6 December 2022 Afternoon Session Analysis

Aussie dollar jumped after a 25 basis point of rate hike from RBA.

The Aussie dollar, which global investors majorly traded, regained its luster after the RBA decided to increase the interest rate by 25 basis points during its early morning meeting. At this juncture, the inflation figure in Australia is still high, at 6.9% for October. With that, the cash rate was adjusted upward from 2.85% to 3.10% to curb sky-high inflation. In the meeting, the official members came to a consensus that the inflation is expected to increase further over the months ahead, whereby the peak would be around 8% within these few months. However, in the long term, the ongoing resolution of global supply-side problems is expected to drag down inflation in the next year. Regarding the economic side, the Australian economy is still growing solidly in the post-covid-19 era. At the same time, the labor market remains very tight as firm is facing hardship in hiring workers. As of writing, the pair of AUD/USD was up by 0.59% to 0.6736.

In the commodities market, the crude oil price edged up 0.49% to $78.10 per barrel as the strengthening of the dollar index urged the non-US buyer to shy away from oil market temporarily. Besides, the gold prices jumped 0.28% to $1773.65 per troy ounce following the technical correction during the previous trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Nov) | 53.2 | 52 | – |

| 23:00 | CAD – Ivey PMI (Nov) | 50.1 | 51 | – |

Technical Analysis

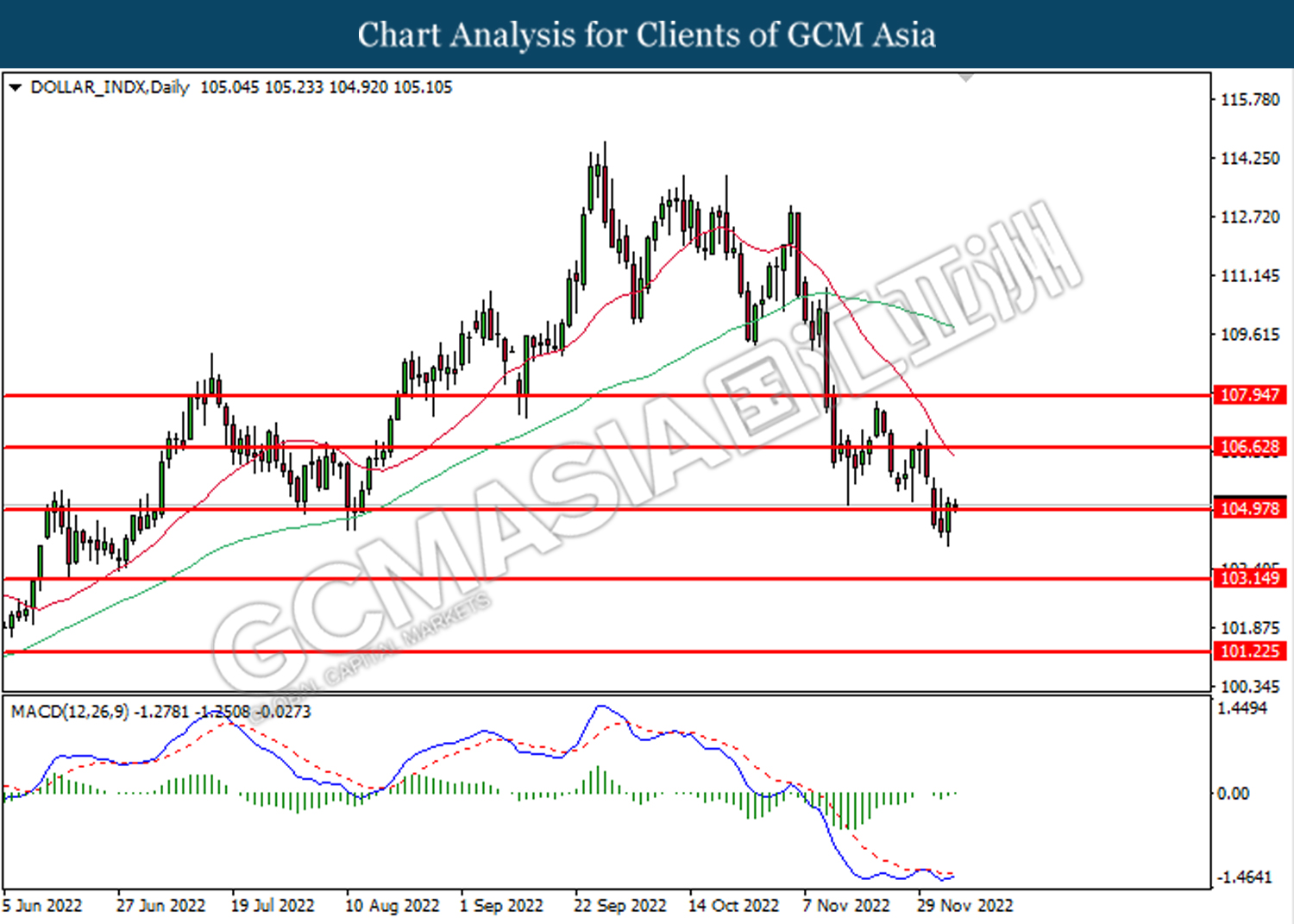

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 105.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 107.95

