5 October 2022 Morning Session Analysis

US Dollar beaten down by bearish economic data.

The Dollar Index which traded against a basket of six major currencies slumped on yesterday after the downbeat employment data has been unleashed. According to Bureau of Labor Statistics, the US JOLTs Job Openings in August has notched down from the previous reading of 11.170M to 10.053M, missing the market forecast of 10.775M. It was the second biggest drop since the global Covid-19 lockdown in April 2020. The lower-than-expected figure of the data has shown that the job recruitments in the US was diminishing, which dialed down the market optimism toward economic progression in the US. Besides that, according to CNBC, the Chicago Purchasing Managers Index in September fell to its lowest level since 2020, and these two data might slow down the rate hike path of Fed in the upcoming meeting, which spurred further bearish momentum on the US Dollar. As of now, in order to gauge the likelihood movement of Dollar Index, market participants would pay their attentions on the announcement of ADP Nonfarm Employment data. As of writing, the Dollar Index dropped by 1.42% to 110.06.

In the commodities market, the crude oil price depreciated by 0.08% to $86.44 per barrel as of writing. Nonetheless, the current trend of oil price remained bullish over the output cut expectation from OPEC+. On the other hand, the gold price raised by 0.18% to $1724.70 per troy ounce as of writing amid the US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Sep) | 48.4 | 48.4 | – |

| 16:30 | GBP – Services PMI (Sep) | 49.2 | 49.2 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Sep) | 132K | 205K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Sep) | 56.9 | 56 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.215M | – | – |

