06 July 2023 Morning Session Analysis

Greenback surged amid hawkish FOMC meeting minutes.

The dollar index, which was traded against a basket of six major currencies, managed to revert from its previous losses after the Federal Reserve released the minutes of its June monetary policy meeting, which tilted toward a hawkish stance as officials worried about a tight labor market. In the meeting minutes, it showed that the officials agreed to keep interest rates unchanged to assess the cumulative impact of previous tightening measures before a further rate hike. However, some Fed officials have advocated a quarter-point rate hike, citing a tight job market. Also, majority of the officials also noted that after rapidly tightening the stance of monetary policy last year, the Committee had already slowed the pace of tightening, and that would be appropriate to slow the pace of tightening further in order to have more time to observe the effects of the cumulative tightening and assess its impact on policy. At this point in time, the market participants are eyeing on the upcoming crucial data such as Nonfarm Payroll in order to scrutinize the future path of Fed’s tightening policy. As of writing, the dollar index rose 0.29% to 103.35.

In the commodities market, crude oil prices appreciated by 1.10% to $71.85 per barrel after a further draw in US oil stockpiles were reported by API. Besides, the gold prices ticked up by 0.08% to $1916.70 per troy ounce after slumping for more than $10 amid hawkish Fed’s meeting minutes.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (Jun) | 278K | 230K | – |

| 20:30 | USD – Initial Jobless Claims | 239K | 245K | – |

| 21:45 | USD – Services PMI (Jun) | 54.9 | 54.1 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jun) | 50.3 | 51.0 | – |

| 22:00 | USD – JOLTs Job Openings (May) | 10.103M | 9.900M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | -9.603M | -0.729M | – |

