07 July 2023 Morning Session Analysis

US dollar surged amid strong labor and services data.

The dollar index, which was traded against a basket of six major currencies, spiked as the latest data revealing a robust U.S. labor market heightened the likelihood of the Federal Reserve raising interest rates later this month. According to the ADP National Employment report, private payrolls saw a significant surge in June, marking the largest increase since February 2022. The ADP data came in at 497K, far stronger than the consensus forecast and prior reading at 228K and 267K respectively. Other than that, in June, the U.S. services sector exhibited a faster-than-anticipated growth, driven by an upturn in new orders. According to the Institute for Supply Management (ISM), the non-manufacturing purchasing managers’ index (PMI) rose to 53.9 last month from May’s 50.3. A reading above 50 indicates expansion in the services industry, which contributes to over two-thirds of the economy. However, the gains of the dollar index was limited by other job data which was also released yesterday’s night. The US labor department reported a moderate rise in the number of new claims for unemployment benefits filed by Americans last week. Also, according to the JOLTs Job Openings released by the US Bureau of Labor Statistics (BLS), the total count of job openings on the final business day of May was 9.824 million, fell short of the market’s anticipated 9.935 million. As of writing, the dollar index dropped -0.25% to 103.10

In the commodities market, crude oil prices edged up by 0.10% to $71.85 per barrel after a big swings up and down followed by the announcement of a series of economic data in the US. Besides, the gold prices ticked up by 0.01% to $1910.90 per troy ounce after a sharp drop yesterday night amid upbeat economic data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Average Hourly Earnings (MoM) (Jun) | 0.3% | 0.3% | – |

