06 August 2020 Afternoon Session Analysis

Aussie slips amid worsening coronavirus in Victoria.

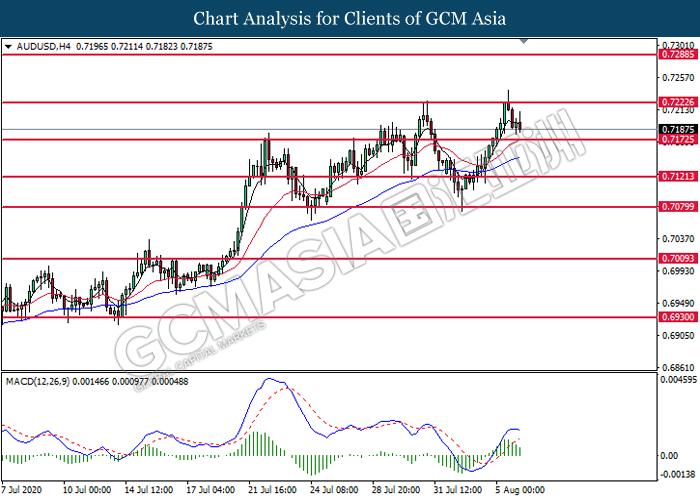

During late Asian session, the Aussie dollar which traded against the greenback and other currency pair have experience fresh selling pressure and fell following gloomy outlook from Australia Prime Minister Scott Morrison and worsening conditions in the Australian state, Victoria. According to reports, Australian Prime Minister Scott Morrison have stated that the Treasury had estimated Victoria’s stage 4 lockdown would reduce the size of the economy in the September quarter by between $7 billion to $9 billion. Besides that, he also expected that the unemployment rate is expected to peak at about 10%. Moreover, the worsening conditions in Victoria adding further reason for investors to shy away from the pair. According to ABC, Victoria have recorded around 471 new coronavirus cases overnight which marked the most devastating day of COVID-19 in the state. At the time of writing, AUD/USD slips 0.04% to 0.7190.

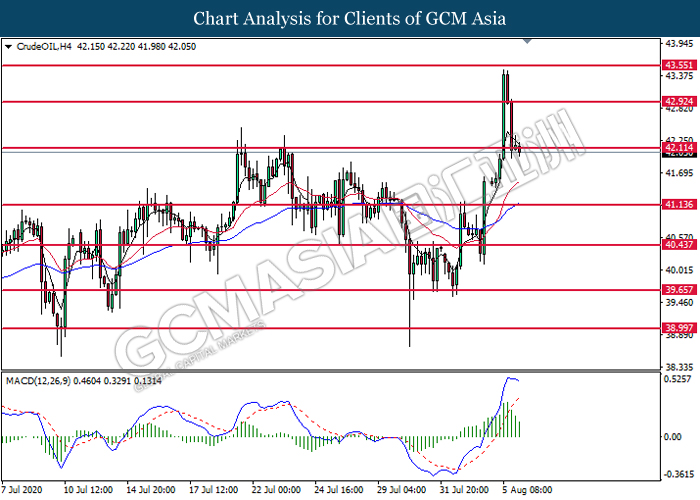

In the commodities market, crude oil price struggles to hold gains and retreats 0.05% to $42.05 per barrel as of writing amid pandemic concerns. Despite EIA recently announce a bigger than expected drop in U.S crude inventories, investors remained wary of rising U.S. refined product inventories at a time when U.S. central bankers said the resurgence in cases was slowing the economic recovery in the world’s biggest oil consumer. On the other hand, gold price soars 0.09% to $2040.16 a troy ounce at the time of writing following dollar weakness and uncertainty continue to propel gold to new heights.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

14:00 GBP BoE Inflation Report

14:00 GBP BoE MPC Meeting Minutes

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – BoE Interest Rate Decision (Jul) | 0.10% | 0.10% | – |

| 16:30 | GBP – Construction PMI (Jul) | 55.3 | 57.0 | – |

| 20:30 | USD – Initial Jobless Claims | 1,434K | 1,400K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 92.55. However, MACD which illustrate diminishing bearish momentum signal suggest the dollar to undergo technical correction in short term toward the higher level.