Technical Analysis

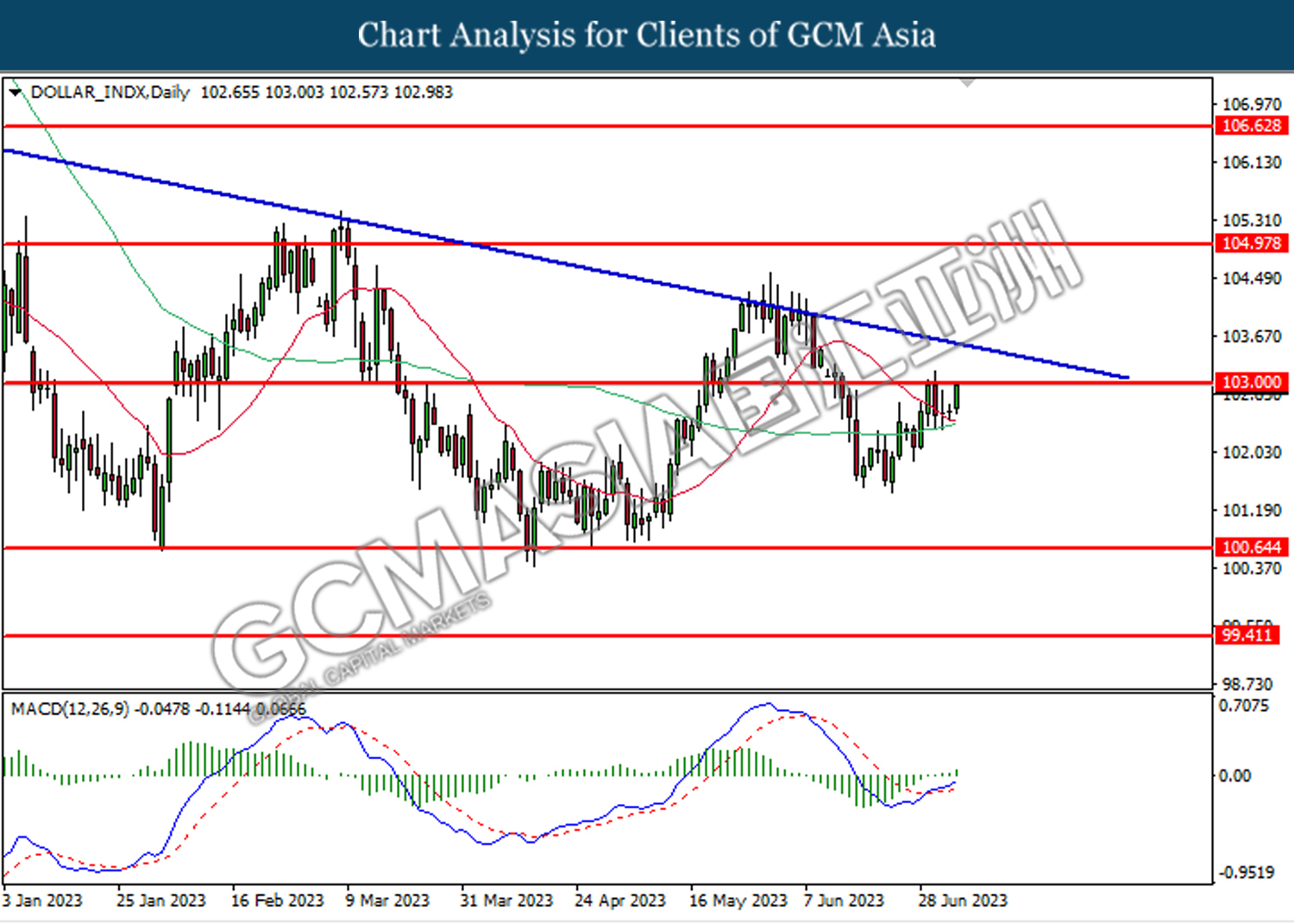

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.00. MACD which illustrated bullish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

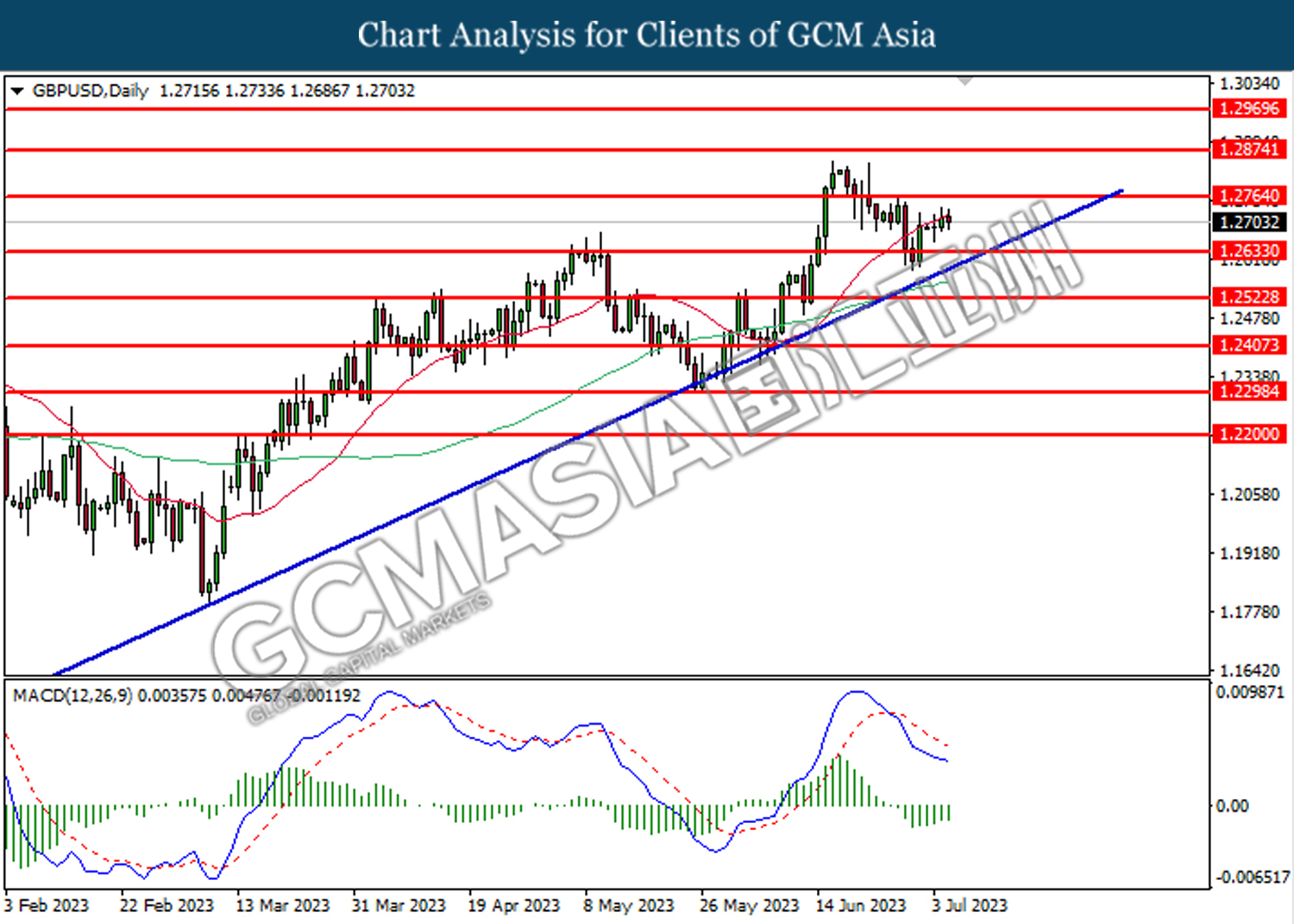

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2635. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

