07 August 2020 Morning Session Analysis

Pound surged over the hawkish sentiment.

The Pound Sterling surged to five-month high against the US Dollar following the Bank of England provided hawkish tone toward the economic progression in the United Kingdom. On yesterday, the Bank of England’s Monetary Policy Committee (MPC) sets the monetary policy to meet the 2% inflation target while boosting the economic and employment rate in the UK. During the monetary policy meeting, the Committee voted unanimously to maintain the interest rate at 0.1% while reiterated that they will continue with existing economic stimulus programmes to sustain the liquidity and solvency ration in the financial market. Besides that, the MPC’s projections assume that the negative impact of the coronavirus toward the economy growth had dissipated gradually over the forecast period, dialling up the market optimism toward the economic progression in the UK. Nonetheless, they will still remain footsteps at current monetary easing policy while eyeing on global growth risk, more stimulus can be anticipated if the course of events urges their economy growth goes against their expectation. As of writing, GBP/USD appreciated by 0.04% to 1.3140.

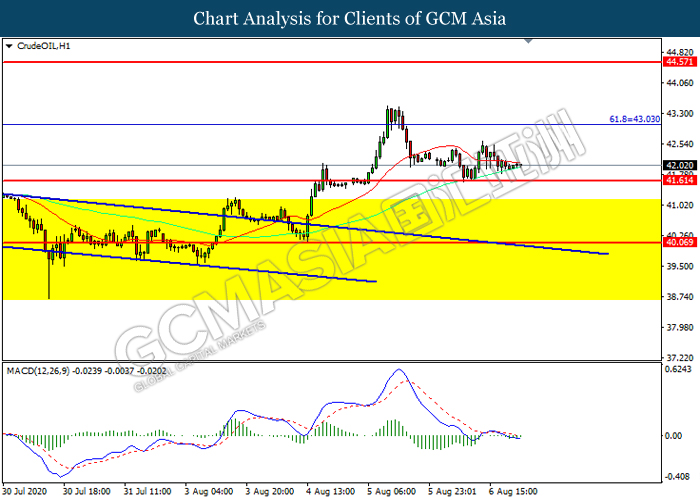

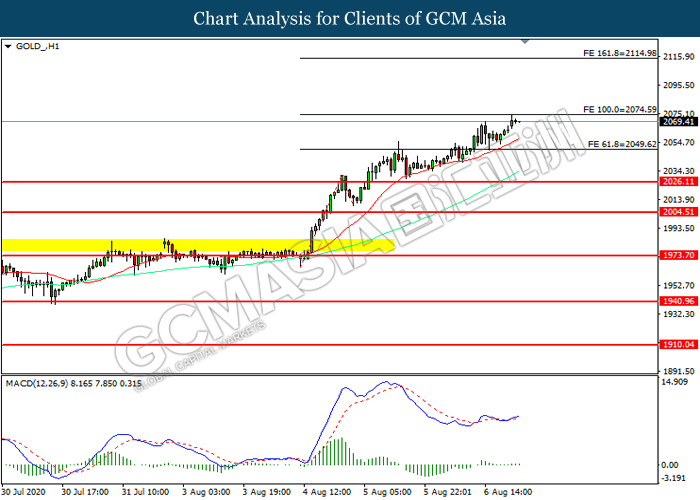

In the commodities market, the crude oil price slumped 0.24% to $42.05 per barrel as of writing. The oil price continues to suffer bearish momentum as market participants still worried that the spiking number of the coronavirus could trigger negative prospect for the demand recovery for this black-commodity in future. On the other hand, the gold price surged 0.30% to $2069.30 per troy ounces amid weakening US Dollar. As for now, investors would scrutinize the latest updates with regards of the Non-farm Payrolls data which will be released tonight in order to gauge the likelihood movement for this safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jul) | 4,800K | 1,600K | – |

| 20:30 | USD – Unemployment Rate (Jul) | 11.1% | 10.5% | – |

| 20:30 | CAD – Employment Change (Jul) | 952.9K | 400.0K | – |

| 22:00 | CAD – Ivey PMI (Jul) | 58.2 | 57.5 | – |

Technical Analysis

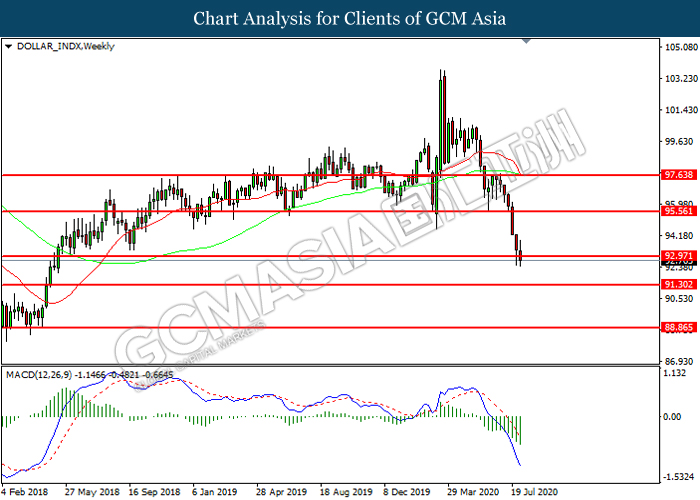

DOLLAR_INDX, Weekly: Dollar index was traded lower following prior breakout below the previous support level at 92.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level at 91.30.

