5 December 2022 Morning Session Analysis

US Dollar skyrocketed upon bullish NFP figures.

The Dollar Index which traded against a basket of six major currencies rose significantly after the upbeat NFP data has been released. According to Bureau of Labor Statistics, the US Nonfarm Payrolls for November came in at the reading of 263K, higher than the market forecast of 200K. Besides, the US Unemployment Rate, which was announced at the same time has remained unchanged from the prior. These essential data have shown that the current US labor market was more substantial than widely expected, as well as boosted up the market optimism toward aggressive rate hikes from Fed. Nonetheless, the Dollar Index has retreated from its gains following the speech of Fed member. According to Reuters, Richmond Fed President Thomas Barkin claimed on Friday that the US was likely in a sustained period in which there will remain a shortage of workers, which complicating the Fed’s aim of getting labor demand back into balance. With that, investors decided to flee away from the US market in order to anticipate further about interest rate decision from Fed. As of writing, the Dollar Index depreciated by 0.07% to 104.42.

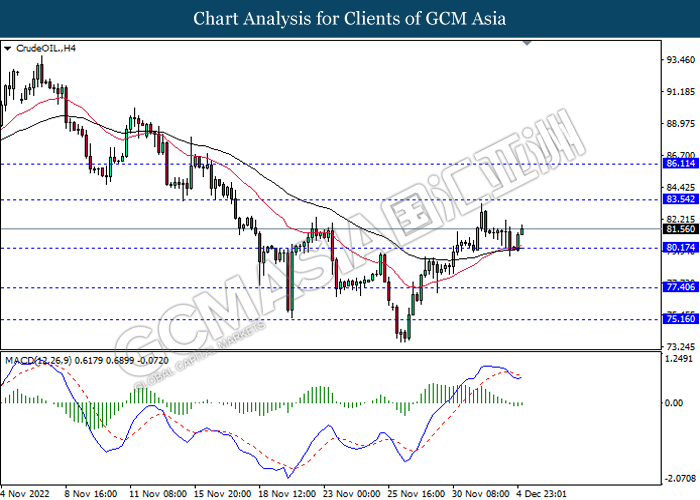

In the commodities market, the crude oil price rose by 2.01% to $81.59 per barrel as of writing following China announced an easing of Covid-19 curbs. In addition, the gold price appreciated by 0.17% to $1799.41 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Nov) | 48.3 | 48.3 | – |

| 17:30 | GBP – Services PMI (Nov) | 48.8 | 48.8 | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Nov) | 54.4 | 53.1 | – |

