5 August 2022 Morning Session Analysis

Pound plummeted following the BoE Interest Rate Decision.

The Pound Sterling, which is widely traded by the investors in globe, plunged significantly after the Bank of England (BoE) interest rate decision has been released. During the BoE meeting, the policymakers have decided to raise the interest rates by 50 basis points from 1.25% to1.75%, the biggest rate hike since 1995. The Monetary Policy Committee revealed that the big rate hike was aimed to tackle the extraordinarily high inflationary pressures in the UK. However, the sell-off pressures were quite heavy last night as a pessimistic statement has been given by the members of BoE. The MPC projects UK to enter into a recession in the 4th quarter of 2022, while expecting it will last for 5 quarters, the longest recession since the global financial crisis. Besides, the BoE also emphasized that the latest surge in gas prices will also further exacerbate the dire outlook for activity in the UK. With the outlook for the UK economic growth remain clouded, the investors flee away from the Pound market and shift their capital to other market. As of writing, the pair of GBP/USD rose 0.01% to 1.2160.

In the commodities market, the crude oil price up 0.20% to $88.00 a barrel after plunging more than 1.3% yesterday as the recession fears continues to grow and investors fear a demand drop for the commodity. Besides, the gold prices rose 0.02% to $1790.40 per troy ounce amid the heightening of geopolitical tensions between the US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 372K | 250K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 3.6% | 3.6% | – |