Resistance level: 94.10, 95.95

Support level: 92.55, 91.45

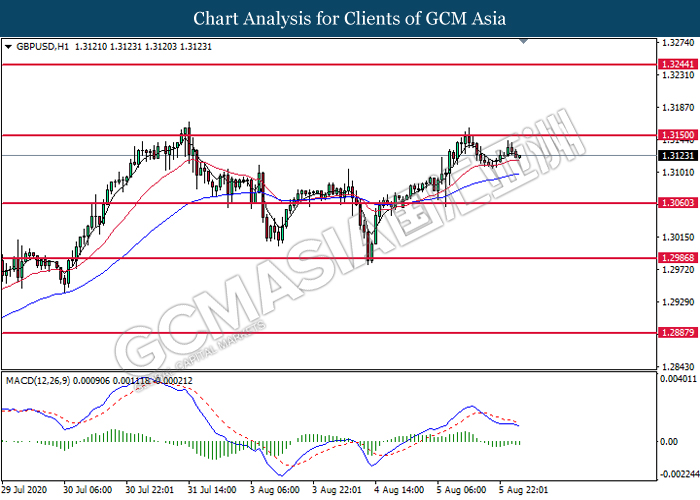

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level at 1.3150. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses toward the support level at 1.3060.

Resistance level: 1.3150, 1.3245

Support level: 1.3060, 1.2985

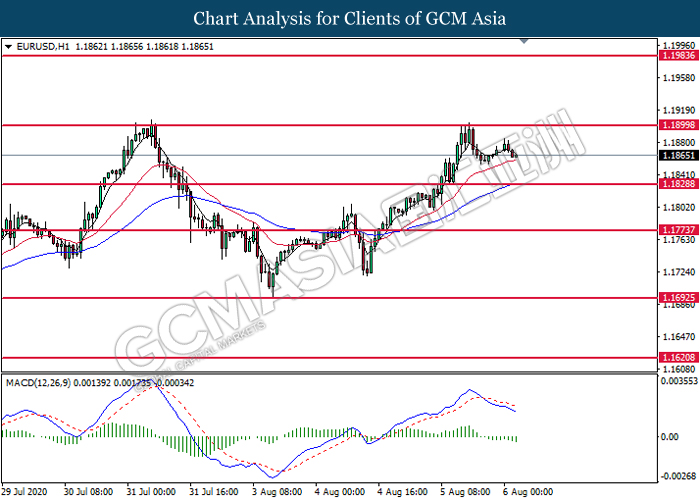

EURUSD, H1: EURUSD was traded lower following prior retracement from the resistance level at 1.1900. MACD which illustrate bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1830.

Resistance level: 1.1900, 1.1985

Support level: 1.1830, 1.1775

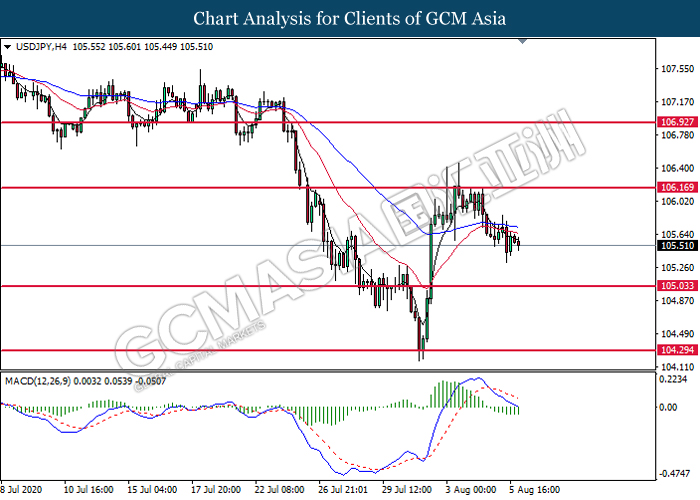

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 106.15. MACD which illustrate bearish bias momentum signal suggest the pair to extend its losses toward the support level at 105.05.

Resistance level: 106.15, 106.95

Support level: 105.05, 104.30

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7225. MACD which illustrate diminishing bullish momentum signal suggest the pair to extend its losses toward the support level at 0.7175.

Resistance level: 0.7225, 0.7290

Support level: 0.7175, 0.7120

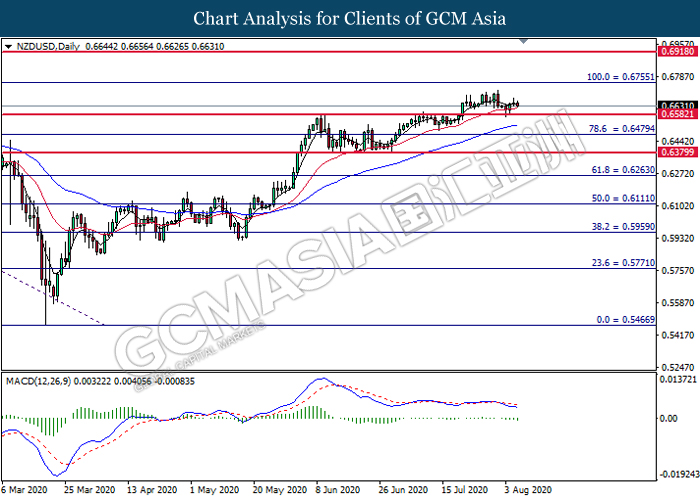

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6580. MACD which illustrate bearish bias momentum suggest the pair to undergo technical correction toward the support level at 0.6580.