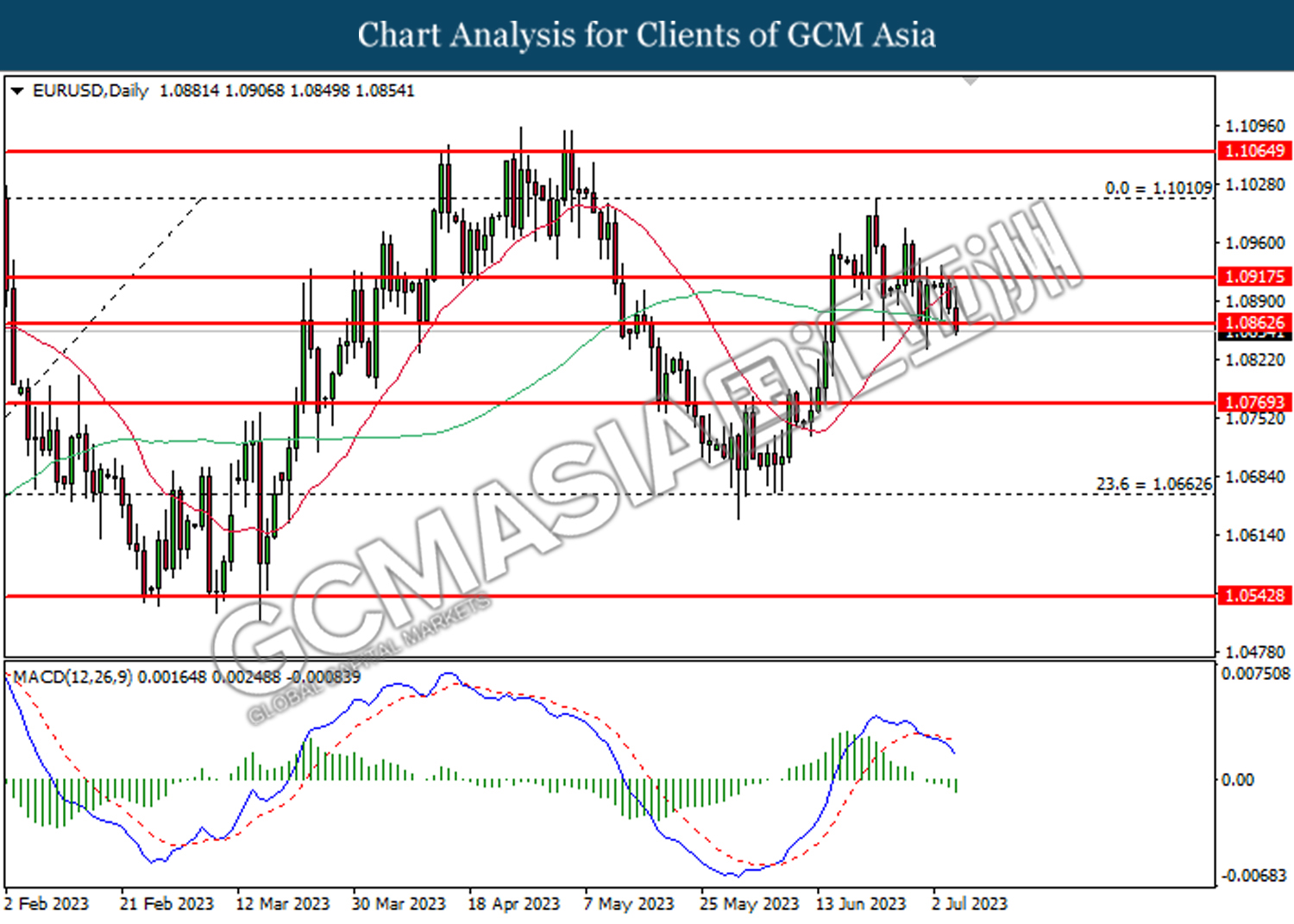

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0865. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

