5 October 2022 Afternoon Session Analysis

Euro extends its gains as hawkish tone from ECB.

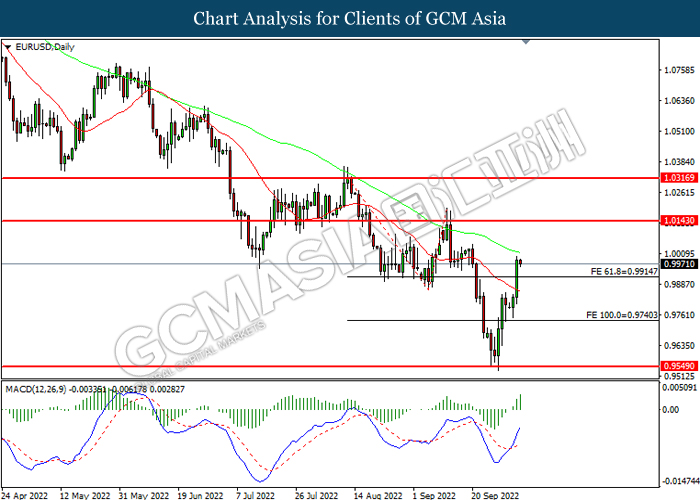

The Euro extends its gains following the European Central Bank unleashed their hawkish tone toward the economic prospect. According to Reuters, the European Central Bank claimed that they would begin to stop stimulating the economy through its monetary policy as inflation rate climbed to all time high, while reiterating to increase interest rate back to its “neutral” territory. Earlier, the Euro zone inflation exceeded past forecasts to hit 10.0% in September, a new record high which will reinforce the European Central Bank for another jumbo interest rate hike next month. Recently, the energy prices started to rebound from its lower level over the speculation of OPEC oil cut, which continue to spur further inflation risk for the Euro zone. While the ECB’s next interest rate meeting is still almost a month away, the policymakers have already made statement with regards of another 75-basis point rate hike on 27th October following a combined 125 basis point of moves in earlier two meetings. As of writing, EUR/USD depreciated by 0.14% to 0.9965.

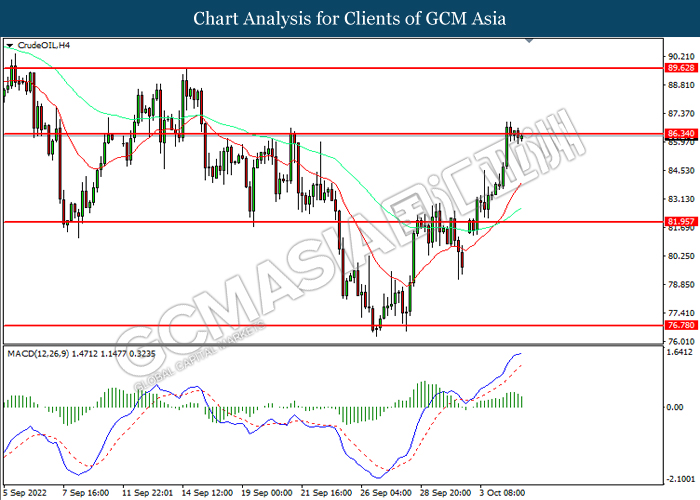

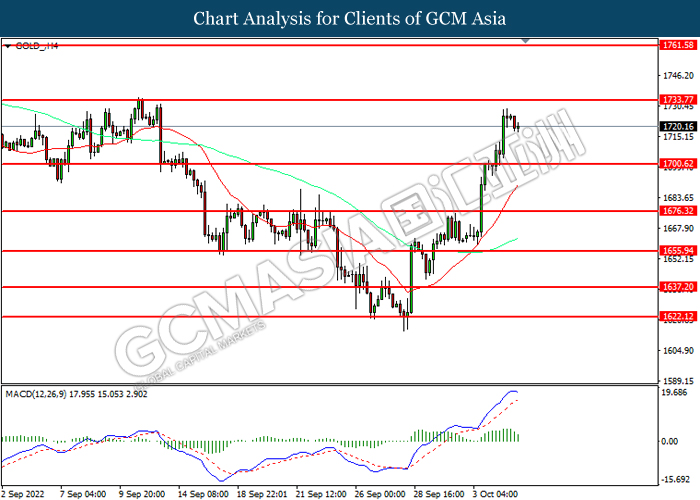

In the commodities market, the crude oil price appreciated by 0.01% to $86.15 per barrel as of writing over the backdrop of downbeat inventory data. According to American Petroleum Institute (API), US API Weekly Crude Oil Stock came in at -1.770M, missing the market forecast at 1.966M. On the other hand, the gold price appreciated by 0.39% to $1719.30 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Sep) | 48.4 | 48.4 | – |

| 16:30 | GBP – Services PMI (Sep) | 49.2 | 49.2 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Sep) | 132K | 205K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Sep) | 56.9 | 56 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.215M | – | – |

