07 July 2023 Afternoon Session Analysis

Japan’s base salaries jumped putting BoJ policy into view.

The Japanese Yen which traded against the dollar index, edged lower after the Japanese Yen strengthened as Japan’s base salaries jumped to 28 years high since 1995. Global financial markets have been monitoring closely Japan’s wage data, as Bank of Japan (BoJ) Kazuo Ueda cited pay growth as a critical factor in deliberations about the shift in policy. Nominal wages, not adjusted for inflation, rose 2.5% from a year earlier to 283,868 yen ($1,972.16). While the real salaries which adjusted for the inflation rose 1.8% to 252,132 yen (USD 1751.67), labour ministry data showed. Economist comments that if inflation is sustainable at around 2% and nominal wages increase from 3% to 3.5%, these conditions would fuel the hopes that BOJ could end its ultra-loosen monetary policy. However, separate data on Friday showed household spending down to -4.0% from -4.4%, lower than market expectations of -2.4%. The high inflation effect weighed on household spending. Some economists commend that BoJ should maintain its ultra-loosen monetary policy to accelerate household spending and real wage growth. As of writing, the USDJPY slipped to -0.09% to 143.93.

In the commodities market, crude oil prices rose by 0.38% to $72.07 per barrel as EIA crude oil inventory showed a deficit result. On the other hand, the cost of gold edged up 0.01% to 1910.94 as the price of gold fell in the previous session after the US released mixed economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (Jun) | 0.3% | 0.3% | – |