Technical Analysis

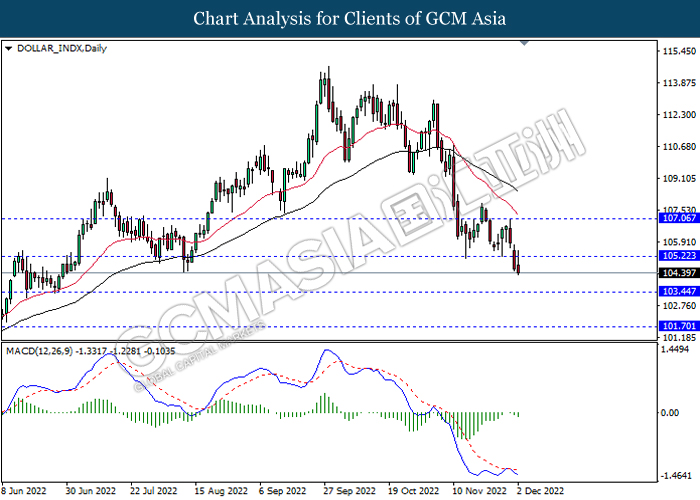

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 105.20, 107.05

Support level: 103.45, 101.70

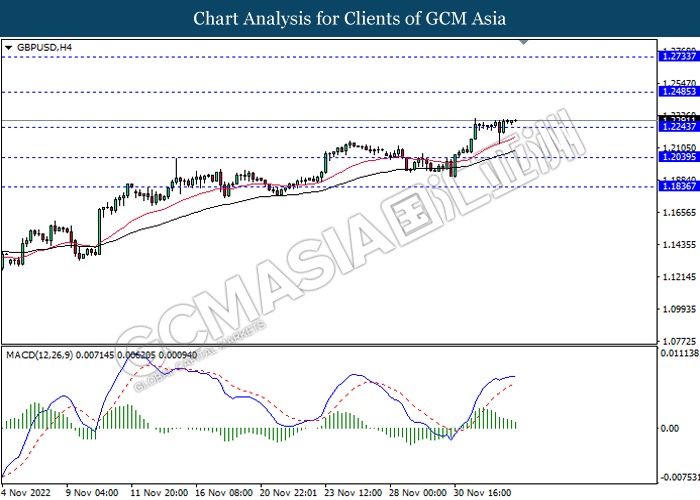

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2485, 1.2735

Support level: 1.2245, 1.2040

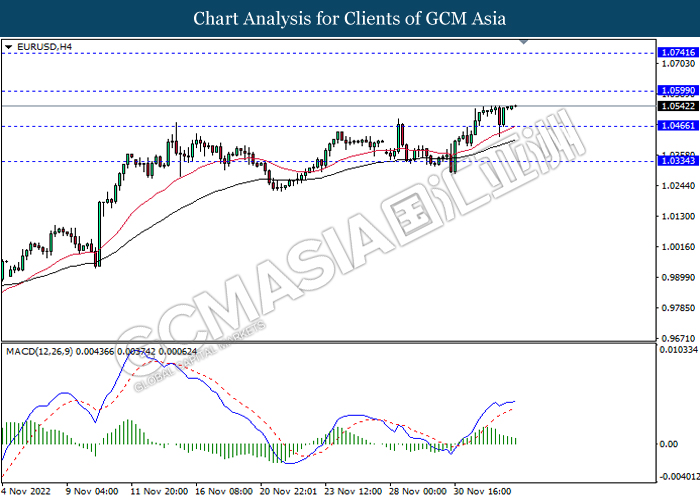

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

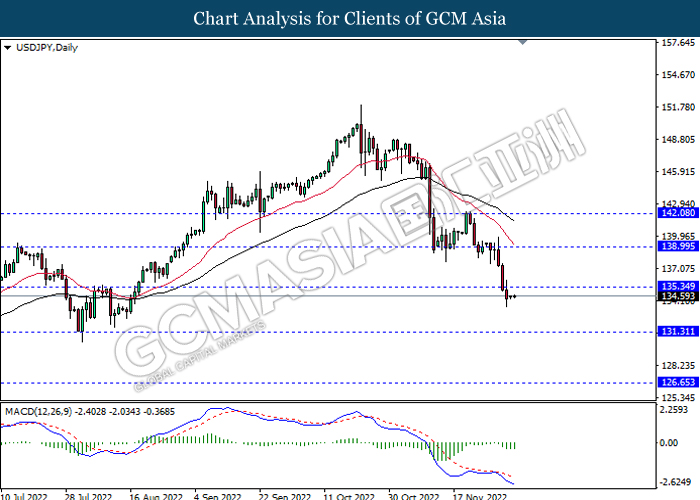

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 135.35, 139.00

Support level: 131.30, 126.65

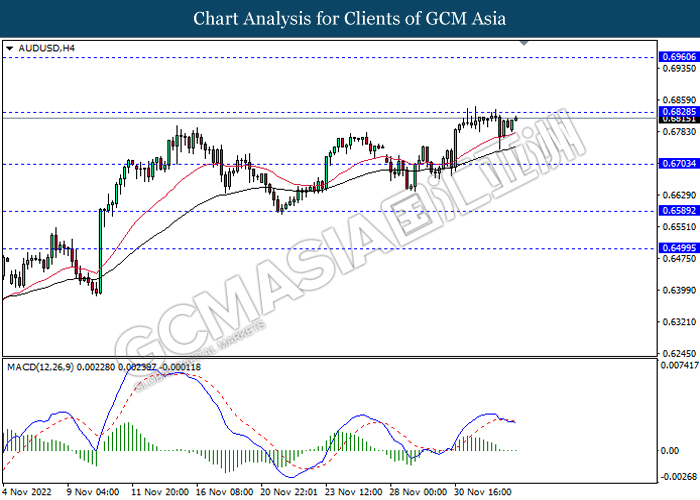

