05 July 2023 Morning Session Analysis

US dollar flat on Independence Day holiday.

The dollar index, which was traded against a basket of six major currencies, experienced a quiet trading session yesterday as the US markets was closed to commemorate the 247th anniversary of the Declaration of Independence signing. With US markets closed for the 4th July public holiday, market activity was relatively subdued. Investors are now awaiting Friday’s U.S. nonfarm payrolls report, which could influence the Federal Reserve’s next decision. Prior to that, the market participants are also eyeing on the FOMC Meeting Minutes for more clues on its interest rate hike path ahead. Also, they will provide valuable insight into why the Fed decided to pause its rate hike cycle and the likelihood of further hikes in the near term. Hence, the views of Federal Reserve on economic growth, monetary policy and inflation would definitely move the market. At this point in time, the probability of a rate hike at the upcoming July 26-27 meeting is now above 86%, according to the CME Fed Watch tool, which also shows growing expectations for another rate hike before the end of the year. As of writing, the dollar index rose 0.10% to 103.10.

In the commodities market, crude oil prices appreciated by 1.27% to $70.95 per barrel as market weighed on the plan of more production cut from Saudi Arabia and Russia in the month of August. Besides, the gold prices ticked up by 0.05% to $1927.00 per troy ounce during the Independence Day holiday.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

02:00 USD FOMC Meeting Minutes

(6th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:50 | EUR – French Services PMI (Jun) | 52.5 | 48.0 | – |

| 15:55 | EUR – German Services PMI (Jun) | 57.2 | 54.1 | – |

| 16:00 | EUR – S&P Global Composite PMI (Jun) | 52.8 | 50.3 | – |

| 16:00 | EUR – Services PMI (Jun) | 55.1 | 52.4 | – |

| 16:30 | GBP – Composite PMI (Jun) | 54.0 | 52.8 | – |

| 16:30 | GBP – Services PMI (Jun) | 55.2 | 53.7 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. However, MACD which illustrated bullish momentum suggests the index to undergo technical correction in short term.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2635. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

