06 July 2023 Afternoon Session Analysis

Pound slips after the UK business shows a sign of vulnerability.

The Pound Sterling which traded against the dollar index, edged lower after the business momentum slowed in June showing a sign of vulnerability despite the business facing lower inflation. UK’s Service sector fell to 53.7 from 55.2, in line with market expectations, while the UK composite PMI also dropped to 52.8 from 54.0, in line with economist’s forecast. UK business momentum growth was reduced to a three-month low after the S&P Global survey showed a slower pace of business growth. According to S&P Global surveys, servicer providers experienced deceleration in overall input price but the cost pressure remains the most sustainable since the first survey began in July 1996. Salary payment continued to surge at the highest, offset by a decline in energy prices. Despite the inflation in the UK being eased, the Bank of England’s (BoE) unexpectedly rising interest rates from 4.50% to 5.00% weighed on consumer demand. Some economists expected that BoE rate rises will push the UK economy into recession later this year after quarter one GDP only grew by 0.1%. As of writing, the GBPUSD slipped by -0.02% to 1.2701.

In the commodities market, crude oil prices rose by 0.07% to $71.84 per barrel as the US crude oil stockpiles fell to -4.382M, lower than the market’s estimation. On the other hand, the price of gold edged up 0.17% to 1918.41 as the price of gold fell in the previous session after the Fed gave the hawkish meeting minutes.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Jun) | 278K | 230K | – |

| 20:30 | USD – Initial Jobless Claims | 239K | 245K | – |

| 21:45 | USD – Services PMI (Jun) | 54.9 | 54.1 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jun) | 50.3 | 51.0 | – |

| 22:00 | USD – JOLTs Job Openings (May) | 10.103M | 9.900M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -9.603M | -0.729M | – |

