6 October 2022 Afternoon Session Analysis

Kiwi surged amid the expected rate hike by RBNZ.

The currency of the New Zealand dollar, which is widely known as the Kiwi, managed to extend its gains toward a higher level following the expected rate hike by the Reserve Bank of New Zealand (RBNZ) yesterday. With the backdrop of persistent sky-high inflationary pressures clouding the New Zealand economy, RBNZ decided to lift the interest rates to a seven-year high, in line with their promise of cooling the overheating economy and stabilize the inflation figure within the territory between 1% to 3% in long term. In the RBNZ October meeting, the central bank raised the cash rate by 0.50% from 3.0% to 3.5%, renewing the record of hiking the rate for the fifth outsized move as well as the eighth hike in the past 1 year. Besides, RBNZ also reiterated that the consumer price inflation is too high and the labour resources are scarce. Compared with the other currencies, persistently high inflation and on-track rate hike boosted the shininess of the Kiwi. As of writing, the pair of NZD/USD rose 0.78% to 0.5780.

In the commodities market, the crude oil price edged up 0.05% to $87.95 per barrel as OPEC agreed to cut oil production by 2 million barrels per day. Besides, the gold prices appreciated by 33% to $1721.95 per troy ounce following the slight retracement of the dollar index.

Today’s Holiday Market Close

Time Market Event

All Day CNY National Day

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Sep) | 49.2 | 48 | – |

| 20:30 | USD – Initial Jobless Claims | 193K | 203K | – |

| 22:00 | CAD – Ivey PMI (Sep) | 60.9 | – | – |

Technical Analysis

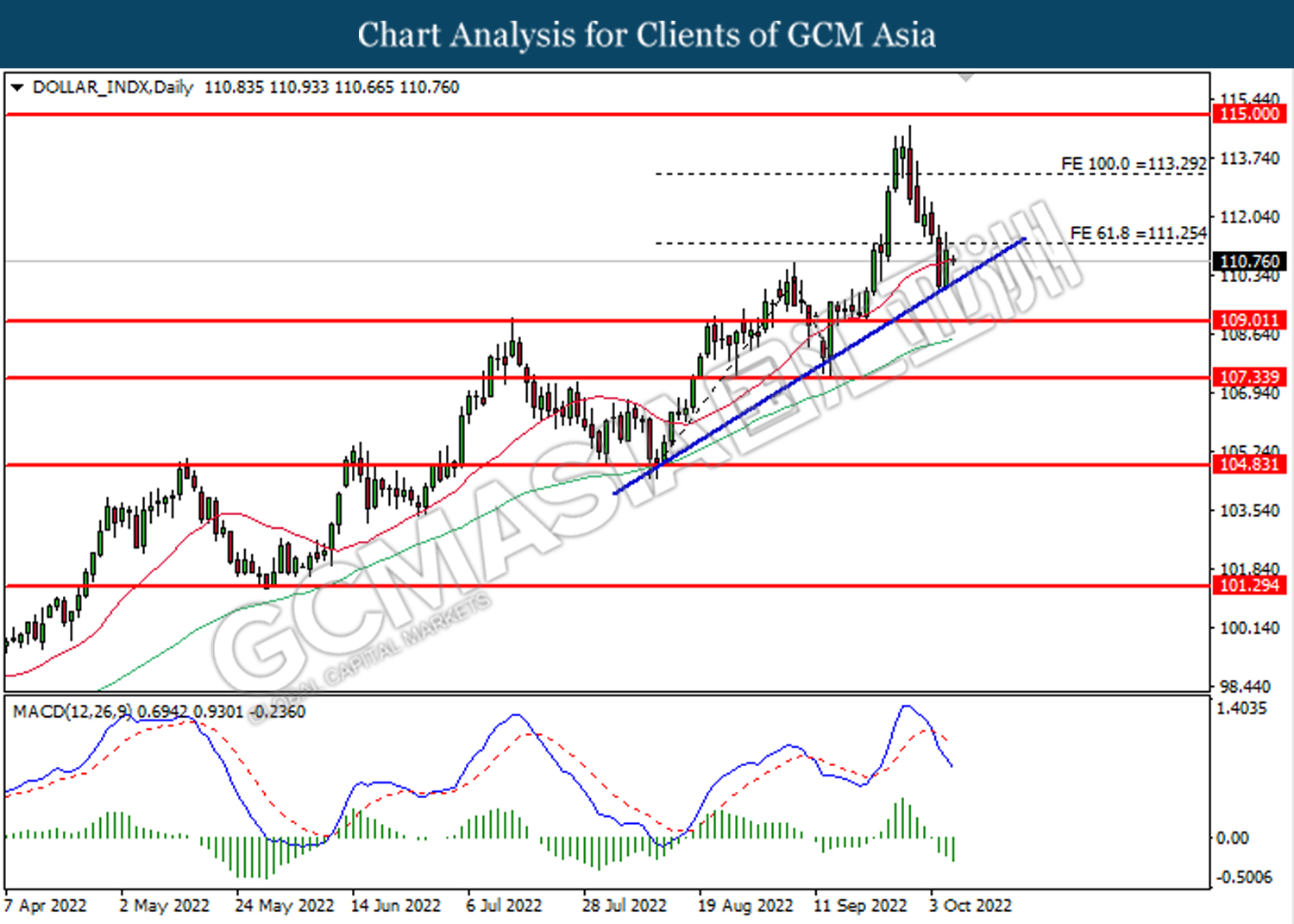

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the upward trendline. However, MACD which illustrated bearish bias momentum suggests the index to undergo short term technical correction.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

