6 June 2017 Daily Analysis

Dollar subdued, rate hike sentiment intact.

Aussie dollar eased slightly on early Tuesday following initial bump while investors awaits the latest central bank rate review later in the day. Pair of AUD/USD ticked down 0.04% and exchange hands at $0.7484. The Reserve Bank of Australia will be releasing its latest interest rate decision while most analyst expects them to maintain it at a record low of 1.50%. On the other hand, US dollar creeps towards six-months low against a basket of six major peers following broad selling pressure across the board. Overnight, US non-manufacturing activity grew at a slower pace in May after ISM reported that its index fell 0.6 points to 56.9. Prior slew of soft economic data, however, has failed to dent investor’s expectation for an interest rate hike by the US Federal Reserve later this month. Referring to the Fed Rate Monitor Tool, almost 90% of traders expects a 25-basis point hike during FOMC’s meeting next week.

As for commodities, crude oil price remained under pressure as concerns over political rift between several Arab states and Qatar may undermine OPEC’s effort to tighten the oversupplied oil market. Crude oil price was down 0.36% to $47.24 a barrel during Asian trading hours. Otherwise, gold price rose 0.18% to $1,281.63 while investors look ahead to a series of risk events later in the week to gauge market sentiment.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Event

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (June) | 1.50% | 1.50% | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 5.743M | 5.650M | – |

| 22:00 | CAD – Ivey PMI (May) | 62.4 | 62.0 | – |

| 04:30 | Crude Oil – API Weekly Crude Oil Stock | -8.670M | – | – |

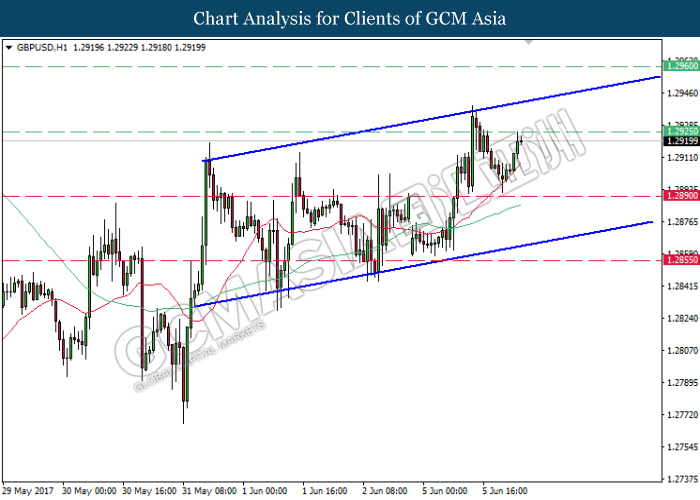

GBPUSD

GBPUSD, H1: GBPUSD remained traded within an upward channel while recently rebounded from the support level of 1.2890. It is expected to extend its upward momentum towards the top level after breaking the resistance level of 1.2925.

Resistance level: 1.2925, 1.2960

Support level: 1.2890, 1.2855

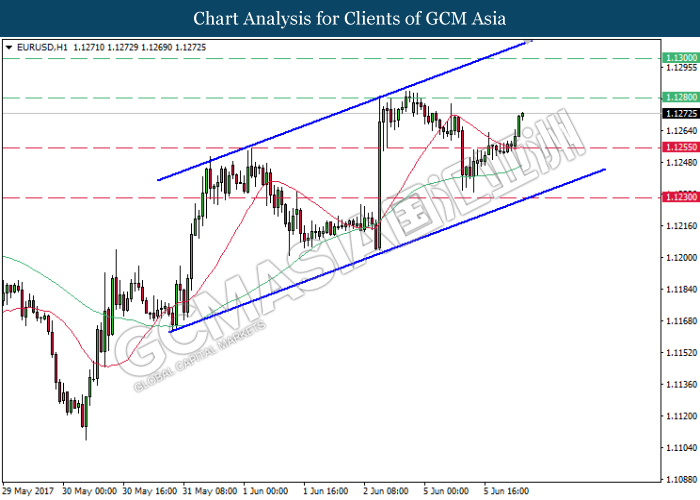

EURUSD

EURUSD, H1: EURUSD remained traded within the upward channel while recently rebounded from the support level of 1.1255. It is expected to extend its gains and move further upwards after breaking the resistance level of 1.1280.