Technical Analysis

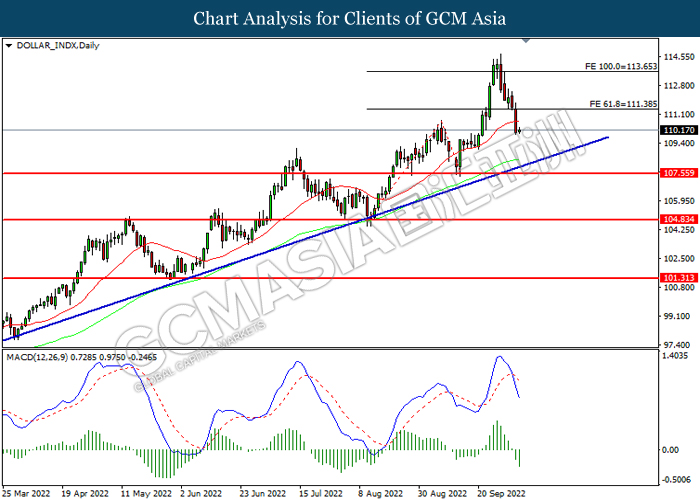

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 111.40, 113.65

Support level: 107.55, 104.85

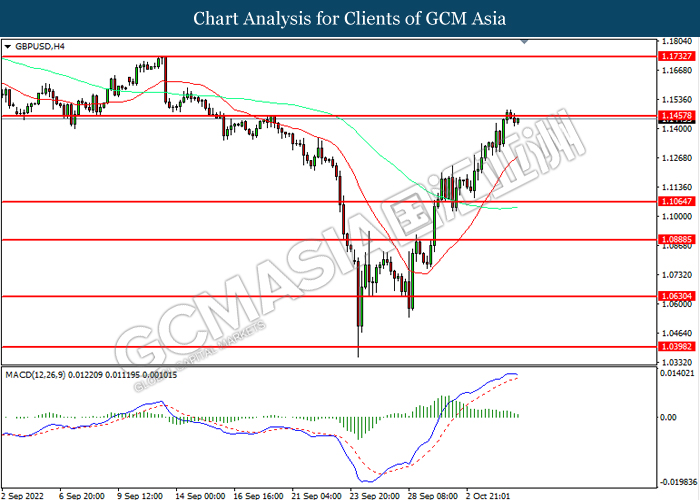

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1455, 1.1730

Support level: 1.1065, 1.0890

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0145, 1.0315

Support level: 0.9915, 0.9740

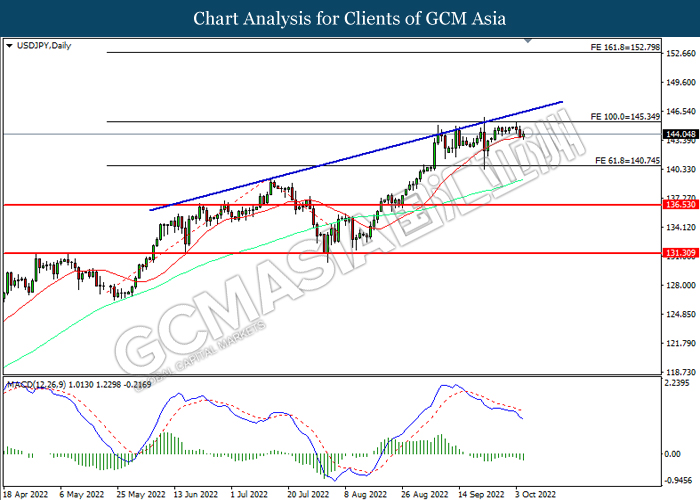

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 145.35, 152.80

Support level: 140.75, 136.55

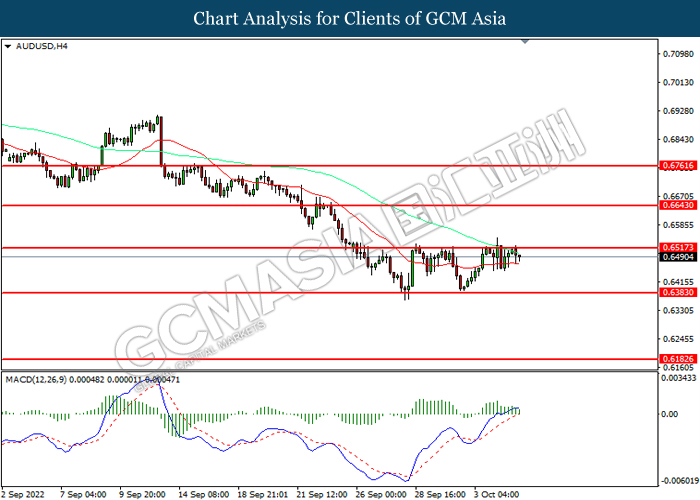

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6515, 0.6645

