6 October 2022 Morning Session Analysis

Bullish economic data pushed US Dollar higher.

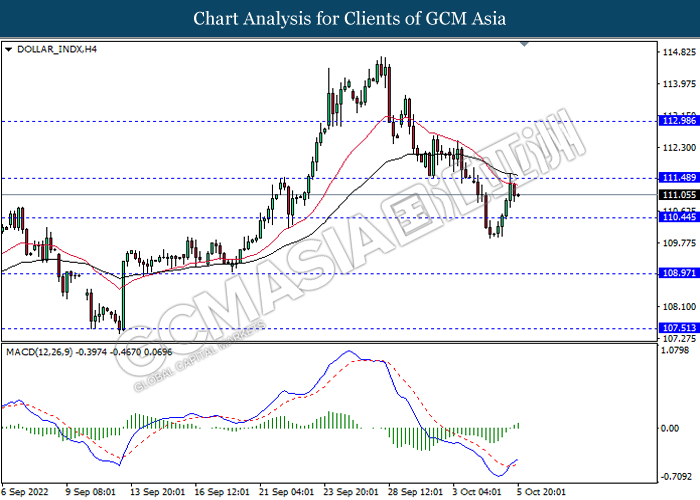

The Dollar Index which traded against a basket of six major currencies surged on yesterday amid the backdrop of upbeat economic data. Yesterday, the US ADP Nonfarm Employment Change has notched up from the previous reading of 185K to 208K, exceeding the market forecast at 200K. Besides that, the US ISM Non-Manufacturing Purchasing Managers Index (PMI) in September had also given a higher-than-expected figures, which posted in at the reading of 56.7 while the consensus expectation was 56.0. These two data has shown that the current US labor market remained tight and the US servicing sector was in expansion, which brought positive prospects toward economic progression in the US. On the other hand the Dollar Index extended its gains over the hawkish statement from Fed member. According to Reuters, Philip Jefferson, one of the recent additions to the Fed’s Washington, D.C.- based board of governors, claimed that the Fed’s willingness to accept “a period of below-trend growth” as it fights to dampen inflation, hinted that the Fed would less likely to slow down the pace of aggressive rate hike. As of writing, the Dollar Index rose by 1.04% to 111.12.

In the commodities market, the crude oil price appreciated by 0.41% to $88.12 per barrel as of writing amid diminishing of crude oil inventories. According to EIA, the US Crude Oil Inventories decreased by 1.356M barrels, while the market was anticipating the increasing by 2.052M barrels. In addition, the gold price rallied by 0.34% to $1717.96 per troy ounce as of writing following the value of US Dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – National Day

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Sep) | 49.2 | 48 | – |

| 20:30 | USD – Initial Jobless Claims | 193K | 203K | – |

| 22:00 | CAD – Ivey PMI (Sep) | 60.9 | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 111.50, 113.00