Resistance level: 1.1280, 1.1300

Support level: 1.1255, 1.1230

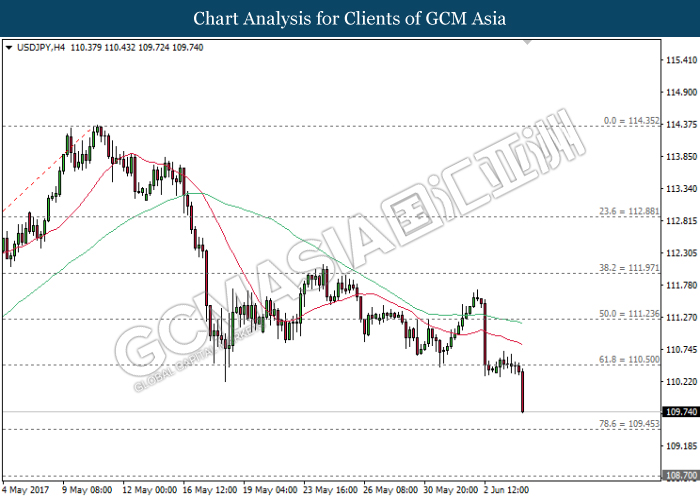

USDJPY

USDJPY, H4: USDJPY extended its losses following prior closure below the strong support level of 110.50. As both MA lines continue to expand downwards, USDJPY is expected to move further down towards the target of support level at 109.45.

Resistance level: 110.50, 111.25

Support level: 109.45, 108.70

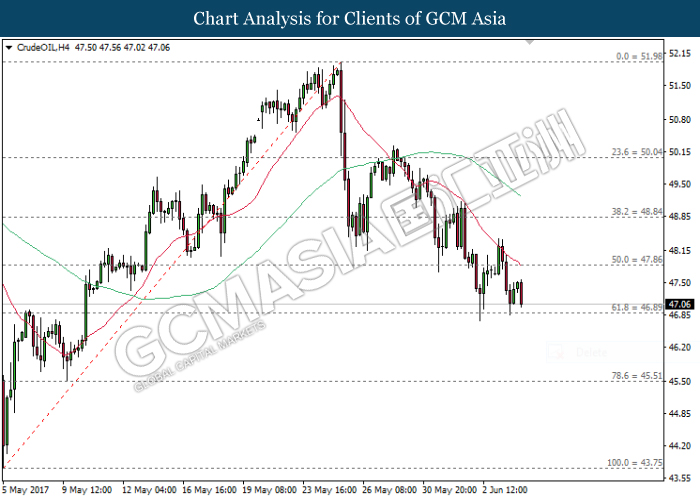

CrudeOIL

CrudeOIL, H4: Crude oil price extended its downtrend following prior downward expansion of both MA lines after the formation of death cross while currently testing near the strong support level of 46.90. A successful closure below the level of 46.90 would suggests crude oil price to move further down towards the target of support level at 45.50.

Resistance level: 47.85, 48.85

Support level: 46.90, 45.50

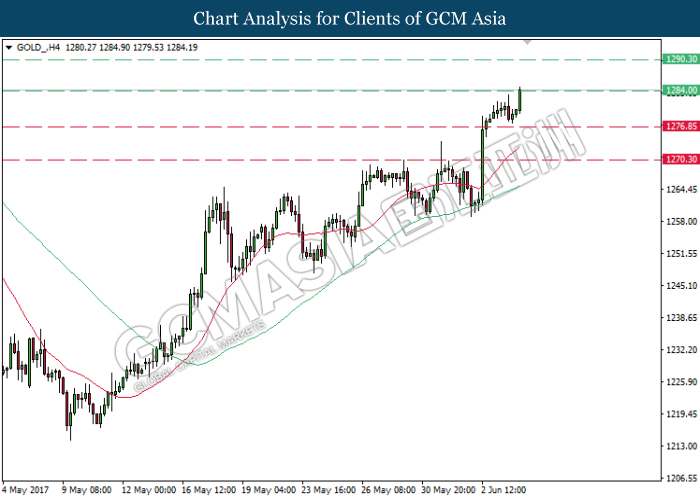

GOLD

GOLD_, H4: Gold price was traded higher following prior rebound from the support level of 1276.85 while currently testing at the resistance level of 1284.00. Gold price is suggested to extend its current uptrend after breaking the resistance level of 1284.00.

Resistance level: 1284.00, 1290.30

Support level: 1276.85, 1270.30