Technical Analysis

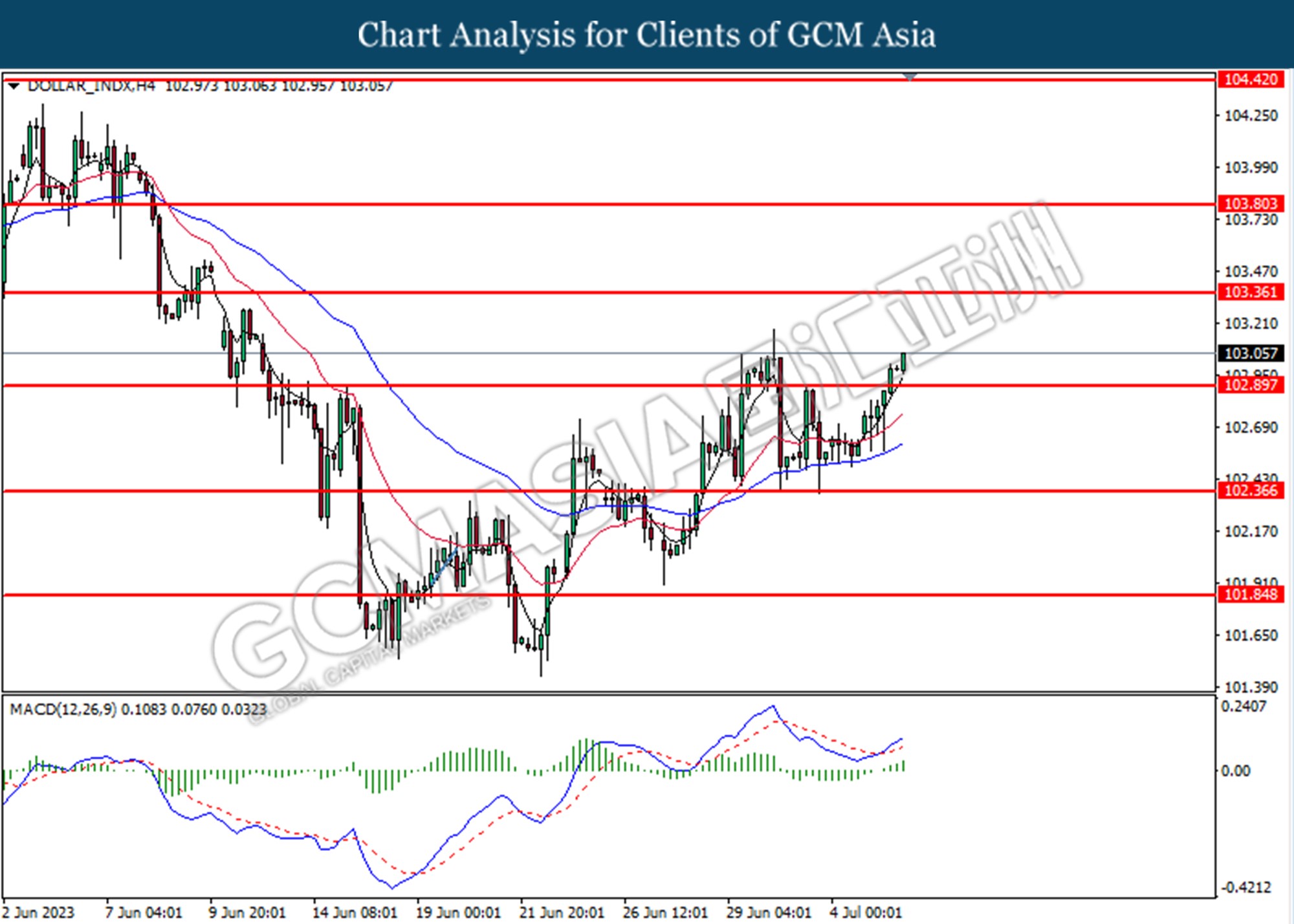

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breaks above the previous resistance level at 102.90. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level.