| 20:30 | CAD – Employment Change (Jul) | -43.2K | 20.0K | – |

| 22:00 | CAD – Ivey PMI (Jul) | 62.2 | 60.0 | – |

Technical Analysis

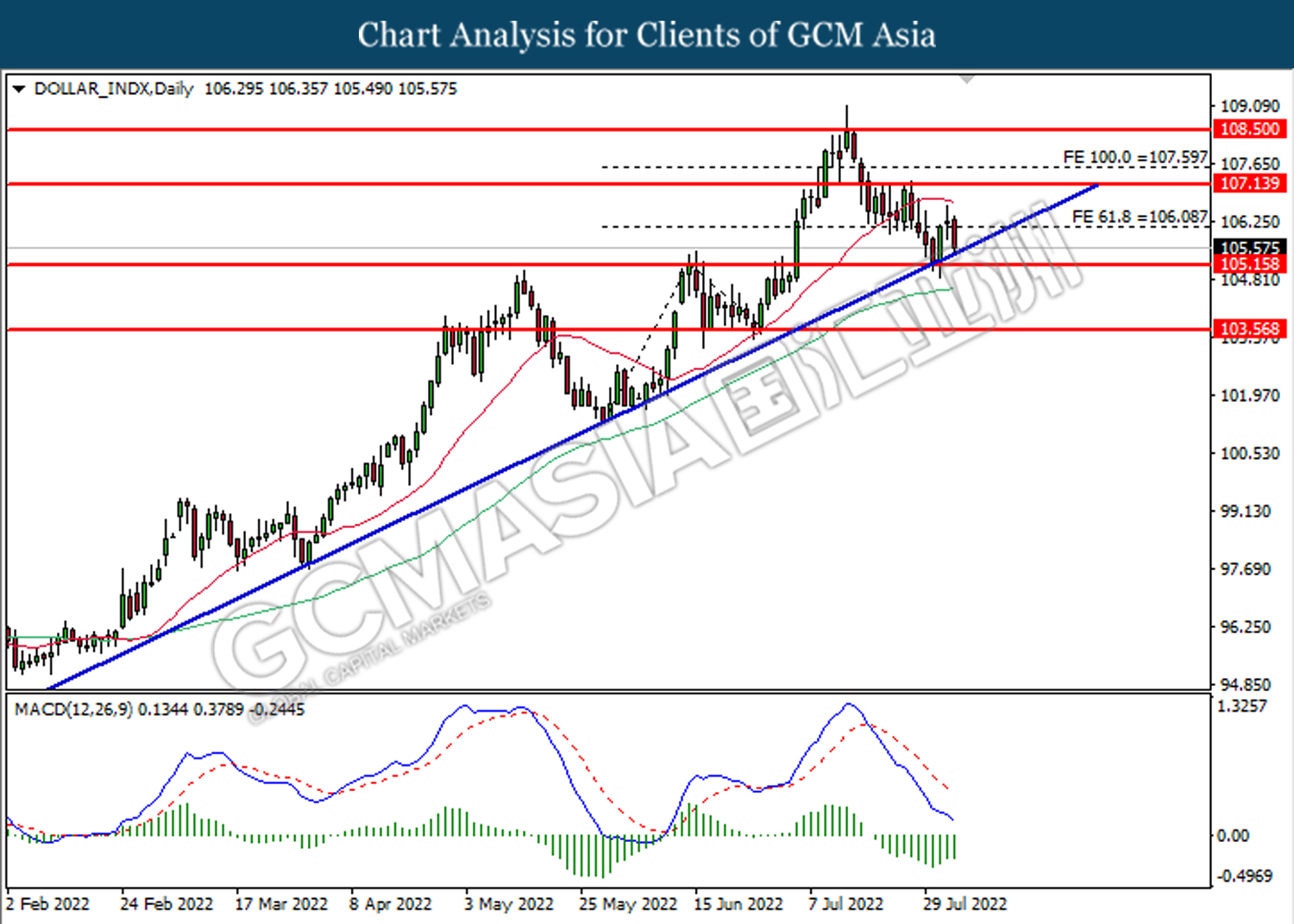

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the upward trendline. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo short-term correction.

