05 August 2020 Morning Session Analysis

Aussie surged over the monetary statement.

The Australian Dollar surged over the hawkish statement from the Reserve Bank of Australia. According to the Australia’s Monetary Policy Statement, the central bank held its monetary policy unchanged while maintaining its benchmark interest rate at 0.25% during the latest monetary meeting. Besides, they reiterated that the economic stimulus package from the central bank in order to support for the Australian economy is working better than expectation. There is a very high level of liquidity in the Australian financial system and borrowing rates are maintained at historical lows level. Indeed, they will still remain their footsteps at Monetary easing while eyeing on the global growth risk, more stimulus can be anticipated if the course of events urges their economy growth goes against their expectation. Besides that, the Australian dollar extend its gains over the backdrop of the positive economic data on yesterday. The Australian Bureau of Statistics have shown that the Australia Retail Sales for last month came in at 2.7%, confounding market forecast for a reading up to 2.4%. As of writing, AUD/USD surged 0.02% to 0.7155.

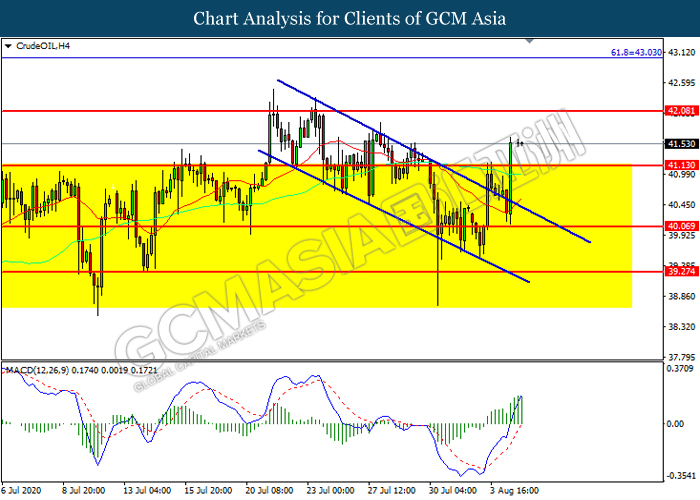

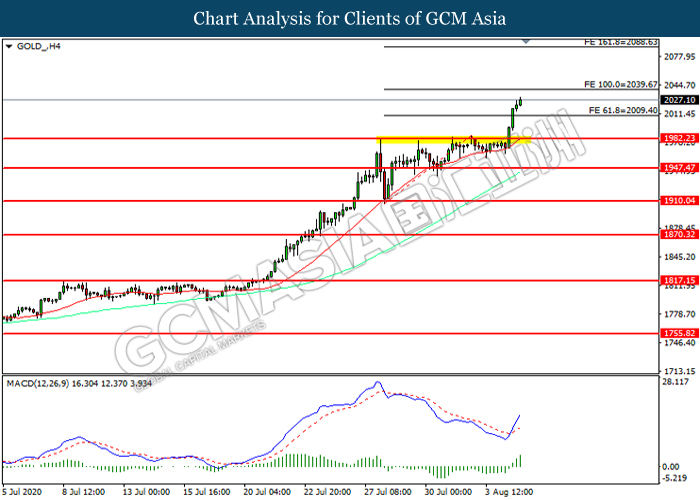

In the commodities market, the crude oil price appreciated by 0.05% to $41.51 per barrel as of writing. The oil price spiked up following the API Weekly Crude Oil stockpiles fell another 8.6 million barrels for the week ending 1st August. As for now, investors would continue to scrutinize the Energy Information Administration (EIA) inventory data in order to receive further trading signals. On the other hand, the gold price appreciated by 0.16% to $2022.65 per troy ounces as of writing amid the worsening conditions of the coronavirus infections, which sparkling the demand for the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Jul) | 47.7 | 57.1 | – |

| 16:30 | GBP – Services PMI (Jul) | 47.1 | 56.6 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Jul) | 2,369K | 1,500K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 57.1 | 55.0 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -10.612M | 0.357M | – |

Technical Analysis

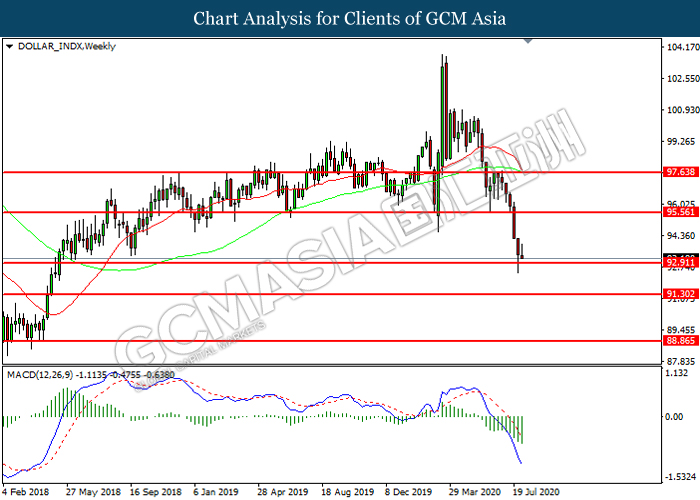

DOLLAR_INDX, Weekly: Dollar index was traded lower while currently testing the support level at 92.90. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 95.55, 97.65