Resistance level:103.35, 103.80

Support level: 102.90, 102.35

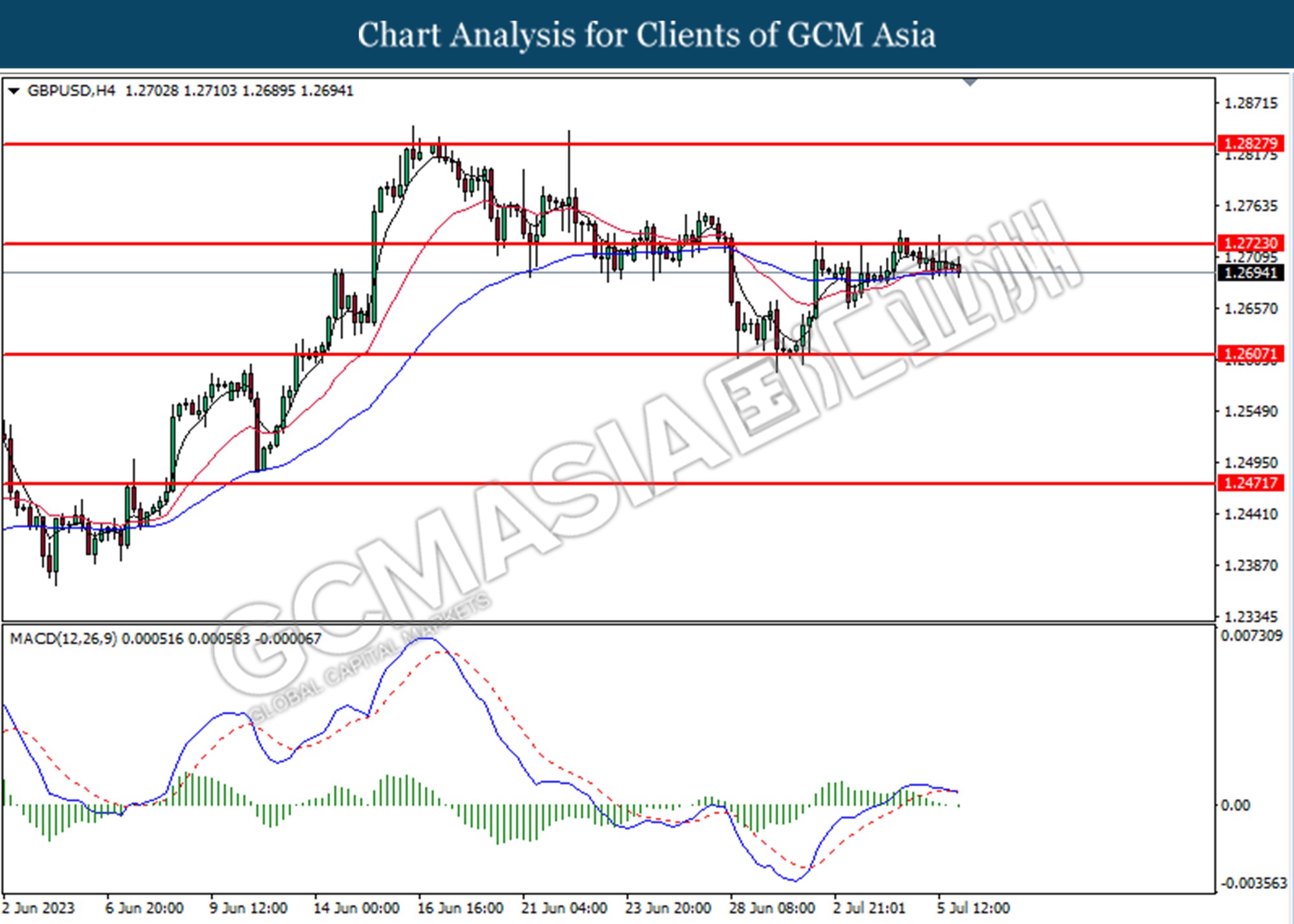

GBPUSD, H4: GBPUSD was traded lower following the rebound from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward support level.