Technical Analysis

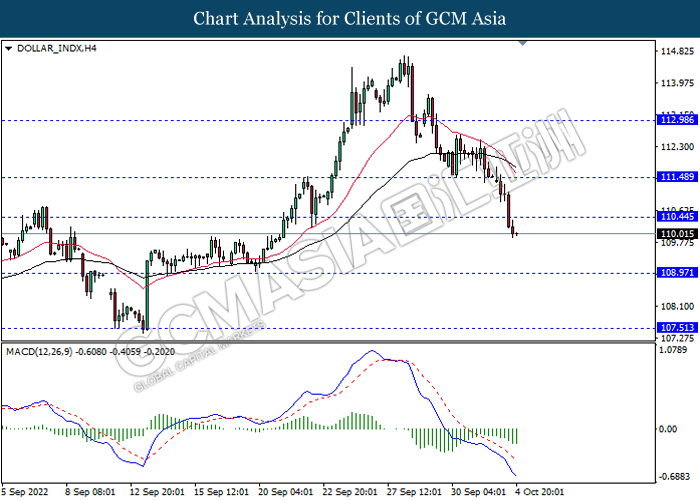

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 110.45, 111.50

Support level: 108.95, 107.50

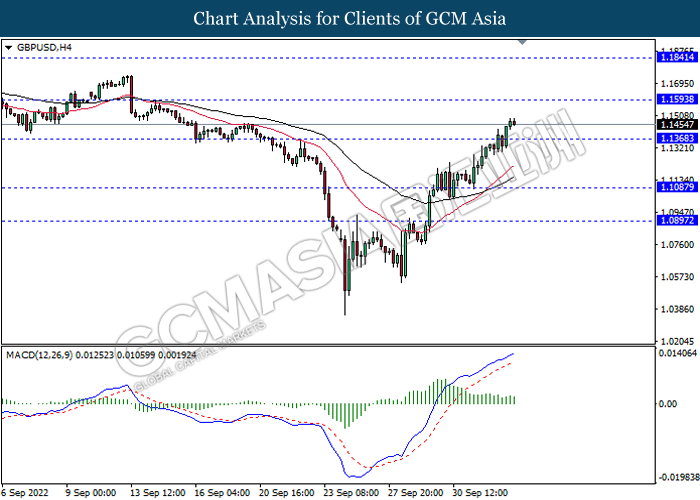

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1595, 1.1840

Support level: 1.1370, 1.1085

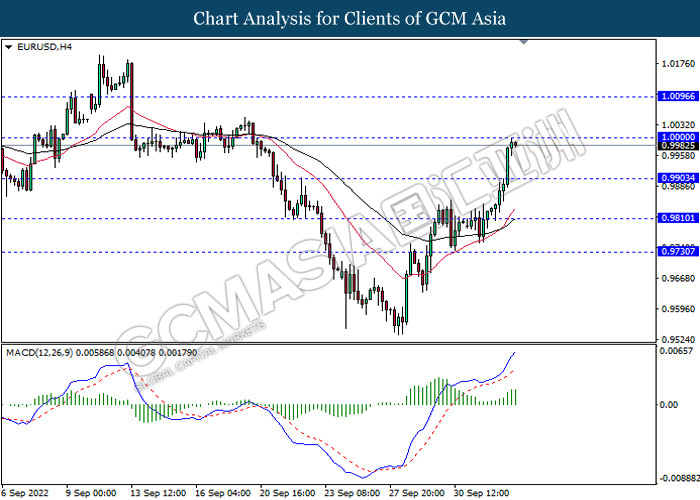

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0000, 1.0095

Support level: 0.9905, 0.9810

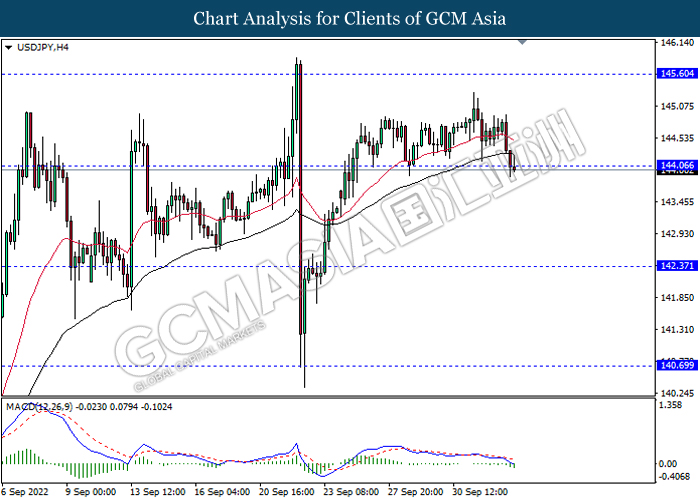

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 144.05, 145.60

Support level: 142.35, 140.70

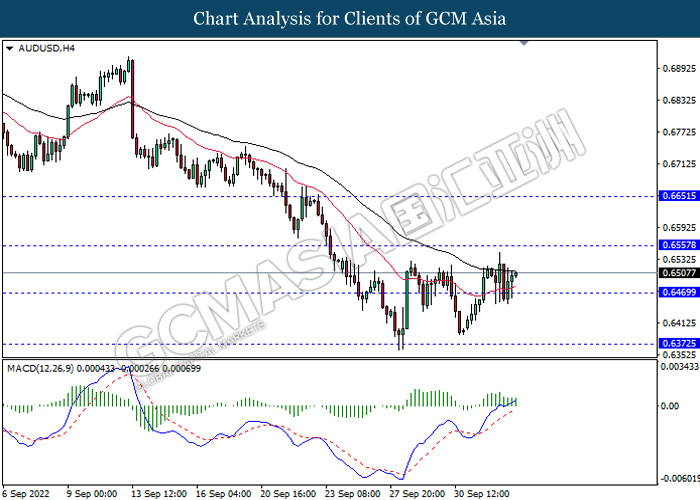

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