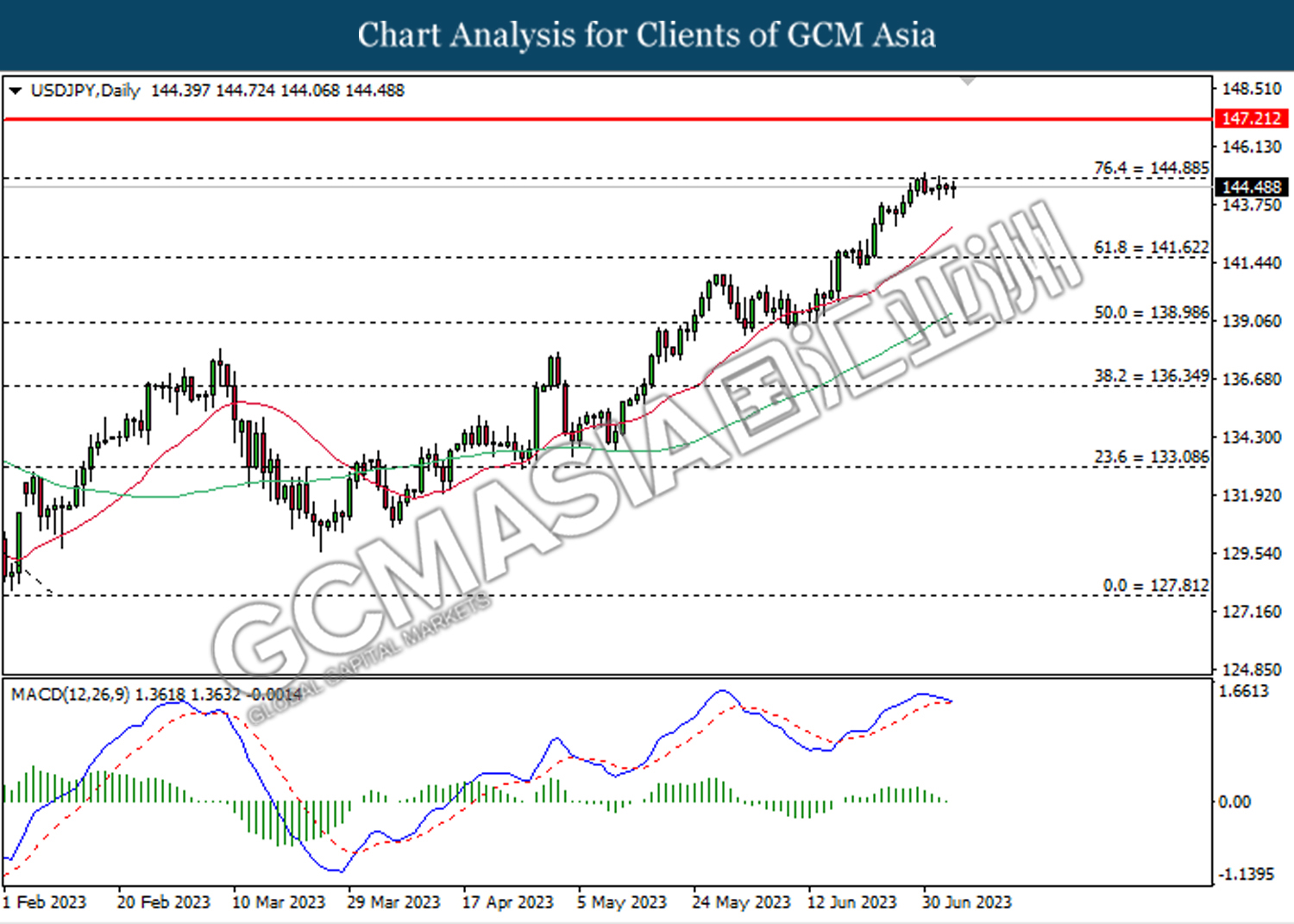

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