Resistance level: 1.2730, 1.2830

Support level: 1.2610, 1.2470

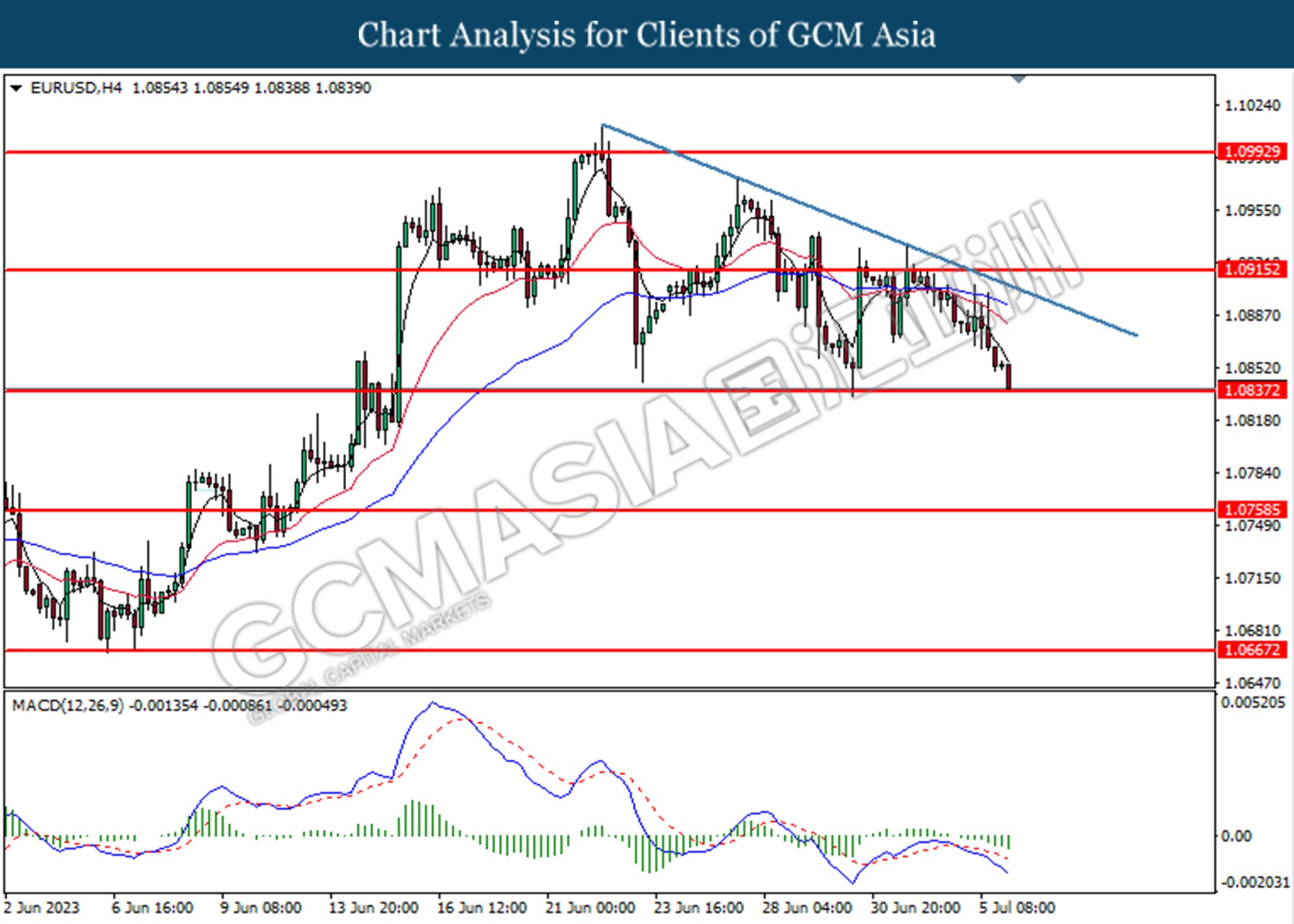

EURUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.0840. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully breaks below the support level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