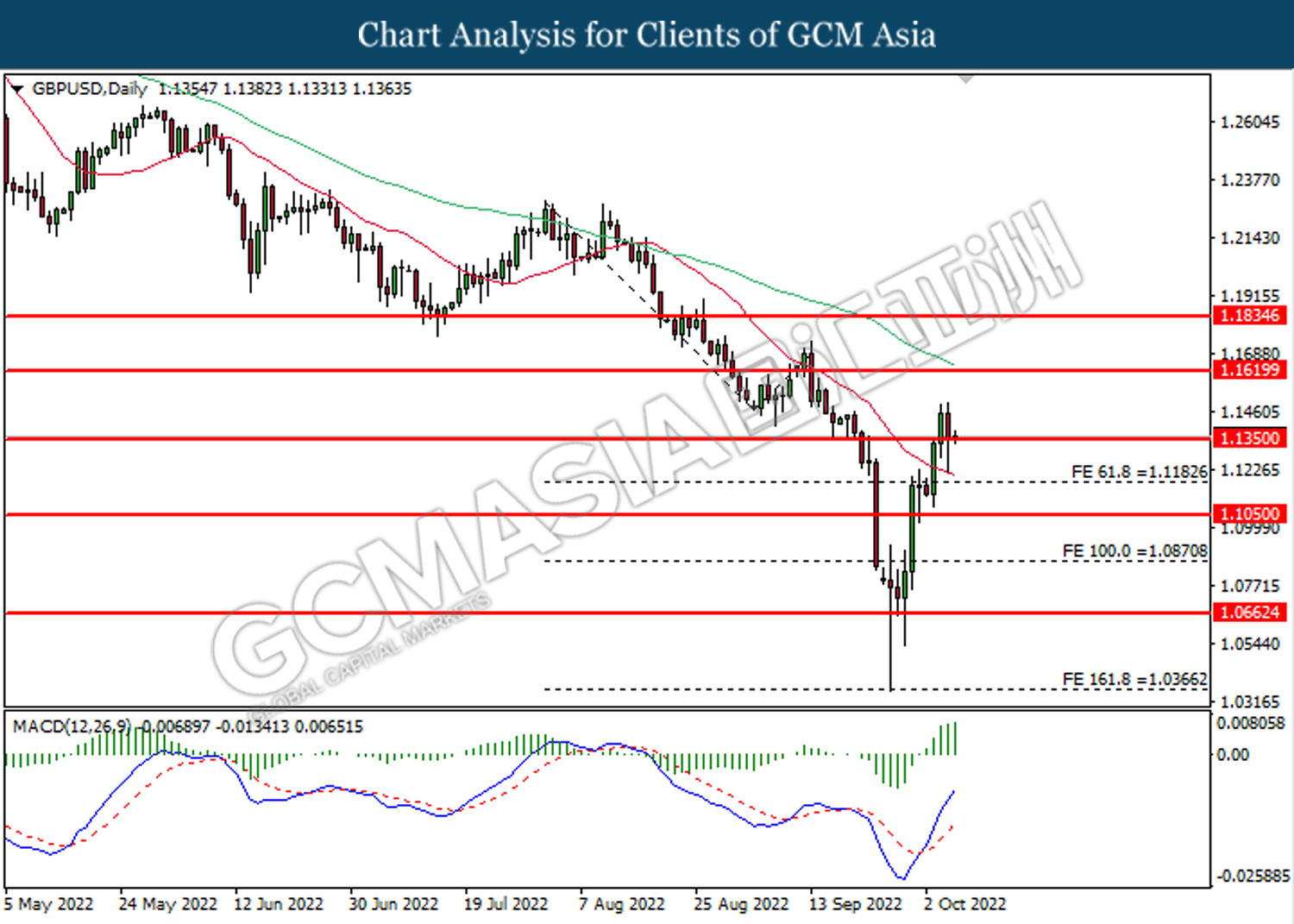

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1350. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1620, 1.1835