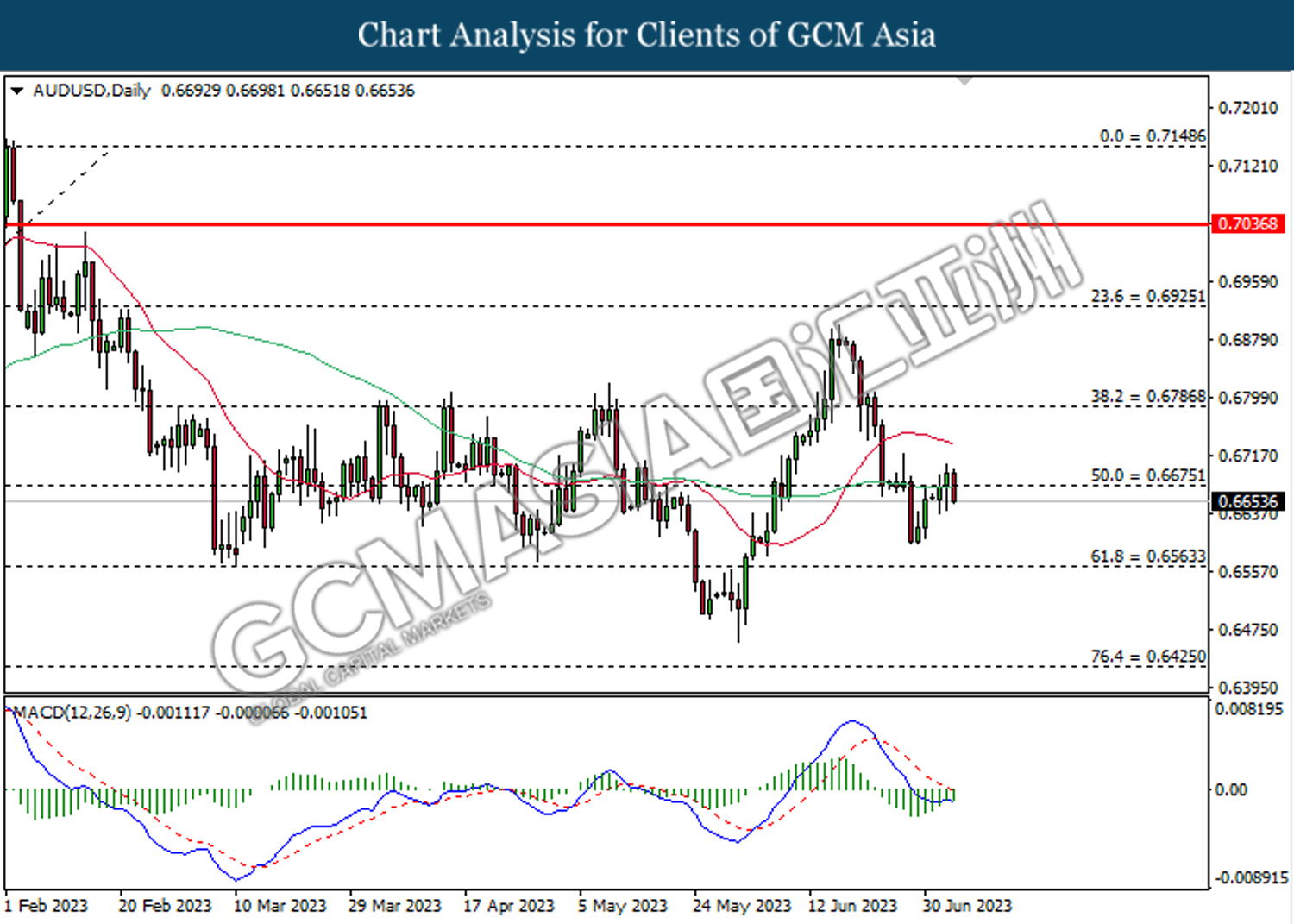

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

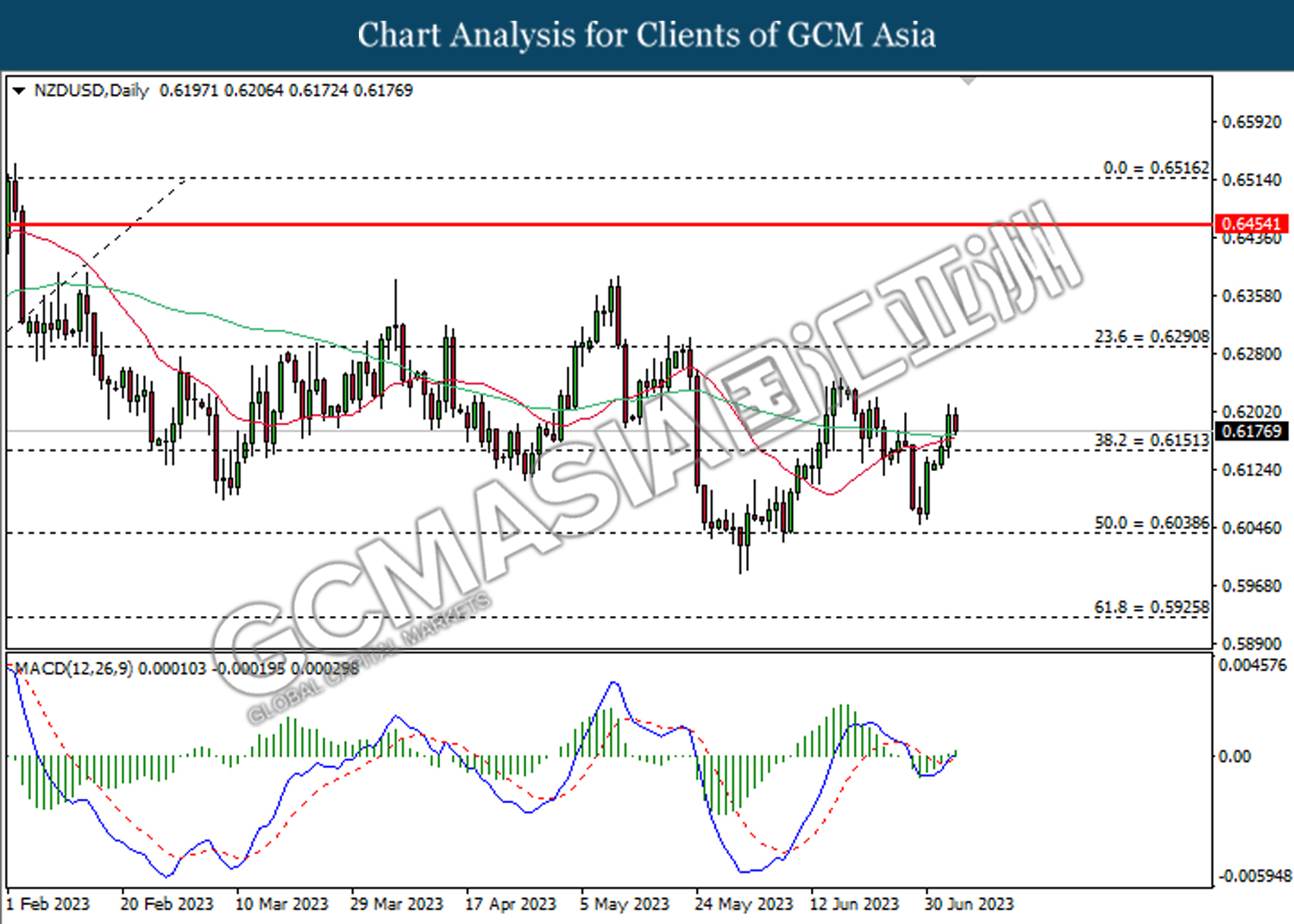