| 20:30 | USD – Nonfarm Payrolls (Jun) | 339K | 225K | – |

| 20:30 | USD – Unemployment Rate (Jun) | 3.7% | 3.7% | – |

Technical Analysis

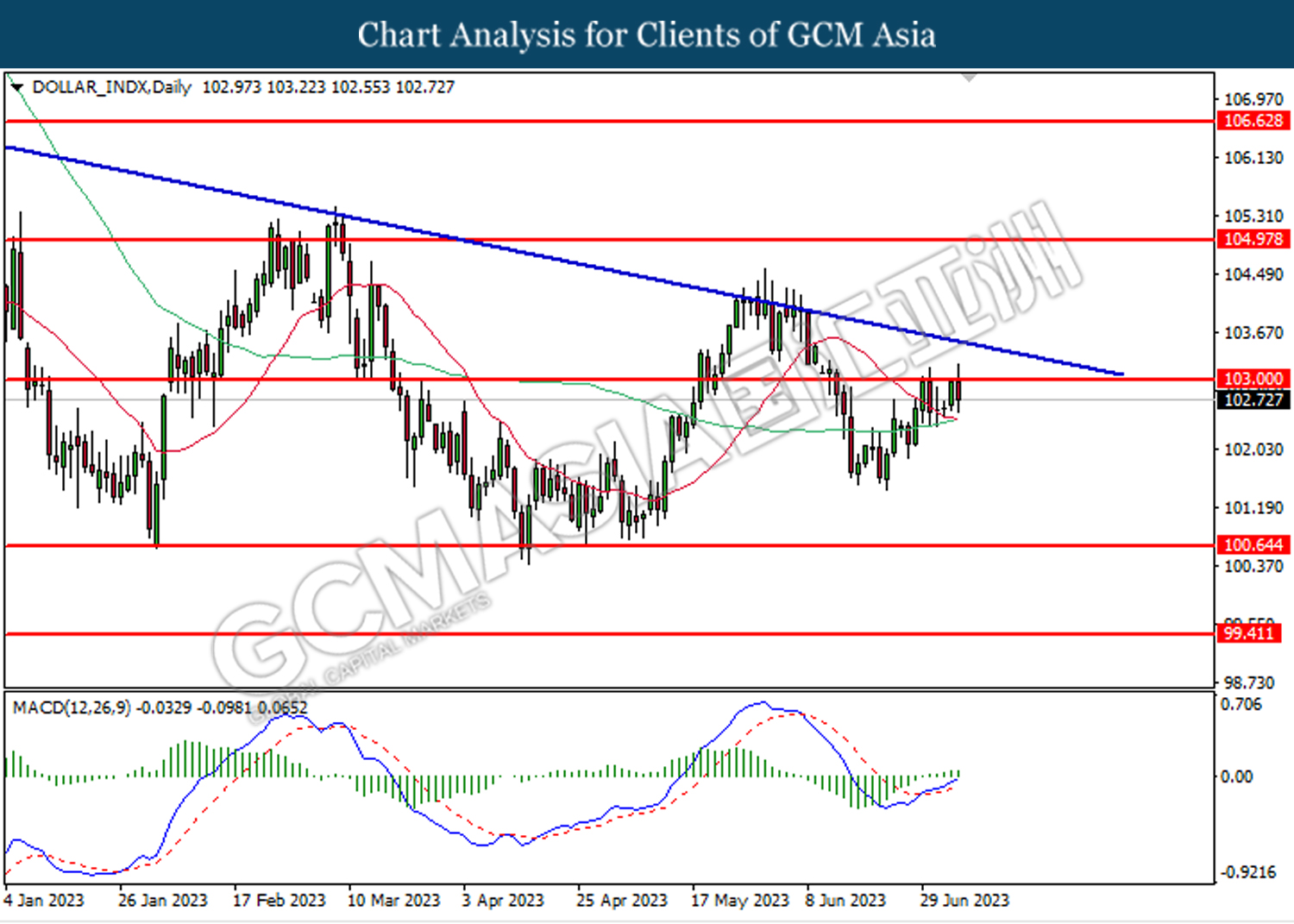

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.00. MACD which illustrated