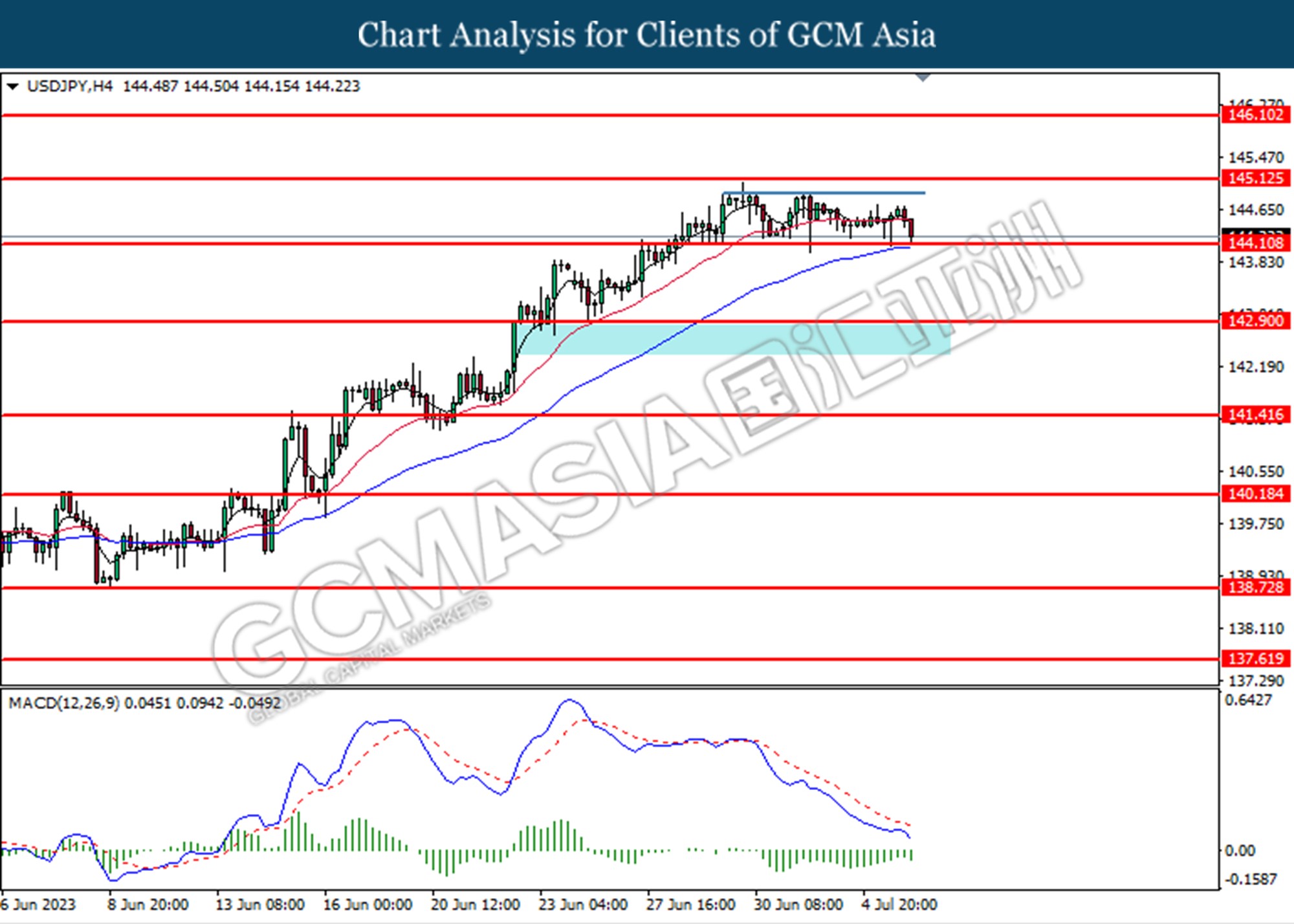

USDJPY, H4: USDJPY was traded lower following currently testing for the support level at 144.10. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully break below the support level.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.6615.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