| 20:30 | USD – Nonfarm Payrolls (Jun) | 339K | 225K | – |

| 20:30 | USD – Unemployment Rate (Jun) | 3.7% | 3.7% | – |

Technical Analysis

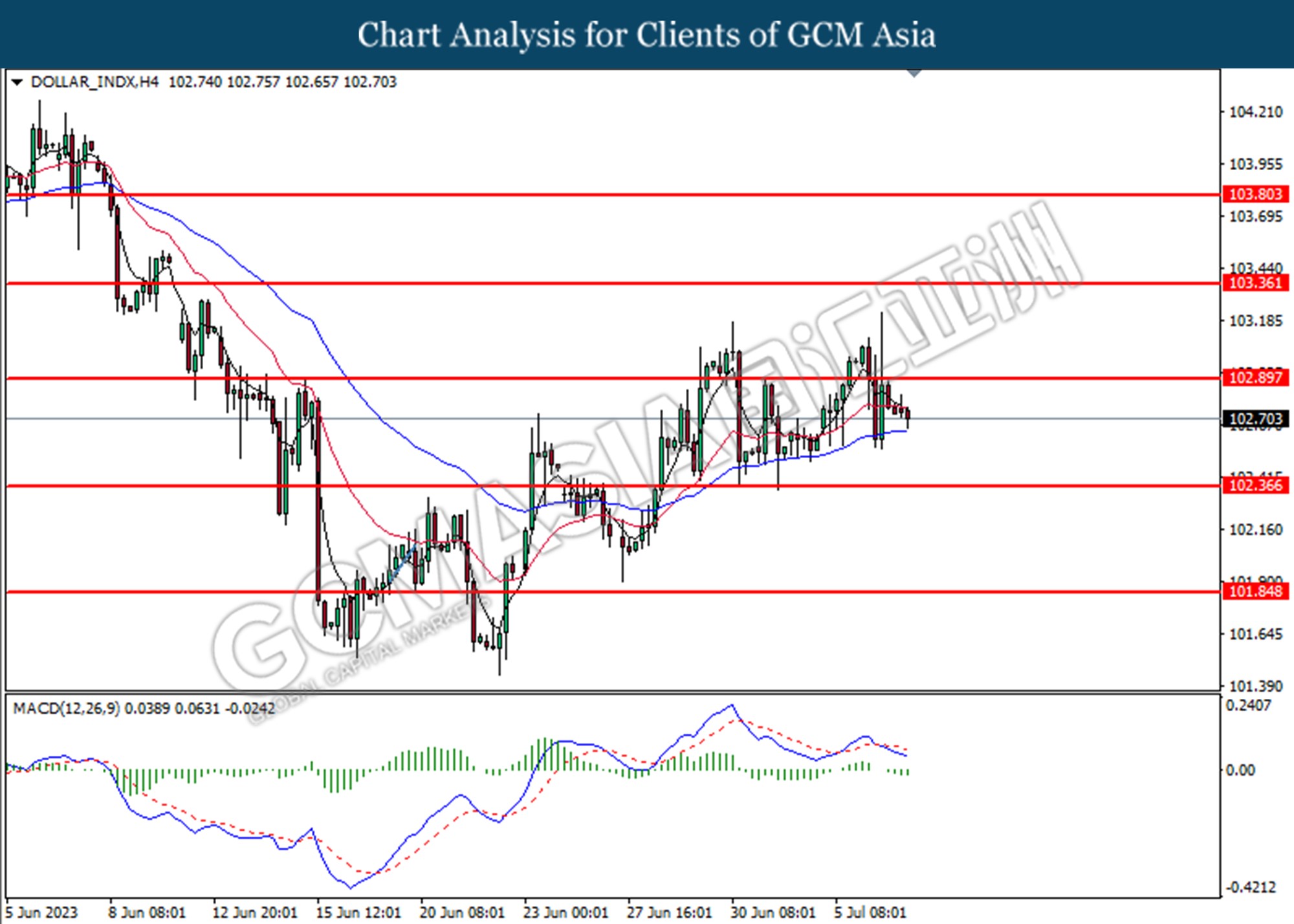

DOLLAR_INDX, H4: Dollar index was traded lower following the prior breaks above the previous support level at 102.90. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

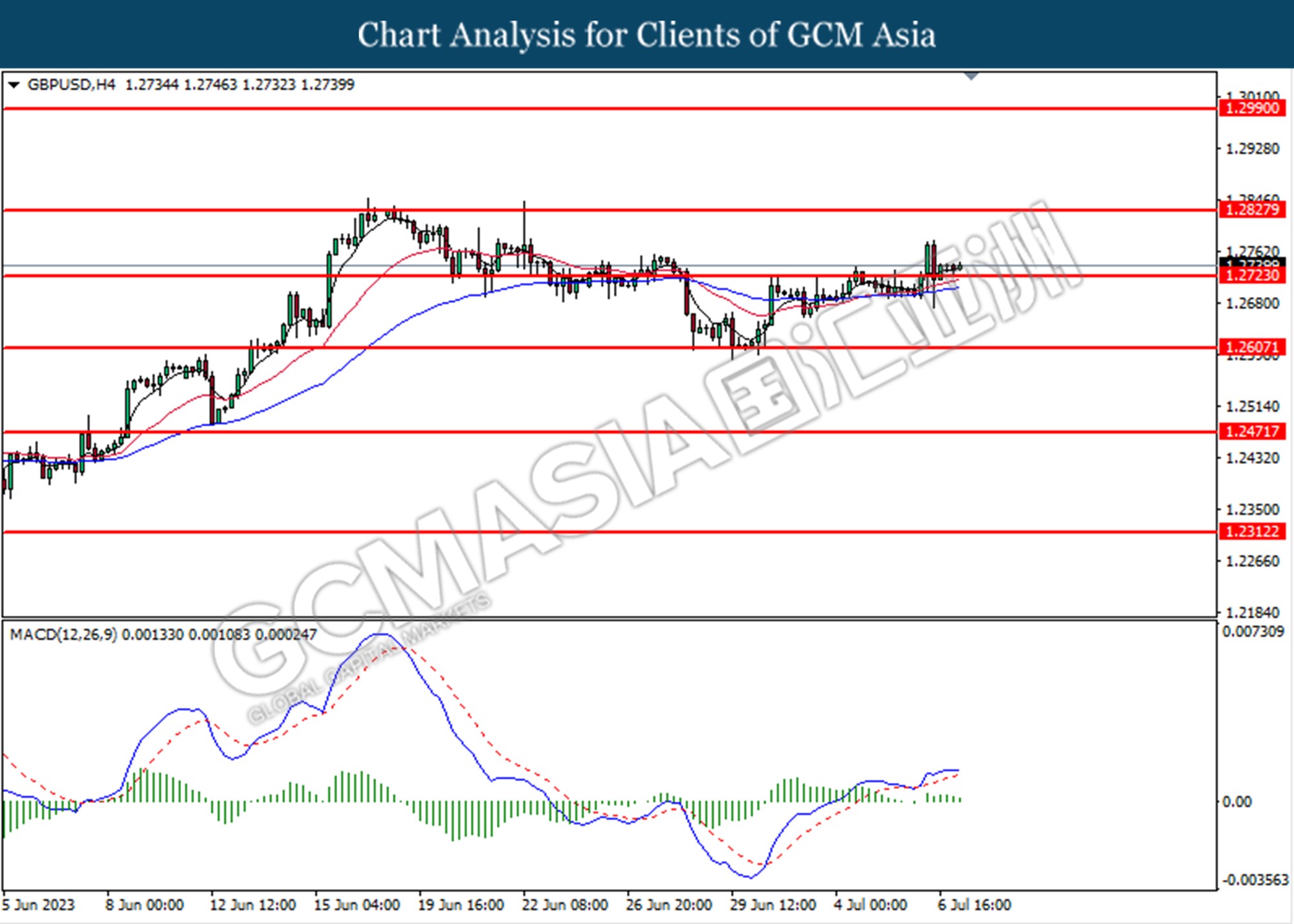

GBPUSD, H4: GBPUSD was traded higher following the rebound from the support level at 1.2723. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.2830, 1.2990

