07 June 2021 Afternoon Session Analysis

Pound slips following virus concerns.

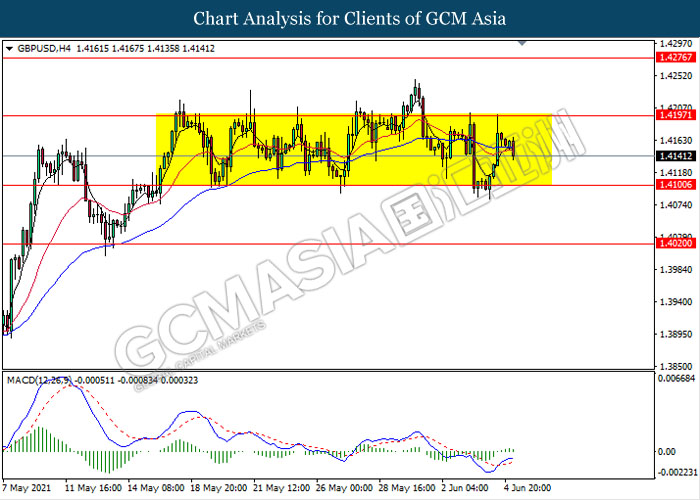

The pound sterling which traded against the greenback and other currency pairs have fell following increasing concerns of new coronavirus cases in the U.K. According to Public Health England, the number of coronavirus cases across the United Kingdom is beginning to increase again as the Indian variant of the virus continues to spread across the country and becomes its most dominant strain. According to Anadolu Agency, the country recorded 6,238 new cases on Friday and between May 29 and June 4, 29,028 people had a confirmed positive test result of the virus. This represents an increase of 39.8 per cent compared to the previous week. The increase has worried investors as it could undermine the momentum of economic recovery and force the UK government to re-impose restrictions, thus diminishing the appeal of the pound sterling. At the time of writing, GBP/USD fell 0.07% to 1.4142.

In the commodities market, crude oil price rose 0.03% to $69.38 per barrel at the time of writing following signs of improved oil demand. Various economic data released by countries such as the US, EU, UK and China showed that the manufacturing and industrial sectors in their respective countries have recovered significantly. Increased activity in the sector will help to increase demand for crude oil used as one of the raw materials for the processing division. On the other hand, gold price rose 0.09% to $1886.81 a troy ounce at the time of writing following dollar weakness.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

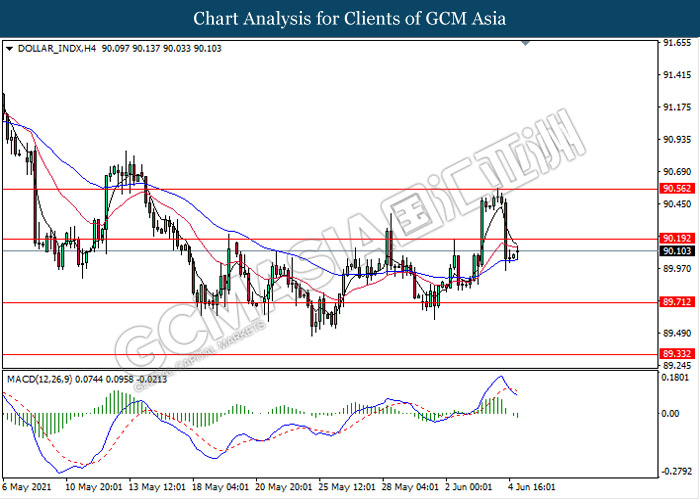

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level 90.20. MACD which illustrate bearish momentum signal with the formation of death cross suggest the dollar to extend its losses towards the support level 89.70.

Resistance level: 90.20, 90.55

Support level: 89.70, 89.35

GBPUSD, H4: GBPUSD remain traded in a sideway channel following recent retracement from the resistance level 1.4195. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to be extend its retracement in short term towards the support level 1.4100.

Resistance level: 1.4195, 1.4275

Support level: 1.4100, 1.4020

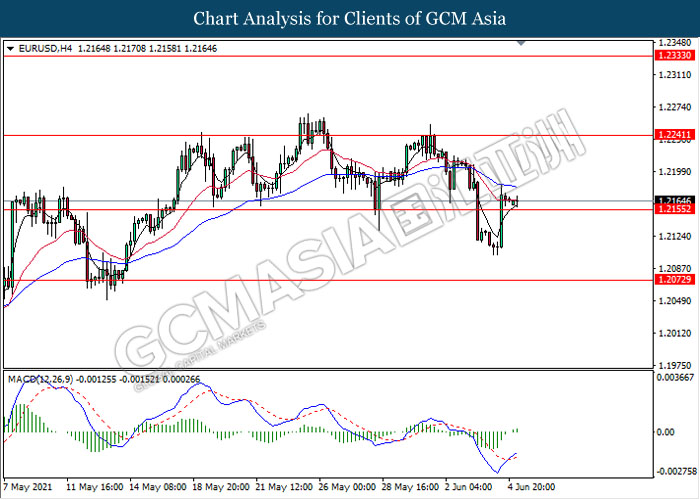

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level 1.2155. MACD which illustrate bullish bias signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.2240.