bullish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2765. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

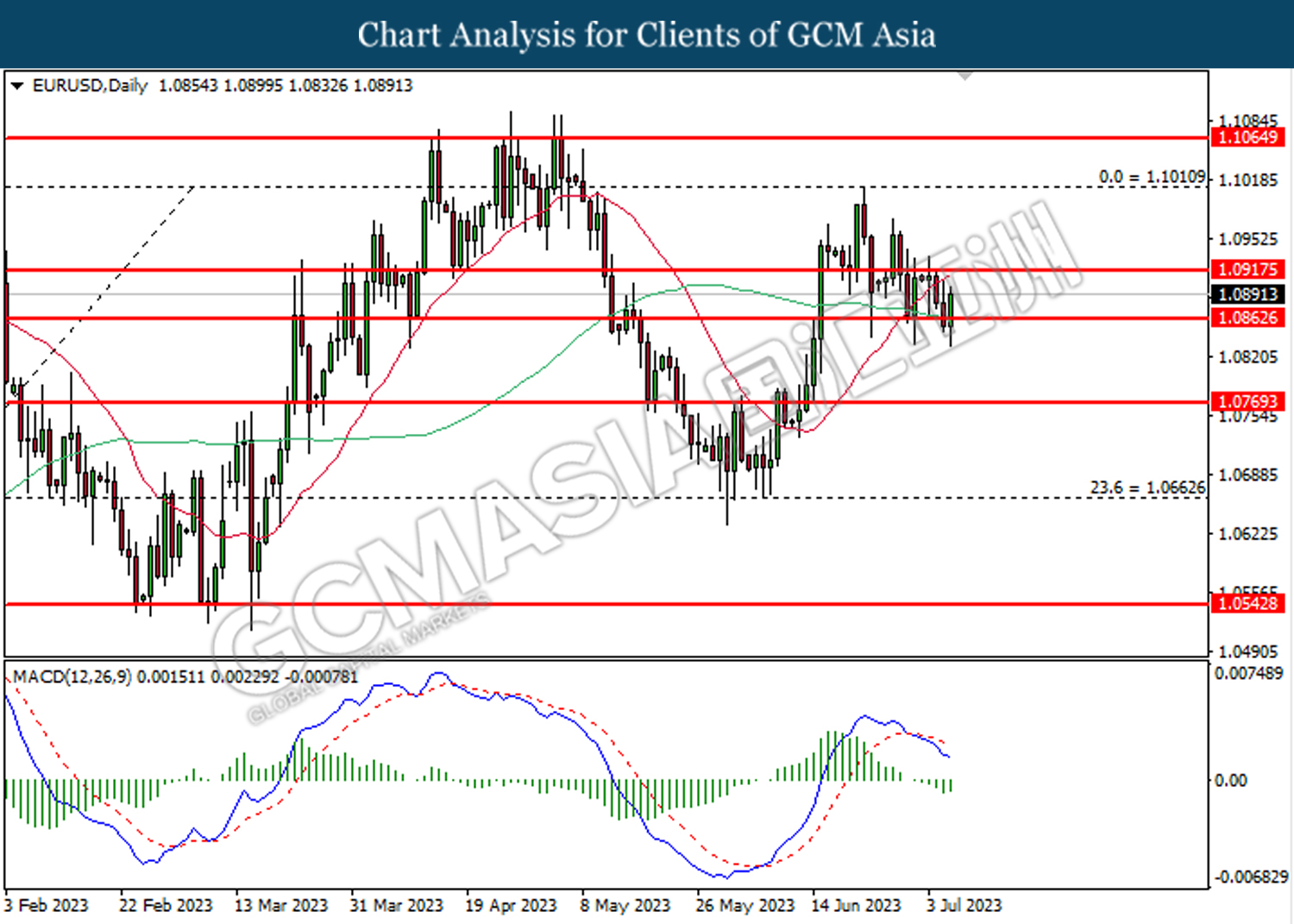

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0865. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