Support level: 92.90, 91.30

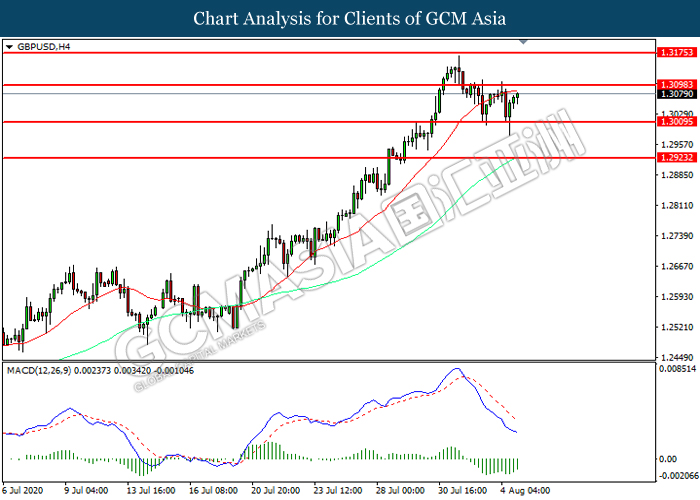

GBPUSD, H4: GBPUSD was traded higher while currently near the resistance level at 1.3100. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3100, 1.3175

Support level: 1.3010, 1.2925

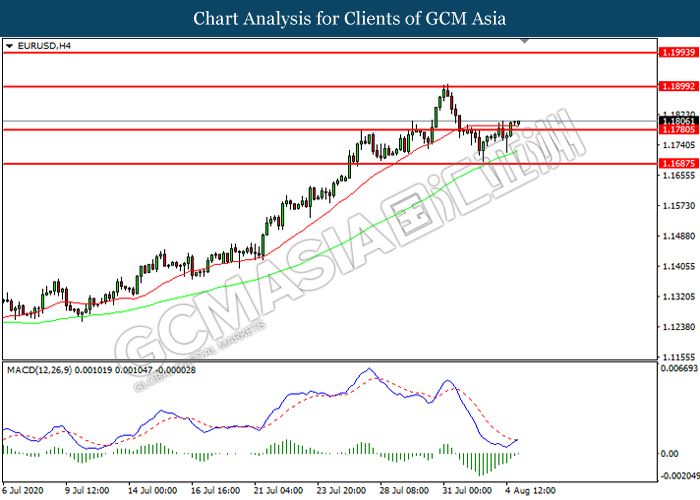

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.1780. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 1.1900.

Resistance level: 1.1900, 1.1995

Support level: 1.1780, 1.1685

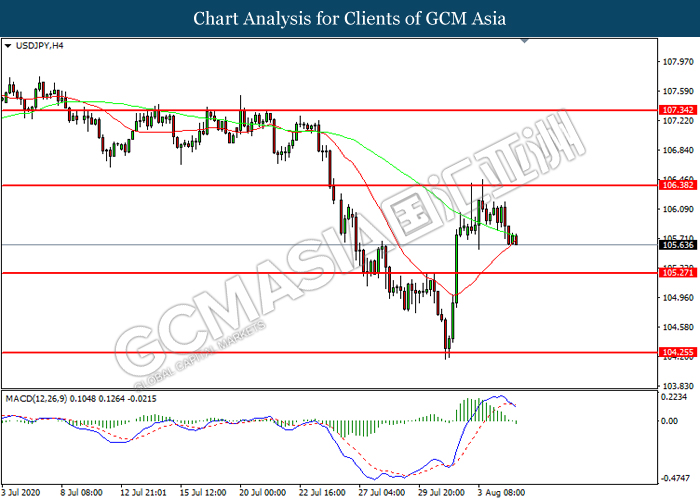

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 106.40. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 105.25.