Support level: 1.2730, 1.2610

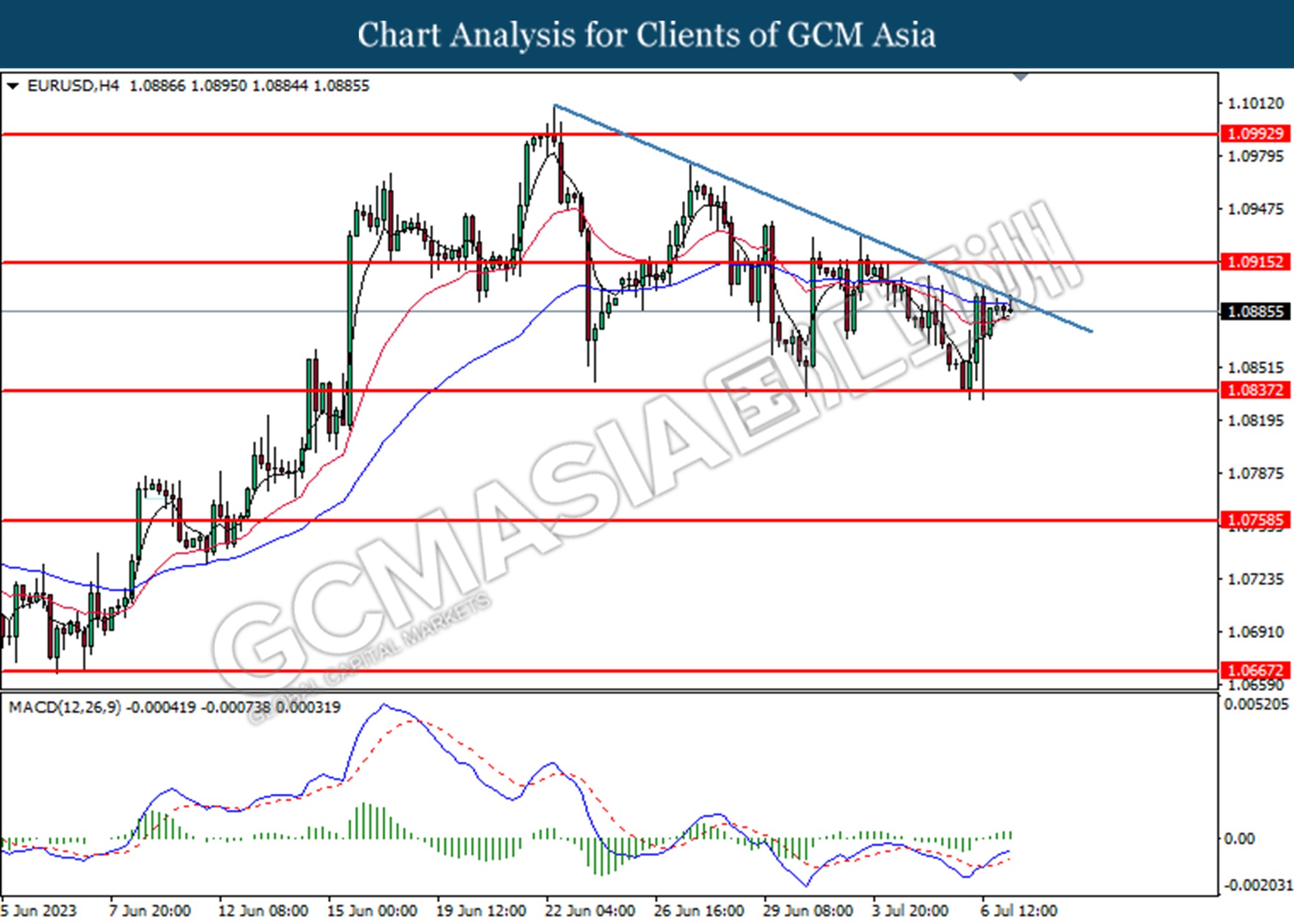

EURUSD, H4: GBPUSD was traded higher following a prior rebound from the support level at 1.0840. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the resistance level at 1.0915.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 144.10. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 142.90.