Resistance level: 92.95, 95.55

Support level: 91.30, 88.85

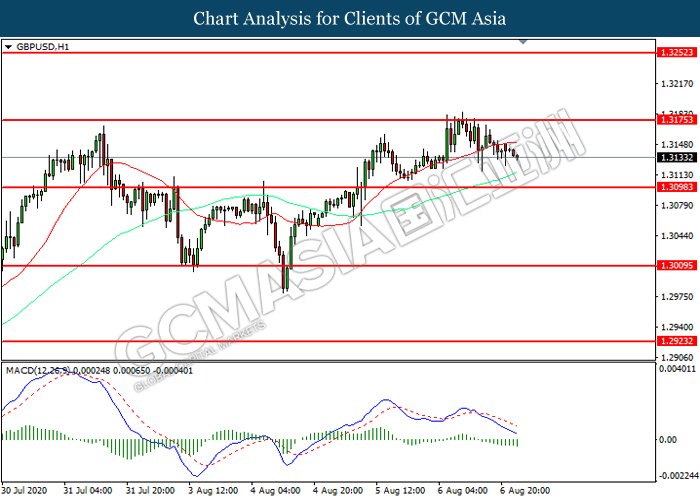

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level at 1.3175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3090.

Resistance level: 1.3175, 1.3250

Support level: 1.3095, 1.3010

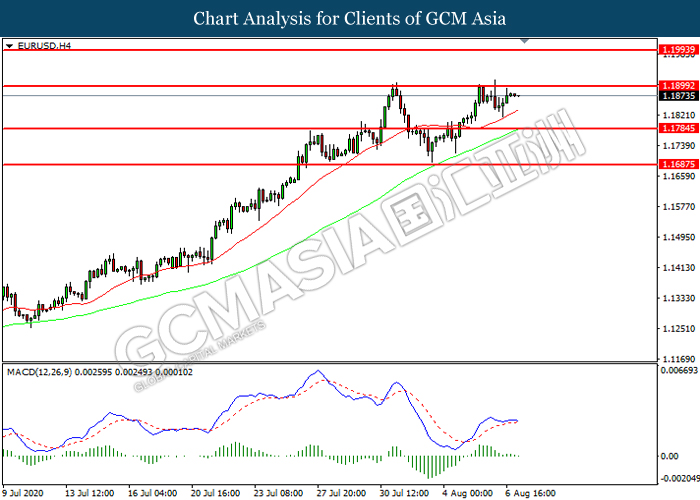

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1900. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1900, 1.1995

Support level: 1.1785, 1.1685

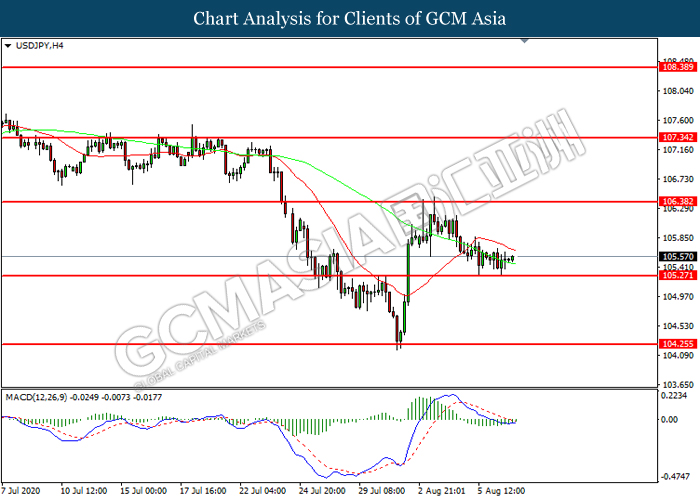

USDJPY, H4: USDJPY was traded lower while currently testing the support level at 105.25. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 106.40, 107.35