Support level: 1.1350, 1.1185

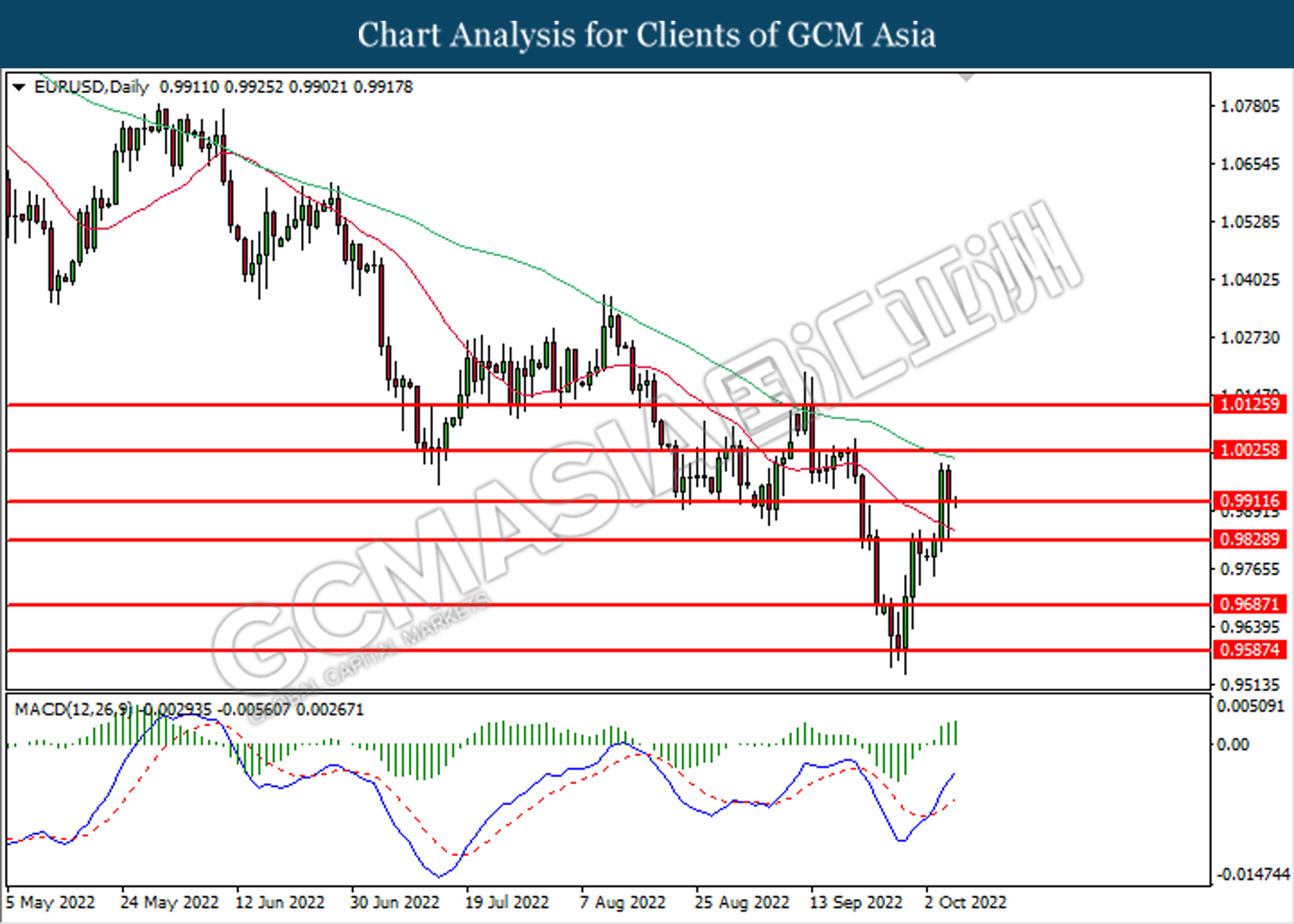

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9910. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0025, 1.0125