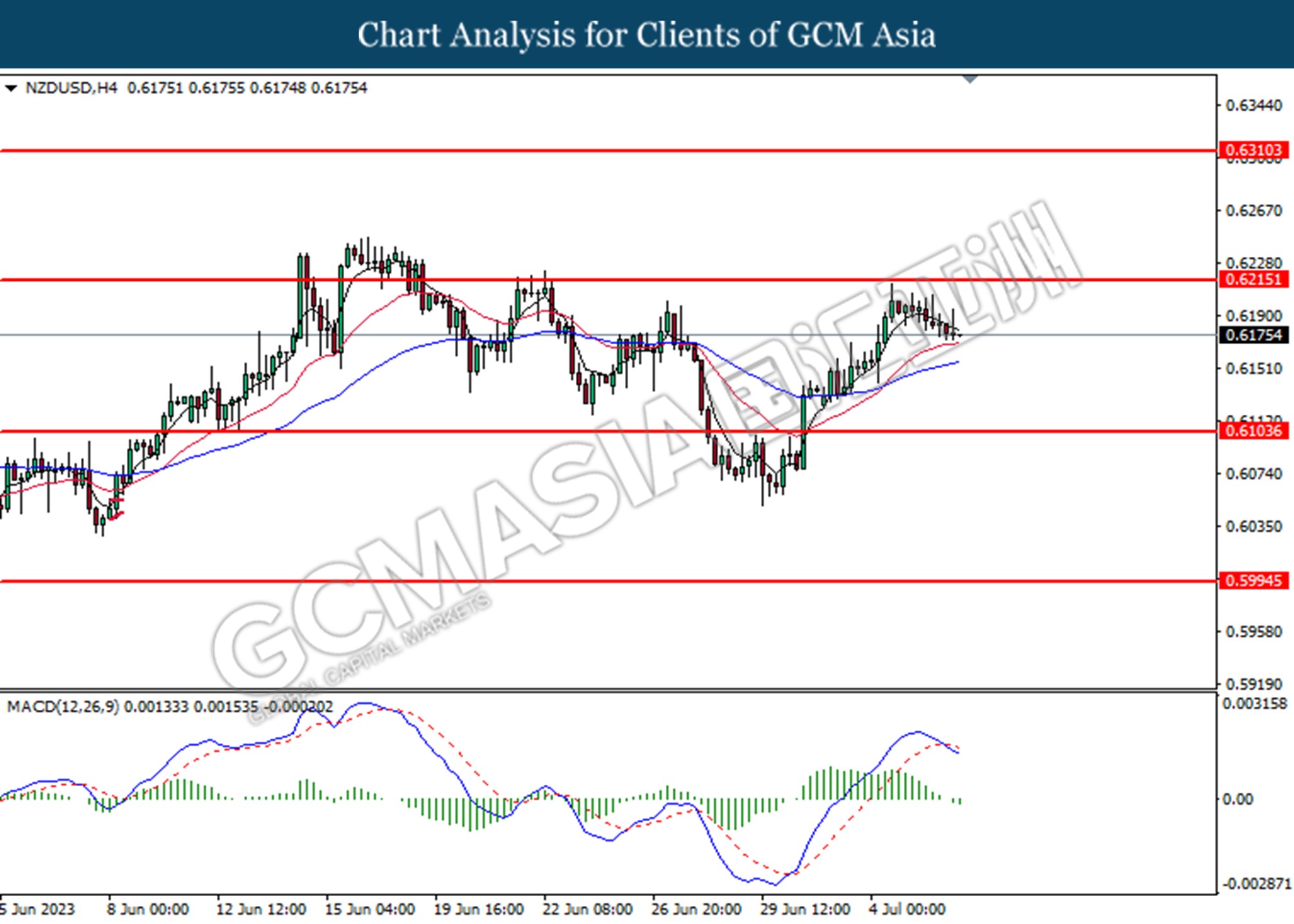

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

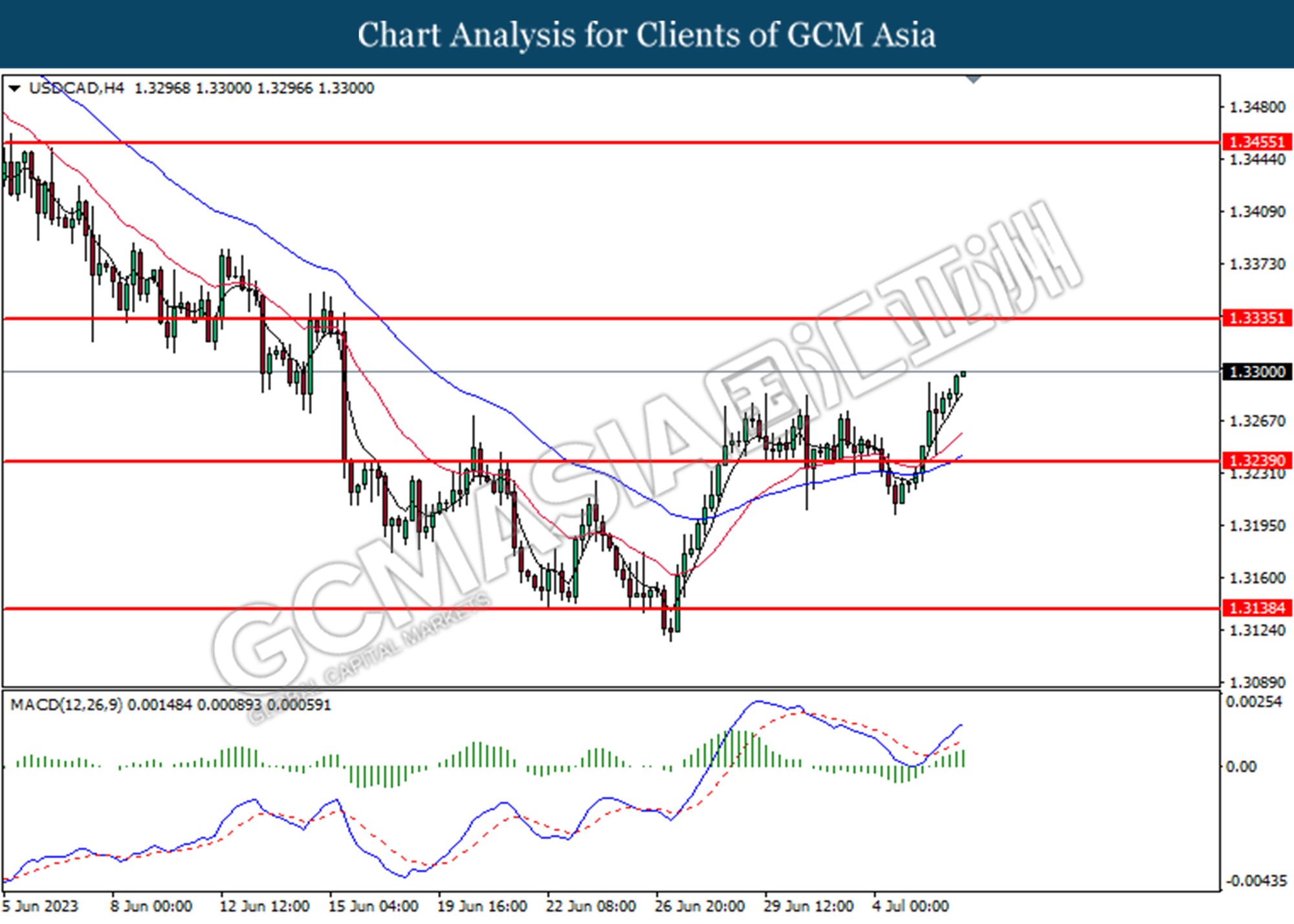

USDCAD, H4: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3240. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3335.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