Resistance level: 1.2240, 1.2335

Support level: 1.2155, 1.2070

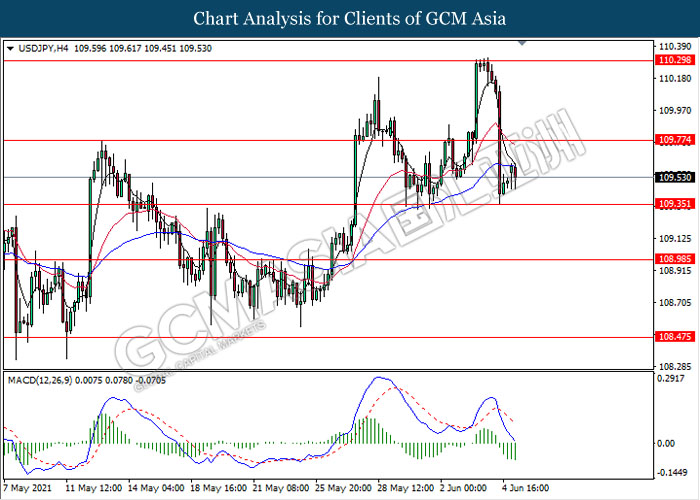

USDJPY, H4: USDJPY was traded lower following recent breakout below the previous support level 109.75. MACD which illustrate bearish momentum signal suggest the pair to extend its losses towards the support level 109.35.

Resistance level: 109.75, 110.30

Support level: 109.35, 109.00

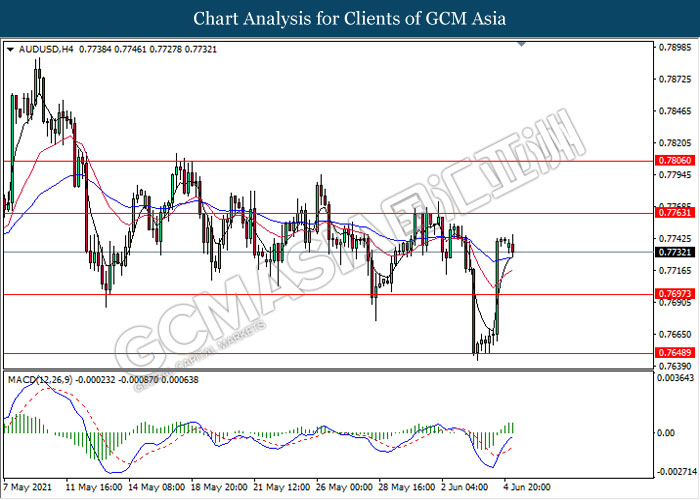

AUDUSD, H4: AUDUSD was traded higher following recent breakout above the previous resistance level 0.7695. However, MACD which illustrate diminishing bullish momentum signal suggest the pair to experience a technical correction back towards the level 0.7695.

Resistance level: 0.7765, 0.7805

Support level: 0.7695, 0.7650

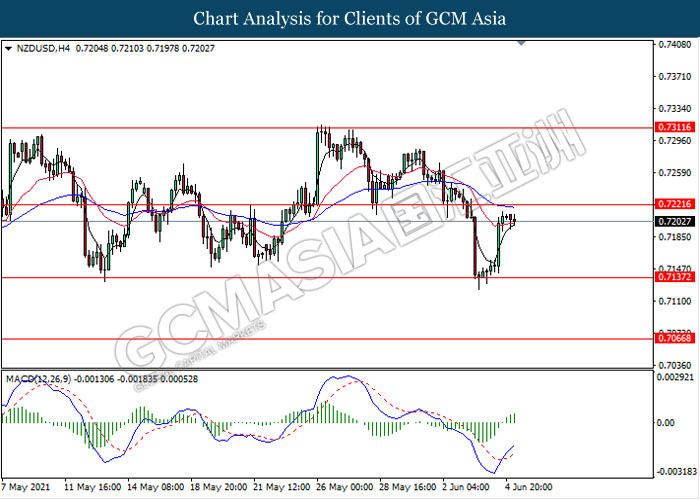

NZDUSD, H4: NZDUSD was traded higher while currently testing near the resistance level 0.7220. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.7220, 0.7310

