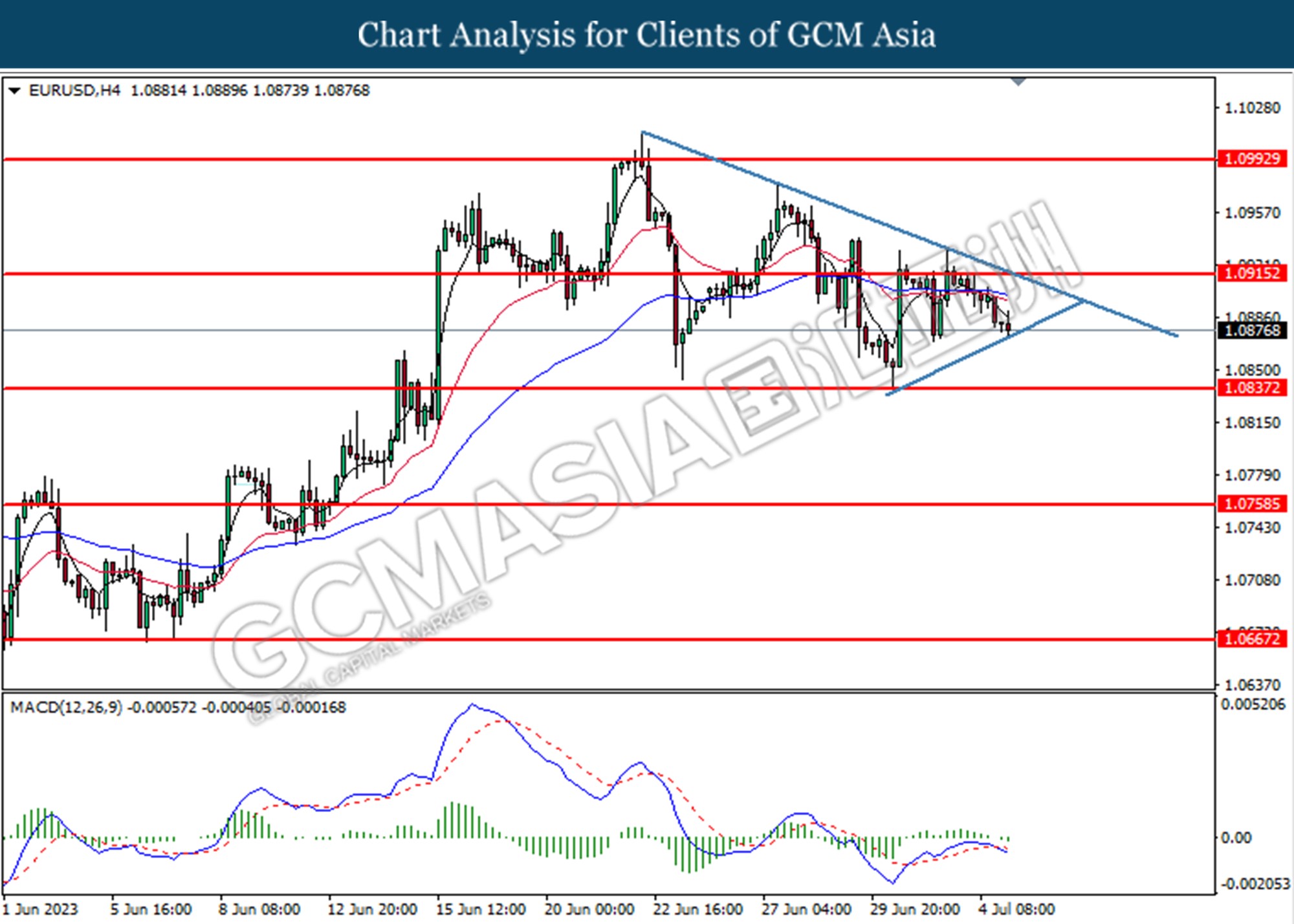

EURUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0840.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