Support level: 105.00, 103.15

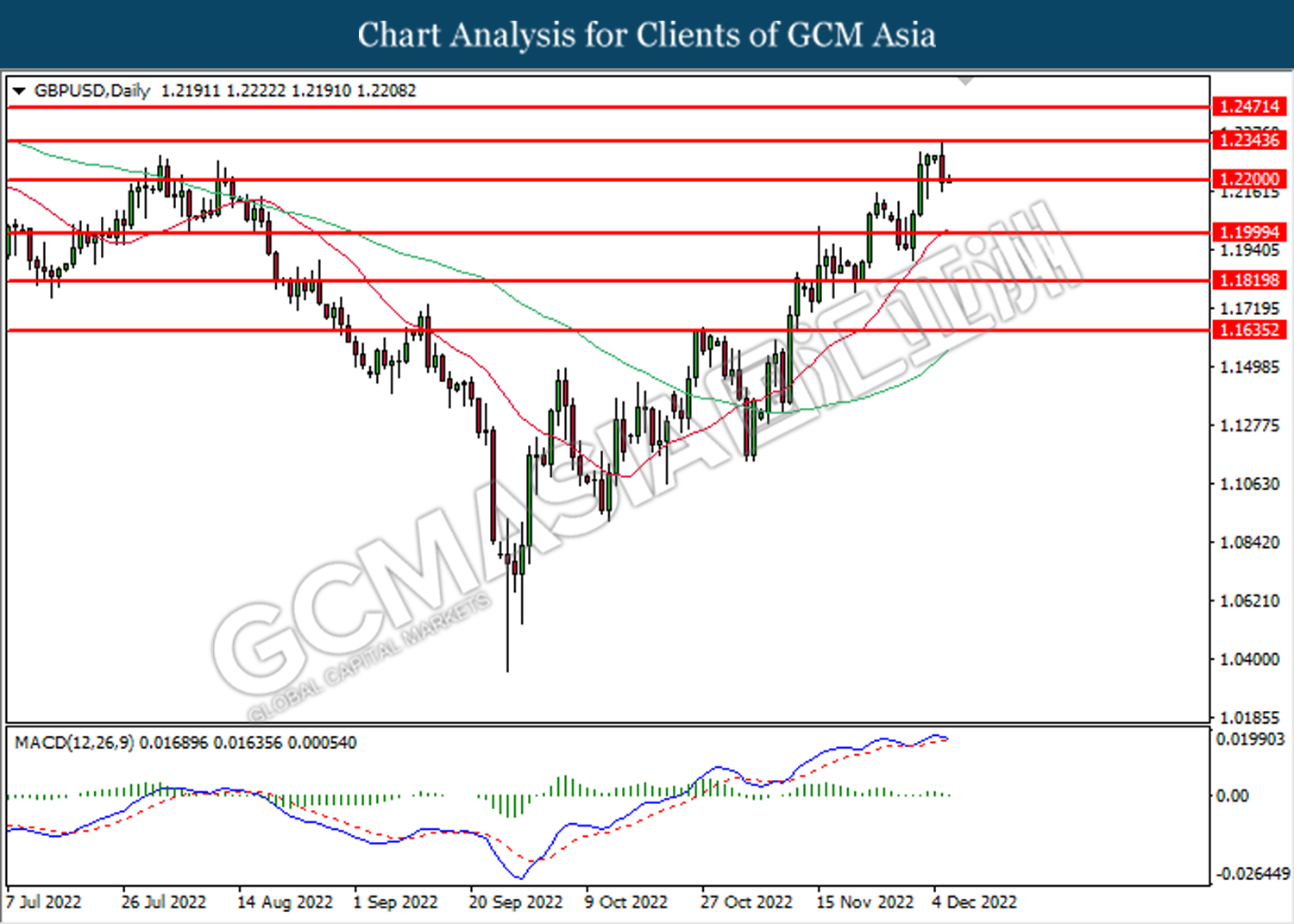

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2000