Support level: 110.45, 108.95

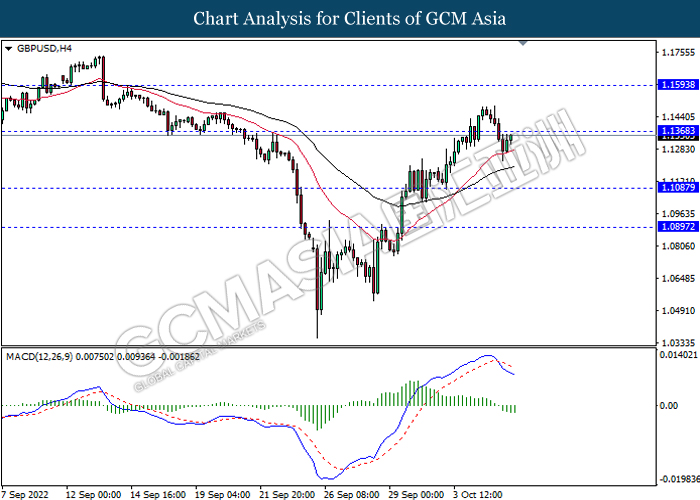

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1370, 1.1595

Support level: 1.1085, 1.0895

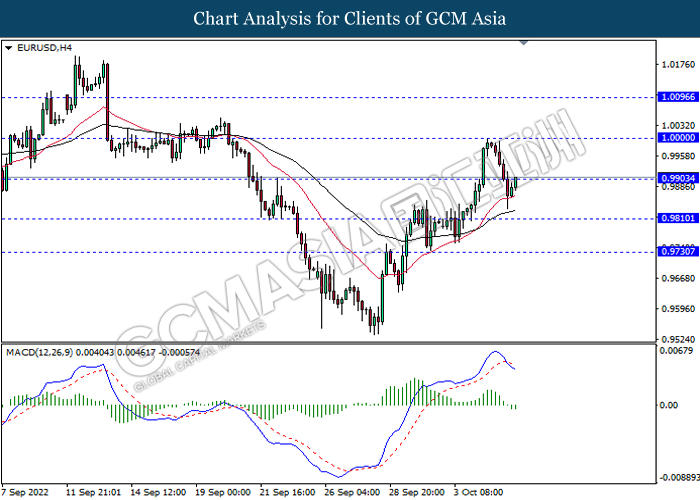

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9905, 1.0000

Support level: 0.9810, 0.9730

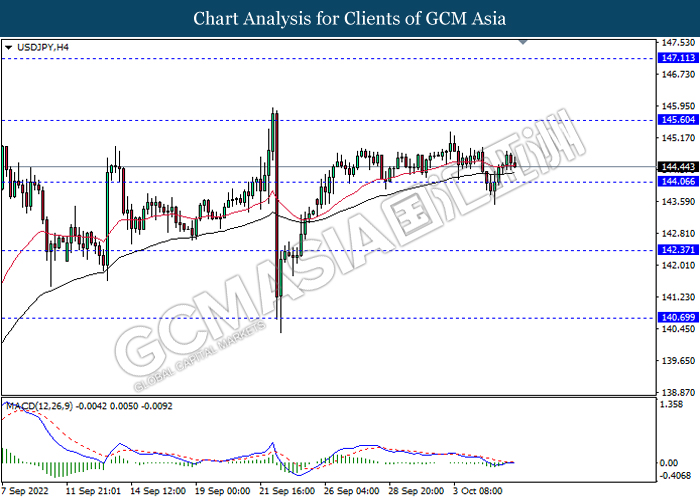

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 145.60, 147.10

Support level: 144.05, 142.35

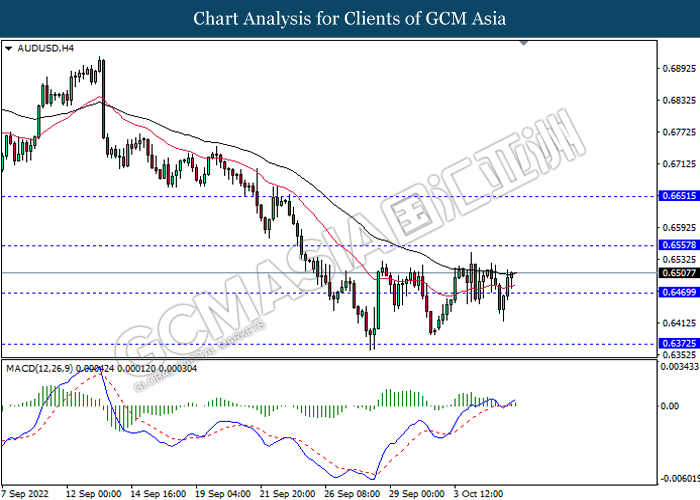

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6555, 0.6650

Support level: 0.6470, 0.6370

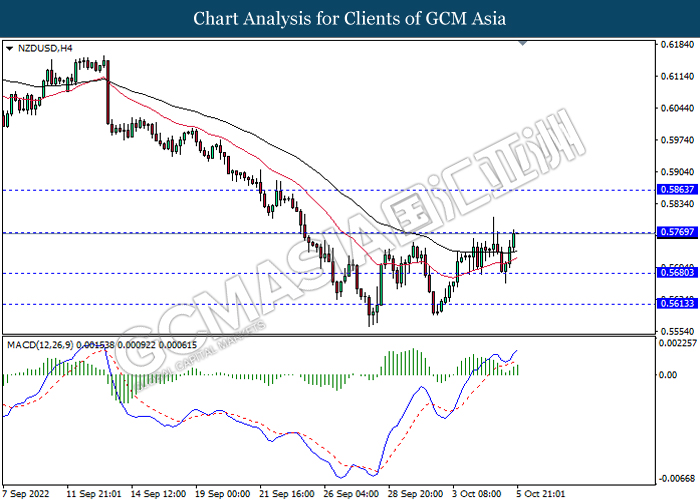