Support level: 0.9910, 0.9830

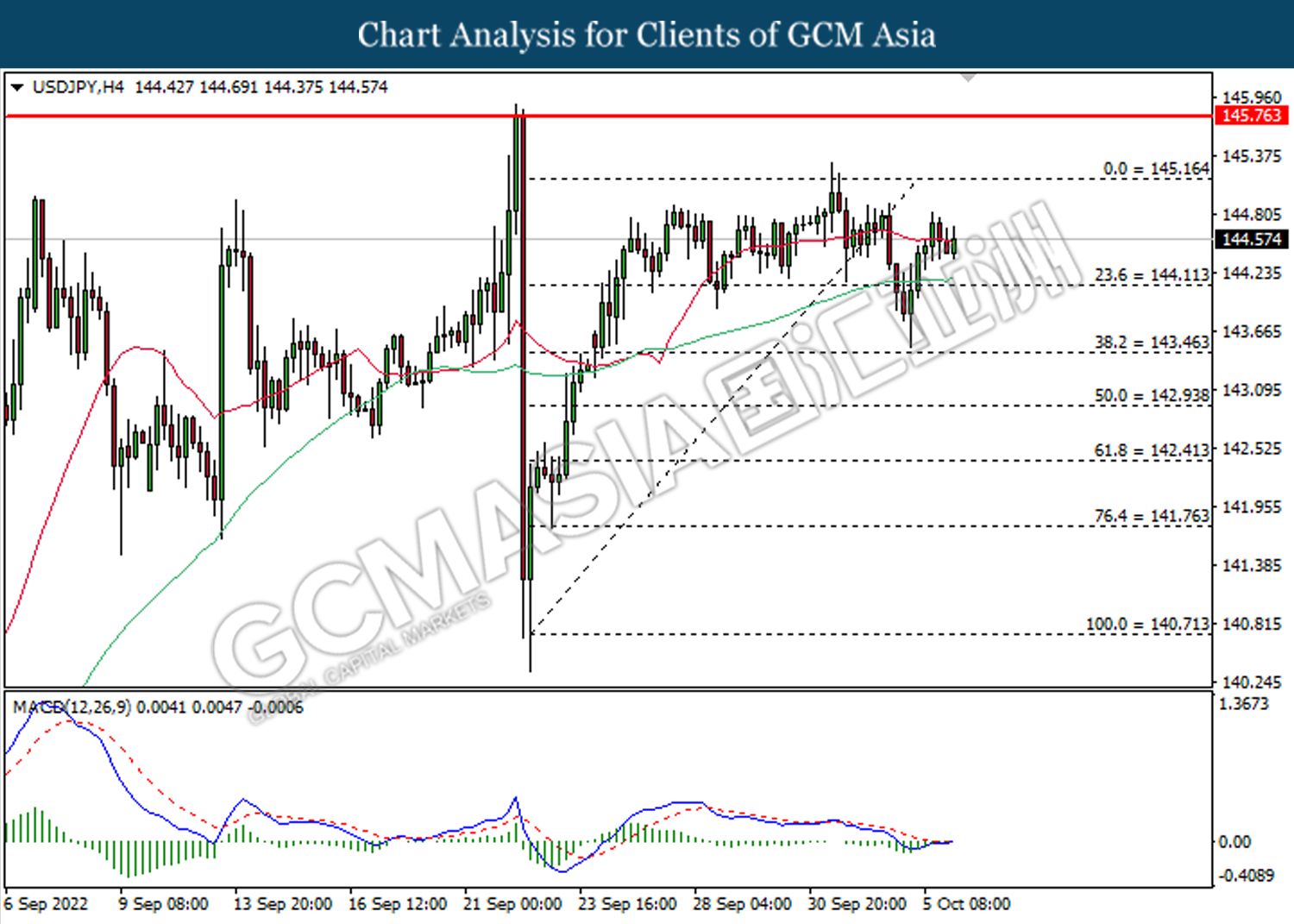

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level at 144.10. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 145.15.

