06 November 2020 Afternoon Session Analysis

Greenback seesawed following flat interest rate decision.

Dollar index which gauges its value against a basket of six major currencies was having mixed pattern after Federal Reserve decided to hold its interest rate unchanged while remain cautious toward the future outlook of US economy. In the Fed meeting, board members unanimously kept it interest rate between the ranges of 0% to 0.25%, remained at the low level as economy continue struggling in the negative impact of Covid-19. Besides, Chairman of Federal Reserve Jerome Powell revealed that despite economic activity and employment have showed some sign of recovery, yet it still well below the level before the coronavirus pandemic hit. Moreover, Federal Reserve noted that central bank still have plenty of measures to help the recovery of economy, while emphasizing that the economy likely to need further fiscal support. With the backdrop of pandemic, US is still the most affected country in the world where it total cases are getting near to 100 million, while the death toll has increased to 240K. Nonetheless, the attentions of market participants will still be the development of the pandemic as well as the ongoing US Election. As of now, dollar index up 0.13% to 92.65.

In the commodities market, crude oil price depreciated 1.94% to $37.95 per barrel as uncertainty over the US Presidential Election continue haunting the market sentiment of this black commodity. Moreover, the resurgence of Covid-19 in European countries tampered the demand of oil market. Besides, gold price up 0.40% to $1941.95 per troy ounce as uncertainty of US election lifted up the demand of safe haven asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21.30 | USD – Nonfarm Payrolls (Oct) | 661K | 600K | – |

| 21.30 | USD – Unemployment Rate (Oct) | 7.9% | 7.7% | – |

| 21.30 | CAD – Employment Change (Oct) | 378.2K | 100.0K | – |

| 23.00 | CAD – Ivey PMI (Oct) | 54.3 | 51.5 | – |

Technical Analysis

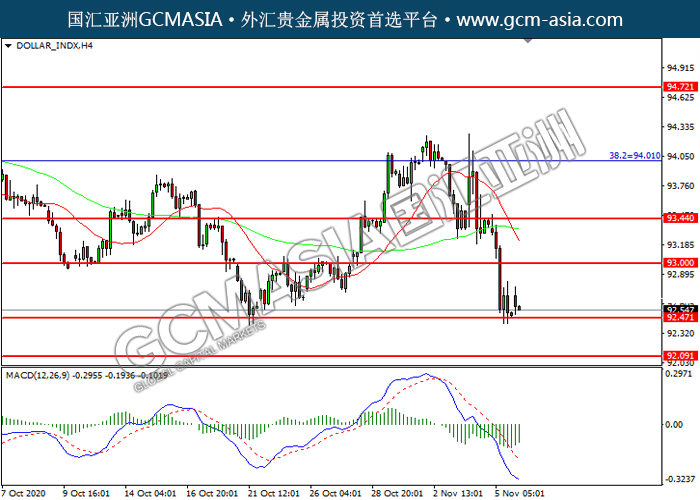

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 92.45. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher in short-term as technical correction.

Resistance level: 93.00, 93.45

Support level: 92.45, 92.10

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3155. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3155, 1.3255

Support level: 1.3065, 1.3010

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1810. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1855, 1.1890

Support level: 1.1765, 1.1705

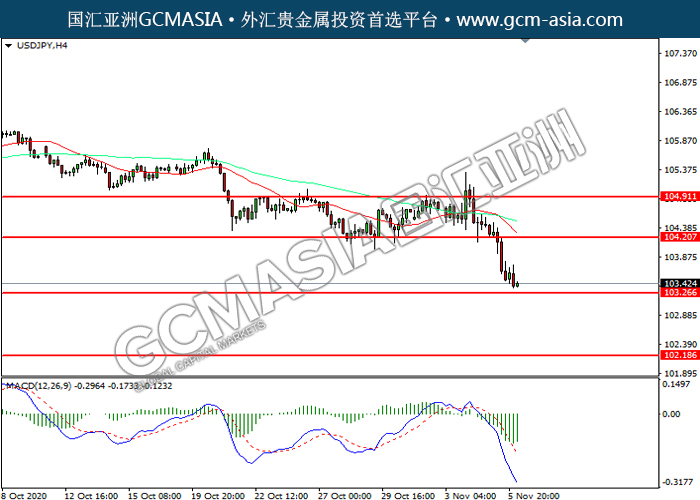

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 103.25. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 104.20, 104.90

Support level: 103.25, 102.20

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7240. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout the support level.

