6 December 2021 Afternoon Session Analysis

Aussie remains weak amid cautious optimism, Omicron.

The Australian dollar which traded against the dollar and other currency pairs have fell following cautious mood towards Australia economy and fears towards Omicron virus. The risk sensitive currency was continue to be battered by the emerging Omicron variant as Australia reported its first community transmission of Omicron recently. New South Wales health authorities are now investigating an outbreak linked to Regents Park Christian School and there are now a total of 13 new Omicron cases linked to the cluster. The ongoing risk of Omicron spread will potential lead to lockdown that will dent local growth and affect economic recovery. On the other hand, investors also cautious ahead of RBA rate decision. RBA Governor Phillip Lowe have been reiterating that data and forecast currently do not warrant a rate hike in 2022. At the time of writing, AUD/USD rose 0.21% to $0.7014.

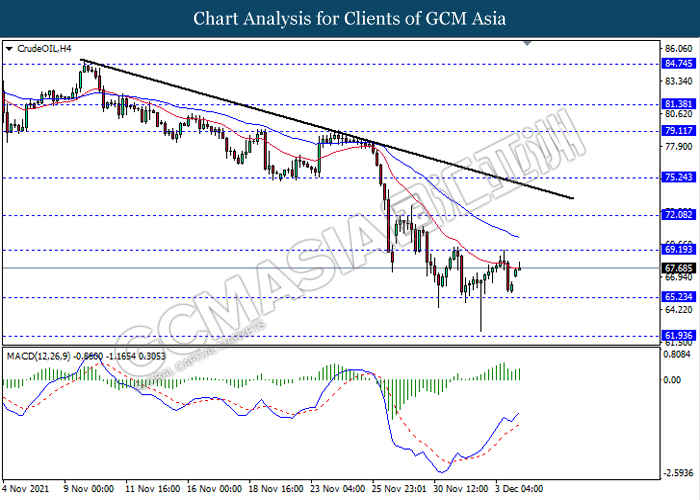

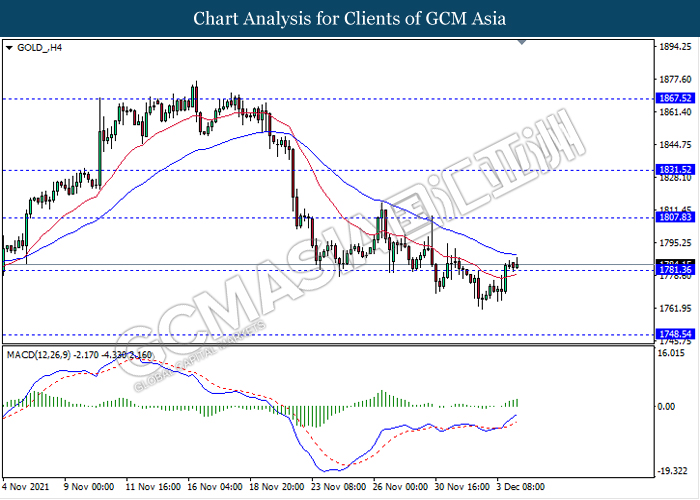

In the commodities market, crude oil price rebound 1.89% to $67.57 a troy ounce as of writing following latest development of Iran denuclearization talks. According to reports, Iran has withdrawn from negotiations denuclearization with France, Germany and the UK recently. Countries involved with negotiations such as the UK and the EU are concerned that they are running out of time to reach a consensus. Therefore, failure to reach an agreement denuclearization means that trade sanctions will be continued on Iran and crude oil exports to another country is prohibited. On the other hand, gold price rose 0.09% to $1784.93 a troy ounce amid dollar retracement.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Nov) | 54.6 | 52.0 | – |

Technical Analysis

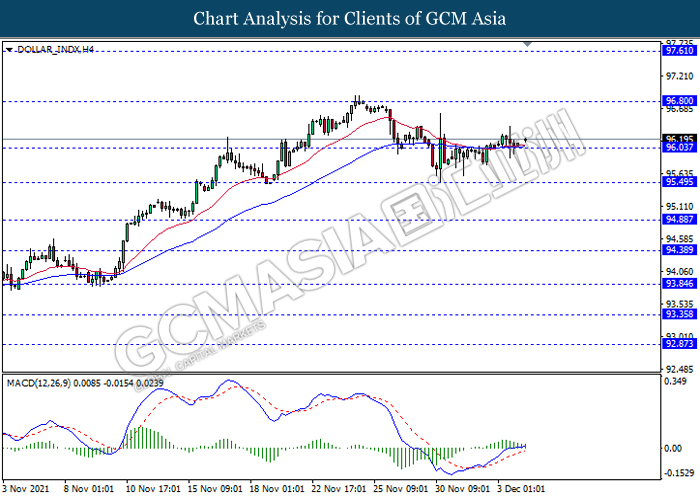

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 96.05. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 96.80.