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6830, 0.6960

Support level: 0.6705, 0.6590

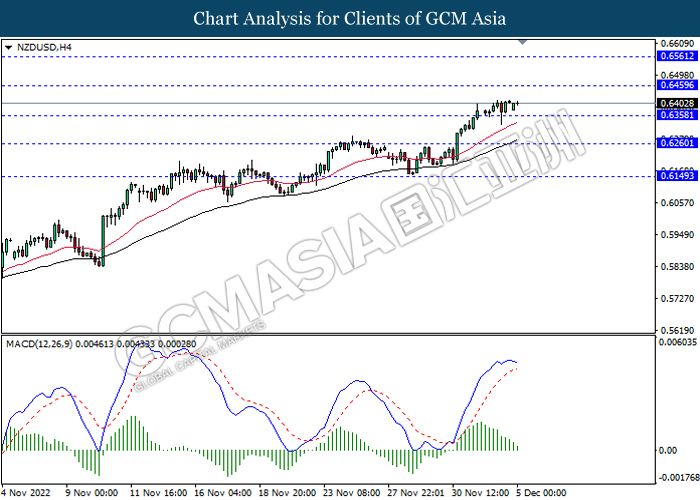

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3455, 1.3635

Support level: 1.3320, 1.3155

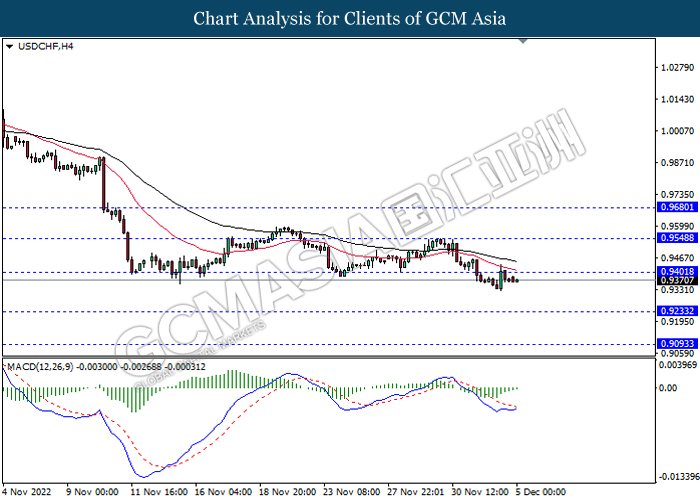

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 83.55, 86.10

Support level: 80.15, 77.40

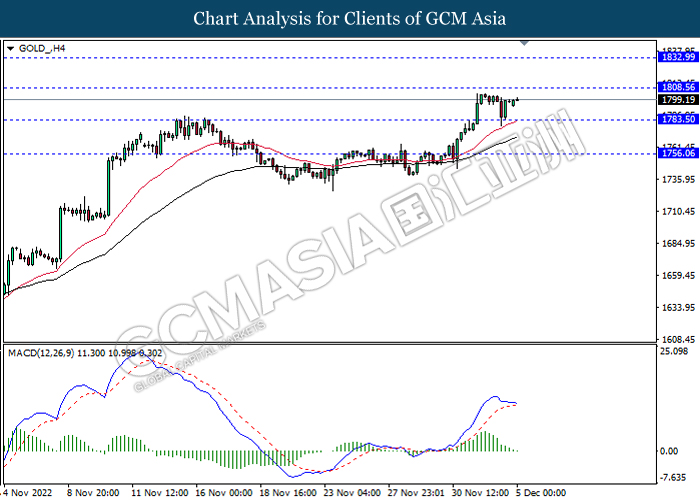

GOLD_, H4: Gold price was traded higher following prior breakout above the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05