Resistance level: 0.6755, 0.6920

Support level: 0.6580, 0.6480

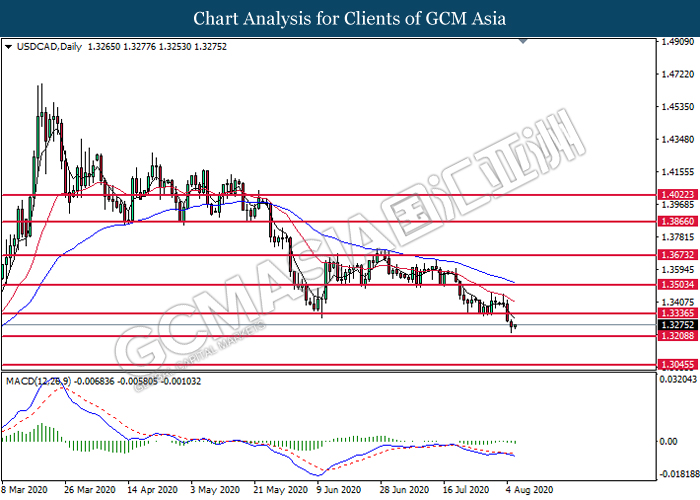

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.3335. MACD which illustrate bearish bias momentum suggest the pair to extend its losses toward the support level at 1.3210.

Resistance level: 1.3335, 1.3505

Support level: 1.3210, 1.3045

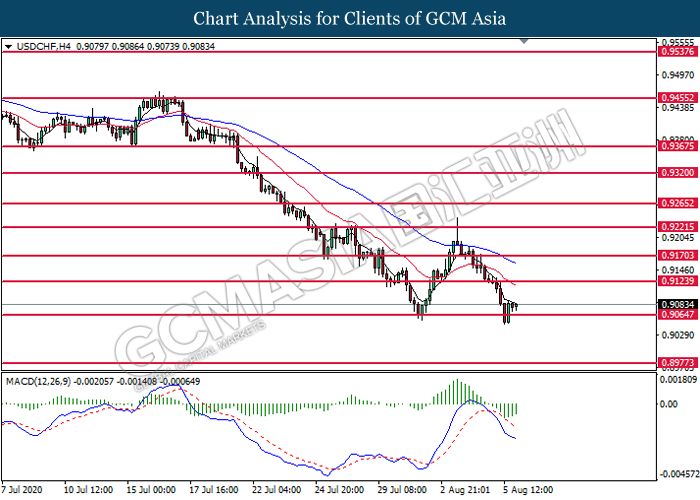

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level at 0.9065. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains toward the resistance level at 0.9125.

Resistance level: 0.9125, 0.9170

Support level: 0.9065, 0.8975

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level at 42.10. MACD which illustrate diminishing bullish momentum signal suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 42.90, 43.55

Support level: 42.10, 41.15

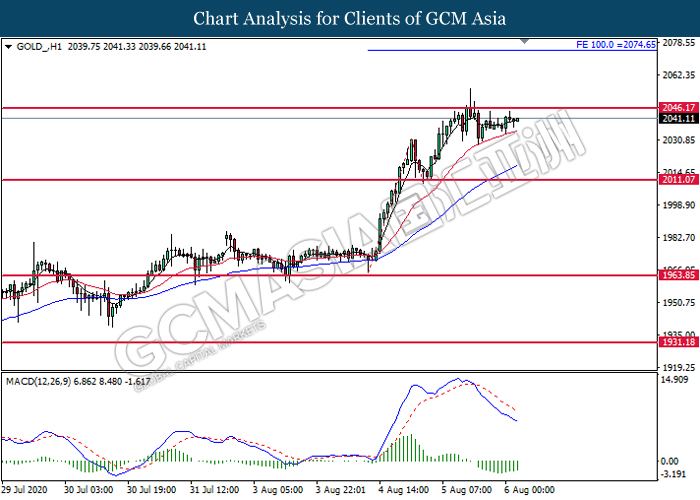

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 2046.15 MACD which illustrate diminishing bearish momentum signal suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2046.15, 2074.65

Support level: 2011.05, 1963.85