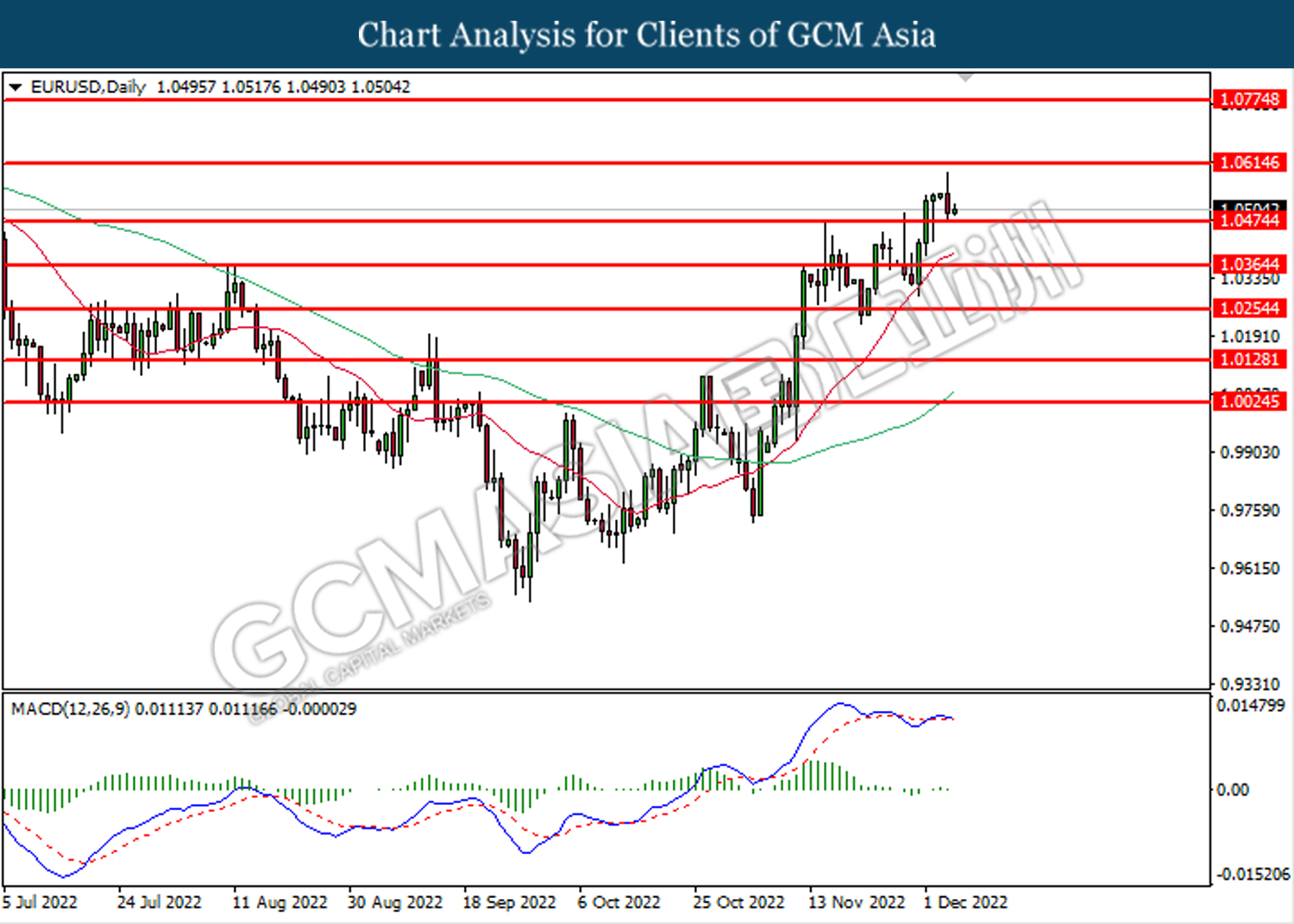

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0475. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