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

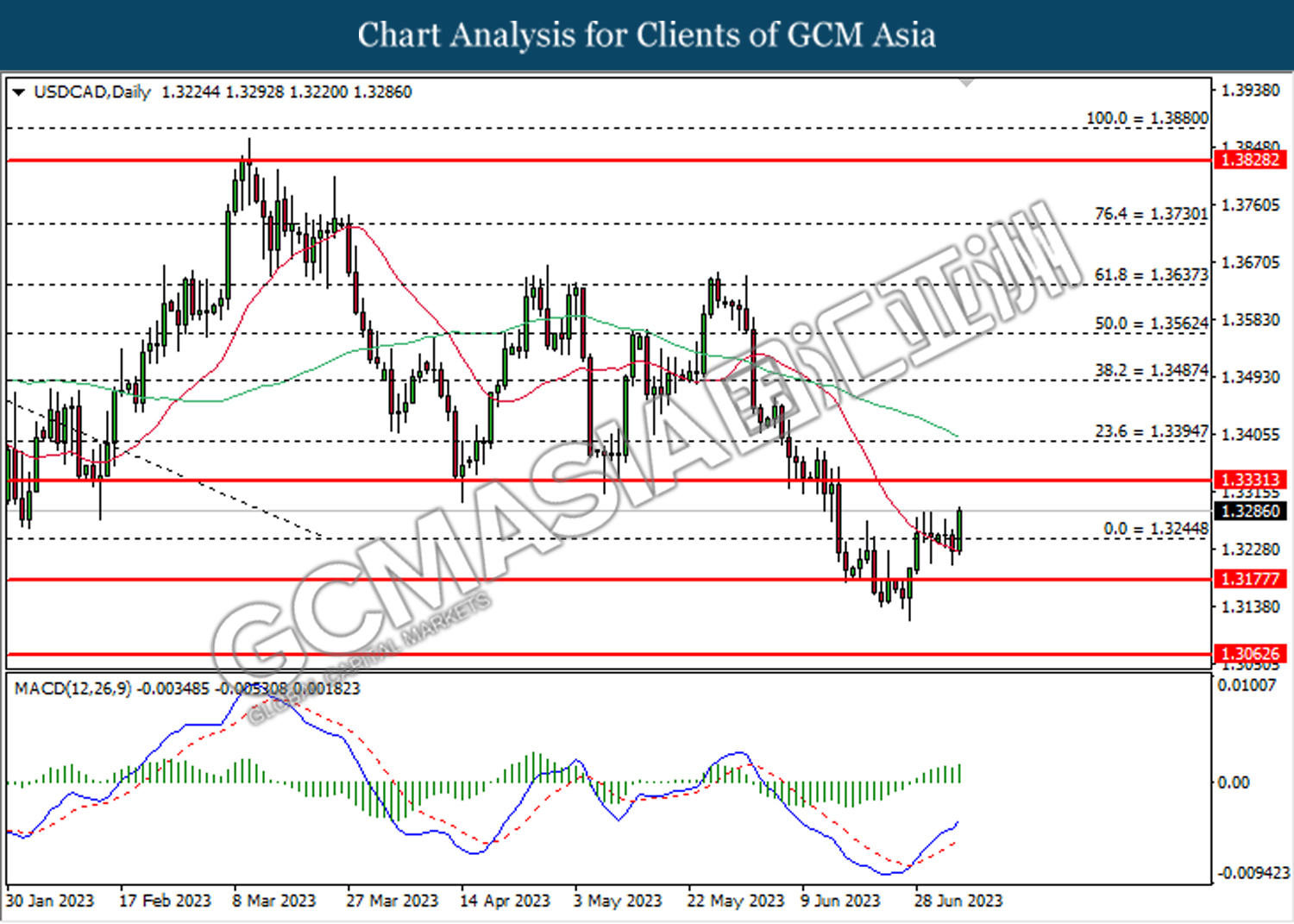