Resistance level: 145.15, 145.75

Support level: 144.10, 143.45

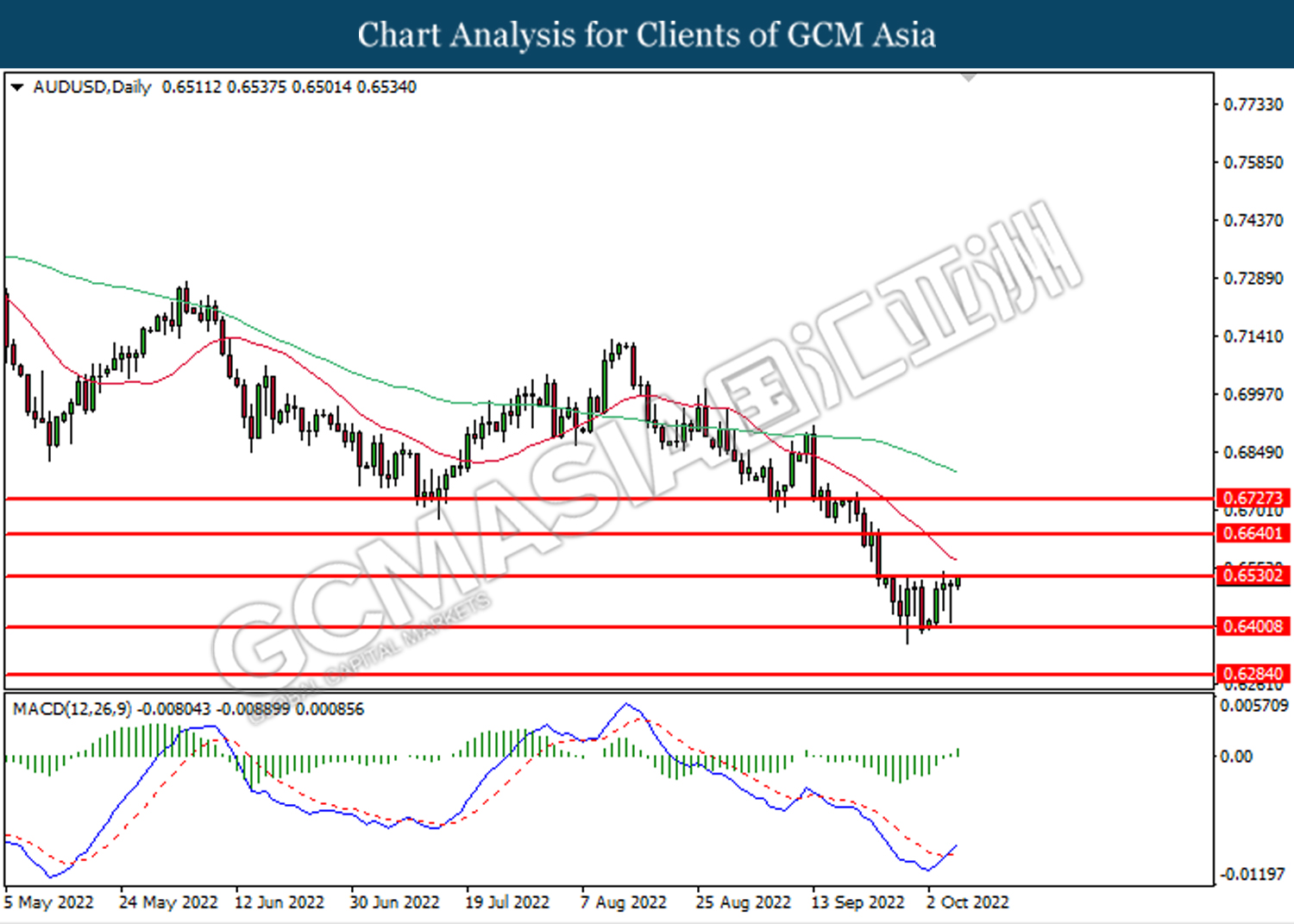

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6530. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