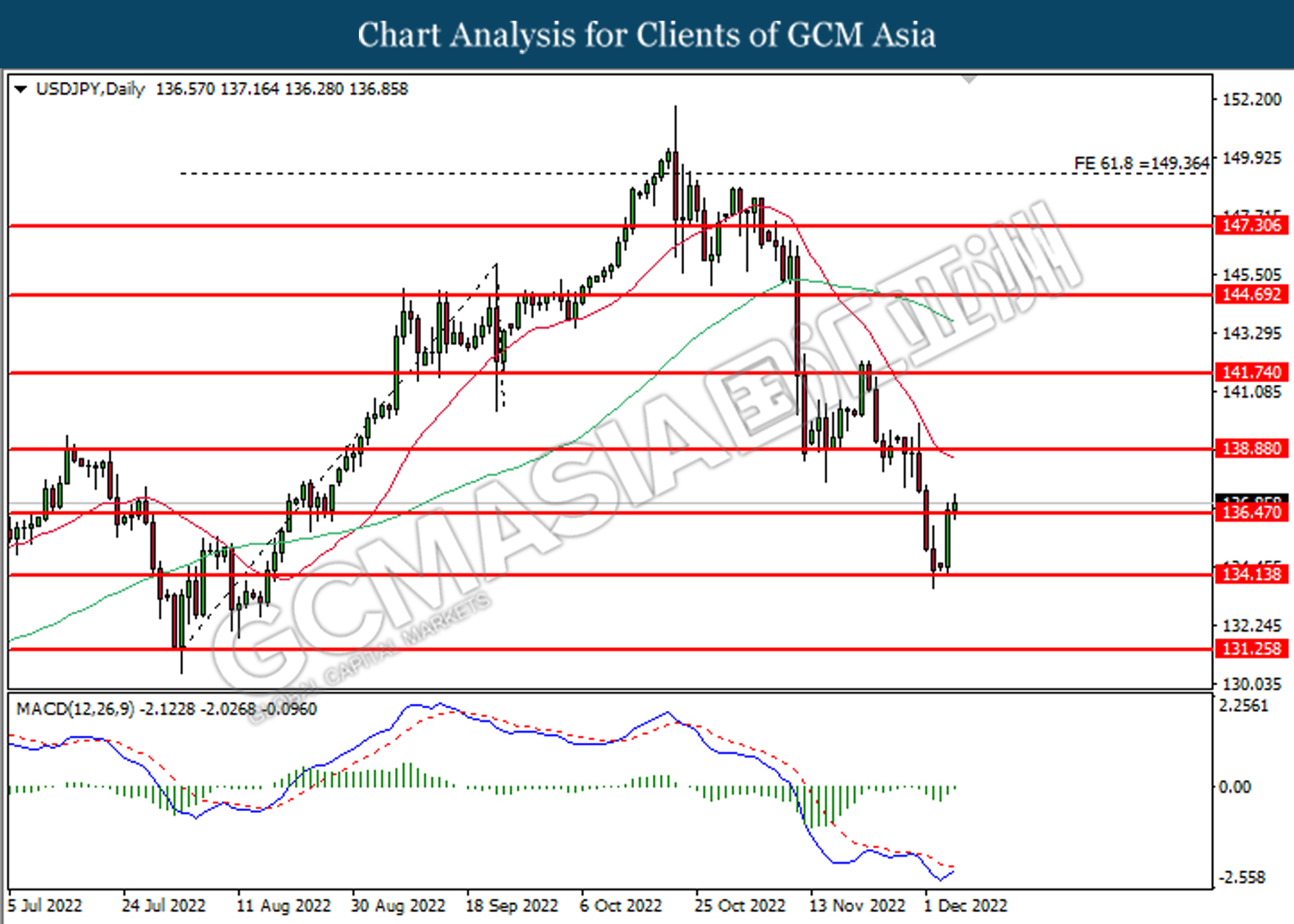

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

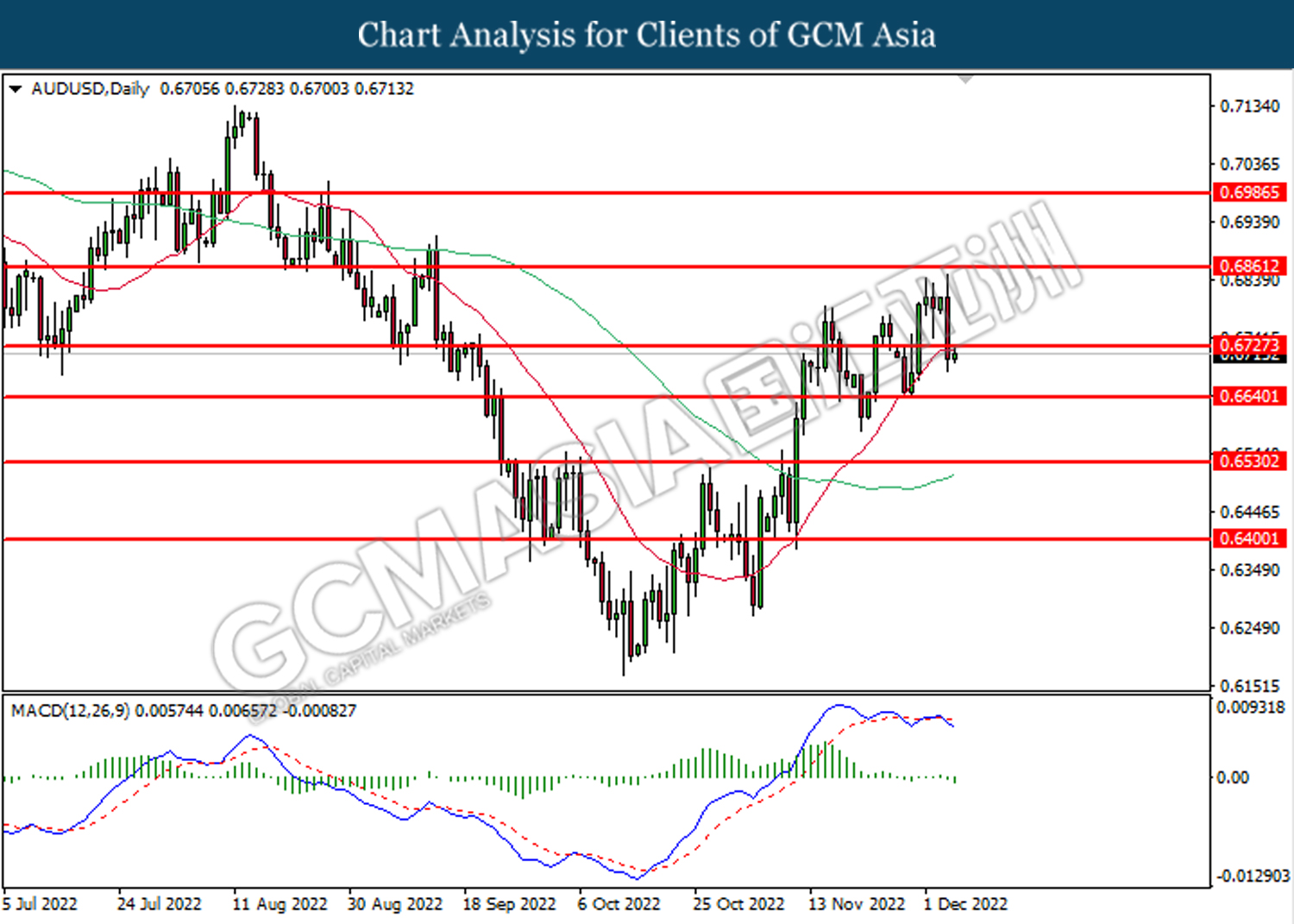

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6640.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