Resistance level: 0.7310, 0.7375

Support level: 0.7240, 0.7135

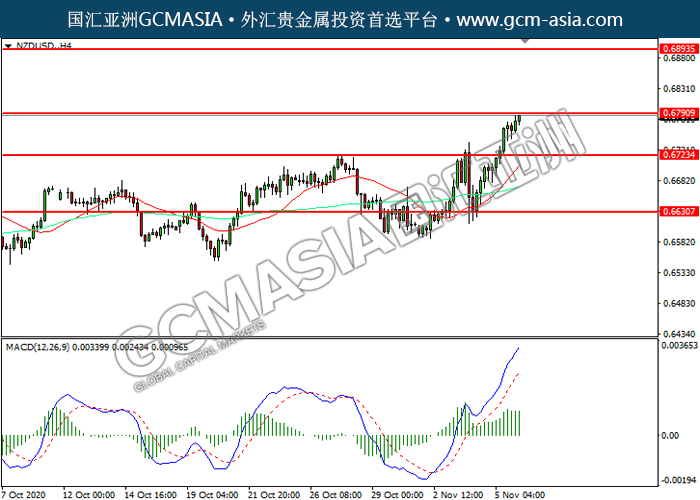

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6790. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6790, 0.6895

Support level: 0.6725, 0.6630

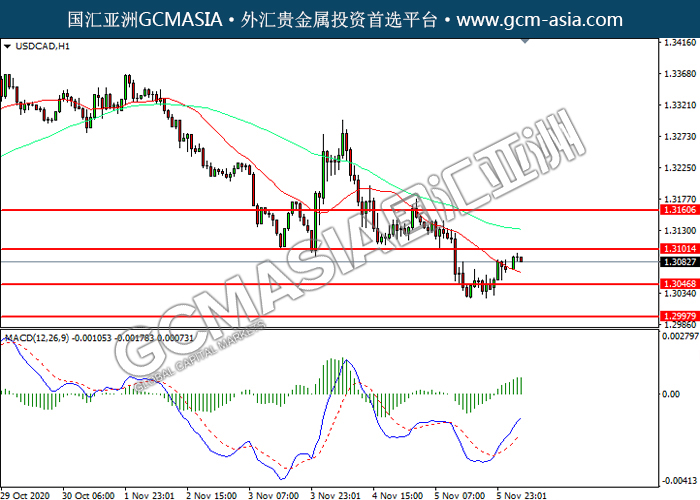

USDCAD, H1: USDCAD was traded higher while currently testing the resistance level at 1.3100. MACD which illustrated increasing bullish momentum suggest the pair after it successfully breakout above the resistance level.

Resistance level: 1.3100, 1.3160

Support level: 1.3045, 1.2995

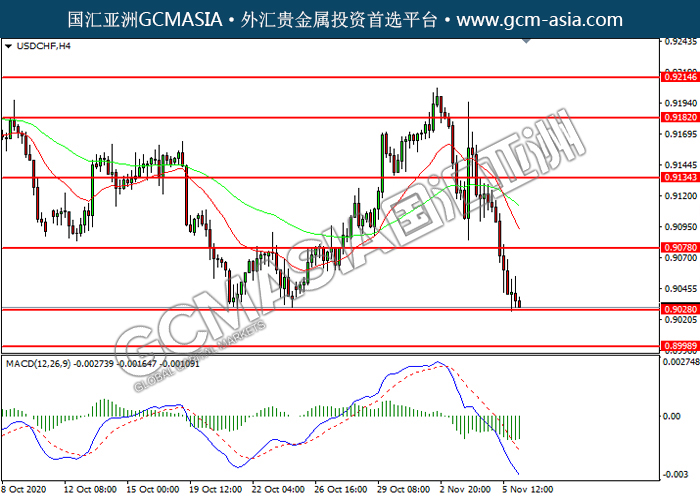

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9030. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9080, 0.9135

Support level: 0.9030, 0.9000

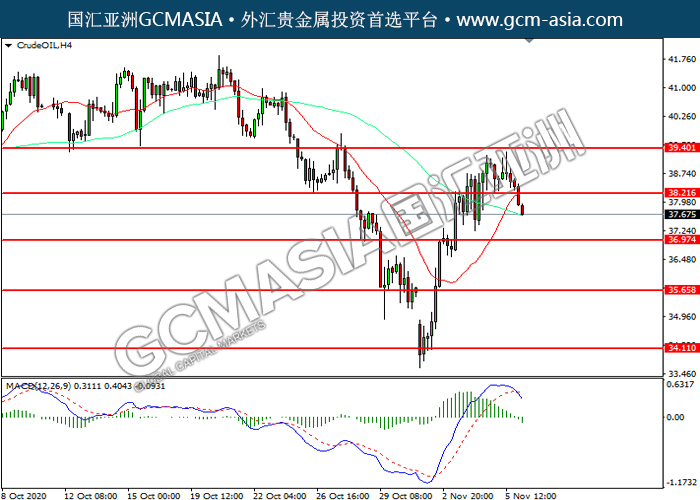

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 38.20. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 36.95.

Resistance level: 38.20, 39.40

Support level: 36.95, 35.65

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1951.65. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level at 1918.10.

Resistance level: 1951.65, 1991.55

Support level: 1918.10, 1869.40