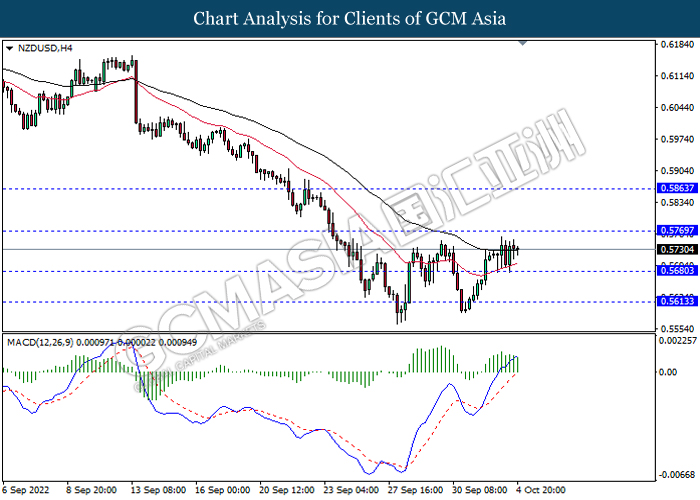

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.5770, 0.5865

Support level: 0.5680, 0.5615

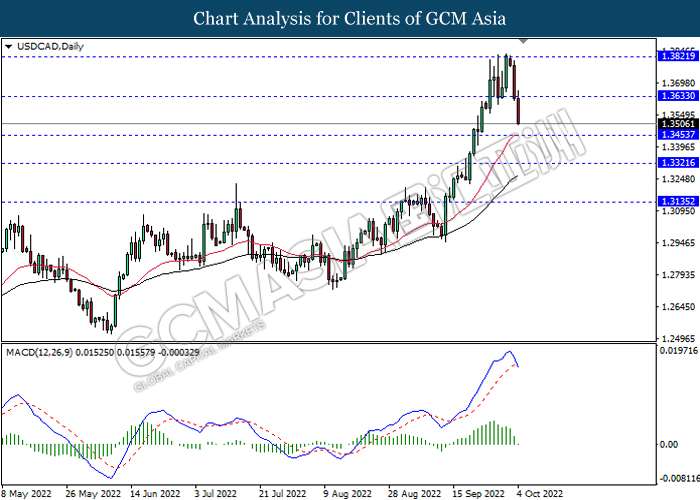

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

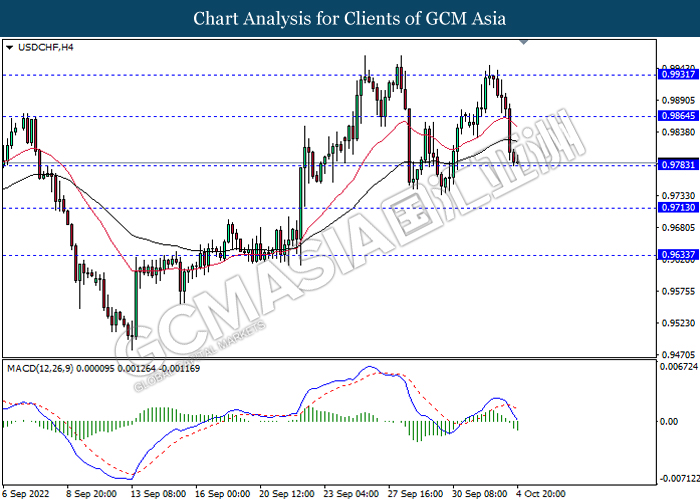

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9865, 0.9930

Support level: 0.9785, 0.9715

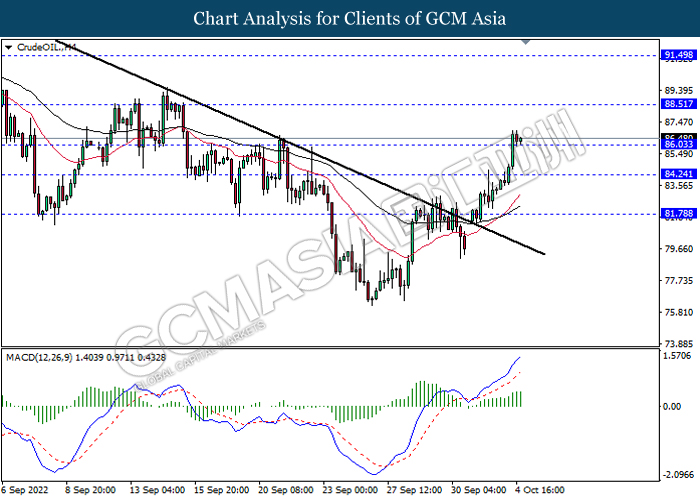

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 88.50, 91.50

Support level: 86.05, 84.25

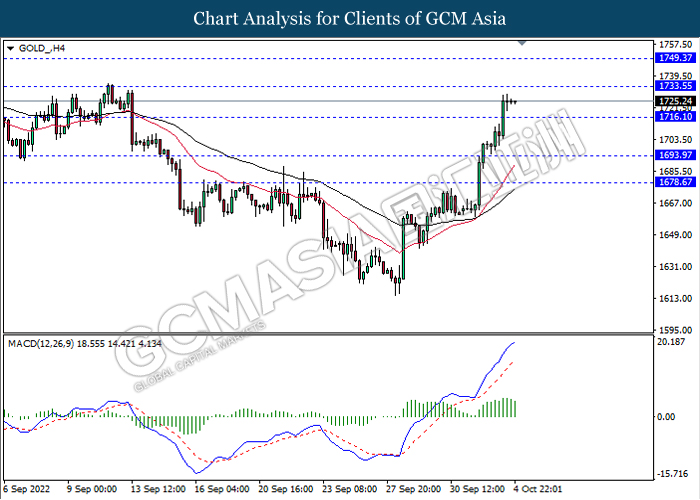

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1733.55, 1749.35

Support level: 1716.10, 1693.95