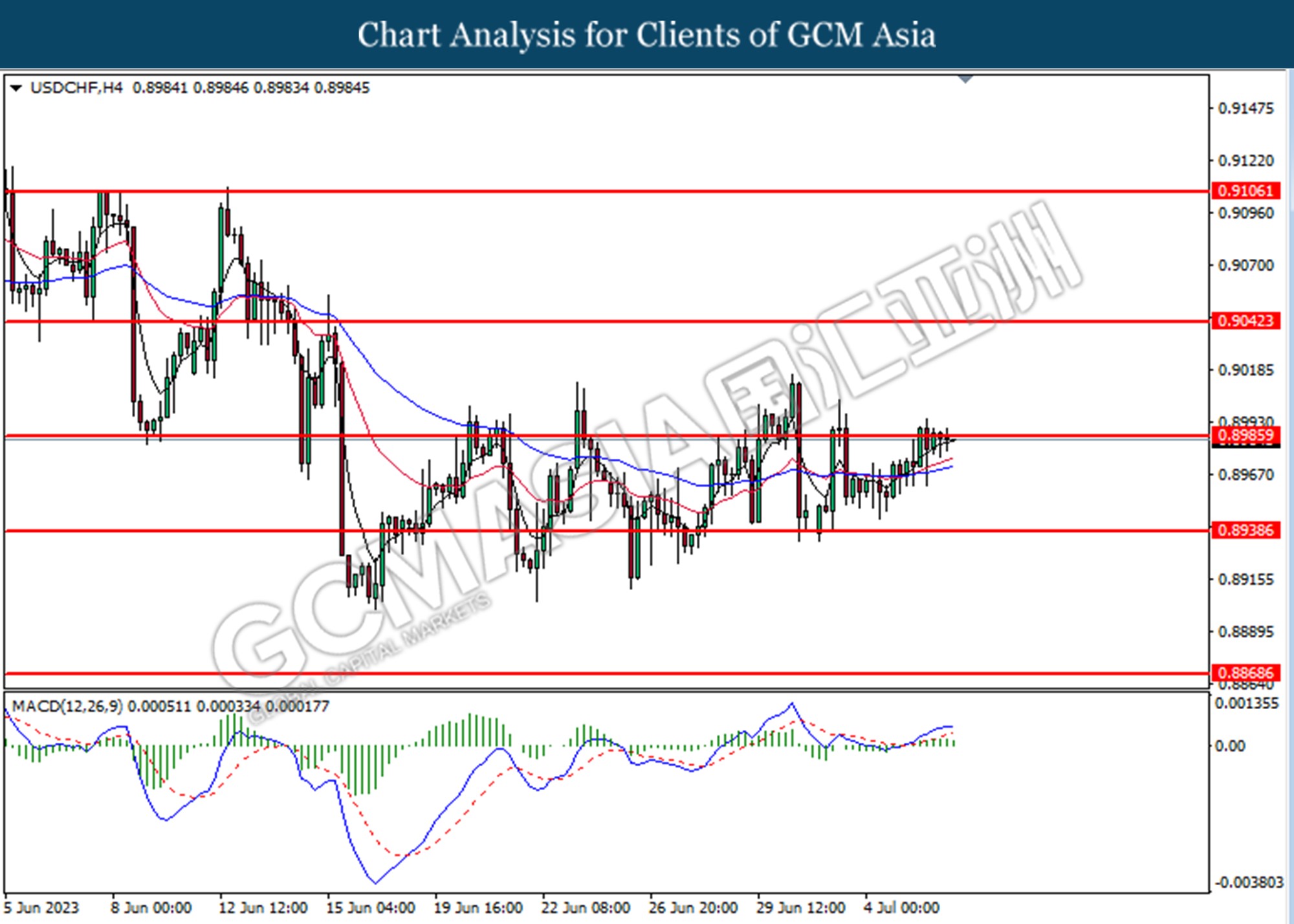

USDCHF, H4: USDCHF was traded lower following the prior retracement from the resistance level at 0.8985. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

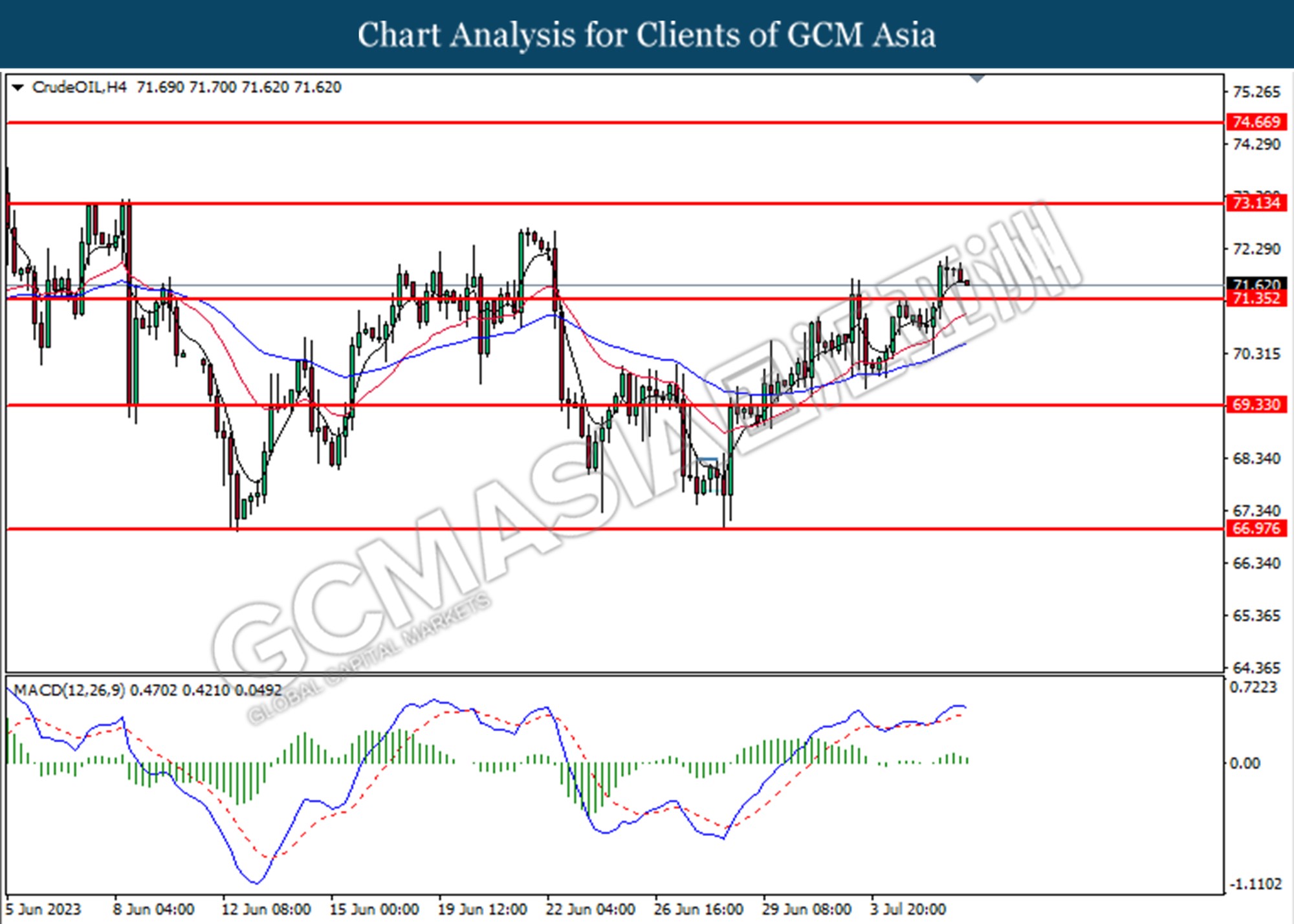

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 71.35.