Resistance level: 144.10, 145.10

Support level: 142.90, 141.40

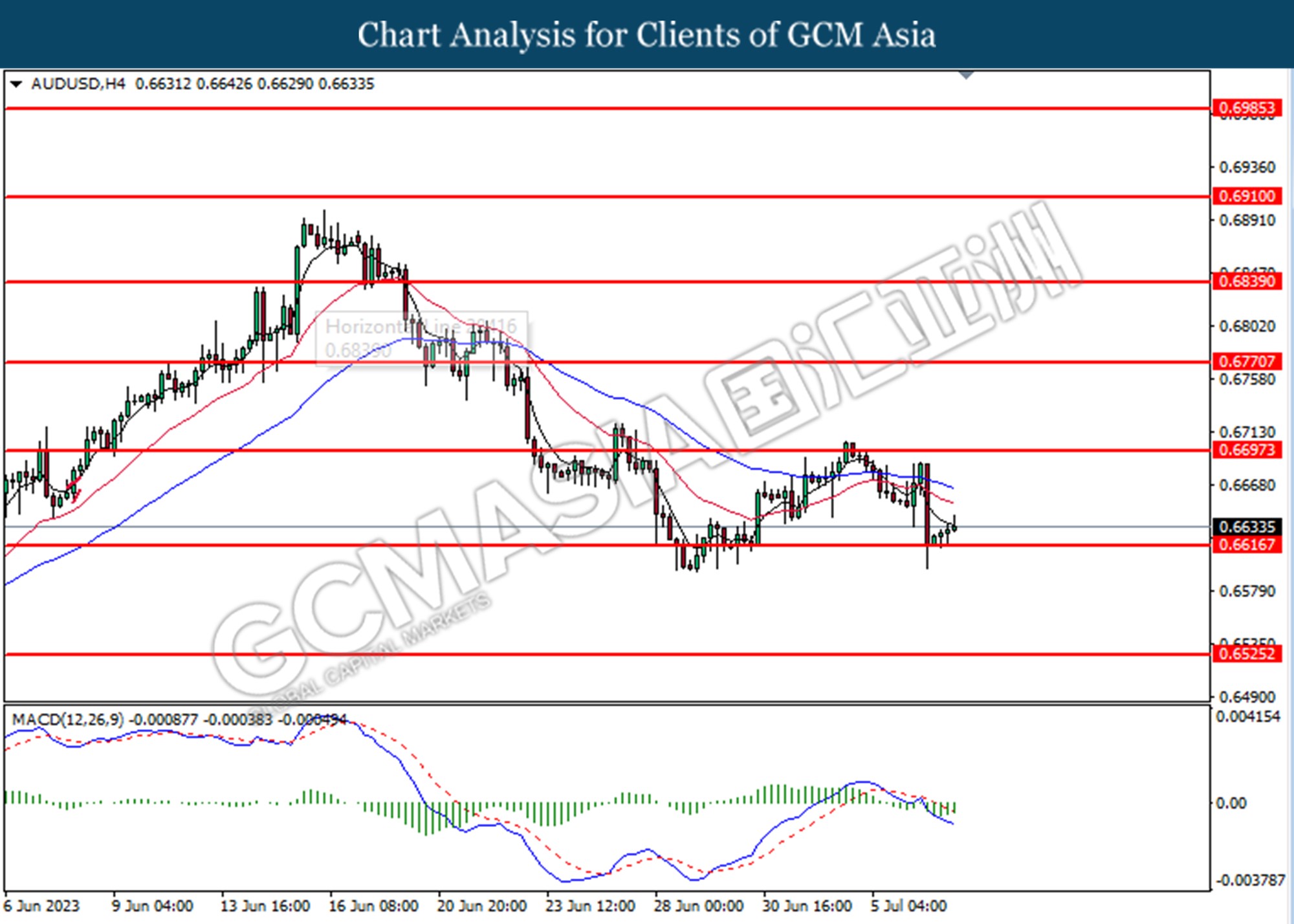

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6615. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