Support level: 0.6385, 0.6185

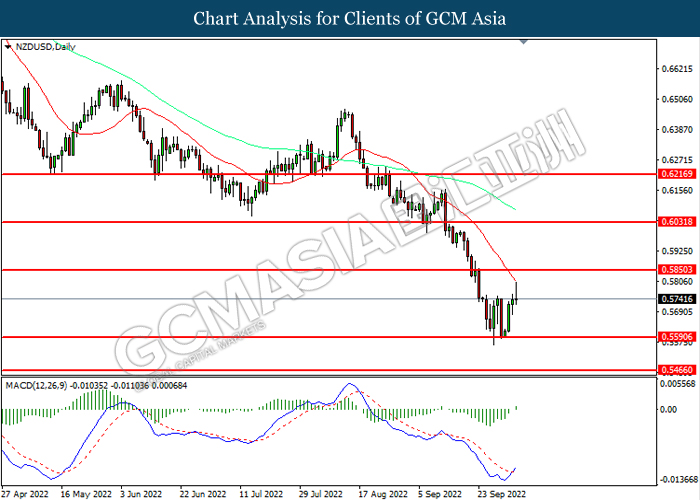

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.5850, 0.6030

Support level: 0.5590, 0.5465

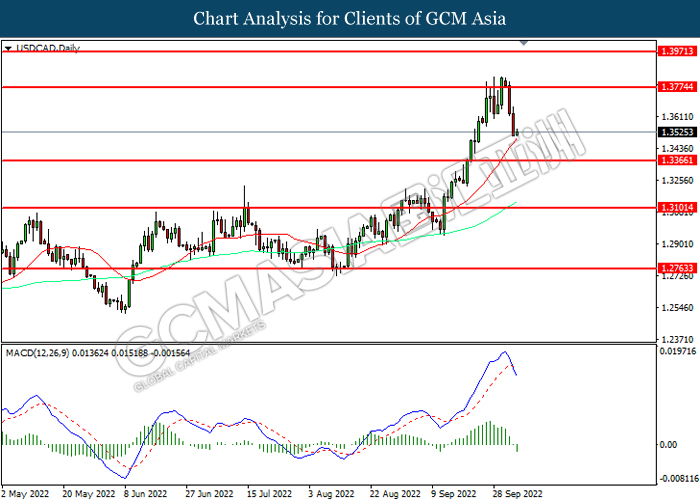

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3775, 1.3970

Support level: 1.3365, 1.3100

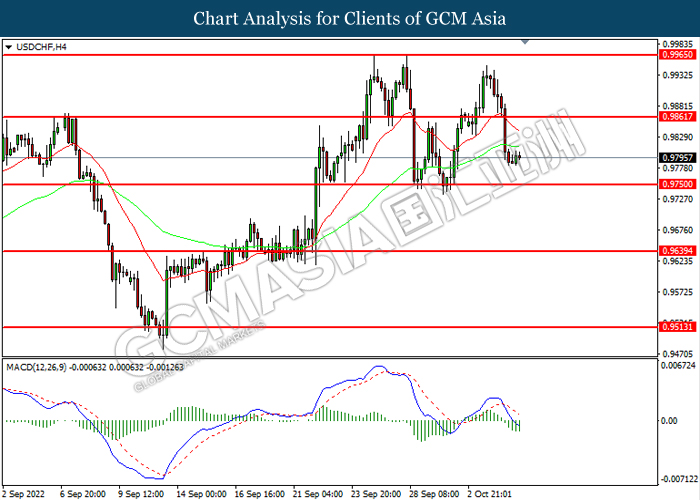

USDCHF, H4: USDCHF was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9860, 0.9965

Support level: 0.9750, 0.9640

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 86.35, 89.65

Support level: 81.95, 76.80

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1733.75, 1761.60

Support level: 1700.60, 1676.30