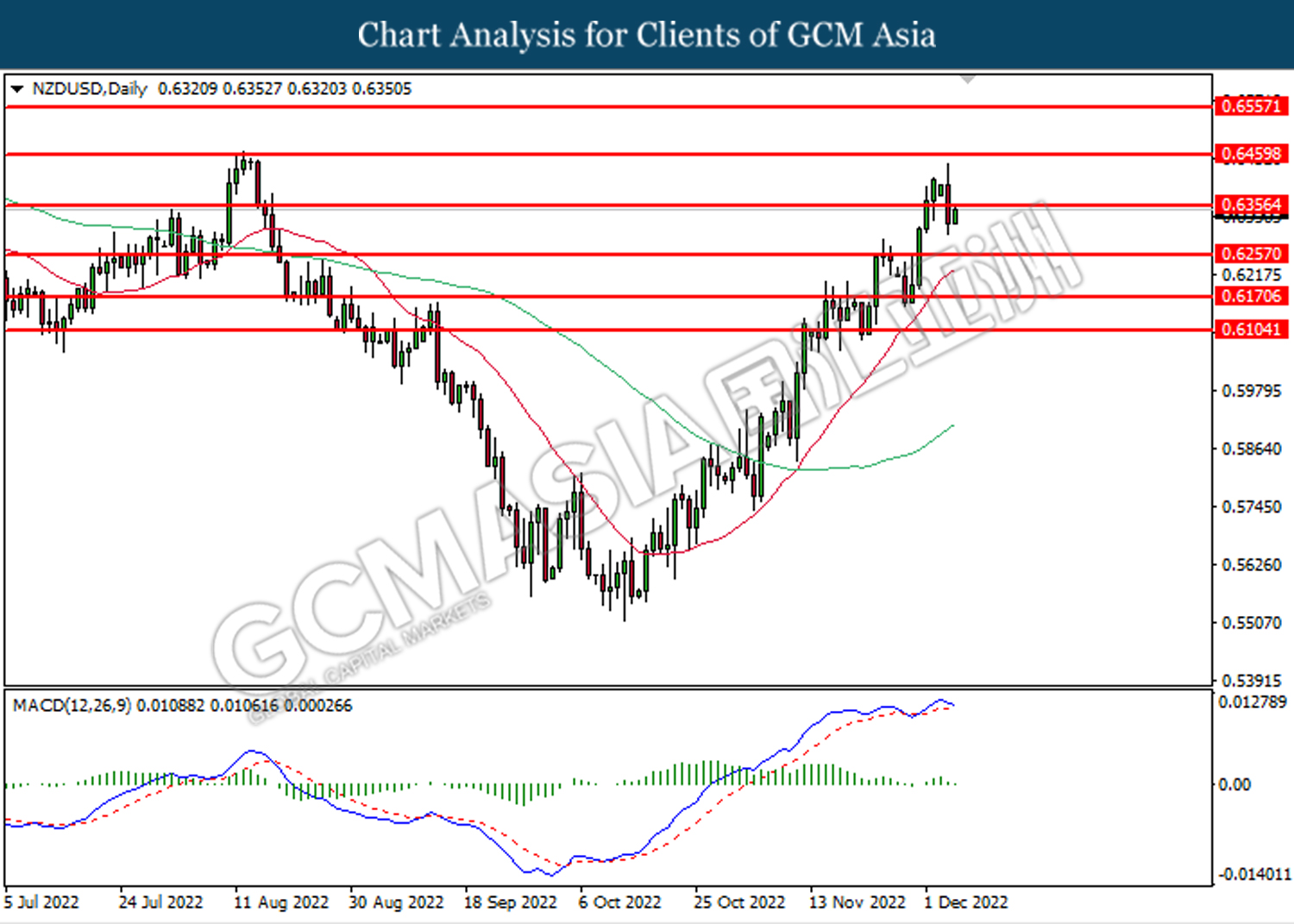

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

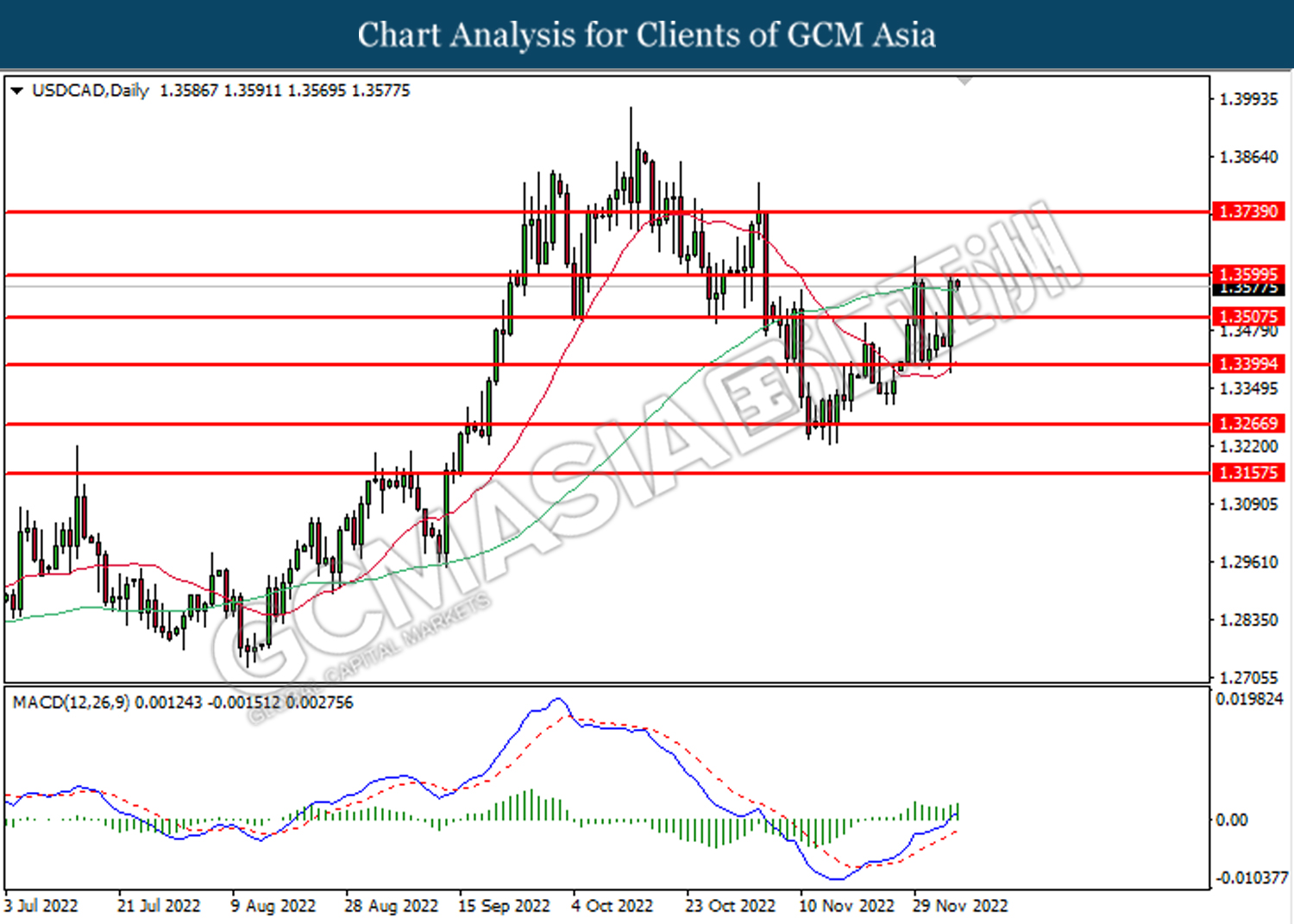

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend it gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