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

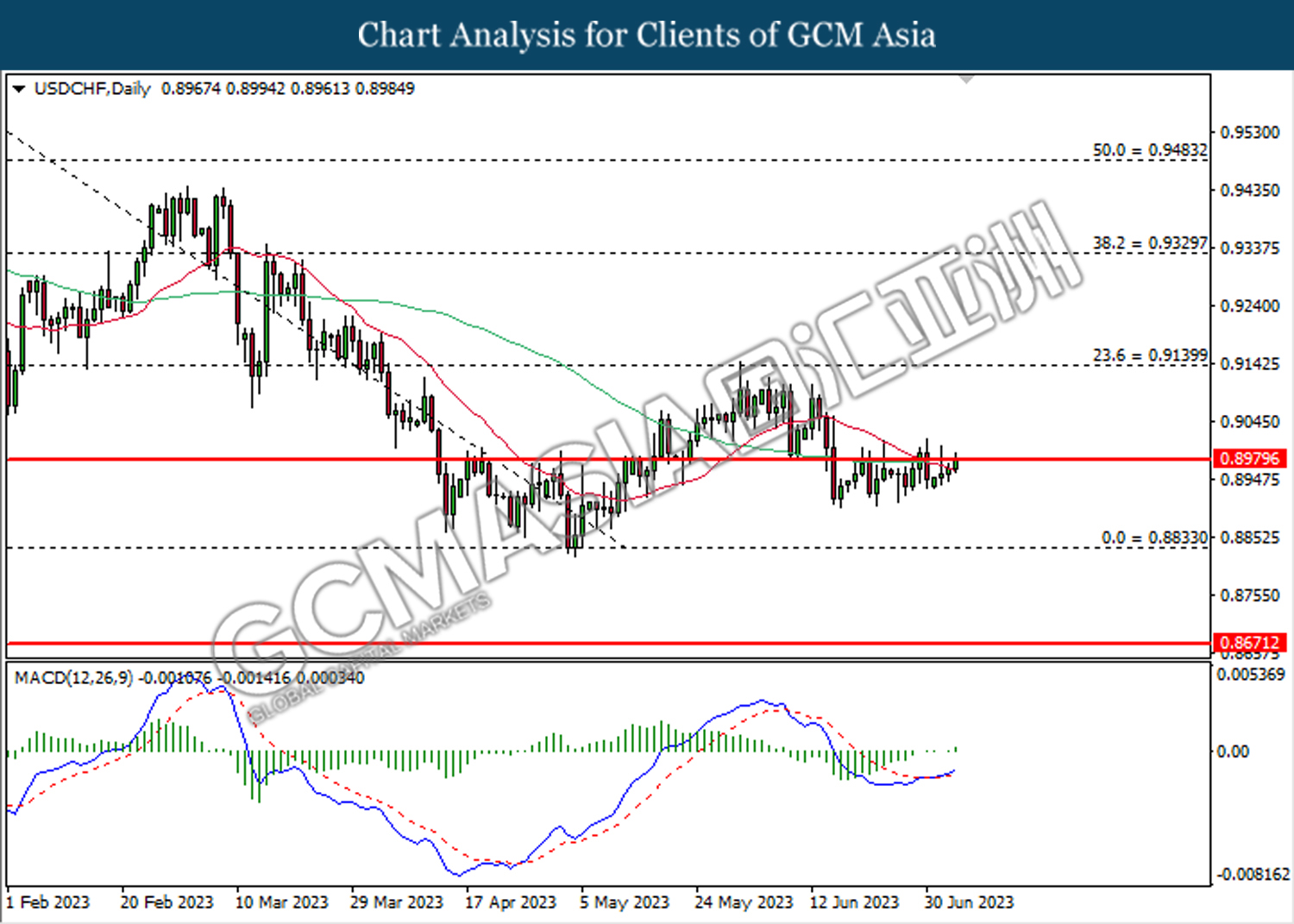

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

