5 August 2022 Afternoon Session Analysis

US Dollar under pressure over the bearish employment data.

The Dollar Index which traded against a basket of six major currencies dropped significantly after the downbeat economic data has been unleashed. According to the US Department of Labor, the US Initial Jobless Claims notched up from the previous reading of 254K to 260K, exceeding the consensus forecast of 259K. The rising of jobless claims data indicated the softening in the labor market, which brought negative prospects for economic progression in the US. Though, the losses experienced by Dollar Index was limited following the hawkish statement from the Fed member. Cleveland Fed President Loretta Mester claimed on Thursday that the central bank should raise its interest rate to above 4% to tackle inflation, and the policy aimed to keep tightening through the first half of next year. As of now, investors would highly focus on the Nonfarm Payrolls and Unemployment Rate from the US to receive further trading signals. As of writing, the Dollar Index appreciated by 0.19% to 105.77.

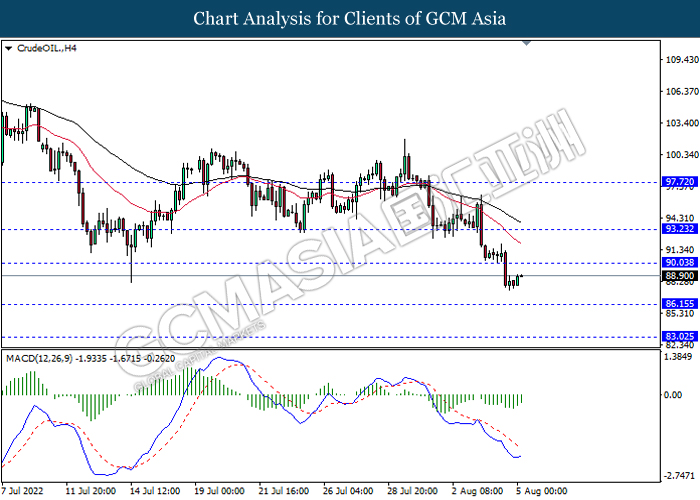

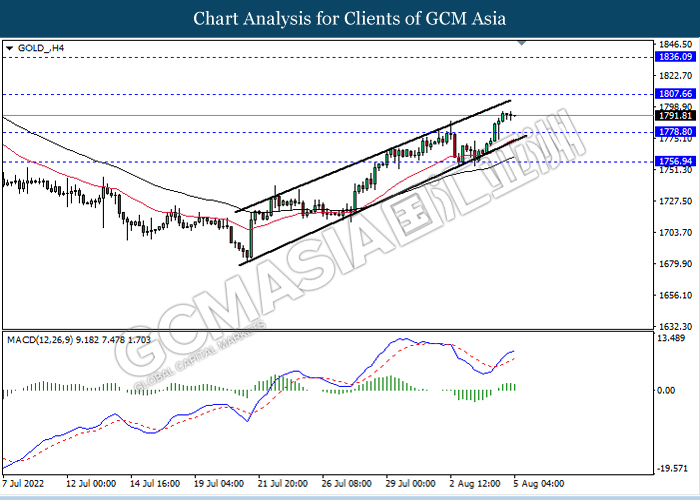

In the commodities market, the crude oil price rose by 0.42% to $88.91 per barrel as of writing after a sharp decline throughout the overnight session following the worries about global economy slowdown keep hovering in the market. Besides that, the gold price edged down by 0.01% to $1789.91 per troy ounce as of writing. However, the gold price surged on yesterday amid the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 372K | 250K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 3.6% | 3.6% | – |

| 20:30 | CAD – Employment Change (Jul) | -43.2K | 20.0K | – |

| 22:00 | CAD – Ivey PMI (Jul) | 62.2 | 60.0 | – |

Technical Analysis

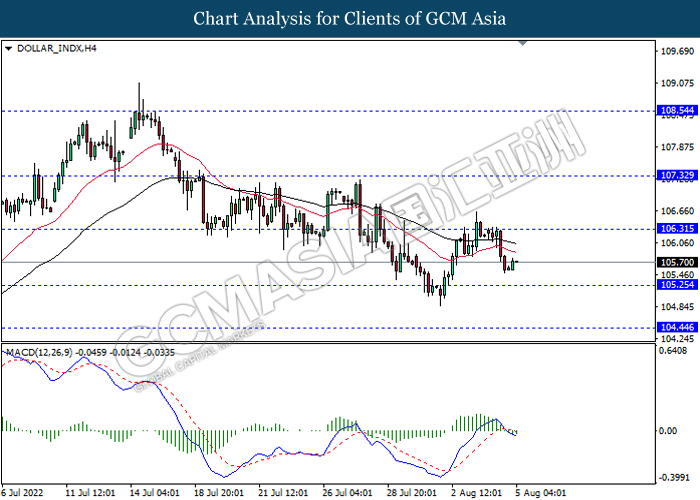

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its gains.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