Resistance level: 106.10, 107.15

Support level: 105.15, 103.55

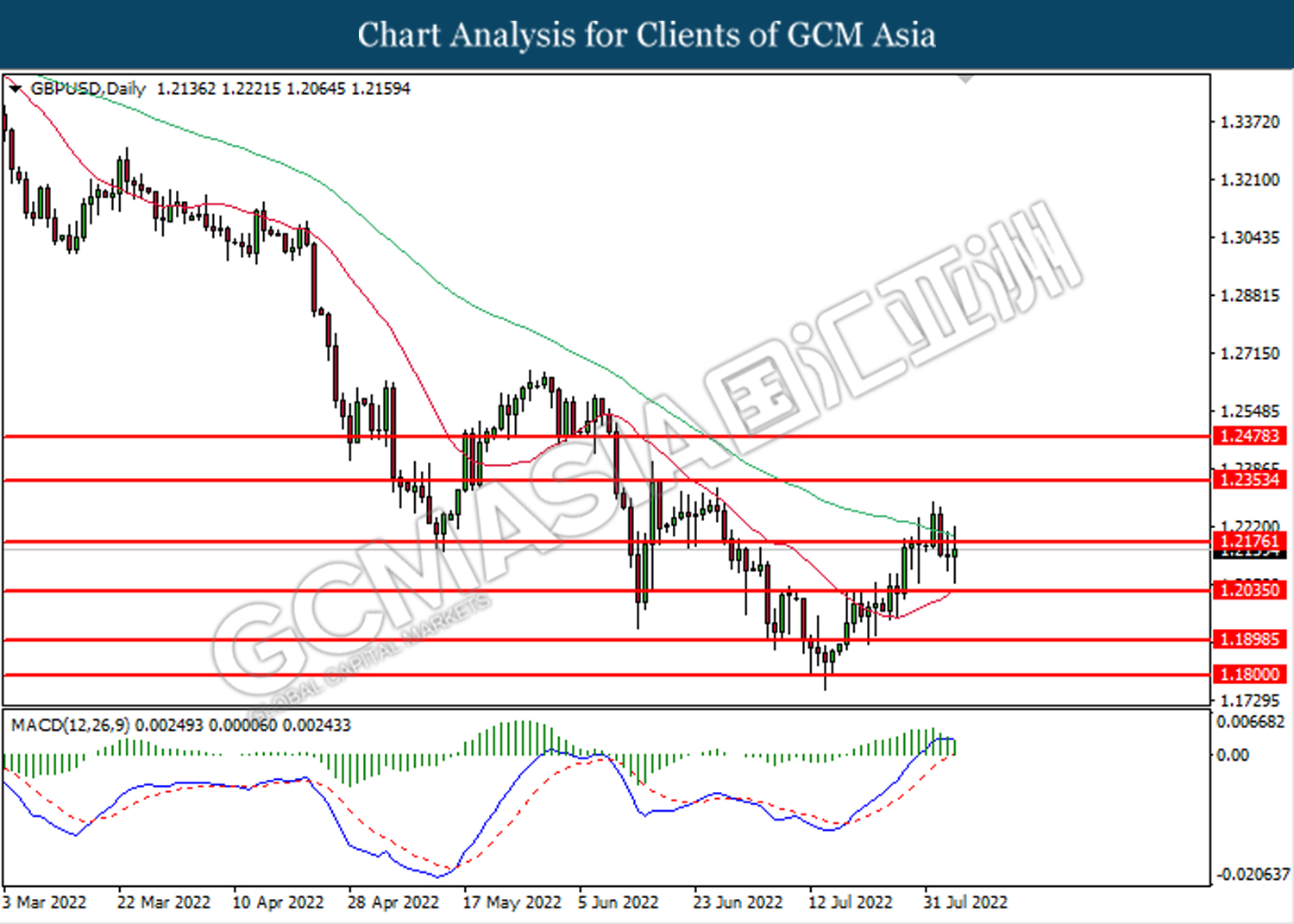

GBPUSD, Daily: GBPUSD was traded higher while currently retesting the resistance level at 1.2175. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction toward the lower level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