Resistance level: 106.40, 107.35

Support level: 105.25, 104.25

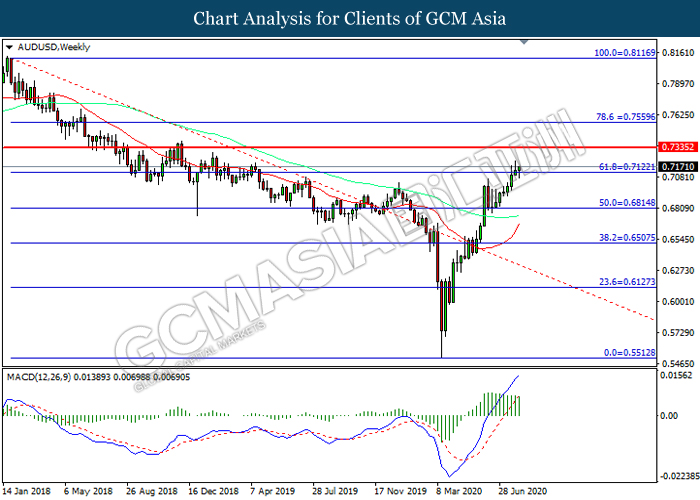

AUDUSD, Weekly: AUDUSD was higher following prior breakout above the previous resistance level at 0.7120. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7335, 0.7560

Support level: 0.7120, 0.6815

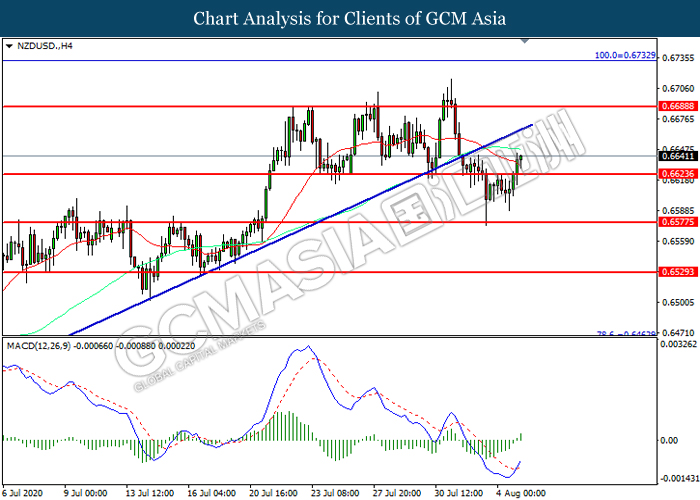

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6625. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6690.

Resistance level: 0.6690, 0.6735

Support level: 0.6625, 0.6575

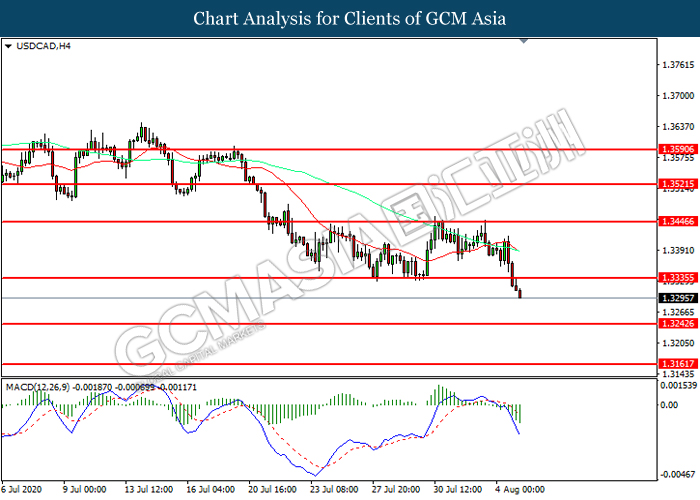

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3335. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3245.

Resistance level: 1.3335, 1.3445

Support level: 1.3245, 1.3160

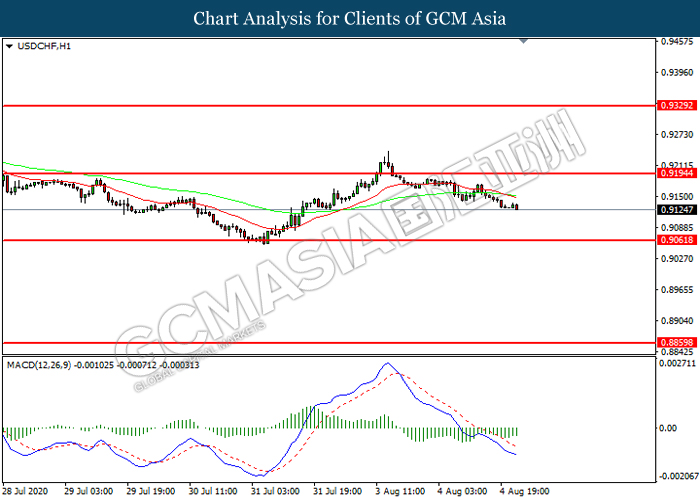

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level at 0.9195. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9195, 0.9330

Support level: 0.9060, 0.8860

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 41.15. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 42.10.

Resistance level: 42.10, 43.05

Support level: 41.15, 40.05

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level at 2010.40. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level at 2039.65.

Resistance level: 2039.65, 2088.65

Support level: 2009.40, 1982.25