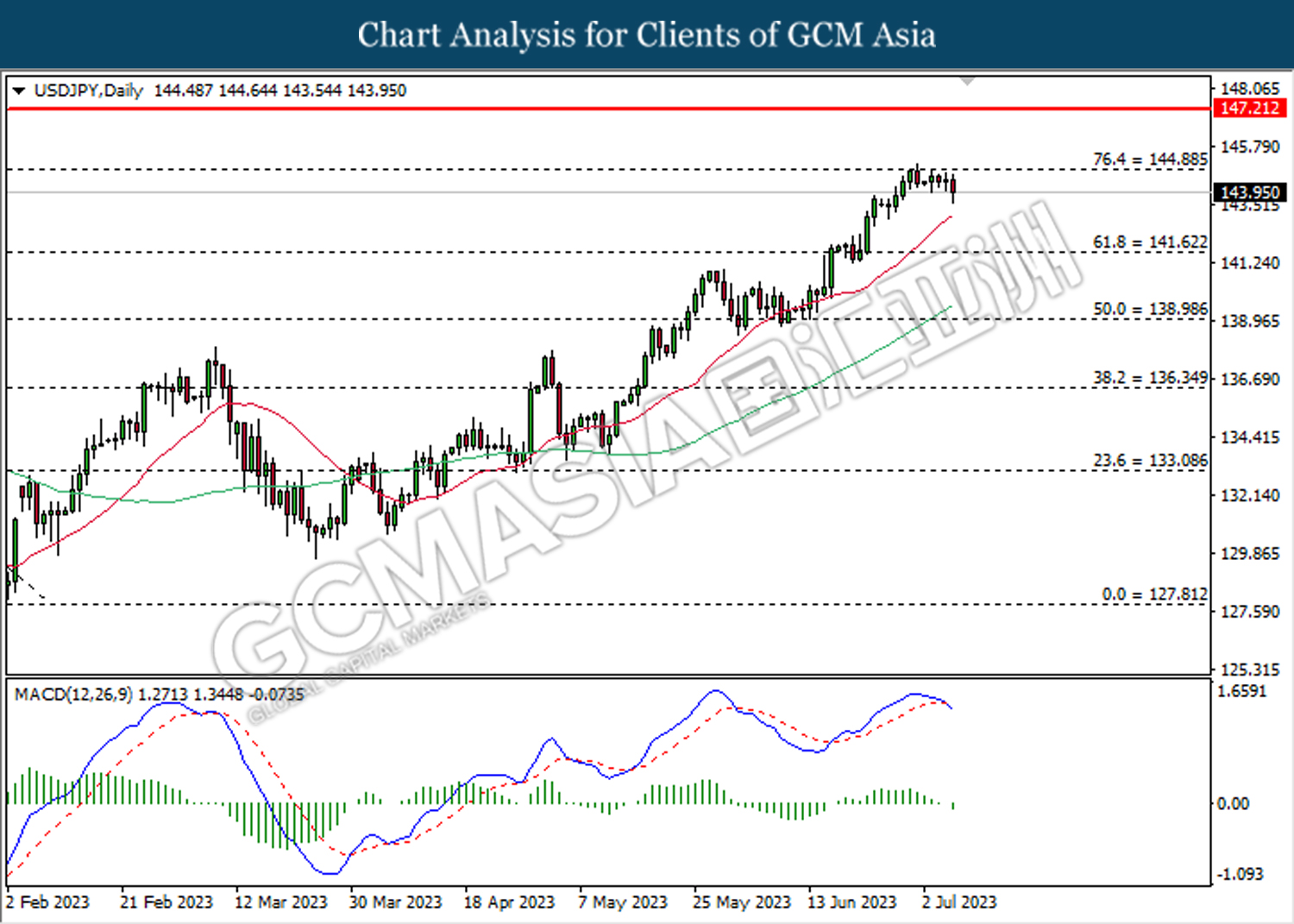

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. However, MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