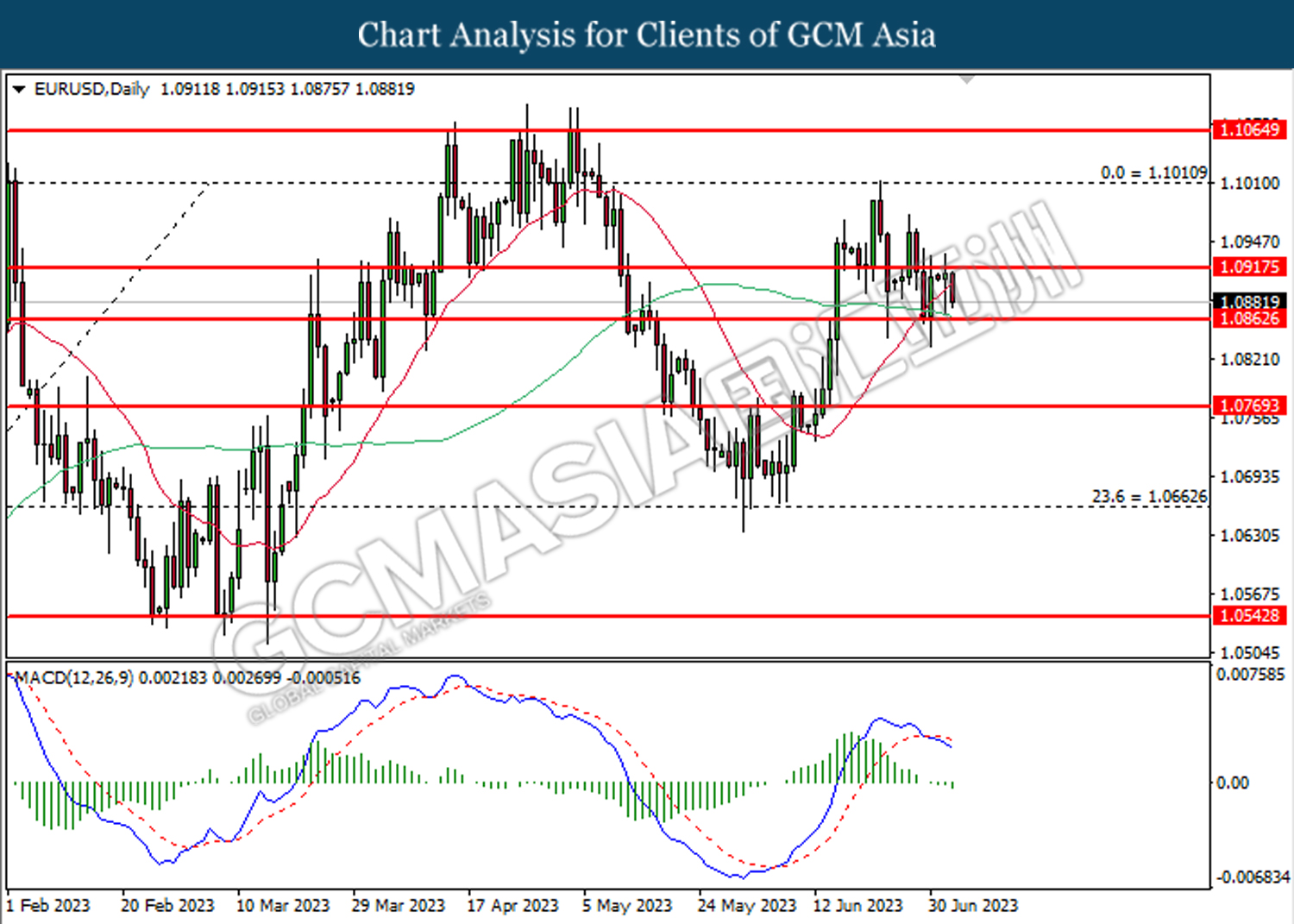

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0865.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