Resistance level: 96.80, 97.60

Support level: 96.05, 95.50

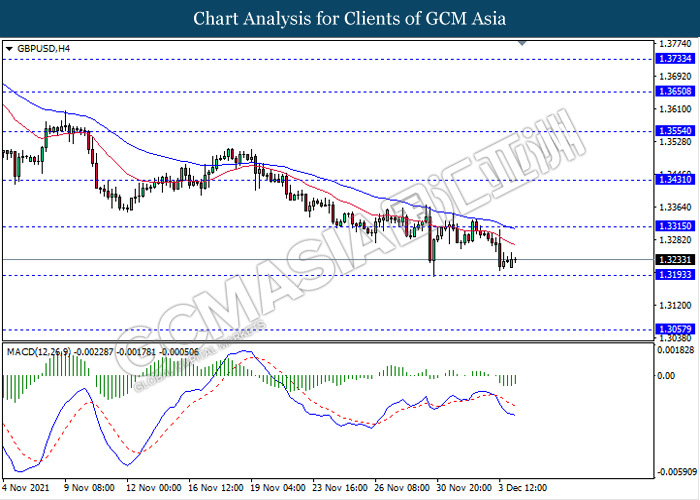

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.3195. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level 1.3195.

Resistance level: 1.3315, 1.3430

Support level: 1.3195, 1.3055

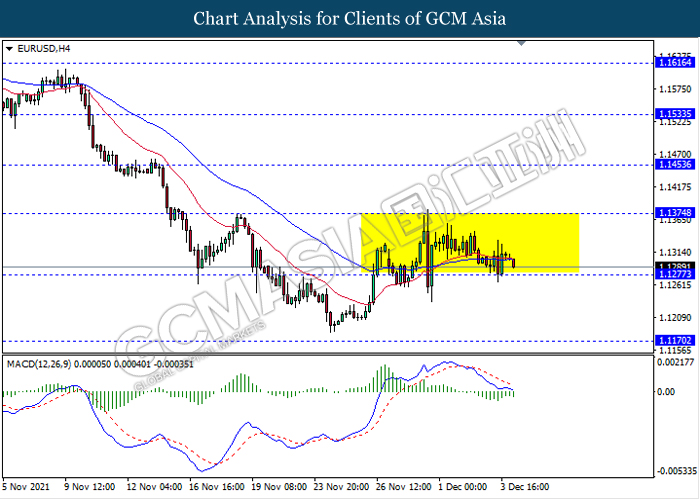

EURUSD, H4: EURUSD remain traded in sideway channel while currently testing near the support level 1.1275. However, MACD which illustrate ongoing bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1375, 1.1455

Support level: 1.1275, 1.1170

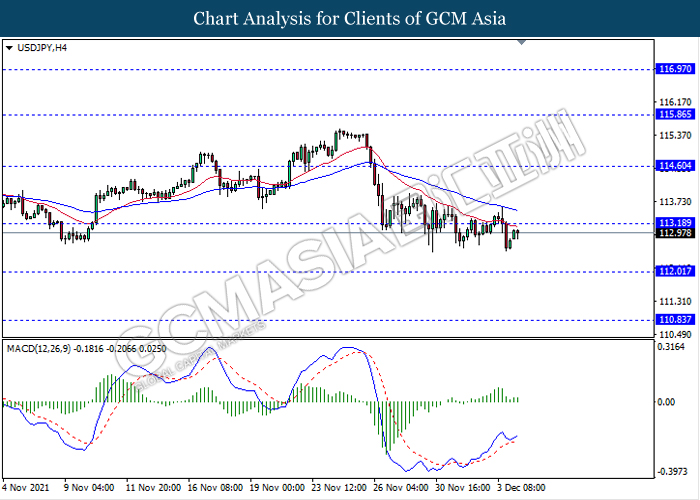

USDJPY, H4: USDJPY was traded lower following prior breakout below the support level 113.20. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level 112.00.

Resistance level: 113.20, 114.60

Support level: 112.00, 110.85

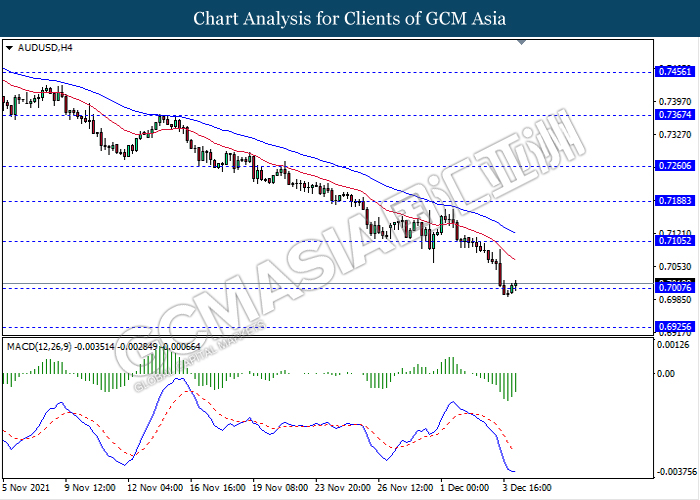

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7005. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 0.7105.