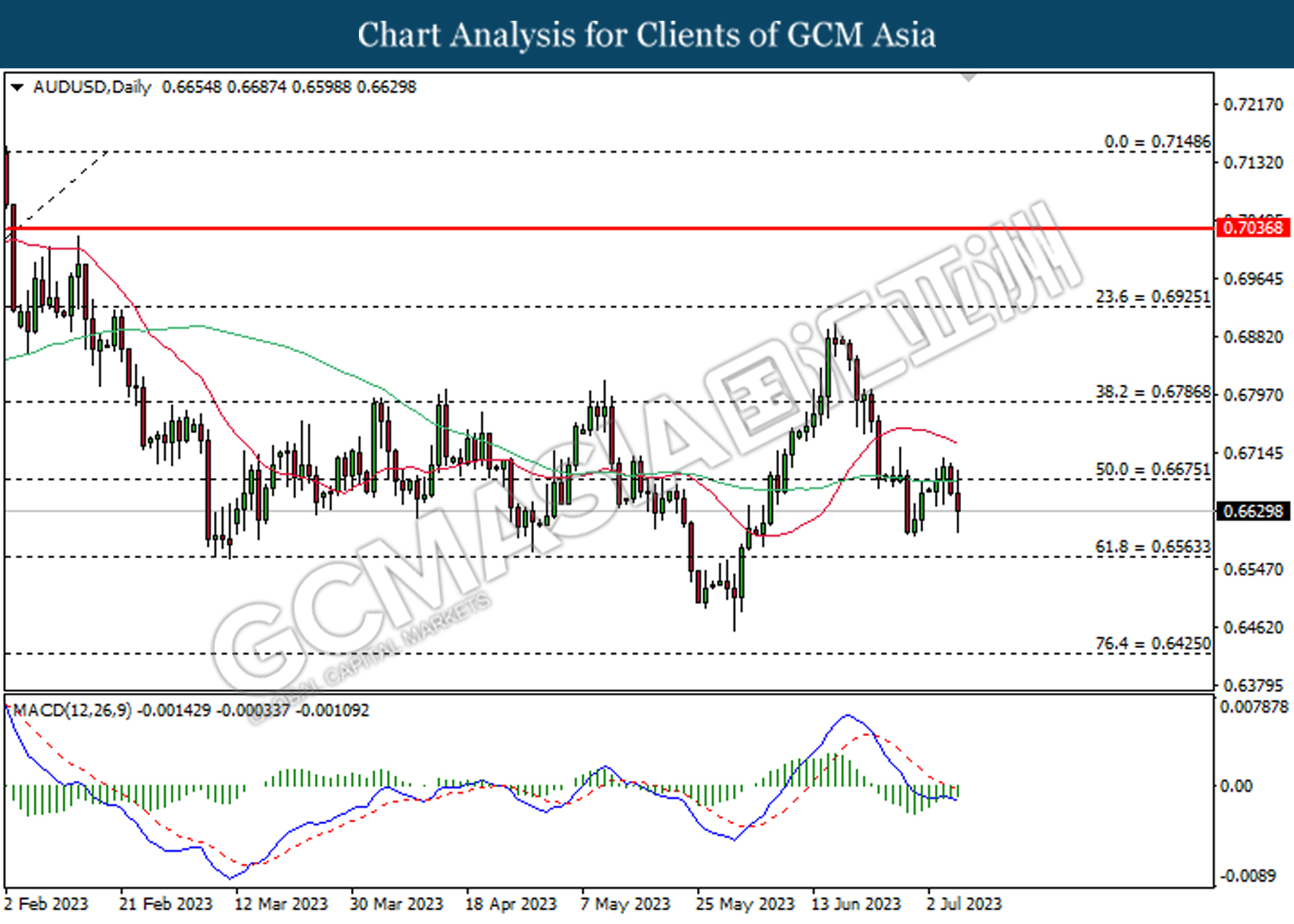

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

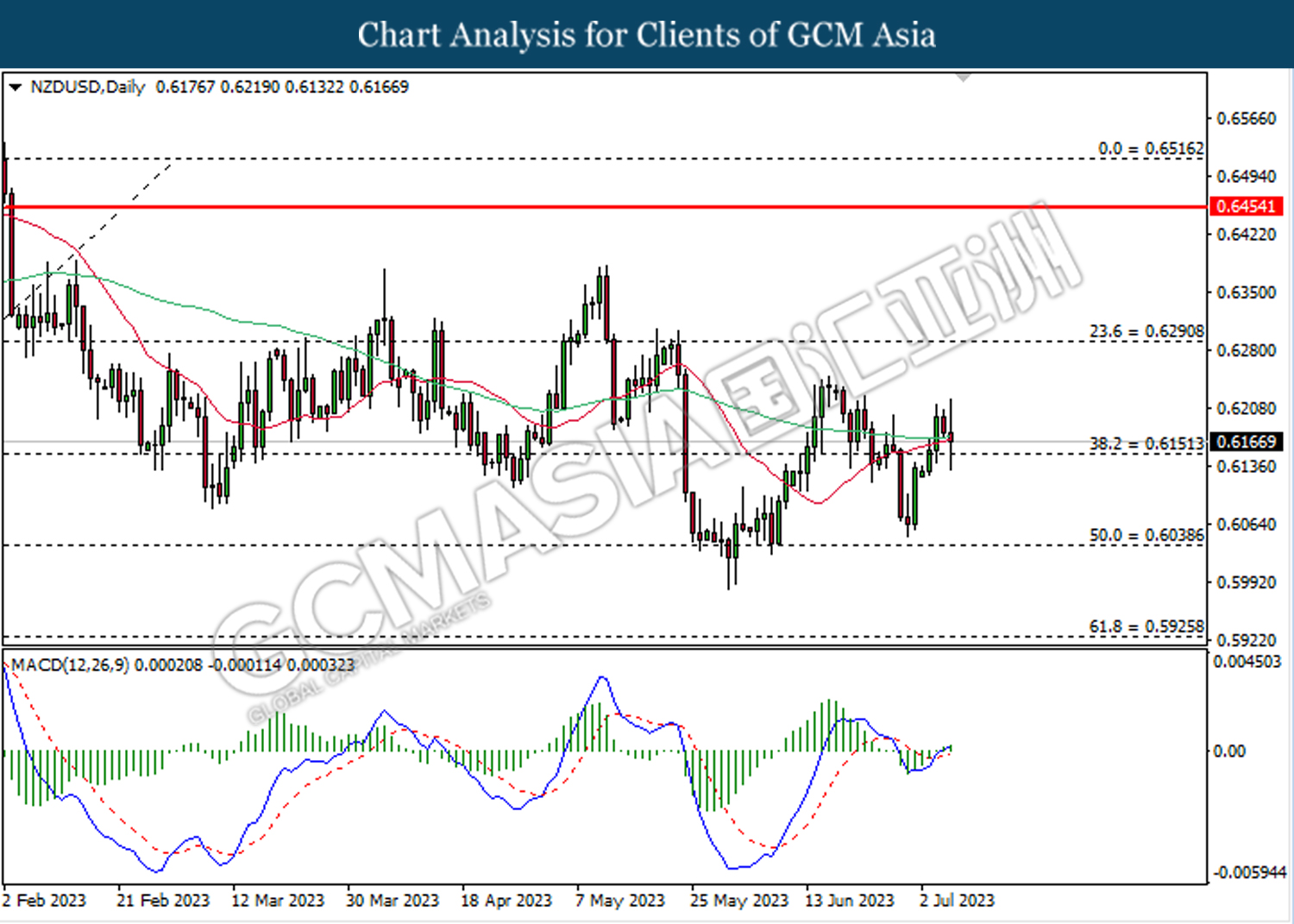

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