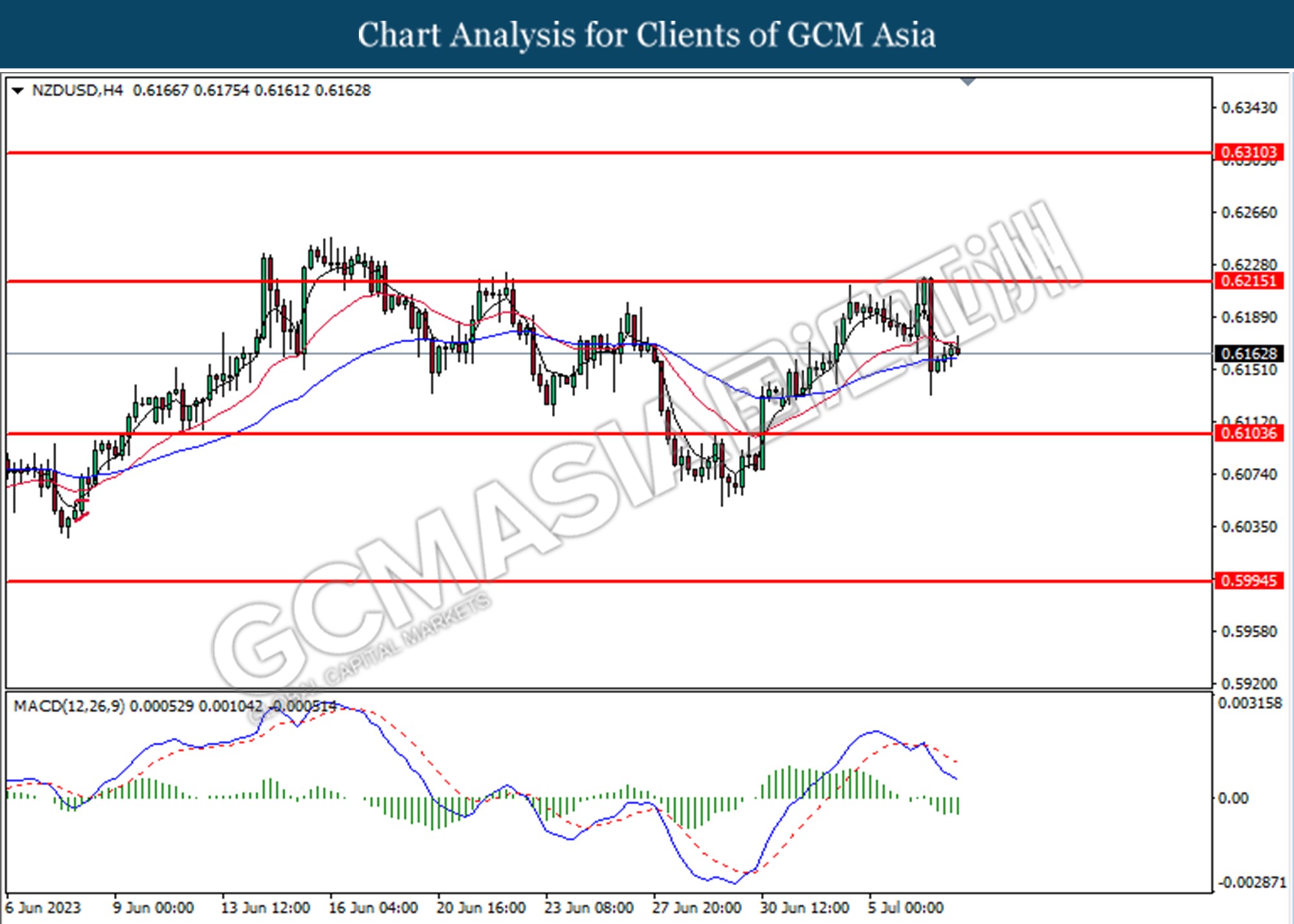

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

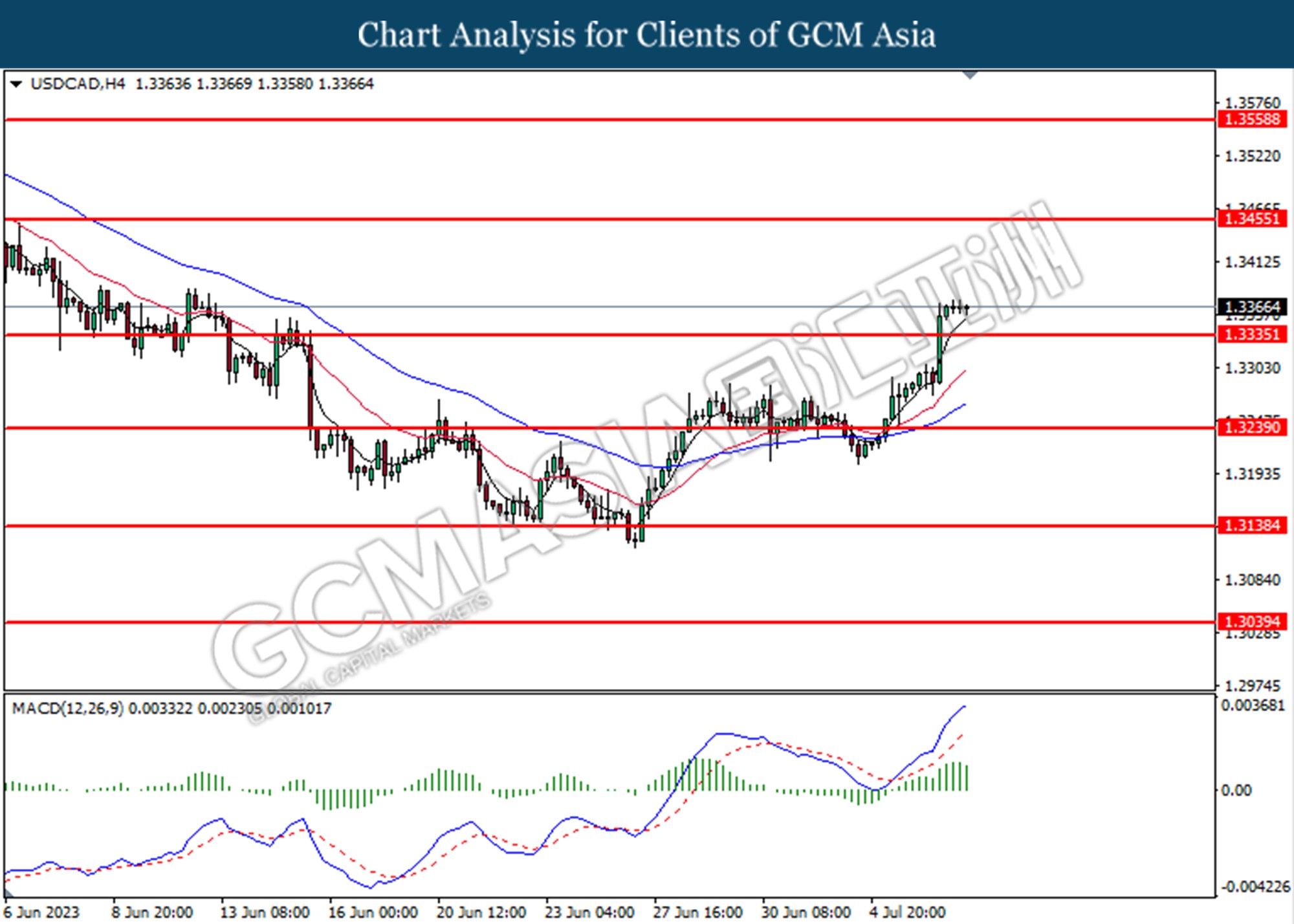

USDCAD, H4: USDCAD was traded higher following the prior breaks above the previous resistance level at 1.3335. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.3455, 1.3560