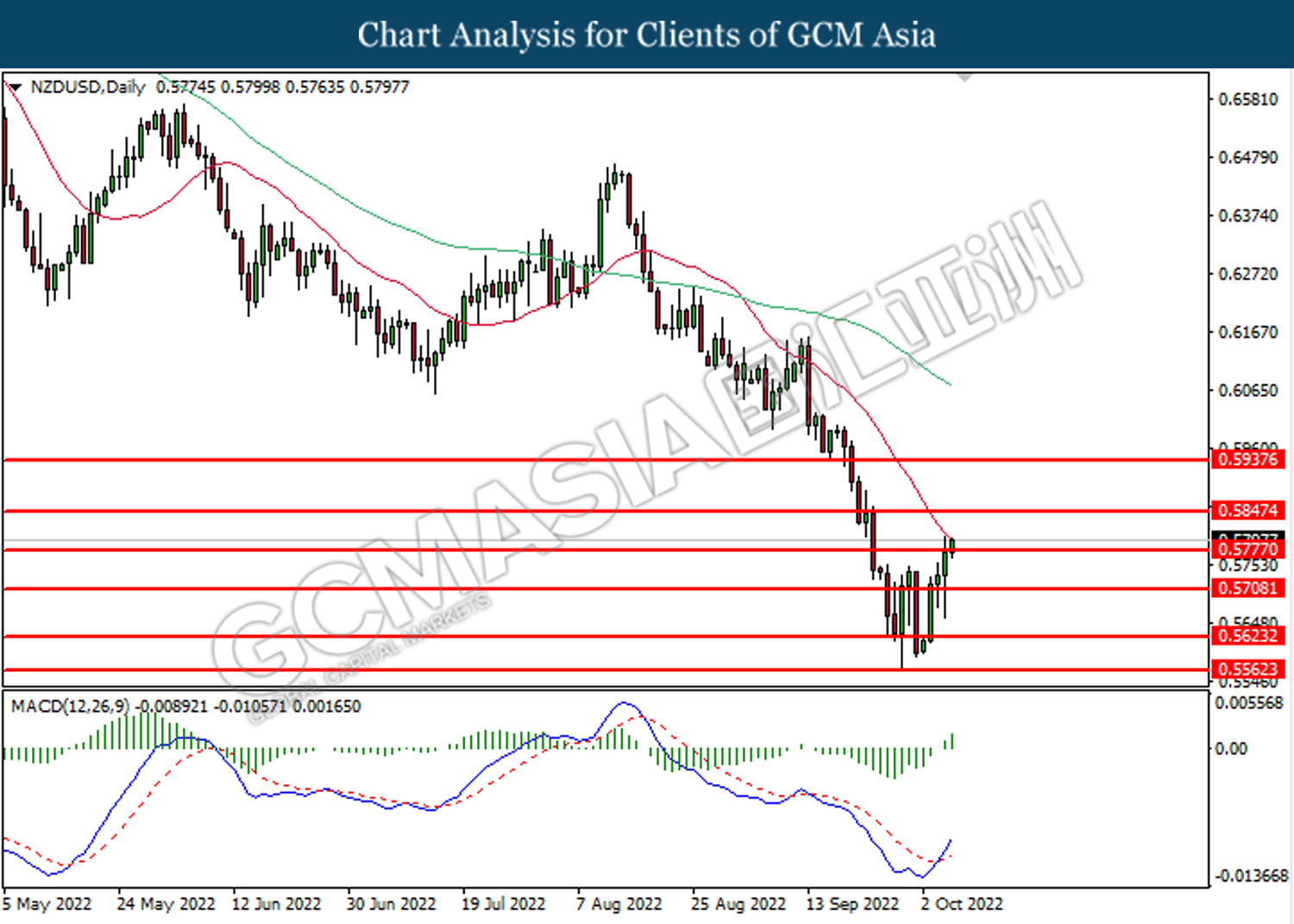

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5775. MACD which illustrated bullish bias momentum suggest the pair to extend gains after its candle successfully closed above the resistance level.