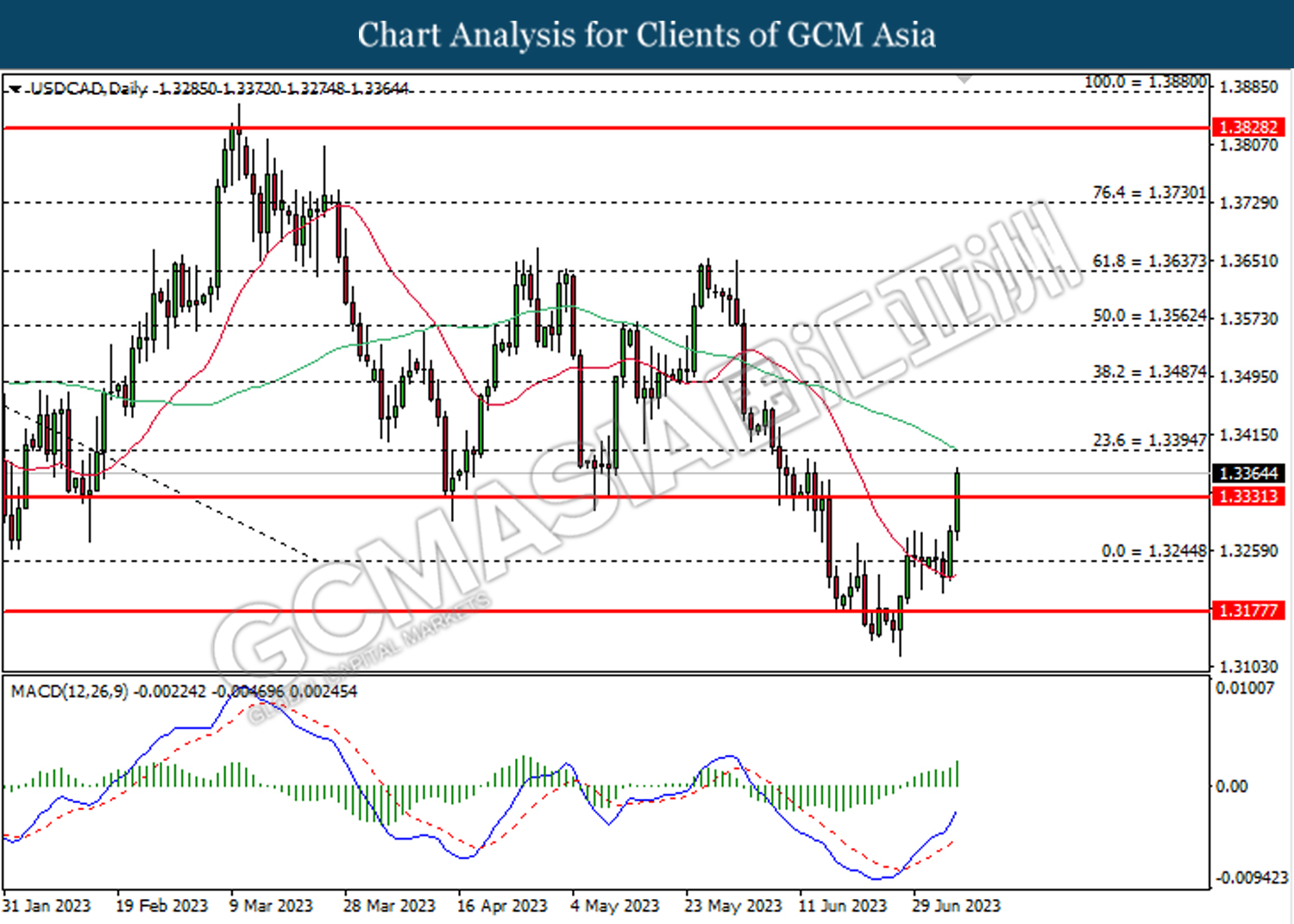

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3330. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3175