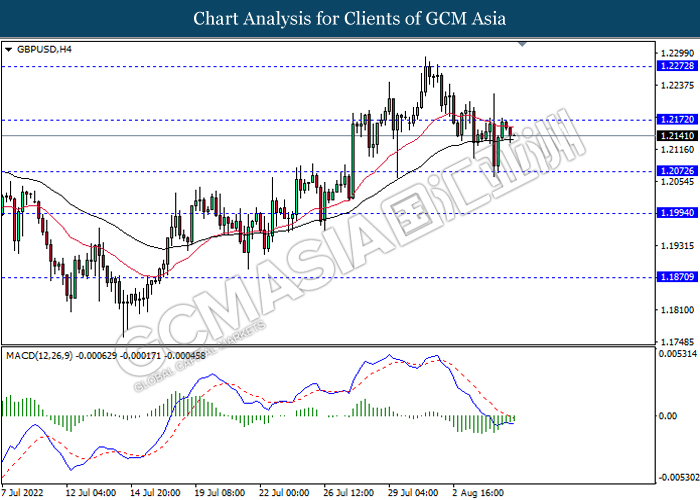

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2170, 1.2270

Support level: 1.2070, 1.1995

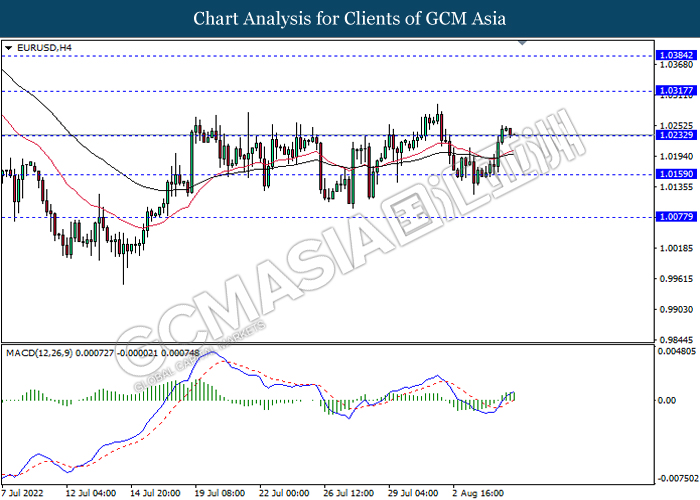

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0315, 1.0385

Support level: 1.0230, 1.0160

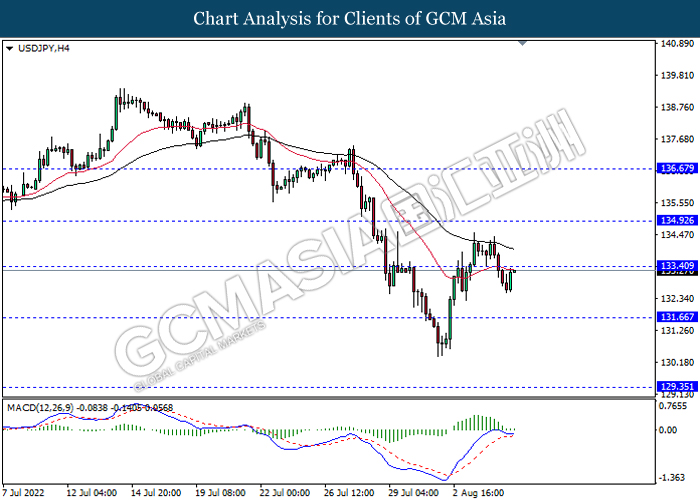

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 133.40, 134.90

Support level: 131.65, 129.35

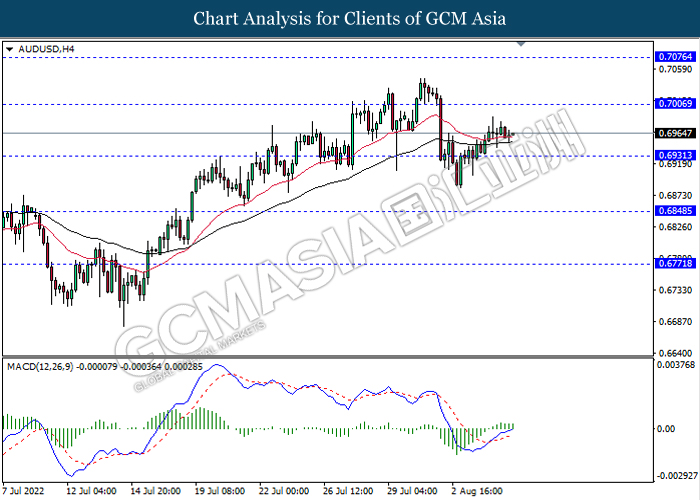