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.5770, 0.5865

Support level: 0.5680, 0.5615

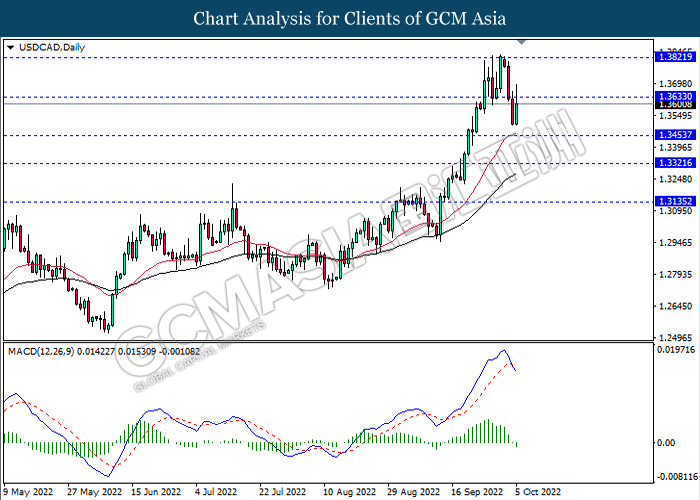

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

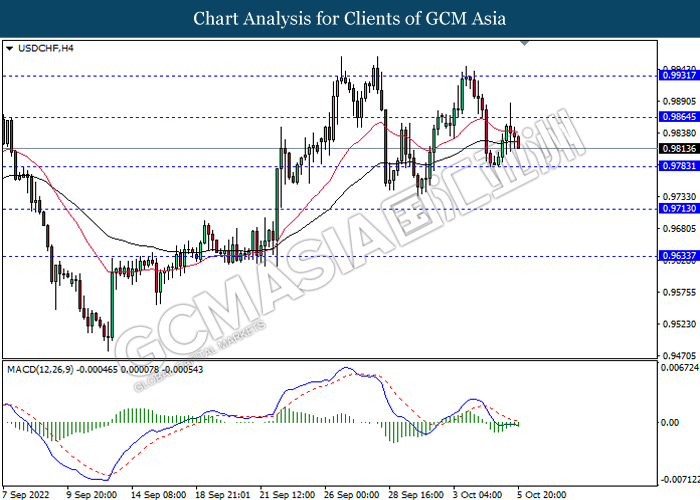

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9865, 0.9930

Support level: 0.9785, 0.9715

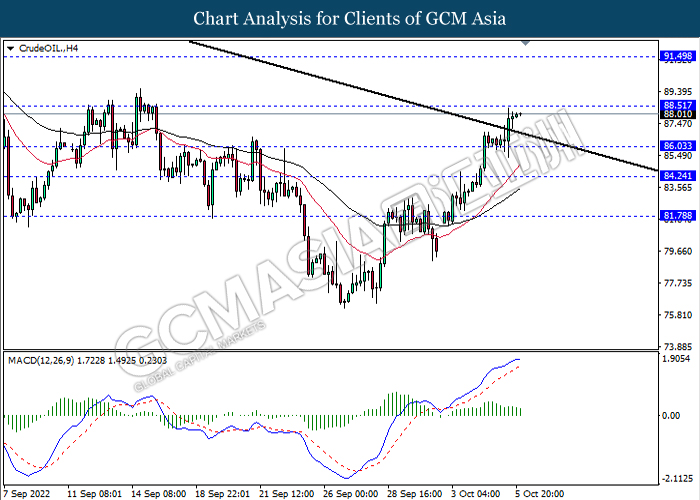

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 88.50, 91.50

Support level: 86.05, 84.25

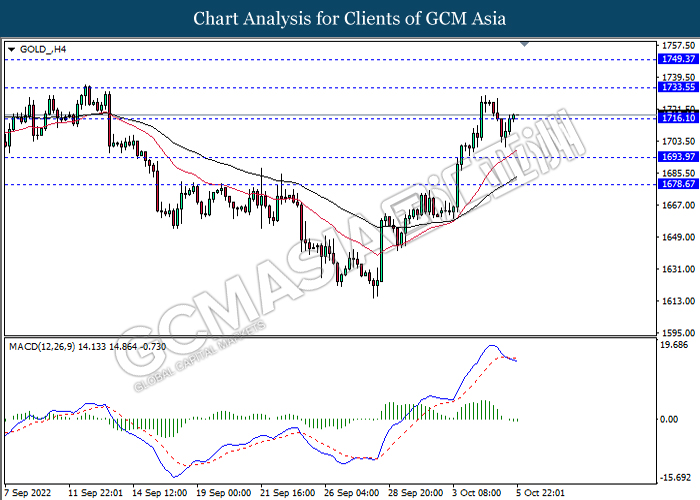

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1733.55, 1749.35

Support level: 1716.10, 1693.95