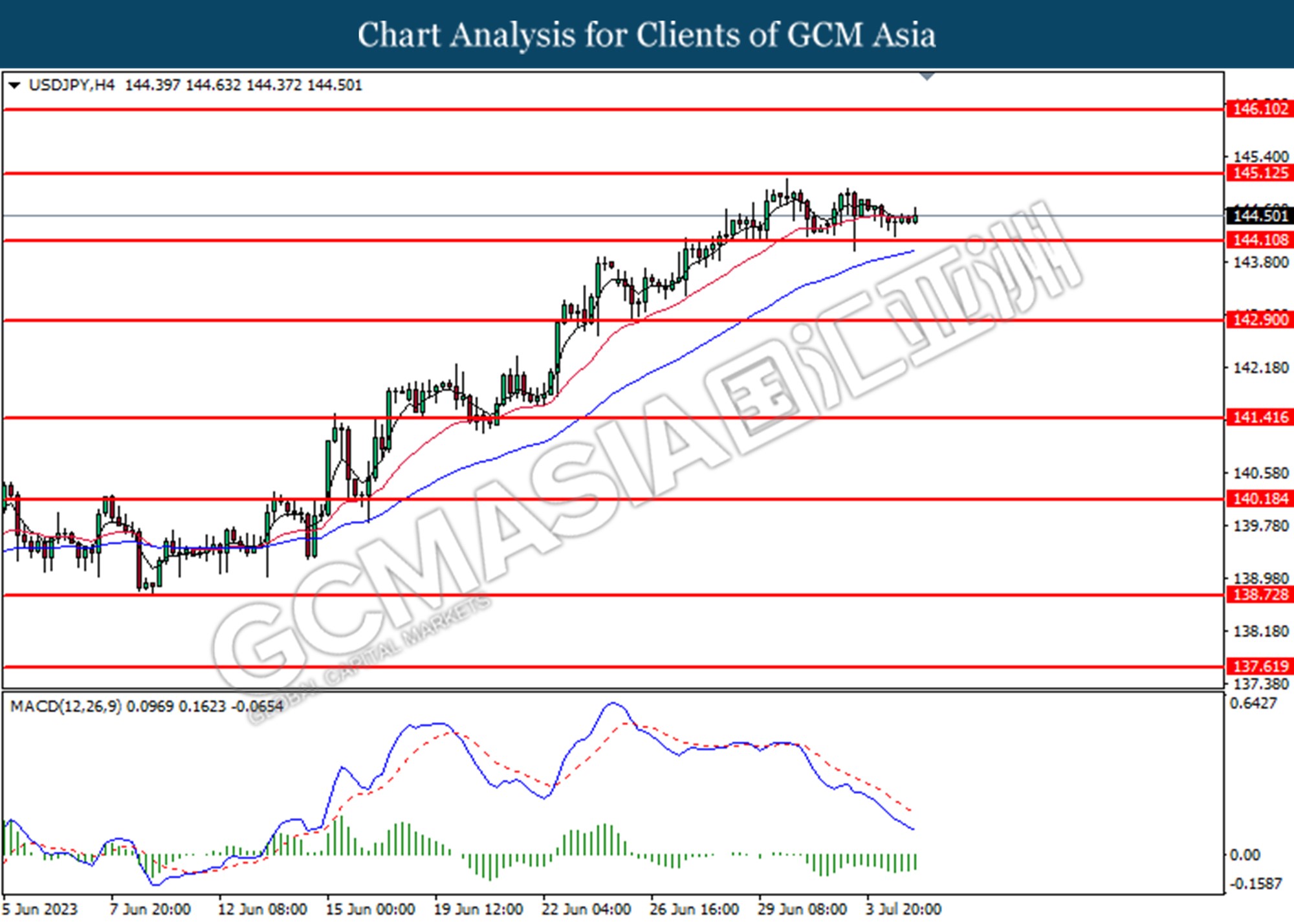

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 144.10. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