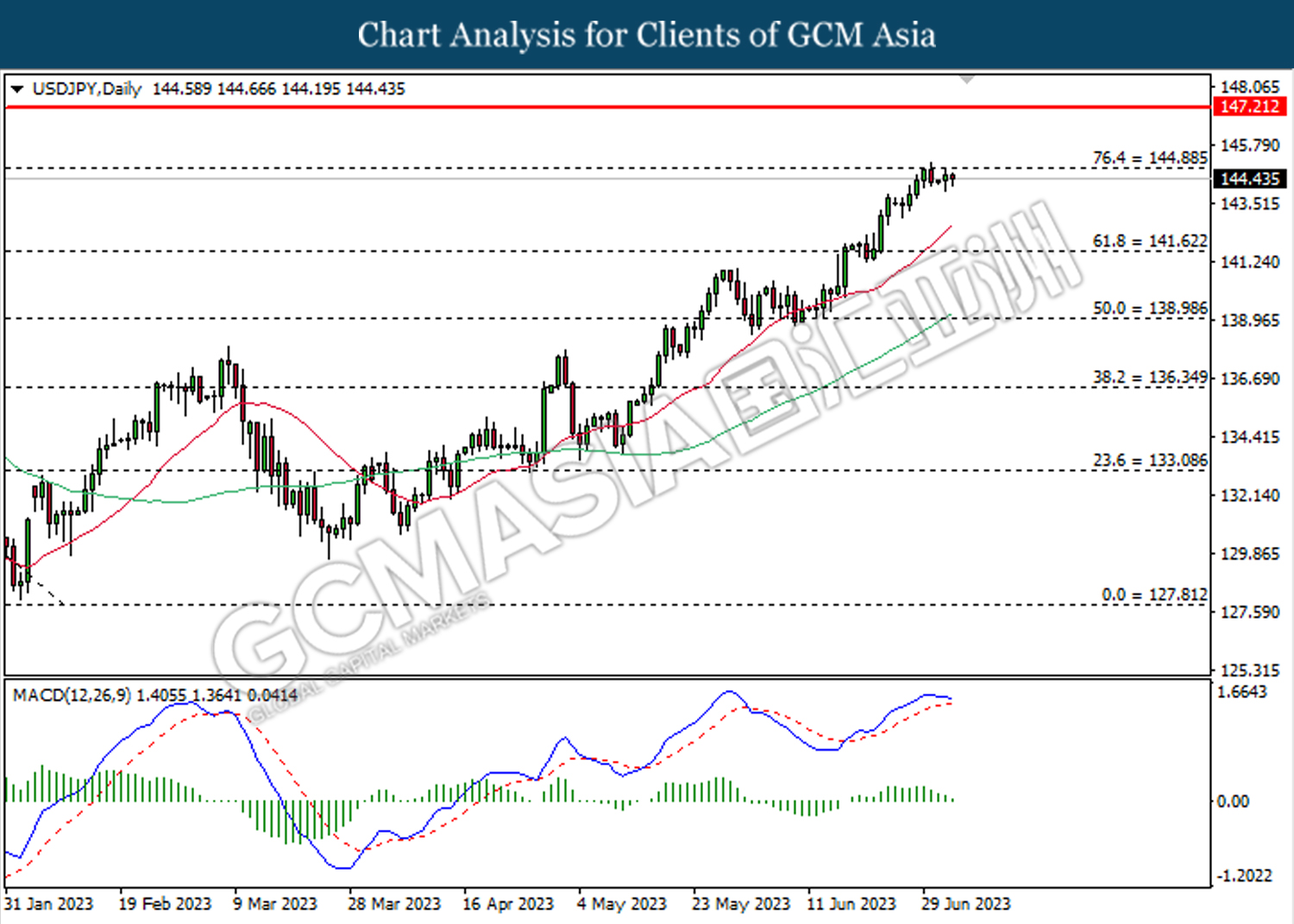

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

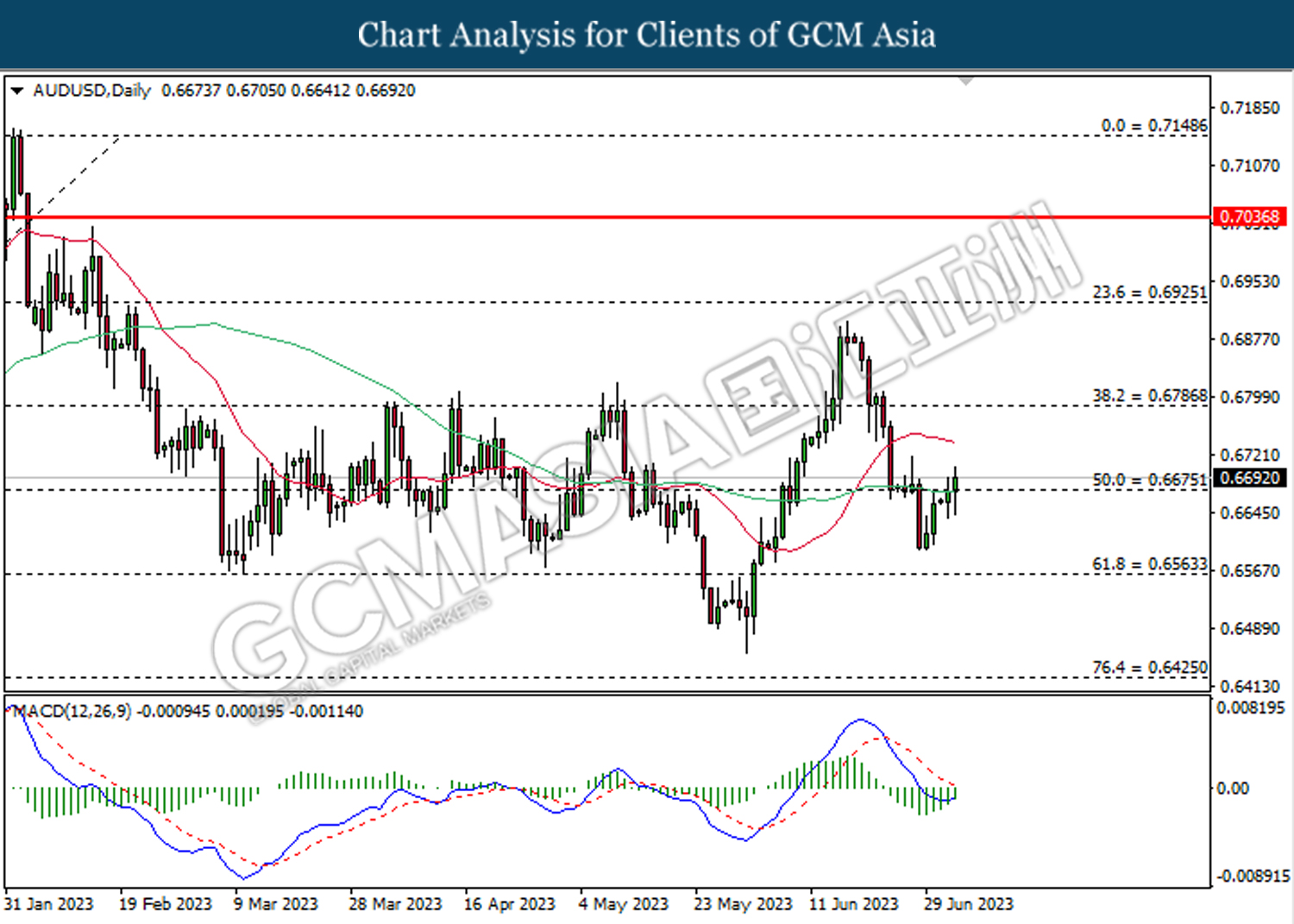