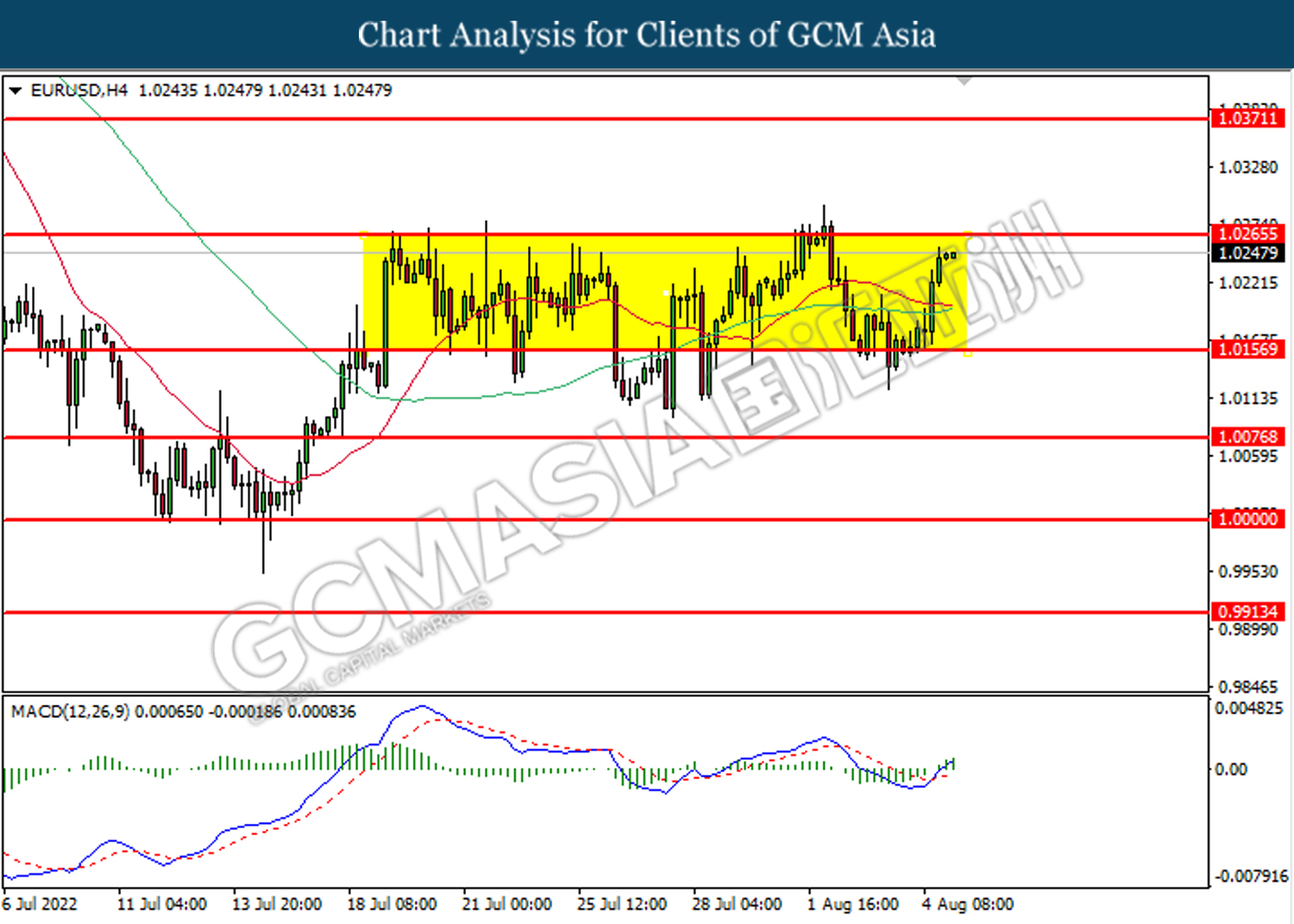

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

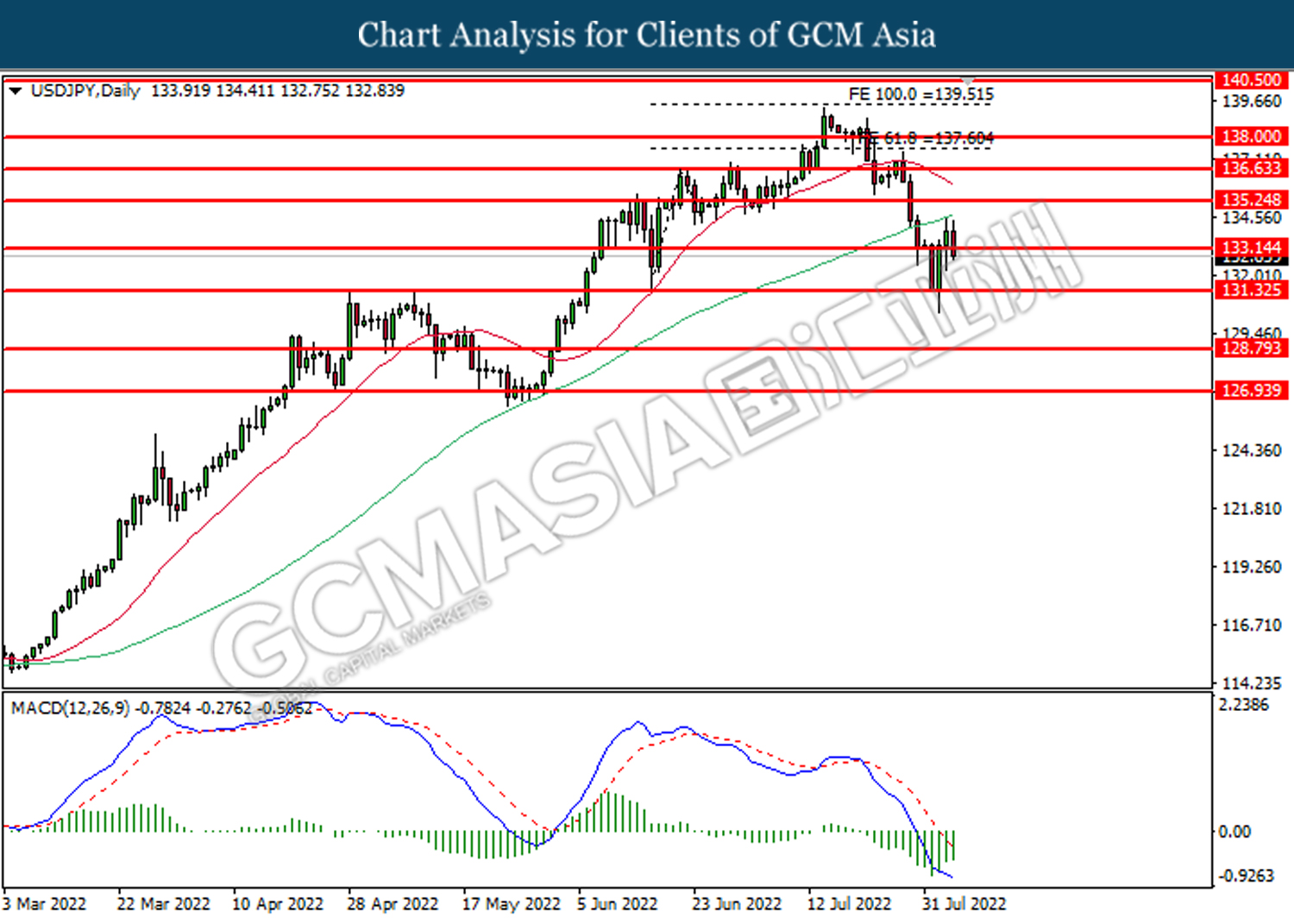

USDJPY, Daily: USDJPY was traded lower while currently retesting the support level at 133.15. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo short-term technical rebound.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