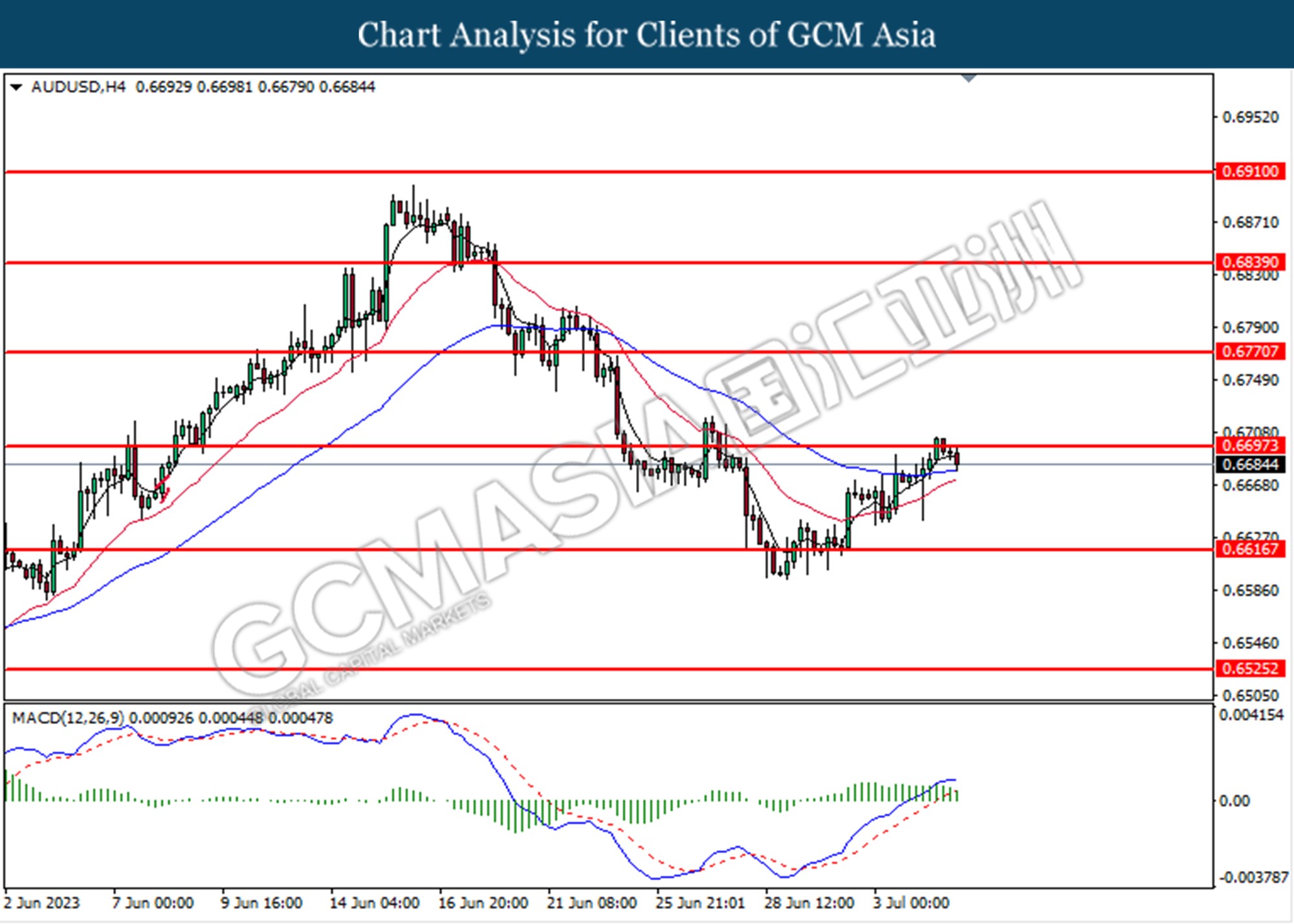

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6700. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