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

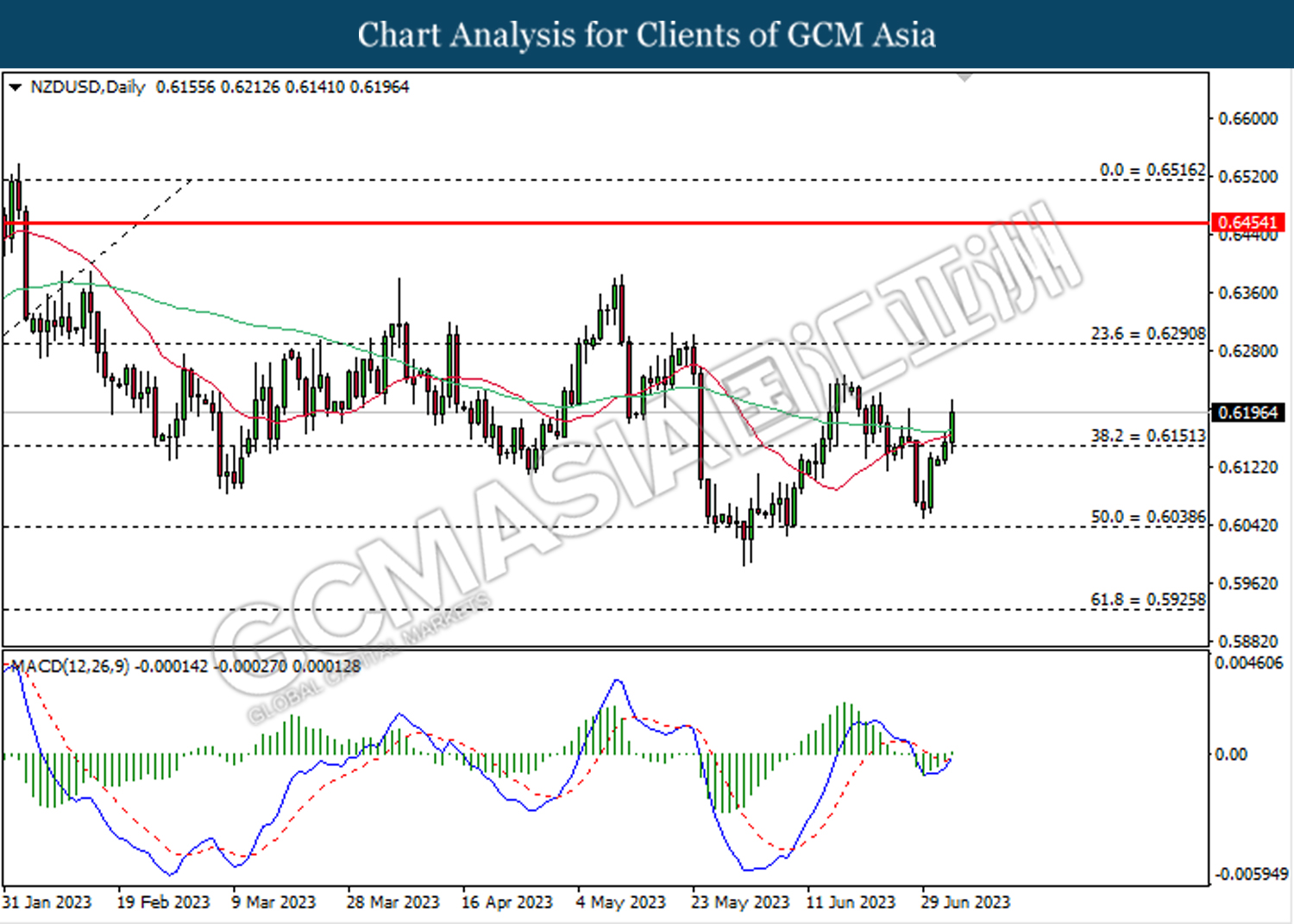

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

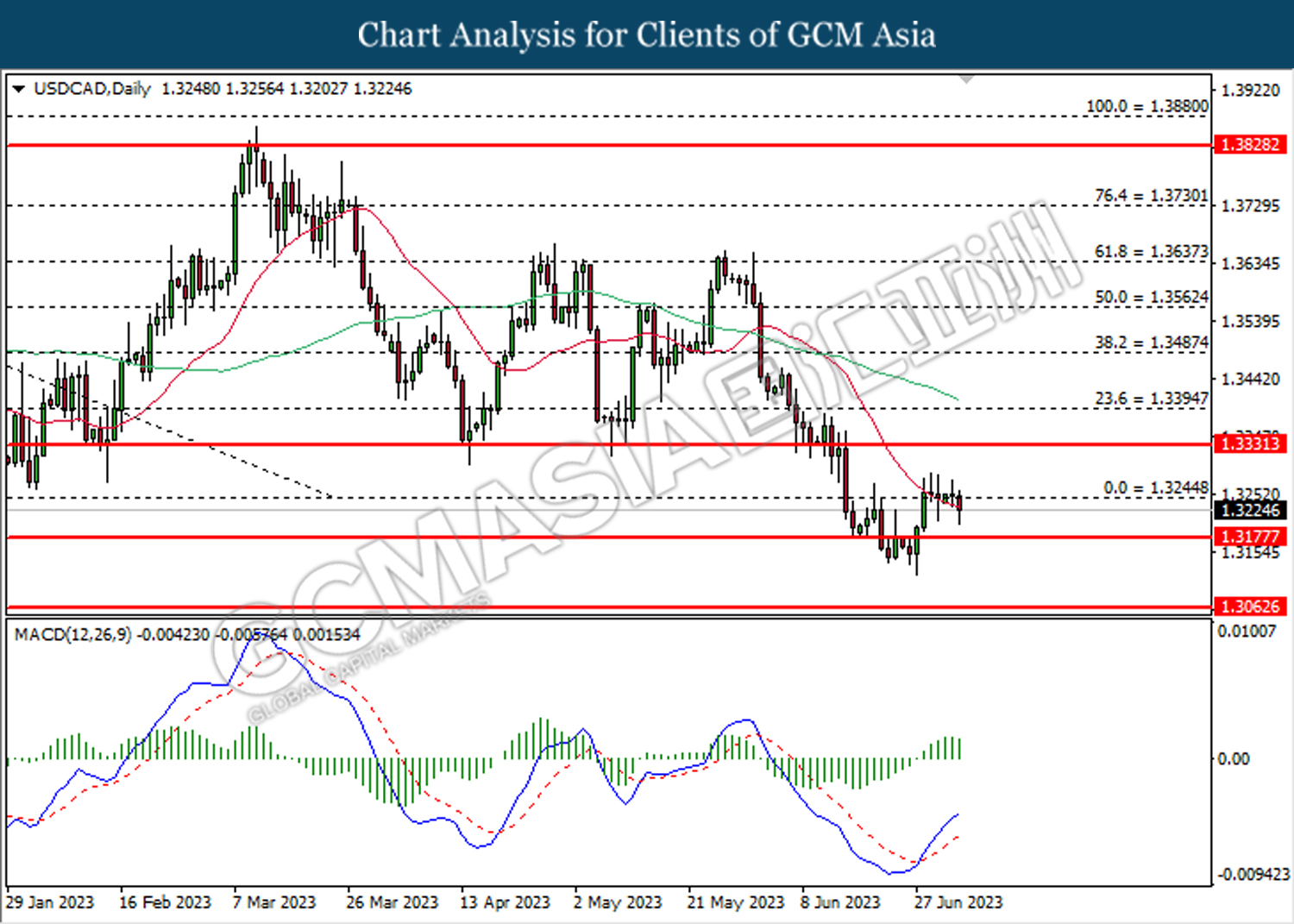

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3245. However, MACD which illustrated bullish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