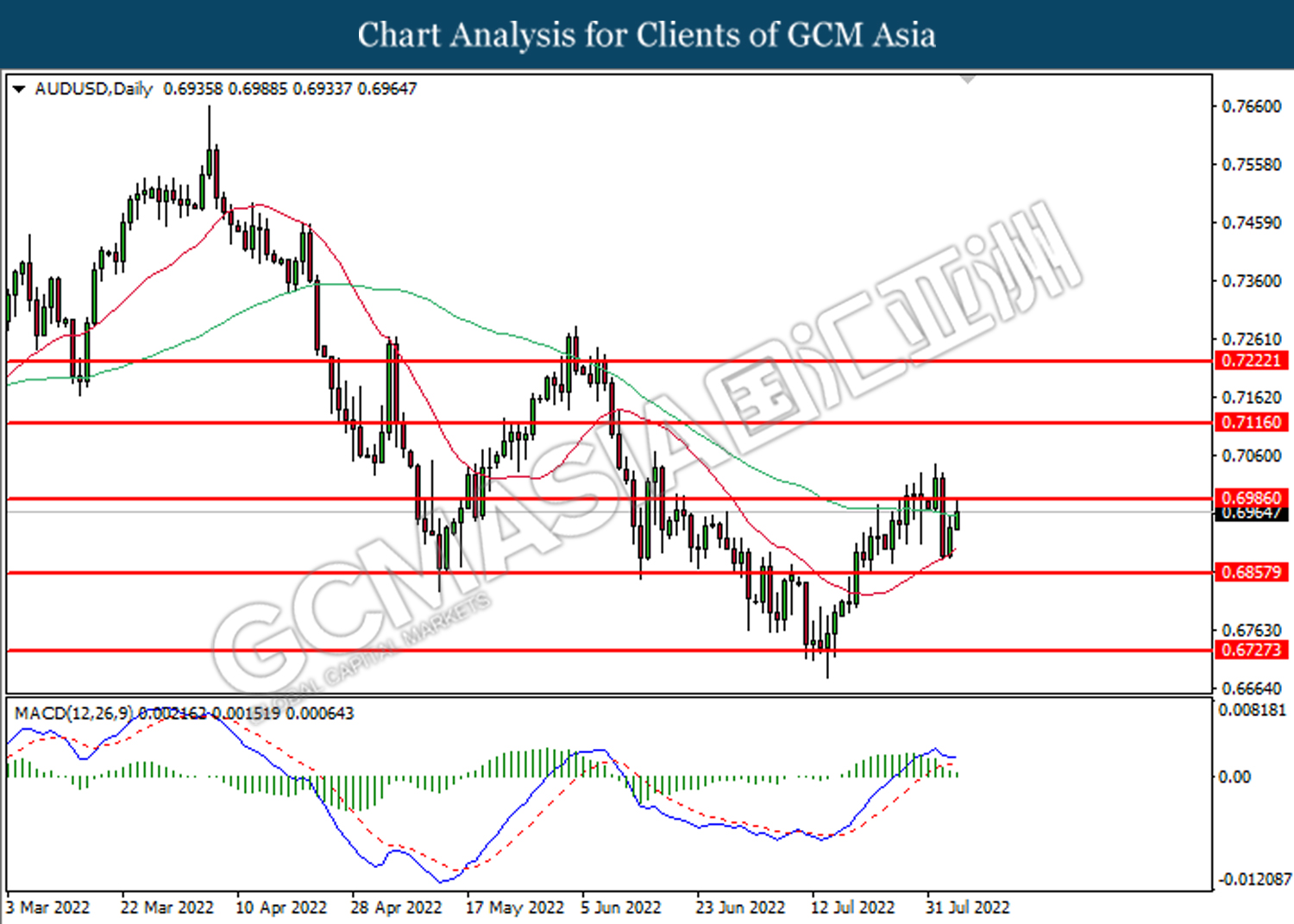

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

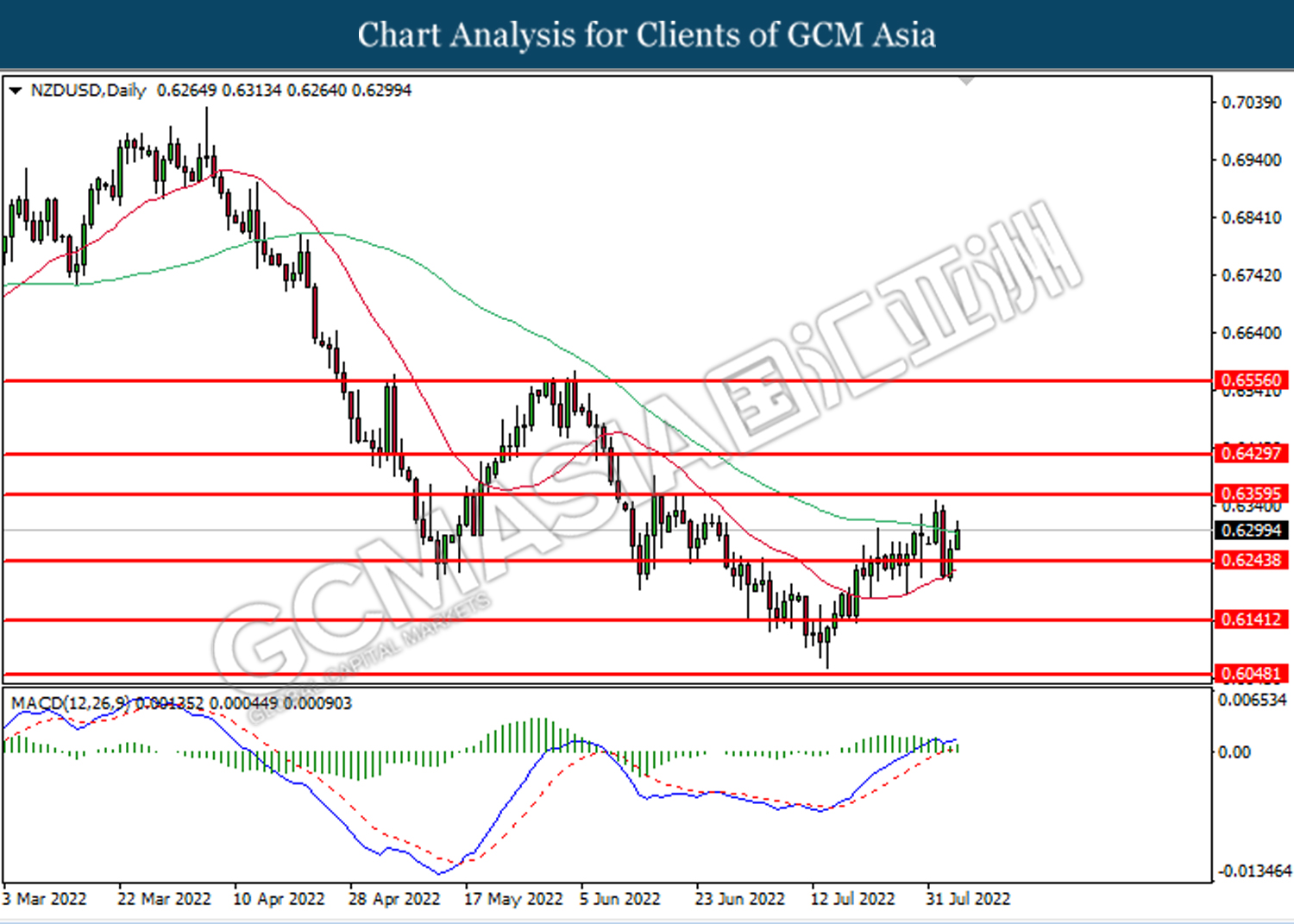

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

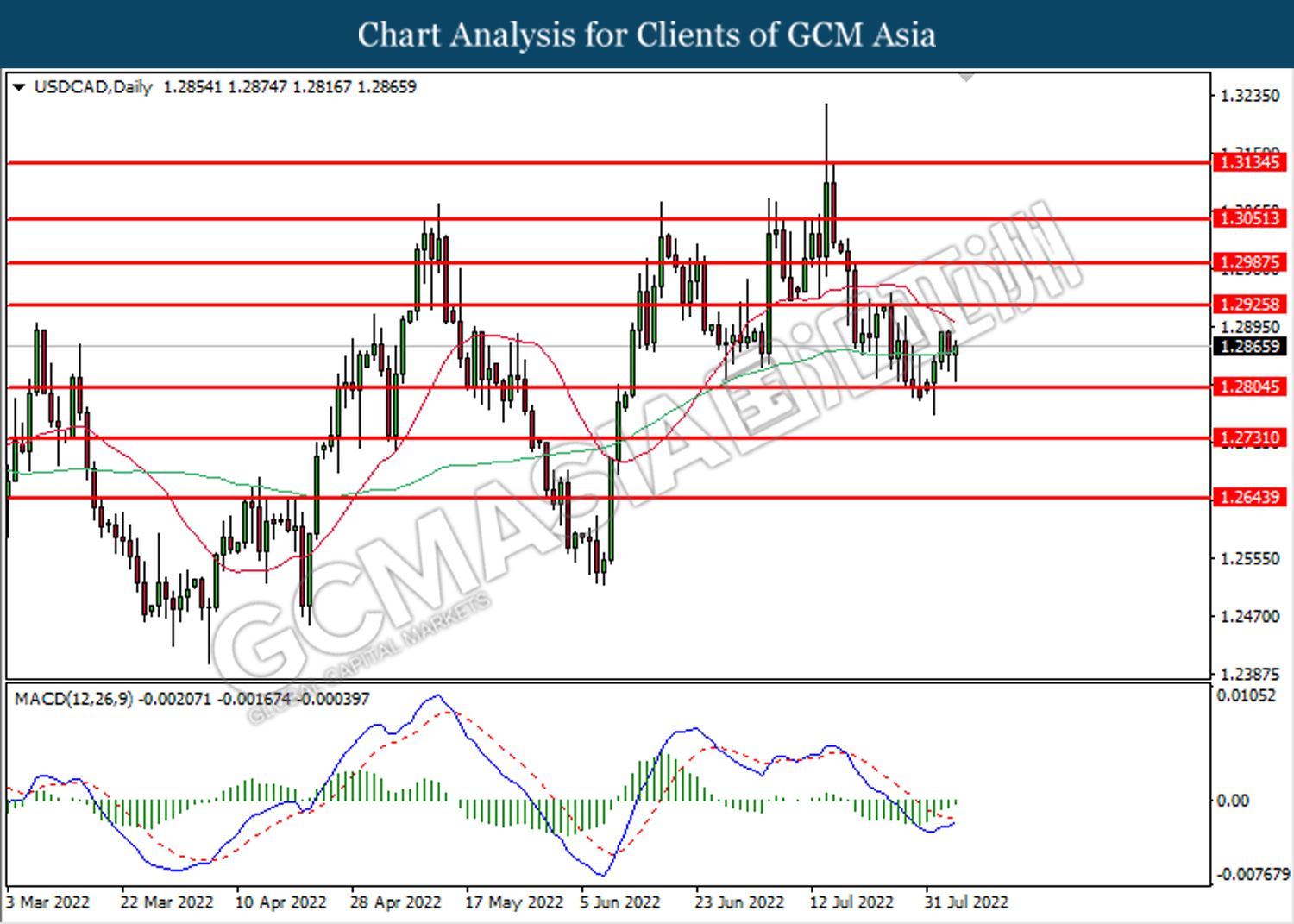