Resistance level: 0.5775, 0.5845

Support level: 0.5710, 0.5625

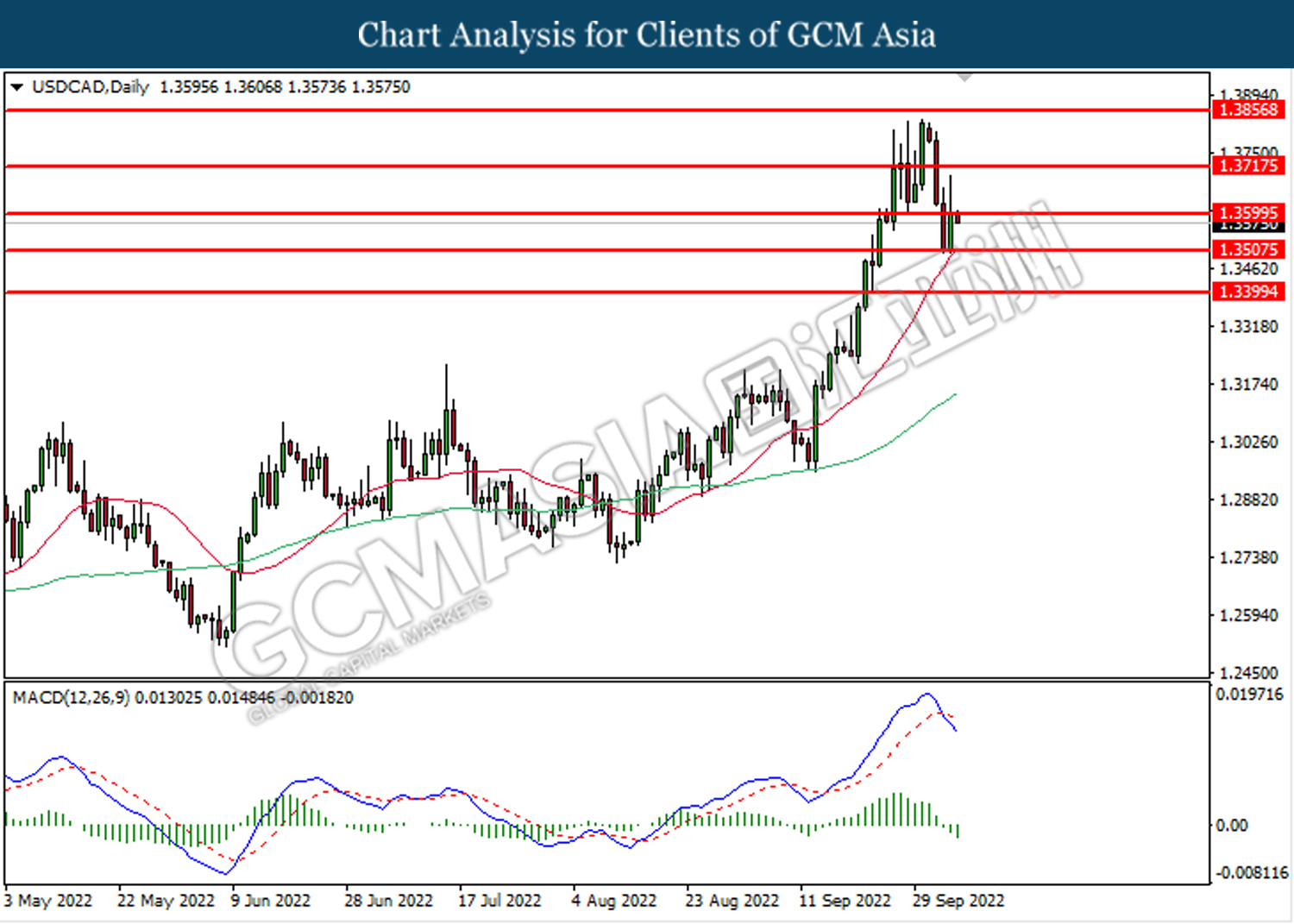

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3600, 1.3715

Support level: 1.3505, 1.3400

USDCHF, H4: USDCHF was traded lower while currently testing the upward trend line. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trend line.