Support level: 1.3335, 1.3240

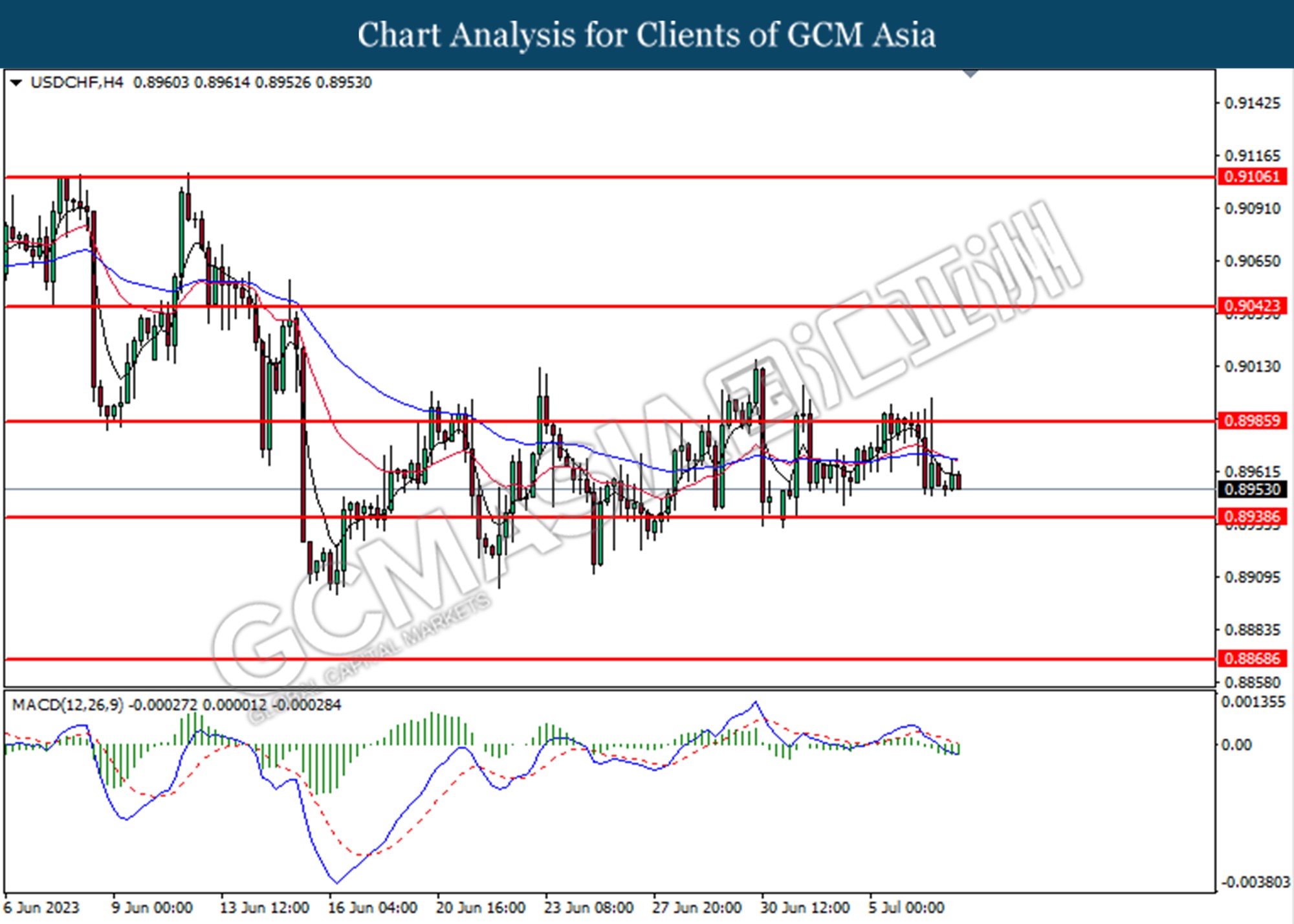

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.8940.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

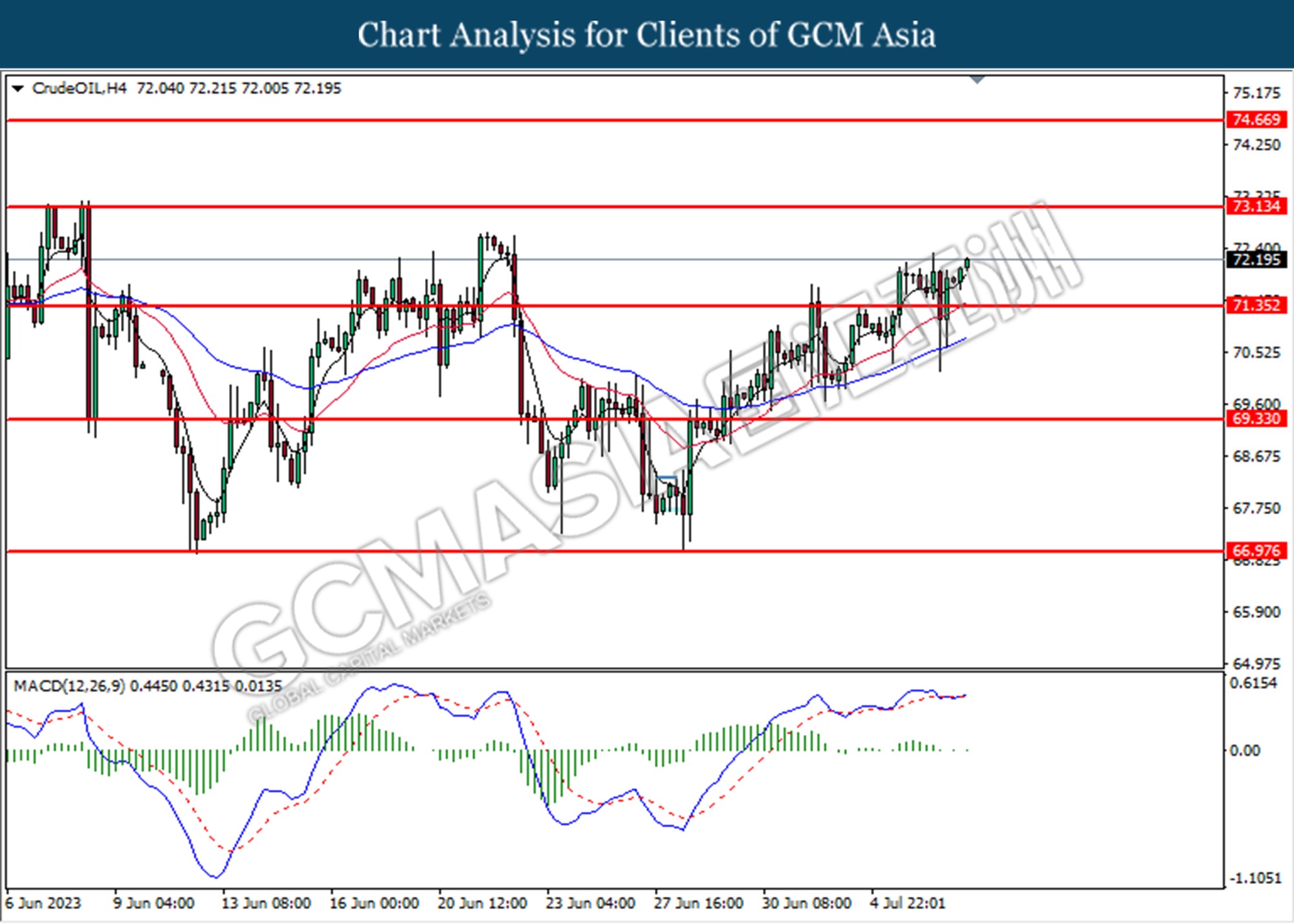

CrudeOIL, H4: Crude oil price was traded lower following the prior rebound from the support level at 71.35. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 73.15, 74.65