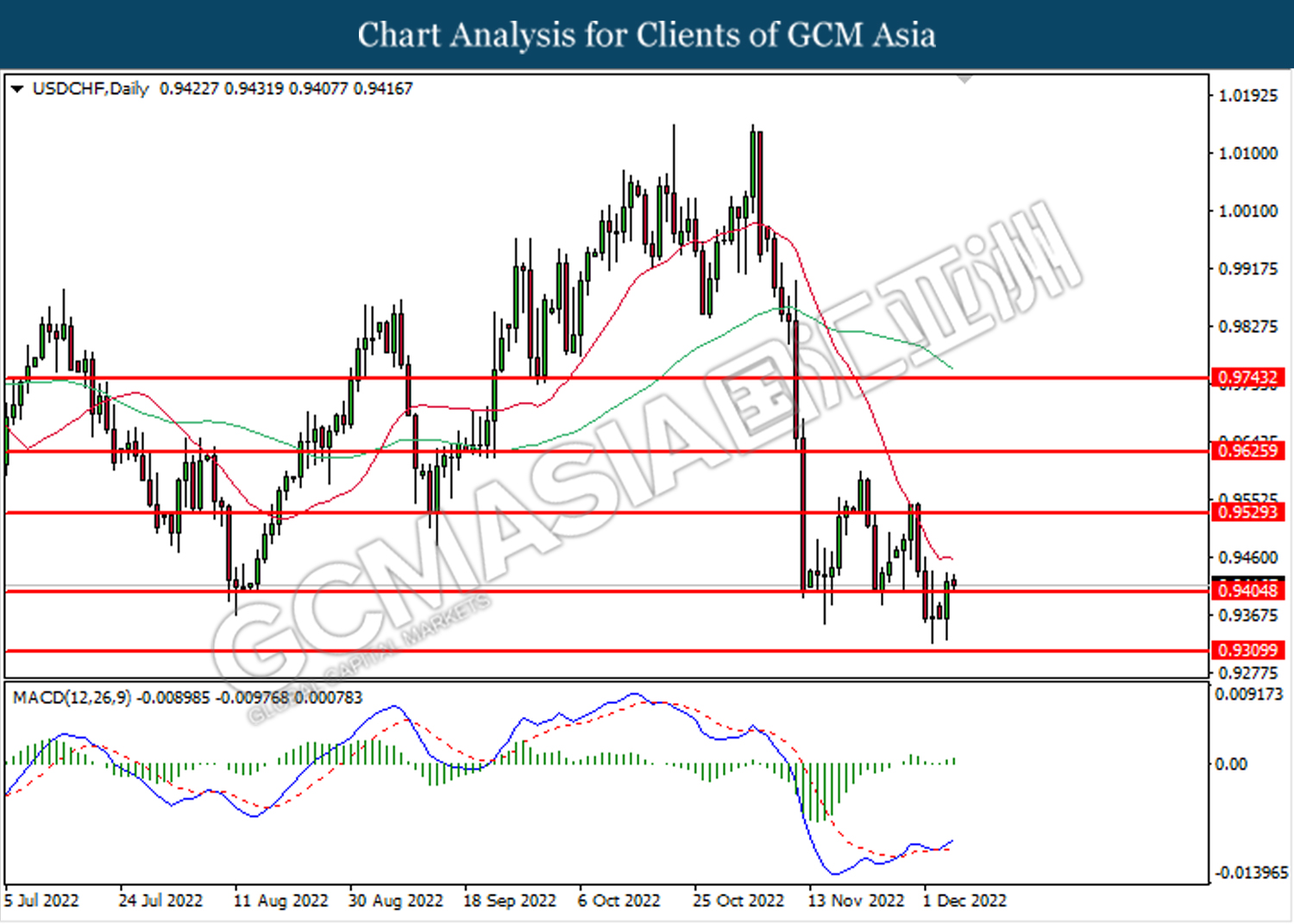

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

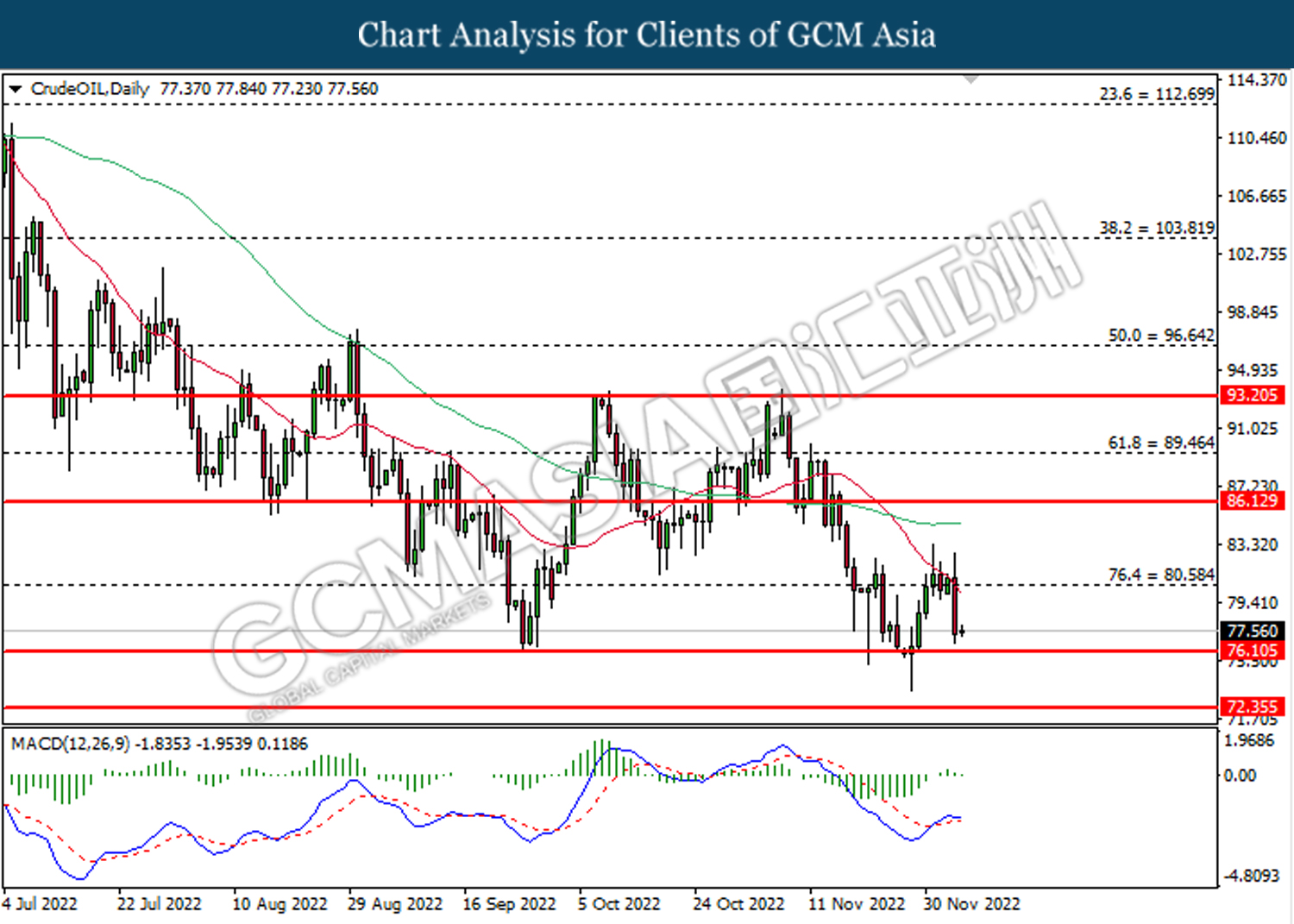

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 80.60. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 80.60, 86.15