Resistance level: 73.15, 74.65

Support level: 71.35, 69.30

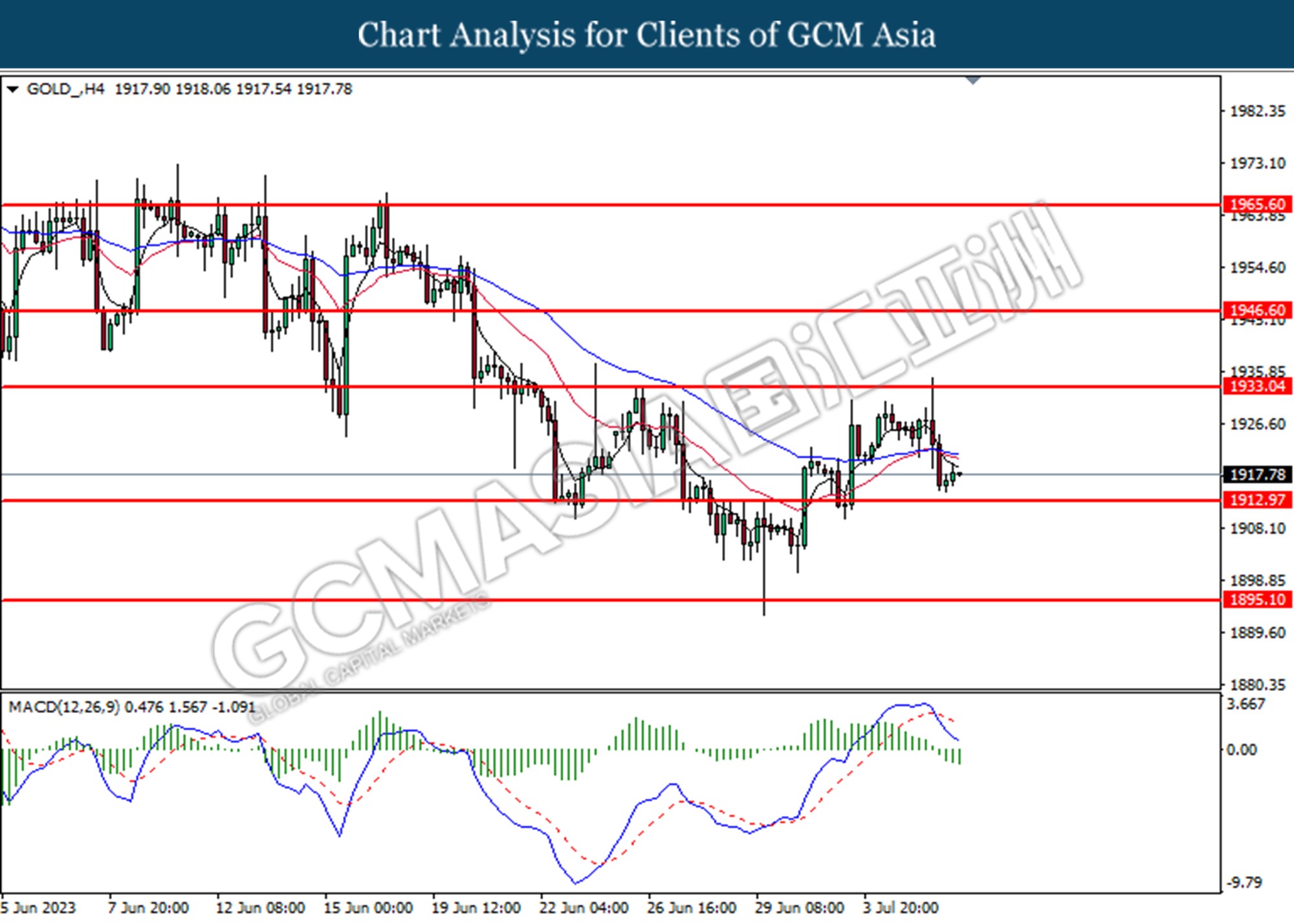

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the commodity undergoes a technical correction in a short term.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10