USDCAD, Daily: USDCAD was traded higher following prior rebound near the support level at 1.2805. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2925.

Resistance level: 1.2925, 1.2985

Support level: 1.2805, 1.2730

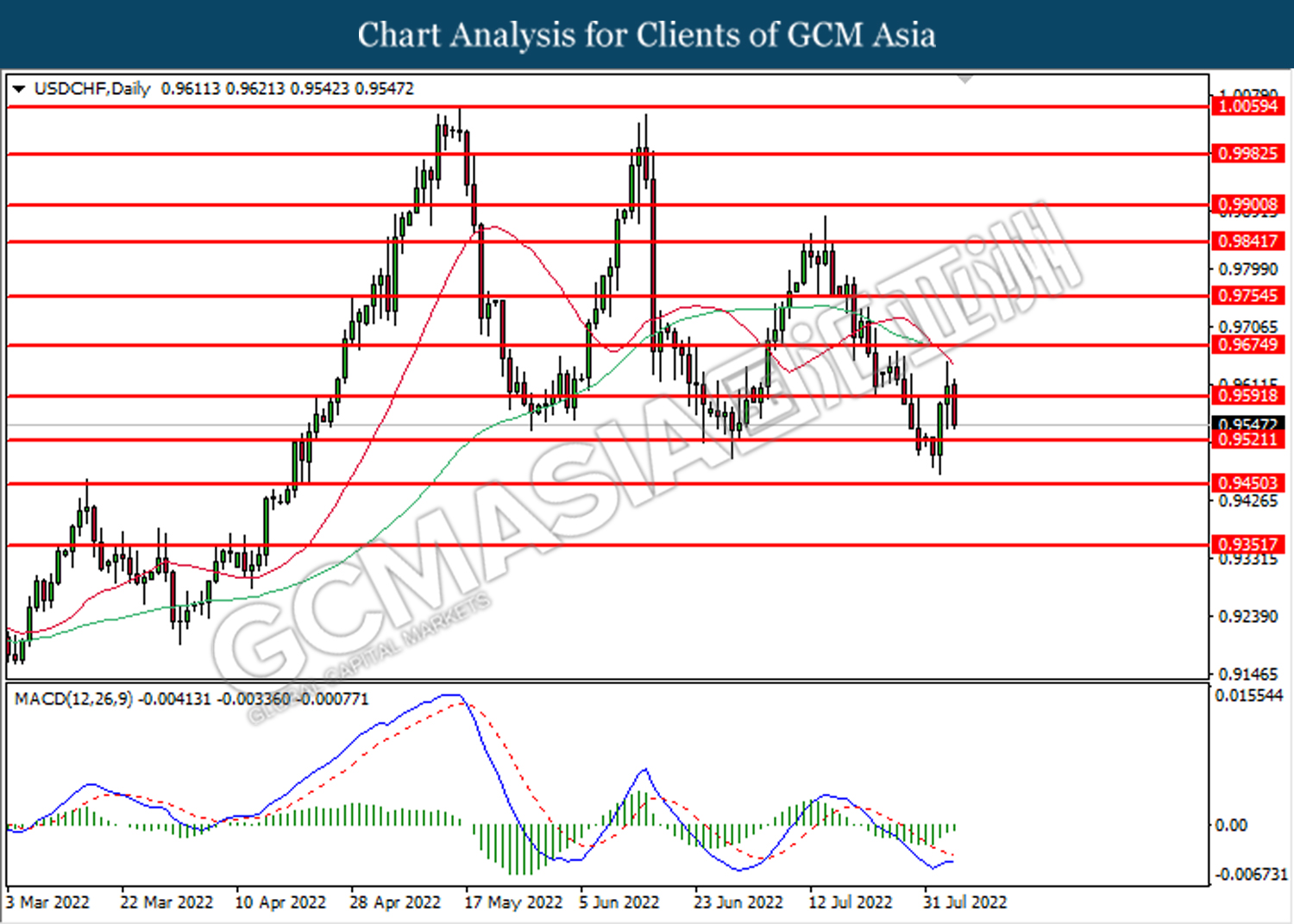

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9590. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo short-term technical rebound.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