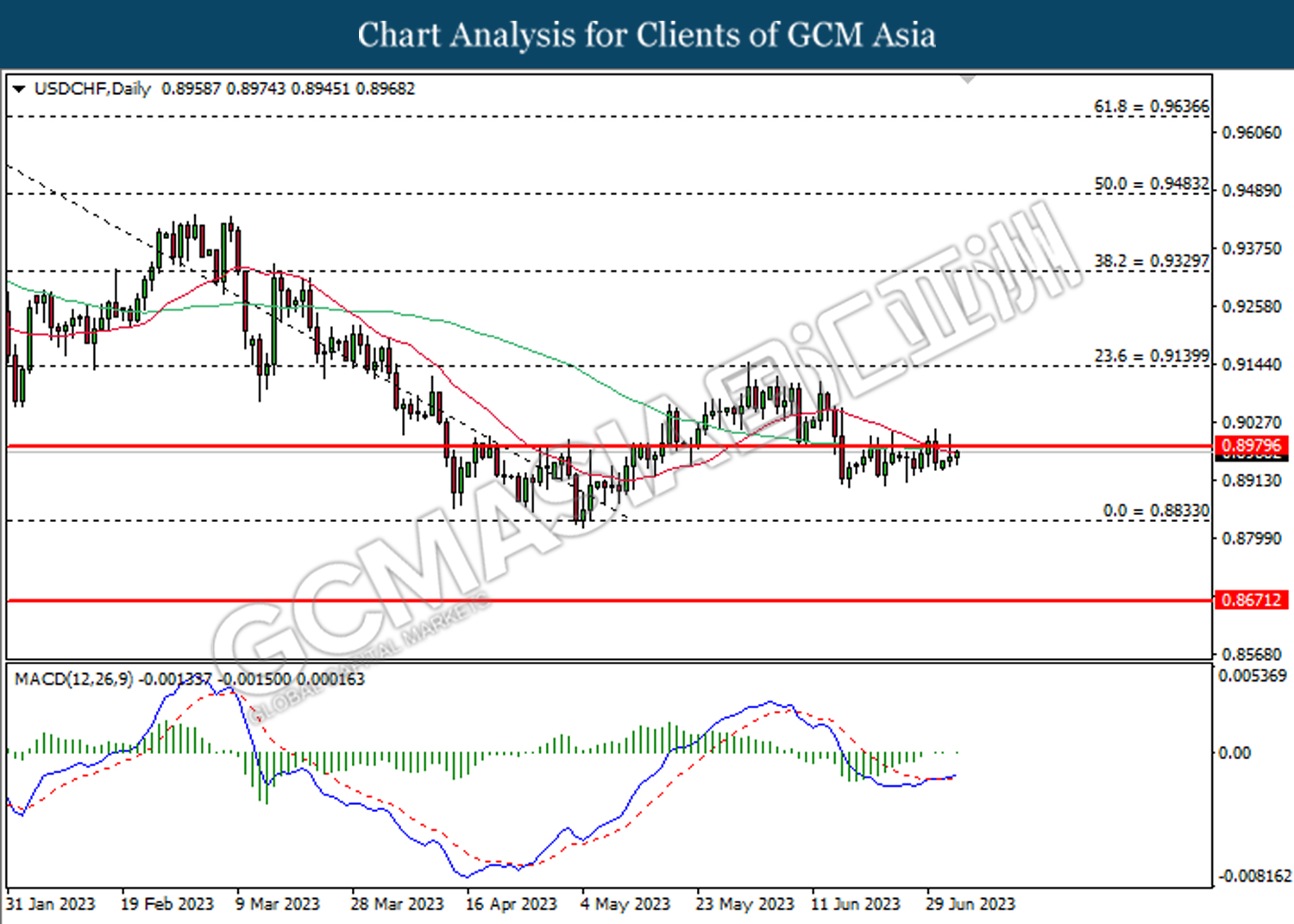

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