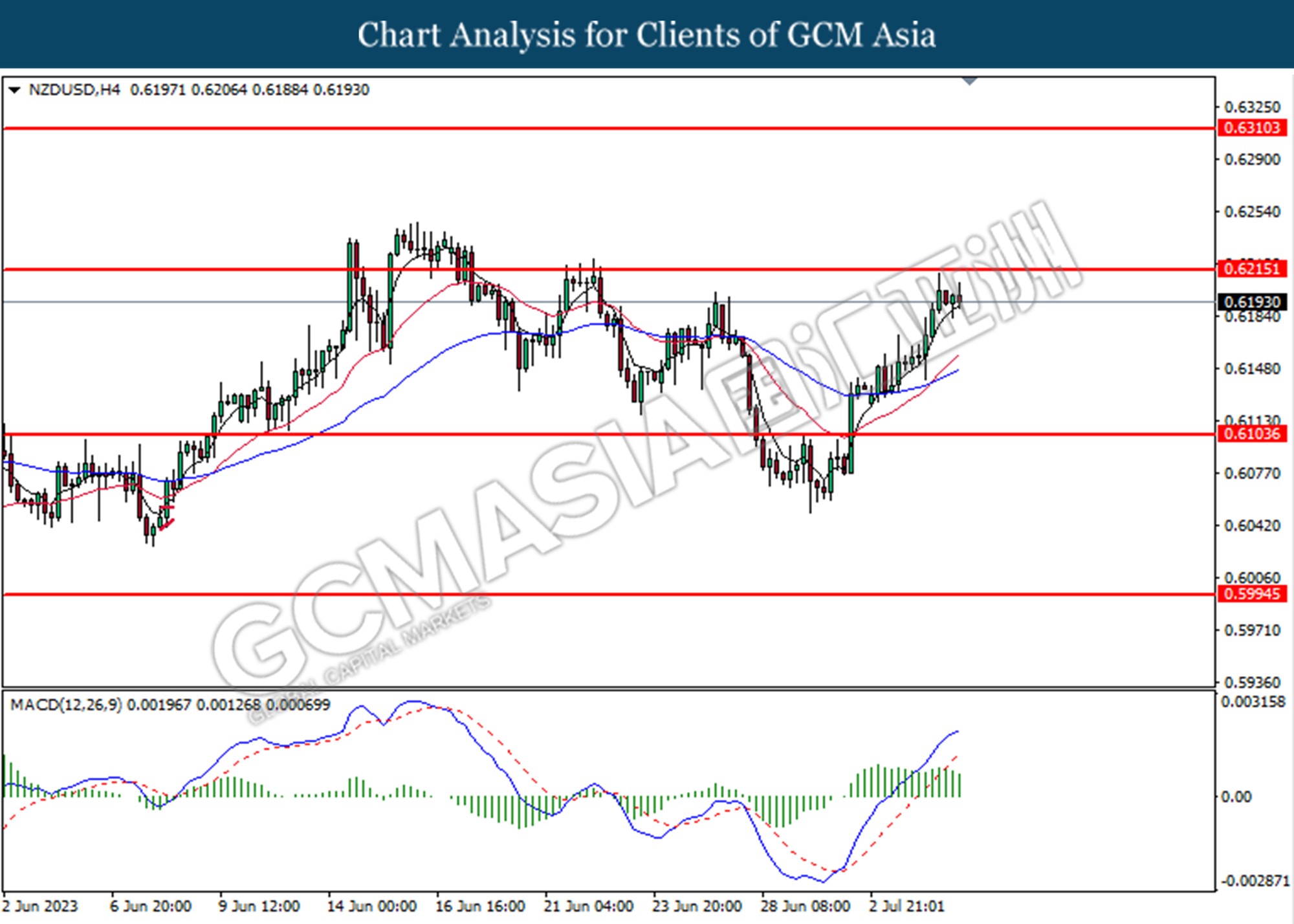

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6105.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