Resistance level: 0.7105, 0.7190

Support level: 0.7005, 0.6925

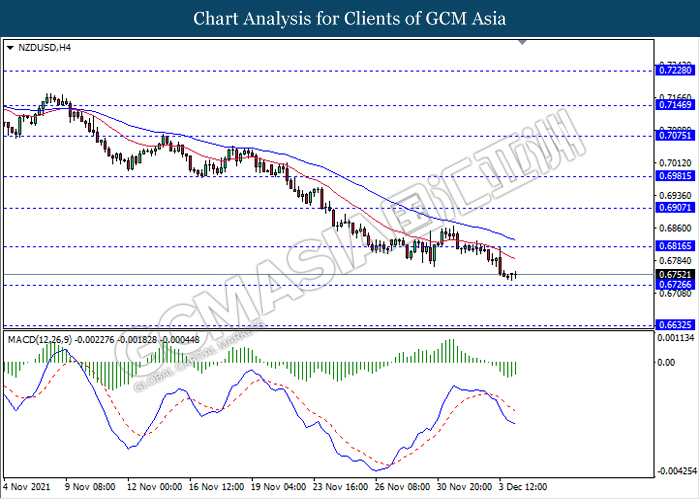

NZDUSD, H4: NZDUSD was traded lower while currently testing near the support level 0.6725. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its rebound towards the resistance level 0.6815.

Resistance level: 0.6815, 0.6905

Support level: 0.6725, 0.6630

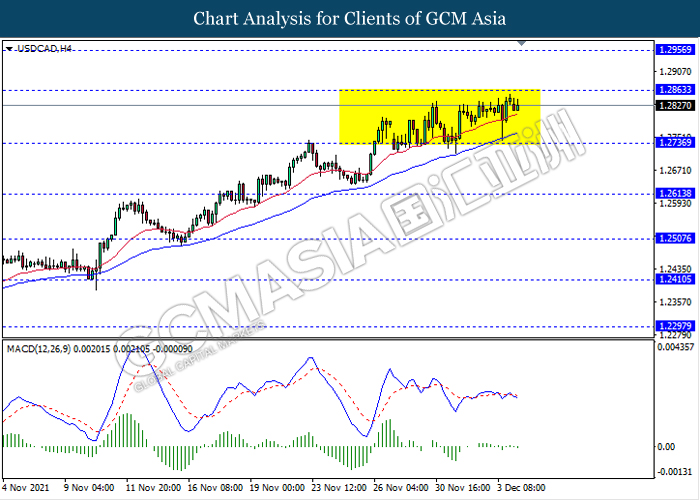

USDCAD, H4: USDCAD was traded flat in a sideway channel while currently testing near the resistance level 1.2865. However, MACD which illustrate bearish momentum signal suggest the pair to be traded lower towards the support level 1.2735.

Resistance level: 1.2865, 1.2955

Support level: 1.2735, 1.2615

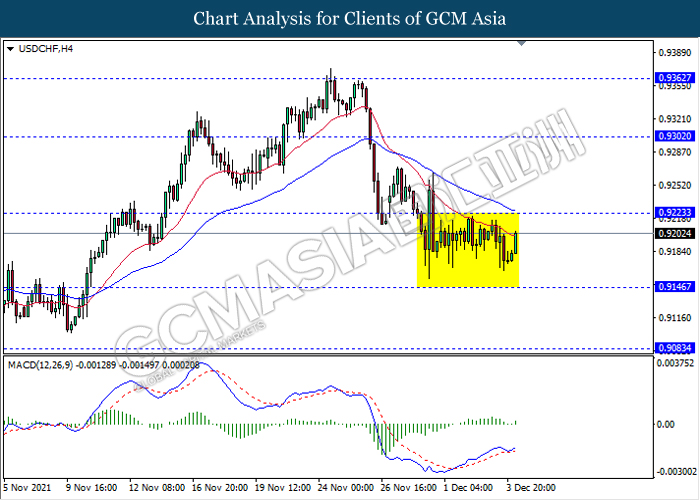

USDCHF, H4: USDCHF remain traded in a sideway channel while currently testing near the resistance level 0.9225. However, MACD which illustrate bullish momentum signal suggest the pair to be traded higher after it breaks above the resistance level 0.9225.

Resistance level: 0.9225, 0.9300

Support level: 0.9145, 0.9085

CrudeOIL, H4: Crude oil price was traded higher following recent rebound from the support level 65.25. MACD which illustrate bullish momentum signal suggest the commodity to extend its rebound towards the resistance level 69.20.

Resistance level: 69.20, 72.10

Support level: 65.25, 61.95

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1781.35. MACD which illustrate bullish momentum signal suggest commodity to extend its gains towards the resistance level 1807.85.

Resistance level: 1807.85, 1831.50

Support level: 1781.35, 1748.55