Resistance level: 0.9825, 0.9920

Support level: 0.9750, 0.9675

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous downward trendline. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 89.45.

Resistance level: 89.45, 96.65

Support level: 86.15, 80.60

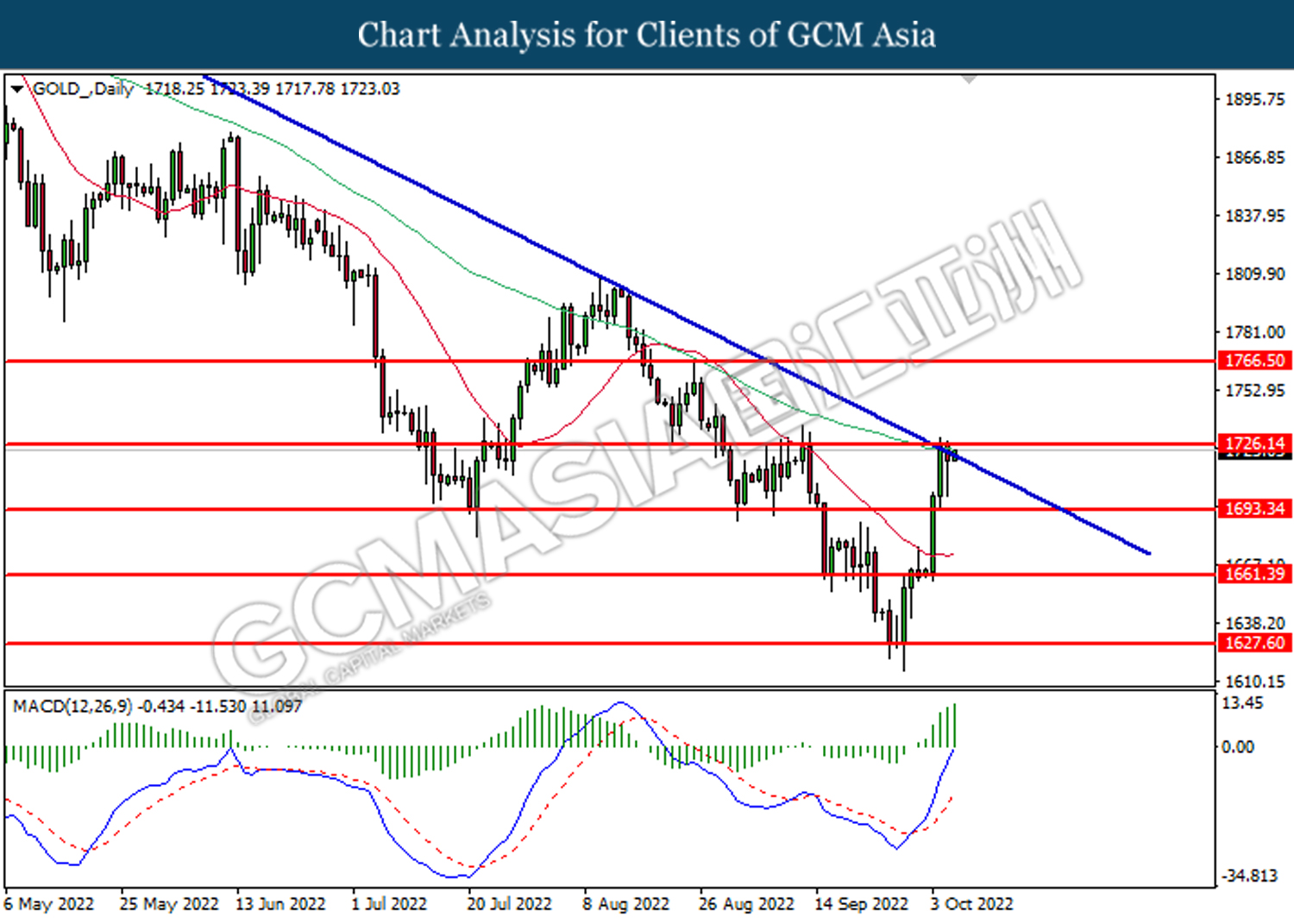

GOLD_, Daily: Gold price was traded higher while currently testing the upward trendline. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1725.15, 1766.50

Support level: 1693.35, 1661.40