6 April 2017 Daily Analysis

US-China summit in view, dollar sags.

US dollar took a step back during Asian trading session, broadly pressured by cautious investors ahead of impending US-China summit and heightened geopolitical risks. The dollar index shed 0.11% and was last quoted at 100.45. Overnight’s minute from March Federal Reserve meeting showed that the outlook was little changed since January while commented that with further strengthening of labor market and progress towards inflation target suggests that rate hikes would likely incline with prior forecast of three times this year. However, FOMC members were undetermined whether stronger inflation would warrant a faster pace of rate hike now or hiking it at a more gradual pace, given the persistence low inflation reading in the past. Against other major currencies, greenback was down 0.30% to 110.39 yen while euro added 0.20% to $1.0681.

As for commodities, crude oil price dipped following a surprise swell in US inventories by 1.566 million barrels, off-skid from economist’s estimate for a draw of 0.435 million barrels. Concurrently, gold price rose 0.77% to $1,254.94 buoyed by overnight’s FOMC meeting minutes.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:00 EUR ECB President Draghi Speaks

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German Factory Orders (MoM) (Feb) | -7.4% | 4.0% | – |

| 20:30 | USD – Initial Jobless Claims | 258K | 250K | – |

| 20:30 | CAD – Building Permits (MoM) (Feb) | 5.4% | – | – |

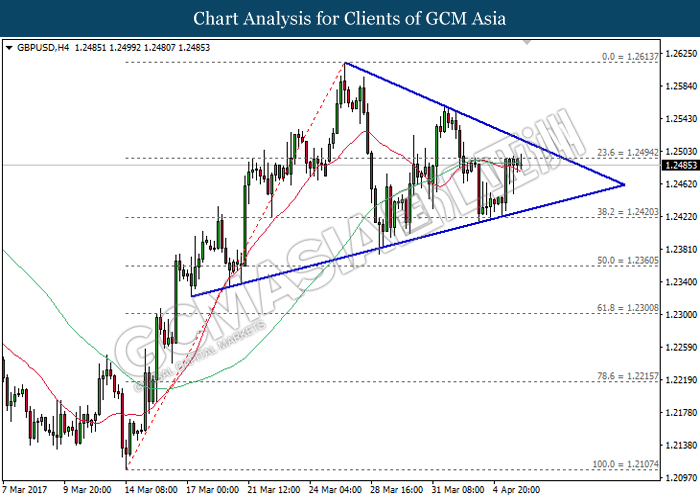

GBPUSD

GBPUSD, H4: GBPUSD remains traded within a narrowing triangle while currently testing near the resistance level of 1.2495. A breakthrough from this level would suggest GBPUSD to advance further up, towards the upper level of the triangle. Otherwise, a retracement would suggest GBPUSD to be traded lower in short-term thereafter within the triangle.

Resistance level: 1.2495, 1.2615

Support level: 1.2420, 1.2360

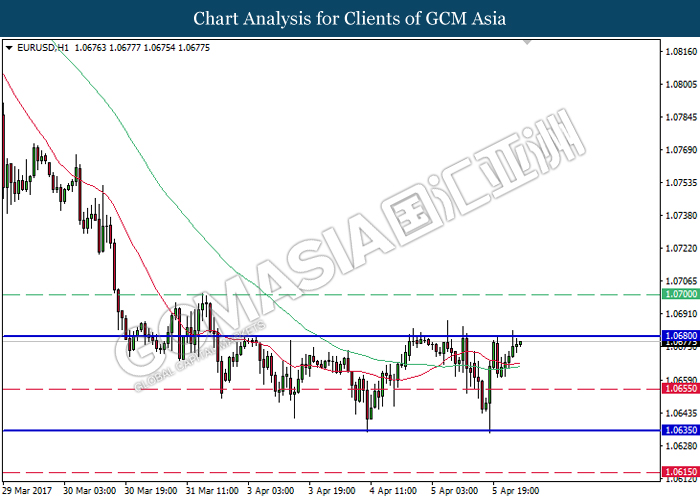

EURUSD

EURUSD, H1: EURUSD remains traded within a sideways channel while currently testing at the top level of the channel, near the resistance level of 1.0680. A breakout from this level would signal a change in trend direction to move further upwards thereafter. Otherwise, a retrace from this level would suggest EURUSD to be traded lower in the short-term thereafter.