Support level: 76.10, 72.35

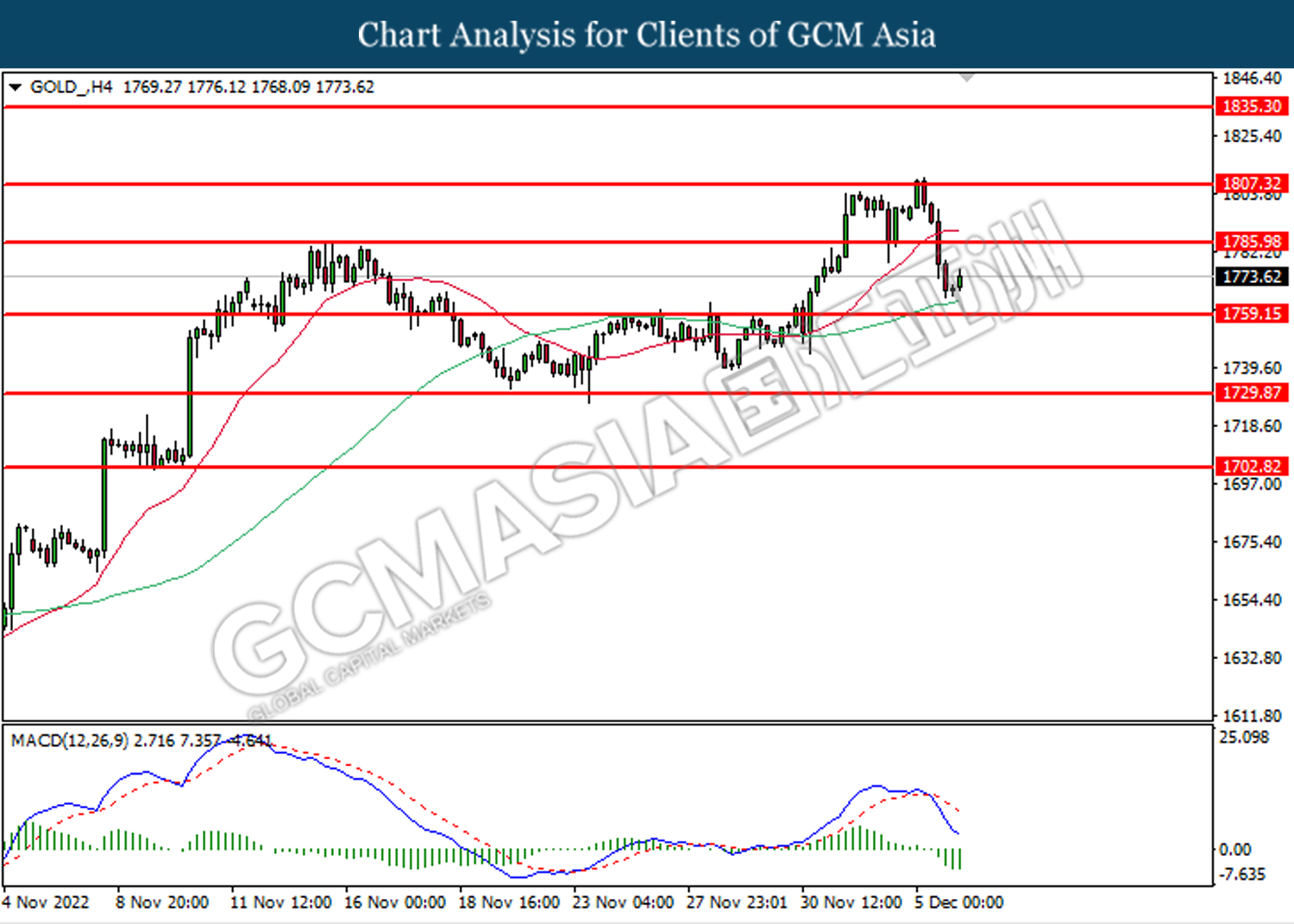

GOLD_, H4: Gold price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its rebound toward the resistance level at 1786.00.

Resistance level: 1786.00, 1807.30

Support level: 1759.15, 1729.85