Support level: 0.7135, 0.7065

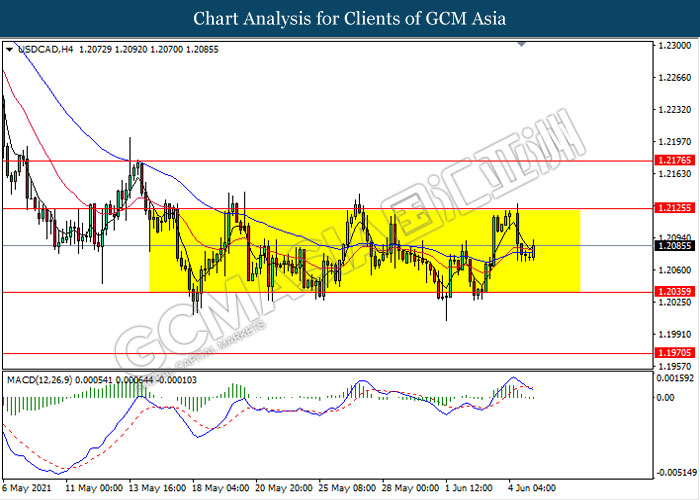

USDCAD, H4: USDCAD remain traded in a sideway channel following recent retracement from the resistance level 1.2125. However, MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to be traded lower towards the support level 1.2035.

Resistance level: 1.2125, 1.2175

Support level: 1.2035, 1.1970

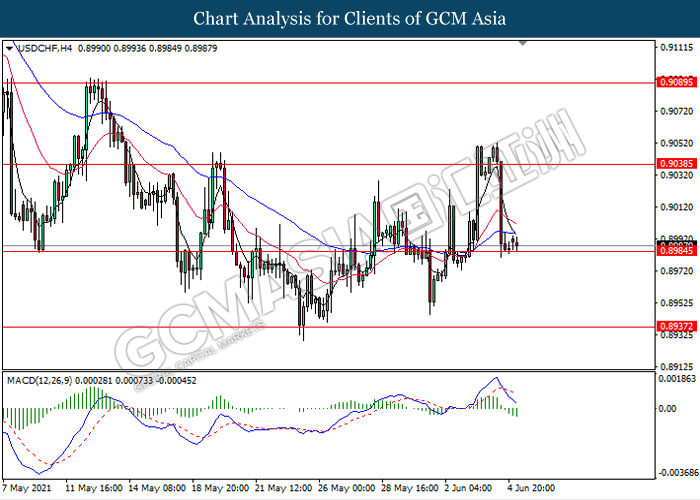

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.8985. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.9040, 0.9090

Support level: 0.8985, 0.8935

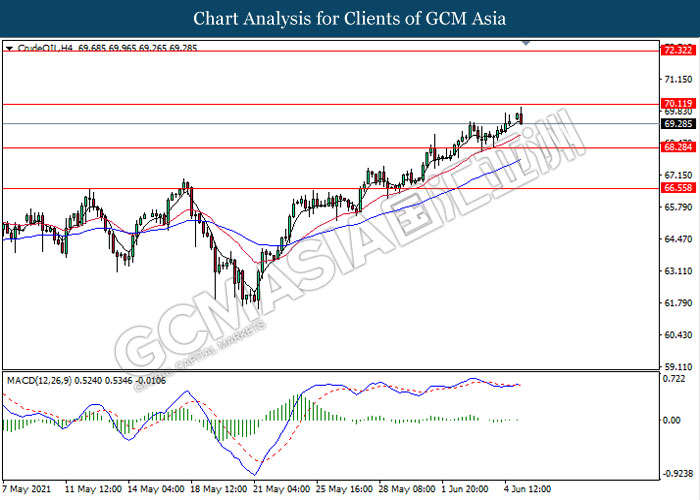

CrudeOIL, H4: Crude oil was traded higher while currently testing near the resistance level 70.10. However, MACD which illustrate bearish bias signal with the formation of death cross suggest the commodity to be traded lower towards the support level 68.30.

Resistance level: 70.10, 72.30

Support level: 68.30, 66.55

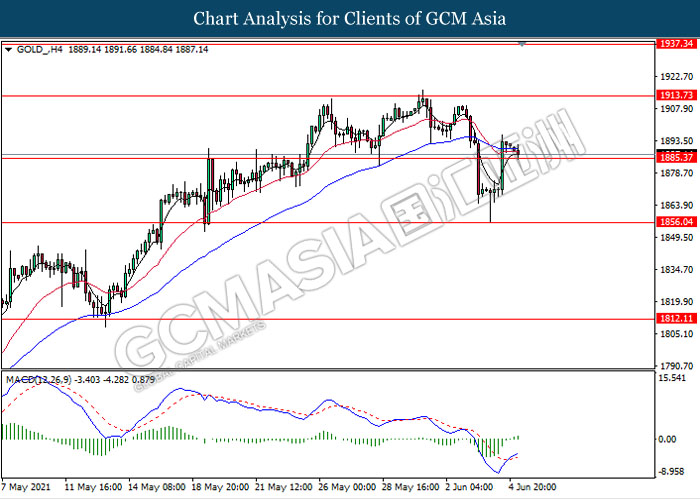

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1885.35. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the commodity to extend its gains towards the resistance level 1913.75.

Resistance level: 1913.75, 1937.35

Support level: 1885.35, 1856.05