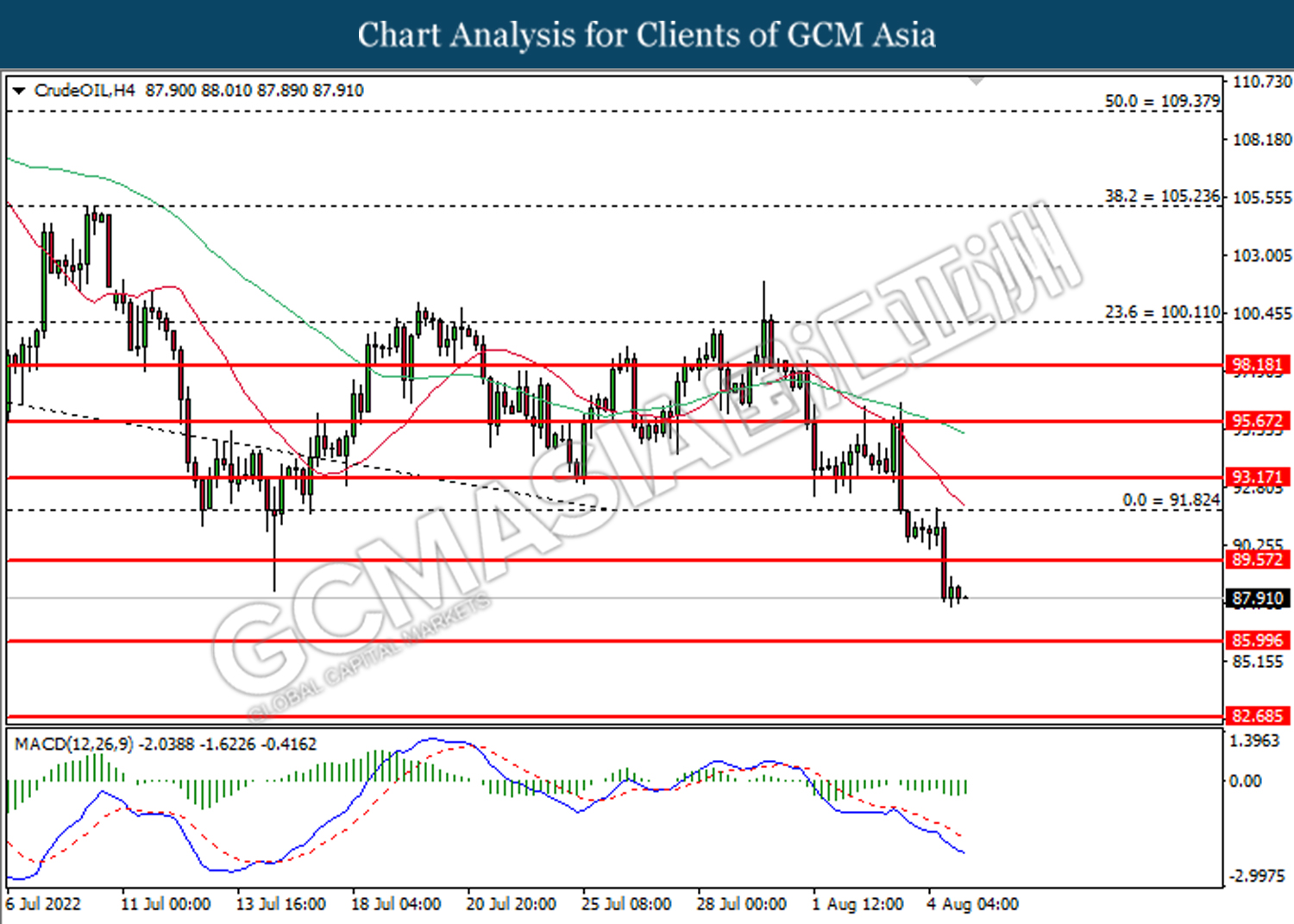

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 89.55. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 86.00.

Resistance level: 89.55, 91.80

Support level: 86.00, 82.70

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1783.20. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1783.20, 1829.75

Support level: 1770.05, 1729.25