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

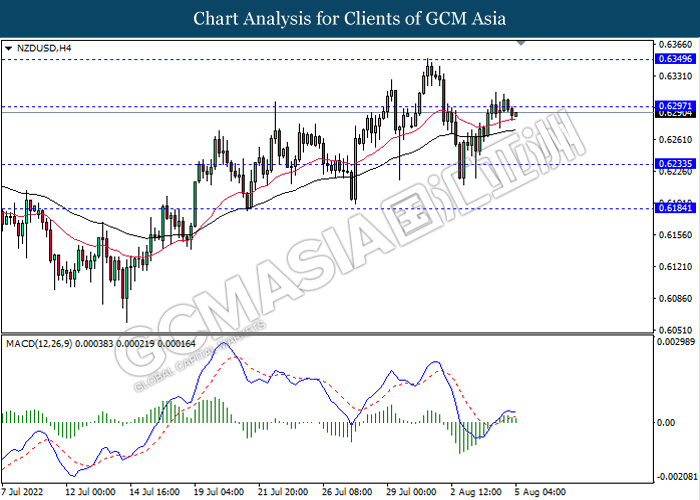

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

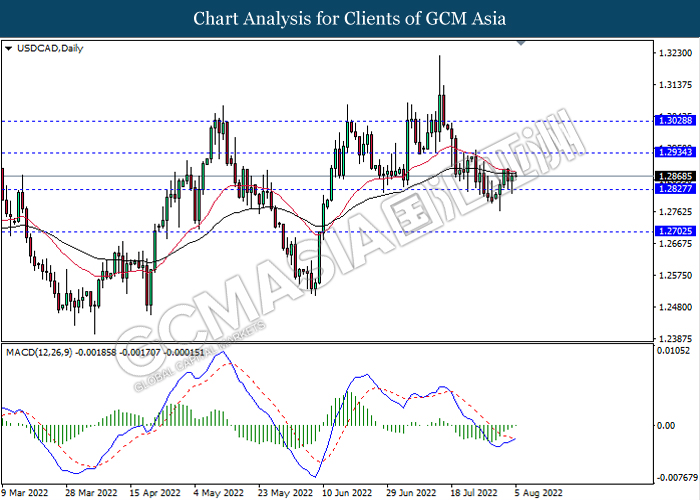

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

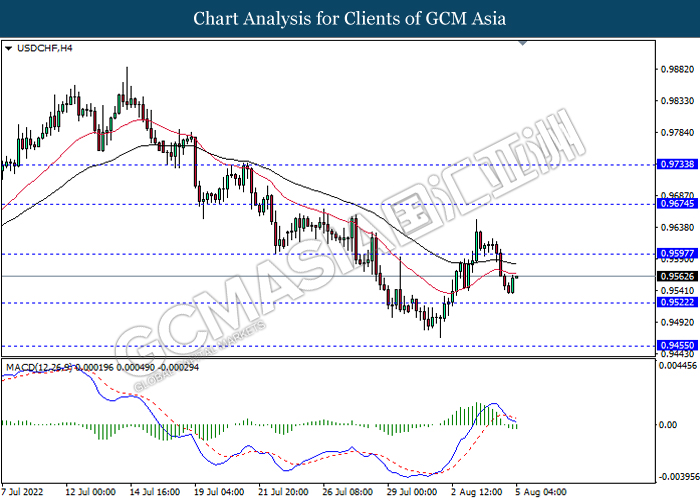

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 90.05, 93.25

Support level: 86.15, 83.00

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1807.65, 1836.10

Support level: 1778.80, 1756.95