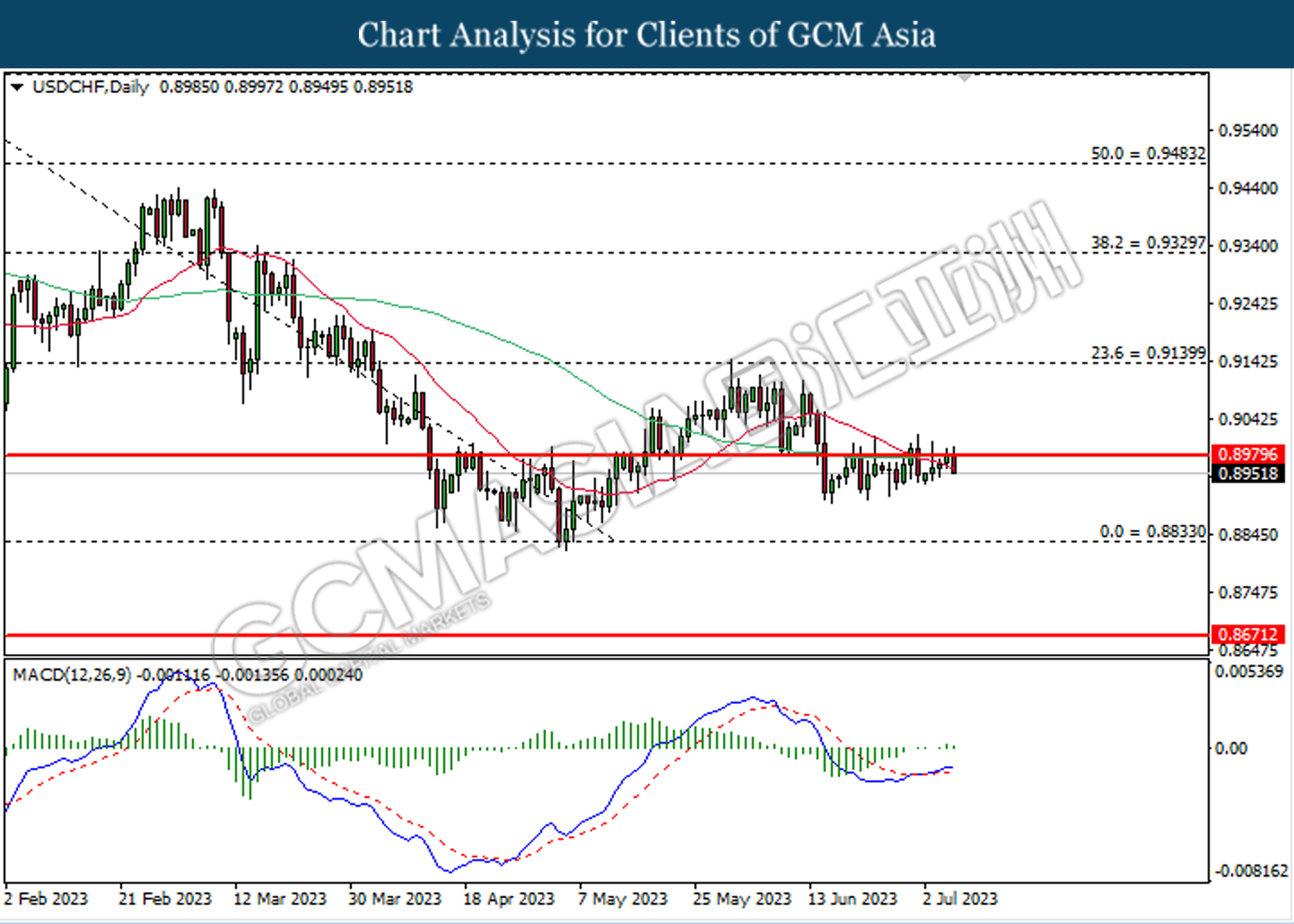

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

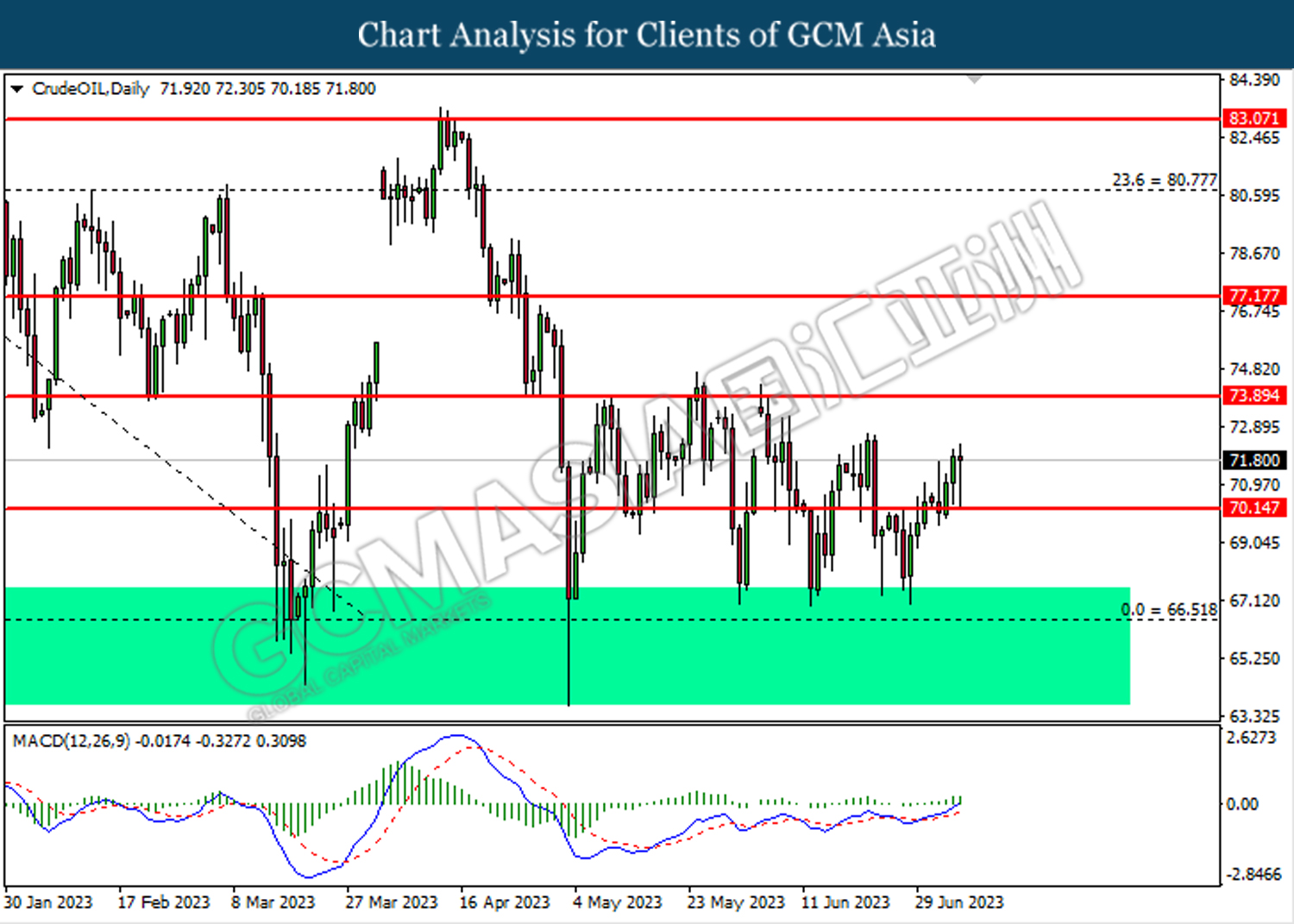