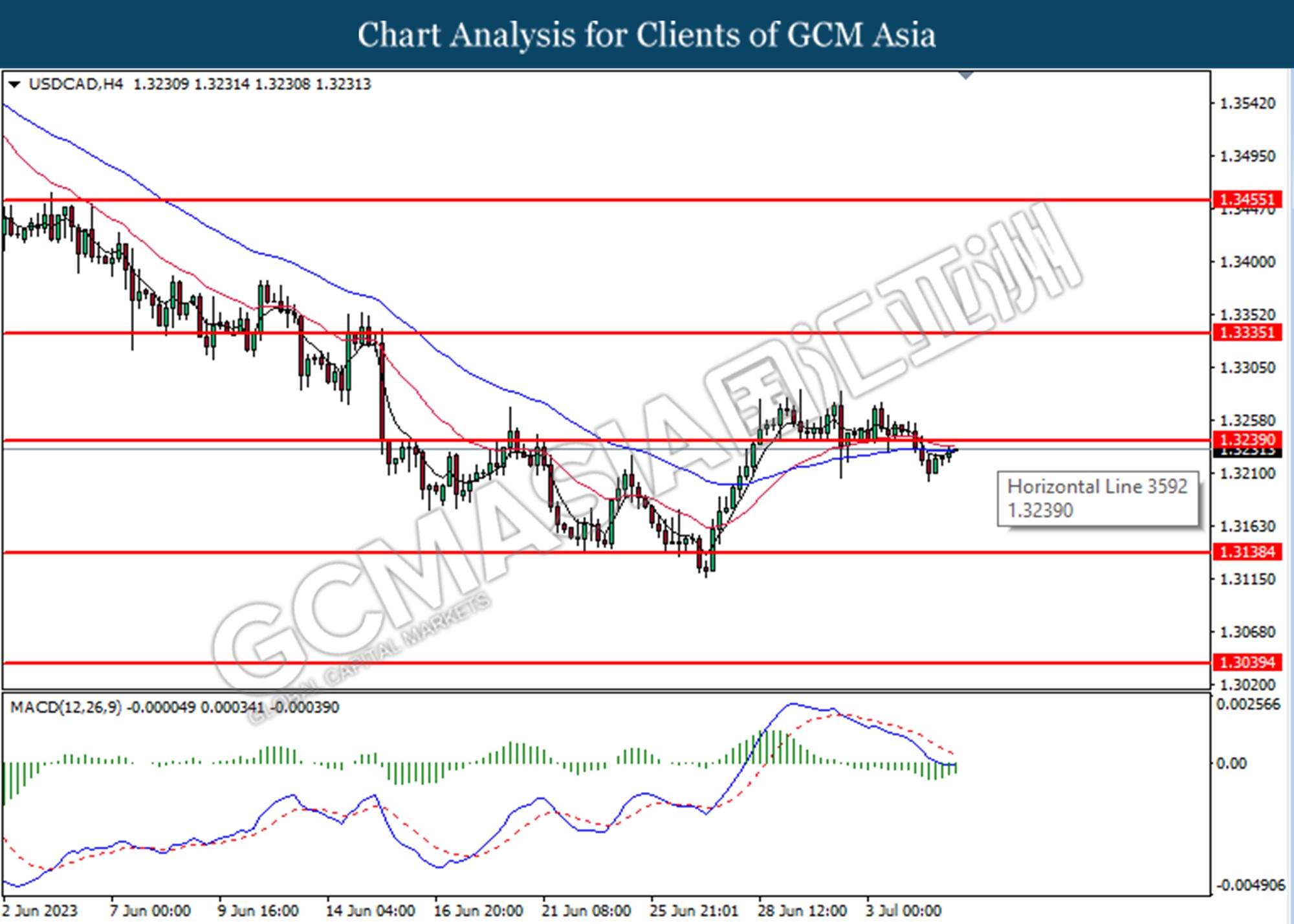

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

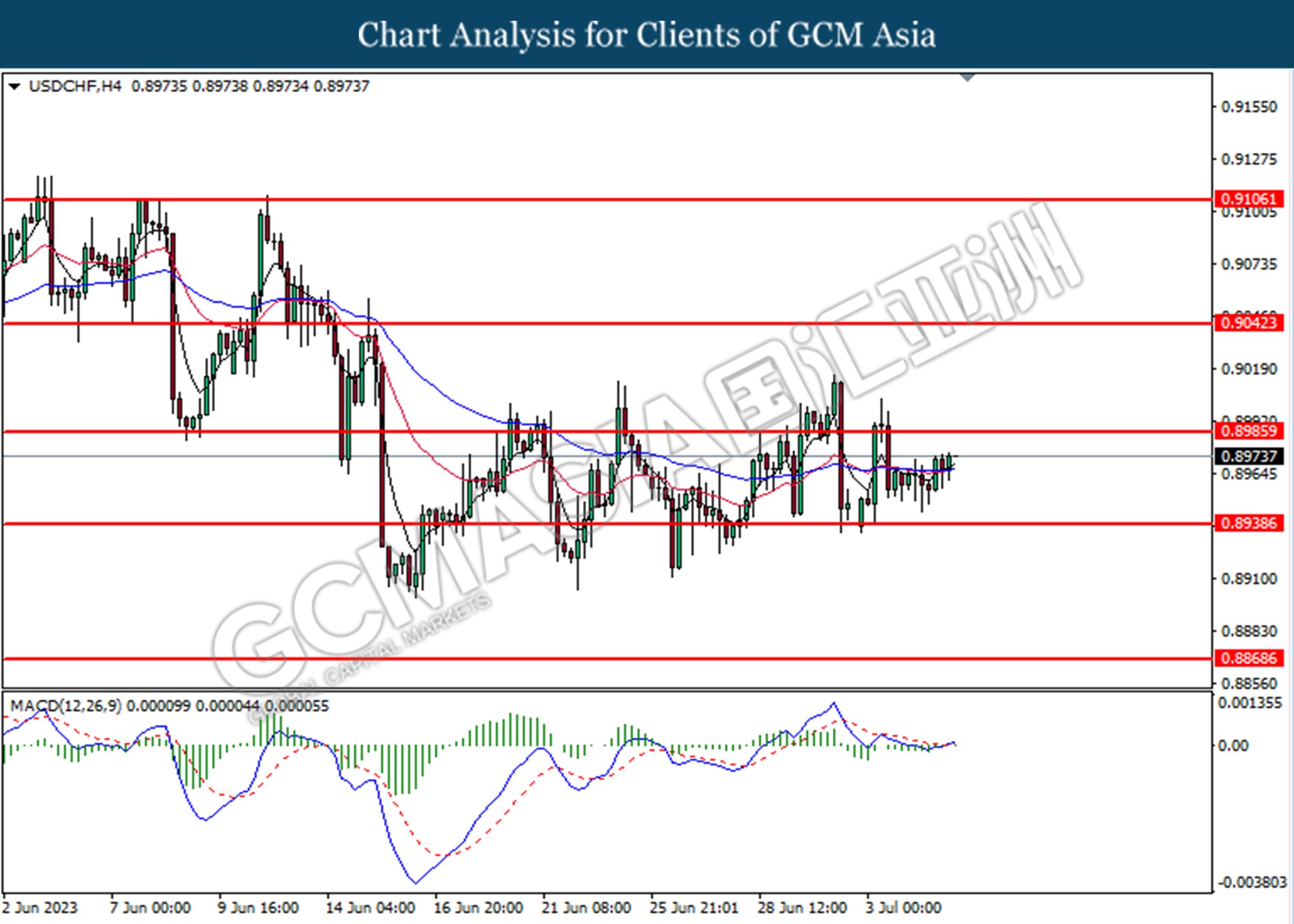

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.8985.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 71.35. MACD which illustrated \bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 71.35,73.15