Support level: 71.35, 69.30

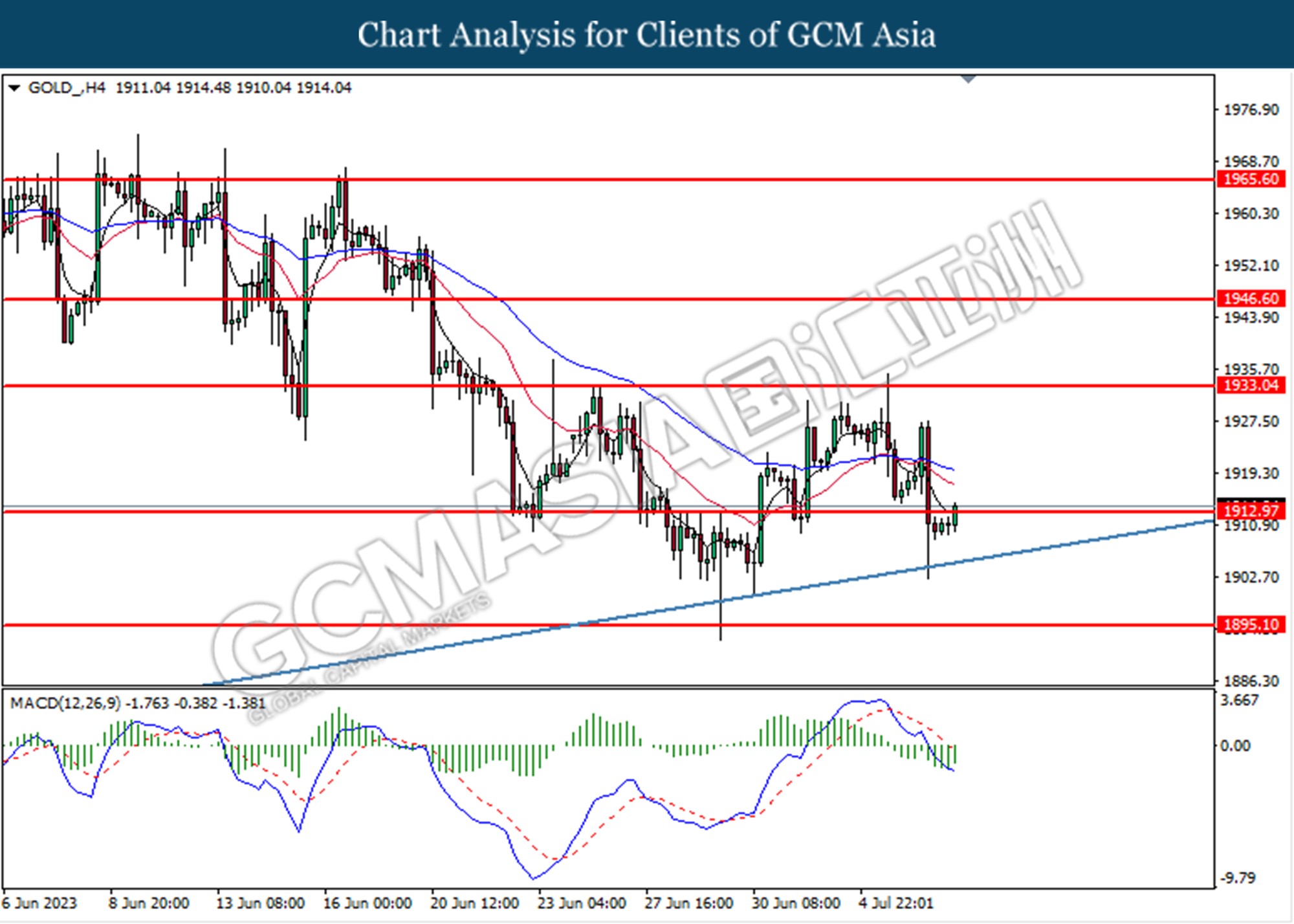

GOLD_, H4: Gold price was traded higher following the prior breaks above the previous resistance level at 1913.00. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10