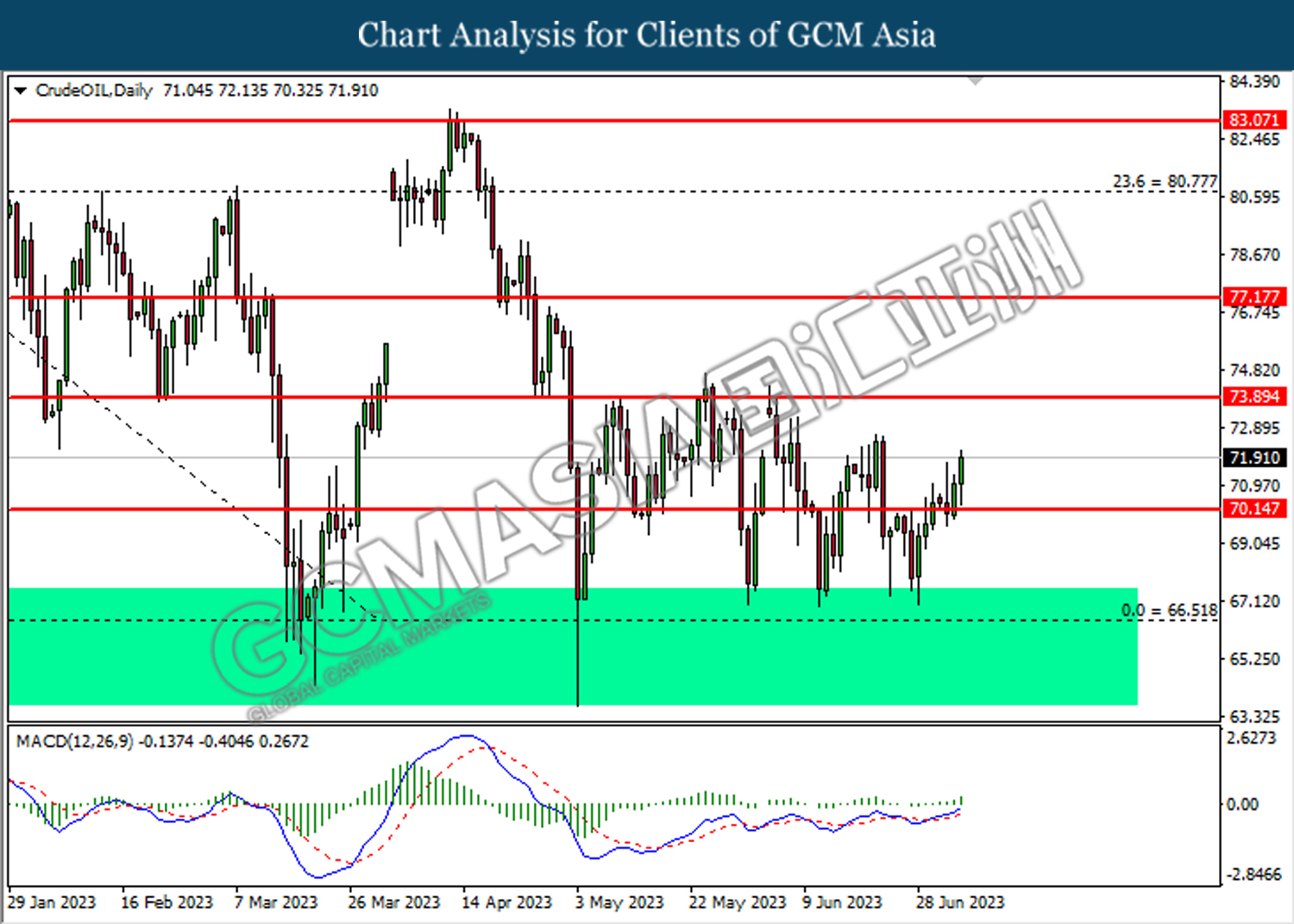

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40