Resistance level: 1.0680, 1.0700

Support level: 1.0655, 1.0635, 1.0615

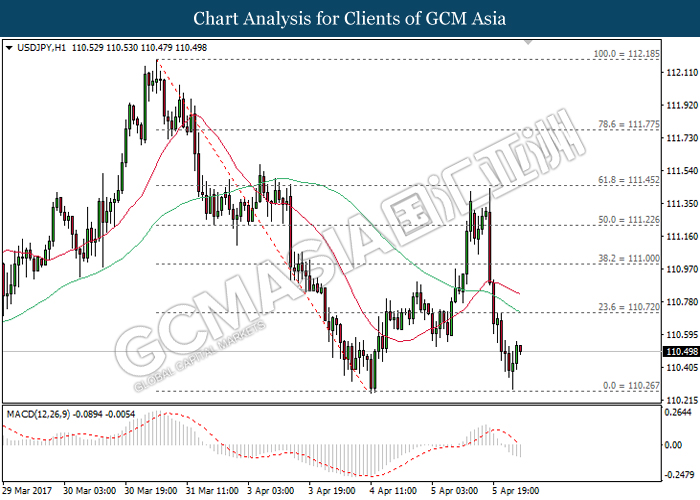

USDJPY

USDJPY, H1: USDJPY was traded higher following prior rebound from the strong support level of 110.25. With regards to the MACD indicator which remains hovered outside of downward momentum, USDJPY is suggested to experience brief retracement period and may be traded higher in the short-term. Otherwise, long-term trend direction suggests USDJPY to advance further down and retest near the level of 110.25.

Resistance level: 110.70, 111.00

Support level: 110.25, 110.10

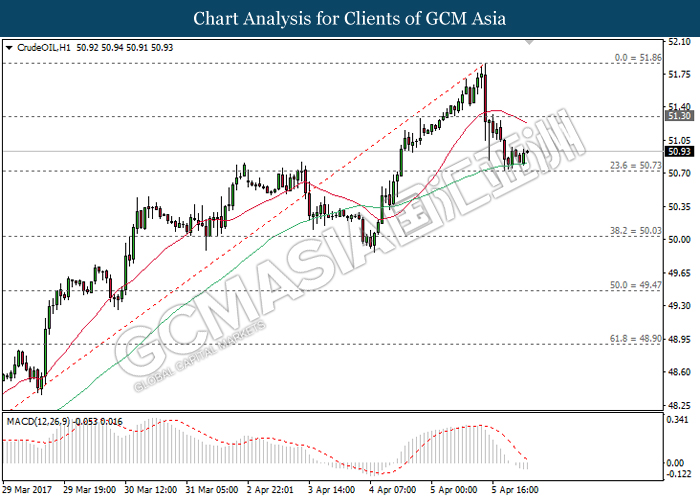

CrudeOIL

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level near 50.75. Referring to the MACD indicator which continues to hover outside of downward momentum suggests crude oil price to be traded higher in the short-term as technical correction. Otherwise, long-term trend direction would suggest crude oil price to extend its downward momentum.

Resistance level: 51.30, 51.85

Support level: 50.75, 50.00

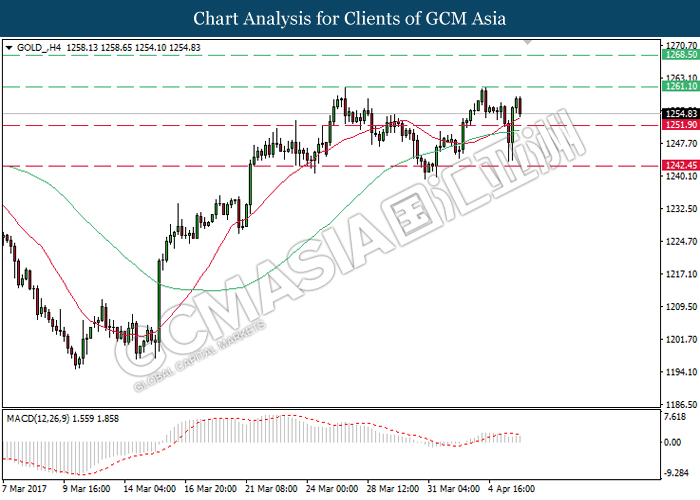

GOLD

GOLD_, H4: Gold price was traded higher following prior rebound from the strong support level near 1242.45. However, as the MACD indicator begins to hover outside of upward momentum, gold price is expected to be traded lower in short-term as brief retracement period. Otherwise, long-term trend direction suggests gold price to advance further upwards and retest near the strong resistance level of 1261.10.

Resistance level: 1261.10, 1268.50

Support level: 1251.90, 1242.45