Support level: 69.30, 67.55

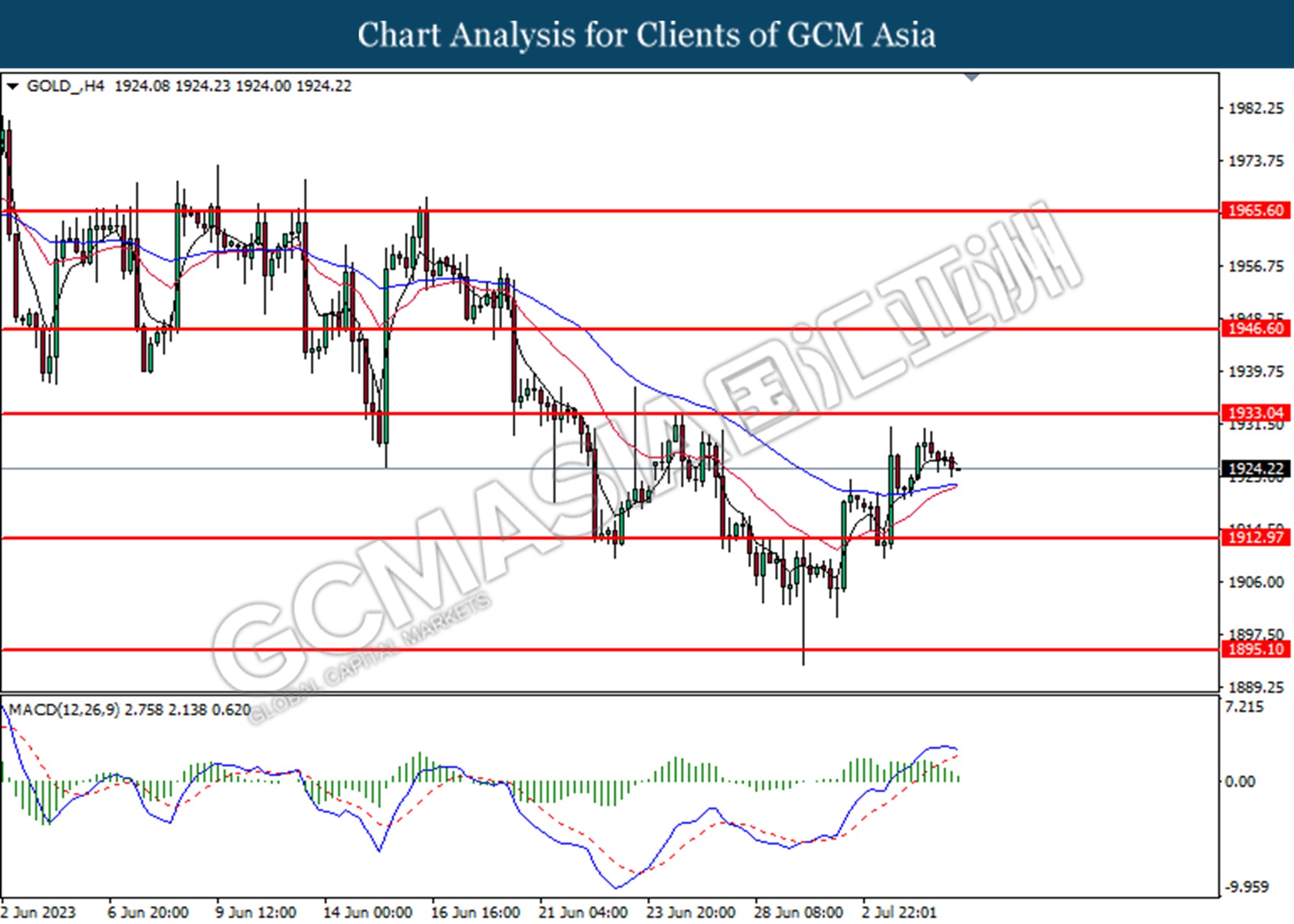

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10