Support level: 105.25, 104.25

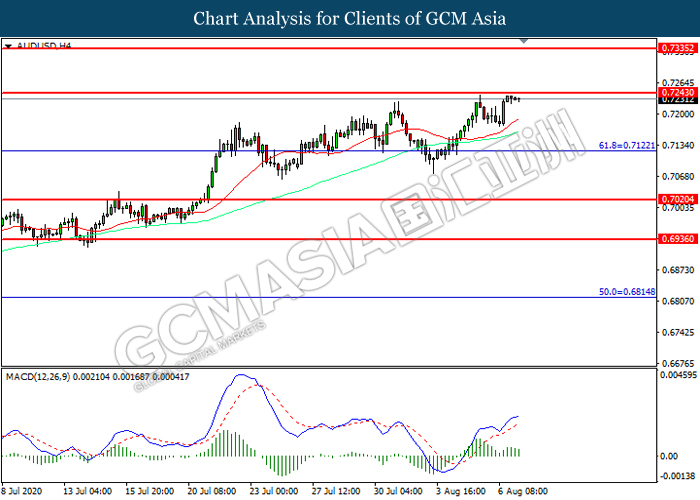

AUDUSD, H4: AUDUSD was higher while currently testing the resistance level at 0.7245. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7245, 0.7335

Support level: 0.7120, 0.7020

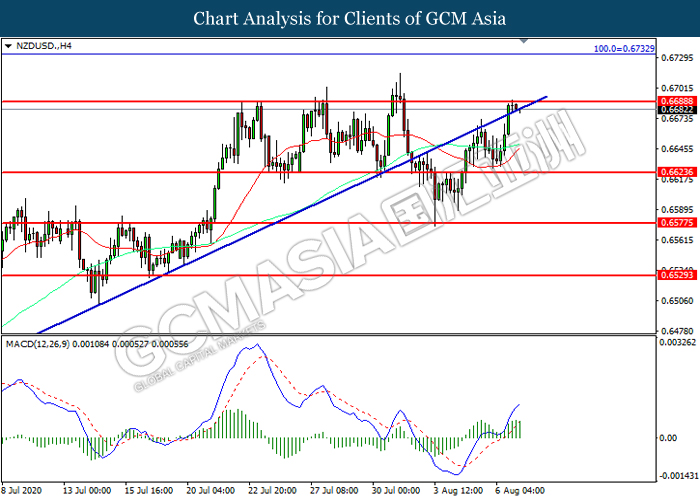

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6690. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6690, 0.6735

Support level: 0.6625, 0.6575

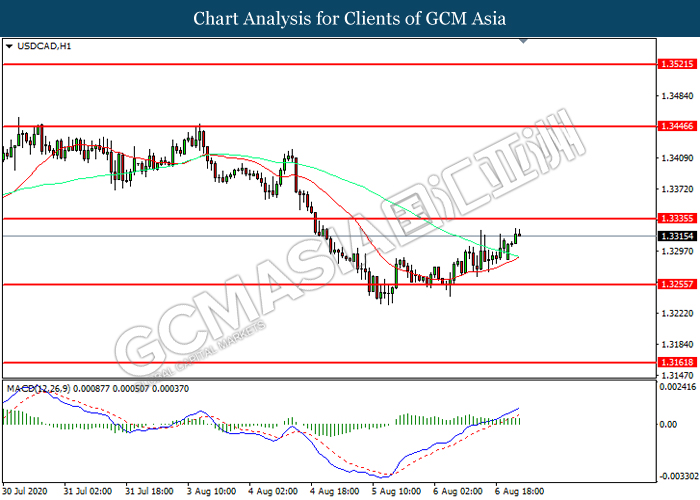

USDCAD, H1: USDCAD was traded higher while currently near the resistance level at 1.3335. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3335, 1.3445

Support level: 1.3255, 1.3160

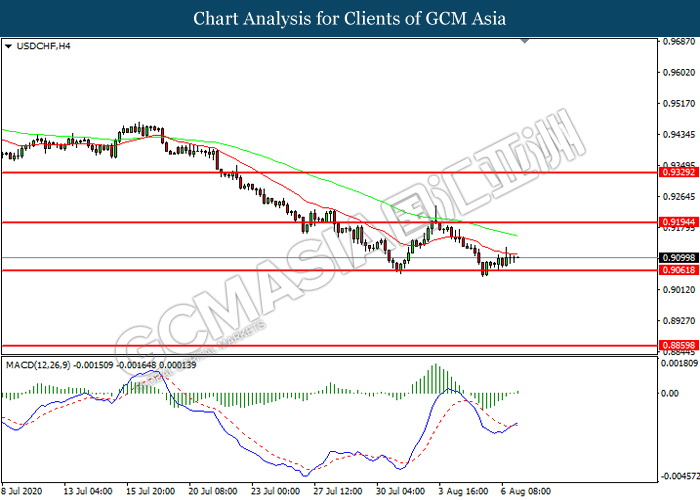

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9060. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.9195, 0.9330

Support level: 0.9060, 0.8860

CrudeOIL, H1: Crude oil price was traded lower while currently near the support level at 41.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 43.05, 44.55

Support level: 41.60, 40.05

GOLD_, H1: Gold price was traded higher while currently testing the resistance level at 2074.60. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 2074.60, 2115.00

Support level: 2049.60, 2026.10