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

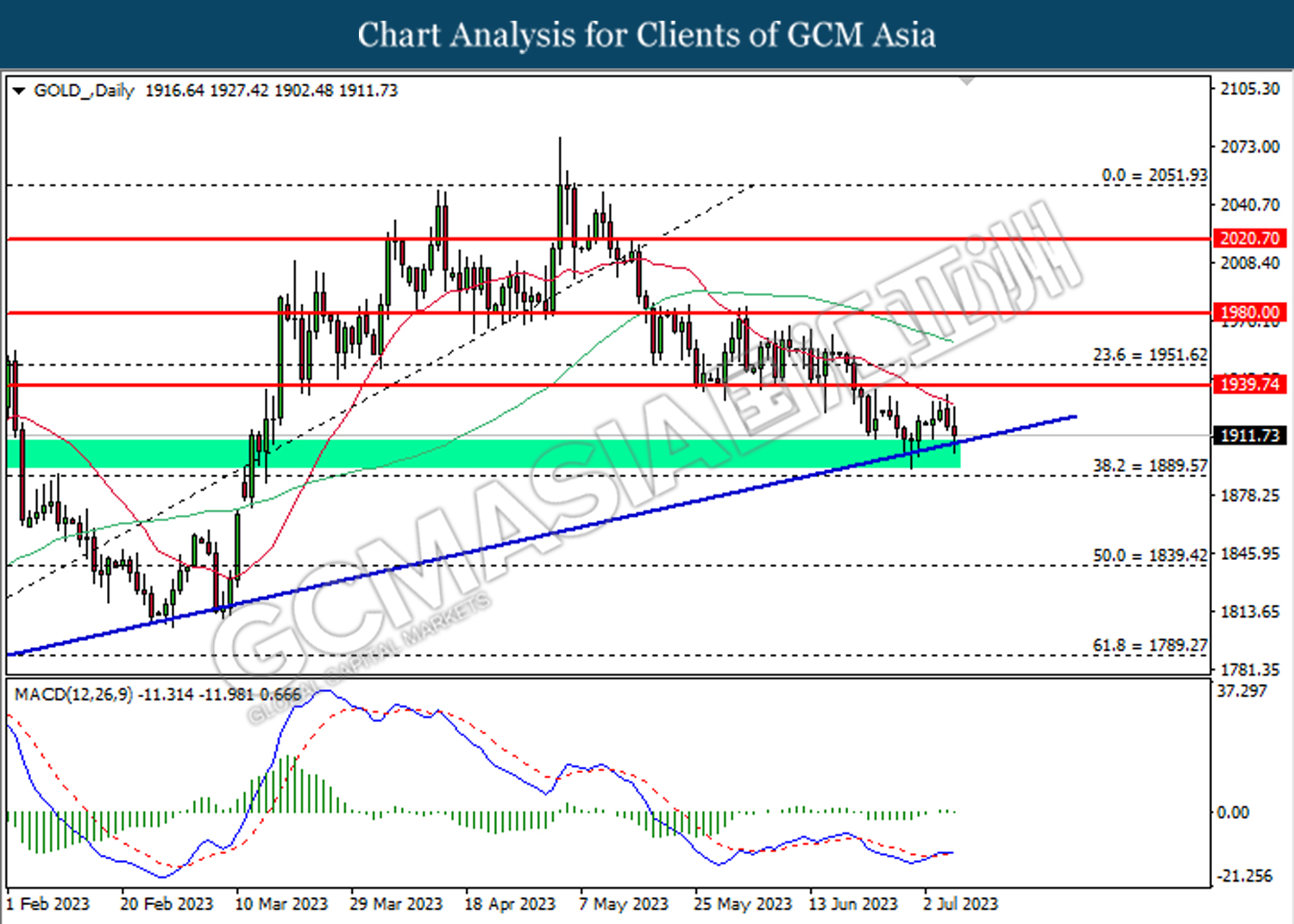

GOLD_, Daily: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40