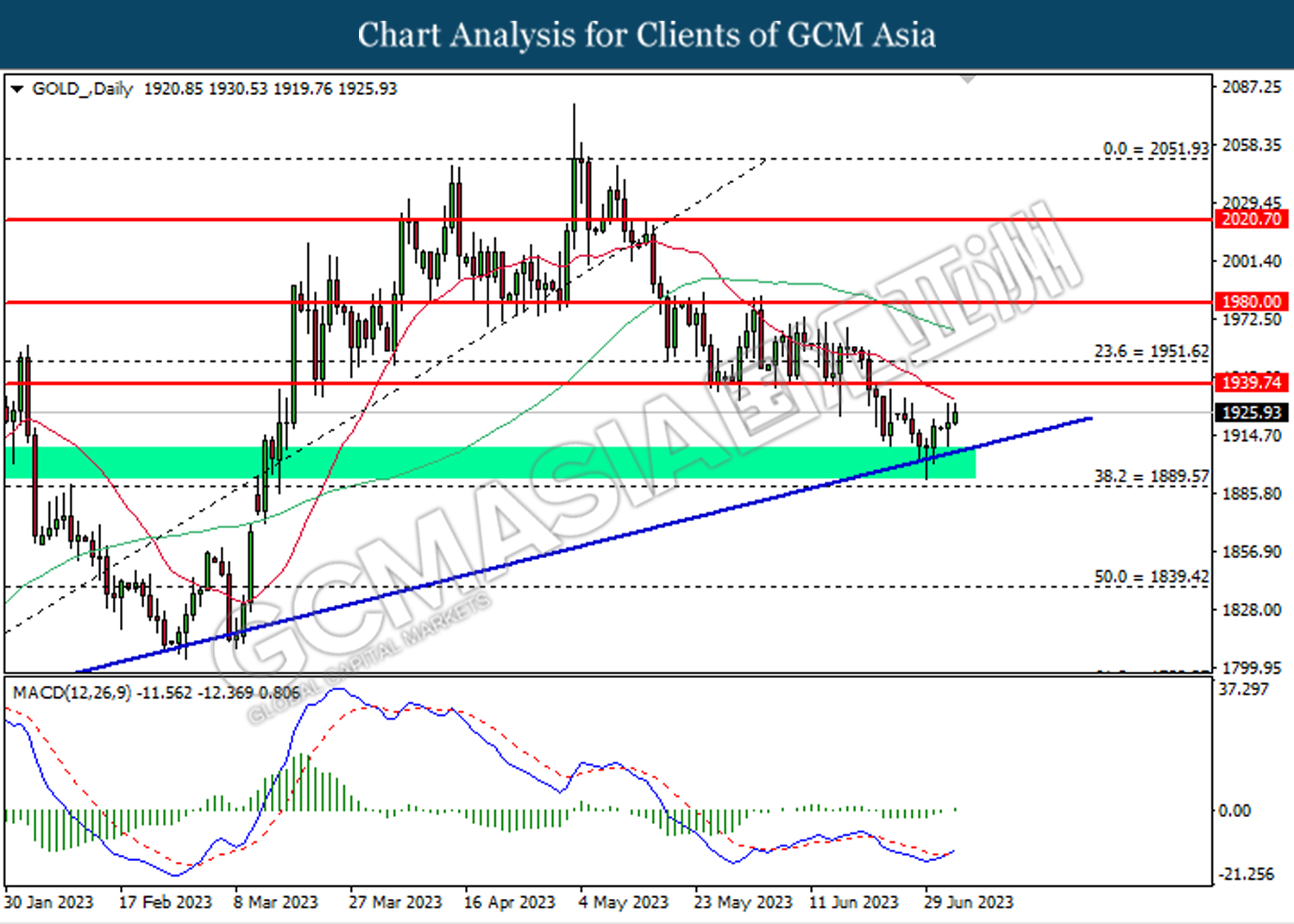

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40